Professional Documents

Culture Documents

Budget 2006 proposals impacting corporates

Uploaded by

SURYA SOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 2006 proposals impacting corporates

Uploaded by

SURYA SCopyright:

Available Formats

affecting corporates and business entities

3 March 2006

Chartered accountants B K Vatsaraj and Mayur Kishnadwala explain the changes

in the corporate tax proposals in the Budget proposals for 2006-07.

Fringe Benefit Tax (FBT):

The following amendments have been made:

At present, FBT is levied on the entire contribution to an approved superannuation

fund made by the employer for employees. Effective Assessment Year (AY) 2007-

08, employer's contribution to the said fund in excess of Rs100,000 per employee

per year would be liable to FBT.

Under the existing provisions, expenditure on distribution of samples in any industry by

the employer is considered as "sales promotion including publicity" and liable to

FBT. As per the amendment, now, expenditure on distribution of free samples of

medicines or of medical equipments to doctors. It may be noted that this

concession is available only to pharmaceutical companies.

Also, payments to any person of repute (not defined !) i.e. a brand ambassador for

promoting the sale of goods and services of the employer will not be liable to

FBT.

Now, expenditure incurred by the employer on an employee's to and fro journey

between the residence and office, free or subsidised transport or transport

allowance, for that purpose is not liable to FBT

Fringe benefits attributable to the employee, on the expenditure incurred by the

employer on tours and travels (including foreign travel), will now be considered

at five per cent instead of 20 per cent earlier. However, the benefit attributable to

conveyance expenses will continue to be 20 per cent.

It is now proposed that if the employer is in the airlines or shipping business

carrying goods or passengers, then the value of fringe benefit attributable to the

employees has been brought down from 20 per cent to five per cent of the

expenditure incurred by the employer on providing such hospitality whether for

food or beverages or in any other manner or use of hotel, boarding and lodging

facilities

Minimum Alternate Tax (MAT) on companies - section 115JB:

Some far reaching changes have been made in this tax, effective A Y 2007-08, as under:

The MAT rate has been enhanced from the present 7.5 per cent to 10 per cent

Earlier, MAT was not chargeable on incomes exempt u/s 10. However, wherever

applicable, it will now be payable on LTCG on securities exempt u/s 10(38).

Correspondingly, expenses incurred to earn such income will now be deductible

for MAT purposes.

Let it be noted that income tax is still not payable on the above LTCG under the normal

provisions of Income tax.

The period for availing the MAT credit has been enhanced from the present five

years to seven years - section 115JAA. The credit so allowed will also be

considered while calculating interest u/s 234A, 234B and 234C, which is a relief

to the assessee.

The normal book depreciation will only be allowed as deduction in calculation of

MAT liability; any excess depreciation charged in accounts due to revaluation of

fixed assets is to be ignored.

Withdrawal of section 10(23G):

The main activity of an infrastructure capital company or infrastructure capital fund is to

make investments in companies carrying on the business of:

developing, maintaining, operating etc. various infrastructure projects defined in

section 80IA(4),

developing special economic zones (SEZ) - 80IAB

developing and building housing projects u/s 80IB(10)

constructing certain specified hotels 80IB(7) or specified hospitals 80IB(11A)

Incomes (dividends, interest on loans advanced and long term capital gains on shares)

received by such infrastructure capital company / fund were exempt from tax u/s

10(23G). Section 10(23G) is now proposed to be deleted effective AY 2007-08.

The implication of this amendment is that, the interest earned and long-term capital gains

(LTCG) on shares on which the securities transaction tax (STT) is not paid, will now be

taxable; of course the dividend received and LTCG on which STT is paid continue to be

exempt u/s 10(33) and 10(38) respectively.

Conversion on interest payable to loan:

Section 43B allows deduction of certain expenses on "payment" basis. A loophole has

been retrospectively plugged whereby, if any interest payable, on borrowing from any

public financial institution or a state financial corporation or a state industrial investment

corporation or a scheduled bank, is converted into a loan, then it cannot be argued that

such interest is deemed to have been paid and hence deduction u/s 43B should be

allowed.

Common expenses that cannot be allocated:

Section 14A provides that deduction will not be allowed of expenses incurred for earning

exempt income. There has been considerable dispute regarding allocation of common

expenses incurred for earning taxable as well as exempt income. The amendment,

effective A Y 2007-08, provides that in all such cases, the income tax assessing officer (A

O) shall mandatorily follow the method prescribed and allocate the expenses.

Withdrawal of exemption to co-operative banks:

Section 80P grants tax benefits to co-operative banks and co-operative societies engaged

in certain specified business activities. As the co-operative banks function on par with

other commercial banks who do not enjoy such exemption, this exemption is withdrawn

effective A Y2007-08

Tax paid in foreign country on international operations:

An assessee having international operations might have paid taxes abroad on incomes

earned there. In certain cases, such taxes paid are allowed to be adjusted / set off against

its Indian tax liability. The taxes so paid will also be considered while calculating interest

u/s 234A, 234B and 234C, which is a relief to the assessee.

However, section 40(a) (ii), effective A Y 2006-07 now provides that in such cases, the

foreign taxes paid will not be allowed as expense in computing its business income as it

results in double benefit.

Transfer pricing:

The provisions of transfer pricing, u/s 92C, relate to computation of arms length price

(ALP) under the most appropriate method, which can be recomputed by the transfer

pricing officer (TPO) at the time of assessment under certain conditions.

On such recomputation, the Total income of the assessee may be enhanced. Presently, the

law provides that in cases of such enhancement, no additional deduction under chapter

VIA (re. deductions from gross total income) or section 10A or 10B, regarding profits on

exports, will be allowed. This restriction has now been rationally made applicable,

effective A Y 2007-08, to assesses claiming deduction u/s 10AA (SEZ units) also.

Extension of time limits:

U/s 80IA(4)(iv), the deduction to power generating, distribution etc. company was

available only if it started its activity on or before 31.3.2006; this limit has been extended

to March 31,.2010

Similarly, u/s 80IA(4)(iii), deduction to an undertaking developing, maintaining,

operating etc. an industrial park or SEZ was available if the activity started before March

31,.2006; this limit has been extended to March 31,.2009

You might also like

- Partnership Agreement SummaryDocument2 pagesPartnership Agreement SummaryJohn EfendiNo ratings yet

- Aswath Damodaran - Valuation of SynergyDocument60 pagesAswath Damodaran - Valuation of SynergyIvaNo ratings yet

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- Adv Fa I CH 1Document30 pagesAdv Fa I CH 1Addi Såïñt GeorgeNo ratings yet

- BIR Rulings Compilation On Income TaxationDocument36 pagesBIR Rulings Compilation On Income Taxationvelasquez0731No ratings yet

- Implications of Past Stock Returns on Market EfficiencyDocument10 pagesImplications of Past Stock Returns on Market EfficiencyRB ChannaNo ratings yet

- Changes Affecting Corporates and BusinesDocument3 pagesChanges Affecting Corporates and BusinesSURYA SNo ratings yet

- BudgetDocument5 pagesBudgetvismay_soodNo ratings yet

- Practical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsDocument13 pagesPractical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsSanath FernandoNo ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamsshrutishindeNo ratings yet

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- Nigeria _ Highlights of Finance Act 2021 _ EY - GlobalDocument16 pagesNigeria _ Highlights of Finance Act 2021 _ EY - GlobalAyodeji BabatundeNo ratings yet

- GratuatyDocument10 pagesGratuatymurugesh_mbahitNo ratings yet

- Self-reliant India Direct Tax at a glanceDocument15 pagesSelf-reliant India Direct Tax at a glanceVi KiNo ratings yet

- IND As Note Implications For Companies in India FinalDocument6 pagesIND As Note Implications For Companies in India FinalRavNeet KaUrNo ratings yet

- So Just What Is Fringe Benefit Tax?Document5 pagesSo Just What Is Fringe Benefit Tax?jasrajaNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Taxation Law Project Provides Insights Into Fringe Benefits TaxDocument16 pagesTaxation Law Project Provides Insights Into Fringe Benefits TaxRakshit JoshiNo ratings yet

- Tax Watch Bulletin Tax Amendment Bills 2023Document22 pagesTax Watch Bulletin Tax Amendment Bills 2023BonnieNo ratings yet

- Union Budget 2012-Income TaxDocument21 pagesUnion Budget 2012-Income TaxFinquity IndiaNo ratings yet

- Major Changes to Income Tax and Wealth Tax in Budget 2009-2010Document9 pagesMajor Changes to Income Tax and Wealth Tax in Budget 2009-2010Irfan AhmadNo ratings yet

- Revenue Regulations (RR) No 10-08Document0 pagesRevenue Regulations (RR) No 10-08sj_adenipNo ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- 44 AdDocument12 pages44 AdbhushanNo ratings yet

- When Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Document6 pagesWhen Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Biswabandhu PalNo ratings yet

- Tax Memorandum 2011finalDocument42 pagesTax Memorandum 2011finalbazitNo ratings yet

- P6MYS AnsDocument12 pagesP6MYS AnsLi HYu ClfEiNo ratings yet

- FAQ On Budget FY 2020-21Document9 pagesFAQ On Budget FY 2020-21GUNANo ratings yet

- Elective Ourse in Commerce ECO-11 Elements of Income TaxDocument12 pagesElective Ourse in Commerce ECO-11 Elements of Income TaxJai GorakhNo ratings yet

- Direct Taxes Code 2010Document14 pagesDirect Taxes Code 2010musti_shahNo ratings yet

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDocument6 pagesWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapNo ratings yet

- Revenue Regulation NoDocument38 pagesRevenue Regulation NolalararafafaNo ratings yet

- Mat - PPT FinalDocument18 pagesMat - PPT FinalAkash PatelNo ratings yet

- Casino Jackpot Accounting TreatmentDocument14 pagesCasino Jackpot Accounting Treatmentkenjames007No ratings yet

- Latest NRB CircularsDocument20 pagesLatest NRB CircularsNista ShresthaNo ratings yet

- Using Relevant Examples Discuss The Importance of Board of Governors in An Institution of LearningDocument10 pagesUsing Relevant Examples Discuss The Importance of Board of Governors in An Institution of Learningivanongia2000No ratings yet

- Presumptive - Taxation BriefDocument8 pagesPresumptive - Taxation BriefStephan KJNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- The Income Tax ActDocument15 pagesThe Income Tax ActfbuameNo ratings yet

- 80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensDocument1 page80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensArjun VermaNo ratings yet

- Delloite CIT (A) PDFDocument7 pagesDelloite CIT (A) PDFshashi vermaNo ratings yet

- Salient Features For The Budget 2010-11Document11 pagesSalient Features For The Budget 2010-11kaashifhassanNo ratings yet

- Budget 2010 in Small Scale IndustriesDocument9 pagesBudget 2010 in Small Scale Industriesurz_spiderman2630No ratings yet

- Federal Budget 2020-21Document7 pagesFederal Budget 2020-21yiang.tranNo ratings yet

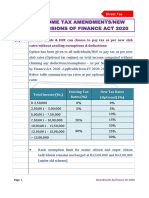

- Income Tax Amendments/New Provisions of Finance Act 2020Document46 pagesIncome Tax Amendments/New Provisions of Finance Act 2020shubhamworkNo ratings yet

- Budget 2020-21 PointersDocument19 pagesBudget 2020-21 PointersJaved MushtaqNo ratings yet

- RMC 59-08 (Mcit) PDFDocument8 pagesRMC 59-08 (Mcit) PDFAnonymous DpHYeqzbp1No ratings yet

- One Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Document6 pagesOne Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Ramasayi Gummadi100% (1)

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Budget 2013 - 2014Document11 pagesBudget 2013 - 2014sdfdhgtj894No ratings yet

- Union Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation MattersDocument29 pagesUnion Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation Mattersnikhilsawant93No ratings yet

- T3 EmployeeDocument4 pagesT3 EmployeeLe YenNo ratings yet

- Salient Features Income Tax)Document5 pagesSalient Features Income Tax)bbaahmad89No ratings yet

- IAS19 (Employee Benefits) SummaryDocument5 pagesIAS19 (Employee Benefits) Summaryfebzz88No ratings yet

- Proposals Related To Personal Taxation: Union Budget 2020Document2 pagesProposals Related To Personal Taxation: Union Budget 2020Vaibhav BajpaiNo ratings yet

- May 2018 SGV SDGSDDocument26 pagesMay 2018 SGV SDGSDBien Bowie A. CortezNo ratings yet

- Interpretations Rulings Book - Set IDocument55 pagesInterpretations Rulings Book - Set IAudithya KahawattaNo ratings yet

- Adv. Accountancy Paper-3Document22 pagesAdv. Accountancy Paper-3Avadhut PaymalleNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- Deloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedDocument4 pagesDeloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedSunil GidwaniNo ratings yet

- Surgery SOPDocument179 pagesSurgery SOPSURYA SNo ratings yet

- 11 Shivam Modules Product SaleDocument4 pages11 Shivam Modules Product SaleSURYA SNo ratings yet

- Vendorisation of QC Process - RFIDocument10 pagesVendorisation of QC Process - RFISURYA SNo ratings yet

- TPS 900 SpecsDocument1 pageTPS 900 SpecsSURYA SNo ratings yet

- Foreign Contribution-FDocument10 pagesForeign Contribution-FSURYA SNo ratings yet

- TNIFMC Building Proposal AnalysisDocument44 pagesTNIFMC Building Proposal AnalysisSURYA SNo ratings yet

- Req For Business ProfileDocument3 pagesReq For Business ProfileSURYA SNo ratings yet

- Chap 003Document58 pagesChap 003islampakistan100% (1)

- It Staffing ContDocument5 pagesIt Staffing ContSURYA SNo ratings yet

- RMO RequiredDocument1 pageRMO RequiredSURYA SNo ratings yet

- Channel Offer Devices 160920Document2 pagesChannel Offer Devices 160920SURYA SNo ratings yet

- SOP PresentDocument9 pagesSOP PresentSURYA SNo ratings yet

- Micro Finance Audited Financial StatementDocument20 pagesMicro Finance Audited Financial StatementSURYA SNo ratings yet

- Tiploa LMD Fim 1904 010 1Document2 pagesTiploa LMD Fim 1904 010 1SURYA SNo ratings yet

- Service Agreement SummaryDocument16 pagesService Agreement SummarySURYA SNo ratings yet

- Agreement For ATM Only 2.16 (1) 6.39 P.M 01.06.2020Document14 pagesAgreement For ATM Only 2.16 (1) 6.39 P.M 01.06.2020SURYA SNo ratings yet

- Agreement For ATM Only 2.16 01.06.2020Document13 pagesAgreement For ATM Only 2.16 01.06.2020SURYA SNo ratings yet

- Agreement WLATMDocument10 pagesAgreement WLATMSURYA SNo ratings yet

- TSCL - Balance SheetDocument52 pagesTSCL - Balance SheetSURYA SNo ratings yet

- Draft LLP AgreementDocument7 pagesDraft LLP AgreementSURYA SNo ratings yet

- CARO and General Udit Report For All PVT CosDocument5 pagesCARO and General Udit Report For All PVT CosSURYA SNo ratings yet

- (I) All Developments, Redevelopments, Erection or Re-Erection, Design, Construction or Reconstruction and Additions and Alterations To A BuildingDocument11 pages(I) All Developments, Redevelopments, Erection or Re-Erection, Design, Construction or Reconstruction and Additions and Alterations To A BuildingadvocacyindyaNo ratings yet

- Norms On Eligibilityempanelment 4.1.2016Document3 pagesNorms On Eligibilityempanelment 4.1.2016SURYA SNo ratings yet

- HFCs (NHB) - Directions 2010Document78 pagesHFCs (NHB) - Directions 2010SURYA SNo ratings yet

- Audit Report With CARO For PVT LTDDocument5 pagesAudit Report With CARO For PVT LTDSURYA SNo ratings yet

- DurgaDocument30 pagesDurgaGanesan MurusamyNo ratings yet

- Companies Act 2013 Applicable IAR For PVT CompanyDocument5 pagesCompanies Act 2013 Applicable IAR For PVT CompanySURYA SNo ratings yet

- Empanelment of Firms of Chartered Accountants As Internal AUDITORS FOR THE YEARS 2019-20 TO 2021-22Document16 pagesEmpanelment of Firms of Chartered Accountants As Internal AUDITORS FOR THE YEARS 2019-20 TO 2021-22SURYA SNo ratings yet

- Internal Audit For Finance SectorDocument1 pageInternal Audit For Finance SectorSURYA SNo ratings yet

- Tirumala Mutt InfoDocument4 pagesTirumala Mutt InfoSURYA SNo ratings yet

- Development of Lifetime Bridge Management System For Expressway Bridges in JapanDocument12 pagesDevelopment of Lifetime Bridge Management System For Expressway Bridges in JapanfiyuNo ratings yet

- Project Report On Capital BudgetingDocument23 pagesProject Report On Capital BudgetingRajesh Ranjan33% (3)

- Test Booklet: General Studies Paper-IDocument11 pagesTest Booklet: General Studies Paper-IMukesh KumarNo ratings yet

- Intermediate Accounting 5EDocument44 pagesIntermediate Accounting 5Ejahanzeb90100% (1)

- PW, FW, Aw: Shreyam PokharelDocument14 pagesPW, FW, Aw: Shreyam PokharelLuna Insorita100% (1)

- 2007-08 VodafonecrDocument378 pages2007-08 VodafonecrManisha BishtNo ratings yet

- Can000034744 2013 1 00 e 03 31Document15 pagesCan000034744 2013 1 00 e 03 31Srikanth JutruNo ratings yet

- Econ 202 Pre-Test 1 Chapters (4, 22-24)Document8 pagesEcon 202 Pre-Test 1 Chapters (4, 22-24)Amogh SharmaNo ratings yet

- THE TIMES BUSINESS - UK - JUNE 13 TH 2021Document14 pagesTHE TIMES BUSINESS - UK - JUNE 13 TH 2021Pepe LuisNo ratings yet

- Brand Portfolio at LOrealDocument17 pagesBrand Portfolio at LOrealFaheemNo ratings yet

- ANNUAL Report Sardar Chemical 2014Document44 pagesANNUAL Report Sardar Chemical 2014Shabana KhanNo ratings yet

- Insurance OutlineDocument6 pagesInsurance Outlinefdafdaf8180No ratings yet

- Questionnaire: Respected Sir/MadamDocument4 pagesQuestionnaire: Respected Sir/MadamhunnyNo ratings yet

- Finance concepts under 40 charsDocument5 pagesFinance concepts under 40 charsBrian P. JohnsonNo ratings yet

- Auditing Theory EssentialsDocument4 pagesAuditing Theory EssentialsZvioule Ma FuentesNo ratings yet

- ACC2007 - Seminar 9 - Complex Group StructuresDocument47 pagesACC2007 - Seminar 9 - Complex Group StructuresCeline LowNo ratings yet

- Determine equilibrium price and output under demand and supplyDocument10 pagesDetermine equilibrium price and output under demand and supplyBisweswar DashNo ratings yet

- Long Term Investment Decision at Kesoram CementDocument10 pagesLong Term Investment Decision at Kesoram CementMOHAMMED KHAYYUMNo ratings yet

- Learning OutcomesDocument48 pagesLearning OutcomesPom Jung0% (1)

- Topics SDADocument1 pageTopics SDAThinkLink, Foreign Affairs www.thinklk.comNo ratings yet

- Brown-Forman Corporation Business Transformation StudyDocument2 pagesBrown-Forman Corporation Business Transformation StudyAvinash MalladhiNo ratings yet

- World Bank Briefing BookDocument4 pagesWorld Bank Briefing Bookapi-554844732No ratings yet

- Ib Export ImportDocument32 pagesIb Export ImportUtkarsh PanditNo ratings yet

- Constraints For Growth of Small and Medium Scale Entreprises FinalDocument80 pagesConstraints For Growth of Small and Medium Scale Entreprises FinalPrince Kennedy Mark OgucheNo ratings yet

- Prudent Private Wealth Company ProfileDocument5 pagesPrudent Private Wealth Company ProfilepratikNo ratings yet

- Types of Banks in Nepal: Yogesh BaniyaDocument7 pagesTypes of Banks in Nepal: Yogesh Baniyaanon_665535262No ratings yet