Professional Documents

Culture Documents

Central Banking Solution

Uploaded by

rupalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banking Solution

Uploaded by

rupalCopyright:

Available Formats

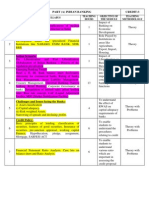

Central Banking-TYBBI-Sem VI(75:25)

QP Code-280901

For any query contact:

Asst. Prof. Shraddha Shukla (Shailendra Degree College): 9967127291/9664819663

Note

a. Below solution is only guideline. If the student’s content is relevant other than the guidelines,

it should be considered and marks should be allotted accordingly.

b. Avoid giving marks in fractions.

Q.1.a.Meaning-Central bank is “an institution charged with the responsibility of managing the expansion

and contraction of the volume of money in the interest of the general public welfare”.

Need of central bank- 1.Direction and regulation, 2.Issue currency notes, 3.Foreign exchange reserve,

4.Banker to government, 5.Banker’s Bank, 6. Control of credit.

b. Role of RBI-1.price stability, 2. Promoting growth, 3. Adequate liquidity, 4. Maintaining currency value,

5. Strengthen prudential regulations(capital adequacy, income recognition, asset classification), 6.

Regulating forex market,7. Legislative initiatives, 8. Setting up financial institutions(ICICI Ltd. , IDBI,

SIDBI, EXIM Bank)

OR

Q.1.c.Conflict between fiscal and monetary policy

Inlation and equity, economic development, Liberalization etc.

d. Factors affecting autonomy of RBI

1.Objectives of Government, 2.Budgetary operations, 3.Top level appointments in RBI, 4.Ownership of

banks,5. Twin role of RBI, 6.Public debt and credit control.

Q.2.a.Various departments of RBI(Any 7 departments)

1.Issue department, 2.Banking department, 3.Exchange control department, 4.Department of banking

operations and development, 5. Industrial finance department, 6. Research and development

department, 7. Legal department,8. Department of finance companies, 9. Department of accounts,

10.Departments of administration, 11. Inspection department, 12. Secretarial department

b. Recommendations of Narasimhan committee

(Students can write recommendations of 1991 or 1998)

OR

Q.2.c. Definition-M & A is the area of corporate finances, management and strategy dealing with

purchasing and/ or joining with other companies.

Impact of M & A-

1. Restricts competition

2. Problems relating to Employees- employees loosing job, transfer.

3. M & A requires amendments in various legislation

4. Affects organisation culture

5. Quest for size

6. Poor credit flow to small business segments

7. Reluctant attitude of community based business for merging

d. Nabard- Introduction, Functions-apex body in rural sector, authority to supervise and coordinate the

functioning of cooperative sector, provides short term credit to State co-op banks and medium

term/long term credit to RRBs and State co-op banks, maintains research and development fund.

Q.3.a.Instruments of monetary policy- bank rate, C.R.R, S.L.R, Repo, Open market operations.

b. Channels of transmission mechanism of monetary policy-interest rate channel, exchange rate

channel, credit availability channel, asset price channel, balance sheet channel.

OR

Q.3.c.Meaning of Credit-Credit means power which one person has to induce another to put economic

goods at his disposal for a time on promise or future payment. Thus, credit attribute or power of the

borrower.

Merits-capital formation, increase consumption, medium of exchange, flexible monetary system,

increase output and employment, development of enterprise, easy payment.

Demerits-cash deposit, Ratio of reserve to deposits, Desire of people to hold cash, business conditions,

credit control

d.Credit creation process-deposits are lent out to businessman-borrowers do not withdraw whole

amount-banks keeps small portion of cash reserves against these deposit-bank uses this reserves money

to create credit.

Q.4.a.Role of SEBI and IRDA-introduction and functions

Functions of SEBI-Protective functions, Developmental Functions, regulatory functions, Protective

functions etc.

Functions of IRDA-Issues registration certificate to insurance companies, protects interest of policy

holders, provides license to intermediaries, regulates and supervises premium rates etc.

b.Capital market reforms-Market pricing of issues, Creation of the regulatory bodies, Open Electronic

Limit Order Book Market, Depository services, Derivatives Trading, Capital from Abroad.

OR

Q.4.c.Reasons of financial instability-weak fundamentals, panic in financial system, weak supervision and

regulation, lack of transparency, mismatches of Assets and Liabilities, Exchange rate volatility,

Inadequate payment system, debt and financial fragility.

d.BASEL Norms

(Students can write Basel I or Basel II)

Tier I and Tier II capital framework, Prudential Norms

Q.5.a.Exchange rate mechanism-Fixed rate system, Flexible rate system, semi-fixed rate system

b.Banking Ombudsman-senior official appointed by RBI to redress customer complaints. Types of

complaint.

c.FEMA- year 1999, Gives powers to central GOVT. to impose the restrictions on deals in foreign

exchange.

d.Finance commission- formed in 22nd nov, 1951, Acts as an instrument to divide proceeds of divisible

taxes between the states and the union govt, Commission is set up every five years by the president,

Functions of commission.

e.NPAs-Classification of NPAs, Measures to tackle the problem of NPAs.

You might also like

- Bank TreasuryDocument61 pagesBank Treasurymip_123100% (1)

- Entity Level ControlsDocument45 pagesEntity Level ControlsNiraj AlltimeNo ratings yet

- HenyaDocument6 pagesHenyaKunnithi Sameunjai100% (1)

- Active Balance Sheet Management: A Treasury & Investment PerspectiveFrom EverandActive Balance Sheet Management: A Treasury & Investment PerspectiveNo ratings yet

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocument210 pagesSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- August 03 2017 Recalls Mls (Ascpi)Document6 pagesAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- Books of AccountsDocument18 pagesBooks of AccountsFrances Marie TemporalNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Alok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeDocument48 pagesAlok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeSwapnil DeshpandeNo ratings yet

- IGCSE Chemistry Section 5 Lesson 3Document43 pagesIGCSE Chemistry Section 5 Lesson 3Bhawana SinghNo ratings yet

- Goods and Services Tax (GST) in IndiaDocument30 pagesGoods and Services Tax (GST) in IndiarupalNo ratings yet

- Export Finance (Case Study Need To Be Added)Document62 pagesExport Finance (Case Study Need To Be Added)rupalNo ratings yet

- Jaiib Indian Financial System Module A Paper 1 PDFDocument95 pagesJaiib Indian Financial System Module A Paper 1 PDFbuddy sepNo ratings yet

- ISO 9001:2015 Explained, Fourth Edition GuideDocument3 pagesISO 9001:2015 Explained, Fourth Edition GuideiresendizNo ratings yet

- Casting Procedures and Defects GuideDocument91 pagesCasting Procedures and Defects GuideJitender Reddy0% (1)

- Risk Management of SbiDocument30 pagesRisk Management of SbiTanay Pandey100% (2)

- Indian Institute of Banking & Finance: CAIIB SyllabusDocument15 pagesIndian Institute of Banking & Finance: CAIIB Syllabusveeresh2907No ratings yet

- CAIIBITDocument27 pagesCAIIBITMLastTryNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Cees CaiibDocument14 pagesCees Caiibbankingexam.aptitudeNo ratings yet

- Ifsfm M2Document98 pagesIfsfm M2Cally CallisterNo ratings yet

- Indian Banking System and ConceptsDocument42 pagesIndian Banking System and ConceptsKaran AroraNo ratings yet

- Indian Financial System 1Document10 pagesIndian Financial System 1fananjelinaNo ratings yet

- Cees Caiib PDFDocument14 pagesCees Caiib PDFJagadeesha MohanNo ratings yet

- Lending Procedures at Standard BankDocument4 pagesLending Procedures at Standard BankAshraf Uddin AhmedNo ratings yet

- Guidelines For InspectionDocument132 pagesGuidelines For InspectiondineshmarginalNo ratings yet

- Riks Modeling of Banking IndustryDocument18 pagesRiks Modeling of Banking IndustrySumra KhanNo ratings yet

- Fundamentals of Financial Management: (Theory and Practicals)Document15 pagesFundamentals of Financial Management: (Theory and Practicals)tawandaNo ratings yet

- Syllabus For Credit Manager & Senior Credit Manager: Detail Syllabus of Professional KnowledgeDocument2 pagesSyllabus For Credit Manager & Senior Credit Manager: Detail Syllabus of Professional KnowledgeSRIJITNo ratings yet

- Brickwork Finance AcademyDocument4 pagesBrickwork Finance AcademyVarun GuptaNo ratings yet

- Banking SyllabusDocument7 pagesBanking SyllabusAnonymous BW3xfMZJ3No ratings yet

- CAIIB Elective Papers Low 032013Document14 pagesCAIIB Elective Papers Low 032013Soumava PaulNo ratings yet

- Indian Banking Sector SyllabusDocument98 pagesIndian Banking Sector SyllabusNikhil JainNo ratings yet

- ALM PPT FinalDocument49 pagesALM PPT FinalNishant SinhaNo ratings yet

- A Research Report For BBS 4th Year 2073Document34 pagesA Research Report For BBS 4th Year 2073Sudhir Yadav100% (1)

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank ManagementAshwin KGNo ratings yet

- CAIIB Syllabus Guide for Banking ExamsDocument19 pagesCAIIB Syllabus Guide for Banking Examsmirhina786No ratings yet

- Unit 1Document39 pagesUnit 1neeshNo ratings yet

- 07 Chapter 1Document72 pages07 Chapter 1Motiram paudelNo ratings yet

- Financial Institutions, Markets and SurveysDocument79 pagesFinancial Institutions, Markets and SurveysTyson KhanNo ratings yet

- Financial Performance of Commercial BanksDocument34 pagesFinancial Performance of Commercial BanksbagyaNo ratings yet

- Financial Performance of Commercial BanksDocument34 pagesFinancial Performance of Commercial BanksbagyaNo ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- Financial Performance of Kumari Bank LimitedDocument24 pagesFinancial Performance of Kumari Bank LimitedAngbuhang Sushil LeembooNo ratings yet

- SLBK604 Credit Mgmt.Document4 pagesSLBK604 Credit Mgmt.Prateek Gupta0% (1)

- Financialmanagementofbanks 151021134204 Lva1 App6892Document41 pagesFinancialmanagementofbanks 151021134204 Lva1 App6892ManavAgarwalNo ratings yet

- UCO Bank performance analysis using CAMELS frameworkDocument69 pagesUCO Bank performance analysis using CAMELS frameworkMilind Singh100% (1)

- Loksewa Sarathi Banking NoteDocument37 pagesLoksewa Sarathi Banking NotePankaj YadavNo ratings yet

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavNo ratings yet

- Commercial Banking Credit Units: 03 Course ObjectivesDocument2 pagesCommercial Banking Credit Units: 03 Course ObjectivesAman DhawanNo ratings yet

- Rishikesh S. Garude': K. G. Joshi College of Arts AND N. G. Bedekar College of Commerce, Thane (W.)Document10 pagesRishikesh S. Garude': K. G. Joshi College of Arts AND N. G. Bedekar College of Commerce, Thane (W.)RishikeshNo ratings yet

- Management of Financial Institutions: DR Surendra Kumar VyasDocument36 pagesManagement of Financial Institutions: DR Surendra Kumar VyasSurendra Kumar VyasNo ratings yet

- Mfi AssignmentDocument5 pagesMfi Assignmentdeepika singhNo ratings yet

- Banking, Evol., Coop BankingDocument30 pagesBanking, Evol., Coop BankingBalakrishnaNo ratings yet

- Indian Financial SystemDocument71 pagesIndian Financial Systemmrinal singhNo ratings yet

- General Awareness and Banking Awareness IBPS PO 2015 Study PlanDocument18 pagesGeneral Awareness and Banking Awareness IBPS PO 2015 Study PlanRajaDurai RamakrishnanNo ratings yet

- Solved Paper FSD-2010Document11 pagesSolved Paper FSD-2010Kiran SoniNo ratings yet

- Mba Finance Syllabus Nagpur UniversityDocument6 pagesMba Finance Syllabus Nagpur UniversityAniketsingh KatreNo ratings yet

- MFI Management and Financial ConceptsDocument15 pagesMFI Management and Financial Conceptsanon_904021637No ratings yet

- Merchant BankingDocument6 pagesMerchant BankingdaogafugNo ratings yet

- Syllabus For BankingDocument15 pagesSyllabus For BankingAnil NamosheNo ratings yet

- SBP Basel IIII Islamia College 29 Dec 2021Document46 pagesSBP Basel IIII Islamia College 29 Dec 2021Abdul HaseebNo ratings yet

- FIM Course Outline and Lesson PlanDocument2 pagesFIM Course Outline and Lesson Plansehrish iqbalNo ratings yet

- ALM Management in Icici BankDocument85 pagesALM Management in Icici BankSrikanth BheemsettiNo ratings yet

- Merchant Banking and Financial ServicesDocument41 pagesMerchant Banking and Financial ServicesSb KarthickNo ratings yet

- Banking Sector Performance and Corporate GovernanceDocument6 pagesBanking Sector Performance and Corporate GovernanceNeeraj MandaiyaNo ratings yet

- BA7026 Banking Financial Services ManagementDocument120 pagesBA7026 Banking Financial Services ManagementchandrasekharNo ratings yet

- Role of branch manager in identifying prospective borrowersDocument3 pagesRole of branch manager in identifying prospective borrowersMd AlimNo ratings yet

- Kedir Mohamed ReDocument51 pagesKedir Mohamed ReBobasa S AhmedNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Shailendra Education Societys Arts Commerce and Science ColleDocument1 pageShailendra Education Societys Arts Commerce and Science CollerupalNo ratings yet

- Science ProjectDocument3 pagesScience ProjectrupalNo ratings yet

- Performa II Enrollment FormDocument1 pagePerforma II Enrollment FormrupalNo ratings yet

- 2 Mumbai UniversityDocument3 pages2 Mumbai UniversityrupalNo ratings yet

- Name: STD: VI Div: Roll No: Date:: Ans:-RAM Stands For Random Access MemoryDocument3 pagesName: STD: VI Div: Roll No: Date:: Ans:-RAM Stands For Random Access MemoryrupalNo ratings yet

- Vol 2 - Issue 3 - Art 12Document14 pagesVol 2 - Issue 3 - Art 12rupalNo ratings yet

- Dhwani ResumeDocument1 pageDhwani ResumerupalNo ratings yet

- College NSS Registration FormDocument2 pagesCollege NSS Registration FormrupalNo ratings yet

- E NominationDocument2 pagesE NominationPrabu cudNo ratings yet

- Citation 268449430Document1 pageCitation 268449430rupalNo ratings yet

- General Knowledge AssignmentDocument5 pagesGeneral Knowledge AssignmentrupalNo ratings yet

- Patient Covid Test ReportDocument1 pagePatient Covid Test ReportrupalNo ratings yet

- Serology Department: Rapid Chromatographic ImmunoassayDocument1 pageSerology Department: Rapid Chromatographic ImmunoassayrupalNo ratings yet

- GST Multiple Choice QuestionsDocument22 pagesGST Multiple Choice QuestionsrupalNo ratings yet

- GST Question BankDocument14 pagesGST Question BankrupalNo ratings yet

- TYBBIDocument4 pagesTYBBIrupalNo ratings yet

- Cfa V Question Bank For InternalDocument2 pagesCfa V Question Bank For InternalrupalNo ratings yet

- Final Project On Credit-Rating-Total 66 PagesDocument66 pagesFinal Project On Credit-Rating-Total 66 PagesrupalNo ratings yet

- Nikhil Project TybmsDocument49 pagesNikhil Project TybmsrupalNo ratings yet

- Social Entrepreneurship: Driving Social ChangeDocument3 pagesSocial Entrepreneurship: Driving Social ChangerupalNo ratings yet

- Science ProjectDocument3 pagesScience ProjectrupalNo ratings yet

- Talent AcquistionDocument14 pagesTalent AcquistionrupalNo ratings yet

- Real Estate ProjectDocument84 pagesReal Estate ProjectrupalNo ratings yet

- Karishma BmsDocument64 pagesKarishma BmsrupalNo ratings yet

- Indian Insurance Industry: A Historical ReviewDocument59 pagesIndian Insurance Industry: A Historical ReviewrupalNo ratings yet

- Customer Satisfaction ICICI BankDocument98 pagesCustomer Satisfaction ICICI BankviveksansonNo ratings yet

- Non Performing Assets in Allahabad BankDocument69 pagesNon Performing Assets in Allahabad BankGotham RamNo ratings yet

- 1541386927184Document3 pages1541386927184rupalNo ratings yet

- If V2 would/wouldn't V1Document2 pagesIf V2 would/wouldn't V1Honey ThinNo ratings yet

- MID TERM Question Paper SETTLEMENT PLANNING - SEC CDocument1 pageMID TERM Question Paper SETTLEMENT PLANNING - SEC CSHASHWAT GUPTANo ratings yet

- Oxford Digital Marketing Programme ProspectusDocument12 pagesOxford Digital Marketing Programme ProspectusLeonard AbellaNo ratings yet

- Biagioli Did Galileo Copy The TelescopeDocument28 pagesBiagioli Did Galileo Copy The TelescopeGregory HooNo ratings yet

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerNo ratings yet

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDocument17 pagesGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanNo ratings yet

- Petty Cash Vouchers:: Accountability Accounted ForDocument3 pagesPetty Cash Vouchers:: Accountability Accounted ForCrizhae OconNo ratings yet

- Acne Treatment Strategies and TherapiesDocument32 pagesAcne Treatment Strategies and TherapiesdokterasadNo ratings yet

- Final Thesis Report YacobDocument114 pagesFinal Thesis Report YacobAddis GetahunNo ratings yet

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47No ratings yet

- Bharhut Stupa Toraa Architectural SplenDocument65 pagesBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNo ratings yet

- 621F Ap4405ccgbDocument8 pages621F Ap4405ccgbAlwinNo ratings yet

- Borello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceDocument10 pagesBorello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceaykutNo ratings yet

- 1.each of The Solids Shown in The Diagram Has The Same MassDocument12 pages1.each of The Solids Shown in The Diagram Has The Same MassrehanNo ratings yet

- Column Array Loudspeaker: Product HighlightsDocument2 pagesColumn Array Loudspeaker: Product HighlightsTricolor GameplayNo ratings yet

- BPL Millipacs 2mm Hardmetrics RarDocument3 pagesBPL Millipacs 2mm Hardmetrics RarGunter BragaNo ratings yet

- GlastonburyDocument4 pagesGlastonburyfatimazahrarahmani02No ratings yet

- Decision Maths 1 AlgorithmsDocument7 pagesDecision Maths 1 AlgorithmsNurul HafiqahNo ratings yet

- Preventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Document21 pagesPreventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Desy Fitriani SarahNo ratings yet

- NAT Order of Operations 82Document39 pagesNAT Order of Operations 82Kike PadillaNo ratings yet

- AFNOR IPTDS BrochureDocument1 pageAFNOR IPTDS Brochurebdiaconu20048672No ratings yet