Professional Documents

Culture Documents

Oil and Gas Tax Revenues Monthly Update

Uploaded by

Rob Port0 ratings0% found this document useful (0 votes)

618 views1 page19.9005.07000

Original Title

19.9005.07000

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document19.9005.07000

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

618 views1 pageOil and Gas Tax Revenues Monthly Update

Uploaded by

Rob Port19.9005.07000

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

19.9005.

07000 Prepared by the Legislative Council staff

OIL AND GAS TAX REVENUES MONTHLY UPDATE

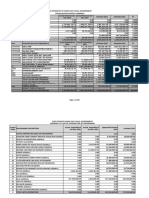

This memorandum provides an update on oil production and prices, oil and gas tax revenue collections, and oil

and gas tax revenue allocations for February 2018 and for the biennium to date. The forecasted amounts reflect

the 2017 legislative revenue forecast, prepared at the close of the 2017 legislative session.

OIL PRODUCTION AND PRICES

The schedule below provides information on oil production and prices for December 2017 and for the biennium

to date. Oil and gas tax revenue allocations reflect production and price from 2 months prior. The actual oil prices

reflect the average of Flint Hills Resources posted prices and West Texas Intermediate posted prices.

December 2017 Biennium to Date

Variance Variance

Actual Forecast Amount Percent Actual Forecast Amount Percent

Average daily oil production 1,181,319 925,000 256,319 28% 1,119,963 925,000 194,963 21%

Average oil price per barrel $54.14 $47.00 $7.14 15% $46.26 $47.00 ($0.74) (2%)

OIL AND GAS TAX REVENUE COLLECTIONS

The chart below provides information on total oil and gas tax revenue collections based on the 2017 legislative

forecast and actual allocations through February 2018.

$200

$180

$160

$140

$120

Millions

$100

$80

$60

$40

$20

$0

2017 Legislative Revenue Forecast Actual

OIL AND GAS TAX REVENUE ALLOCATIONS

The schedule below provides information on oil and gas tax revenue allocations to the Three Affiliated Tribes of

the Fort Berthold Reservation, state funds, and political subdivisions for February 2018 and for the biennium to

date.

Amounts Shown in Millions

February 2018 Biennium to Date

Variance Variance

Actual Forecast Amount Percent Actual Forecast Amount Percent

Three Affiliated Tribes $18.26 $9.35 $8.91 95% $101.14 $64.56 $36.58 57%

Legacy fund 50.31 36.41 13.90 38% 280.95 251.37 29.58 12%

North Dakota outdoor heritage fund 1.24 0.90 0.34 38% 7.06 6.19 0.87 14%

Abandoned well reclamation fund 0.62 0.45 0.17 38% 3.53 3.10 0.43 14%

Oil and gas impact grant fund 0.00 0.00 0.00 N/A 28.35 29.11 (0.76) (3%)

Political subdivisions 26.49 19.71 6.78 34% 174.31 154.35 19.96 13%

Energy impact fund 0.00 0.00 0.00 N/A 2.00 2.00 0.00 0%

Common schools trust fund 7.17 5.60 1.57 28% 39.39 38.63 0.76 2%

Foundation aid stabilization fund 7.17 5.60 1.57 28% 39.39 38.63 0.76 2%

Resources trust fund 14.33 11.19 3.14 28% 78.78 77.26 1.52 2%

Oil and gas research fund 1.60 0.83 0.77 93% 7.91 4.75 3.16 67%

General fund 0.00 8.17 (8.17) (100%) 200.00 200.00 0.00 0%

Tax relief fund 58.77 32.52 26.25 81% 74.81 32.52 42.29 130%

Budget stabilization fund 0.00 0.00 0.00 N/A 0.00 0.00 0.00 N/A

Lignite research fund 0.00 0.00 0.00 N/A 0.00 0.00 0.00 N/A

Strategic investment and improvements fund 0.00 0.00 0.00 N/A 0.00 0.00 0.00 N/A

State disaster relief fund 0.00 0.00 0.00 N/A 0.00 0.00 0.00 N/A

Total oil and gas tax revenue allocations $185.96 $130.73 $55.23 42% $1,037.62 $902.47 $135.15 15%

North Dakota Legislative Council February 2018

You might also like

- Oil and Gas Tax Revenues Monthly UpdateDocument1 pageOil and Gas Tax Revenues Monthly UpdateRob PortNo ratings yet

- Oil and Gas Tax Revenues Monthly UpdateDocument1 pageOil and Gas Tax Revenues Monthly UpdateRob PortNo ratings yet

- Texas Comptroller 2017Document8 pagesTexas Comptroller 2017lcalabreseNo ratings yet

- SOBO February 15, 2017 Agenda PacketDocument13 pagesSOBO February 15, 2017 Agenda PacketOaklandCBDsNo ratings yet

- Hubbard County Payable 2024 Preliminary Levy ChartDocument2 pagesHubbard County Payable 2024 Preliminary Levy ChartShannon GeisenNo ratings yet

- Datos Generales: Unidades ProducidasDocument10 pagesDatos Generales: Unidades ProducidasJavier Lopez RodriguezNo ratings yet

- Economics Evaluation SpreadsheetDocument4 pagesEconomics Evaluation SpreadsheetTemitope BelloNo ratings yet

- 2021 Budget in Brief Executive SummaryDocument2 pages2021 Budget in Brief Executive SummaryScott AtkinsonNo ratings yet

- Tax Fiscal Note 060910Document2 pagesTax Fiscal Note 060910jmicekNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- 2021 Regional Hospital District BudgetDocument3 pages2021 Regional Hospital District BudgetTom SummerNo ratings yet

- FY 2019 - Revenue Report - 12-31-2018Document8 pagesFY 2019 - Revenue Report - 12-31-2018Russ LatinoNo ratings yet

- M - R T R: Ining Elated AX EvenuesDocument14 pagesM - R T R: Ining Elated AX EvenuesGregorius Aryoko GautamaNo ratings yet

- Sept BudgetDocument3 pagesSept BudgetRob PortNo ratings yet

- February 2017 Tax ReceiptsDocument2 pagesFebruary 2017 Tax ReceiptsBrian DulleNo ratings yet

- Up On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesUp On M&A Speculation: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNo ratings yet

- State of Connecticut Department of Revenue Services 450 COLUMBUS BLVD. HARTFORD, CT 06103-1837 Mark Boughton, CommissionerDocument1 pageState of Connecticut Department of Revenue Services 450 COLUMBUS BLVD. HARTFORD, CT 06103-1837 Mark Boughton, CommissionerHelen BennettNo ratings yet

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Document40 pagesSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghNo ratings yet

- Ulster County 2019 Budget SummaryDocument21 pagesUlster County 2019 Budget SummaryDaily FreemanNo ratings yet

- Budget Highlights: The Institute of Chartered Accountants of NepalDocument31 pagesBudget Highlights: The Institute of Chartered Accountants of Nepalshankar k.c.No ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Convergence League Tables - Research ReportDocument5 pagesConvergence League Tables - Research ReportkaveriNo ratings yet

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanNo ratings yet

- Financial Documents Learner NotesDocument21 pagesFinancial Documents Learner NotesYolanda WillsonNo ratings yet

- RELEASE: Budget Chair Wallace Proposes Revenue Solution For Special SessionDocument1 pageRELEASE: Budget Chair Wallace Proposes Revenue Solution For Special SessionTheOkie.comNo ratings yet

- Mayor Chokwe Antar Lumumba's FY19 Budget PresentationDocument25 pagesMayor Chokwe Antar Lumumba's FY19 Budget Presentationthe kingfishNo ratings yet

- State Financ2003Document12 pagesState Financ2003pmanikNo ratings yet

- Aug. 12 East Grand Forks 2021 Preliminary BudgetDocument93 pagesAug. 12 East Grand Forks 2021 Preliminary BudgetJoe BowenNo ratings yet

- Year Geico Dividend Per Share in $ Total Dividend To Berkshire Hathaway in $ MillionDocument8 pagesYear Geico Dividend Per Share in $ Total Dividend To Berkshire Hathaway in $ MillionIshan KakkarNo ratings yet

- 14936-HMFBNP Public Presentation of 2022 FGN Budget (v4) - ProshareDocument59 pages14936-HMFBNP Public Presentation of 2022 FGN Budget (v4) - ProshareGodwin IwekaNo ratings yet

- Fiscal ImpactDocument2 pagesFiscal ImpactJeremy TurleyNo ratings yet

- Fin Proj MDDocument5 pagesFin Proj MDKhatab OmerNo ratings yet

- Measuring The Revenue Shortfall 04-19-10Document4 pagesMeasuring The Revenue Shortfall 04-19-10Grant BosseNo ratings yet

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- Treasury Weekly Report W-33-1Document2 pagesTreasury Weekly Report W-33-1shyamalNo ratings yet

- 03train LawDocument30 pages03train LawMikael James VillanuevaNo ratings yet

- Adam Belyamani Soala EnergyDocument35 pagesAdam Belyamani Soala EnergyAjay TulpuleNo ratings yet

- Revenue ProjectionsDocument1 pageRevenue ProjectionsVIRIMAI SIGNINo ratings yet

- FY2018 - JUN Fincl Comparative SummaryDocument1 pageFY2018 - JUN Fincl Comparative SummaryNewsChannel 9 StaffNo ratings yet

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathNo ratings yet

- Annual Financial Report: Your Company NameDocument3 pagesAnnual Financial Report: Your Company NameKumar SinghNo ratings yet

- Annual Financial Report: Your Company NameDocument3 pagesAnnual Financial Report: Your Company NameThảo NguyễnNo ratings yet

- Fina Sample ReportsDocument61 pagesFina Sample ReportsqNo ratings yet

- Legislature Revenue ForecastDocument4 pagesLegislature Revenue ForecastRob PortNo ratings yet

- APC 3Q EPS Preview: Smooth Sailing in 3Q But 2019 Guidance Could Be The HighlightDocument10 pagesAPC 3Q EPS Preview: Smooth Sailing in 3Q But 2019 Guidance Could Be The HighlightAshokNo ratings yet

- P & L Statement For November 20XX & December 20XXDocument2 pagesP & L Statement For November 20XX & December 20XXsneha dhamijaNo ratings yet

- HR 6760 Distributional EffectsDocument2 pagesHR 6760 Distributional EffectsStephen LoiaconiNo ratings yet

- Math 1090Document8 pagesMath 1090api-287030709No ratings yet

- Tis Distribution ScheduleDocument1 pageTis Distribution ScheduleChris VaughnNo ratings yet

- FMR REPORT August 2023 CompressedDocument24 pagesFMR REPORT August 2023 CompressedAniqa AsgharNo ratings yet

- Ondo East 2022 Finalt BudgetDocument182 pagesOndo East 2022 Finalt Budgetojo bamideleNo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- 2010-2011 Preliminary Budget DiscussionDocument15 pages2010-2011 Preliminary Budget DiscussionCFBISDNo ratings yet

- Ator Property RecordsDocument2 pagesAtor Property RecordsErin LaviolaNo ratings yet

- Fin 201 - SDocument10 pagesFin 201 - SAhsanur HossainNo ratings yet

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket careNo ratings yet

- FY 2020 - Revenue Report - 09-30-2019Document8 pagesFY 2020 - Revenue Report - 09-30-2019Russ LatinoNo ratings yet

- Project 6Document10 pagesProject 6api-489150270No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Legalize Cannabis PetitionDocument25 pagesLegalize Cannabis PetitionRob PortNo ratings yet

- Katrina ChristiansenDocument566 pagesKatrina ChristiansenRob PortNo ratings yet

- Mohr Candidate FilingDocument32 pagesMohr Candidate FilingRob PortNo ratings yet

- 7 - Resolution on CO2 Private Property and Eminent DomainDocument1 page7 - Resolution on CO2 Private Property and Eminent DomainRob PortNo ratings yet

- Presidential Caucuses Media Advisory 29feb24Document1 pagePresidential Caucuses Media Advisory 29feb24Rob PortNo ratings yet

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortNo ratings yet

- Retire CongressDocument1 pageRetire CongressRob PortNo ratings yet

- Simons Pre-Trial BriefDocument5 pagesSimons Pre-Trial BriefRob PortNo ratings yet

- Vote No on 7 - Full Page - Complete (1)Document2 pagesVote No on 7 - Full Page - Complete (1)Rob PortNo ratings yet

- Protect District 37s Rights LetterDocument1 pageProtect District 37s Rights LetterRob PortNo ratings yet

- Burleigh County Conflict Case Stenehjem Email No Prosecution LetterDocument28 pagesBurleigh County Conflict Case Stenehjem Email No Prosecution LetterRob PortNo ratings yet

- Legendary PacDocument1 pageLegendary PacRob PortNo ratings yet

- UND Reporton Conflict InvestigationDocument34 pagesUND Reporton Conflict InvestigationRob PortNo ratings yet

- 2011 o 12Document3 pages2011 o 12Rob PortNo ratings yet

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortNo ratings yet

- BSPI Media Release 2-2-2023Document1 pageBSPI Media Release 2-2-2023Rob PortNo ratings yet

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- Miller AnnouncementDocument1 pageMiller AnnouncementRob PortNo ratings yet

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- Brocker EmailDocument1 pageBrocker EmailJeremy TurleyNo ratings yet

- PD Ir2314849Document6 pagesPD Ir2314849Rob PortNo ratings yet

- Approved Property Tax Petition 29june23Document8 pagesApproved Property Tax Petition 29june23Rob PortNo ratings yet

- 25 5061 02000 Meeting AgendaDocument3 pages25 5061 02000 Meeting AgendaRob PortNo ratings yet

- Matt Entz Contract AmendmentsDocument4 pagesMatt Entz Contract AmendmentsMike McFeelyNo ratings yet

- Best of America PAC FEC ReportsDocument9 pagesBest of America PAC FEC ReportsRob PortNo ratings yet

- Election Integrity Ballot MeasureDocument13 pagesElection Integrity Ballot MeasureRob PortNo ratings yet

- Combined ReportsDocument131 pagesCombined ReportsRob PortNo ratings yet

- Combined ReportsDocument131 pagesCombined ReportsRob PortNo ratings yet

- Pierce PieceDocument2 pagesPierce PieceRob PortNo ratings yet

- NDGOP August MonthlyDocument22 pagesNDGOP August MonthlyRob PortNo ratings yet

- Intertanko - Marpol Annex IIDocument30 pagesIntertanko - Marpol Annex IIdodoi_neelr100% (1)

- ASTM D874 - Sulfated AshDocument5 pagesASTM D874 - Sulfated AshWynona BasilioNo ratings yet

- Mgmi PDFDocument40 pagesMgmi PDFDaneshwer VermaNo ratings yet

- 1 Introduction of EOR LecturesDocument19 pages1 Introduction of EOR LecturessereptNo ratings yet

- LNG Fall05Document100 pagesLNG Fall05recutuNo ratings yet

- Chemistry Criterion D ResearchDocument7 pagesChemistry Criterion D ResearchNjeri GichangiNo ratings yet

- Oil Spills Cleanup Chikcken FeatherDocument5 pagesOil Spills Cleanup Chikcken FeatherFaris MatNo ratings yet

- Oligocene-Miocene MaykopDocument33 pagesOligocene-Miocene Maykopmoonrock1No ratings yet

- Catalogo Vaselinas H & RDocument20 pagesCatalogo Vaselinas H & RHENRY CASTILLONo ratings yet

- EsmaDocument19 pagesEsmaJacob Joseph100% (1)

- Oil and Gas Career GuideDocument17 pagesOil and Gas Career GuidePraveen Tiwari100% (1)

- Profil EngDocument52 pagesProfil EngReza RhiNo ratings yet

- Methanol Safe Handling Manual Final EnglishDocument207 pagesMethanol Safe Handling Manual Final Englishkenoly123No ratings yet

- Turbo Ex PandersDocument7 pagesTurbo Ex Pandersdean427No ratings yet

- ASTM D1319 - Jtvo9242Document7 pagesASTM D1319 - Jtvo9242Nayth Andres GalazNo ratings yet

- Production Decline Analysis ModelsDocument45 pagesProduction Decline Analysis ModelsjeedNo ratings yet

- Rafiq - S CV TerminalDocument3 pagesRafiq - S CV Terminalaqeelkhan7942No ratings yet

- @Ltwrwi?Rqs'Ptt-Fm TFZ: Indian StandardDocument6 pages@Ltwrwi?Rqs'Ptt-Fm TFZ: Indian StandardAmanulla KhanNo ratings yet

- DistilationDocument11 pagesDistilationMuhammad HusseinNo ratings yet

- TVS Jupiter Maintenance Schedule PDFDocument3 pagesTVS Jupiter Maintenance Schedule PDFRajat SharmaNo ratings yet

- MegalinearDocument102 pagesMegalinearDragan ObradovicNo ratings yet

- Pumps-Yantai Gemsun Import and Export Co,.LtdDocument21 pagesPumps-Yantai Gemsun Import and Export Co,.LtdZahid LatifNo ratings yet

- John Mensah's CV PDFDocument1 pageJohn Mensah's CV PDFJOHN MENSAHNo ratings yet

- Micros Orb Environmental Products BrochureDocument71 pagesMicros Orb Environmental Products BrochureJavierNo ratings yet

- Subsurface Geology PDFDocument60 pagesSubsurface Geology PDFZhunio BenavidesNo ratings yet

- Using Technology To Increase Middle Distillate Production-EnglishDocument6 pagesUsing Technology To Increase Middle Distillate Production-Englishsaleh4060No ratings yet

- Petron Corporation: Leading Philippine Oil Refining CompanyDocument25 pagesPetron Corporation: Leading Philippine Oil Refining CompanyAhnJello100% (3)

- The Properties and States of Matter: A Comprehensive GuideDocument38 pagesThe Properties and States of Matter: A Comprehensive GuideAlezander GalindoNo ratings yet

- Producing, Undeveloped Fields and License: Existing - Future Producing InfrastructureDocument1 pageProducing, Undeveloped Fields and License: Existing - Future Producing InfrastructureLekanNo ratings yet

- Trafigura Beheer BV Annual Report 2013Document53 pagesTrafigura Beheer BV Annual Report 2013kr2983No ratings yet