Professional Documents

Culture Documents

Modul 8 Benefit Cost Ratio - Ver - Rani PDF

Uploaded by

Rizki AnggraeniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Modul 8 Benefit Cost Ratio - Ver - Rani PDF

Uploaded by

Rizki AnggraeniCopyright:

Available Formats

Module 8: Benefit-Cost Ratio

SI-4251 Ekonomi Teknik

Rani G. K. Pradoto

Outline Module 8

Benefit – Cost Ratio

8-2 SI-4251 Ekonomi Teknik

The Benefit – Cost Analysis

The most commonly used method for comparing

economic alternatives.

This method is often considered as “supplementary”

to present worth analysis.

The objective is to determine whether the benefit

(gained) in return to any cost (spent) is favorable.

Basically it is desired that we will gain more than

we have spent.

Benefit – Cost > 0 B/C > 1.0

8-3 SI-4251 Ekonomi Teknik

Classification

Benefit (B) all favorable return/gain or

advantages

Disbenefit (D) negative benefit, any negative (loss)

result

Cost (C) all things that one pays/expends in

order to have return

Benefit income from an investment, e.g., interest

Disbenefit loss of value or (initial) income due to an

investment

Cost expenditure

8-4 SI-4251 Ekonomi Teknik

B/C Analysis for A Single Project

Conventional B/C

B D

B/C

C

Modified B/C

- includes operation & maintenance cost

- initial investment replaces cost as denominator

B D O& M

B/C

I

Calculation can be made in present worth, future worth or annuity

8-5 SI-4251 Ekonomi Teknik

B - C Analysis for A Single Project

Conventional B-C

B C (B D) C

Modified B-C

- includes operation & maintenance cost

B C (B D O & M ) I

Calculation can be made in present worth, future worth or annuity

8-6 SI-4251 Ekonomi Teknik

Exercise

A new machine having an initial investment of Rp 225 million and additional Rp 35 million a year

for maintenance and operation cost, is estimated to generate Rp 95 million per year in revenue.

On the other hand, installation of this new machine will cost the company to lose Rp 3.2 million

per year from selling by product. The machine can latter be sold for Rp 75 million at the end of

5 year and the rate of return is set at 8%. Do the benefit cost analysis.

Conventional method:

Cost C1 = Rp 225 million 225 (A/P, 8, 5) = 56.3535

Cost C2 = Rp 35 million/year 35 = 35

Benefit B1 = Rp 95 million/year 95 = 95

Benefit B2 = Rp 75 million at end of 5 year 75 (A/F, 8, 5) = 12.7845

Disbenefit D = Rp 3.2 million/year 32 = 3.2

(A/P, 8, 5) = 0.25046 (A/F, 8, 5) = 0.17046

B/C = [(95 + 12.7845) – 3.2 - 35]/(56.3535) = 1.2348

B - C = [(95 + 12.7845) – 3.2 - 35] – [56.3535] = Rp 13.231 million

8-7 SI-4251 Ekonomi Teknik Muhamad Abduh, Ph.D.

Exercise

A new machine having an initial investment of Rp 225 million and additional Rp 35 million a year

for maintenance and operation cost, is estimated to generate Rp 95 million per year in revenue.

On the other hand, installation of this new machine will cost the company to lose Rp 3.2 million

per year from selling by product. The machine can latter be sold for Rp 75 million at the end of

5 year and the rate of return is set at 8%. Do the benefit cost analysis.

Modified method:

Cost C1 = Rp 725 million 225 (A/P, 8, 5) = 56.3535

Cost C2 = Rp 35 million/year 35 = 35

Benefit B1 = Rp 95 million/year 95 = 95

Benefit B2 = Rp 75 million at end of 5 year 75 (A/F, 8, 5) = 12.7845

Disbenefit D = Rp 3.2 million/year 32 = 3.2

(A/P, 8, 5) = 0.25046 (A/F, 8, 5) = 0.17046

B/C = [(95 + 12.7845) – 3.2]/(56.3535 + 35) = 1.1448

B - C = [(95 + 12.7845) – 3.2] – [56.3535 + 35] = Rp 13.231 million

8-8 SI-4251 Ekonomi Teknik

Comparing two alternatives using B/C

analysis

Overpass A Tunnel B

Initial cost 1,250 million 3,500 millions

Yearly maintenance cost 27.50 million 55 million

Road user cost per year 425 million 350 million

Useful life 20 years 20 years

Interest rate 10%

COST:

EUAWA = 1,250 (A/P, 10, 20) + 27.50 = 1,250 (0.1175) + 27.50 = 174.375 million

EUAWB = 3,500 (A/P, 10, 20) + 55.00 = 3,500 (0.1175) + 55.00 = 466.250 million

Δ Cost = EUAWB – EUAWA = 466.250 – 174.375 = 291.875 million

BENEFIT:

EUAWA = 425 million EUAWB = 350 million Δ Benefit = 425-350 = 75 million

B/C = 75/291.875 = 0. 2570

B-C = 75 – 291.875 = -216.875

8-9 SI-4251 Ekonomi Teknik

Selection form Mutually Exclusive

Alternatives

Incremental B/C Analysis

X Y Z

Initial cost - 250,000,000 -240,000,000 -320,000,000

Yearly expenses - 135,000,000 -123,500,000 -130,000,000

Yearly revenues 390,000,000 381,000,000 420,500,000

Salvage value 45,000,000 52,000,000 202,000,000

period 5 5 5

Interest rate 12%

8-10 SI-4251 Ekonomi Teknik

Selection form Mutually Exclusive

Alternatives (benar)

Incremental B/C Analysis

Y X Z

Initial cost, (I) -240,000,000 -250,000,000 -320,000,000

Yearly expenses, (C) -123,500,000 -135,000,000 -130,000,000

Yearly revenues, (B) 381,000,000 390,000,000 420,500,000

UAEW of Salvage value, (B) 52,000,000 45,000,000 202,000,000

Overall B/C

B–C

Alternative to compare

Incremental benefit

Incremental cost

Incremental B/C

Decision

8-11 SI-4251 Ekonomi Teknik

Selection form Mutually Exclusive

Alternatives (benar)

Incremental B/C Analysis

Y X Z

Initial cost, (I) -240,000,000 -250,000,000 -320,000,000

Yearly expenses, (C) -123,500,000 -135,000,000 -130,000,000

Yearly revenues, (B) 381,000,000 390,000,000 420,500,000

UAEW of Salvage value, (B)

Overall B/C >1 <1

B–C

Alternative to compare YES Y to Z

Incremental benefit 262,219,000

Incremental cost 101,176,800

Incremental B/C 2.5

Decision Z

8-12 SI-4251 Ekonomi Teknik

Homework #8

A ready-mix concrete producer is considering to install a new mixer system:

Operating characteristics System A System B System C

Installed cost ($) 2,250,000 2,950,000 2,750,000

Annual Operating cost ($) 320,000 495,000 401,500

Annual production (cm) 10,500 21,200 19,900

Unit price ($/cm) 122.50 122.50 122.50

Overhaul cost ($/ 2 years) 220,000 245,000 295,000

Salvage value ($) 221,500 308,000 367,500

Useful life (year) 3 4 4

at rate of return 10% determine which system should be installed using B/C

analysis?

8-13 SI-4251 Ekonomi Teknik

You might also like

- Management Accounting Exam Practice KitDocument405 pagesManagement Accounting Exam Practice Kittshepiso msimanga100% (4)

- Case Capital BudgetingDocument10 pagesCase Capital Budgetingvinagoya100% (1)

- Time Wise ItineraryDocument3 pagesTime Wise ItineraryKeshav BahetiNo ratings yet

- Performance Management System at BHELDocument24 pagesPerformance Management System at BHELshweta_46664100% (3)

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost RatioRhonita Dea AndariniNo ratings yet

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost RatioAbu Abdul Fattah100% (1)

- Module 8 Benefit Cost RatioDocument13 pagesModule 8 Benefit Cost Ratiozulma siregarNo ratings yet

- Module 8 Benefit Cost Ratio PDFDocument4 pagesModule 8 Benefit Cost Ratio PDFRio DpNo ratings yet

- Chapter 4Document21 pagesChapter 4ananiya dawitNo ratings yet

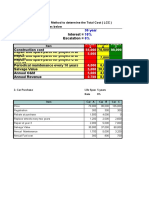

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- Lecture 12 Benefit Cost AnalysisDocument25 pagesLecture 12 Benefit Cost AnalysisHamad RazaNo ratings yet

- Final Exam SolutionDocument6 pagesFinal Exam SolutionRoronoa ZoroNo ratings yet

- Marr Calculation and ExamplesDocument4 pagesMarr Calculation and ExamplesAi manNo ratings yet

- Module 7 Incremental Method PDFDocument14 pagesModule 7 Incremental Method PDFRizki AnggraeniNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRizki AnggraeniNo ratings yet

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhNo ratings yet

- Module 7 Incremental Method - RevDocument18 pagesModule 7 Incremental Method - RevReza PahleviNo ratings yet

- Module 7 Incremental Method - RevDocument18 pagesModule 7 Incremental Method - RevYun TelNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRhonita Dea AndariniNo ratings yet

- Chapter9 BenefitcostanalysisDocument9 pagesChapter9 BenefitcostanalysistobiveNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- Chapter 1.6 Financial Management Part - I: Objective Type Questions and AnswersDocument8 pagesChapter 1.6 Financial Management Part - I: Objective Type Questions and AnswerspriyadarshankrNo ratings yet

- Depreciation CH 10Document40 pagesDepreciation CH 10احمد عمر حديدNo ratings yet

- Homework 8 EktekDocument4 pagesHomework 8 Ektekryukenakuma1No ratings yet

- 123 - 17-chapter-17-FeasibilityAnalysisDocument21 pages123 - 17-chapter-17-FeasibilityAnalysisHrvoje ErorNo ratings yet

- Lecture 7 NotesDocument6 pagesLecture 7 NotesAna-Maria GhNo ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- CHAPTER 7 - Handouts For Students-1Document3 pagesCHAPTER 7 - Handouts For Students-1ErmiasNo ratings yet

- F2 Past Paper - Question12-2003Document15 pagesF2 Past Paper - Question12-2003ArsalanACCANo ratings yet

- Depreciation: Principles of Engineering Economic Analysis, 5th EditionDocument25 pagesDepreciation: Principles of Engineering Economic Analysis, 5th EditionnorahNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Solutions Manual To Accompany Engineering Economy 6th Edition 9780073205342Document9 pagesSolutions Manual To Accompany Engineering Economy 6th Edition 9780073205342IvanWilliamssacj100% (45)

- The Cost of ProductionDocument69 pagesThe Cost of ProductionShawn Joshua YapNo ratings yet

- Ch11 ExercisesDocument4 pagesCh11 Exercisestrangtt231004No ratings yet

- Engineering EconomicsDocument5 pagesEngineering EconomicsamanNo ratings yet

- Engineering Economy: Benefit Cost AnalysisDocument16 pagesEngineering Economy: Benefit Cost AnalysisEngr XsadNo ratings yet

- Benifit Cost AnalysisDocument22 pagesBenifit Cost AnalysisNazmul Haque ParthibNo ratings yet

- DepreciationDocument8 pagesDepreciationJeremiah Egia ReyesNo ratings yet

- 06 Annual Worth AnalysisDocument19 pages06 Annual Worth Analysis王泓鈞No ratings yet

- Replacement Analysis: Shah Murtoza MorshedDocument12 pagesReplacement Analysis: Shah Murtoza MorshedSarkarAhmmedRedwan SuvroNo ratings yet

- CE 22 - Engineering Economy: General InstructionsDocument1 pageCE 22 - Engineering Economy: General InstructionsMarco ConopioNo ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- 6886 Valuation 2Document25 pages6886 Valuation 2api-3699305100% (1)

- Lecture 11 Life Cycle Costing 2Document21 pagesLecture 11 Life Cycle Costing 2KHAIRIEL IZZAT AZMANNo ratings yet

- Ce 22 MWX HW4Document1 pageCe 22 MWX HW4Jonas Lemuel DatuNo ratings yet

- Name: Huzaifa Ali Section: C ROLL # CV-2018-122Document5 pagesName: Huzaifa Ali Section: C ROLL # CV-2018-122hunzala aliNo ratings yet

- ACCT105 Quizzes and SolutionsDocument8 pagesACCT105 Quizzes and SolutionsAway To PonderNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1CJ alandyNo ratings yet

- Assignment 3Document8 pagesAssignment 3octoNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- Case Studies in Engineering Economics For Electrical Engineering StudentsDocument6 pagesCase Studies in Engineering Economics For Electrical Engineering Studentsryan macutoNo ratings yet

- Illustrative Examples Part2Document31 pagesIllustrative Examples Part2WengFai ChongNo ratings yet

- The Cost of ProductionDocument64 pagesThe Cost of ProductionSHOBANA96No ratings yet

- Topic 4 AW and BC Ratio ComparisonsDocument7 pagesTopic 4 AW and BC Ratio Comparisonssalman hussainNo ratings yet

- Assigned Task Capital BudgetingDocument7 pagesAssigned Task Capital Budgetingjennyrose.navajaNo ratings yet

- Final Exam, s2, 2019-FINALDocument13 pagesFinal Exam, s2, 2019-FINALReenalNo ratings yet

- Capital Budgeting Activity-2Document3 pagesCapital Budgeting Activity-2Shazia TunioNo ratings yet

- Equivalent Uniform Annual CostDocument40 pagesEquivalent Uniform Annual CostDr. Rogelio C. Golez, JrNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Model 11 DepreciationDocument15 pagesModel 11 DepreciationAldi GunawanNo ratings yet

- Module 7 Incremental Method PDFDocument14 pagesModule 7 Incremental Method PDFRizki AnggraeniNo ratings yet

- Module 9 Replacement AnalysisDocument17 pagesModule 9 Replacement AnalysisRizki AnggraeniNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRizki AnggraeniNo ratings yet

- Module 14 Sensitivity AnalysisDocument14 pagesModule 14 Sensitivity AnalysisRizki AnggraeniNo ratings yet

- Problems and Prospects of Organic Horticultural Farming in BangladeshDocument10 pagesProblems and Prospects of Organic Horticultural Farming in BangladeshMahamud Hasan PrinceNo ratings yet

- Foreign Trade: Ricardian ModelDocument11 pagesForeign Trade: Ricardian Modelellenam23No ratings yet

- The Impact of Motivation On Organizational PerformanceDocument96 pagesThe Impact of Motivation On Organizational PerformanceRandolph Ogbodu100% (2)

- 25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyDocument22 pages25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyHema and syedNo ratings yet

- ECO 303 PQsDocument21 pagesECO 303 PQsoyekanolalekan028284No ratings yet

- Sinar Mas: Introduction To and Overview ofDocument26 pagesSinar Mas: Introduction To and Overview ofBayuNo ratings yet

- Adriana Cisneros and Gustavo Cisneros - Bloomberg InterviewDocument5 pagesAdriana Cisneros and Gustavo Cisneros - Bloomberg InterviewAdriana CisnerosNo ratings yet

- RSAW Review of The Year 2021Document14 pagesRSAW Review of The Year 2021Prasamsa PNo ratings yet

- CBR ProcterGamble 06Document2 pagesCBR ProcterGamble 06Kuljeet Kaur ThethiNo ratings yet

- Class Test 3 Answer SchemeDocument5 pagesClass Test 3 Answer SchemeSujata NawleNo ratings yet

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDocument3 pagesQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiNo ratings yet

- Update 14Document82 pagesUpdate 14suvromallickNo ratings yet

- Template AOI (Non-Stock)Document5 pagesTemplate AOI (Non-Stock)AaronNo ratings yet

- Solutions For InequalitiesDocument2 pagesSolutions For InequalitiesCrynos DanNo ratings yet

- Malabon AIP 2014+amendments PDFDocument81 pagesMalabon AIP 2014+amendments PDFCorics HerbuelaNo ratings yet

- Globalization and The Sociology of Immanuel Wallerstein: A Critical AppraisalDocument23 pagesGlobalization and The Sociology of Immanuel Wallerstein: A Critical AppraisalMario__7No ratings yet

- Power For All - ToolsDocument6 pagesPower For All - Toolsdan marchisNo ratings yet

- LAVA - Mobile - Case StudyDocument3 pagesLAVA - Mobile - Case StudySatyesh.s100% (1)

- 2009 BIR-RMC ContentsDocument56 pages2009 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Writing A Case Study ReportDocument9 pagesWriting A Case Study ReportjimzjNo ratings yet

- Performa Teknis Overall - Jul 2023Document95 pagesPerforma Teknis Overall - Jul 2023adiNo ratings yet

- Eldorado DredgeDocument2 pagesEldorado DredgeNeenNo ratings yet

- Real Estate Player in BangaloreDocument20 pagesReal Estate Player in BangaloreAnkit GoelNo ratings yet

- Model Sale AgreementDocument4 pagesModel Sale AgreementNagaraj KumbleNo ratings yet

- Asian PaintsDocument13 pagesAsian PaintsGOPS000No ratings yet

- TB Chapter 05 Risk and Risk of ReturnsDocument80 pagesTB Chapter 05 Risk and Risk of Returnsabed kayaliNo ratings yet

- Revised Scheme of Studyb - SC (Hons.) Agri Economics (UAF)Document15 pagesRevised Scheme of Studyb - SC (Hons.) Agri Economics (UAF)Irfy BegNo ratings yet

- Evaluation Sheet For Extension ServicesDocument1 pageEvaluation Sheet For Extension Servicesailine donaireNo ratings yet