Professional Documents

Culture Documents

Alex Sharp's Portfolio

Uploaded by

FurqanTariq0 ratings0% found this document useful (0 votes)

216 views6 pagesExcel file for HBS case

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExcel file for HBS case

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

216 views6 pagesAlex Sharp's Portfolio

Uploaded by

FurqanTariqExcel file for HBS case

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

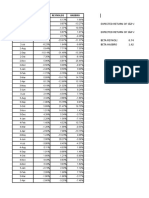

Date S&P 500 REYNOLDS HASBRO PORTFOLIO S&P, REYNOLDS

2-Jan -1.70% 6.13% 1.66% -1.62%

2-Feb -2.31% 9.87% -13.27% -2.19%

2-Mar 4.37% -1.37% 10.55% 4.31%

2-Apr -5.06% 6.87% 1.01% -4.94%

2-May -1.19% 2.17% -4.26% -1.16%

2-Jun -7.15% -23.97% -11.37% -7.32%

2-Jul -8.23% 1.64% -9.66% -8.13%

2-Aug 0.64% 7.71% 7.35% 0.71%

2-Sep -10.14% -31.48% -15.36% -10.35%

2-Oct 7.35% 0.57% -8.18% 7.28%

2-Nov 5.96% -4.81% 25.44% 5.85%

2-Dec -5.50% 9.09% -9.91% -5.35%

3-Jan -2.46% 0.59% 3.90% -2.43%

3-Feb -1.72% -5.78% 0.92% -1.76%

3-Mar 0.89% -19.17% 14.70% 0.69%

3-Apr 8.12% -12.68% 15.19% 7.91%

3-May 6.18% 21.02% 0.06% 6.33%

3-Jun 1.48% 9.15% 9.24% 1.56%

3-Jul 2.18% -4.54% 7.78% 2.11%

3-Aug 2.34% -3.86% -1.86% 2.28%

3-Sep -1.06% 15.78% 0.97% -0.89%

3-Oct 5.89% 21.47% 16.70% 6.05%

3-Nov 1.51% 14.93% 1.42% 1.64%

3-Dec 4.39% 5.34% -3.75% 4.40%

4-Jan 2.20% 1.56% -7.19% 2.19%

4-Feb 1.40% 4.52% 10.73% 1.43%

4-Mar -1.20% -1.99% -0.55% -1.21%

4-Apr -2.56% 7.06% -13.15% -2.46%

4-May 1.24% -13.23% 4.08% 1.10%

4-Jun 2.00% 20.27% -3.36% 2.18%

4-Jul -3.88% 6.45% -4.37% -3.78%

4-Aug 0.11% 4.93% 1.98% 0.16%

4-Sep 1.91% -9.88% 1.46% 1.79%

4-Oct 1.66% 1.21% -5.90% 1.66%

4-Nov 4.43% 9.83% 7.57% 4.48%

4-Dec 3.34% 3.93% 1.84% 3.35%

5-Jan -2.74% 2.32% 1.14% -2.69%

5-Feb 2.09% 1.90% 7.76% 2.09%

5-Mar -1.86% -1.66% -3.17% -1.86%

5-Apr -2.66% -3.25% -7.48% -2.67%

5-May 3.59% 6.34% 6.66% 3.62%

5-Jun 0.99% -4.96% 3.02% 0.93%

5-Jul 4.22% 5.72% 5.53% 4.24%

5-Aug -0.78% 0.76% -5.65% -0.76%

5-Sep 0.93% -1.10% -5.07% 0.91%

5-Oct -2.19% 2.38% -4.12% -2.14%

5-Nov 3.82% 4.73% 8.39% 3.83%

5-Dec 0.19% 7.09% -1.18% 0.26%

6-Jan 3.90% 6.08% 5.05% 3.92%

6-Feb -0.36% 4.96% -4.29% -0.31%

6-Mar 1.76% -0.61% 3.99% 1.74%

6-Apr 1.15% 3.93% -6.59% 1.18%

6-May -3.30% 0.26% -5.94% -3.26%

6-Jun -0.19% 4.88% -2.32% -0.14%

6-Jul -0.28% 9.96% 3.26% -0.18%

6-Aug 2.30% 2.65% 8.56% 2.30%

6-Sep 1.81% -4.76% 12.07% 1.74%

6-Oct 3.60% 1.92% 13.93% 3.58%

6-Nov 2.13% 1.71% 3.20% 2.13%

6-Dec 0.91% 1.91% 1.87% 0.92%

PORTFOLIO S&P, HASBRO

-1.67%

-2.42%

4.43%

-5.00%

-1.22%

-7.19%

-8.24%

0.71%

-10.19%

7.19%

6.15%

-5.54%

-2.40%

-1.69%

1.03%

8.19%

6.12%

1.56%

2.24%

2.30%

-1.04%

6.00%

1.51%

4.31%

2.11%

1.49%

-1.19%

-2.67%

1.27%

1.95%

-3.88%

0.13%

1.91%

1.58%

4.46%

3.33%

-2.70%

2.15%

-1.87%

-2.71%

3.62%

1.01%

4.23%

-0.83%

0.87%

-2.21%

3.87%

0.18%

3.91%

-0.40%

1.78%

1.07%

-3.33%

-0.21%

-0.24%

2.36%

1.91%

3.70%

2.14%

0.92%

Alex Sharpe Case Study Submitted by 19010025

S&P Reynolds Hasbro

From only the R_avg and stdev it seem

R_Avg 6.89% 22.50% 14.21% riskier with higher stdev but has highe

Stdev 12.48% 32.45% 28.11% return.

However, assuming that 1% is invested

R_PORTFOLIO_AVG 7.05% 6.97% them, the portfolio risk is lower in case

Reynolds as compared to Hasbro and t

R_PORTFOLIO_STDEV 12.51% 12.60% return is higher with Reynolds in portfo

Assuming 99% investment in S&P and 1% investment in Reynolds or Hasbro

Beta with Reynolds is lower than 1 me

S&P 500, REYNOLDS S&P 500, HASBRO greatly affected by market change. Has

COVARIANCE 0.0009385487 0.0018111143 as its beta is greater than 1 which mea

market rises it will rise rapidly but conv

BETA 0.7235003192 1.396136128 market drops it will drop rapidly too.

REQUIRED RATE OF RETURN

Assume market risk premium 6.00%

Risk free rate 0.89% Again shows Hasbro is riskier and henc

S&P 500, REYNOLDS 5.23% rate of return is higher

S&P 500, HASBRO 9.27%

REYNOLDS IS LESS RISKIER INVESTMENT. ALEX SHOULD PICK IT

R_avg and stdev it seems Reynolds is

gher stdev but has higher rate of

uming that 1% is invested in either of

tfolio risk is lower in case with

ompared to Hasbro and the rate of

er with Reynolds in portfolio

nolds is lower than 1 meaning its not

ed by market change. Hasbro is riskier

reater than 1 which means that when

will rise rapidly but conversly as

it will drop rapidly too.

Hasbro is riskier and hence the required

is higher

You might also like

- S&P 500, Reynolds, Hasbro stock returns & analysisDocument3 pagesS&P 500, Reynolds, Hasbro stock returns & analysisSiona Maria NathanielNo ratings yet

- Date S&P 500 Reynolds HasbroDocument2 pagesDate S&P 500 Reynolds HasbroSaad MasoodNo ratings yet

- Alex Sharpe 1Document4 pagesAlex Sharpe 1Twisha Priya100% (1)

- Alex Sharpe CaseDocument17 pagesAlex Sharpe Casemusunna galibNo ratings yet

- CORPORATE FINANCE I CASE ANALYSIS: SHARPE'S STOCK PORTFOLIODocument5 pagesCORPORATE FINANCE I CASE ANALYSIS: SHARPE'S STOCK PORTFOLIOSindhuja KumarNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireZain AliNo ratings yet

- Portfolio Analysis-Case On Alex SharpeDocument30 pagesPortfolio Analysis-Case On Alex SharpeKomalDewanandChaudharyNo ratings yet

- Alex Sharpe's Portfolio StudyDocument6 pagesAlex Sharpe's Portfolio Studyanusha100% (1)

- SearsvswalmartDocument7 pagesSearsvswalmartXie KeyangNo ratings yet

- FinanceDocument3 pagesFinanceAaqib ChaturbhaiNo ratings yet

- Chapter 5 - Group DisposalsDocument4 pagesChapter 5 - Group DisposalsSheikh Mass JahNo ratings yet

- Arcadian Business CaseDocument20 pagesArcadian Business CaseHeniNo ratings yet

- Alex Sharpe Case Write UpDocument2 pagesAlex Sharpe Case Write UpInoue JpNo ratings yet

- Partners Healthcare (Tables and Exhibits)Document9 pagesPartners Healthcare (Tables and Exhibits)sahilkuNo ratings yet

- The Body Shop Plc 2001: Historical Financial AnalysisDocument13 pagesThe Body Shop Plc 2001: Historical Financial AnalysisNaman Nepal100% (1)

- Case Study 2 - Alex SharpeDocument3 pagesCase Study 2 - Alex SharpeNell Mizuno100% (3)

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- MidlandDocument4 pagesMidlandsophieNo ratings yet

- Portfolio Analysis Case On Alex SharpeDocument30 pagesPortfolio Analysis Case On Alex Sharpeplayjake18No ratings yet

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- Calculating AHC's Cost of Capital Using CAPMDocument9 pagesCalculating AHC's Cost of Capital Using CAPMElaineKongNo ratings yet

- NuWare 1 PagerDocument1 pageNuWare 1 Pagervelusn100% (1)

- Cash Conversion CycleDocument7 pagesCash Conversion Cyclebarakkat72No ratings yet

- Case Study: Alex Sharpe’s Risky Stock PortfolioDocument3 pagesCase Study: Alex Sharpe’s Risky Stock PortfolioBilal Rafaqat TanoliNo ratings yet

- Rosario FinalDocument13 pagesRosario FinalDiksha_Singh_6639No ratings yet

- CF Murphy Stores CLC DraftDocument12 pagesCF Murphy Stores CLC DraftPavithra TamilNo ratings yet

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoNo ratings yet

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- CASE REPORT GRADING RUBRICDocument2 pagesCASE REPORT GRADING RUBRICHa shtNo ratings yet

- Ameritrade Case Sheet Cost of EquityDocument31 pagesAmeritrade Case Sheet Cost of Equitytripti maheshwariNo ratings yet

- A 109 SMDocument39 pagesA 109 SMRam Krishna KrishNo ratings yet

- Group Ariel StudentsDocument8 pagesGroup Ariel Studentsbaashii4No ratings yet

- Hill Country Snack Foods CompanyDocument14 pagesHill Country Snack Foods CompanyVeni GuptaNo ratings yet

- Zip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)Document12 pagesZip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)JacksonNo ratings yet

- Ch07 P2 Build A ModelDocument3 pagesCh07 P2 Build A ModelQudsiya KalhoroNo ratings yet

- 1 Based On Prior Experience Gbi Estimates That ApproximatelyDocument2 pages1 Based On Prior Experience Gbi Estimates That Approximatelyjoanne bajetaNo ratings yet

- Innocents Abroad - Currencies and International Stock ReturnsDocument112 pagesInnocents Abroad - Currencies and International Stock ReturnsGragnor PrideNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Tax Rate Efectivo 14% Pagina 9Document36 pagesTax Rate Efectivo 14% Pagina 9RodrigoHermosilla227100% (1)

- Apache Case Study Analysis of Risk Management TechniquesDocument14 pagesApache Case Study Analysis of Risk Management TechniquesSreenandan NambiarNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Document52 pagesThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorNo ratings yet

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- Buffett CaseDocument15 pagesBuffett CaseElizabeth MillerNo ratings yet

- Globalizing Capital Budgeting at AESDocument3 pagesGlobalizing Capital Budgeting at AESXimenaLopezCifuentesNo ratings yet

- Eaton Corporation Portfolio Transformation ValuationDocument1 pageEaton Corporation Portfolio Transformation ValuationSulaiman AminNo ratings yet

- JKhoggesDocument6 pagesJKhoggesDegrace NsNo ratings yet

- Earnings Quality and Accounting Methods at NuwareDocument22 pagesEarnings Quality and Accounting Methods at NuwaresslbsNo ratings yet

- CM FinanceforUndergradsDocument5 pagesCM FinanceforUndergradsChaucer19No ratings yet

- CPPIB's Private Equity Strategy vs Fund of FundsDocument3 pagesCPPIB's Private Equity Strategy vs Fund of FundsJitesh Thakur100% (1)

- RSM433 Eaton Corporation PDFDocument3 pagesRSM433 Eaton Corporation PDFRitesh SinghNo ratings yet

- M&M Pizza Assignment - Group 6Document4 pagesM&M Pizza Assignment - Group 6Arnnava SharmaNo ratings yet

- Sears Holdings CorpDocument7 pagesSears Holdings CorpKristine Angelie100% (1)

- Value Line PublishingDocument11 pagesValue Line PublishingIrka Dewi Tanemaru100% (3)

- Capital Structure of ENCANADocument6 pagesCapital Structure of ENCANAsujata shahNo ratings yet

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Alex Case StudyDocument4 pagesAlex Case StudyPratiksha GhosalNo ratings yet

- Alex Sharpe S PortfolioDocument3 pagesAlex Sharpe S Portfolionishnath satyaNo ratings yet

- Stock Performance Index & Company ReturnsDocument2 pagesStock Performance Index & Company ReturnsJoaquinDesriviersNo ratings yet

- Stock and Index Returns Over TimeDocument11 pagesStock and Index Returns Over TimeVijeta KatariaNo ratings yet

- Beta Management CorpDocument11 pagesBeta Management CorpKaneez FatimaNo ratings yet

- Marriot Corporation WACC and Beta AnalysisDocument2 pagesMarriot Corporation WACC and Beta AnalysisFurqanTariqNo ratings yet

- Segmentation Data AnalysisDocument9 pagesSegmentation Data AnalysisFurqanTariqNo ratings yet

- Progress Report of TPS at ABHSDocument3 pagesProgress Report of TPS at ABHSFurqanTariqNo ratings yet

- Tandoors StartupDocument5 pagesTandoors StartupFurqanTariqNo ratings yet

- 10 - Submarine Sandwich Dec 2016Document6 pages10 - Submarine Sandwich Dec 2016FurqanTariqNo ratings yet

- Allied Sugar CompanyDocument9 pagesAllied Sugar CompanyFurqanTariqNo ratings yet

- Ali Beauty Hair Saloon: 19010025 Operations Management Tools Assignment 1 PDFDocument1 pageAli Beauty Hair Saloon: 19010025 Operations Management Tools Assignment 1 PDFFurqanTariqNo ratings yet

- PorciniDocument2 pagesPorciniFurqanTariqNo ratings yet

- Generate Optimal Profit Scenario for Raisin ProcessingDocument4 pagesGenerate Optimal Profit Scenario for Raisin ProcessingFurqanTariqNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Predicting Customer ChurnDocument285 pagesPredicting Customer ChurnFurqanTariqNo ratings yet

- Important Linux CommandsDocument1 pageImportant Linux CommandsFurqanTariqNo ratings yet

- Contour IntegralDocument2 pagesContour IntegralFurqanTariqNo ratings yet

- ExecutiveSummary Pakistan Consumer Electronics Report 625625Document5 pagesExecutiveSummary Pakistan Consumer Electronics Report 625625FurqanTariqNo ratings yet

- Legal Opinion - Hemalakshmi Civil Contractor (Kodungaiyur Prop)Document8 pagesLegal Opinion - Hemalakshmi Civil Contractor (Kodungaiyur Prop)kalaivaniNo ratings yet

- MergersDocument24 pagesMergersAdina NeamtuNo ratings yet

- 4587 - 2848 - 3 - 1899 - 69 - Fixed Assets-2012Document20 pages4587 - 2848 - 3 - 1899 - 69 - Fixed Assets-2012Abhinav SachdevaNo ratings yet

- Ancient Egyptian Economics - Ashby, MuataDocument82 pagesAncient Egyptian Economics - Ashby, MuataAntonio Michael100% (25)

- NTSE 2017-18 (Stage-III) SAT Question Paper TypeDocument3 pagesNTSE 2017-18 (Stage-III) SAT Question Paper Typesharad5191No ratings yet

- Inma Bank LC FormDocument4 pagesInma Bank LC FormMohammed Hammad RizviNo ratings yet

- GST Project PDFDocument47 pagesGST Project PDFjassi7nishadNo ratings yet

- Subramanyam Chapter07Document34 pagesSubramanyam Chapter07Saras Ina Pramesti100% (2)

- Capital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp TaxDocument2 pagesCapital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp Taxloonie tunesNo ratings yet

- Recent List of Additions Jan.2016 PDFDocument25 pagesRecent List of Additions Jan.2016 PDFchirurocksNo ratings yet

- Romania'S Goal Within Europe'S 2020 Strategy: A. Dumitrescu I. TacheDocument8 pagesRomania'S Goal Within Europe'S 2020 Strategy: A. Dumitrescu I. TacheIulia LauraNo ratings yet

- Notice: Superfund Response and Remedial Actions, Proposed Settlements, Etc.: Greenberg Salvage Yard, ILDocument2 pagesNotice: Superfund Response and Remedial Actions, Proposed Settlements, Etc.: Greenberg Salvage Yard, ILJustia.comNo ratings yet

- GE CW - Module 1Document25 pagesGE CW - Module 1gio rizaladoNo ratings yet

- Chap 009Document30 pagesChap 009Anbang XiaoNo ratings yet

- Vadimpopei 2907Document1 pageVadimpopei 2907Natalia DotencoNo ratings yet

- PEST AnalysisDocument2 pagesPEST Analysism_tahir_saeed57270% (1)

- 1995 US Hazardous Waste Treatment Facilities ListDocument92 pages1995 US Hazardous Waste Treatment Facilities ListOthmar WagnerNo ratings yet

- Chapter 2eco740Document29 pagesChapter 2eco740HarlinniNo ratings yet

- Reforming Sri Lanka's Centralized University System Through Liberalization and CompetitionDocument2 pagesReforming Sri Lanka's Centralized University System Through Liberalization and Competitionireshad21No ratings yet

- Don'ts - Prohibited UsesDocument16 pagesDon'ts - Prohibited Useskenneth kittlesonNo ratings yet

- Exam Practice Questions: 1.11 Price Controls: IB EconomicsDocument3 pagesExam Practice Questions: 1.11 Price Controls: IB EconomicsSOURAV MONDALNo ratings yet

- Letter Compendium NO NOA ENDocument9 pagesLetter Compendium NO NOA ENBoban TrpevskiNo ratings yet

- Capital Market in India and Identification of IndexDocument17 pagesCapital Market in India and Identification of Indexmahesh19689No ratings yet

- Philippine Tourism Overview Political Structures and SubdivisionsDocument2 pagesPhilippine Tourism Overview Political Structures and Subdivisionspatricia navasNo ratings yet

- 1991 Indian Economic Crisis and Reforms v4Document20 pages1991 Indian Economic Crisis and Reforms v4Hicham Azm100% (1)

- IB Economics 1 Resources Ans1Document28 pagesIB Economics 1 Resources Ans1shafNo ratings yet

- Seq 23 0464 0Document5 pagesSeq 23 0464 0AbdEl-Rahman AbdEl-NasserNo ratings yet

- CTM 201301Document29 pagesCTM 201301ist00% (1)

- Lalamove + GEDocument4 pagesLalamove + GErashiqah razlanNo ratings yet

- Etoro FeesDocument6 pagesEtoro FeesAlfa BetaNo ratings yet