Professional Documents

Culture Documents

BIR Ruling 219-93 Digest

Uploaded by

kim_santos_20Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Ruling 219-93 Digest

Uploaded by

kim_santos_20Copyright:

Available Formats

o The legal expenses incurred in court proceedings, where the taxpayer

was awarded moral damages, are not deductible from gross income,

EXCLUSIONS FROM GROSS INCOME

Tax Code in General under Section 29(a) of the Tax Code2

o Attorney's fees awarded to your client as part of the damages shall not

BIR Ruling 219-93 dated 17 May 1993

be subject to income tax, the same being merely a

SUMMARY reimbursement of his expenses/advances in the course of the

Atty. Jose Maacop wrote to the BIR on behalf of his client, Michael Lawrence requesting hearing of his case.

the BIR to rule on whether or not award of damages such as moral, exemplary and This opinion finds support in the case of Gold Green Mining

attorney's fees or reimbursement of client's advances to lawyers are subject to withholding Corporation vs. Tabios3, holding that the so-called "legal

tax. The BIR held that they are not deductible from gross income and are therefore not fees" are expenses incurred in the carrying on of a trade or

subject to income tax. business.

Award of damages, such as moral, exemplary and attorney's fees, are not

DOCTRINE subject to income tax and consequently, to the withholding tax.

OTHER NOTES

Amounts received by a taxpayer as moral damages are not considered taxable

income This ruling is being issued on the basis of the foregoing facts as represented.

The legal expenses incurred in court proceedings, where the taxpayer was However, if upon investigation, it will be disclosed that the facts are different, then

awarded moral damages, are not deductible from gross income this ruling shall be considered null and void

Attorney's fees awarded to your client as part of the damages shall not be

subject to income tax, the same being merely a reimbursement of his Digester:

expenses/advances in the course of the hearing of his case.

FACTS

Atty. Jose Maacop wrote to the BIR on behalf of his client, Michael Lawrence

("ML") in a letter dated August 12, 1992

In the said letter, Maacop and his client Lawrence are requesting for a ruling as

to whether or not award of damages such as moral, exemplary and attorney's

fees or reimbursement of your client's advances to his lawyers, are subject to

withholding tax.

The letter contained the following facts:

o ML was awarded unpaid salaries and commission, plus moral and

exemplary damages and attorney's fees in NLRC Case No. 00-11-

043031-87, entitled "Michael Lawrence vs. LEP International Phil.,

Inc."

o Said award has already become final and executory

o Respondent LEP International is willing to pay the award less the

withholding tax thereon

o ML believes that the unpaid salaries and commission are subject

to withholding tax

o ML also believes that the damages which consist of moral and

exemplary damages and attorney's fees are not subject to

withholding tax to which the respondent LEP International

disagrees

BIR answered said letter in its BIR Ruling No. 219-93 dated 17 May 1993:

o Amounts received by a taxpayer as moral damages are not

considered taxable income1

1 3

par. 60, 12 Vol. 1, Mertens Law of Federal Income Taxation CIR, CTA Case No. 1497, April 27, 1967 (1988 Ed.Araas Commentary, p. 190)

2

par. 1130, p. 39001, 1969 U.S. Master Tax Guide

You might also like

- GDocument3 pagesGdenvergamlosenNo ratings yet

- 544 - Vda. de Ampil v. AlvendiaDocument1 page544 - Vda. de Ampil v. AlvendiaAiken Alagban LadinesNo ratings yet

- Case Digest #3 - CIR Vs - Mirant PagbilaoDocument3 pagesCase Digest #3 - CIR Vs - Mirant PagbilaoMark AmistosoNo ratings yet

- Case Digest 1-4Document10 pagesCase Digest 1-4Patricia Ann Sarabia ArevaloNo ratings yet

- Jurisdiction Over The PersonDocument37 pagesJurisdiction Over The PersonFelip MatNo ratings yet

- Digest Kalilid Wood Industries CorporationDocument2 pagesDigest Kalilid Wood Industries CorporationJeannie Delfino-BoadoNo ratings yet

- 127 Scra 9 (GR 119761) Commisioner vs. CADocument23 pages127 Scra 9 (GR 119761) Commisioner vs. CARuel FernandezNo ratings yet

- Cursino Vs BautistaDocument3 pagesCursino Vs BautistaJay Kent RoilesNo ratings yet

- Omnibus Sworn CertificationDocument1 pageOmnibus Sworn CertificationmusicaBGNo ratings yet

- Tax AsynchDocument8 pagesTax AsynchNeil FrangilimanNo ratings yet

- 1 Commissioner of Internal Revenue vs. JavierDocument7 pages1 Commissioner of Internal Revenue vs. JavierAriel Conrad MalimasNo ratings yet

- EVD - Vda de Bacang Vs CADocument5 pagesEVD - Vda de Bacang Vs CALudica OjaNo ratings yet

- 2 - Marshall-Wells V ElserDocument2 pages2 - Marshall-Wells V ElserNicole PTNo ratings yet

- Polido v. CADocument2 pagesPolido v. CAAbigayle RecioNo ratings yet

- Platon Notes Civil Procedure QuiambaoDocument64 pagesPlaton Notes Civil Procedure QuiambaoYoan Baclig BuenoNo ratings yet

- 8A Ong Vs CADocument14 pages8A Ong Vs CASiobhan Robin100% (1)

- Tan Kapoe v. Masa (Digest)Document1 pageTan Kapoe v. Masa (Digest)Trixie MarianoNo ratings yet

- 123567-1999-Pacheco v. Court of AppealsDocument10 pages123567-1999-Pacheco v. Court of AppealsMa. Hazel Joy FacoNo ratings yet

- MODULE II: Trademarks: ObjectivesDocument76 pagesMODULE II: Trademarks: ObjectivesAdimeshLochanNo ratings yet

- Negado vs. MakabentaDocument1 pageNegado vs. MakabentadaybarbaNo ratings yet

- Sky Cable Vs CtaDocument11 pagesSky Cable Vs CtaAriel Mark PilotinNo ratings yet

- (As Modified) : Lyceum Northwestern University College of Law Dagupan CityDocument10 pages(As Modified) : Lyceum Northwestern University College of Law Dagupan CityMona LizaNo ratings yet

- Navarro Vs DomagtoyDocument6 pagesNavarro Vs Domagtoyrm2803No ratings yet

- Phil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Document29 pagesPhil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Juni VegaNo ratings yet

- 13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Document13 pages13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Jopan SJNo ratings yet

- 4 - G.R. No. 117982 - CIR V CADocument4 pages4 - G.R. No. 117982 - CIR V CARenz Francis LimNo ratings yet

- 17 - Solidbank Corporation vs. Mindanao Ferroalloy CorporationDocument10 pages17 - Solidbank Corporation vs. Mindanao Ferroalloy CorporationanajuanitoNo ratings yet

- 0010100-Rule-71-Special-Writs NotesDocument23 pages0010100-Rule-71-Special-Writs NotesJulius OtsukaNo ratings yet

- Retainer AgreementsampleDocument2 pagesRetainer AgreementsampleJomik Lim EscarrillaNo ratings yet

- Chiang Kai Shek School, Petitioner, vs. Court of Appeals and Faustina Franco Oh, ResponDocument5 pagesChiang Kai Shek School, Petitioner, vs. Court of Appeals and Faustina Franco Oh, ResponJetJuárez0% (1)

- Jurat SampleDocument1 pageJurat SampleBienvenido RiveraNo ratings yet

- American Home Assurance v. Tantuco Scire LicetDocument2 pagesAmerican Home Assurance v. Tantuco Scire LicetJetJuárezNo ratings yet

- G.R. No. 93252, 93746 & 95245 - Ganzon v. Court of AppealsDocument7 pagesG.R. No. 93252, 93746 & 95245 - Ganzon v. Court of AppealsDenise GordonNo ratings yet

- Transportation Law Case Digests and SynthesisDocument10 pagesTransportation Law Case Digests and SynthesisDessa ReyesNo ratings yet

- Cir V Cta GR No 106611, July 21, 1994 FactsDocument39 pagesCir V Cta GR No 106611, July 21, 1994 FactsAnonymous r1cRm7FNo ratings yet

- Gavieres Vs TaveraDocument4 pagesGavieres Vs Taveradominicci2026No ratings yet

- Agustin vs. InocencioDocument2 pagesAgustin vs. InocencioJose IbarraNo ratings yet

- CIR vs. Hawaiian-Philippine CompanyDocument6 pagesCIR vs. Hawaiian-Philippine CompanyJohn Fredrick BucuNo ratings yet

- Rev. Fr. Casimiro Lladoc vs. CirDocument5 pagesRev. Fr. Casimiro Lladoc vs. CirJoyce VillanuevaNo ratings yet

- People Vs ChowduryDocument14 pagesPeople Vs ChowduryEmma Ruby Aguilar-ApradoNo ratings yet

- Torts and Damages Digested CasesDocument4 pagesTorts and Damages Digested CasesMarygrace MalilayNo ratings yet

- Time, He Disclosed To This Court The Other Judicial Proceedings Which He Had Commenced in Connection WithDocument3 pagesTime, He Disclosed To This Court The Other Judicial Proceedings Which He Had Commenced in Connection WithMykee NavalNo ratings yet

- Republic Vs EvangelistaDocument1 pageRepublic Vs EvangelistasakuraNo ratings yet

- Simon V Canlas Judicial Admissions ContradicteddocxDocument2 pagesSimon V Canlas Judicial Admissions ContradicteddocxJuan AntonioNo ratings yet

- Case 2: Vs - Sandiganbayan (Fourth Division), Jose LDocument3 pagesCase 2: Vs - Sandiganbayan (Fourth Division), Jose Lidmu bcpo100% (1)

- 010 Rafael E. Maninang and Soledad L. Maninang v. Court of Appeals Et Al.Document3 pages010 Rafael E. Maninang and Soledad L. Maninang v. Court of Appeals Et Al.Kim GuevarraNo ratings yet

- Mercado v. Court of AppealsDocument3 pagesMercado v. Court of AppealsChase DaclanNo ratings yet

- Cui vs. PiccioDocument1 pageCui vs. PiccioMagna AsisNo ratings yet

- Corporation: Advantages DisadvantagesDocument27 pagesCorporation: Advantages DisadvantagesRoy Kenneth LingatNo ratings yet

- Corpo Pardo V Hercules Lumber LucianoDocument2 pagesCorpo Pardo V Hercules Lumber LucianoArnold AdanoNo ratings yet

- Commissioner Vs Magsaysay LinesDocument2 pagesCommissioner Vs Magsaysay LinesVerlynMayThereseCaroNo ratings yet

- Isaac Vs Mendoza 2Document4 pagesIsaac Vs Mendoza 2Huzzain PangcogaNo ratings yet

- G.R. No. 210987Document2 pagesG.R. No. 210987Earl Andre PerezNo ratings yet

- Page 1 of 6Document6 pagesPage 1 of 6loschudentNo ratings yet

- Bpi Vs ManikanDocument2 pagesBpi Vs ManikanJoshuaLavegaAbrinaNo ratings yet

- Organo Vs SandiganbayanDocument6 pagesOrgano Vs SandiganbayanxxhoneyxxNo ratings yet

- Case No. 1 Cayetano vs. Monsod 201 SCRA 210 September 1991: FactsDocument2 pagesCase No. 1 Cayetano vs. Monsod 201 SCRA 210 September 1991: FactsJohn Will S. PatarlasNo ratings yet

- Suggested Answers To Tax Mock BarDocument5 pagesSuggested Answers To Tax Mock BarChic PabalanNo ratings yet

- Assignment in LEGAL COMMDocument3 pagesAssignment in LEGAL COMMSai PastranaNo ratings yet

- BIR Ruling No. 219-93Document1 pageBIR Ruling No. 219-93Lyceum LawlibraryNo ratings yet

- March 26, 2019Document34 pagesMarch 26, 2019kim_santos_20No ratings yet

- We RememberDocument2 pagesWe Rememberkim_santos_20No ratings yet

- April 2, 2019Document63 pagesApril 2, 2019kim_santos_20No ratings yet

- Convention TextDocument10 pagesConvention Textkim_santos_20No ratings yet

- Oblicon 2nd Week Digest CompileDocument78 pagesOblicon 2nd Week Digest Compilekim_santos_20No ratings yet

- PLDT Ultera Request BillingDocument1 pagePLDT Ultera Request Billingkim_santos_20No ratings yet

- Obligations and Contracts NotesDocument1 pageObligations and Contracts Noteskim_santos_20No ratings yet

- Tenchavez vs. EscañoDocument4 pagesTenchavez vs. Escañokim_santos_20No ratings yet

- Onde v. Civil RegistrarDocument2 pagesOnde v. Civil Registrarkim_santos_20No ratings yet

- ADR PresentationDocument65 pagesADR Presentationkim_santos_20100% (1)

- Alert Security V PasawilanDocument2 pagesAlert Security V Pasawilankim_santos_20No ratings yet

- 129 Ramoran V Jardine CMGDocument1 page129 Ramoran V Jardine CMGkim_santos_20No ratings yet

- Alzate v. Aldana DigestDocument2 pagesAlzate v. Aldana Digestkim_santos_20No ratings yet

- Mactan Workers Union v. AboitizDocument1 pageMactan Workers Union v. Aboitizkim_santos_20No ratings yet

- Case Summary: Obligations of The PartiesDocument2 pagesCase Summary: Obligations of The Partieskim_santos_20100% (1)

- (JLAA) Agency & Partnership Syllabus 2016-2017 PDFDocument12 pages(JLAA) Agency & Partnership Syllabus 2016-2017 PDFkim_santos_20No ratings yet

- Letran v. Assoc of Employees of LetranDocument2 pagesLetran v. Assoc of Employees of Letrankim_santos_20No ratings yet

- Alliance v. Samana Case DigestDocument1 pageAlliance v. Samana Case Digestkim_santos_20No ratings yet

- Atty. Montano v. Atty. VercelesDocument2 pagesAtty. Montano v. Atty. Verceleskim_santos_20100% (1)

- Order For MediationDocument3 pagesOrder For Mediationkim_santos_20No ratings yet

- 07 TSN of Abad With CrossDocument12 pages07 TSN of Abad With Crosskim_santos_20100% (2)

- Distribution of Work Outreach 2018Document4 pagesDistribution of Work Outreach 2018kim_santos_20No ratings yet

- Managerial Employees: Bound by More Exacting Rules/ Reason For The RuleDocument1 pageManagerial Employees: Bound by More Exacting Rules/ Reason For The Rulekim_santos_20No ratings yet

- Compilation ObliconDocument7 pagesCompilation Obliconkim_santos_20No ratings yet

- Holcim v. ObraDocument2 pagesHolcim v. Obrakim_santos_20No ratings yet

- Sap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalDocument1 pageSap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalSI Debasish MandalNo ratings yet

- Assignment: Government Municipel Degree College FaisalabadDocument28 pagesAssignment: Government Municipel Degree College FaisalabadARASTOO K KHYALNo ratings yet

- SyllabusDocument76 pagesSyllabusamattirkeyNo ratings yet

- 42 KV, 10 Ka Metal OxideDocument2 pages42 KV, 10 Ka Metal OxideSSE TRD JabalpurNo ratings yet

- Impact of New Housing Units On Existing Rents 090120Document57 pagesImpact of New Housing Units On Existing Rents 090120pkrysl2384No ratings yet

- Project On Ambuja CementDocument66 pagesProject On Ambuja CementMOHITKOLLINo ratings yet

- Internal TradeDocument17 pagesInternal TradeUmesh PanchalNo ratings yet

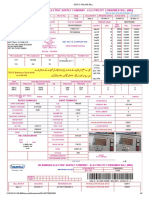

- Islamabad Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesIslamabad Electric Supply Company - Electricity Consumer Bill (Mdi)saleem khanNo ratings yet

- Solved MR and Mrs Janus Operate A Restaurant Business As ADocument1 pageSolved MR and Mrs Janus Operate A Restaurant Business As AAnbu jaromiaNo ratings yet

- List of PI Questions For Bcom StudentsDocument2 pagesList of PI Questions For Bcom StudentsAdyasha SahuNo ratings yet

- Cambridge IGCSE: Economics 0455/12Document12 pagesCambridge IGCSE: Economics 0455/12ShadyNo ratings yet

- Adobe Scan Jul 28, 2022Document1 pageAdobe Scan Jul 28, 2022Palani KumarNo ratings yet

- Key Financial Ratios of HCL TechnologiesDocument9 pagesKey Financial Ratios of HCL TechnologiesshirleyNo ratings yet

- Corporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismDocument49 pagesCorporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismronaqvNo ratings yet

- Interpretation of Statutes AssignmentDocument32 pagesInterpretation of Statutes AssignmentHimanish ChakrabortyNo ratings yet

- 1999 BIR RulingsDocument74 pages1999 BIR Rulingschris cardinoNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaKerwin Lester MandacNo ratings yet

- Trial Balance 2020Document13 pagesTrial Balance 2020Wilton MwaseNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)MABI ESPENIDONo ratings yet

- Padmatai Ratilal Mali Pay SlipsDocument3 pagesPadmatai Ratilal Mali Pay SlipsDevenNo ratings yet

- 28 Lladoc v. Commissioner of Internal Revenue PDFDocument2 pages28 Lladoc v. Commissioner of Internal Revenue PDFKJPL_1987No ratings yet

- OD119978131985722000Document1 pageOD119978131985722000pankaj hitlarNo ratings yet

- Synthesis EssayDocument6 pagesSynthesis Essayapi-254149514No ratings yet

- Tanzania Warehouse License Board and TechDocument38 pagesTanzania Warehouse License Board and TechGurisha AhadiNo ratings yet

- Ibus Final PaperDocument13 pagesIbus Final Paperapi-578941689No ratings yet

- ConsolidatedCustomerInvoice 27035262 RRY 1610391057Document3 pagesConsolidatedCustomerInvoice 27035262 RRY 1610391057NaniNo ratings yet

- Customs Act 4Document12 pagesCustoms Act 4Sheetal SaylekarNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance Policypinakin medhatNo ratings yet

- Latest Alza 20HBDocument1 pageLatest Alza 20HBsharimi adasmedsbNo ratings yet