Professional Documents

Culture Documents

Computation For The Year 2015

Uploaded by

joshuaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computation For The Year 2015

Uploaded by

joshuaCopyright:

Available Formats

Computation for the year 2015

I. Liquidity ratio

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡 18,298,994.87

Current ratio(Times): 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑙𝑖𝑡𝑒𝑠= 3,049,120.74 = 6.00

𝑄𝑢𝑖𝑐𝑘 𝐴𝑠𝑠𝑒𝑡 14,088,666.87

Quick ratio(Times):𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠= 3,049,120.74 = 4.62

II. Leverage ratio

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 3,049,120.74

Debt to asset ratio (%): = = 0.16

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡 18,298,994.87

III. Activity ratio

𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑅𝑒𝑐𝑒𝑖𝑣𝑒𝑏𝑙𝑒 9,938,115.24

Day Sales Outstanding(Days): 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 = 159,731,796.56 = 22

360 360

𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 151,576,460.12

Inventory Turnover Ratio: = =36

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 4210328

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 159,731,796.56

Total Asset Turnover (Times): = = 8.73

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 18,298,994.87

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 159,731,796.56

Fixed Asset Turnover (Times):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡= 4

= 39,932,949.14

IV. Profitability Ratios

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 2,762,203.28

Net Profit Margin (%): = =0.0173

𝑆𝑎𝑙𝑒𝑠 159,731,796.56

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 2,762,203.28

Return on Total Asset (%):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠=18,298,998.87= 0.1509

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 2,762,203.28

Return on Stockholders’ Equity (%):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦=15,249,878.13= 0.1811

Earnings per Share= 55.24

Computation for the year 2016

I. Liquidity ratio

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡 22,585,960.89

Current ratio(Times): = = 5.71

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑙𝑖𝑡𝑒𝑠 3,955,952.68

𝑄𝑢𝑖𝑐𝑘 𝐴𝑠𝑠𝑒𝑡 18,012,455.15

Quick ratio(Times): = = 4.55

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 3,955,952.68

II. Leverage ratio

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 3,955,952.68

Debt to asset ratio (%): 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡

= 22,585,964.89= 0.18

III. Activity Ratios

𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑅𝑒𝑐𝑒𝑖𝑣𝑒𝑏𝑙𝑒 11,452,291

Day Sales Outstanding (Days): 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 = 199,977,925.08 = 21

360 360

𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 190,977,280.78

Inventory Turnover Ratio:𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦= 4,021,943.66

= 47.48

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 199,977,925.08

Total Asset Turnover (Times):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠= 20,442,477.88 = 9.78

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 199,977,925.08

Fixed Asset Turnover (Times): = = 49,994,481.27

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡 4

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 3,380,134.08

Net Profit Margin (%): 𝑆𝑎𝑙𝑒𝑠

=199,977,280.78= 0.0169

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 3,380,134.08

Return on Total Asset (%):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠=20,442,477.88= 0.165

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 3,380,134.08

Return on Stockholders’ Equity (%):𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦=16,939,945.17= 0.1995

Earnings per Share= 67.6

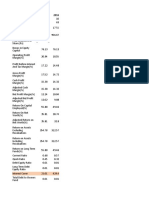

2016 2015

Liquidity Ratios

Current Ratio (Times) 5.71 6.00

Quick or Acid-Test Ratio (Times) 4.55 4.62

Leverage Ratios

Debt-to-Total Asset Ratio (%) 0.18 0.16

Activity Ratios

Day Sales Outstanding (Days) 8 11

Inventory Turnover Ratio 47.48 36.00

Total Asset Turnover (Times) 9.78 8.73

Fixed Asset Turnover (Times) 49,994,481.27 39,932,949.14

Times Interest Earned N/A N/A

Profitability Ratios

Net Profit Margin (%) 0.0169 0.0173

Return on Total Asset (%) 0.165 0.1509

Return on Stockholders’ Equity (%) 0.1995 0.1811

Earnings per Share 67.6 55.24

You might also like

- AT Quizzer 1 Overview of Auditing Answer Key PDFDocument11 pagesAT Quizzer 1 Overview of Auditing Answer Key PDFKimyMalaya100% (5)

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Tata Docomo bill details for account 910080161Document5 pagesTata Docomo bill details for account 910080161Vatsal PurohitNo ratings yet

- CPA Review: Code of Ethics for Professional Accountants in the PhilippinesDocument20 pagesCPA Review: Code of Ethics for Professional Accountants in the PhilippinesJedidiah SmithNo ratings yet

- Philippine Laws on Credit TransactionsDocument5 pagesPhilippine Laws on Credit TransactionsCamille ArominNo ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal0% (4)

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- San Beda Credit TransactionsDocument33 pagesSan Beda Credit TransactionsLenard Trinidad100% (5)

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Wealth Management & Asset ManagementDocument32 pagesWealth Management & Asset ManagementVineetChandakNo ratings yet

- PCP 96175276 PDFDocument3 pagesPCP 96175276 PDFpvsairam100% (5)

- Account StatementDocument12 pagesAccount StatementGajendra Khileri GajrajNo ratings yet

- Global Employer Branding PDFDocument32 pagesGlobal Employer Branding PDFIuliana DidanNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- PROBLEM 4-29 Changes in Cost Structure: Break Event Analysis: Operating Leverage, Margin of Safety (L04, L05, LO8)Document4 pagesPROBLEM 4-29 Changes in Cost Structure: Break Event Analysis: Operating Leverage, Margin of Safety (L04, L05, LO8)SamintangNo ratings yet

- Audit stockholders' equity problemsDocument7 pagesAudit stockholders' equity problemsLizette Oliva80% (5)

- Week 4Document9 pagesWeek 4kishorbombe.unofficialNo ratings yet

- Category of Financial Ratios No. YearDocument3 pagesCategory of Financial Ratios No. YearIkaNo ratings yet

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- Daiz, Kate - Cement Companies - Audited Financial Statement AnalysisDocument100 pagesDaiz, Kate - Cement Companies - Audited Financial Statement AnalysisKate DaizNo ratings yet

- Ratios Micro TilDocument1 pageRatios Micro TilVeronica BaileyNo ratings yet

- Ayesha Steel Ratio Analysis Current Quick Working Capital Profitability Return Assets Equity EPS Margin Inventory Assets Receivable Debts Equity TIE Capitalization Value Added EVADocument5 pagesAyesha Steel Ratio Analysis Current Quick Working Capital Profitability Return Assets Equity EPS Margin Inventory Assets Receivable Debts Equity TIE Capitalization Value Added EVAMuhammad AwaisNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- Bsman 3193 Assignment 3aDocument22 pagesBsman 3193 Assignment 3aGlynn Tan100% (1)

- Business Finance Quiz 3-SeratoDocument4 pagesBusiness Finance Quiz 3-SeratoDaryl SeratoNo ratings yet

- Breakeven Analysis and Payback PeriodDocument6 pagesBreakeven Analysis and Payback PeriodErvin Cajes DetallaNo ratings yet

- Financial Ratio Analysis for YMATHBUSFIN Class Midterm Assignment #3Document1 pageFinancial Ratio Analysis for YMATHBUSFIN Class Midterm Assignment #3마리레나No ratings yet

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Report INDDocument13 pagesReport INDKacangHitamNo ratings yet

- APO Cement Corp. HolcimDocument46 pagesAPO Cement Corp. HolcimKate DaizNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Alimentation Couche-Tard Ratio Analysis 2019-2016Document2 pagesAlimentation Couche-Tard Ratio Analysis 2019-2016/jncjdncjdnNo ratings yet

- Company Background - Jollibee1Document5 pagesCompany Background - Jollibee1Ray marNo ratings yet

- A.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Document7 pagesA.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Levi Lazareno EugenioNo ratings yet

- Ratio Analysis of PT TelekomunikasiDocument7 pagesRatio Analysis of PT TelekomunikasiJae Bok LeeNo ratings yet

- Balance Sheet and Income Statement Ratio AnalysisDocument5 pagesBalance Sheet and Income Statement Ratio AnalysisBilal TariqNo ratings yet

- Airtel Ratio AnalysisDocument8 pagesAirtel Ratio AnalysishjiyoNo ratings yet

- MAXIS Financial Ratios Analysis 2013-2014Document4 pagesMAXIS Financial Ratios Analysis 2013-2014CalonneFrNo ratings yet

- Financial ratio calculation analysisDocument2 pagesFinancial ratio calculation analysisAbank FahriNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Tugas Personal 1 FINC6193Document9 pagesTugas Personal 1 FINC6193alif syahputra11No ratings yet

- JaletaDocument8 pagesJaletaአረጋዊ ሐይለማርያምNo ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- Analyzing Financial Statements and Key Profitability RatiosDocument15 pagesAnalyzing Financial Statements and Key Profitability RatiosMohammad Al AkoumNo ratings yet

- Recording Sales and Costs for Installment and Regular SalesDocument2 pagesRecording Sales and Costs for Installment and Regular Salesjohn carlos doringoNo ratings yet

- Ch13-Leverage, Capital Structure-Part 2Document32 pagesCh13-Leverage, Capital Structure-Part 2Hatem MohammedNo ratings yet

- Nator Group Is Establishing A Factory in New South WaleDocument3 pagesNator Group Is Establishing A Factory in New South WaleKDVNo ratings yet

- Colgate-Palmolive Financial Analysis: Profits Up 41% Over 5 YearsDocument7 pagesColgate-Palmolive Financial Analysis: Profits Up 41% Over 5 YearsAkash DidhariaNo ratings yet

- Reformulated Income Statement of Century Ply: Operating RevenueDocument2 pagesReformulated Income Statement of Century Ply: Operating RevenueBhoomika GuptaNo ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- 17691e0002 Assignment 2Document4 pages17691e0002 Assignment 2Ajay KumarNo ratings yet

- Financial Ratios For Dar Al Shefaa Corporation 2015Document6 pagesFinancial Ratios For Dar Al Shefaa Corporation 2015Lina Jardaneh (Lina Jardaneh)No ratings yet

- Jollibee Foods Corporation Statement of Comprehensive IncomeDocument17 pagesJollibee Foods Corporation Statement of Comprehensive IncomeavimalditaNo ratings yet

- Financial Performance and Ratio Trends Over 4 YearsDocument2 pagesFinancial Performance and Ratio Trends Over 4 YearsASHOK JAINNo ratings yet

- AlnoorDocument4 pagesAlnoorZain KhalidNo ratings yet

- 8.1: Introduction and Objective of Finance DepartmentDocument10 pages8.1: Introduction and Objective of Finance DepartmentHarsh SiddhapuraNo ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Financial Ratios Analysis of Company from 2018-2021Document12 pagesFinancial Ratios Analysis of Company from 2018-2021AkshitNo ratings yet

- Key Financial Ratios of GAIL India - in Rs. Cr.Document2 pagesKey Financial Ratios of GAIL India - in Rs. Cr.Anonymous N7yzbYbHNo ratings yet

- Balance Sheet2Document5 pagesBalance Sheet2anujaNo ratings yet

- Latihan Bab 3Document19 pagesLatihan Bab 3Noura AdriantyNo ratings yet

- Ar-2019 JKTL141060 2Document1 pageAr-2019 JKTL141060 2Alfian Nur HudaNo ratings yet

- Profitability Ratios Stock Price NiftyDocument3 pagesProfitability Ratios Stock Price Niftyneekuj malikNo ratings yet

- Assignment - 01Document4 pagesAssignment - 01SP VetNo ratings yet

- Emu LinesDocument22 pagesEmu LinesRahul MehraNo ratings yet

- FIN Individual AssignmentDocument8 pagesFIN Individual AssignmentMuhammad Muzammel100% (1)

- LeaseDocument6 pagesLeasevnprakash sharmaNo ratings yet

- Balance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsDocument16 pagesBalance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsPRIYA GNAESWARANNo ratings yet

- Train Law Awareness LectureDocument7 pagesTrain Law Awareness LecturejoshuaNo ratings yet

- Special LawsDocument7 pagesSpecial LawsjoshuaNo ratings yet

- Chapter 01 - Business CombinationsDocument17 pagesChapter 01 - Business CombinationsTina LundstromNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- Analysis of Key Financial Ratios for Helix CorpDocument2 pagesAnalysis of Key Financial Ratios for Helix CorpjoshuaNo ratings yet

- Analysis of Key Financial Ratios for Helix CorpDocument2 pagesAnalysis of Key Financial Ratios for Helix CorpjoshuaNo ratings yet

- Vision and Mission StatementDocument6 pagesVision and Mission StatementjoshuaNo ratings yet

- Auditing ReportDocument15 pagesAuditing ReportjoshuaNo ratings yet

- Law on Sales, Agency and Credit Transactions in the PhilippinesDocument2 pagesLaw on Sales, Agency and Credit Transactions in the PhilippinesPrincess Beldad33% (3)

- Start: Use Bamboo Stake or Not?Document1 pageStart: Use Bamboo Stake or Not?joshuaNo ratings yet

- Helix Steel vision recognizedDocument4 pagesHelix Steel vision recognizedjoshuaNo ratings yet

- Auditing Multiple ChoiceDocument18 pagesAuditing Multiple ChoiceAken Lieram Ats AnaNo ratings yet

- Presentation 1Document64 pagesPresentation 1joshuaNo ratings yet

- Notes To AdvaccDocument1 pageNotes To AdvaccjoshuaNo ratings yet

- Basic AccountingDocument12 pagesBasic AccountingjoshuaNo ratings yet

- Quiz BeeDocument15 pagesQuiz Beejoshua100% (1)

- SRGG Group 1Document20 pagesSRGG Group 1joshuaNo ratings yet

- QuestionsDocument80 pagesQuestionsjoshuaNo ratings yet

- Canning History and Food Preservation MethodsDocument4 pagesCanning History and Food Preservation MethodsjoshuaNo ratings yet

- PDFDocument8 pagesPDFjoshuaNo ratings yet

- Canning History and Food Preservation MethodsDocument4 pagesCanning History and Food Preservation MethodsjoshuaNo ratings yet

- JnvuDocument14 pagesJnvuSourav SenNo ratings yet

- TPA Deals Only With Immovable Property'Document17 pagesTPA Deals Only With Immovable Property'Prachi Verma0% (1)

- Republic of Kenya: Kenya Gazette Supplement No. 107 (Acts No.11)Document26 pagesRepublic of Kenya: Kenya Gazette Supplement No. 107 (Acts No.11)Benard OderoNo ratings yet

- Lê H NG Linh Tel: 0903 978 552 Faculty of ESP FTUDocument29 pagesLê H NG Linh Tel: 0903 978 552 Faculty of ESP FTUPham Thi Kim OanhNo ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- FM Final ProjectDocument20 pagesFM Final ProjectNuman RoxNo ratings yet

- MAS-06 Operational BudgetingDocument7 pagesMAS-06 Operational BudgetingKrizza MaeNo ratings yet

- Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700Document30 pagesEpicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700nerz8830No ratings yet

- Math Final ProjectDocument6 pagesMath Final Projectapi-247933607No ratings yet

- Cash in Bank Register: Appendix 37Document2 pagesCash in Bank Register: Appendix 37Lani LacarrozaNo ratings yet

- Press Release: Arwade Infrastructure Limited D-U-N-S® Number: 86-414-9519Document4 pagesPress Release: Arwade Infrastructure Limited D-U-N-S® Number: 86-414-9519Ravi BabuNo ratings yet

- Offset Agreement - Wikipedia, The Free EncyclopediaDocument20 pagesOffset Agreement - Wikipedia, The Free EncyclopedianeerajscribdNo ratings yet

- NFLX Initiating Coverage JSDocument12 pagesNFLX Initiating Coverage JSBrian BolanNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- Court Rules Expropriation for Private Subdivision Not Valid Public UseDocument489 pagesCourt Rules Expropriation for Private Subdivision Not Valid Public UseNico FerrerNo ratings yet

- MCQ NpoDocument6 pagesMCQ NpoSurya ShekharNo ratings yet

- Https WWW - Irctc.co - in Eticketing PrintTicketDocument1 pageHttps WWW - Irctc.co - in Eticketing PrintTicketKalyan UppadaNo ratings yet

- Financial Management Part 3 UpdatedDocument65 pagesFinancial Management Part 3 UpdatedMarielle Ace Gole CruzNo ratings yet

- Conceptual Framework and Accounting Standards: College of Business Administration Final Examination in (ACCN03B)Document4 pagesConceptual Framework and Accounting Standards: College of Business Administration Final Examination in (ACCN03B)Gianna Gracelyn G GeronimoNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- Error Correction (Part 2) - Suspense Accounts (Including RQS)Document6 pagesError Correction (Part 2) - Suspense Accounts (Including RQS)King JulianNo ratings yet

- CLEANSING PROCESS FOR DIVIDENDS AND GAINSDocument2 pagesCLEANSING PROCESS FOR DIVIDENDS AND GAINSAbdul Aziz MuhammadNo ratings yet