Professional Documents

Culture Documents

Recobn Example

Uploaded by

Dayu MirahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recobn Example

Uploaded by

Dayu MirahCopyright:

Available Formats

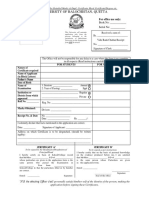

Company pennsylvania’s bank statement dated December, 31 2015 shows a balance of Rp 200

000 000 The company's cash records on the same date show a balance of Rp 180 000 000.

Following additional information is available:

1. Following checks issued by the company to its customers are still outstanding:

No. 846 issued on Nov 29 Rp 2000 000

No. 875 issued on Dec 26 Rp 1500 000

No. 878 issued on Dec 29 Rp 3000 000

No. 881 issued on Dec 31 Rp 1750 000

2. A deposit of Rp 4750 000 made on Dec 31 does not appear on bank statement.

3. An NSF check of Rp 9750 000 was returned by the bank with the bank statement.

4. The bank charged Rp 3500 000 as service fee.

5. Interest income earned on the company's average cash balance at bank was Rp 20000000

6. The bank collected a note receivable on behalf of the company. Amount received by the

bank on the note was Rp 6500 000. This includes Rp 5000 000 interest income. The bank

charged a collection fee of $1500 000.

7. A deposit of Rp 9000 000 was incorrectly entered as Rp 4750 000 in the company's cash

records.

Prepare a bank reconciliation statement using the above information.

Solution:

Pennsylvania company

Bank Reconciliation

December 31, 2015

Balance as per Bank, Dec 31 Rp 200 000 000

Add: Deposit in Transit 4750 000

204 750 000

Less: Outstanding Checks:

No. 846 issued on Nov 29 2000 000

No. 875 issued on Dec 26 1500 000

No. 878 issued on Dec 29 3000 000

No. 881 issued on Dec 31 Rp 1750 000

Rp 8250 000

Adjusted Bank Balance Rp 196 500 000

Balance as per Books, Dec 31 Rp 180 000 000

Add:

Interest Income from Bank Rp 20 000 000

Note Receivable Collected by Bank Rp 5000 000

Interest Income from Note Receivable Rp 1500 000

Deposit Understated Rp 4250 000

Rp 30 750 000

Rp 210 750 000

Less:

NSF Check Rp 9750 000

Bank Service Fee Rp 3500 000

Bank Collection Fee Rp 1000 000

Rp 14 250 000

Adjusted Book Balance Rp 196 500 000

You might also like

- Laporan Penjualan Dwijaya Desember 2019Document70 pagesLaporan Penjualan Dwijaya Desember 2019Dayu MirahNo ratings yet

- UnknownDocument20 pagesUnknownDayu MirahNo ratings yet

- Land and Building CaseDocument4 pagesLand and Building CaseDayu MirahNo ratings yet

- Sap ViraDocument3 pagesSap ViraDayu MirahNo ratings yet

- Jawaban Metodologi Minus 6Document6 pagesJawaban Metodologi Minus 6Dayu MirahNo ratings yet

- BackgroundDocument1 pageBackgroundDayu MirahNo ratings yet

- Implementing SAK ETAP Standards in Village Credit Institutions (LPDsDocument5 pagesImplementing SAK ETAP Standards in Village Credit Institutions (LPDsDayu MirahNo ratings yet

- CH 052Document36 pagesCH 052Peishi OngNo ratings yet

- Uji Heteroskedastisitas dan MultikolinearitasDocument5 pagesUji Heteroskedastisitas dan MultikolinearitasDayu MirahNo ratings yet

- Ak Hotel PaperDocument13 pagesAk Hotel PaperDayu MirahNo ratings yet

- Jawaban MetodDocument2 pagesJawaban MetodDayu MirahNo ratings yet

- The Case StudyDocument7 pagesThe Case StudyDayu MirahNo ratings yet

- Lathan SoalDocument6 pagesLathan SoalDayu MirahNo ratings yet

- SUMMARYDocument1 pageSUMMARYDayu MirahNo ratings yet

- The Lab Experiment MateriDocument4 pagesThe Lab Experiment MateriDayu MirahNo ratings yet

- Chapter 5Document21 pagesChapter 5Dayu MirahNo ratings yet

- Chapter 6 (Paper)Document7 pagesChapter 6 (Paper)Dayu MirahNo ratings yet

- Chapter 11 (Paper)Document8 pagesChapter 11 (Paper)Dayu MirahNo ratings yet

- The Case StudyDocument7 pagesThe Case StudyDayu MirahNo ratings yet

- Etika Bisnis Chapter 8Document20 pagesEtika Bisnis Chapter 8Dayu MirahNo ratings yet

- Chapter 8 Ethics and The EmployeeDocument27 pagesChapter 8 Ethics and The EmployeeLHNo ratings yet

- Chapter 5 (Paper)Document7 pagesChapter 5 (Paper)Dayu MirahNo ratings yet

- Political LobbyingDocument1 pagePolitical LobbyingDayu MirahNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementDayu MirahNo ratings yet

- Flight Date Depart Arrive PriceDocument1 pageFlight Date Depart Arrive PriceDayu MirahNo ratings yet

- SummaryDocument1 pageSummaryDayu MirahNo ratings yet

- Statement of Financial Accounting Concept NoDocument2 pagesStatement of Financial Accounting Concept NoDayu MirahNo ratings yet

- 2.1 The Objective of General Purpose Financial ReportingDocument10 pages2.1 The Objective of General Purpose Financial ReportingDayu MirahNo ratings yet

- Statement of Financial Accounting Concept NoDocument2 pagesStatement of Financial Accounting Concept NoDayu MirahNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MobileBill 1069691680Document8 pagesMobileBill 1069691680Sharret ShaNo ratings yet

- Legal Profession Chapter II 11-16Document16 pagesLegal Profession Chapter II 11-16Paul ValerosNo ratings yet

- E Ticket of Air AsiaDocument3 pagesE Ticket of Air AsiaRishi JakarNo ratings yet

- Punjab Bus BrandingDocument12 pagesPunjab Bus BrandingMohit ChhabriaNo ratings yet

- Account Management Agreement - Agreed Form 18mar11-1Document17 pagesAccount Management Agreement - Agreed Form 18mar11-1UltimanoticiasNo ratings yet

- Ronny Vogel Letter To Federal Judge Max Cogburn in Lindberg CaseDocument4 pagesRonny Vogel Letter To Federal Judge Max Cogburn in Lindberg Case13WMAZNo ratings yet

- JTC Quarterly Market Report For 1Q2022Document45 pagesJTC Quarterly Market Report For 1Q2022MingYaoNo ratings yet

- V TransDocument6 pagesV TransRupak BhattacharjeeNo ratings yet

- Rudaga - Regulations - 2021Document7 pagesRudaga - Regulations - 2021sidharthNo ratings yet

- A Study On E-Banking Services by Commercial Banks in Madurai DistrictDocument16 pagesA Study On E-Banking Services by Commercial Banks in Madurai DistrictSandyNo ratings yet

- Gepco Online BillDocument2 pagesGepco Online BillMehr UmairNo ratings yet

- Btech Admission 2013Document14 pagesBtech Admission 2013Vaibhav7789No ratings yet

- 11 MNS Business PlanDocument5 pages11 MNS Business PlanmittleNo ratings yet

- Marina Memorandum Circular No. 112, December 15, 1995Document6 pagesMarina Memorandum Circular No. 112, December 15, 1995riaheartsNo ratings yet

- Puerto Princesa Bike Rental AgreementDocument2 pagesPuerto Princesa Bike Rental AgreementJan LeeNo ratings yet

- Atty. Ada D. Abad Atty. Ada D. AbadDocument150 pagesAtty. Ada D. Abad Atty. Ada D. AbadMike AlejandriaNo ratings yet

- Significant Accounting Policies for PanchayatsDocument102 pagesSignificant Accounting Policies for PanchayatstheorytidingsNo ratings yet

- Vip Program Dealer Guidelines-IndependentsDocument5 pagesVip Program Dealer Guidelines-IndependentswaliagauravNo ratings yet

- River Cities' Reader #936Document60 pagesRiver Cities' Reader #936River Cities ReaderNo ratings yet

- THKQT200623-016 (Batam + Day Tour)Document7 pagesTHKQT200623-016 (Batam + Day Tour)wardaNo ratings yet

- 98 Pabugais Vs SahijwaniDocument3 pages98 Pabugais Vs SahijwaniMichael John Duavit Congress Office100% (1)

- 2 (1) - G.O.Ms - No.901.MA DT 31.12 2007 PDFDocument12 pages2 (1) - G.O.Ms - No.901.MA DT 31.12 2007 PDFM V N MurtyNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCherylBalazsNo ratings yet

- Gross V AT&TDocument233 pagesGross V AT&Tjonathan_skillingsNo ratings yet

- LPU Enrollment Form BreakdownDocument1 pageLPU Enrollment Form BreakdownAJ MirandaNo ratings yet

- RBI Format ROI PCDocument6 pagesRBI Format ROI PCSandesh ManeNo ratings yet

- BSNL Software PackagesDocument48 pagesBSNL Software Packagessur123bhiNo ratings yet

- UoB Application Form For Detailed Marks & Dupl-CertificateDocument2 pagesUoB Application Form For Detailed Marks & Dupl-CertificateAbdul munirNo ratings yet

- Contract - StudentsDocument5 pagesContract - StudentsdineshsirasatNo ratings yet

- Event Management Output: Rubicar G. UbanaDocument18 pagesEvent Management Output: Rubicar G. Ubanajean gonzagaNo ratings yet