Professional Documents

Culture Documents

2 Property Description and Location (Item 4)

Uploaded by

Bengi Gregori Mayhuire LeonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Property Description and Location (Item 4)

Uploaded by

Bengi Gregori Mayhuire LeonCopyright:

Available Formats

SRK Consulting (U.S.), Inc.

NI 43-101 Technical Report – Bongará Zinc Project Page 3

2 Property Description and Location (Item 4)

Information in Section 2 of this report is from the 2013 Votorantim report on Bongará Mineral

Resources. Other references are cited as appropriate.

2.1 Property Location

The Bongará Zinc Project (the Project) is a mineral exploration project comprised of sixteen

contiguous mining concessions, covering approximately 12,600 hectares. The concession titles are

in the names of Minera Bongará and Votorantim Metais and are subject to the Minera Bongará joint

venture agreement between Solitario and Votorantim.

The Project is located in the Eastern Cordillera of Peru at the sub-Andean front in the upper Amazon

River Basin. It is within the boundary of the Shipasbamba community, 680km north-northeast of Lima

and and 245 km northeast of Chiclayo, Peru, in the District of Shipasbamba, Bongará Province,

Amazonas Department (Figure 2-1). The Project area can be reached from the coastal city of

Chiclayo by the paved Carretera Marginal road. The central point coordinates of the Project are

approximately 825,248 East and, 9,352,626 North (UTM Zone 17S, Datum WGS 84). Elevation

ranges from 1,800 meters above sea level (masl) to approximately 3,200 masl. The climate is

classified as high altitude tropical jungle in the upper regions of the Amazon basin. The annual

rainfall average exceeds 1 m with up to 2 m in the cloud forest at higher elevations.

BJM/JBP/LE Solitario_BongaraZn_NI43-101_TR_181700 090_012_LAE June 18, 2014

Department Capital Department Boundary

Provincial Capital Provincial Boundary

District Capital District Boundary

Minor Town Exploration Prospect

Asphalt Road Mineral Rights

Graded Road

Airport

River

Bongará Project

Location Map

Technical Report on Resources

<CLIENT LOGO

/NAME> Project Location Map

Job No: 181700.090

Bongará Zinc Project Date: Approved: Figure:

2-1

Source: Votorantim, 2013b 2013 BJM

SRK Consulting (U.S.), Inc.

NI 43-101 Technical Report – Bongará Zinc Project Page 5

2.2 Mineral Titles

The mineral concessions granted by the Peruvian government that comprise the Project land

position (Property) are listed in Table 2.2.1 and shown in Figure 2-2. According to Peruvian law,

concessions may be held indefinitely, subject only to payment of annual fees to the government.

Annual concession fees as required by law are paid annually to the Peruvian government. When this

study was initiated, concession payments were current, with 2013 fees of $98,600 paid on May 31,

2013. Concession fees for 2014 were due for payment by May 31, 2014 in accordance with Table

2.2.1.

Votorantim, as operator of the joint venture company Minera Bongará, has entered into a surface

rights agreement with the local community of Shipasbamba which controls the surface rights of the

Project. This agreement provides for an annual payments and funding for mutually agreed upon

social development programs in return for the right to perform exploration work including road

building and drilling. From time to time, Votorantim also enters into surface rights agreements with

individual private landowners within the community to provide access for exploration work.

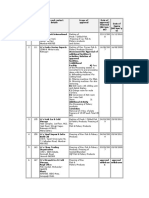

Table 2.2.1: List of Mineral Claims

2014 Holding

Concession Name Number Claim Date Hectares Fees (US$) District Province Department

BONGARA

CINCUENTICINCO 10233396 8/7/1996 1000 $23,000.00 SHIPASBAMBA BONGARA AMAZONAS

BONGARA

CINCUENTICUATRO 10233296 8/7/1996 600 $13,800.00 SHIPASBAMBA BONGARA AMAZONAS

BONGARA

VEINTISIETE 10783595 6/26/1995 300 $6,900.00 SHIPASBAMBA BONGARA AMAZONAS

DEL PIERO CINCO 10000306 1/3/2006 1000 $9,000.00 SHIPASBAMBA BONGARA AMAZONAS

DEL PIERO CUATRO 10000206 1/3/2006 500 $4,500.00 SHIPASBAMBA BONGARA AMAZONAS

DEL PIERO DOS 10338405 11/2/2005 600 $5,400.00 FLORIDA BONGARA AMAZONAS

DEL PIERO SEIS 10204507 3/26/2007 1000 $9,000.00 CAJARURO UTCUBAMBA AMAZONAS

DEL PIERO TRES 10338605 11/2/2005 700 $6,300.00 SHIPASBAMBA BONGARA AMAZONAS

DEL PIERO UNO 10338505 11/2/2005 1000 $9,000.00 FLORIDA BONGARA AMAZONAS

VM 42 10190507 3/21/2007 1000 $9,000.00 SHIPASBAMBA BONGARA AMAZONAS

VM 74 10193707 3/21/2007 1000 $9,000.00 SHIPASBAMBA BONGARA AMAZONAS

VM 75 10193807 3/21/2007 1000 $9,000.00 SHIPASBAMBA BONGARA AMAZONAS

VM 94 10045708 1/28/2008 900 $2,700.00 FLORIDA BONGARA AMAZONAS

VM 95 10045808 1/28/2008 500 $1,500.00 FLORIDA BONGARA AMAZONAS

VM 97 10046008 1/28/2008 1000 $3,000.00 SHIPASBAMBA BONGARA AMAZONAS

VM 98 10046108 1/28/2008 500 $1,500.00 SHIPASBAMBA BONGARA AMAZONAS

TOTAL 12600 $122,600.00

BJM/JBP/LE Solitario_BongaraZn_NI43-101_TR_181700 090_012_LAE June 18, 2014

Zinc-Lead-Silver Resource

Technical Report on Resources

<CLIENT LOGO

/NAME> Map of Mineral Claims

Job No: 181700.090

Bongará Zinc Project Date: Approved: Figure:

2-2

Source: Solitario, modified by SRK, 2014 2014 BJM

SRK Consulting (U.S.), Inc.

NI 43-101 Technical Report – Bongará Zinc Project Page 7

2.2.1 Nature and Extent of Issuer’s Interest

The Project is controlled by Minera Bongará S.A., a subsidiary of Solitario, and is subject to a joint

venture agreement with Votorantim since 2006.

On August 15, 2006, an Agreement Letter was signed between Solitario, Minera Bongará (a wholly

owned subsidiary of Solitario) and Votorantim. The Letter defined the commitment of Votorantim to

fund U.S. $ 1.0 MM in an annual mineral exploration program, which began in late October 2006.

On March 24, 2007, a definitive agreement superseding the Letter Agreement was signed between

the Companies. This definitive agreement (Agreement) provides that the project interest owned by

Votorantim and Solitario will be held through the ownership of shares in the joint operating company

Minera Bongará, which controls 100% of the mineral rights and assets of the project.

Solitario currently owns 100% of the shareholding interest in Minera Bongará. Votorantim can earn

up to 70% in the joint operating company through the funding of an initial $1.0M exploration program

(completed), by funding annual exploration and development expenditures and by making cash

payments of $100,000 on August 15, 2007 (completed) and $200,000 on subsequent anniversaries

of that date. Votorantim is the operator of the Project and is responsible for keeping the property in

good standing. The option to earn 70% interest can be exercised by Votorantim at any time by

pledging to start the project's production based on a completed feasibility study. Votorantim has

further agreed to finance Solitario's 30% participating interest to production through a loan facility

from Votorantim to Solitario. Solitario will repay this loan from 50% of Solitario's cash flow

distributions from the joint operating company.

2.2.2 Property and Title in Peru

Mining in Peru is governed by the General Mining Law, which specifies that all mineral assets belong

to the federal government. Mining concessions granted to individuals or other entities authorize the

title holder to perform all minerals related activates from exploration to exploitation and, once titled,

are irrevocable for so long as the fees are paid to the federal government on time. A provisional

claim is applied for and title is granted if no other claim exists over the same area. A claim can only

be granted in multiples of a quadricula, which is a 100 hectare plot, up to a maximum size of 1000

hectares. No monumentation of the claim boundary in the field is necessary.

Annually a payment of US$ 3.00 per hectare ($1.00 for a “small miner”) must be made by the end of

June to the Ministry of Energy and Mines (MEM) or the claim is automatically forfeited. Any claim not

in commercial production exceeding a pro-rated average of $100 per hectare for any year after the

sixth anniversary incurs a penalty payment of US$ 6.00 added to the annual payment. If, by the 12

th

anniversary, commercial production has not been achieved then the penalty increases to US$ 20.00.

The penalties are waived if the title holder shows that investments for each claim exceed ten times

the value of the penalty for any given year.

Concessions are real assets and are subject to laws of private property. Foreign entities have the

same rights as Peruvians to hold claims except for a zone within 50 km of international borders. Title

holders have a right of access and development of minerals but an agreement is required with

private property surface rights owners and formalized “Communities”. To ratify an agreement with a

Community a majority of all members must vote in favor of the agreement as written. A recently

issued law (as modified) also requires formal consultation with indigenous tribes in certain areas.

BJM/JBP/LE Solitario_BongaraZn_NI43-101_TR_181700 090_012_LAE June 18, 2014

SRK Consulting (U.S.), Inc.

NI 43-101 Technical Report – Bongará Zinc Project Page 8

2.3 Royalties, Agreements and Encumbrances

Peru imposes a sliding scale net smelter return royalty (NSR) on all precious and base metal

production of 1% on all gross proceeds from production up to $60,000,000, a 2% NSR on proceeds

between $60,000,000 and $120,000,000 and a 3% NSR on proceeds in excess of $120,000,000. No

other royalty encumbrances exist for the Project.

Corporate income tax in Peru is charged at a flat rate of 30%. However, mining companies must also

pay an additional tax varying from 2 to 8.4% of net operating profit.

2.4 Environmental Liabilities and Permitting

Environmental permits for mineral exploration programs are divided into two classes. Class I permits

allow construction and drilling for up to 20 platforms with a maximum disturbance of 10 hectares. A

Class II permit provides for more than 20 drill locations or for a disturbance area of greater than 10

hectares.

Class I permits require little more than a notification process for approval. Class II drilling permits

require an environmental impact declaration (DIA), a permit for harvesting trees (if applicable), an

archeological survey report (CIRA), a water use permit (ALA) and a Closure Plan.

Permitting requirements for mining include an Estudio de Impacto Ambiental (EIA) that describes in

detail the mining plan and evaluates the impacts of the plan on environmental and social attributes of

the property. Baseline studies include air quality, surface and groundwater quality, flora and fauna

surveys, archeological surveys and a study of the social conditions of the immediate property and an

area of interest that includes local communities. Public meetings are required in order that local

community members can learn about and comment on the proposed operation.

Many of the baseline studies required for mining have been completed by Votorantim.

2.4.1 Required Permits and Status

Votorantim has filed applications for and received Class II permits for various phases of the Project

and has filed and received the required associated permits. The Project is in compliance with all

permitting requirements necessary for undertaking planned activities relating to exploration.

Specific authorizations, permits and licenses required for future mining include:

EIA (as modified during the mine life);

Mine Closure Plan and Final Mine Closure Plan within two years of end of operation;

Certificate of Nonexistence of Archaeological Remains;

Water Use License (groundwater and/or surface water);

Water construction authorization;

Sewage authorization;

Drinking water treatment facility license;

Explosives use license and explosives storage licenses;

Controlled chemicals certificate;

Beneficiation concession;

Mining authorization;

Closure bonding; and

Environmental Management Plan approval.

BJM/JBP/LE Solitario_BongaraZn_NI43-101_TR_181700 090_012_LAE June 18, 2014

SRK Consulting (U.S.), Inc.

NI 43-101 Technical Report – Bongará Zinc Project Page 9

2.5 Other Significant Factors and Risks

There are no known significant factors or risks affecting the current status of the Project that are not

discussed herein.

BJM/JBP/LE Solitario_BongaraZn_NI43-101_TR_181700 090_012_LAE June 18, 2014

You might also like

- SBA 7a Loan Guaranty ProgramDocument37 pagesSBA 7a Loan Guaranty Programed_nycNo ratings yet

- Blossomvale TransactionDocument14 pagesBlossomvale TransactionSGYong14No ratings yet

- The Dao of Corporate Finance, Q Ratios, and Stock Market Crashes, by Mark SpitznagelDocument11 pagesThe Dao of Corporate Finance, Q Ratios, and Stock Market Crashes, by Mark Spitznagelxyz321321321100% (2)

- Five-Forces Analysis For CSD Cola Wars CDocument2 pagesFive-Forces Analysis For CSD Cola Wars CasheNo ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- PMRB Meeting Minutes JUne 27, 2013Document6 pagesPMRB Meeting Minutes JUne 27, 2013Aiyah Angchangco Oliver PalarNo ratings yet

- 2022 StatementsDocument43 pages2022 StatementssachinNo ratings yet

- Chapter 8 Financial Liability - Notes PayableDocument35 pagesChapter 8 Financial Liability - Notes Payablewala akong pake sayoNo ratings yet

- Brgy Ordinance 04-2022 - Amendment of Tax OrdinanceDocument4 pagesBrgy Ordinance 04-2022 - Amendment of Tax OrdinanceWest Crame100% (3)

- KPMG Report On Direct-Selling PDFDocument94 pagesKPMG Report On Direct-Selling PDFRahul Gupta100% (2)

- Report-Reconnection of Detached Mooring Buoy 4 (641Document6 pagesReport-Reconnection of Detached Mooring Buoy 4 (641Earl Justin EnriqueNo ratings yet

- ACTA DE TRABAJO BOLIVAR 11 03 2023-Signed-SignedDocument2 pagesACTA DE TRABAJO BOLIVAR 11 03 2023-Signed-SignedSergio CamachoNo ratings yet

- JDVC Public Hearing ESP EnglishDocument25 pagesJDVC Public Hearing ESP EnglishPrecious GenevineNo ratings yet

- Aip-2018 FinalDocument134 pagesAip-2018 FinalJustin RuzzelNo ratings yet

- Presentation MiningDocument7 pagesPresentation MiningVince PaulNo ratings yet

- Infra Structure ProjectDocument11 pagesInfra Structure Projectsairam046No ratings yet

- Notice Mine'sDocument1 pageNotice Mine'saryannetNo ratings yet

- SB 2 2019 BPF2Document7 pagesSB 2 2019 BPF2John Lee PerezNo ratings yet

- Repair Order: RO No.:RO002740 Icon Equipment Solutions Philippines, IncDocument2 pagesRepair Order: RO No.:RO002740 Icon Equipment Solutions Philippines, IncMark EsguerraNo ratings yet

- Mineral Sharing Agreement ApplicationsDocument64 pagesMineral Sharing Agreement ApplicationsMhareen Rose LlavadoNo ratings yet

- SAPA Presentation - 8-31-18Document34 pagesSAPA Presentation - 8-31-18Roi AlcaideNo ratings yet

- Villa Martia: Project Information LocationDocument10 pagesVilla Martia: Project Information LocationSGYong14No ratings yet

- Resolution (12) - Trash Traps (Candaba)Document5 pagesResolution (12) - Trash Traps (Candaba)PENRO PampangaNo ratings yet

- FY 2019 STATUS OF CONTRACTS Region 4b PDFDocument70 pagesFY 2019 STATUS OF CONTRACTS Region 4b PDFErlan Selva SottoNo ratings yet

- 2020 Development FundDocument91 pages2020 Development FundIvoneZarahDingleAbaoNo ratings yet

- SCIC - Hydro and Tunneling RecordsDocument1 pageSCIC - Hydro and Tunneling RecordsTonny SuakNo ratings yet

- Jeep Rental Summary January 9-13, 2023Document1 pageJeep Rental Summary January 9-13, 2023josselNo ratings yet

- 1 Small Water Impounding Project (SWIP)Document3 pages1 Small Water Impounding Project (SWIP)Russel Renz de MesaNo ratings yet

- Jeep Rental Summary January 4-8, 2023Document1 pageJeep Rental Summary January 4-8, 2023josselNo ratings yet

- 2019inds Ms72 PDFDocument2 pages2019inds Ms72 PDFHemanthKumarNo ratings yet

- Sand Rate GODocument2 pagesSand Rate GOABDUL MATEEN MdNo ratings yet

- Agenda: Notice and Call of Special Meeting of The Lakeport City CouncilDocument5 pagesAgenda: Notice and Call of Special Meeting of The Lakeport City CouncilLakeCoNewsNo ratings yet

- Inspection Report MamsarDocument4 pagesInspection Report MamsarKim MoritNo ratings yet

- RDO No. 22 - Baler, AuroraDocument107 pagesRDO No. 22 - Baler, AuroraRon Catalan100% (1)

- Topsheet of Recon Latest Nov 15 PMDocument317 pagesTopsheet of Recon Latest Nov 15 PM[AP-STUDENT] Ina Rose LaquiNo ratings yet

- Trade Support Agreement Proposal: Uni-Care Hygienic Products, IncDocument5 pagesTrade Support Agreement Proposal: Uni-Care Hygienic Products, Incarvin quiazonNo ratings yet

- 919020013783113Document1 page919020013783113Ankur SharmaNo ratings yet

- 1 Ministério Do Desenvolvimento Agrário: ISSN 1677-7042Document1 page1 Ministério Do Desenvolvimento Agrário: ISSN 1677-7042Paulo Cesar JuniorNo ratings yet

- Document No 8Document2 pagesDocument No 8sscc 1521No ratings yet

- RC Enterprise: Computer Desktop Repair/ Parts SalesDocument1 pageRC Enterprise: Computer Desktop Repair/ Parts SalesJheuz DumaopNo ratings yet

- CBA-CSBO - RevDocument16 pagesCBA-CSBO - RevRonaldo SacoNo ratings yet

- SIMONE Transparency Board-MarchDocument2 pagesSIMONE Transparency Board-Marchjack macabatalNo ratings yet

- Contract Agreement: Department of Public Works and Highways Office of The District EngineerDocument5 pagesContract Agreement: Department of Public Works and Highways Office of The District EngineerRyanCallejaNo ratings yet

- Resolution (11) - Trash Traps (Guagua)Document5 pagesResolution (11) - Trash Traps (Guagua)PENRO PampangaNo ratings yet

- NDDC BudgetDocument431 pagesNDDC BudgetAkpevweoghene Kelvin IdogunNo ratings yet

- RDO No. 21A - North PampangaDocument509 pagesRDO No. 21A - North PampangaMenchie GordyNo ratings yet

- INSPECTION-REPORT-OF-RIVER-CHANNEL-IN-BRGY Ponong in Magarao, Camarines SurDocument3 pagesINSPECTION-REPORT-OF-RIVER-CHANNEL-IN-BRGY Ponong in Magarao, Camarines SurBerp OnrubiaNo ratings yet

- Bridge Cbuk 1693Document13 pagesBridge Cbuk 1693dulanbackup1No ratings yet

- Rute Planning May 2023Document515 pagesRute Planning May 2023Naufal NabilNo ratings yet

- VRV Bill Ra1Document1 pageVRV Bill Ra1G.MurtazaNo ratings yet

- Resolution (10) - Trash Traps (Sasmuan)Document5 pagesResolution (10) - Trash Traps (Sasmuan)PENRO PampangaNo ratings yet

- 3UUP - REP - O&M-Rep-2019 - 05Document16 pages3UUP - REP - O&M-Rep-2019 - 05David SabaflyNo ratings yet

- GyM K CC3 178 M Sign EditableDocument1 pageGyM K CC3 178 M Sign EditableJesus Huaylla RojasNo ratings yet

- R13 MineralProductionByContractorOperatorDocument10 pagesR13 MineralProductionByContractorOperatorhanch20006No ratings yet

- Ericsson PO 4528864146 - 151 - Ambulgama Dialog - CM0368Document2 pagesEricsson PO 4528864146 - 151 - Ambulgama Dialog - CM0368Madhushan SilvaNo ratings yet

- AIP Economic ServicesDocument1 pageAIP Economic ServicessangguniangkabataanbrgycaghaloNo ratings yet

- EU Approved Units EIA - MaharashtraDocument7 pagesEU Approved Units EIA - MaharashtragibinkumarNo ratings yet

- July 31Document246 pagesJuly 31Angie BitesNo ratings yet

- Overtime Order Bantay Dagat Sa BrgyDocument1 pageOvertime Order Bantay Dagat Sa BrgyMaRo PimentelNo ratings yet

- DGS - Real Estate Inventory 2011-04-08-06-00-31Document553 pagesDGS - Real Estate Inventory 2011-04-08-06-00-31Tim A TellerNo ratings yet

- Mag2 Construction Materials Price Data 082620Document45 pagesMag2 Construction Materials Price Data 082620ForceNo ratings yet

- Offshore Site SelectionDocument50 pagesOffshore Site SelectionRaprap DorilagNo ratings yet

- Special AppropriationsDocument8 pagesSpecial AppropriationsCharles D. FloresNo ratings yet

- 17-012 IFC-Drawings 02-18 - DiffDocument25 pages17-012 IFC-Drawings 02-18 - DiffMatthew KarabelaNo ratings yet

- Repair Order: RO No.:RO003019 Icon Equipment Solutions Philippines, IncDocument2 pagesRepair Order: RO No.:RO003019 Icon Equipment Solutions Philippines, IncMark EsguerraNo ratings yet

- Confronting Drought in Africa's Drylands: Opportunities for Enhancing ResilienceFrom EverandConfronting Drought in Africa's Drylands: Opportunities for Enhancing ResilienceNo ratings yet

- 2015 BCom Hons 2015 SemSysSyllabus 030615Document38 pages2015 BCom Hons 2015 SemSysSyllabus 030615kalpesh deora100% (2)

- Supply Chain Drivers and Obstacles: © 2007 Pearson EducationDocument10 pagesSupply Chain Drivers and Obstacles: © 2007 Pearson Educationrks32No ratings yet

- Trading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266Document4 pagesTrading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266ngNo ratings yet

- CA Refresher For LIC AAODocument70 pagesCA Refresher For LIC AAOBibhuti bhusan maharanaNo ratings yet

- Beryl A Howell Financial Disclosure Report For Howell, Beryl ADocument22 pagesBeryl A Howell Financial Disclosure Report For Howell, Beryl AJudicial Watch, Inc.No ratings yet

- Consultant Invoice: FHI 360. Menara Salemba 3rd Floor, Jl. Salemba Raya No.5 Jakarta Pusat 10440 Indonesia OtherDocument2 pagesConsultant Invoice: FHI 360. Menara Salemba 3rd Floor, Jl. Salemba Raya No.5 Jakarta Pusat 10440 Indonesia OtherMunazar SaifannurNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- Equity Fincing RiskDocument62 pagesEquity Fincing RiskBrian HughesNo ratings yet

- 7110 s18 QP 23Document24 pages7110 s18 QP 23Shahzaib ShahbazNo ratings yet

- GF 617 Globalisation of ServicesDocument4 pagesGF 617 Globalisation of ServicesTowardinho14No ratings yet

- Goods and Service Tax: Without Input CreditDocument44 pagesGoods and Service Tax: Without Input CreditpranjalNo ratings yet

- Microeconomics Assignment 2Document4 pagesMicroeconomics Assignment 2Stremio HubNo ratings yet

- Logistics Management PJT GLS VS VRJDocument20 pagesLogistics Management PJT GLS VS VRJSHABNAMH HASANNo ratings yet

- Exide Life New Fulfilling LifeDocument11 pagesExide Life New Fulfilling LifeJagadish JDNo ratings yet

- 2025 Clean From Waste-DikonversiDocument4 pages2025 Clean From Waste-DikonversiEnzela SidaurukNo ratings yet

- YouGov International FMCG Report 2021Document58 pagesYouGov International FMCG Report 2021zoya shahidNo ratings yet

- TREIT Circular 2010Document110 pagesTREIT Circular 2010sladurantayeNo ratings yet

- LankaBangla Annual Integrated Report 2019Document392 pagesLankaBangla Annual Integrated Report 2019Afia Nazmul 1813081630No ratings yet

- Course Outline - Insurance Risk Management - SumiDocument8 pagesCourse Outline - Insurance Risk Management - SumiTazrin RashidNo ratings yet

- R 1 F R 1 F P: ExamplesDocument4 pagesR 1 F R 1 F P: ExamplesXander Christian RaymundoNo ratings yet

- Current Sanitation Practices in The Philippines (Final)Document7 pagesCurrent Sanitation Practices in The Philippines (Final)Mara Benzon-BarrientosNo ratings yet

- Week7 Afar06Document11 pagesWeek7 Afar06Hermz ComzNo ratings yet

- Nadine Brown Resume 500Document1 pageNadine Brown Resume 500Randy MakoNo ratings yet