Professional Documents

Culture Documents

Paper - Strategic Fit

Uploaded by

makrandkumar0 ratings0% found this document useful (0 votes)

29 views3 pagesStrategic fit

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStrategic fit

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views3 pagesPaper - Strategic Fit

Uploaded by

makrandkumarStrategic fit

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

See

discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/280238296

Strategic fit

Chapter · January 2014

CITATIONS READS

0 513

2 authors, including:

John McGee

The University of Warwick

145 PUBLICATIONS 1,290 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Wiley Encyclopedia - Strategic Management View project

individual research View project

All content following this page was uploaded by John McGee on 21 July 2015.

The user has requested enhancement of the downloaded file.

strategic fit1 less than operating each individually. The key to

such cost reductions is therefore diversification

Derek F. Channon and John McGee into businesses with strategic fit.

Market-related fit occurs when the activity

Seen from a systems perspective, the task of cost chains of different businesses overlap

management is to keep the organization in a such that they attempt to reach the same

controlled balance against the multiple and consumers via similar distribution channels,

diverse forces in the broader strategic context. or are marketed and promoted in similar ways.

The term strategic fit (or alignment) is used to In addition to such economies of scope, it

indicate how a strategy needs to be “fitted” may also be possible to transfer selling skills,

(“aligned”) with its external context and how promotion and advertising skills, and product

the internal organization needs to be properly positioning/differentiation skills across busi-

meshed (“aligned”) with the strategy. The nesses. Care must, however, be taken to ensure

strategic fit of strategy with the external context that market-related fit is possible. Successful

and of strategy with internal organization is a examples include Canon’s strategic position in

prime task of the general management team. cameras and photographic equipment being

The essential intangible barrier to strategy logically extended into copying and imaging

imitation is strategic fit. The way in which a equipment, and Honda’s position in motor-

firm’s activities and capabilities fit together cycles being extended into other activities

is often achieved by sustained learning (see using engines, including automobiles and

ORGANIZATIONAL LEARNING) and experimen- lawnmowers. However, not all such moves are

tation over time and cannot readily be imitated successful. Thus, British American Tobacco

by would-be followers. For example, all car (BAT) found that selling branded cosmetics was

assemblers know that BMW produces its cars to different than selling branded tobacco items.

enhance driver appeal, but it is extraordinarily Operating fit is achieved where the potential

difficult to replicate the way in which BMW has for cost sharing or skills transfer can occur

learned to fit everything together. Strategic fit is in procurement, R&D, production, assembly,

the classic response to the economic analyst who and/or administration. Cost sharing among

says that all profits decay: “yes, maybe – but these activities can lead to economies of scale.

look how long it takes.” Again, successes such as the sale of life insur-

Strategic fit occurs usually in related diversi- ance policies by retail banking branches can

fied concerns (see RELATED DIVERSIFICATION) as be identified. Similarly, failures are frequently

a result of superior competitive position arising due to inabilities to insure integration between

from overall lower cost and the successful activities from different businesses brought

transfer of core skills, technology, and manage- together by acquisition.

rial know-how between businesses. The earlier Management fit occurs when different

concepts of synergy and shared experience have business units enjoy comparable types of

similar meanings. entrepreneurial administrative or operating

Strategic fit, however, may apply in apparently problems. This type of gain is very difficult to

unrelated businesses where financial synergy achieve due to differences in corporate culture.

may be found. For example, a high cash flow Classic failures in achieving such fit gains

business may financially complement a business occurred in the attempted diversification moves

that is a high capital user. Examples of this by the oil industry majors after the first oil price

phenomenon include Reo Stakis – a combina- shock in 1973. Redefinitions of their businesses

tion of casinos and hotels – the Ladbroke Group into “energy” and “raw materials” encouraged

and Donald Trump’s empire, all of which are moves into minerals, coal, and gas. Most of these

engaged in similar sets of activities. moves were serious failures, or the expected

Diversification into businesses in which shared strategic fit did not materialize.

technology, marketing, and production skills are Ironically, the only strategic fit which is almost

required can lead to economies of scope when certain to be achieved is the financial fit. The

the costs of operating two or more businesses are operational strategic fits have lower probabilities

Wiley Encyclopedia of Management, edited by Professor Sir Cary L Cooper.

Copyright © 2014 John Wiley & Sons, Ltd.

2 strategic fit

of success, and that for marketing being higher Grant, R.M. (2011) Contemporary Strategy Analysis, 7th

than that for production, which, in turn, is edn, Basil Blackwell, Oxford.

higher than that for R&D. Gresov, C. (1989) Exploring fit and misfit with multiple

The McKinsey (see MCKINSEY 7S MODEL) contingencies. Administrative Science Quarterly, 34,

(Waterman, 1982) is a classic example of model 431–453.

designed to explain and portray internal strategic Lindow, C.M., Stubner, S. and Wulf, T. (2010) Strategic

fit where the 7Ss represent characteristics of fit within family firms: the role of family influence and

the effect on performance. Journal of Family Business

the organization, namely, strategy, structure,

Strategy, 1(3 September), 167–178.

systems, style, staff, skills, and shared values.

McGee, J., Wilson, D. and Thomas, H. (2010) Strategy:

The strategic fit concept has also been criti- Analysis and Practice, 2nd edn, McGraw-Hill, Maid-

cized as being too static and limiting, focusing enhead, pp. 170–171.

as it does on existing resources and the existing Smith, D. and Ibrahim, G. (2006) Cluster dynamics:

environment rather than seeking out the future corporate strategy, industry evolution and technology

opportunities and threats which are the focus trajectories – a case study of the east midlands

of firms with strategic intent. However, lack aerospace cluster. Local Economy., 21 (4), 362–377.

of consistency between a firm’s strategy and Venkatraman, N. (1989) The concept of fit in strategy

its internal and external environments can be research: toward verbal and statistical correspon-

a significant contributor to corporate failure. dence. Academy of Management Review, 14 (3),

For example, expansions into foreign markets 423–444.

frequently face difficulties because the foreign Venkatraman, N. and Camillus, J.C. (1984) Exploring the

market context is different, and therefore a concept of “fit” in strategic management. Academy of

Management Review, 9 (3), 513–525.

modified strategic approach is required (e.g.,

Venkatraman, N. and Prescott, J.E. (1990) Environment-

Laura Ashley in the US market, Disney with

strategy coalignment: an empirical test of its perfor-

EuroDisney, and General Motors in Japan all mance implications. Strategic Management Journal, 11

faced difficulties, see Grant, 2011). Similarly, (1), 1–23.

failure to match a strategy with resources can Waterman, R. (1982) The seven elements of strategic fit.

lead to an overstretching of limited resources. Journal of Business Strategy, 3, 68–72.

Xu, S., Cavusgil, S.T. and White, J.C. (2006) The

ENDNOTES impact of strategic fit among strategy, structure, and

processes on multinational corporation performance:

1 Original article by Derek F. Channon. Updated

a multimethod assessment. Journal of International

by John McGee. Marketing, 14 (2), 1–31.

Zajac, E.J., Kraatz, M.S. and Bresser, R.K.F. (2000)

Modeling the dynamics of strategic fit: a normative

Bibliography

approach to strategic change. Strategic Management

Journal, 21 (4), 429–453, April.

Dobni, C.B. and Luffman, G. (2000) Market orienta-

tion and market strategy profiling: an empirical test

of environment-behaviour-action coalignment and its

performance implications. Management Decision, 38

(8), 503–519.

View publication stats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Business Plan - Medical Partners Homecare 06th December 2017Document46 pagesBusiness Plan - Medical Partners Homecare 06th December 2017InfiniteKnowledge100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Summer Internship Project Prashant 1Document54 pagesSummer Internship Project Prashant 1prashant ganesh patil100% (3)

- Answers of The Core Questions - 2018 2Document15 pagesAnswers of The Core Questions - 2018 2Aniruddha RantuNo ratings yet

- Summary Strategic Database Marketing Arthur M Hughes PDFDocument51 pagesSummary Strategic Database Marketing Arthur M Hughes PDFMariano MilesNo ratings yet

- Do Small Cities Need Waste-To-Energy PlantsDocument3 pagesDo Small Cities Need Waste-To-Energy PlantsmakrandkumarNo ratings yet

- Bill Summary - Bankruptcy Code Amendment Bill, 2017Document1 pageBill Summary - Bankruptcy Code Amendment Bill, 2017makrandkumarNo ratings yet

- FAQ Final EnglishDocument2 pagesFAQ Final EnglishmakrandkumarNo ratings yet

- FAQ Final EnglishDocument2 pagesFAQ Final EnglishmakrandkumarNo ratings yet

- # DummyDocument1 page# DummymakrandkumarNo ratings yet

- Paper - Michael J. Lanning - Building Market Focused Organizations 1989Document21 pagesPaper - Michael J. Lanning - Building Market Focused Organizations 1989makrandkumarNo ratings yet

- Sample Contact Data - 100Document9 pagesSample Contact Data - 100Krishan KakkarNo ratings yet

- AssignmentDocument2 pagesAssignmentde_stanszaNo ratings yet

- United States Court of Appeals: For The First CircuitDocument25 pagesUnited States Court of Appeals: For The First CircuitScribd Government DocsNo ratings yet

- A Case Study On NikeDocument10 pagesA Case Study On Nikesuraj_simkhadaNo ratings yet

- TQM and Quality ManagementDocument22 pagesTQM and Quality ManagementCriseldo CalinawanNo ratings yet

- Employer Branding A Potent Organizational ToolDocument16 pagesEmployer Branding A Potent Organizational Toolengmostafa_2007No ratings yet

- INDUSTRY FORCES ANALYSISDocument9 pagesINDUSTRY FORCES ANALYSISHaseeb TariqNo ratings yet

- SNV Strategy On BCC (En)Document10 pagesSNV Strategy On BCC (En)WSSP_QuyNhonNo ratings yet

- Marketing Strategies Towards Achievement in Bakery Business in Phetchaburi and Prachuap Kirikhan ProvincesDocument5 pagesMarketing Strategies Towards Achievement in Bakery Business in Phetchaburi and Prachuap Kirikhan ProvincesIJAR JOURNALNo ratings yet

- Edp MQPDocument24 pagesEdp MQPHarshal VaidyaNo ratings yet

- JUDO STRATEGY FOR SMALL COMPANIESDocument2 pagesJUDO STRATEGY FOR SMALL COMPANIESbellaNo ratings yet

- 2018 CPM-done-withmock PDFDocument38 pages2018 CPM-done-withmock PDFLee KimNo ratings yet

- Turkish Airline Marketing StrategyDocument1 pageTurkish Airline Marketing StrategyHitenParmar0% (1)

- Anna Whitehouse ResumeDocument1 pageAnna Whitehouse Resumeapi-210293689No ratings yet

- 10 Steps To Start A Primary SchoolDocument10 pages10 Steps To Start A Primary SchoolShankar Jha0% (1)

- Asian Paints PDFDocument36 pagesAsian Paints PDFPreeti AroraNo ratings yet

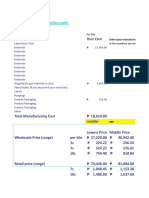

- Calculate manufacturing costs and pricing for 1kg productsDocument6 pagesCalculate manufacturing costs and pricing for 1kg productsCotton VenturaNo ratings yet

- Suzuki Enquiry Max Azure Integration HLDDocument22 pagesSuzuki Enquiry Max Azure Integration HLDsunil kumarNo ratings yet

- Case 2Document2 pagesCase 2Christine EstherNo ratings yet

- Intended Strategy DevelopmentDocument8 pagesIntended Strategy DevelopmentMubeen MusthakeemNo ratings yet

- Elasticity and Its ApplicationsDocument22 pagesElasticity and Its ApplicationsChaseNo ratings yet

- AI - Marketing by Maurosamlul V1.1: Discover The Power of Artificial IntelligenceDocument20 pagesAI - Marketing by Maurosamlul V1.1: Discover The Power of Artificial IntelligenceSyreNo ratings yet

- Session 19 20 Pricing LevelDocument25 pagesSession 19 20 Pricing LevelRaman SainiNo ratings yet

- Visleño MARKETINGACT1Document2 pagesVisleño MARKETINGACT1victor vislenoNo ratings yet

- Pepsico Group 6Document34 pagesPepsico Group 6Aanchal KalraNo ratings yet

- Annual Report General MillsDocument94 pagesAnnual Report General MillsSankalp KathuriaNo ratings yet