Professional Documents

Culture Documents

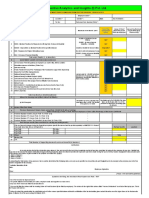

Income Tax Calculator FY 2010 11

Uploaded by

sankssCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculator FY 2010 11

Uploaded by

sankssCopyright:

Available Formats

INCOME TAX CALCULATOR FOR FINANCIAL YEAR 2

Instructions :

1.Please enter gross annual figures.

2. Please enter values in Highlighted cells only.

DISCLAIMER : This calculator is to help you find out your personal indecative total tax liability. Efforts have been made to cover most of th

are advised to consult any qualified chartered accountant or tax consultant to know your actual Tax Liability.

Assessee Type you are Male or Female (<65 years of age)

Specify whether

or Sr. Citizen Male PersonalMoney.in is a Persona

Components of Salary Annual Amount Management, Financial Planning

A.1 Basic Salary Rs.0 Management to effectively mana

A.2 House Rent Allowance Rs.0

If you liked this INCOME TAX CA

A.3 Transport Allowance Rs.0

Articles. Sunscription is totally FR

A.4 Medical Reimbursement Rs.0

method to gain regular access to

A.5 Leave Travel Allowance (LTA) Rs.0

A.6 Special Allowance Rs.0

A.7 Bonus Rs.0 * Subscribe Free Email Update

A.8 Other Allowances Rs.0 * Subscribe RSS Feeds

Gross Salary (A) Rs.0 * For any query or support ple

Exemptions/Deductions Maximim Limit

B.1 House Rent Exemption

Annual Rent Paid Rs.0

Assessee Residing in Other Cities

I) 40% of Basic Salary Rs.0 Rs.0

ii) Actual HRA Received Rs.0

iii) Rent Paid minus 10% of Basic Salary Rs.0

Total House Rent Exemption

B.2 Transport Allowance Rs.9,600

B.3 Medical Reimbursement Rs.15,000

Total (B)

Gross Taxable Salary Income (A-B)

Income from Housing

Reliefe on Interest paid on Housing Loan Rs.150,000

Any other Income

Gross Total Income

Deduction under Chapter VIA

Under Section

The following tax saving investments may be considered for computation of income tax deduction at source for

Deduction u/s 80D to 80U

C.1 family

Medical Insurance Premium - for the parent or parents U/Sec 80D(2A)

C.2 of the assessee Parents are NOT Sr. U/Sec

citizen80D(2B)

C.3 Expenditure on Handicapped Dependents / Deposits made with LIC, etc. for maintenance of handicapped

Disability Percentage of the Handicapped Dependents Less than 80% disability

U/Sec 80DD

C.4 Exp. likely to be incurred on specified disease or ailment (Cancer/AIDS etc.)

Exp incurred on senior citizen No U/Sec 80DDB

C.5 (in case of disability

Self Disability Percentage Less than 80% disability

U/Sec 80 U

Interest on Education Loan (for self education) from

C.6

Charitiable or Financial Institution. (No Limit) U/Sec 80E

Total Deduction u/s 80D to 80U

Investments under Sections

Self Contribution 80C

in Provident & 80CCC

Fund. qualifying

Assessee's rate of for deductionsw.r.t

PF contribution upto Rs.1 Lac or Rs.1.2 Lac

D.1 Basic Salary is @ U/Sec 80C

D.2 Voluntary Contribution Provident Fund U/Sec 80C

D.3 INVESTMENT IN PENSION SCHEME U/Sec 80 CCC

D.4 HOUSING LOAN PRINCIPAL REPAYMENT U/Sec 80C

D.5 PUBLIC PROVIDENT FUND (PPF) U/Sec 80C

D.6 LIFE INSURANCE PREMIUM PAID U/Sec 80C

D.7 UNIT LINKED INSURANCE PLANS U/Sec 80C

D.8 NSC-NATIONAL SAVING CERTIFICATE U/Sec 80C

D.9 DEPOSIT IN NATIONAL SAVING SCHEME (NSS) U/Sec 80C

D.10 INFRASTRUCTURE INVESTMENT in approved BONDS U/Sec 80C

MUTUALLINK

D.11 EQUITY FUNDS notified

SAVING under SECTION

SCHEME(ELSS) 10(23D)

Mutual Funds notified under SECTION U/Sec 80C

D.12 10(23D)

TERM DEPOSIT with a SCH.Bank in a notified Scheme for a term not less U/Sec 80C

D.13 than 5 years.

TUTION FEES PAID (Only full time education tution fees paid to any Indian Univ, College, U/Sec 80C

D.14 School) U/Sec 80C

D.15 SENIOR CITIZENS SAVINGS SCHEME Rules, 2004 U/Sec 80C

D.16 POST OFFICE TIME DEPOSIT Rules, 1981 for a term not less than 5 years U/Sec 80C

Total Deduction u/s 80C and 80CCC

Total Deduction under Chapter VIA

Net Total Taxable Income

Tax on Total Income

Add Surcharge

Add Education Cess

Total Tax Payable in respective Financial Years

Total Tax Savings in FY-10-11 with respect to Tax Payable in FY-09-10

R FINANCIAL YEAR 2010-11

ve been made to cover most of the scenarios of Income, Exemptions, Deductions, etc. However, you

lity.

Assessee Type

ersonalMoney.in is a Personal Finance Blog that provides expert advice on Money Male

anagement, Financial Planning, Investment, Insurance, Loans and Personal Wealth Female

anagement to effectively manage your personal money. Sr. Citizen

you liked this INCOME TAX CALCULATOR, you might also like other PersonalMoney.in

ticles. Sunscription is totally FREE. You can choose any of the following subscription

ethod to gain regular access to PersonalMoney.in.

Subscribe Free Email Updates

Subscribe RSS Feeds

For any query or support please send email to admin@personalmoney.in

Under Section Amount Amount

U/Sec 10(13A) Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0

Rs.0

Rs.0 Rs.0

U/S 24(1)(Vi) Rs.0 Rs.0

Rs.0 Rs.0

Rs.0

FY-09-10 FY-10-11

Actual Amount Maximim Limit Eligible Amount

Maximim Limit

Eligible Amount

tax deduction at source for the financial year.

Rs.0 Rs.15,000 Rs.0 Rs.15,000 Rs.0

Rs.0 Rs.15,000 Rs.0 Rs.15,000 Rs.0

aintenance of handicapped Dependents

Rs.0 Rs.50,000 Rs.0 Rs.50,000 Rs.0

Rs.0 Rs.40,000 Rs.0 Rs.40,000 Rs.0

Rs.0 Rs.50,000 Rs.0 Rs.50,000 Rs.0

Rs.0 No Limit Rs.0 No Limit Rs.0

Rs.0 Rs.0

s.1 Lac or Rs.1.2 Lac

Rs.0 12% Rs.0 12% Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.10,000 Rs.0 Rs.10,000 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 Rs.0

Rs.0 0.00%

Resident of HRA Basic Salary Relief Rate Disability Percentage for Sec 80DD and 80

Chennai 50 Less than 80% disability

Delhi 50 More than 80% disability

Kolkata 50

Mumbai 50

Other Cities 40

Assessee's Rate Applied 40

Assessee Type Applied Male

entage for Sec 80DD and 80U

You might also like

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- Tax Calculator 2010-2011Document1 pageTax Calculator 2010-2011Sanjay Kumar GuptaNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleNo ratings yet

- Income Tax Calculator FY 2010 11 1Document2 pagesIncome Tax Calculator FY 2010 11 1nchary_2010No ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 4 Chapter VI-ADocument11 pages4 Chapter VI-AVENKATESWARLUMCOMNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Gopi IT2021 Tentative CalculationsheetDocument4 pagesGopi IT2021 Tentative CalculationsheetAR G.KAPILANNo ratings yet

- D COMPUTATION OF TOTAL INCOME (TAX) LatestDocument6 pagesD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheNo ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18No ratings yet

- Tax Calculator FASTDocument20 pagesTax Calculator FASTdamani.manojNo ratings yet

- Income Tax Calculator titleDocument12 pagesIncome Tax Calculator titleUdaysinh PatilNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Document42 pagesCBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Ashish GangwalNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Form 16 certificate for salary incomeDocument1 pageForm 16 certificate for salary incomeSourabhthakral_1No ratings yet

- Tax Calculator 7.1 (T) 2012 13Document17 pagesTax Calculator 7.1 (T) 2012 13karthickNo ratings yet

- Auto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesDocument6 pagesAuto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesashutoshbinduNo ratings yet

- Deductions under Chapter VI-A of the Income Tax ActDocument5 pagesDeductions under Chapter VI-A of the Income Tax Act6804 Anushka GhoshNo ratings yet

- Section 80 Deduction TableDocument6 pagesSection 80 Deduction TablevineyNo ratings yet

- Handbook - Tax Planning Level 1Document22 pagesHandbook - Tax Planning Level 1Prem SagarNo ratings yet

- Income Tax Material: Unit 9 - DeductionsDocument9 pagesIncome Tax Material: Unit 9 - DeductionsKARAN WADHWA 2012168No ratings yet

- Handbook - Tax Planning Level 2Document30 pagesHandbook - Tax Planning Level 2Malli Arjun staff guitar zgkNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- TaxPlanning06 07Document17 pagesTaxPlanning06 07Lathif PashaNo ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Receipt of house rent submissionDocument3 pagesReceipt of house rent submissionPatrick Jude Lucas PsychologyNo ratings yet

- Form No 12BB FY 2020-21 (AY 2021-22)Document6 pagesForm No 12BB FY 2020-21 (AY 2021-22)Avinash ChandraNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Document3 pages(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredNo ratings yet

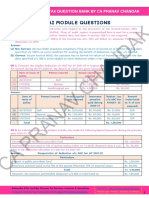

- ICAI MODULE QUESTIONS ON INCOME TAX DEDUCTIONSDocument25 pagesICAI MODULE QUESTIONS ON INCOME TAX DEDUCTIONSSavya SachiNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Inc Tax DedDocument38 pagesInc Tax DedpoojaNo ratings yet

- IT Declaration Form 2014-15 - After BudgetDocument2 pagesIT Declaration Form 2014-15 - After BudgetAkram M. AlmotaaNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Tax NewDocument3 pagesTax NewRakesh KumarNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Employee Declaration Form 15Document4 pagesEmployee Declaration Form 15Bliss BilluNo ratings yet

- Deductions From Gross Total IncomeDocument4 pagesDeductions From Gross Total Income887 shivam guptaNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Income Tax Calculation StatementDocument36 pagesIncome Tax Calculation StatementKingKamalNo ratings yet

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- Income Tax DepartmentDocument4 pagesIncome Tax Departmentmansi joshiNo ratings yet

- Annexure ADocument1 pageAnnexure Apanduram tiyuNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- CeylincoQuoteDocument3 pagesCeylincoQuotejulani pabasariNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet