Professional Documents

Culture Documents

Amunt: Foilows:-Fanualy

Uploaded by

julie anne mae mendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amunt: Foilows:-Fanualy

Uploaded by

julie anne mae mendozaCopyright:

Available Formats

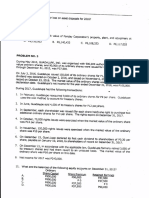

PROBLEM NO.

2 I

I

InfiormaUon for PAITIDAY CORPORATION'S Property, Plant and Equipment for zofg ls as foilows:-

Amunt balances at fanualy 1, 2O16:

Debit Credit

Land P 450,000

Bulldlng 3,600,000

Accumulafsd deprecdUon P789,300

Macfrinery bhd equipment 2,700,000

AccumulaBd depreclaUon 750,000

Automo$\re equipment 345,000

Acctjmu lated depreciation 253,800

Deprcciation metlrod and ,:seful life:

Building: 150or6-decllning balance; 25 yearc

Machlnery and eqtripment: Straight-line; 10 years

Aubmotive equipmenB Sum-of-@grf.digts; + yrs .j:

t,

Leasehdd lmprovernents: Straight-line

The residualvaiue of the depreciable asseB ls immateriat. It is the compant's policy to compute

depreciaBon trc the nearest month.

Transactions during 2016 and other information weft: as follorrus:

1. On Jantary 21 zgE,Panday punhased a rrcw car fur P30,OO0 casfr and a tradein of a Z.fear

old car with a cost of P24000 and a bookyalrrc of P8,100. The new car has a cash price of

P36,000; the marlat value oTthe trade-in ls not known.

2. On Aprll 1,2016, a machine purctraseci forP69r00Qon AF,ril 1,2011 was destrcryed.by ftre.

Panday recoverd P46,500 from its insurance'Ubmpany.

3. On May 1, 2016, costs of P504,000 were incurred to irnprove leased office premises. The

leasehold improvements have a useful llfe of 8 yeais. The related lease, whiclr terminates on

. Decenrber 3L,2022, is renewable for an addiUorual 6-yeir term. 'Ihe decision to rene-ur will

be made ln 2022 basd on office spae rreeds at that Ume,

4, On July 1, 2016, machinery and equipment were purchased at a toEl invoice cost of P840,000;

addiUonal costs of P15,000 for freight and P75,000 for installation were incurred.

5. Panday determined that the automoUve equipment comprising the P345,000 balance at

January 1, 2016 would have been depreciated at a totai amount of*54.000 for the year ended

December 31,2016.

5. What ls tte depreciation o(pense on mocfiinen/ and etluipnrent for 2016?

A. P311,325 s B. p316,500 C. p357,e,?-5 D. p306,825

7. What ls the total depreciaUon o<pense for the year encied Drcemirer 3:t, 2016?

A. P594,207 B. P584,967 c. P593,367 D. P588,867

8. What is the total accumulated depreciaUon balance orr December 11.,2A!,6?

A. P2,328,557 B. p2;j3,057 C. p2/,60,667 D. p2,351,967

You might also like

- PPE Testing ResultsDocument11 pagesPPE Testing ResultsPaul Anthony AspuriaNo ratings yet

- IA 3 ReviewDocument34 pagesIA 3 ReviewHell LuciNo ratings yet

- Ppe QuizDocument4 pagesPpe QuizJayson CerradoNo ratings yet

- Quiz - For PrintingDocument9 pagesQuiz - For PrintingDin Rose Gonzales100% (1)

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Audit of InventoryDocument9 pagesAudit of InventoryEliyah JhonsonNo ratings yet

- Audit of PPEDocument7 pagesAudit of PPEJerra MaquisoNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Problem 1Document23 pagesProblem 1cynthia reyesNo ratings yet

- Audit of Investing CycleDocument12 pagesAudit of Investing CycleBryan JamesNo ratings yet

- Auditing Problems PPE Self-Construction CostsDocument17 pagesAuditing Problems PPE Self-Construction CostsMakiri Sajili II50% (2)

- Applied Auditing Audit of PPEDocument2 pagesApplied Auditing Audit of PPECar Mae LaNo ratings yet

- AP Quiz No. 5 PPEDocument9 pagesAP Quiz No. 5 PPEJeremiah MadlangsakayNo ratings yet

- Cebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSDocument9 pagesCebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSLoren Lordwell MoyaniNo ratings yet

- Pmecpar FT AP InvestingDocument12 pagesPmecpar FT AP InvestingBryan JamesNo ratings yet

- Total Cost: C o Ototl CastDocument10 pagesTotal Cost: C o Ototl CastCeline FloranzaNo ratings yet

- Ap 59 1stpb - 5 06 PDFDocument9 pagesAp 59 1stpb - 5 06 PDFJasmin NgNo ratings yet

- AP-5903Q - PPE & IntangiblesDocument5 pagesAP-5903Q - PPE & Intangiblesxxxxxxxxx67% (3)

- Partnership FormationDocument13 pagesPartnership FormationGround ZeroNo ratings yet

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument9 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicKarlayaanNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Chapter 7 PpeDocument5 pagesChapter 7 PpeCristine Joy Ramirez LetranNo ratings yet

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- UNIT 2 Discussion ProblemsDocument6 pagesUNIT 2 Discussion ProblemsCal PedreroNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- Acquisition and Self-Construction Equipment Cost CalculationsDocument35 pagesAcquisition and Self-Construction Equipment Cost Calculationslordaiztrand50% (2)

- Chapter 7 Caselette Audit of Ppe PDFDocument35 pagesChapter 7 Caselette Audit of Ppe PDFErica PortesNo ratings yet

- Problems Audit of Property Plant and Equipmentdocx PresentDocument10 pagesProblems Audit of Property Plant and Equipmentdocx PresentDominic RomeroNo ratings yet

- Problem No. 1Document20 pagesProblem No. 1ChrisNo ratings yet

- AFAR 01 - Partnership FormationDocument2 pagesAFAR 01 - Partnership FormationSamantha Alice LysanderNo ratings yet

- Auditing Problems Test Banks - PPE Part 1Document4 pagesAuditing Problems Test Banks - PPE Part 1Alliah Mae ArbastoNo ratings yet

- AUD-Audit of PPE With AnswersDocument34 pagesAUD-Audit of PPE With AnswersOlive Grace Caniedo100% (1)

- ReSA CPA Review Batch 43 Week 1 Partnership FormationDocument6 pagesReSA CPA Review Batch 43 Week 1 Partnership FormationNathalie Shien DagaragaNo ratings yet

- AP 59 1stPB 5.06Document9 pagesAP 59 1stPB 5.06Rosalina BoronganNo ratings yet

- Ap Set ADocument2 pagesAp Set APaula VillarubiaNo ratings yet

- Ppes Problem 5-3 Domingo Company Acquires A New: Dr. To Machinery and Equipment of P29,333,333Document7 pagesPpes Problem 5-3 Domingo Company Acquires A New: Dr. To Machinery and Equipment of P29,333,333Hell LuciNo ratings yet

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocument4 pagesCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFYvette Pauline JovenNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFMarie Christine RamosNo ratings yet

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- 02 - Audit of Property, Plant and EquipmentDocument8 pages02 - Audit of Property, Plant and EquipmentAlarich CatayocNo ratings yet

- Audit of PPE TitleDocument35 pagesAudit of PPE TitleJoshua LapinidNo ratings yet

- Audit of PPE - Homework - AnswersDocument15 pagesAudit of PPE - Homework - AnswersMarnelli CatalanNo ratings yet

- Impairment Sample ExerciseDocument4 pagesImpairment Sample Exerciselet me live in peaceNo ratings yet

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Revision Questions ACC5CREDocument32 pagesRevision Questions ACC5CREbikashNo ratings yet

- 4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostDocument11 pages4 Property Plant Equipment Classification Acquisition Govt Grant and Borrowing CostElvie PepitoNo ratings yet

- Philippines: Energy Sector Assessment, Strategy, and Road MapFrom EverandPhilippines: Energy Sector Assessment, Strategy, and Road MapNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

- The Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?From EverandThe Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?No ratings yet

- Waste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesFrom EverandWaste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesRating: 5 out of 5 stars5/5 (1)

- Shen YueDocument1 pageShen Yuejulie anne mae mendozaNo ratings yet

- BIR EFPS Quick GuideDocument2 pagesBIR EFPS Quick Guidejulie anne mae mendozaNo ratings yet

- BIR Form 1906 ApplicationDocument1 pageBIR Form 1906 ApplicationAnnamaAnnamaNo ratings yet

- Iar - Iaasb vs. PcaobDocument13 pagesIar - Iaasb vs. Pcaobjulie anne mae mendozaNo ratings yet

- Adminstrative Officer IDocument3 pagesAdminstrative Officer Ijulie anne mae mendozaNo ratings yet

- New IAR Key Audit MattersDocument4 pagesNew IAR Key Audit Mattersjulie anne mae mendozaNo ratings yet

- Audit Reporting-At A Glance-Final USE ME PDFDocument12 pagesAudit Reporting-At A Glance-Final USE ME PDFhgcisoNo ratings yet

- New IAR DiscussionDocument4 pagesNew IAR Discussionjulie anne mae mendozaNo ratings yet

- New Auditor's Report Effective December 15, 2016 - Philippine Accounting UpdatesDocument3 pagesNew Auditor's Report Effective December 15, 2016 - Philippine Accounting UpdatesEricaNo ratings yet

- The New Auditor ReportDocument12 pagesThe New Auditor ReportSanja Noele RBNo ratings yet

- Mendoza Written ReportDocument6 pagesMendoza Written Reportjulie anne mae mendozaNo ratings yet

- AuditingDocument67 pagesAuditingHengky Jaya95% (19)

- D. All of The Above Are RequiredDocument2 pagesD. All of The Above Are Requiredjulie anne mae mendozaNo ratings yet

- Changing Nature of Policy FormulationDocument21 pagesChanging Nature of Policy Formulationjulie anne mae mendozaNo ratings yet

- Administrative and Finance Department Accounting DivisionDocument10 pagesAdministrative and Finance Department Accounting Divisionjulie anne mae mendozaNo ratings yet

- DramaDocument6 pagesDramajulie anne mae mendozaNo ratings yet

- PSA 706 Revised CleanDocument17 pagesPSA 706 Revised CleanRheneir MoraNo ratings yet

- Net gain or loss on asset disposals for Guadalupe Inc in 2016Document1 pageNet gain or loss on asset disposals for Guadalupe Inc in 2016julie anne mae mendozaNo ratings yet

- Philhealth ER1-Employer FormDocument1 pagePhilhealth ER1-Employer FormAimee F67% (3)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Chapter 28 PDFDocument19 pagesChapter 28 PDFjulie anne mae mendozaNo ratings yet

- Audit Rev 1Document1 pageAudit Rev 1julie anne mae mendozaNo ratings yet

- AutobiographyDocument2 pagesAutobiographyjulie anne mae mendoza83% (6)

- SSSForms ER Registration PDFDocument2 pagesSSSForms ER Registration PDFjulie anne mae mendozaNo ratings yet

- Recipe Ham & Cheese Pizza CupcakeDocument3 pagesRecipe Ham & Cheese Pizza Cupcakejulie anne mae mendozaNo ratings yet

- DanceDocument3 pagesDancejulie anne mae mendozaNo ratings yet

- Work SchedDocument1 pageWork Schedjulie anne mae mendozaNo ratings yet

- MusicDocument5 pagesMusicjulie anne mae mendozaNo ratings yet

- Research ReportDocument4 pagesResearch Reportjulie anne mae mendozaNo ratings yet

- Hemas Holdings PLC - Interim Report 2022/23 - Q2Document20 pagesHemas Holdings PLC - Interim Report 2022/23 - Q2kasun witharanaNo ratings yet

- City of Busselton - Adopted Budget 2016-2017Document314 pagesCity of Busselton - Adopted Budget 2016-2017NeenNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- Week 1B Chapter2financeDocument11 pagesWeek 1B Chapter2financeEllen Joy PenieroNo ratings yet

- 1 RevaluationDocument38 pages1 RevaluationAbdul RaufNo ratings yet

- MoJen ACC Pre TermDocument8 pagesMoJen ACC Pre TermHuong Thu Ha100% (1)

- IAS 21 Foreign Currency Translation for Tanzanian Company with Zambian BranchDocument12 pagesIAS 21 Foreign Currency Translation for Tanzanian Company with Zambian BranchNicole TaylorNo ratings yet

- MODULE 5-The Five Major AccountsDocument6 pagesMODULE 5-The Five Major Accountsgerlie gabrielNo ratings yet

- Govacc - Financial Assets and Investments: Katrine Celine C. Gutierrez, CPADocument6 pagesGovacc - Financial Assets and Investments: Katrine Celine C. Gutierrez, CPAbobo kaNo ratings yet

- Strategic Business Management Exam July 2019Document18 pagesStrategic Business Management Exam July 2019Wong AndrewNo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- T6 Lecture Note For Chapter 1 To 5Document42 pagesT6 Lecture Note For Chapter 1 To 5Mahbubul Karim ShahinNo ratings yet

- Financial Statement Analysis Unit 3Document12 pagesFinancial Statement Analysis Unit 3Jiya KothariNo ratings yet

- Book Recommended --- Ultimate Book of Accountancy Class 12th CBSEDocument16 pagesBook Recommended --- Ultimate Book of Accountancy Class 12th CBSESubhamita DasNo ratings yet

- AP-5906Q ReceivablesDocument3 pagesAP-5906Q Receivablesjhouvan100% (1)

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- (H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaDocument19 pages(H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaARGHYA MANDALNo ratings yet

- Ipsas 17 Ppe As Adopted by MG GuidelinesDocument57 pagesIpsas 17 Ppe As Adopted by MG GuidelinesRico PerdanaNo ratings yet

- IAS - 16 Property, Plant and EquipmentDocument11 pagesIAS - 16 Property, Plant and EquipmentButt ArhamNo ratings yet

- CF Assignment Final SubmissionDocument52 pagesCF Assignment Final SubmissionnidhidNo ratings yet

- 2 Ivrw AnilDocument57 pages2 Ivrw AnilJason StathamNo ratings yet

- CR Assignemt Unit 3Document25 pagesCR Assignemt Unit 3Calida SoaresNo ratings yet

- 只限教師參閱 For Teachers' Use Only: Provided by dse.lifeDocument22 pages只限教師參閱 For Teachers' Use Only: Provided by dse.lifenw08042No ratings yet

- Internship Report On Financial PerformanDocument64 pagesInternship Report On Financial PerformanRaihan AhsanNo ratings yet

- Acc030 Classification ExerciseDocument2 pagesAcc030 Classification ExerciseAqilahNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- CRPC-Raport Anual 2022 ENGDocument89 pagesCRPC-Raport Anual 2022 ENGBo PNo ratings yet

- Sandeep MaheshwariDocument56 pagesSandeep MaheshwarisandeephedaNo ratings yet

- Generic - Introduction To Financial Management (20 Credits)Document178 pagesGeneric - Introduction To Financial Management (20 Credits)thabosimonnkosi.940No ratings yet

- Capital Expenditure (CAPEX)Document2 pagesCapital Expenditure (CAPEX)GurjeevAnandNo ratings yet