Professional Documents

Culture Documents

CIR Vs ST Lukes

Uploaded by

MeAnn TumbagaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR Vs ST Lukes

Uploaded by

MeAnn TumbagaCopyright:

Available Formats

Commissioner of Internal Revenue vs.

St Luke's Medical Center

Facts:

St. Luke’s Medical Center, Inc. (St. Luke’s) is a hospital organized as a non-stock and non-profit

corporation. St. Luke’s accepts both paying and non-paying patients. The BIR assessed St.

Luke’s deficiency taxes for 1998 comprised of deficiency income tax, value-added tax, and

withholding tax. The BIR claimed that St. Luke’s should be liable for income tax at a preferential

rate of 10% as provided for by Section 27(B). Further, the BIR claimed that St. Luke’s was

actually operating for profit in 1998 because only 13% of its revenues came from charitable

purposes. Moreover, the hospital’s board of trustees, officers and employees directly benefit

from its profits and assets.

On the other hand, St. Luke’s maintained that it is a non-stock and non-profit institution for

charitable and social welfare purposes exempt from income tax under Section 30(E) and (G) of

the NIRC. It argued that the making of profit per se does not destroy its income tax exemption.

Issue:

The sole issue is whether St. Luke’s is liable for deficiency income tax in 1998 under Section

27(B) of the NIRC, which imposes a preferential tax rate of 10^ on the income of proprietary

non-profit hospitals.

Ruling:

Yes. St Luke’s is liable under sec 27(b) of the NIRC

Section 30(E) and (G) of the NIRC requires that an institution be “operated exclusively” for

charitable or social welfare purposes to be completely exempt from income tax. An institution

under Section 30(E) or (G) does not lose its tax exemption if it earns income from its for-profit

activities. Such income from for-profit activities, under the last paragraph of Section 30, is

merely subject to income tax, previously at the ordinary corporate rate but now at the preferential

10% rate pursuant to Section 27(B).

In other words, revenues from commercial (e.g., for-profit) activity (in this case, paying patients)

are taxable, but the organization remains tax-exempt on its actual charitable activities. There is

no "relatedness" test here as under our UBIT; the only question is whether an activity is for-

profit (commercial).

St. Luke’s fails to meet the requirements under Section 30(E) and (G) of the NIRC to be

completely tax exempt from all its income. However, it remains a proprietary non-profit hospital

under Section 27(B) of the NIRC as long as it does not distribute any of its profits to its members

and such profits are reinvested pursuant to its corporate purposes. St. Luke’s, as a proprietary

non-profit hospital, is entitled to the preferential tax rate of 10% on its net income from its for-

profit activities.

St. Luke’s is therefore liable for deficiency income tax in 1998 under Section 27(B) of the NIRC.

You might also like

- CIR Vs ST LukesDocument4 pagesCIR Vs ST LukesJohn Dexter FuentesNo ratings yet

- Commissioner of St. Lukes CAse Digest TAxDocument1 pageCommissioner of St. Lukes CAse Digest TAxKayee KatNo ratings yet

- Cir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorDocument2 pagesCir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorsakuraNo ratings yet

- BIR Circular on Taxing Non-Profit Clubs Ruled InvalidDocument2 pagesBIR Circular on Taxing Non-Profit Clubs Ruled InvalidEllenNo ratings yet

- CIR Vs Stanley PHDocument2 pagesCIR Vs Stanley PHAnneNo ratings yet

- Tax CasesDocument9 pagesTax CasesJan Mar Gigi GallegoNo ratings yet

- CIR Vs General FoodsDocument4 pagesCIR Vs General FoodsMonaVargasNo ratings yet

- Cir V Spouses Manly Digest (Tax)Document1 pageCir V Spouses Manly Digest (Tax)Erika Bianca ParasNo ratings yet

- Cir Vs Central Luzon Drug CorporationDocument7 pagesCir Vs Central Luzon Drug CorporationErika Libberman HeinzNo ratings yet

- Ing N.V. Metro Manila Branch Vs Cir DigestDocument2 pagesIng N.V. Metro Manila Branch Vs Cir Digestbrian jay hernandezNo ratings yet

- Vera v. FernandezDocument2 pagesVera v. FernandezReinerr NuestroNo ratings yet

- Collector Vs GoodrichDocument2 pagesCollector Vs GoodrichMadsSalazarNo ratings yet

- Supreme Court: Republic of The Philippines Manila First DivisionDocument10 pagesSupreme Court: Republic of The Philippines Manila First DivisionJopan SJNo ratings yet

- CITY GOVERNMENT OF QUEZON vs. BAYANTELDocument2 pagesCITY GOVERNMENT OF QUEZON vs. BAYANTELAngela Mericci G. MejiaNo ratings yet

- Herrera V Quezon City Board of Assessment GR No L-15270Document8 pagesHerrera V Quezon City Board of Assessment GR No L-15270KidMonkey2299No ratings yet

- 142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Document2 pages142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Jopan SJNo ratings yet

- 1 - MANILA GAS vs. CIR - PabloDocument2 pages1 - MANILA GAS vs. CIR - PabloCherith MonteroNo ratings yet

- 124 CIR v. BOACDocument2 pages124 CIR v. BOACMiw CortesNo ratings yet

- Tax - Mindanao II Geothermal Partnership vs. Cir DigestDocument4 pagesTax - Mindanao II Geothermal Partnership vs. Cir DigestMaria Cherrylen Castor Quijada100% (1)

- Caltex v. COADocument6 pagesCaltex v. COAHappy Dreams PhilippinesNo ratings yet

- Angeles Univ Foundation v. City of AngelesDocument2 pagesAngeles Univ Foundation v. City of AngelesGlenn Mark Frejas RinionNo ratings yet

- Government Vs FrankDocument2 pagesGovernment Vs FrankWonder WomanNo ratings yet

- Case No. 3 Tax Case DigestDocument3 pagesCase No. 3 Tax Case Digestkc lovessNo ratings yet

- CIR Vs MarubeniDocument2 pagesCIR Vs MarubeniKervy Sanell SalazarNo ratings yet

- DLSU Tax Exemption UpheldDocument2 pagesDLSU Tax Exemption UpheldNinya Saquilabon60% (5)

- 64 Mesina vs. IACDocument5 pages64 Mesina vs. IACCharm Divina LascotaNo ratings yet

- Atlas Consolidated Mining and Dev't Corp vs. CIRDocument2 pagesAtlas Consolidated Mining and Dev't Corp vs. CIRmaica_prudente100% (1)

- 1 Tax Rev - CIR Vs Javier 199 Scra 824Document8 pages1 Tax Rev - CIR Vs Javier 199 Scra 824LucioJr Avergonzado100% (1)

- CIR vs. San Miguel Corp Tax DigestDocument2 pagesCIR vs. San Miguel Corp Tax DigestCJ100% (3)

- Manila Bank examines grace period for minimum corporate income taxDocument2 pagesManila Bank examines grace period for minimum corporate income taxCheska VergaraNo ratings yet

- 06 - Vidal de Roces v. PosadasDocument2 pages06 - Vidal de Roces v. Posadascool_peachNo ratings yet

- Family Feud Dismissal Rule InterpretationDocument6 pagesFamily Feud Dismissal Rule InterpretationRioNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- 71 Ing Bank VSDocument2 pages71 Ing Bank VSManuel Villanueva100% (1)

- TAX CIR Vs IsabelaDocument1 pageTAX CIR Vs IsabelaEly VelascoNo ratings yet

- LAND BANK OF THE PHILIPPINES Vs CACAYURANDocument2 pagesLAND BANK OF THE PHILIPPINES Vs CACAYURANJyrus CimatuNo ratings yet

- Cir Vs CA and Ymca (Summary)Document4 pagesCir Vs CA and Ymca (Summary)ian clark MarinduqueNo ratings yet

- CITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCDocument2 pagesCITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCEmil BautistaNo ratings yet

- Lung Center of The PH v. QCDocument3 pagesLung Center of The PH v. QCJB GuevarraNo ratings yet

- CIR vs. Algue, G.R. No. L-28896, February 17, 1988Document8 pagesCIR vs. Algue, G.R. No. L-28896, February 17, 1988Machida AbrahamNo ratings yet

- P&G Phils Can Claim Tax RefundDocument3 pagesP&G Phils Can Claim Tax RefundKarl MinglanaNo ratings yet

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- Digests For TaxDocument12 pagesDigests For TaxFender BoyangNo ratings yet

- Angeles Univ Foundation V City of AngelesDocument4 pagesAngeles Univ Foundation V City of AngelesjeyarelsiNo ratings yet

- LTD Cases 3Document8 pagesLTD Cases 3Mark JNo ratings yet

- Digests TaxDocument17 pagesDigests TaxMav ZamoraNo ratings yet

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDocument2 pagesJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningNo ratings yet

- Tax Exempt Status of Non-Profit FoundationsDocument16 pagesTax Exempt Status of Non-Profit FoundationsPhulagyn CañedoNo ratings yet

- SC declares sections of RR 10-2008 null and void for adding qualifications not found in R.A. 9504Document5 pagesSC declares sections of RR 10-2008 null and void for adding qualifications not found in R.A. 9504Chelle BelenzoNo ratings yet

- Silkair v. CIR: Proper party to claim excise tax refund is statutory taxpayerDocument3 pagesSilkair v. CIR: Proper party to claim excise tax refund is statutory taxpayerRob100% (1)

- Air Canada Vs Cir G.R. No.169507, January 11, 2016 FactsDocument2 pagesAir Canada Vs Cir G.R. No.169507, January 11, 2016 FactsTonifranz Sareno100% (1)

- SC rules on VAT deductions in construction sub-contractingDocument46 pagesSC rules on VAT deductions in construction sub-contractingDeb Bie100% (1)

- Tax-Public Purpose (Digest)Document9 pagesTax-Public Purpose (Digest)GM AlfonsoNo ratings yet

- Tax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Document22 pagesTax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Harlene Kaye Dayag TaguinodNo ratings yet

- 50-Meralco Vs Province of LagunaDocument2 pages50-Meralco Vs Province of LagunaKris GrubaNo ratings yet

- Cir v. Procter & Gamble Philippines Manufacturing Corpoation, & CtaDocument2 pagesCir v. Procter & Gamble Philippines Manufacturing Corpoation, & CtaDirect LukeNo ratings yet

- CIR Vs Pineda DigestDocument1 pageCIR Vs Pineda DigestRoz Lourdiz CamachoNo ratings yet

- CIR Barred from Assessing Bank for 1998 TaxesDocument2 pagesCIR Barred from Assessing Bank for 1998 TaxesCecil MoriNo ratings yet

- Republic Vs PatanaoDocument1 pageRepublic Vs PatanaoAnonymous XsaqDYDNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument1 pageCommissioner of Internal Revenue vs. ST Luke's Medical CenterTJ Dasalla GallardoNo ratings yet

- Title Xiv DissolutionDocument5 pagesTitle Xiv DissolutionMeAnn Tumbaga0% (1)

- I Have A StoryDocument3 pagesI Have A StoryMeAnn TumbagaNo ratings yet

- What Do You See - Using Photos To Teach About Perception PDFDocument4 pagesWhat Do You See - Using Photos To Teach About Perception PDFMeAnn TumbagaNo ratings yet

- Title Xiii One Person CorporationDocument4 pagesTitle Xiii One Person CorporationMeAnn TumbagaNo ratings yet

- Civil Syllabus PDFDocument14 pagesCivil Syllabus PDFHabib SimbanNo ratings yet

- Title X Appraisal RightDocument3 pagesTitle X Appraisal RightMeAnn TumbagaNo ratings yet

- Title Iii Board of Directors - Trustees and OfficersDocument7 pagesTitle Iii Board of Directors - Trustees and OfficersMeAnn TumbagaNo ratings yet

- Title Xii Close CorporationsDocument5 pagesTitle Xii Close CorporationsMeAnn TumbagaNo ratings yet

- Title Ix Merger and ConsolidationDocument3 pagesTitle Ix Merger and ConsolidationMeAnn TumbagaNo ratings yet

- VII Stocks and StockholdersDocument7 pagesVII Stocks and StockholdersMeAnn TumbagaNo ratings yet

- Title Xi Nonstock CorporationsDocument2 pagesTitle Xi Nonstock CorporationsMeAnn Tumbaga100% (1)

- 5Document2 pages5MeAnn TumbagaNo ratings yet

- Corporate Books and Records RightsDocument3 pagesCorporate Books and Records RightsMeAnn TumbagaNo ratings yet

- Title V by LawsDocument1 pageTitle V by LawsMeAnn TumbagaNo ratings yet

- Title XV Foreign CorporationDocument1 pageTitle XV Foreign CorporationMeAnn TumbagaNo ratings yet

- Part II Incorporation and Corporate ExistenceDocument7 pagesPart II Incorporation and Corporate ExistenceMeAnn TumbagaNo ratings yet

- Insurance CasesDocument61 pagesInsurance CasesMeAnn TumbagaNo ratings yet

- ThesisDocument322 pagesThesisMeAnn TumbagaNo ratings yet

- MITIGATING CIRCUMSTANCES REDUCE CRIME PENALTYDocument6 pagesMITIGATING CIRCUMSTANCES REDUCE CRIME PENALTYMeAnn Tumbaga100% (1)

- KeihinDocument1 pageKeihinMeAnn TumbagaNo ratings yet

- Midterm Reviewer in Public CorporationDocument9 pagesMidterm Reviewer in Public CorporationMeAnn TumbagaNo ratings yet

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Special Proceedings Memory Aid PDFDocument37 pagesSpecial Proceedings Memory Aid PDFMarcko LimNo ratings yet

- Justifying CirmcumstanceDocument8 pagesJustifying CirmcumstanceMeAnn TumbagaNo ratings yet

- Insurance Case Digests (Part 1)Document3 pagesInsurance Case Digests (Part 1)JohnAlexanderBelderol100% (1)

- Justifying CirmcumstanceDocument8 pagesJustifying CirmcumstanceMeAnn TumbagaNo ratings yet

- 103394Document5 pages103394MeAnn TumbagaNo ratings yet

- Banco Filipino Vs CIRDocument3 pagesBanco Filipino Vs CIRMeAnn TumbagaNo ratings yet

- 105525Document56 pages105525MeAnn TumbagaNo ratings yet

- CIR vs. Kudos Metal Tax AssessmentDocument2 pagesCIR vs. Kudos Metal Tax AssessmentMeAnn TumbagaNo ratings yet

- Offer Letter For Marketing ExecutivesDocument2 pagesOffer Letter For Marketing ExecutivesRahul SinghNo ratings yet

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Document1 pageSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNo ratings yet

- Caf 8 Aud Spring 2022Document3 pagesCaf 8 Aud Spring 2022Huma BashirNo ratings yet

- PNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawDocument3 pagesPNB V. Se, Et Al.: 18 April 1996 G.R. No. 119231 Hermosisima, JR., J.: Special Laws - Warehouse Receipts LawKelvin ZabatNo ratings yet

- Presenting India's Biggest NYE 2023 Destination PartyDocument14 pagesPresenting India's Biggest NYE 2023 Destination PartyJadhav RamakanthNo ratings yet

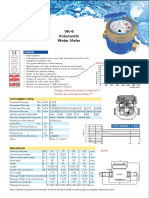

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- Medhat CVDocument2 pagesMedhat CVSemsem MakNo ratings yet

- Chapter 2 FlywheelDocument24 pagesChapter 2 Flywheelshazwani zamriNo ratings yet

- CS221 - Artificial Intelligence - Machine Learning - 3 Linear ClassificationDocument28 pagesCS221 - Artificial Intelligence - Machine Learning - 3 Linear ClassificationArdiansyah Mochamad NugrahaNo ratings yet

- Computer Application in Business NOTES PDFDocument78 pagesComputer Application in Business NOTES PDFGhulam Sarwar SoomroNo ratings yet

- Examples 5 PDFDocument2 pagesExamples 5 PDFskaderbe1No ratings yet

- Ge Dir ReportsDocument1 pageGe Dir Reportsselvam chidambaramNo ratings yet

- Manual Centrifugadora - Jouan B4i - 2Document6 pagesManual Centrifugadora - Jouan B4i - 2Rita RosadoNo ratings yet

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNo ratings yet

- Personal Selling ProcessDocument21 pagesPersonal Selling ProcessRuchika Singh MalyanNo ratings yet

- AGE-WELL Annual Report 2021-2022Document31 pagesAGE-WELL Annual Report 2021-2022Alexandra DanielleNo ratings yet

- MA5616 V800R311C01 Configuration Guide 02Document741 pagesMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNo ratings yet

- March 29, 2013 Strathmore TimesDocument31 pagesMarch 29, 2013 Strathmore TimesStrathmore TimesNo ratings yet

- SAPGLDocument130 pagesSAPGL2414566No ratings yet

- $$TR Sas 114 AllDocument384 pages$$TR Sas 114 Allctudose4282No ratings yet

- Corephotonics Dual-Camera LawsuitDocument53 pagesCorephotonics Dual-Camera LawsuitMikey CampbellNo ratings yet

- Getting Started With DAX Formulas in Power BI, Power Pivot, and SSASDocument19 pagesGetting Started With DAX Formulas in Power BI, Power Pivot, and SSASJohn WickNo ratings yet

- ICT FX4Model FrameworkDocument20 pagesICT FX4Model FrameworkSnowNo ratings yet

- Porsche Scheduled Maintenance Plan BrochureDocument2 pagesPorsche Scheduled Maintenance Plan BrochureDavid LusignanNo ratings yet

- Manual Circulação Forçada PT2008Document52 pagesManual Circulação Forçada PT2008Nuno BaltazarNo ratings yet

- Zaranda Finlay 684 Manual Parts CatalogDocument405 pagesZaranda Finlay 684 Manual Parts CatalogRicky Vil100% (2)

- Converted File d7206cc0Document15 pagesConverted File d7206cc0warzarwNo ratings yet

- DPD 2Document1 pageDPD 2api-338470076No ratings yet

- COKE MidtermDocument46 pagesCOKE MidtermKomal SharmaNo ratings yet

- Part 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Document127 pagesPart 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Duyen Pham75% (4)