Professional Documents

Culture Documents

Drill Problems - Community Tax:: Mr. Lafa Mrs. Lafa

Uploaded by

RealEXcellenceOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Drill Problems - Community Tax:: Mr. Lafa Mrs. Lafa

Uploaded by

RealEXcellenceCopyright:

Available Formats

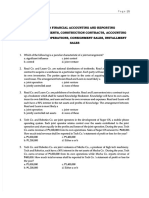

Community Tax

DRILL PROBLEMS – COMMUNITY TAX:

1. Non-payment of the following is not a ground for imprisonment

a. Income tax c. Community tax

b. Value-Added Tax d. Donor’s tax

2. Which statement is correct?

I. Aliens who have stayed in the Philippines most of the time during the taxable year are required to pay

community tax in the Philippines

II. If a person loses the benefit of exemption on June 20 of the current year, he shall be liable for the

community tax on that same day

III. For purposes of community tax, general professional partnership are taxable as a corporation

a. All are correct c. Only I and II are correct

b. Only I and III are incorrect d. Only the second is correct

3. The maximum additional community tax payable by an individual and a corporation, respectively is

a. P5,000; P10,000 c. P5,005; P10,200

b. P5,005; P10,005 d. P5,005; P10,500

4. An exempt individual may secure community tax certificate by paying

a. P5.00 c. P10.00

b. P1.00 d. None

5. Payments of community tax is required to inhabitants of the Philippines whose age is at least

a. 15 c. 21

b. 18 d. 24

6. Drill: Compute the community tax under each of the following cases.

A. Mr. Douglas Alboria earned P800,000 salaries last year. __________

B. Mr. Douglas is unemployed resident who has a vacant lot valued at P300,000. ___________

C. Mr. Douglas Alboria earned the following income last year:

Salaries P 800,000

Income from profession 785,800

Rental income from properties 482,900

____________

D. Assume Mr. Douglas earned P6,874,800 in the preceding year. ______________

E. Mr. and Mrs. Lafa are both employed. Mr. Lafa is also medical practitioner while Mrs. Lafa owns a beauty

saloon. The following relates to the details of the income of the spouses.

Mr. Lafa Mrs. Lafa

Salaries P 400,000 P 420,000

Income from profession 3,200,000

Income from business 2,400,000

Community Tax

Mr. Lafa opted to pay the additional community tax.

Mr. Lafa _________________ Mrs. Lafa ________________

F. A partnership which is engaged in selling shoes had the following revenue last year:

Sales (P7.2M collected in cash) P 8,000,000

Less: Cost of sales 5,000,000

Gross income P 3,000,000

Interest income from client notes 50,000

Dividend income 214,000

Gain on sale of equipment 100,000

Total income P 3,364,000

Less: Expenses 1,500,000

Net income P 1,864,000

_______________

G. ABC Corporation is engaged in property leasing. Last year, it collected P3,489,000 rentals from various

tenants from its commercial building. Last year’s valuation of the building are compiled below:

Land Building Total

Appraisal value P 4,000,000 P 4,500,0000 P 8,500,000

Zonal value 5,000,000 - 5,000,000

Assessed value 1,218,000 1,415,000 2,633,000

_______________

H. Adonis Company, a domestic corporation, had the following receipts from business and property values:

Philippines Abroad Total

Gross receipts P 3,000,000 P 2,500,0000 P 5,500,000

Value of lands and buildings 12,000,000 8,000,000 20,000,000

Value of equipment 3,200,000 2,400,000 5,600,000

_______________

I. Megaworld Corporation, a real estate company, had a total assessed value of land in the previous year

aggregating P30,000,000. _____________

J. A corporation with total real estate properties assessed value aggregating P14,000,000 started operation on

January 2 of the year. _____________

You might also like

- AndrewDocument1 pageAndrewCristine Salvacion Pamatian50% (2)

- Chapter Exercises DeductionsDocument11 pagesChapter Exercises DeductionsShaine KeefeNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- Quiz 1 - Balance SheetDocument3 pagesQuiz 1 - Balance SheetCindy Craus100% (1)

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Audit of Liabilities Exercise 1: SolutionDocument14 pagesAudit of Liabilities Exercise 1: SolutionCharis Marie UrgelNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- Gov Acc Post TestDocument15 pagesGov Acc Post Test수지No ratings yet

- TAX02 Lecture Input TaxDocument5 pagesTAX02 Lecture Input TaxJames DiazNo ratings yet

- Problem 7-1: True or False False: Fact PatternDocument23 pagesProblem 7-1: True or False False: Fact PatternMichael Brian TorresNo ratings yet

- Donor's Tax QuizDocument2 pagesDonor's Tax Quizsujulove foreverNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- CTDI Tax Formatting QuestionsDocument13 pagesCTDI Tax Formatting QuestionsMaryane AngelaNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Ix - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionDocument12 pagesIx - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionKirstine DelegenciaNo ratings yet

- Yes, Since The Leased Portion Is Not ActuallyDocument2 pagesYes, Since The Leased Portion Is Not ActuallyResty VillaroelNo ratings yet

- Gusting Accounting System - OjerioCJDocument134 pagesGusting Accounting System - OjerioCJHedi mar NecorNo ratings yet

- QUIZ 4 - Income TaxDocument4 pagesQUIZ 4 - Income TaxTUAZON JR., NESTOR A.No ratings yet

- Midterm Exam Palapuz, John Mark Bsac 3a 1Document6 pagesMidterm Exam Palapuz, John Mark Bsac 3a 1John Mark PalapuzNo ratings yet

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- DeductionsDocument4 pagesDeductionsDianna RabadonNo ratings yet

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Estate Tax Guide for PhilippinesDocument50 pagesEstate Tax Guide for PhilippinesLea JoaquinNo ratings yet

- UCP Tax Guide: Income Tax for IndividualsDocument9 pagesUCP Tax Guide: Income Tax for IndividualsDin Rose GonzalesNo ratings yet

- REVIEW MATERIALS FOR TAX102: TRANSFER AND BUSINESS TAXATIONDocument17 pagesREVIEW MATERIALS FOR TAX102: TRANSFER AND BUSINESS TAXATIONElizah Faye AlcantaraNo ratings yet

- At 9013Document9 pagesAt 9013Aljur SalamedaNo ratings yet

- Mansci - Chapter 3Document2 pagesMansci - Chapter 3Rae WorksNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- MAC Material 2Document33 pagesMAC Material 2Blessy Zedlav LacbainNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- MINDANAO STATE UNIVERSITY ACCOUNTANCY QUIZ SERIES 3Document4 pagesMINDANAO STATE UNIVERSITY ACCOUNTANCY QUIZ SERIES 3Cardo DalisayNo ratings yet

- BLT Quizzer Unknown Donors TaxDocument6 pagesBLT Quizzer Unknown Donors TaxtrishaNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- TAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsDocument1 pageTAX004 Assignment 2.2: Taxable Net Gift and Donor's Tax: InstructionsGie MaeNo ratings yet

- TX10 - Other Percentage TaxDocument15 pagesTX10 - Other Percentage TaxKatzkie Montemayor GodinezNo ratings yet

- 12943Document4 pages12943Madelyn Jane IgnacioNo ratings yet

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDocument18 pagesMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNo ratings yet

- Midterm Examination in Auditing and Assurance Concepts and Applications Part 1Document10 pagesMidterm Examination in Auditing and Assurance Concepts and Applications Part 1Maricar PinedaNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- Mas2 JoDocument10 pagesMas2 JoFery AnnNo ratings yet

- Chapter 6 - Financial AssetsDocument20 pagesChapter 6 - Financial Assetsjerome orillosaNo ratings yet

- 90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Document11 pages90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Hazel Grace PaguiaNo ratings yet

- Comprehensive Exam-Income TaxationDocument5 pagesComprehensive Exam-Income TaxationKaren May JimenezNo ratings yet

- 3004 Home Office and BranchesDocument6 pages3004 Home Office and BranchesTatianaNo ratings yet

- RMYC Cup 2 - RevDocument9 pagesRMYC Cup 2 - RevJasper Andrew AdjaraniNo ratings yet

- CH 07Document50 pagesCH 07Janesene SolNo ratings yet

- 68125672575bdf96fc857f403531f1c9-copyDocument9 pages68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- INTGR TAX 009 DeductionsDocument6 pagesINTGR TAX 009 DeductionsJohn Paul SiodacalNo ratings yet

- Elimination Round QuestionnairesDocument5 pagesElimination Round Questionnairesmitakumo uwuNo ratings yet

- Cazo Juan ValdezDocument26 pagesCazo Juan Valdezux20nr091No ratings yet

- JUNE22 - ACT InvoiceDocument2 pagesJUNE22 - ACT InvoiceSamarth HandurNo ratings yet

- Leave PolicyDocument5 pagesLeave PolicyanamikabmwNo ratings yet

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Document3 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 496Justia.comNo ratings yet

- Witherspoon v. City of Miami Beach, Et Al - Document No. 93Document3 pagesWitherspoon v. City of Miami Beach, Et Al - Document No. 93Justia.comNo ratings yet

- Code of Ethics and Guidelines Iaap: I. Analyst-Patient RelationshipsDocument4 pagesCode of Ethics and Guidelines Iaap: I. Analyst-Patient RelationshipsChiriac Andrei TudorNo ratings yet

- Conjugal Property Named On The ParamourDocument8 pagesConjugal Property Named On The ParamourMan2x SalomonNo ratings yet

- Hidri Complaint - Feds Seek To Claim Watertown Property Where Pot, Counterfeit Cash Were Found.Document12 pagesHidri Complaint - Feds Seek To Claim Watertown Property Where Pot, Counterfeit Cash Were Found.Republican-AmericanNo ratings yet

- Innovation and Excellence Reviwer Edjpm Lesson 5 and 6Document11 pagesInnovation and Excellence Reviwer Edjpm Lesson 5 and 6Edjon PayongayongNo ratings yet

- Executive Secretary: Approved IRR For EO 262Document27 pagesExecutive Secretary: Approved IRR For EO 262San PedroNo ratings yet

- GOOD GOVERNANCE IN PAKISTAN PROBLEMSDocument19 pagesGOOD GOVERNANCE IN PAKISTAN PROBLEMSKaleem MarwatNo ratings yet

- Supreme Court Appeal on Murder ConvictionDocument43 pagesSupreme Court Appeal on Murder ConvictionVinita Ritwik100% (1)

- Mambayya House: Aminu Kano Centre For Democratic StudiesDocument51 pagesMambayya House: Aminu Kano Centre For Democratic Studieshamza abdulNo ratings yet

- Misolas v. PangaDocument14 pagesMisolas v. PangaAnonymous ymCyFqNo ratings yet

- Med All U.Aoow: VIGOUR MOBILE INDIA PVT LTD 601A-610 GOOD Earth City Centre, Malibu Towne Sector-50 GURGAONDocument1 pageMed All U.Aoow: VIGOUR MOBILE INDIA PVT LTD 601A-610 GOOD Earth City Centre, Malibu Towne Sector-50 GURGAONĹökèśh ŠîńghNo ratings yet

- Prepositions Exercise ExplainedDocument4 pagesPrepositions Exercise Explainediwibab 2018No ratings yet

- LIABILITYDocument8 pagesLIABILITYkaviyapriyaNo ratings yet

- Architectural Consultancy AgreementDocument6 pagesArchitectural Consultancy AgreementprashinNo ratings yet

- Overview of The BSPDocument27 pagesOverview of The BSPSherra ElizagaNo ratings yet

- Visit RelativesDocument5 pagesVisit RelativesYahring AbdullohNo ratings yet

- Ex-Parte Manifestation: Regional Trial CourtDocument4 pagesEx-Parte Manifestation: Regional Trial CourtManny SandichoNo ratings yet

- Barredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Document1 pageBarredo vs. Hon. Vinarao, Director, Bureau of Corrections (Spec Pro)Judy Miraflores DumdumaNo ratings yet

- People vs Omaweng (Consent to searchDocument1 pagePeople vs Omaweng (Consent to searchCharles Roger Raya100% (2)

- University of London La2024 ZADocument3 pagesUniversity of London La2024 ZASaydul ImranNo ratings yet

- 121-160 JurisprudenceDocument44 pages121-160 JurisprudencejilliankadNo ratings yet

- Blue Calypso v. MyLikesDocument4 pagesBlue Calypso v. MyLikesPatent LitigationNo ratings yet

- Format of Application: For Official Use Only SL - No. of Application Year Course Whether ApprovedDocument8 pagesFormat of Application: For Official Use Only SL - No. of Application Year Course Whether Approvedabhishek123hitNo ratings yet

- Pecson V CA (1995)Document4 pagesPecson V CA (1995)Zan BillonesNo ratings yet

- Project Team Roles & ResponsibilitiesDocument1 pageProject Team Roles & ResponsibilitiesSheena Mae de LeonNo ratings yet

- Chapter 3 Case DigestDocument7 pagesChapter 3 Case DigestAudreyNo ratings yet