Professional Documents

Culture Documents

Tugas Individu

Uploaded by

Muhammad Fauzan H FauzanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas Individu

Uploaded by

Muhammad Fauzan H FauzanCopyright:

Available Formats

Solutions

Preliminary computations (in thousands)

Investment cost January 2 $600

Implied total fair value of Sal ($600 / 80%) $750

Less: Book value (500)

Excess fair value over book value $250

Excess allocated to:

Inventory $ 25

Remainder to goodwill 225

Excess fair value over book value $250

1 Income from Sal

Sals reported net income $140

Less: Excess allocated to inventory (sold in 2011) (25)

Sal adjusted income $115

Pans 80% share $ 92

2 Noncontrolling interest share

Sals adjusted income $115 x 20% noncontrolling interest $ 23

3 Noncontrolling interest December 31

Sals equity book value $520

Add: Unamortized excess (Goodwill) 225

Sals equity fair value $745

20% noncontrolling interest $149

4 Investment in Sal December 31

Investment cost January 2 $600

Add: Income from Sal (given)* 100

Less: Dividends ($120 x 80%) (96)

Investment in Sal December 31 $604

* Based on Required

5 Consolidated net income $383.4

Noncontrolling interest share 23

Controlling interest share equals Parent NI under equity method $360.4

Solutions

1 $700,000 ($300,000 + $440,000 - $40,000 intercompany)

Preliminary computations for 2 and 3

Investment cost on January 1, 2011 $28,000

Implied total fair value of Sar ($28,000 / 70%) $40,000

Book value of Sar 30,000

Excess allocated entirely to Goodwill $10,000

2 Pims separate income for 2013 $24,000

Loss from investment in Sar ($1,000 x 70%) (700)

Controlling share of consolidated net income $23,300

Noncontrolling share (300)

Consolidated net income $23,000

3 Investment cost January 1, 2011 $28,000

Add: Share of income less dividends 2011 2013* 280

Investment balance December 31, 2013 $28,280

*($1,400 income - $1,000 dividends) 70%

Solutions

Preliminary computations

Investment cost $580,000

Implied total fair value of Sin ($580,000 / 80%) $725,000

Book value 600,000

Total excess fair value over book value $125,000

Excess allocated to:

Equipment (5-year life) $ 50,000

Patents (10-year amortization period) 75,000

Total excess fair value over book value $125,000

Income from Sin 2011 2012

Sins reported net income $120,000 $150,000

Less: Depreciation of excess allocated to equipment (10,000) (10,000)

Amortization of patents (7,500) (7,500)

Sins adjusted income $102,500 $132,500

Income from Sin (80%) $ 82,000 $106,000

1 Consolidated net income for 2011

income under equity method $340,000

Add: Noncontrolling interest share 20,500

Consolidated net income $360,500

2 Investment in Sin December 31, 2011

Cost January 1 $580,000

Add: Income from Sin 2011 82,000

Less: Dividends from Sin 2011 ($80,000 x 80%) (64,000)

Investment in Sin December 31 $598,000

3 Noncontrolling interest share 2011

($102,500 adjusted income x 20%) $ 20,500

4 Noncontrolling interest December 31, 2012

Sins equity book value at acquisition date $600,000

Add: Income less dividends for 2011 and 2012* 100,000

Sins equity book value at December 31, 2012 700,000

Unamortized excess at December 31, 2012 90,000

Sins equity fair value at December 31, 2012 $790,000

Noncontrolling interest percentage 20%

Noncontrolling interest December 31, 2012 $158,000

*2011 Net Income $120,000

2011 Dividends (80,000)

2012 Net Income 150,000

2012 Dividends (90,000)

Total $100,000

Solutions

2011 2012 2013

Pan's separate income $ 900,000 $1,200,000 $1,050,000

Add: 80% of She's reported income 1,200,000 1,320,000 1,140,000

Add: Realization of profits in beginning inventory 90,000 120,000

Less: Unrealized profits in ending Inventory (90,000) (120,000) (60,000)

Controlling share of consolidated NI $2,010,000 $2,490,000 $2,250,000

Noncontrolling interest share

1,500,000 x 20% 300,000

1,650,000 x 20% 330,000

1,425,000 x 20% 285,000

Consolidated net income $2,310,000 $2,820,000 $2,535,000

Solutions

1 Noncontrolling interest share

Sev's reported net income $ 50,000 $ 140

Add: Intercompany profit from upstream sales in beginning inventory 5,000

Less: Intercompany profit from upstream sales in ending inventory (10,000)

Sevs adjusted and realized income $ 45,000

Noncontrolling interest share (40%) $ 18,000

2 Consolidated sales

Combined sales $1,250,000

Less: Intercompany sales (100,000)

Consolidated sales $1,150,000

3 Consolidated cost of sales

Combined cost of sales $ 650,000

Less: Intercompany sales (100,000)

Intercompany profit in beginning inventory (5,000)

Add: Intercompany profit in ending inventory 10,000

Consolidated cost of sales $ 555,000

4 Total Consolidated Income

Combined income $ 300,000

Less: Intercompany profit in ending inventory (10,000)

Add: Intercompany profit in beginning inventory 5,000

Total Consolidated Income $ 295,000

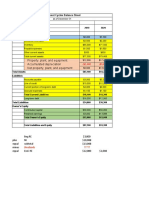

Solutions

Pap Corporation and Subsidiary

Consolidated Income Statement

December 31, 2013

(in thousands)

Sales ($2,000 + $1,000 - $180 intercompany) $ 2,820

Cost of sales ($800 + $500 - $180 intercompany - $20 unrealized profit

in beginning inventory + $30 unrealized profit in ending inventory (1,130)

Gross profit $ 1,690

Depreciation expense (340)

Other expenses ($180 + $120) (300)

Total consolidated income 1,050

Less : Noncontrolling interest share ($300 + $20 profit in beginning

inventory - $30 profit in end. inventory) x 20% (58)

Controlling interest share of consolidated net income $ 992

Supporting computations

Cost of investment in Sak at January 1, 2012 $ 1,200

Implied fair value of Sak ($1,200 / 80%) $ 1,500

Book value of Sak (1,400)

Goodwill $ 100

You might also like

- AP Research Survival Guide - RevisedDocument58 pagesAP Research Survival Guide - RevisedBadrEddin IsmailNo ratings yet

- Calculate Break-Even Point Using Accounting Profit FormulaDocument5 pagesCalculate Break-Even Point Using Accounting Profit FormulagiangphtNo ratings yet

- JD Sdn. BHD Study CaseDocument5 pagesJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Trend Graphs - Sample AnswerDocument4 pagesTrend Graphs - Sample AnswerannieannsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- P-H Agua PDFDocument1 pageP-H Agua PDFSarah B. LopesNo ratings yet

- P4Document21 pagesP4reviska100% (1)

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- MENG 6502 Financial ratios analysisDocument6 pagesMENG 6502 Financial ratios analysisruss jhingoorieNo ratings yet

- Method Statement Pressure TestingDocument15 pagesMethod Statement Pressure TestingAkmaldeen AhamedNo ratings yet

- Enhanced Instructional Management by Parents, Community and Teachers (e-IMPACT)Document27 pagesEnhanced Instructional Management by Parents, Community and Teachers (e-IMPACT)Ryan Q. Blanco100% (1)

- Sunrise Bakery NPV AnalysisDocument4 pagesSunrise Bakery NPV Analysisrutvik55% (11)

- Numerical Solution of Ordinary Differential EquationsDocument31 pagesNumerical Solution of Ordinary Differential Equationschandu3072002100% (1)

- P4Document21 pagesP4nancy tomanda100% (1)

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- P4-1: Consolidated Financials for Pea Corp and Subsidiary Sen CorpDocument21 pagesP4-1: Consolidated Financials for Pea Corp and Subsidiary Sen Corpnancy tomanda100% (1)

- PACL Lodha Commette Final NOTICE of SALE With Property DetailsDocument4 pagesPACL Lodha Commette Final NOTICE of SALE With Property DetailsVivek Agrawal100% (2)

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Document4 pagesAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter 8Document3 pagesChapter 8Yasmeen YoussefNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- Bab 4 Kelompok 7Document5 pagesBab 4 Kelompok 7Nadiyah ShofwahNo ratings yet

- Project Cost and Revenue Recognition Over 3 YearsDocument3 pagesProject Cost and Revenue Recognition Over 3 YearsHappy MichaelNo ratings yet

- Consolidated financial statements of Pal CorporationDocument5 pagesConsolidated financial statements of Pal CorporationfebbiniaNo ratings yet

- Consolidates Cost of Sales For 2011Document2 pagesConsolidates Cost of Sales For 2011mediana mutiaNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Group financial report analysisDocument5 pagesGroup financial report analysisAhmad SaleemNo ratings yet

- Advance Financial Assignment #2Document10 pagesAdvance Financial Assignment #2peterNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- Chapter 2. Model For Financial Statements, Cash Flows, and TaxesDocument3 pagesChapter 2. Model For Financial Statements, Cash Flows, and TaxesNaser Fayyaz KhawajaNo ratings yet

- Preliminary computations Pop Corporation investment in StuDocument4 pagesPreliminary computations Pop Corporation investment in StuKimberlyNo ratings yet

- UTS AKL 2 - Resky Awaliah (A031181004)Document3 pagesUTS AKL 2 - Resky Awaliah (A031181004)Resky AwaliahNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- UTECH CVP Income Statement 2010Document8 pagesUTECH CVP Income Statement 2010dcarruciniNo ratings yet

- 2.0 FIN Plan & Forecasting v1Document62 pages2.0 FIN Plan & Forecasting v1Omer CrestianiNo ratings yet

- Akl Week 8Document5 pagesAkl Week 8Rifda AmaliaNo ratings yet

- Manajemen Keuangan Kelompok CaiaDocument6 pagesManajemen Keuangan Kelompok CaiaintandewiNo ratings yet

- Akl1 Week 6Document2 pagesAkl1 Week 6tolha ramadhaniNo ratings yet

- Pilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Document9 pagesPilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Desi AprilianiNo ratings yet

- Tugas Problem - Kel7Document3 pagesTugas Problem - Kel7AshdhNo ratings yet

- Cash Flow and Financial Planning Chapter SolutionsDocument3 pagesCash Flow and Financial Planning Chapter SolutionsSaifur R. SabbirNo ratings yet

- Balance Sheet: (In Millions of Dollars) AssetsDocument8 pagesBalance Sheet: (In Millions of Dollars) AssetsThiện Nhân100% (1)

- Supds and Suds Income Statement AnalysisDocument8 pagesSupds and Suds Income Statement Analysisalvin kesumaNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Jay Tesla: ExplanationDocument9 pagesJay Tesla: ExplanationJonathan Cheung100% (1)

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Cumberland's Financial ReportsDocument8 pagesCumberland's Financial ReportsAaisha AnsariNo ratings yet

- Spuds and Suds Income Statement Leverage MeasuresDocument8 pagesSpuds and Suds Income Statement Leverage Measuresreza gunawanNo ratings yet

- Balance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisDocument8 pagesBalance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisMikkoNo ratings yet

- Consolidated Intercompany EliminationsDocument32 pagesConsolidated Intercompany EliminationsPindi YulinarNo ratings yet

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- FM II Assignment 3 SolutionDocument2 pagesFM II Assignment 3 SolutionSheryar NaeemNo ratings yet

- Sazkiya Aldina - Lat Soal AKL 1 Chapter 2Document3 pagesSazkiya Aldina - Lat Soal AKL 1 Chapter 2sazkiyaNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- CH 3 ADocument7 pagesCH 3 AZakariaHasaneenNo ratings yet

- Tarea 1 Formato en ExcelDocument6 pagesTarea 1 Formato en Excelregis.ds27No ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Nama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan IiDocument3 pagesNama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan Iidian sariNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- IFRS's Impact on the Principle of Conservatism in Indonesian Accounting StandardsDocument11 pagesIFRS's Impact on the Principle of Conservatism in Indonesian Accounting StandardsMuhammad Fauzan H FauzanNo ratings yet

- Timeline Ielts PDFDocument2 pagesTimeline Ielts PDFMuhammad Fauzan H FauzanNo ratings yet

- Nomor VoucherDocument1 pageNomor VoucherMuhammad Fauzan H FauzanNo ratings yet

- Timeline Ielts PDFDocument1 pageTimeline Ielts PDFMuhammad Fauzan H FauzanNo ratings yet

- Nomor VoucherDocument1 pageNomor VoucherMuhammad Fauzan H FauzanNo ratings yet

- Tool010 Fin PDFDocument71 pagesTool010 Fin PDFDiv EmeresNo ratings yet

- Chap 003Document16 pagesChap 003Michael YuleNo ratings yet

- What Is Strategy and Why Is It Important?: Student VersionDocument15 pagesWhat Is Strategy and Why Is It Important?: Student VersionMuhammad Fauzan H FauzanNo ratings yet

- 11 CH 20Document57 pages11 CH 20Nitin WakodeNo ratings yet

- ID Analisis Prinsip Ekonomi Islam Terhadap Operasional Produk Investasi Emas Pada PDocument17 pagesID Analisis Prinsip Ekonomi Islam Terhadap Operasional Produk Investasi Emas Pada PMuhammad Fauzan H FauzanNo ratings yet

- Ringakasan Rumus VentingDocument1 pageRingakasan Rumus VentingMuhammad Fauzan H FauzanNo ratings yet

- Tugas Kuliah Ke-8 - SHE - Convertible Securities & EPSDocument3 pagesTugas Kuliah Ke-8 - SHE - Convertible Securities & EPSMuhammad Fauzan H FauzanNo ratings yet

- International Society of Iranian Studies, Taylor & Francis, Ltd. Iranian StudiesDocument26 pagesInternational Society of Iranian Studies, Taylor & Francis, Ltd. Iranian StudiesMuhammad Fauzan H FauzanNo ratings yet

- Move Over G7, It's Time For A New and Improved G11: Long ShadowDocument16 pagesMove Over G7, It's Time For A New and Improved G11: Long ShadowVidhi SharmaNo ratings yet

- Certification of Psychology Specialists Application Form: Cover PageDocument3 pagesCertification of Psychology Specialists Application Form: Cover PageJona Mae MetroNo ratings yet

- Canberra As A Planned CityDocument12 pagesCanberra As A Planned Citybrumbies15100% (1)

- #1Document7 pages#1Ramírez OmarNo ratings yet

- 935 Ubi PBK Statement PDFDocument20 pages935 Ubi PBK Statement PDFTECHNO ACCOUNTNo ratings yet

- Active Sound Gateway - Installation - EngDocument9 pagesActive Sound Gateway - Installation - EngDanut TrifNo ratings yet

- The Three Key Linkages: Improving The Connections Between Marketing and SalesDocument5 pagesThe Three Key Linkages: Improving The Connections Between Marketing and SalesRuxandra PopaNo ratings yet

- Nidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)Document2 pagesNidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)jdchandrapal4980No ratings yet

- PronPack 5 Sample MaterialDocument13 pagesPronPack 5 Sample MaterialAlice FewingsNo ratings yet

- Communication in Application: WhatsappDocument18 pagesCommunication in Application: WhatsappNurul SuhanaNo ratings yet

- Ferain Et Al, 2016 - The Fatty Acid Profile of Rainbow Trout Liver Cells Modulates Their Tolerance To Methylmercury and CadmiumDocument12 pagesFerain Et Al, 2016 - The Fatty Acid Profile of Rainbow Trout Liver Cells Modulates Their Tolerance To Methylmercury and Cadmiumarthur5927No ratings yet

- Organization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcDocument32 pagesOrganization & Management: Manuel L. Hermosa, RN, Mba, Man, Edd, LPT, MaedcManny HermosaNo ratings yet

- LinkedIn Learning - Workplace Learning Report 2021 EN 1Document65 pagesLinkedIn Learning - Workplace Learning Report 2021 EN 1Ronald FriasNo ratings yet

- Motor Operated ValveDocument6 pagesMotor Operated ValveYosses Sang NahkodaNo ratings yet

- Mod. 34 Classic Compact T06Document4 pagesMod. 34 Classic Compact T06Jaime Li AliNo ratings yet

- Key Personnel'S Affidavit of Commitment To Work On The ContractDocument14 pagesKey Personnel'S Affidavit of Commitment To Work On The ContractMica BisaresNo ratings yet

- Organized Educator Seeks New OpportunityDocument1 pageOrganized Educator Seeks New OpportunityCaren Pogoy ManiquezNo ratings yet

- Lehman BrothersDocument10 pagesLehman BrothersJaikishin RuprajNo ratings yet

- Phenolic Compounds in Rice May Reduce Health RisksDocument7 pagesPhenolic Compounds in Rice May Reduce Health RisksMuhammad Usman AkramNo ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- Sonochemical Synthesis of NanomaterialsDocument13 pagesSonochemical Synthesis of NanomaterialsMarcos LoredoNo ratings yet

- Mediclaim - ChecklistDocument4 pagesMediclaim - ChecklistKarthi KeyanNo ratings yet

- AE3212 I 2 Static Stab 1 AcDocument23 pagesAE3212 I 2 Static Stab 1 AcRadj90No ratings yet