Professional Documents

Culture Documents

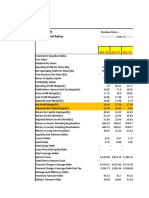

Tata Motors: Previous Years

Uploaded by

Harsh Bansal0 ratings0% found this document useful (0 votes)

10 views5 pagesThis document contains key financial ratios for Tata Motors from March 2017 to March 2013. It includes ratios related to investment valuation, profitability, liquidity and solvency, debt coverage, management efficiency, profit and loss account, and cash flow indicators. The ratios show figures such as operating profit per share, net operating profit per share, return on capital employed, current ratio, and debt to equity ratio over the five-year period.

Original Description:

TM

Original Title

5 Yrs Ratios

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains key financial ratios for Tata Motors from March 2017 to March 2013. It includes ratios related to investment valuation, profitability, liquidity and solvency, debt coverage, management efficiency, profit and loss account, and cash flow indicators. The ratios show figures such as operating profit per share, net operating profit per share, return on capital employed, current ratio, and debt to equity ratio over the five-year period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views5 pagesTata Motors: Previous Years

Uploaded by

Harsh BansalThis document contains key financial ratios for Tata Motors from March 2017 to March 2013. It includes ratios related to investment valuation, profitability, liquidity and solvency, debt coverage, management efficiency, profit and loss account, and cash flow indicators. The ratios show figures such as operating profit per share, net operating profit per share, return on capital employed, current ratio, and debt to equity ratio over the five-year period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

Tata Motors Previous Years »

Consolidated Key Financial ------------------- in Rs. Cr.

Ratios -------------------

Mar '17 Mar '16 Mar '15 Mar '14 Mar '13

Investment Valuation Ratios

Face Value 2 2 2 2 2

Dividend Per Share -- -- -- -- --

Operating Profit Per Share (Rs) 87.13 108.24 121.91 108.24 76.95

Net Operating Profit Per Share

794.18 811.5 816.47 723.38 591.88

(Rs)

Free Reserves Per Share (Rs) -- -- -- -- --

Bonus in Equity Capital 16.38 16.38 17.28 17.28 17.44

Profitability Ratios

Operating Profit Margin(%) 10.97 13.33 14.93 14.96 13

Profit Before Interest And Tax

4.32 7.13 9.8 10.16 8.95

Margin(%)

Gross Profit Margin(%) 4.33 7.16 9.83 10.2 8.99

Cash Profit Margin(%) 8.45 10.93 10.47 11.19 9.51

Adjusted Cash Margin(%) 8.45 10.93 10.47 11.19 9.51

Net Profit Margin(%) 2.76 4 5.32 6 5.23

Adjusted Net Profit Margin(%) 2.75 3.98 5.3 5.98 5.21

Return On Capital Employed(%) 9.38 14.4 21.32 20.39 21.87

Return On Net Worth(%) 12.83 13.64 24.86 21.33 26.31

Adjusted Return on Net Worth(%) 8.52 16.37 25.32 23 27.83

Return on Assets Excluding

170.98 237.83 174.73 203.75 117.86

Revaluations

Return on Assets Including

170.98 237.9 174.8 203.82 117.98

Revaluations

Return on Long Term Funds(%) 10.47 15.62 23.81 22.18 25.52

Liquidity And Solvency Ratios

Current Ratio 0.78 0.82 0.8 0.94 0.81

Quick Ratio 0.6 0.63 0.66 0.78 0.7

Debt Equity Ratio 1.28 0.78 1.23 0.84 1.16

Long Term Debt Equity Ratio 1.04 0.64 1 0.69 0.85

Debt Coverage Ratios

Interest Cover 2.93 4.48 5.5 5.19 5.01

Total Debt to Owners Fund 1.28 0.78 1.23 0.84 1.16

Financial Charges Coverage Ratio 7.16 8.16 8.26 7.53 7.14

Financial Charges Coverage Ratio

6.98 7.06 6.63 6.3 5.91

Post Tax

Management Efficiency Ratios

Inventory Turnover Ratio 7.82 8.39 9.1 8.68 9.23

Debtors Turnover Ratio 19.93 21.55 22.7 21.64 19.69

Investments Turnover Ratio 7.82 8.39 9.1 8.68 9.23

Fixed Assets Turnover Ratio 2.62 2.18 2.43 2.44 2.51

Total Assets Turnover Ratio 2.79 2.72 2.93 2.52 3.21

Asset Turnover Ratio 1.94 2.04 2.13 2.3 2.45

Average Raw Material Holding -- -- -- -- --

Average Finished Goods Held -- -- -- -- --

Number of Days In Working

-71.54 -17.74 -16.28 -4.02 -10

Capital

Profit & Loss Account Ratios

Material Cost Composition 65.15 60.74 62.79 63.61 66.06

Imported Composition of Raw

-- -- -- -- --

Materials Consumed

Selling Distribution Cost

-- -- -- -- --

Composition

Expenses as Composition of Total

-- -- -- -- --

Sales

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 0.97 1 0.43 5.47 7.64

Dividend Payout Ratio Cash Profit 0.28 0.39 0.21 3.05 4.33

Earning Retention Ratio 98.53 99.17 99.58 94.93 92.78

Cash Earning Retention Ratio 99.69 99.64 99.79 97.08 95.81

AdjustedCash Flow Times 3.26 2.09 2.5 2.1 2.42

Source : Dion Global Solutions Limited

You might also like

- Bata India key financial ratios for past 5 yearsDocument2 pagesBata India key financial ratios for past 5 yearsSanket BhondageNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Investment Valuation Ratios Over 5 YearsDocument16 pagesInvestment Valuation Ratios Over 5 Yearsgaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Investment Valuation Ratios TableDocument4 pagesInvestment Valuation Ratios Tablehoney08priya1No ratings yet

- Housing Ratio PDFDocument2 pagesHousing Ratio PDFAbdul Khaliq ChoudharyNo ratings yet

- in Rs. Cr. - Key Financial Ratios of HDFC BankDocument8 pagesin Rs. Cr. - Key Financial Ratios of HDFC BankthodupunooripkNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosTejaswiniNo ratings yet

- RatiosDocument2 pagesRatiosAbhay Kumar SinghNo ratings yet

- Coal India Financial RatiosDocument2 pagesCoal India Financial RatiosvanishaNo ratings yet

- Hindustan Unilever key financial ratios over 5 yearsDocument6 pagesHindustan Unilever key financial ratios over 5 yearsMANIVISHVARJOON BOOMINATHANNo ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Key Financial Ratios of Tata Motors: - in Rs. Cr.Document3 pagesKey Financial Ratios of Tata Motors: - in Rs. Cr.ajinkyamahajanNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Industry Analysis RatioDocument79 pagesIndustry Analysis Ratiopratz1996No ratings yet

- Larsen & Toubro InfotechDocument2 pagesLarsen & Toubro InfotechPriyaPrasadNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- RatiosDocument2 pagesRatiosPRATHAMNo ratings yet

- State Bank of India: Key Financial Ratios - in Rs. Cr.Document4 pagesState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7No ratings yet

- BaljiDocument4 pagesBaljiBalaji SuburajNo ratings yet

- Ratios of BajajDocument2 pagesRatios of BajajSunil KumarNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Bajaj Auto Financial Ratios AnalysisDocument17 pagesBajaj Auto Financial Ratios AnalysisYuvraj BholaNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Profit and loss analysis of 5 yearsDocument5 pagesProfit and loss analysis of 5 yearspratikNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- TCS Ratio AnalysisDocument2 pagesTCS Ratio AnalysisLogesh SureshNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- ONGC Financial AnalysisDocument13 pagesONGC Financial Analysisdipshi92No ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- Nestle RatioDocument12 pagesNestle RatiomuzamilbasuNo ratings yet

- Financial Ratios of Zee Entertainment Over 5 YearsDocument2 pagesFinancial Ratios of Zee Entertainment Over 5 Yearssagar naikNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- DR Reddy RatiosDocument6 pagesDR Reddy RatiosRezwan KhanNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Document4 pagesPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Report Card: Attribute Value DateDocument20 pagesReport Card: Attribute Value DateMp SunilNo ratings yet

- Praj Industries Ltd. - Research Center Balance Sheet AnalysisDocument19 pagesPraj Industries Ltd. - Research Center Balance Sheet AnalysisnehaNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Financial RatioDocument16 pagesFinancial RatioSantanu ModiNo ratings yet

- JAIIB PPB Sample Questions by Murugan-Nov 19 Exams PDFDocument595 pagesJAIIB PPB Sample Questions by Murugan-Nov 19 Exams PDFsandeep Aadhya67% (3)

- Sales ForecastingDocument19 pagesSales ForecastingHarsh Bansal100% (1)

- Dashboard:RFM ANALYSISDocument1 pageDashboard:RFM ANALYSISHarsh BansalNo ratings yet

- The Cover LetterDocument5 pagesThe Cover LetterZain UlabideenNo ratings yet

- Wind 5Document4 pagesWind 5Harsh BansalNo ratings yet

- Lakshmangarh - 332311 Distt. Sikar (Raj) : PH: 01573-225001-225012 (12 Lines) Fax: 01573-225045Document1 pageLakshmangarh - 332311 Distt. Sikar (Raj) : PH: 01573-225001-225012 (12 Lines) Fax: 01573-225045Harsh BansalNo ratings yet

- Navneet ReportDocument17 pagesNavneet ReportIshaan GuptaNo ratings yet

- VA TECH WABAG CaseDocument2 pagesVA TECH WABAG CaseHarsh BansalNo ratings yet

- CoverDocument9 pagesCoverHarsh BansalNo ratings yet

- Use of The Auxiliaries: A) I) Do, Does, DidDocument5 pagesUse of The Auxiliaries: A) I) Do, Does, DidHarsh BansalNo ratings yet

- The Prospects of Non Conventional Source of Energy in IndiaDocument19 pagesThe Prospects of Non Conventional Source of Energy in IndiaHarsh BansalNo ratings yet

- Wind 5Document4 pagesWind 5Harsh BansalNo ratings yet

- Lakshmangarh - 332311 Distt. Sikar (Raj) : PH: 01573-225001-225012 (12 Lines) Fax: 01573-225045Document1 pageLakshmangarh - 332311 Distt. Sikar (Raj) : PH: 01573-225001-225012 (12 Lines) Fax: 01573-225045Harsh BansalNo ratings yet

- Energy BookletDocument144 pagesEnergy BookletHarsh BansalNo ratings yet

- Navneet Publications Complete Brand StudyDocument34 pagesNavneet Publications Complete Brand Studydyumna100% (1)

- Organization Structure, Departm Ents, Function, RelationshipDocument5 pagesOrganization Structure, Departm Ents, Function, RelationshipHarsh BansalNo ratings yet

- HRM Functions of GoogleDocument13 pagesHRM Functions of GoogleHarsh BansalNo ratings yet

- Century Ply Final ReportDocument25 pagesCentury Ply Final ReportHarsh Bansal0% (1)

- Century PlyDocument5 pagesCentury PlyHarsh BansalNo ratings yet

- Consolidated Tata Review July 2014Document88 pagesConsolidated Tata Review July 2014Harsh BansalNo ratings yet

- Or Case Study Term 3Document6 pagesOr Case Study Term 3Harsh BansalNo ratings yet

- Whirlpool and The Global Appliance IndustryDocument6 pagesWhirlpool and The Global Appliance IndustryHarsh Bansal100% (1)

- 3vol4no4 PDFDocument5 pages3vol4no4 PDFwasiuddinNo ratings yet

- HRM Functions of GoogleDocument13 pagesHRM Functions of GoogleHarsh BansalNo ratings yet

- Final ReportDocument7 pagesFinal ReportHarsh Bansal50% (2)

- Organizational Structure of Century PlyDocument24 pagesOrganizational Structure of Century PlyHarsh BansalNo ratings yet

- Performance AppraisalDocument2 pagesPerformance AppraisalLakshya AggarwalNo ratings yet

- Whirlpool and The Global Appliance IndustryDocument6 pagesWhirlpool and The Global Appliance IndustryHarsh Bansal100% (1)

- HRM CasesDocument13 pagesHRM CasesHarsh BansalNo ratings yet

- Ob FinalDocument5 pagesOb FinalHarsh BansalNo ratings yet

- Vgalan DMDocument2 pagesVgalan DMvinnygoldNo ratings yet

- Portfolio On Philippine Politics and Governance: 1 Quarter, 1 SemesterDocument18 pagesPortfolio On Philippine Politics and Governance: 1 Quarter, 1 SemesterDexter SaladinoNo ratings yet

- (655338325) Econ-FnalsDocument31 pages(655338325) Econ-FnalsShai RaNo ratings yet

- Project Feasibility Study AnalysisDocument3 pagesProject Feasibility Study AnalysisJanus Aries SimbilloNo ratings yet

- Bba 402 PDFDocument2 pagesBba 402 PDFarmaanNo ratings yet

- Local Economic Development StrategyDocument17 pagesLocal Economic Development StrategyMaria Kathreena Andrea AdevaNo ratings yet

- Indian Capital Market Writen AssignmentDocument7 pagesIndian Capital Market Writen AssignmentHs Tripathi100% (1)

- Olicy Eries: Who Owns Taxi Licences?Document22 pagesOlicy Eries: Who Owns Taxi Licences?Asafo AddaiNo ratings yet

- Gross Domestic Product DefinitionDocument19 pagesGross Domestic Product DefinitionGlenNo ratings yet

- Hedging Strategies Using Futures and OptionsDocument5 pagesHedging Strategies Using Futures and Optionsniravthegreate999No ratings yet

- Market Value BasisDocument11 pagesMarket Value BasisAtnapaz JodNo ratings yet

- International Marketing Chapter 16 NotesDocument5 pagesInternational Marketing Chapter 16 NotesRicardo SanchezNo ratings yet

- Ba (H) 20-Sem.i-Iii-V PDFDocument14 pagesBa (H) 20-Sem.i-Iii-V PDFapoorvaNo ratings yet

- Business Cycles: Causes and CharacteristicsDocument108 pagesBusiness Cycles: Causes and CharacteristicsBai Alleha MusaNo ratings yet

- Roadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Document17 pagesRoadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Gc DmNo ratings yet

- I. Economic Environment (1) I: The Philippines WT/TPR/S/59Document15 pagesI. Economic Environment (1) I: The Philippines WT/TPR/S/59Roselyn MonsayNo ratings yet

- Pool of Questions of Economix Quizbee 2013Document17 pagesPool of Questions of Economix Quizbee 2013John Vincent Pardilla100% (1)

- Bachelor of IT and Management CollegeDocument36 pagesBachelor of IT and Management CollegeKIST College0% (1)

- Transport 2040 - Automation Technology Employment - The Future o PDFDocument169 pagesTransport 2040 - Automation Technology Employment - The Future o PDFdisembryanNo ratings yet

- Who Is An EntrepreneurDocument29 pagesWho Is An EntrepreneurmeliasuzzielNo ratings yet

- Physical DistributionDocument61 pagesPhysical DistributionPeter Dindah100% (2)

- Chapter 12Document100 pagesChapter 12cutiee cookieyNo ratings yet

- AQR Portfolio Rebalancing Part 1 Strategic Asset AllocationDocument16 pagesAQR Portfolio Rebalancing Part 1 Strategic Asset Allocationlaozi222No ratings yet

- Programmes in English SapienzaDocument37 pagesProgrammes in English SapienzaAzucena CortezNo ratings yet

- p2 - Guerrero Ch10Document28 pagesp2 - Guerrero Ch10JerichoPedragosa67% (3)

- Ace Hardware Indonesia IndonesiaDocument435 pagesAce Hardware Indonesia IndonesiaDataGroup Retailer Analysis100% (2)

- EOQ1Document2 pagesEOQ1Shivraj GaikwadNo ratings yet

- ECON 365 NotesDocument82 pagesECON 365 Notesrushikesh KanireNo ratings yet

- fb91 PDFDocument6 pagesfb91 PDFShivaditya VermanNo ratings yet