Professional Documents

Culture Documents

Quiz Dissolution

Uploaded by

ronaldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Dissolution

Uploaded by

ronaldCopyright:

Available Formats

1. Distinguish Dissolution, Winding up, and a.

By the death of any partner

termination. b. By the insolvency of any partner or

the partnership;

Dissolution is the change in the c. By the civil interdiction of any

relation of the partners caused by any partner;

partner ceasing to be associated in d. When a specific thing, a partner

the carrying on of the business. had promised to contribute,

perishes before its delivery. Or

Winding up is the actual process of where the partner only

settling the business or partnership contributed the use or enjoyment

affairs after dissolution, involving the of the thing and has reserved

collection and distribution of ownership thereof, its loss, before

partnership assets, payment of debts, or after delivery dissolves the

and determination of the value of partnership.

each partners interest in the e. By any event which makes it

partnership. unlawful for the business of the

partnership to be carried on or

Termination is that point in time f. for the members to carry it on in

when all partnership affairs are partnership.

completely wound up and finally g. In contravention of the agreement

settled. It signifies the end of the between the partners, where the

partnership life. circumstances do not permit a

dissolution under any other

2. Provide the causes of dissolution with provision of this article by the

court decree. express will of any partner at any

time

a. A partner has been declared h. a. Without violation of the

insane or of unsound mind agreement between the partners

b. A partner becomes in any other i. By the termination of the definite

way incapable of performing his term or particular undertaking

part of the partnership contract specified in the agreement;

c. A partner has been guilty of such

conduct as tend to affect ii. By the express will of any partner,

prejudicially the carrying on of the who must act in good faith, when

business no definite term or particular

d. The business of the partnership undertaking is specified;

can only be carried on in a loss

e. Other circumstances render a iii. By the express will of all the

dissolution equitable. partners who have not assigned

f. A partner willfully or persistently their interest or suffered them to

commits a breach of the be charged for their separate

partnership agreement, or debts, either before or after the

otherwise so conducts himself in termination of any specified term

matters relating to the partnership or particular undertaking;

business that it is not reasonably

practicable to carry on the iv. By the expulsion of any partner

business in partnership with him. from the business bona fide in

accordance with such power

conferred by the agreement

between the partners;

3. Provide the causes of dissolution

WITHOUT court decree. 4. What is the effect of dissolution?

Dissolution terminates all partnership obligations beyond

authority of any partner to act for the amount of their capital

the partnership, except for acts contributions

necessary to wind up partnership

affairs and acts necessary to d. The limited partners may ask

complete transactions begun but for the return of their capital

not then finished contributions under the

conditions prescribed by law

5. Who are the persons authorized to wind e. The partnership debts are paid

up partnership? out of the common fund and

the individual properties of the

a. partners designated by the general partners

agreement

b. in the absence of such agreement,

all partners who have not 2. Distinguish General and Limited

wrongfully dissolved the partnership.

partnership

c. legal representative of last Limited partners liability extends

surviving partner not insolvent only to his capital contribution,

while a General

partner is personally liable for

6. what is the rank of order of payment in partnership obligations.

the liabilities of the partnership?

As a general rule, name of a

(a) Those owing to creditors other limited partner must not appear in

than partners, the firm name, while the Name of

(b) Those owing to partners other a general partner may appear in

than for capital and profits, the firm name.

(c) Those owing to partners in

respect of capital, Limited partner must contribute

(d) Those owing to partners in cash or property to the

respect of profits. partnership but not

Services, while General partner

may contribute money, property or

industry to the partnership.

1. What are the characteristics of limited

Limited partner has no share in

partnership?

the management of a limited

partnership and

a. Limited partnership is formed

renders himself liable to

by substantial compliance in

partnership creditors as a general

good faith with the statutory

partner if he takes part in the

requirements

control of the business, while

General partners have an equal

b. One or more general partners

right

control the business and are

in the management of the

personally liable to creditors

business (when the manner of

management has not been agreed

c. One or more limited partners

upon).

contribute to the capital and

share in the profits but do not

Firm name must be followed by

participate in the management

the word Limited, while in General

of the business and are not

personally liable for

partnership there is no such c. The person suffered a loss as a

requirement result of reliance upon such

false statement.

3. What are the requirements for a

limited partner?

6. What is the effect of death, insanity,

a. A certificate or articles of insolvency, or civil interdiction of any

limited partnership which partner?

states the matters enumerated

in Article 1844, which must be The retirement or withdrawal,

signed and sworn; death, insolvency, insanity, or civil

b. Such certificate must be filed interdiction of a general partner

for record in the Office of the dissolves the partnership, while

Securities any of such causes affecting a

and Exchange Commission. limited partner does not result in

its dissolution unless, of course,

4. Is strict compliance required? there is only one limited partner.

No. A strict compliance with the 7. What are the rights of limited

legal requirements is not partners?

necessary. It is sufficient that

there is substantial compliance in a. To have the partnership books

good faith. If there is no kept at the principal place of

substantial compliance, the business of the partnership

partnership becomes a general b. To inspect, at a reasonable

partnership as far as hour, partnership books and

third persons are concerned, in copy any of them

which all the members are liable c. To demand true and full

as general information of the things

partners. affecting the partnership

d. To demand a formal account of

5. Explain the liability in case of false the partnership affairs

statement in certificate. whenever circumstances

render it just and reasonable

Any partner to the certificate e. To ask for dissolution and

containing a false statement is winding up by decree of court

liable to one who suffers loss by

reliance on such certificate

provided the following requisites 8. What are the restrictions/prohibitions

are present: to a limited partner?

a. He knew the statement to be a. receiving or holding as

false at the time he signed the collateral security any

certificate, or subsequently partnership property; or

having sufficient time to cancel b. receiving any payment,

or amend it or file a petition for conveyance, or release from

its cancellation or amendment, liability if it will prejudice the

he failed to do so partnership creditors

b. The person seeking to enforce

liability has relied upon the

false statement in transacting

business with the partnership

You might also like

- Business Associations OutlineDocument34 pagesBusiness Associations Outlinebobsmittyunc100% (1)

- Partnership Agreement: State of New York Rev. 133C834Document6 pagesPartnership Agreement: State of New York Rev. 133C834wewNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- Partnership Dissolution Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Dissolution Name: Date: Professor: Section: Score: QuizNahwi KimpaNo ratings yet

- Donation ReviewerDocument6 pagesDonation ReviewerronaldNo ratings yet

- SEC jurisdiction over indirect acquisition of sharesDocument4 pagesSEC jurisdiction over indirect acquisition of sharesronaldNo ratings yet

- 3 ACCT 2A&B P. DissolutionDocument10 pages3 ACCT 2A&B P. DissolutionBrian Christian VillaluzNo ratings yet

- Law On Partnership and Corporation Study Guide de LeonDocument9 pagesLaw On Partnership and Corporation Study Guide de LeonLhorene Hope Dueñas0% (2)

- 1848-1852 General Rules and ExceptionDocument7 pages1848-1852 General Rules and ExceptionJulo R. Taleon100% (1)

- Review Session 3 Conceptual FrameworkDocument16 pagesReview Session 3 Conceptual Frameworkalyanna alanoNo ratings yet

- Partnership and Corporation Accounting Course SyllabusDocument6 pagesPartnership and Corporation Accounting Course SyllabusMaebell P. ValdezNo ratings yet

- MODULE 5 - Partnership Nature and FormationDocument31 pagesMODULE 5 - Partnership Nature and FormationFRANCES JEANALLEN DE JESUS100% (1)

- MODULE 7 - Partnership DissolutionDocument35 pagesMODULE 7 - Partnership DissolutionGab Ignacio0% (1)

- Real Estate Fund PPM ExcerptDocument18 pagesReal Estate Fund PPM Excerptnzcruiser100% (1)

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionNahwi KimpaNo ratings yet

- Multiple Choice Partnership ProblemsDocument10 pagesMultiple Choice Partnership ProblemsMary Joyce GarciaNo ratings yet

- Corporation Accounting TheoriesDocument20 pagesCorporation Accounting TheoriesClient Carl AcostaNo ratings yet

- Test BankDocument11 pagesTest BankFritzie Valdeavilla100% (2)

- Week 7 (Partnership)Document24 pagesWeek 7 (Partnership)Quevyn Kohl Surban100% (3)

- Dissolution and Winding Up of PartnershipsDocument47 pagesDissolution and Winding Up of PartnershipsJesús Lapuz50% (2)

- Partnership & CorporationDocument27 pagesPartnership & CorporationEra Christine ParaisoNo ratings yet

- Lesson 3 Partnership OperationsDocument30 pagesLesson 3 Partnership Operationsheyhey100% (1)

- RA 8791 General Banking ActDocument22 pagesRA 8791 General Banking ActStephanie Mei100% (1)

- Article 1767-1768Document13 pagesArticle 1767-1768janeNo ratings yet

- Cdi Set BDocument201 pagesCdi Set BronaldNo ratings yet

- Limited Partnership NotesDocument9 pagesLimited Partnership NotesJelly BeanNo ratings yet

- Partnership ExercisesDocument35 pagesPartnership ExercisesshiieeNo ratings yet

- Business Structure Types and Registration ProcessDocument22 pagesBusiness Structure Types and Registration ProcessDerrick Maatla MoadiNo ratings yet

- Law On Partnership and Corporation by Hector de LeonDocument204 pagesLaw On Partnership and Corporation by Hector de LeonSweet Emme0% (1)

- Law On Partnership SummaryDocument10 pagesLaw On Partnership SummaryBarbette Jane Chin100% (1)

- Reviewer in FAR Operations and FormationDocument9 pagesReviewer in FAR Operations and FormationALMA MORENANo ratings yet

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- Batangas State University study guide on partnerships and corporationsDocument89 pagesBatangas State University study guide on partnerships and corporationsCindy Evangelista100% (4)

- Partnership Dissolution Accounting in the PhilippinesDocument6 pagesPartnership Dissolution Accounting in the PhilippinesJenina CrisologoNo ratings yet

- Accounting for Partnership LiquidationDocument4 pagesAccounting for Partnership LiquidationSteffany RoqueNo ratings yet

- Partnership ReviewerDocument11 pagesPartnership Reviewerbae joohyun0% (1)

- Intro To Partnership Corporation Accounting PDFDocument11 pagesIntro To Partnership Corporation Accounting PDFMyMy Margallo100% (1)

- Quiz#5Document3 pagesQuiz#5ishinoya keishi100% (1)

- Corporation Hand Out - RevisedDocument11 pagesCorporation Hand Out - RevisedEichelle Joy ZuluetaNo ratings yet

- Quiz in PartnershipDocument5 pagesQuiz in PartnershipPrincessAngelaDeLeon0% (1)

- Iv: Accounting For Dissolution (Changes in Membership) of A PartnershipDocument18 pagesIv: Accounting For Dissolution (Changes in Membership) of A PartnershipBerhanu ShancoNo ratings yet

- Application of payment and partnership obligationsDocument3 pagesApplication of payment and partnership obligationswivada100% (1)

- Philippine court rules dispute over telecom shares listing is intra-corporateDocument2 pagesPhilippine court rules dispute over telecom shares listing is intra-corporateronald100% (4)

- MidTerm Exam, Partnership Formation, Operation and DissolutionDocument3 pagesMidTerm Exam, Partnership Formation, Operation and DissolutionIñego Begdorf100% (5)

- Philippine Law On Joint VenturesDocument21 pagesPhilippine Law On Joint VenturesKeemeeDasCuballes100% (1)

- HandOut No. 3 ParCor Partnership DissolutionDocument9 pagesHandOut No. 3 ParCor Partnership Dissolutionnatalie clyde matesNo ratings yet

- The Law On Partnerships and Private CorporationsDocument32 pagesThe Law On Partnerships and Private CorporationsFluffy SnowbearNo ratings yet

- Cases - Shares and ShareholdersDocument5 pagesCases - Shares and ShareholdersAling KinaiNo ratings yet

- Article 1792 To 1997Document12 pagesArticle 1792 To 1997Sukh Gill100% (1)

- Perena vs. ZarateDocument1 pagePerena vs. Zarateronald100% (1)

- Agcaoili vs. FarinasDocument1 pageAgcaoili vs. Farinasronald67% (3)

- Should Always: Exercise 1-1. True or FalseDocument7 pagesShould Always: Exercise 1-1. True or FalseDeanmark RondinaNo ratings yet

- LA SALLE UNIVERSITY PARTNERSHIPS EXAMDocument11 pagesLA SALLE UNIVERSITY PARTNERSHIPS EXAMNicole Andrea TuazonNo ratings yet

- Partnership Formation, Operations & DissolutionDocument6 pagesPartnership Formation, Operations & DissolutionAdrianneHarve100% (2)

- Home Quiz Partnership AccountingDocument3 pagesHome Quiz Partnership AccountingKeith Anthony AmorNo ratings yet

- Partnership OperationsDocument2 pagesPartnership OperationsKristel SumabatNo ratings yet

- Partnership and Corporation TheoriesDocument16 pagesPartnership and Corporation TheoriesYuki kuranNo ratings yet

- Advance AccountingDocument12 pagesAdvance AccountingunknownNo ratings yet

- Partnership Liquidation Chapter 4 QuizDocument3 pagesPartnership Liquidation Chapter 4 QuizKimberly Quin CañasNo ratings yet

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- Partnership Liquidation ProblemsDocument3 pagesPartnership Liquidation ProblemsErma Caseñas50% (2)

- Partnership Liquidation AccountingDocument56 pagesPartnership Liquidation AccountingAj ZNo ratings yet

- Financial Accounting Ch16Document44 pagesFinancial Accounting Ch16Diana Fu100% (1)

- Partnership Formation GuideDocument6 pagesPartnership Formation GuideLee SuarezNo ratings yet

- Ac Far Quiz4Document5 pagesAc Far Quiz4Kristine Joy CutillarNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Saint Vincent College of CabuyaoDocument4 pagesSaint Vincent College of CabuyaoRovic OrdonioNo ratings yet

- Partnerships Reviewer For CPA AspirantsDocument18 pagesPartnerships Reviewer For CPA Aspirantsojodelaplata1486No ratings yet

- FAR 2 Q2 - Sample Problems With Solutions - FOR EMAILDocument11 pagesFAR 2 Q2 - Sample Problems With Solutions - FOR EMAILJoyce Anne GarduqueNo ratings yet

- 5VIFYKT8CDocument6 pages5VIFYKT8CKisha Faburada RiveraNo ratings yet

- Chapter 2 - BlawreDocument4 pagesChapter 2 - BlawreBUENAFE, Randene Marie YohanNo ratings yet

- Com Rev NotesDocument30 pagesCom Rev NotesOmie Jehan Hadji-AzisNo ratings yet

- Datu RAF PDFDocument1 pageDatu RAF PDFronaldNo ratings yet

- Po1 Recruitment Application FormDocument1 pagePo1 Recruitment Application FormronaldNo ratings yet

- Po1 Recruitment Application FormDocument1 pagePo1 Recruitment Application FormronaldNo ratings yet

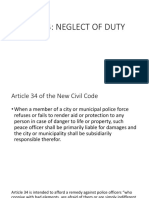

- Police Neglect of Duty LiabilityDocument2 pagesPolice Neglect of Duty LiabilityronaldNo ratings yet

- SEC Jurisdiction Over Indirect Share AcquisitionsDocument1 pageSEC Jurisdiction Over Indirect Share AcquisitionsronaldNo ratings yet

- Guardianship PDFDocument4 pagesGuardianship PDFronaldNo ratings yet

- Foreign Investment ActDocument2 pagesForeign Investment ActronaldNo ratings yet

- Po1 Recruitment Application FormDocument1 pagePo1 Recruitment Application FormronaldNo ratings yet

- Duty of Police to Protect Life and PropertyDocument7 pagesDuty of Police to Protect Life and PropertyronaldNo ratings yet

- Torts First QuizDocument2 pagesTorts First QuizronaldNo ratings yet

- Sec Firsy Quize ReviewerDocument1 pageSec Firsy Quize ReviewerronaldNo ratings yet

- Feb 16 2019 Case Transpo Law Torres MadridDocument7 pagesFeb 16 2019 Case Transpo Law Torres MadridronaldNo ratings yet

- Corporation Code PDFDocument23 pagesCorporation Code PDFronaldNo ratings yet

- Torts First QuizDocument2 pagesTorts First QuizronaldNo ratings yet

- Wassmer VsDocument1 pageWassmer VsronaldNo ratings yet

- RTC jurisdiction over commercial casesDocument2 pagesRTC jurisdiction over commercial casesronaldNo ratings yet

- Securities Regulation Code RA8799Document3 pagesSecurities Regulation Code RA8799ronaldNo ratings yet

- Ra 8799Document45 pagesRa 8799Colleen Rose GuanteroNo ratings yet

- Securities Regulation Code RA8799Document3 pagesSecurities Regulation Code RA8799ronaldNo ratings yet

- PCSC and BDO CaseDocument3 pagesPCSC and BDO CaseronaldNo ratings yet

- Scheduleofclass 2 Ndsem 20182019 PinakalastnaDocument28 pagesScheduleofclass 2 Ndsem 20182019 PinakalastnaronaldNo ratings yet

- To Be Admissible, The Evidence Must Be Both Relevant andDocument1 pageTo Be Admissible, The Evidence Must Be Both Relevant andronaldNo ratings yet

- Credit TXN 1933-1940Document1 pageCredit TXN 1933-1940ronaldNo ratings yet

- Business Laws Partnership CorporationDocument205 pagesBusiness Laws Partnership CorporationHendriech Del MundoNo ratings yet

- BAT4M UniversityCollege Grade 12 Accounting Chapter 12 Study NotesDocument5 pagesBAT4M UniversityCollege Grade 12 Accounting Chapter 12 Study NotesBingyi Angela ZhouNo ratings yet

- Far 1 Partnership FormationDocument6 pagesFar 1 Partnership Formationunlocks by xijiNo ratings yet

- Companies Act of OmanDocument41 pagesCompanies Act of Omanvirg0o0o0No ratings yet

- Chapter 6 - Organizational Study (Solar Powerbank)Document26 pagesChapter 6 - Organizational Study (Solar Powerbank)Red SecretarioNo ratings yet

- Chapter 4Document30 pagesChapter 4ინგლისურის ელ. წიგნებიNo ratings yet

- Civil and Commercial Law SummaryDocument9 pagesCivil and Commercial Law Summarylee jenoNo ratings yet

- CHAPTER FOUR-Limited Partnership - Joshua - DaarolDocument2 pagesCHAPTER FOUR-Limited Partnership - Joshua - DaarolJoshua DaarolNo ratings yet

- CADocument72 pagesCAGeorge Mitchell S. Guerrero100% (1)

- Fundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankDocument68 pagesFundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankEricBergermfcrd100% (13)

- Article 1767Document2 pagesArticle 1767Noreen67% (9)

- Law On Partnerships: CHAPTER 1: General ProvisionsDocument7 pagesLaw On Partnerships: CHAPTER 1: General ProvisionsSteffi KawNo ratings yet

- RFBT 2 Partnerships Module 2 Lesson 1Document10 pagesRFBT 2 Partnerships Module 2 Lesson 1JQ RandomNo ratings yet

- Pacson AGENCYMIDTERMSNEUDocument3 pagesPacson AGENCYMIDTERMSNEUMark Angelo PonferradoNo ratings yet

- Conflict of Interest StateDocument136 pagesConflict of Interest StateMarcus RiordanNo ratings yet

- Cannabis Business License Application: City of Lathrup VillageDocument14 pagesCannabis Business License Application: City of Lathrup VillageGovchat orgNo ratings yet

- What Is A Business Partnership?Document3 pagesWhat Is A Business Partnership?Skylar FunnelNo ratings yet

- Nature and Functions of OfficeDocument15 pagesNature and Functions of OfficeJinky B. Canobas80% (5)

- Business Law By: Seyoum Teka Chapter One: Introduction To LawDocument162 pagesBusiness Law By: Seyoum Teka Chapter One: Introduction To LawalemayehuNo ratings yet

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- Law on Partnership and Corporation DiscussionDocument2 pagesLaw on Partnership and Corporation DiscussionJeane BongalanNo ratings yet

- Joint Ventures in SingaporeDocument13 pagesJoint Ventures in SingaporesochealaoNo ratings yet

- URIBE NotesDocument14 pagesURIBE NotesRizza De la PazNo ratings yet

- Pool Canvas: Creation SettingsDocument14 pagesPool Canvas: Creation SettingsRialeeNo ratings yet

- Chapter 17 - Partnership FormationDocument3 pagesChapter 17 - Partnership FormationKaori MiyazonoNo ratings yet