Professional Documents

Culture Documents

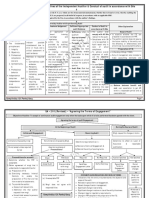

SA Flowcharts 2

Uploaded by

partymongerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SA Flowcharts 2

Uploaded by

partymongerCopyright:

Available Formats

SA 200 (Revised) Overall Objectives of the Independent Auditor & Conduct of audit in accordance with SAs

(a) To obtain reasonable assurance about whether the F. S. as a whole are free from material misstatement, whether due to fraud or error, thereby enabling the

auditor to express an opinion on whether the F.S. are prepared, in all material respects, in accordance with an applicable FRF.

(b) To report on the F.S. and communicate as required by the SAs, in accordance with the auditors findings.

Aspects to be considered by Auditor while performing Audit

Ethical Professional Professional Judgement Sufficient Appropriate Conduct of Audit in Other Explanation

Requirements Skepticism audit Evidence accordance with SAs

Comprise Code of Attitude that includes a The application of Sufficiency refers to The auditor shall Scope of Audit

Ethics issued by questioning mind, relevant training, quantum and comply with All SAs to examine whether the F.S. are

being alert to knowledge and Appropriateness relevant to the audit. prepared in accordance with FRF.

ICAI including

conditions which may experience, Compliance with SA The auditors opinion does not assure,

independence. refers to quality.

within the context is to be specified in the future viability of the entity nor

indicate possible Purpose: to reduce

The fundamental provided by auditing, Audit report only in the efficiency or effectiveness with

misstatement due to audit risk to an which mngt. has conducted the affairs.

principles are: accounting and ethical case of actual

error or fraud, and a acceptably low level

1. Integrity standards, compliance. Preparation of F.S.

critical assessment of

2. Objectivity in making informed and thereby enable To achieve overall is the duty of Mngt./TCWG.

audit evidence.

3. Professional decisions about the the auditor to draw objectives of audit, Duty of management also includes to

Alertness is required courses of action reasonable use the objective

competence & make accounting estimates and

w.r.t. that are appropriate in conclusions on which stated in Individual

due care selection and application of

1. Contradictory audit the circumstances of the SAs.

to base the auditors appropriate accounting policies.

4. Confidentiality, evidence. audit engagement. In case Entire SA is

opinion.

& 2. Reliability of It is required w.r.t.: not relevant due to Inherent Limitations for an audit

documents. Audit Risk: Risk that

5. Professional Materiality & audit risk. non existence of (a) Nature of Financial reporting:

3. Conditions the auditor expresses prescribed

behavior NTE of audit procedures. involves judgment by Mngt. based

indicating possible Evaluating sufficiency & an inappropriate audit conditions, comply

Independence on facts and circumstances.

frauds. appropriateness of audit opinion when the F.S. with relevant

comprises both (b) Nature of audit Procedures:

4. Circumstances procedures. are materially requirements.

directed towards obtaining

independence of requiring audit In case of failure to

Evaluating mngt misstated. reasonable assurance.

mind and procedures in judgment in applying achieve an objective

Audit Risk is a (c) Balance between benefit and

independence of addition to those applicable FRF. determine the need

function of the RMM cost: user expectation to get AR

suggested in SAs. Drawing conclusions of modified opinion

appearance. and detection risk. within a reasonable period and at

based on audit evidence. or withdrawal.

reasonable cost.

Compiled by: CA. Pankaj Garg Page 1

SA 210 (Revised) Agreeing the Terms of Engagement

Objective of Auditor: To accept or continue an audit engagement only when the basis upon which it is to be performed has been agreed with the client.

Agreeing the terms of audit Engagement

At the Beginning of Audit During the Course of Audit

Initial audit Engagement Recurring Audit Mngt. request for changes in terms

Limitations Imposed by mngt. No Limitations Imposed by Mngt. Determine its effect on Level of

Determine requirements w.r.t.:

Assurance & reasonable

(a) Revision of terms of Engagement; &

Do not accept unless required Ascertain existence of Justification

by law Preconditions* (b) Remind the entity of existing terms

Preconditions for an audit Exist Not Exist Required Not Required Auditor Satisfied Not Satisfied

1. Determine whether the FRF is

acceptable.

Accept Audit Discuss matter Send New No Further Duty Record New Do not

2. Obtain agreement of mngt that it Terms in

with mngt. Engagement Letter accept the

understands its responsibilities for: Engagement changes

(a) Preparation of F.S. Letter

(b) Exercising necessary Internal

Do not accept audit in case of: CIRCUMSTANCES REQUIRING REVISION IN TERMS Mngt. not

Controls to enable the

(a) Unacceptable FRF Indications that the entity misunderstands the objective and permit the

preparation of F.S. that are free

scope of the audit. auditor to

from material misstatements. or continue

Revised or special terms of engagement.

(c) To provide the auditor: (b) Mngt. does not agree with Recent change of senior management.

Access to all relevant info. responsibilities Significant change in ownership.

Additional info that auditor Withdraw &

Significant change in nature or size of the entitys business.

requests from mngt. Report to

Change in legal or regulatory requirements.

Compiled by: CA. Pankaj Garg appropriate

Unrestricted access to persons Change in FRF adopted in the preparation of the F.S.

authority

within the entity. A change in other reporting requirements.

Compiled by: CA. Pankaj Garg Page 2

SA 220 (revised) Quality Control for an audit of F.S.

Objective: Implement QC Policies that provide Reasonable Assurance that audit complies with professional standards and audit report issued is appropriate

Leadership Ethical Independence Acceptance / Continuance Assignment of Engagement Performance Monitoring

Responsibilities

Requirements of Client relationship Engagement

Team

EP should EP to remain alert Be satisfied that EP to be satisfied 1. Direction, Supervision and Obtain reasonable

performance:

emphasize the for evidence of Form a conclusion on appropriate procedures that ET & assurance that

compliance with Auditors Expert EP shall take the responsibility for

ET the following: non-compliance regarding client acceptance directions, supervision & performance firms policies /

applicable independence not part of ET

Compliance with relevant ethical requirements

/ continuance have been of audit engagement in compliance with procedures relating

have appropriate standards & regulatory requirements, &.

with requirements by ET followed. to QC are relevant,

Obtain relevant competence & to make an appropriate AR.

professional through: Determine whether capabilities to: 2. Reviews: adequate, and

information from Firm

Standards and Inquiry. conclusions reached are Perform audit EP shall take the following responsibilities: operating

appropriate. engagement in a. Reviews are being performed in

legal Observation. Identify & Evaluate effectively.

accordance with policies / procedures.

requirements. circumstances & accordance

b. Be Satisfied that SAAE has been obtained

If there is an with Consider:

Compliance

Relationship that threatens If EP obtains information to support the conclusions reached and

indications of non- independence that would have caused firm professional AR to be issued through Results of firms

with firms

compliance with to withdraw the engagement, standards and Review of Audit Documentation. monitoring

Quality Evaluate information on communicate information regulatory or Discussion with ET

relevant ethical process.

Control identified breaches. promptly to firm legal 3. Consultation:

requirements, EP EP shall undertake consultation Whether

Policies. requirements,

should: wherever required. deficiencies

Issuance of Determine if these Examples of Information and Ensure its implementation

Consult others in threaten independence Enable an AR noted may affect

appropriate 4. Engagement Quality Control Review:

the firm. 1. Integrity of Principal that is required in case of listed entities. the audit

audit report. Take appropriate action Owners, Mngt & TCWG

Determine appropriate in Matters to be evaluated by EQCR engagement.

Ability to raise to eliminate such threats 2. Competency of ET to

appropriate the

concerns perform engagement. Discussion of significant matters with ET.

or circumstances.

action. 3. Availability of necessary

without fear. Review of FS & proposed audit report.

Promptly report capabilities, including time &

Quality is

inability to take resources. Review of selected audit documentation

essential & appropriate action to 4. Compliance with relevant

indispensable ethical requirements. 5. Differences of Opinion: follow the firms

in engagement Compiled by: CA. Pankaj Garg 5. Significant matters that policies & procedures for dealing with and

arises during the current or resolving differences of opinion.

performance.

previous audit engagement.

Compiled by: CA. Pankaj Garg Page 3

SA 230 (Revised) Audit Documentation

General concepts Form, Content & Extent of Specific Documentation Retention Ownership

Documentation Period

Documentation is the

Meaning: Record of: Auditor shall prepare audit documentation

property of the Auditor.

Audit procedures performed that is sufficient to enable an experienced 7 Years from May at his discretion

Relevant audit evidence

auditor to understand: date of Audit make portions of or

obtained, &

(a) NTE of the audit procedures; Report extracts from

Conclusions reached Compiled by: CA.

(b) Results of audit procedures performed, documentation available

Pankaj Garg

Purpose: includes the following: & audit evidence obtained; to client.

Assist in Planning and

(c) Significant matters arising during the

performance of Audit.

audit and the conclusions reached Documentation of Documentation of Documentation of

Direction, supervision &

Review of work. thereon, significant professional Discussion Departure from a matters arising after the

To fix accountability. judgments made in the reaching those relevant requirement Date of Auditors Report

Record for future reference. conclusions.

Quality control review and Factors affecting form, content & extent Significant Reasons for the Circumstance

inspections Matters departure. encountered.

1. The size and complexity of the entity.

Conduct of external Discussed with Alternative New or additional

inspections. 2. The nature of the audit procedures to be

Mngt. And procedures procedures

performed. TCWG. performed. performed, audit

Nature documentation must 3. Identified RMM. When and with evidence obtained,

provide for: 4. Significance of audit evidence obtained. whom the conclusions reached,

Sufficient and appropriate 5. Nature & extent of exceptions identified. discussion took and their effect on the

record of the basis for place. auditors report.

6. Need to document a conclusion or the

auditors report. How the auditor When and by whom

basis for a conclusion not readily

Evidence that the audit was address the the changes to audit

determinable from the documentation of

planned and performed in inconsistency (if documentation were

the work performed or audit evidence any detected made and reviewed.

accordance with SAs & other

obtained. during

regulatory requirements.

7. The audit methodology and tools used. discussion)

Compiled by: CA. Pankaj Garg Page 4

SA 240 (Revised) The Auditors Responsibilities Relating to Fraud in an Audit of Financial Statements

Fraud Risk Factors / Management Duties Auditors Responsibilities

Meaning and Nature of Fraud

Characteristics of Fraud

Meaning: Intentional Act involving use of deception to Incentive or pressure to Commit Fraud: Primary responsibility To obtain reasonable assurance

obtain an unjust or illegal advantage. Arises when mngt is under pressure to for prevention & that F.S. as a whole are free from

achieve an unrealistic target. detection of fraud rests material Misstatements.

Auditor is concerned with Fraud that causes Perceived opportunity to do so: with Mngt and TCWG

Arises when an individual believes that Maintain an attitude of

Material Misstatement.

internal control can be overridden. To ensure prevention of Professional Skepticism

Misstatement may result from: Rationalization to do so: fraud Mngt. must have an

A Fraudulent Financial Reporting Arises when an individual possess an commitment to create an Circumstances indicate existence of

1. Recording fictitious journal entries to attitude or character that allows them material Misstatement

culture of honesty and

manipulate operating results. knowingly and intentionally to commit a

Ethical behavior.

2. Inappropriate assumptions. dishonest act.

3. Changing judgements to estimate account Consider whether such a

balances. Risk associated for non detection of material misstatements misstatement is an indication of

4. Omitting, advancing or delaying recognition of Fraud. If Fraud identified

Due to Inherent limitations there is always an unavoidable risk of material

events and transactions occurred during the misstatement in F.S. due to Fraud.

year. Risk of non detecting a material misstatement resulting from fraud is Communicate to Mngt.

5. Concealing facts that affect the amount higher than the risk of non detecting one resulting from error. &TCWG (also to Regulatory &

recorded in F.S.

Risk of Material Misstatements due to Management Fraud is higher than Enforcement authorities, if

6. Engaging in Complex Transactions that are

due to Employee Fraud. required by Law

structured to misrepresent the financial

position or financial performance.

Conditions or events which increases risk of fraud or error Auditor unable to complete the

7. Altering records relating to significant

1. Discrepancies in Accounting Records: arises due to improper recording, engagement.

transactions.

unauthorised transactions, last minute adjustments.

B Misappropriation of Assets

2. Conflicting or missing evidences: missing documents, altered Consider the Possibility of

1. Embezzling receipts. withdrawing.

documents, non availability of original documents, unexplained items etc.

2. Stealing physical assets.

3. Unusual relationship between auditor & mngt: undue time pressure,

3. Causing an entity to pay for goods and services

unusual delay in providing info, unwillingness to address weaknesses in IC. If withdraw:

not received.

4. Others: Mngt not allowing auditor to meet with TCWG, varied accounting Discuss with Mngt & TCWG, &

4. Using entity assets for personal use. Report to appropriate persons

policies, frequent changes in accounting estimates.

Compiled by: CA. Pankaj Garg Page 5

SA 250 (Revised) Consideration of Laws and Regulations in an Audit of F.S.

Management Responsibilities Auditors Responsibilities

Basic Responsibilities Specific Auditor Reporting responsibilities Indicators considered by

Responsibilities w.r.t. Auditor

Procedure in

Obtain general

case any Non-

understanding of L& R having Other L& R that do not To TCWG Auditor Report Regularity &

direct effect on affect amount and Compliance is Enforcement Authorities

Legal & Regulatory

Framework applicable determination disclosures in F.S. but identified /

Compliance by Entity of material compliance with which Suspected Material Unable to If required by Law

with that Framework. amount and may be fundamental to Effect on Conclude

due to Investigations by regulatory

disclosures in operating aspects. F.S.

Limitation bodies.

Compliance of L & R is duty of F.S.

Mngt & TCWG and may be imposed by Payment of fines or penalties.

performed through: Payments for unspecified

Q/A

1. Monitoring legal requirements Obtain services to consultants, related

& ensuring that operating parties etc.

obtain SAAE Perform limited understanding of

procedures are designed to Mngt. Circumstances Excessive Sales commissions or

procedures: the Act.

meet these requirements. agents fees.

2. Instituting & operating

Inquiring of Mngt; &

Circumstances in Purchasing at prices

appropriate systems of IC. Inspecting Q/D Consider the significantly above or below

which it is

3. Developing, publicising and Correspondence with Effect market price.

to ensure occurred.

following a code of conduct. relevant Licensing / Unusual payments in cash.

4. Ensuring employees are compliance Regulatory authority Evaluate possible

Unusual payments towards legal

properly trained & understand effects on F.S. and retainership fees.

the code of conduct. Matters involving non-

Discuss with Payments without proper

5. Monitoring compliance with to identify instances of compliance.

Mngt. & TCWG exchange control

code of conduct & take actions non compliance. If TCWG is involved, documentation.

to discipline employees who Obtain legal communicate to Higher Level, Existence of an information

fail to comply with it. advice wherever if any system which fails, to provide

6. Engaging legal advisors to

required Otherwise, obtain Legal Advice an adequate audit trail or

assist in monitoring legal

Obtain Written Representation that all sufficient evidence.

requirements.

instances of non-compliance or Unauthorised transactions or

7. Maintaining a register of Compiled by: CA. Pankaj Garg

suspected non-compliance have been improperly recorded

significant L & R with which the

transactions.

entity has to comply. disclosed to auditor.

Adverse media comment.

Compiled by: CA. Pankaj Garg Page 6

SA 260 (Revised) Communication with TCWG

Meaning of Auditors Responsibilities Communication Process Factors affecting Mode of

Management & Communication

TCWG

TCWG: Persons with Determine the Matters to be communicated Communication may be Size, operating structure,

responsibility for appropriate Oral /written control environment, & legal

overseeing the (a) Auditors responsibility in relate to F.S. Audit. Detail/Summarised structure of entity.

person to whom

(b) Planned scope & timing of audit Structured /Unstructured In the case of an audit of special

strategic directions & communication

(c) Significant findings from audit w.r.t. Should be in writing purpose F.S., whether the

obligations related to is to be made.

Accounting Policies auditor also audits the entitys

Accountability. when oral

Accounting Estimates general purpose F. S.

Management : Person communication is not

F. S. Disclosures Requirements of respective law

with executive adequate. specifying written

Significant difficulties encountered

responsibility for during the audit. Communication should communication with TCWG in a

conduct of entitys Examples of Significant difficulties be on timely basis prescribed form.

1. Significant delay in providing info Expectations of TCWG,

operation

2. Unnecessarily brief time to complete including arrangements made

Evaluate adequacy of for periodic meetings or

the audit.

3. Extensive unexpected effort to obtain communication for the communications with the

SAAE. purpose of the audit. auditor.

Determine the need to communicate with 4. Unavailability of Expected The amount of ongoing contact

Governing body, if communicates with information. and dialogue the auditor has

If not adequate, evaluate

5. Restriction imposed by management. with TCWG.

subgroup. its effect, on the auditors

6. Scope limitation imposed by

If all of TCWG are involved in managing the Significant changes in the

management assessment of the risks of

membership of a governing

entity, and the matter has been material misstatement.

Material weakness in I.C. body.

communicated with persons having

Matters discuss with Mngt.

managerial responsibility, the matters need

Other significant Matters.

not be communicated again to the same Compiled by: CA. Pankaj Garg

(d) Statement w.r.t. compliance of ethical

persons in their governing role. requirements regarding independence.

Compiled by: CA. Pankaj Garg Page 7

SA-265 Communicating Deficiencies in Internal Control to TCWG & Management

Meaning of Auditors Responsibilities

deficiency in internal

control

(a) Inability of I.C to prevent Identification of deficiencies in Communication of deficiencies in Internal Control

detect & correct misstatement ; Internal Control

or

Mode of communication Content of communication

(b) Absence of control necessary

Determine whether on the basis of

to prevent, detect & correct

work done any deficiency in In writing

misstatements internal control is identified

Determine whether individually or To TCWG To Mngt. (a) Description of deficiencies

in combination they constitute (b) Explanation of their potential

significant deficiencies effect

(c) Sufficient information to explain

Indicators of Significant Deficiencies Significant Significant that purpose of the audit is to

deficiencies deficiencies express an opinion

1. Evidence of ineffective aspects of control environment.

and other I. C. is evaluated to design

2. Entitys Risk assessment process Absent/ineffective. deficiencies further audit procedures

3. Ineffective response to identified significant Risks.

4. Correction of prior period misstatements arising due to fraud/error.

5. Management inability to oversee F.S. Preparation.

Compiled by: CA. Pankaj Garg

6. Misstatements detected by the auditors procedures were not

prevented, or detected and corrected by the entity I.C.

Compiled by: CA. Pankaj Garg Page 8

SA 299 Responsibility of Joint Auditors

Division of work Co-ordination Responsibilities of Joint Auditors Reporting

By Mutual discussion If one auditor comes Generally a Single Report

Separate Joint & several

to know a matter

If joint auditors disagree -

relevant for other, he

On basis of identifiable units should communicate Separate Report

or specified areas it immediately in No one is bound by Majority.

writing to other joint For work for work not divided

auditor before allocated for joint decision w.r.t. N,

If not possible with submission of report. T, E of audit procedure.

respect to followings: for matters brought to

Assets/Liabilities; or knowledge of all by any

Income/Expense; or one of them and on which

Period they all agree.

Disclosure requirements

in F.S.

Work should not be

divided for Imp. areas Compliance of audit

report with statutory

requirement

Work so divided should be

documented and

communicated to the

entity.

Compiled by: CA. Pankaj Garg

Compiled by: CA. Pankaj Garg Page 9

SA 300 (Revised) Planning in an audit of Financial Statements

Importance of Planning Preliminary Engagement Activities Planning Activities

1. To devote appropriate attention to (a) Procedures required by SA -220 w.r.t. Establishment of Audit Strategy Development of

important areas. continuous of Client relationship. Audit Plan.

2. Identify and Resolve potential (b) Evaluate compliance with Ethical so as to set the scope, timing &

problems on timely basis. direction of the audit

Requirements (SA-220) NTE of RAP (SA-

3. Properly organized & managed Audit. Factors to be considered

(c) Understanding of terms of 315)

4. Assists selection of ET members with Characteristics of Engagement.

Engagement (SA-210) NTE of furthers

requisite capabilities and competence. Reporting Objectives.

5. Co-ordination of work done by Significant factors to direct ET Audit Procedures

auditors of components and experts. Planning A Continuous Process efforts. (SA-330)

6. Facilitating direction and supervision Result of Preliminary Other Planned

of Engagement team. Engagement Activities.

Audit Procedure.

NTE of Procedures to be

performed.

Planning is not a discrete phase of an audit but rather a continuous process. It begins shortly

CHANGES TO PLANNING DECISIONS

after completion of previous audit & continues until completion of current audit engagement.

Auditor shall update & change overall audit strategy and audit plan

It includes consideration of timing of certain activities & audit procedures that need to be

as necessary during the course of the audit.

completed prior to performance of further audit procedures. E.g., planning includes the need to Audit Strategy and Audit Plan may need to be modified as a result

consider, prior to the auditors identification and assessment of the RMM, such matters as: of unexpected events, changes in conditions, or the audit evidence

1. The analytical procedures to be applied as risk assessment procedures. obtained from the results of audit procedures.

Based on the revised consideration of assessed risks, auditor need

2. Obtaining a general understanding of the legal and regulatory framework.

to modify the NTE of further audit procedures. This may be the case

3. The determination of materiality.

Compiled by: when information comes to the auditors attention that differs

4. The involvement of experts. significantly from the information available when the auditor

CA. Pankaj Garg

5. The performance of other risk assessment procedures. planned the audit procedures.

Compiled by: CA. Pankaj Garg Page 1

SA 315 (Revised) Identifying and Assessing the Risk of Material Misstatements through understanding the Entity and Its Environment .

Risk Assessment Understanding of Entity & its Environment Risk in CIS Environment

Procedures

Risk imposed by IT/CIS Areas to be examined

Auditor shall obtain understanding of:

Program Development &

Procedures to obtain an 1. Relevant Industry, Regulatory & other External Reliance on programs that process

Maintenance.

understanding of entity Factors including FRF. inaccurate data or do inaccurate

System Software Support.

& its environment 2. Nature of Entity including. processing. Operations Including processing

including I.C. Its Operations

Unauthorized access to data that of data.

To Identify and assess Ownership & Governance structure

may result in destruction of data. Physical CIS security.

Types of investments

the RMM at F.S. and Control over access to

The way Entity is structured & how it is financed Unauthorized changes to data in

Assertion Level. specialized CIS utility programs.

3. Selection & Application of Accounting Policies & Master files.

reasons for changes thereto.

It Includes Unauthorized changes to systems. Components of Internal Control

4. Entity objectives & Strategies & those business

a. Inquiry of mngt.& others risks that may result in increase RMM. Failure to make necessary changes.

1. Control Environment

b. Analytical Procedures 5. Measurement & review of Financial Performance. Potential loss of data Communication of Ethical values.

c. Observation & Inspection 6. Internal control relevant to audit. 2. Risk Assessment Process

Inability to access data as required.

Identify Business Risk

Estimating significant Risks

Identification and Assessment of RMM Assessing Likelihood of occurrence.

Deciding response

a) F.S. Level: RMM that Assertions evaluated Steps in Risk Risk require special 3. Information System relevant to FR:

relate pervasively to Transaction Occurrence consideration Classes of transactions

Assessment

the F.S. as a whole and occurred Completeness 1. Risk of fraud Accounting procedures

Process:

potentially affect many during the Accuracy 2. Risk related to recent Accounting records

assertions. year Cut-Off Identify risks significant Economic,

Classification Financial Reporting Process.

b) Assertion level for Assess & Evaluate Accounting & other

Account Existence Controls over journal entries

classes of the identified risks. Developments.

balances at Rights & Obligations 4. Control Activities relevant to Audit

Transaction, Account 3. Complexity of Transactions.

period end Completeness Relate identified Information processes

Balances &

Valuation &

4. Transactions with Related

risk to what go Segregation of duties.

disclosures: It helps Disclosure Parties

in determining the NTE wrong at assertion 5. Significant Unusual Physical controls

Presentation Occurrence

of further audit & Completeness level. Transaction Performance Reviews

procedures necessary Disclosures Classification Likelihood of 5. Monitoring of Controls

to obtain SAAE. Accuracy & Valuation misstatement. Compiled by: CA. Pankaj Garg Assess effectiveness of I.C. Performance.

Compiled by: CA. Pankaj Garg Page 2

SA 320 (Revised) Materiality in Planning and Performing an Audit

Concept of Materiality Performance Materiality Auditors Duties

Materiality is a subject of The amount set by auditor at (a) Upon establishing the overall audit strategy, the auditor shall

professional judgment and less than materiality for F.S as a whole determine the materiality for the F. S. as a whole.

discussion presented in FRF (b) Determine the materiality level for specific transactions for

to reduce to an appropriately low level

which misstatements of lower amount be expected to influence

provides a reference to the auditor in the probability that the aggregate of the

the economic decisions of users.

determining materiality. uncorrected & undetected misstatement (c) Determine the performance materiality for purpose of assessing

If FRF does not include a discussion, exceeds materiality for F. S. as a whole the RMM and determining the NTE of further audit procedures.

following can be referred:

(a) Misstatements including

omissions expected to influence Revision of Materiality Use of benchmark in determining Materiality

the economic decision of users.

(b) Size or nature of misstatement & In event of becoming aware of information A %age is often applied to a chosen benchmark as a starting

the surrounding circumstances. that would have caused auditor to have point in determining materiality for the F.S. as a whole.

(c) Common financial information determined a different amount initially, Factors affecting identification of appropriate benchmark

needs of the users as a group. auditor shall revise materiality for the F.S. as a 1. The elements of the financial statements;

whole & if required, for particular classes of 2. Items on which the attention of the users of the particular

transactions, account balances or disclosures. entitys financial statements tends to be focused;

Compiled by: CA. Pankaj Garg

If the auditor concludes that a lower 3. The nature of the entity, where the entity is at in its life

materiality than that initially determined is cycle, and the industry and economic environment in

Judgment of materiality provides a

appropriate, the auditor shall determine which the entity operates;

basis for:

whether it is necessary to revise performance 4. The entitys ownership structure and the way it is

(a) Determination of NTE of RAP

materiality, and whether the NTE of the financed; and

(b) Identifying and assessing RMM.

further audit procedures remain appropriate. 5. The relative volatility of the benchmark.

(c) NTE of further audit procedures.

Compiled by: CA. Pankaj Garg Page 3

SA 330 Responses to Assessed Risks

Objective: To obtain Sufficient and Appropriate Audit Evidence about Assessed Risk of Material Misstatement through design and implementing Appropriate Responses

Tests of Controls Substantive Procedures

Procedures designed to evaluate the operating effectiveness of controls in preventing, Procedures designed to detect material misstatements at assertion level.

detecting or correcting material misstatements at assertion level. It comprises of:

a) Test of details (of classes of transactions, Account Balances and

Obtain audit evidences w.r.t. (a) Application of controls (b) Consistency of application Disclosures); &

(c) By whom & by what means they applied Compiled by: CA. Pankaj Garg

b) Substantive Analytical Procedures

Evaluate the audit evidences

External Auditor shall consider whether EC procedures are to be

Material weaknesses identified Confirmation performed as substantive audit procedures.

(EC) Factors that may assist the auditor are:

Communicate to Mngt. & TCWG on timely basis

procedures 1. Confirming party knowledge of Subject Matter.

Special Considerations Factors warranting re-test of as 2. Ability or Willingness of intended confirming part to

Using Audit Evidence obtained in Interim Period: controls substantive respond.

Obtain audit Evidence for significant changes 1. Deficient control environment. procedures 3. Objectivity of Intending Party.

subsequent to Interim Period. 2. Deficient monitoring of

Closing Reconciling F.S. with underlying A/cing Records

controls.

Determine the additional Evidence to be obtain for Process

3. Significant manual element to Examine Material Journal Entries & other adjustments

remaning period.

relevant controls. made during the course of preparing the F.S.

Using Audit Evidence obtained during previous

4. Personnel changes that Significant Procedures that are specifically responsive to that risk

audits: Establish Continuing relevance of that evidence significantly affect the

by determining significant changes subsequent to Risks needs to be applied

application of control.

previous audit 5. Changing circumstances that

Changes occurs: Test the controls in current audit indicate the need for changes

No Change Occurs: Test the controls once in three in the control. Timing: When Substantive procedures are applied for interim period, the

audits 6. Deficient general IT-controls. auditor shall cover remaining period by appropriate procedures

Compiled by: CA. Pankaj Garg Page 4

SA 402 (Revised) Audit Considerations relating to an Entity Using a Service Organisation

Auditors Objective Obtaining understanding of services Auditors considerations

provided by service Organisation (S.O.)

Compiled by: CA. Pankaj Garg

Obtain an The user auditor shall obtain an User auditor shall evaluate the design and implementation of relevant controls of

understanding of understanding of how user entity uses the user entity that relate to the services provided by service organization.

nature & significance User auditor shall determine whether a sufficient understanding of nature and

services of a service organization in the user

of service provided by significance of services provided by service organization and their effect on the

entity operation, including:

the S.O. and their user entity internal control relevant to the audit has been obtained.

(a) Nature of service provided by the S.O. and If user auditor is unable to obtain a sufficient understanding from the user entity,

effect on the users

entity internal control significance of services to user entity. user auditor shall obtain that understanding from the following procedures:

relevant to the audit, (b) Nature and materiality of the transactions (a) Obtaining a Type 1 or Type 2 Report, if available.

(b) Contacting the service organization, through the user entity.

sufficient to identify processed or financial reporting processes

(c) Visiting the service organization.

and assess the RMM. affected by service organizations.

(d) Using another auditor to perform procedures that will provide the

To design and (c) Degree of interaction between activities of necessary information about the relevant controls at the S.O.

perform audit

S.O. and those of the user entity. If a S.O. uses subservice organisation, the service auditors report may either

procedures

(d) The nature of relationship between user include or exclude the subservice organisations relevant control objectives

responsive to those

& related controls in the service organisations description of its system & in

risks. entity and the service organization.

the scope of service auditors engagement. These two methods of reporting

are known as the inclusive method and the carve-out method, respectively.

User Auditor: An auditor who audits and Reports on the financial If Type 1 or Type 2 report excludes the controls at a subservice

statements of a user entity. organisation, and the services provided by the subservice organisation are

relevant to the audit of the user entitys financial statements, the user

User Entity: An Entity that uses a service organization and whose financial

auditor is required to apply the requirements of this SA in respect of the

statements are being audited. subservice organisation.

Type 1 Report: Report on the description and design of internal controls at Nature and extent of work to be performed by the user auditor regarding

a service organization for a specified date. the services provided by a subservice organisation depend on the nature

and significance of those services to the user entity and the relevance of

Type 2 Report: Report on the description, design and operating

those services to the audit.

effectiveness of controls at a service organsation for a specified period.

Compiled by: CA. Pankaj Garg Page 5

SA 450 Evaluation of Misstatements Identified during the Audit

Meaning and Causes of Auditors Procedures if Misstatements identified

Misstatements

Difference between Accumulate the misstatements other than those that clearly trivial

amounts, classification, presentation

or disclosure of a reported financial

Communicate to management & request them to correct. Determine whether any

statement item,

revision required in Audit

and

Strategy/Plan.

amount, classification, presentation or Management corrects Management refuses

disclosure that is required for the item

to be in accordance of FRF. Perform Additional Understand the reason for not making Audit Strategy and Audit

Causes of Misstatement Procedures to Plan require revision if

(a) Inaccuracy in gathering or determine whether

Re-assess the materiality

processing data from which the misstatements Nature of identified

F.S. are prepared; remain. misstatements and the

If material, communicate uncorrected

(b) Omission of an amount or circumstances of their

misstatement and their effect on his opinion to

disclosure; occurrence indicate that

TCWG with a request that uncorrected

(c) Incorrect accounting estimate other misstatements may

misstatements be corrected.

arising from overlooking, or clear exist that, could be material;

Compiled by:

misinterpretation of, facts; and or

Not corrected

(d) Unreasonable judgments of CA. PANKAJ GARG Aggregate of misstatements

management concerning accumulated during the

Obtain a written representation from

accounting estimates. audit approaches materiality

management/TCWG w.r.t their believing that

(e) Inappropriate selection & determined in accordance

effect of uncorrected misstatements are

application of accounting policies with SA 320 (Revised).

immaterial.

Compiled by: CA. Pankaj Garg Page 6

SA 500 Audit Evidence

Meaning and Nature of Auditors duties when an information to be used as audit evidence Audit Procedures & Methods

Audit Evidence (A.E.) for obtaining audit evidence

Meaning of A.E. Information prepared using Information Procedures to obtain A.E. Methods to obtain A.E.

Information used by auditor work of Management Expert Produced by entity (a) RAP 1. Inspection

(b) FAP (Responses): 2. Observation.

In arriving at the conclusion Tests of Control (ToC), 3. External Confirmations

1 Evaluate Competence, Capability and Obtain A.E. about the

Objectivity of the Expert Substantive 4. Recalculation

On which auditors opinion is Source of Information for evaluation: 1. Tests of Details (ToD) 5. Re-performance

Accuracy and

based. Personal Experience with previous work. 2. Substantive Analytical 6. Analytical procedures

Completeness of info.

Discussion with that expert.

Nature of A.E. Procedures (SAP) 7. Inquiry (Oral/Written)

Discussion with others. Evaluate whether info

A.E. needs to be Knowledge of experts qualification, is

memberships, other forms of recognitions.

Published books or papers. Reliability of Audit Evidence

Sufficient Appropriate sufficiently precise

Auditors expert.

Measure of Measure of and detailed for

2 Obtain an understating of expert work

quantity quality auditors purposes.

Area of Specialty

Affected by Relevance & Applicable professional standards.

RMM & reliability in Legal & Regulatory Requirements. (a) External Evidences are considered more reliable than internal evidences.

Quality of providing Assumptions and Methods used.

(b) The reliability of internal evidence is increased when the related controls, imposed

Nature of Source Data used.

Audit support for by entity are effective.

3 Evaluate the appropriateness of Expert work

evidences conclusion. (c) Audit evidence obtained directly by the auditor is more reliable than audit

Finding & Conclusion Relevance,

Reasonableness & Consistency with other evidence obtained indirectly.

A.E. (d) Audit evidence in documentary form, is more reliable than evidence obtained

Compiled by: Assumptions and Methods Relevance

orally.

and Reasonableness.

CA. PANKAJ GARG (e) Audit evidence provided by original documents is more reliable than audit

Source Data Relevance, Completeness

and accuracy. evidence provided by photocopies.

Compiled by: CA. Pankaj Garg Page 1

SA 501 Audit Evidence Specific Considerations for Selected Items

Inventory Litigation & Claims Completeness

Compiled by: CA. Pankaj Garg

Existence & Condition

Auditor is required to identify litigation and claims

by following procedures:

Inquiry: of Mngt. & others within entity,

General Procedures Special Procedures including in house legal counsel.

Review minutes of meetings of TCWG,

When inventory is material to the F.S. 1 Inventory counting conducted at date other than communication between entity & external legal

B/S date counsel.

the auditor shall obtain SAAE Perform audit procedures to obtain audit evidence Review legal expenses account.

If management refuses to permit auditor to

about whether changes in inventory between the count

regarding existence & condition by communicate with legal counsel / external legal

date and the date of the F.S. are properly recorded. counsel refuses / auditor unable to collect SAAE

2 Auditor unable to attend Inventory Count by performing alternate procedures

(a) Attendance at physical inventory

Make or observe some physical counts on an alternative

counting, unless impracticable, to: Modify Opinion in accordance with SA 705

date,

Evaluate mngt. instructions &

procedures for recording & and perform audit procedures on intervening Segment Reporting

controlling the results of the entitys transactions Presentation & Disclosures

physical inventory counting; 3 Attendance at inventory count is impracticable

Observe the performance of Perform alternative audit procedures to obtain S.A.A.E. Obtain SAAE regarding presentation & disclosure of segment

regarding existence and condition of inventory. information in accordance with the applicable FRF by:

managements count procedures;

(a) Obtaining an understanding of the methods used by

Inspect the inventory; management in determining segment information, and

If it is not possible to do so, modify the opinion in the

Perform test counts; auditors report in accordance with SA 705. Evaluate whether such methods are likely to result in

(b) Performing audit procedures over the disclosure in accordance with the applicable FRF; and

4 Inventory under custody and control of Third Party

Where appropriate, testing the application of such

entitys final inventory records to Obtain S.A.A.E by performing the following: methods; and

determine whether they accurately (a) Request confirmation from third party. (b) Performing analytical procedures or other audit

reflect actual inventory count results. (b) Perform Inspection/other audit procedure. procedures appropriate in the circumstances.

Compiled by: CA. Pankaj Garg Page 2

SA 505 External Confirmation

The objective of the auditor, when using external confirmation procedures, is to design and perform such procedures to obtain relevant and reliable audit

evidence.

Meaning & Type of E.C. External Confirmation Audit Procedures in Special Circumstances Limited use of ve

Procedures Request

Mngt. refuses to allow the auditor to send request

Audit Evidence obtained as a direct written As it provides less

Determining the information to

response to auditor from 3rd Party in Inquire the reasons persuasive evidence

be confirmed.

Paper/Electronic/Other form. Evaluate the implications on RMM than the positive

Selecting the Appropriate Third Perform Alternative Audit procedure. Confirmation request.

2 Types Party. Refusal appears to Communicate to

be unreasonable TCWG.

+ ve Request - ve request Designing the confirmation

Circumstances in

request. Unable to collect Determine its affect

Request that 3rd Party Request that 3rd Party

which negative

respond directly to respond directly to audit evidence on Opinion

Sending the request including request may be used

auditor auditor

follow up. Responses to E.C. request as sole substantive

indicating whether it only if it disagrees

agrees or disagrees Creates Doubt Obtain Further procedure:

With the info in request with the information in Factors to be considered while Evidences

Low RMM.

or the request designing E.C. request: Not Reliable Consider its affect on

providing requested Population consists

Assertions being addressed. NTE of other procedures

info. of large no. of small,

Specific identified RMM. No Response Perform Alternative

homogenous

Areas where External Confirmation may be obtained: Layout and presentation of procedure

(a) Bank balance & Other confirmation from account balances.

request.

Unable to collect Determine its affect on

bankers Expectation of low

Prior Experience of audit.

(b) Account Receivable/Account Payable Balances evidence Opinion

Method of Communication. exception rate.

(c) Stock Lying with Third Parties Exception occurs Investigate to determine

Management Authorization. Auditor not aware

(d) Property Title Deed held by third parties

misstatement of circumstances

(e) Investments Purchased but delivery not taken. Ability of confirming party to

(f) Loan from Lenders provide the requested that 3rd party

(g) Terms of agreement or Transaction with Third information Compiled by: CA. Pankaj Garg disregard request.

Parties

Compiled by: CA. Pankaj Garg Page 3

SA 510 Initial Audit Engagements Opening Balances

Meaning of Initial Audit Engagement: An Engagement in which financial statements for prior period are not audited or were audited by predecessor auditor.

Meaning of Opening balance A/c balance that exist at beginning of period & also includes disclosures exists at beginning of period.

Audit Procedures Audit Conclusion & Reporting

Opening Balance Consistency of Modification in Opening Balance Consistency of Modification in

Accounting Predecessor Accounting Predecessor Auditors

Auditors Report

Policies Policies

Report

Balance

Read most recent F.S. and auditor Obtain SAAE Evaluate the Unable to Contain material Inconsistency Modification remains

report thereon. effect of obtain SAAE misstatements not exists relevant & material for

Obtain S.A. audit evidence w.r.t. modification properly or Current Period F.S.

existence of any material accounted / Changes not

misstatement by disclosed in properly

Determining correct b/f of prior current year F. S. accounted or

period closing balance. disclosed

Determining application of

appropriate accounting policies. w.r.t.

Modify Current Year

If any misstatement detected consistent

Qualified / Audit Report

perform additional procedures to application

Disclaimer Qualified / Adverse Report accordingly

determine their effect on current or

Period financial statements. Proper

If misstatement exists in Current accounting & in assessing Compiled by: CA. Pankaj Garg

Period F.S. communicate to Mngt & disclosure for RMM in Current

TCWG. changes. period F.S.

Compiled by: CA. Pankaj Garg Page 4

SA 520 Analytical Procedures

Meaning and Nature of Analytical Procedures Auditors Procedures

Evaluation of financial information 1 Determine the suitability of particular substantive analytical procedures (SAP)

Following factors requires consideration:

through analysis of relationships

1. SAPs more suitable to large volumes of transactions tending to be predictable over time.

2. But suitability of AP influenced by:

among both financial and non-financial data.

AND Nature of assertion.

also encompass such investigation as is necessary of Auditors assessment of APs effectiveness to identify material misstatement.

identified fluctuations or relationships that are 3. In some cases unsophisticated predictive models may be useful.

inconsistent with other relevant information or that 4. Different types of APs provide different levels of assurance.

differ from expected values by a significant amount. 5. Particular SAP may be considered suitable when ToD are performed on same assertion.

Analytical Procedures

2 Evaluate the reliability of data

Following factors affects the reliability:

Consideration of Consideration of

Source of the information available.

Comparisons of relationships among

Financial Information Comparability of the information available. Compiled by: CA. Pankaj Garg

with comparable Elements of financial Nature and relevance of the information available, and

information for prior information Controls over the preparation of the information

periods. or 3 Develop an expectation of recorded amounts or ratios and evaluate whether the expectation is

or Financial information sufficiently precise to identify material misstatement.

with anticipated results and relevant non-

4 Determine the amount of any difference of recorded amounts from expected values that is

of the entity financial information.

acceptable without further investigation.

or

Auditors expectations 5 Investigating Results of Analytical Procedures

or If auditor identified fluctuations or relationships that are inconsistent with other relevant information

Similar industry or differ from expected values by a significant amount, the auditor shall investigate such differences by:

information. (a) Inquiring of management; and

(b) Performing other audit procedures as necessary in the circumstances.

Compiled by: CA. Pankaj Garg Page 5

SA 530 (Revised) AUDIT SAMPLING

Meaning & Types of Audit Sampling Sampling risk Auditors Duties

Application of audit procedures to < Risk that auditors conclusion based on a sample may be different from 1 Sample design, size and selection of items

100 % of items within a population. the conclusion if the entire population were subjected to same audit (i) While designing, consider the purpose of

procedure. the audit procedure and the

Types of Sampling

characteristics of the population.

(a) Statistical Sampling: An

(ii) Sample size should be sufficient to

approach to sampling that has the

reduce sampling risk to an acceptably

following characteristics: Test of Tests of details Compiled by: low level.

Random selection of the controls CA. Pankaj Garg (iii) Selection should be in such a way that

sample items; and each sampling unit in the population has

a chance of selection.

The use of probability

Controls are Material Affects audit 2 Perform audit procedures

theory to evaluate sample

more effective misstatements does effectiveness and is (i) Perform audit procedures, appropriate

results, including

to the purpose, on each item selected.

than they not exist when in more likely to lead to

measurement of sampling (ii) If the audit procedure is not applicable

actually are fact it does. an inappropriate

risk. to selected item, perform the procedure

audit opinion. on a replacement item.

(b) Non Statistical Sampling: A

sampling approach that does not (iii) If the auditor is unable to apply designed

audit procedures/alternative procedure

have characteristics of random Controls are Material Affects audit to a selected item, consider that item as

selection and use of probability

less effective misstatement exists efficiency as it would a deviation.

theory is considered non-

than they when in fact it does lead to additional 3 Evaluation of results of audit sampling

statistical sampling. To determine whether the use of audit

actually are not work to establish

that initial sampling has provided a reasonable basis

for conclusions about the population that

conclusions were

has been tested.

incorrect.

Compiled by: CA. Pankaj Garg Page 6

SA 540 (Revised) Auditing Accounting Estimates(AE), including Fair Value Accounting Estimates and Related Disclosures

Objective of Auditor: To obtain SAAE whether (a) AE including Fair Value AE are reasonable; and (b) related disclosures in the F.S. are adequate.

Meaning & Nature of Auditors Duties

Accounting Estimates Compiled by: CA. Pankaj Garg

Accounting estimate: Risk Assessment Procedures & Responses to Assessed Risks

An approximation of a monetary Related Activities

amount in the absence of a Based on assessed RMM, auditor shall determine:

precise means of measurement. Whether management has appropriately applied the applicable FRF.

This term is used for an amount Whether the methods are appropriate and have been applied consistently.

1. Obtain an understating of:

measured at fair value where

Requirements of applicable FRF

there is estimation uncertainty.

How management identifies

Estimation Uncertainty: General Responses to Specific Responses to Significant Estimation

transactions, events and

The susceptibility of an Assessed RMM Uncertainties

conditions that give rise to need

accounting estimate & related 1. Determine whether events 1. Evaluate the following:

for accounting estimates.

disclosures to an inherent risk of occurring upto date of How management has considered

Estimation making process

precision in its measurement. auditors report provide alternative assumptions or outcomes,

adopted by mngt. and data on

Examples of Accounting Estimates

which they are based. audit evidence regarding How management has addressed

Provision for Bad Debt,

Estimation making process AE. estimation uncertainty in making the

Inventory loss,

Methods/Model used in making 2. Test how management accounting estimate.

Warranty Obligations,

Accounting estimates. made the accounting Whether the significant assumptions

Depreciation,

Relevant Controls estimate and the data on used by management are reasonable.

Provision against carrying

Use of Management Expert. which it is based. Managements intent to carry out

amount of investments, etc.

Changes in the methods from 3. Test the operating specific courses of action and its ability

Examples of Fair Value A.E.

the prior period along with effectiveness of the to do so.

Share Based Payments,

reasons. controls. 2. If in auditors judgement, management has

Assets held for disposal,

Assessment of effect of 4. Develop a point estimate not adequately addressed the effects of

Financial Instruments,

estimation uncertainties. or a range to evaluate estimation uncertainty, the auditor shall

Assets acquired in business develop a range with which to evaluate the

2. Review of outcome of accounting managements point

combinations

estimates of prior period. estimate. reasonableness of the accounting estimates.

Compiled by: CA. Pankaj Garg Page 7

SA 550 Related Parties Compiled by: CA. Pankaj Garg

Meaning of Related Party Auditors Duties

EITHER Risk Assessment procedures Responses to Assessed Risks

Related party as defined in applicable FRF (AS

18).

OR 1 Understanding the Entitys RP relationship and Transactions 1 Identification of unidentified /

Where applicable FRF establishes minimal or undisclosed RP or RP transaction.

a. Auditor to inquire management regarding:

no RP requirements:

Identity of entitys RP, changes from prior period. Communicate to other members of ET.

a. A person/entity having control/ significant

influence, over reporting entity; Nature of relationships between entity and RP. Request Mngt to identify the transactions

b. Entity over which reporting entity has Type & purpose of transactions with RP. with the newly identified RP.

control / significant influence, and b. Obtain understanding whether mngt has established controls to: Inquire reasons for mngt failure to

c. Entity under common control with Identify, account for & disclose RP relationships & transactions. identify RP or disclose RP relationship

reporting entity, through: and transactions.

Authorise & approve significant transactions with RP.

Common controlling ownership Reconsider the risk that other

Owners who are close family members Authorise & approve significant transactions outside normal course of business.

unidentified RP or undisclosed RP

Common key Mngt. 2 Maintaining Alertness for RP Information when Reviewing

transactions may exist.

Records/Documents

If non disclosure appears intentional,

Auditor to remain alert when inspecting records w.r.t. info indicating existence of RP

Auditors responsibilities in relation to RP relationships or transactions not previously identified or disclosed.

evaluate implications for audit.

If auditor identifies significant transactions outside entitys normal course of 2 Identified significant RP Transactions

Obtain an understanding of RP outside Entitys Normal course of

business, inquire of mngt about (a) Nature of these transactions, and (b)

Relation and Transactions: Business.

a. To recognize Fraud Risk factors Whether RP could be involved.

Inspect underlying contracts to evaluate

General

b. To conclude whether F.S. in so far Possible Sources for identification of RP Information:

business rationale.

as they are affected by those 1 Income Tax Returns 7 Shareholders Register

Examine the terms on which transactions

relations and transactions achieve 2 Internal Audit Report 8 Life insurance Polcies

takes place.

true and fair presentation and 3 Contracts with Mngt 9 Statement of conflict of interest

Collect evidences w.r.t. approval and

not misleading. 4 Contracts outside normal 10 Information supplied to authorisation of transaction.

Perform audit procedures to course of business regulatory authorities Collect evidences for appropriate

Identify, Assess & Respond to RMM. 5 Contracts re-negotiated 11 Specific Invoices from advisors accounting & disclosure in compliance of

Specific (FRF established

Evaluate whether Identified RP

accounting & Disclosure

6 Register of Investments 12 FRF.

relationships & Transactions have 3 Assertions that RP Transactions were

3 Identifying Fraud risk factors

requirements)

been appropriately accounted for & conducted on arm Length price.

disclosed as per FRF. Domination of mgmt by a single person or small group without compensating

Collect SAAE w.r.t. mngt assertion of

Obtain WR from Mngt./TCWG w.r.t. controls is a fraud risk factor.

Arms length transaction.

Disclosure to auditor the Indicators of dominant influence:

Compare transaction prices with the

identity of RP of which they are RP has vetoed significant business decisions taken by mgmt or TCWG.

prices for identical transactions

aware; and Significant transactions are referred to RP for final approval. prevailing in ordinary course of business.

Appropriate accounting & No/ little debate among mgmt or TCWG regarding business proposal initiated by RP.

Engage expert to determine market value.

disclosure as per FRF. Transactions involving the RP are rarely independently reviewed / approved.

Compiled by: CA. Pankaj Garg Page 8

SA 560 Subsequent Events

Meaning Events occurring between the date of F.S. and the date of Auditors Report AND Facts that become known to auditor after the date of Auditors report.

Auditors Duties Compiled by: CA. Pankaj Garg

Events occurring between the date of F.S. and the date of Auditors report Facts that become known to Auditor after date of Auditors report

(i) Perform procedures to obtain SAAE that all events which require adjustment / Before issue of F.S. After issue of F.S.

disclosure have been identified. 1. In general Auditor has no obligation. 1. In general Auditor has no obligation.

2. However, in case of significant 2. However, in case of significant

(ii) For the purpose of determining nature and timing of procedures, auditor may:

matter matter

(a) Obtain the understanding of procedures applied by mngt for identification of

Discuss with Management Discuss with Management

significant events. Determine need to amend F.S.

Determine need to amend F.S.

(b) Inquire the Management as to Occurrence of subsequent events which may Inquire how mngt intends to

Inquire how mngt intends to

affect the F.S. address the matter in F.S.

address the matter in F.S.

(c) Read the Minutes of Meetings that held after the B/S date. 3. If Mngt. amend the F.S. audior shall

3. If Mngt. amend the F.S. auditor shall

Carry out procedures on

(d) Study the Interim Financial Statements, if any. Extent procedures to date of new amended F.S.

(iii) If auditor identifies any event which require any adjustment/disclosure, he should report, and Review the steps taken by mngt

ensure its appropriate treatment in F.S. provide a new auditor report on to ensure that recipient of F.S.

(iv) Obtain a WR from the Mngt. that all known events have been appropriately amended F.S. are informed of the situation.

adjusted/disclosed, as the case may be. or provide a new auditor report on

Amend the audit report to amended F.S.

Specific Inquiries to be made from management include an additional date or

1. Whether new commitments, borrowings or guarantees have been entered into. restricted to that amendment Amend the audit report to

and include an EOM/OMP. include an additional date

2. Whether sales or acquisitions of assets have occurred or are planned.

4. If mngt refuses to amend the F.S. restricted to that amendment

3. Whether there have been increases in capital or issuance of debt instruments.

Modify the report if not yet and include an EOM/OMP.

4. Whether any assets have been appropriated by government or destroyed. 4. If mngt refuses to amend the F.S.

5. Whether there have been any developments regarding contingencies. provided to entity.

Notify to mngt and TCWG, that

6. Whether any unusual accounting adjustments have been made. If report already issued, notify to

the auditor will seek to prevent

7. Whether any events have occurred that will bring into question the appropriateness mngt and TCWG not to issue F.S. reliance on Auditors Report.

of accounting policies used in the F.S.. to third parties. If mngt/TCWG does not take

8. Whether any events have occurred that are relevant to the measurement of If mngt still issues F.S., take necessary steps, take appropriate

estimates or provisions made in the F.S. appropriate action to prevent action to prevent reliance on

9. Whether any events have occurred that are relevant to the recoverability of assets. reliance on auditors report. auditors report.

Compiled by: CA. Pankaj Garg Page 9

SA 570 (Revised) Going Concern

Mngt. Responsibilities Auditors Duties. Conditions that may case doubt

about G.C. Assumption

Responsibilities

Asses the entitys ability To obtain SAAE about the For this purpose auditor is required to A Financial Conditions

to continue as a going appropriateness of mngt use of a) Cover the same period as that used by mngt. 1. Net Liability position.

concern. going concern assumption 2. Non renewal of borrowings.

b) Consider whether mngt has considered all

General purpose F.S. are 3. Withdrawal of Financial

relevant information of which auditor is aware. Support.

prepared on a going Determine whether mngt has

4. Adverse Financial Ratios.

concern basis unless already performed a preliminary Request mngt to make its assessment of entitys 5. Inability to pay creditors.

management intends to assessment of entity ability to ability to continue as going concern. 6. Substantial Losses.

liquidate the entity or to continue as going concern.

Evaluate management plans for future. 7. Inability to arrange finances.

cease operation. 8. Negative Operating cash flow.

Consider the reliability of cash flow forecast.

In case F.S. are not Auditor identifies events that cast 9. Deterioration in value of assets.

prepared on going significant doubt on entity ability Considering availability of additional facts or

10. Discontinuation of dividend.

concern basis, the fact to continue as going concern. information since the date of mngt assessment. B Operating Conditions

would need to be Requesting WR from Mngt. regarding their plans 1. Management intention to

appropriately disclosed. Perform additional procedures for future action and the feasibility of these plans liquidate the entity.

2. Loss of KMP.

3. Loss of a major market, key

Going concern Mngt. unwilling to make its assessment customer, franchise etc.

Assumption Appropriate Going Concern Assumption 4. Labour Difficulties.

but Material Uncertainty Inappropriate 5. Shortage of Important Supplies.

exists 6. Emergence of successful

competitor.

C Others

Determine whether F.S. Adverse Opinion Consider the implications on Auditors Report

1. Non compliance of Statutory

makes relevant disclosure Requirements.

2. Pending legal proceedings

Yes No against the entity.

Compiled by: CA. Pankaj Garg 3. Uninsured or underinsured

EOM Q/A assets.

Compiled by: CA. Pankaj Garg Page 10

SA 580 Written Representation

Meaning and Nature of WR Requirements of SA 580

A written statement by Matters for which WR may be obtained Auditor Responses in different Situations

Management

Management refuses to Reliability of WR is doubtful

provided to auditor

provide WR

(a) Preparation and

presentation of Financial

to confirm certain matters

Statements: Discuss the matter with In case of having concerns

Management responsibilities

or

In accordance with applicable management about competence and

to support other audit evidence. FRF. Re-evaluate the reliability integrity of mngt, determine

WR recognized as audit evidence (b) Information provided to and integrity of management. their effect in reliability of

as a response to inquiries. 1 Auditor: Determine possible effect on WR and other audit

WR do not provide SAAE as agreed in terms of the opinion. evidence in general.

WR should be in the form of a engagement Issue disclaimer of opinion. IF WR inconsistent with

representation letter addressed (c) Description of management other evidences, perform

to Auditor. Responsibilities: additional procedures.

WR shall be obtained for all In the manner as described in If conclude that WR is not

Compiled by:

financial statements and terms of engagement reliable, determine possible

period(s) referred in Auditors As required by other SA CA. Pankaj Garg

effect on audit opinion.

Report. Or In case of sufficient doubt

Others

Date of WR shall be as near as 2 Where auditor determines that it over integrity of

practicable to the date of the is necessary to obtain one or more management, issue a

Auditors report. WR. disclaimer of opinion.

Compiled by: CA. Pankaj Garg Page 11

SA 600 Using the Work of Another Auditor

Applicability: In situation where an auditor (principal auditor - PA), reporting on the financial information of an entity, uses the work of another auditor (other auditor - OA) w.r.t.

to the financial information of one/more components (Division, Branch subsidiary, J. V. etc.), included in the financial information of the entity.

Non applicability: (a) Joint auditors (b) Auditors relationship with a predecessor auditor.

Principal Auditors Procedures Documentation Coordination Reporting

1. Consider the professional competence of Other 1. Components whose FS are 1. Sufficient liaison/co- 1. Express a qualified /

Auditor, if Other Auditor is not a member of ICAI. audited by Other Auditor ordination between Principal disclaimer of opinion

2. Visit component and examine books of account, if and Other auditor. because of scope

and their significance to

limitation:

essential. the financial information

2. Principal auditor may require

If Principal Auditor

3. Obtain sufficient appropriate evidence, that work of Other Auditor to answer a

of the entity as a whole. concludes that he

Other Auditor is adequate for Principal Auditor's detailed questionnaire.

2. Names of the other cannot use the work of

purposes. 3. Other Auditor should

auditors. Other Auditor;

4. Discuss audit procedures applied by Other Auditor. coordinate with Principal

3. Any conclusions reached PA unable to perform

5. Review a written summary of Other Auditors Auditor:

sufficient additional

that individual Adhering to time-table.

procedures and findings through

procedures regarding

questionnaires/checklist. components are not Bringing to the attention of

FI of the component

6. Consider significant findings of Other Auditor: material. PA any significant finding.

audited by OA.

Discuss audit findings with OA and Mgt. of 4. Procedures performed Compliance with relevant

2. Report should state

component. regarding components. statutory requirements.

clearly division of

Perform supplemental tests if necessary. 5. Conclusions reached. Respond to detailed

responsibility

questionnaire.

7. In case Other Auditor is not a professionally qualified 6. Manner of dealing with between PA and OA.

auditor - for instance, where a component is situated in Modified Report of Other

foreign country: Auditor while finalising

Procedures mentioned above assume added Compiled by: CA. Pankaj Garg

Principal Auditors Report.

importance.

Compiled by: CA. Pankaj Garg Page 1

SA 610 (Revised) Using the Work of Internal Auditors

Meaning & scope of Relationship External Auditors Procedures w.r.t. Evaluation of Internal Audit Documentatio

Internal Audit Function between Internal

Audit Function & Conclusions regarding the

Meaning Determine evaluation & adequacy of

External Auditor

An appraisal activity. work.

Established/ provided. Audit procedures performed

Adequacy of Internal Audit If Adequate, consider

Role & objectives of on internal auditor work.

As a service to entity. Work for External Auditors its effect on N, T, E of

internal audit function

Also include Purpose External auditors Using Specific Work

determined by Mngt/

examining, Procedures.

TCWG. of Internal auditor

evaluating & By evaluating the following

Notwithstanding

monitoring

Degree of autonomy / Objec ti vi ty of the Evaluate the following:

adequacy / effectiveness of

objectivity, internal i nter na l a udi t f u nc ti on; Specific work was performed by

Internal Control.

audit function is not Tec hni c a l c ompete nc y Internal Auditors having adequate

independent of entity. of i nte rna l a udi t ors; Nature of specific technical training & proficiency.

External auditor has Prof essi ona l c a re w i th work performed by Work was properly supervised,

Scope of Internal Audit:

sole responsibility for w hi c h the i nte rna l Internal Auditor. reviewed & documented.

Monitoring of I. C.

audit opinion, and a udi tors w orks; a nd Assessed RMM. Adequate audit evidence obtained

Examination of financial

that responsibility not C ommuni c a ti on Degree of subjectivity by Internal auditor.

& operating information.

reduced by use of betw ee n i nte rna l in evaluation of audit Conclusions reached are

Review of operating

work of internal a udi tors & e xte rna l evidence by internal appropriate & reports prepared by

activities.

auditors. a udi tor. auditor. internal auditors are consistent

Review of compliance

with the results of work performed.

with laws & regulations.

Exceptions / unusual matters

Risk management. Compiled by: CA. Pankaj Garg disclosed by Internal Auditor are

Governance.

properly resolved.

Compiled by: CA. Pankaj Garg Page 2

SA 620 Using the Work of Auditors Expert

Meaning of Auditors Expert Procedures to be followed while using the work of auditors expert

An individual or organisation 1 Determining need for an Auditors Expert 4 Agreement with Auditors Expert

possessing expertise in field An auditors expert may be needed to assist the auditor for the Need to be in writing and cover the followings:

followings: Nature, scope and Objectives of Auditors Expert

other than accounting/auditing,

Obtaining an understanding of entity & its environment, including IC. work.

whose work is used by the Identifying and assessing the risks of material misstatement. Respective Role and Responsibilities of Auditor

auditor Determining & implementing overall responses to assessed risks. and auditors Expert.

to assist the auditor in obtaining Designing and performing further audit procedures to respond to NTE of Communication including form of report.

SAAE. assessed risks. Confidentiality requirements to be observed by

Evaluating the sufficiency and appropriateness of audit evidence

Auditors Expert.

obtained.

Areas where work of AE can be