Professional Documents

Culture Documents

Final2010 PressAddwith CFS

Uploaded by

tihadaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final2010 PressAddwith CFS

Uploaded by

tihadaCopyright:

Available Formats

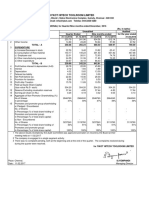

STATE BANK OF INDIA STATE BANK OF INDIA

Central Office, Mumbai - 400 021 Central Office, Mumbai - 400 001.

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31st MARCH 2010 AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31ST MARCH 2010

Rs. in crores Segment-wise Revenue, Results and Capital Employed

Consolidated

Particulars Quarter ended Year ended Year Ended Part A : Primary Segments Rs.in.crores

31.03.2010 31.03.2009 31.03.2010 31.03.2009 31.03.2010 31.03.2009 Year ended

Particulars 31.03.2010 31.03.2009

1 Interest Earned (a)+(b)+(c)+(d) 17965.59 17342.39 70993.92 63788.43 100080.73 91667.01

(a) Interest/discount on advances/bills 12967.32 12083.61 50632.64 46404.71 72298.74 67285.12 1 Segment Revenue (income)

(b) Income on Investments 4452.33 4230.89 17736.30 15574.11 24614.07 22079.30 a Treasury 22054.89 19838.88

(c) Interest on balances with Reserve Bank of India and other interbank 217.66 857.27 1511.92 1399.62 1826.54 1783.50 b Corporate / Wholesale Banking 26196.28 24241.41

(d) Others 328.28 170.62 1113.06 409.99 1341.38 519.09 c Retail Banking 37158.24 32398.93

Add / (Less) : Unallocated 552.66

2 Other Income 4508.53 4718.22 14968.15 12690.79 33771.10 21426.08 Total 85962.07 76479.22

3 TOTAL INCOME (1+2) 22474.12 22060.61 85962.07 76479.22 133851.83 113093.09 2 Segment Results (Profit before tax)

4 Interest Expended 11244.15 12500.45 47322.48 42915.29 66637.51 62626.46 a Treasury 4666.00 3744.64

b Corporate / Wholesale Banking 4755.35 5071.12

5 Operating Expenses (i) + (ii) 6036.09 4283.11 20318.68 15648.70 42415.39 26201.15 c Retail Banking 6491.25 7222.86

(i) Employee cost 3591.76 2349.60 12754.65 9747.31 16331.06 12626.62 Total 15912.60 16038.62

(ii) Other Operating Expenses 2444.33 1933.51 7564.03 5901.39 26084.33 13574.53 Add / (Less) : Unallocated -1986.52 -1857.96

6 TOTAL EXPENDITURE (4) + (5) 17280.24 16783.56 67641.16 58563.99 109052.90 88827.61 Operating Profit 13926.08 14180.66

(excluding Provisions and Contingencies) Less : Tax 4760.03 5059.42

7 OPERATING PROFIT (3 - 6) 5193.88 5277.05 18320.91 17915.23 24798.93 24265.48 Less : Extraordinary Profit / Loss

(before Provisions and Contingencies) Net Profit 9166.05 9121.24

8 Provisions (other than tax) and Contingenecies 2349.40 1377.66 4394.83 3734.57 6116.91 6000.08

--- of which provisions for Non-performing assets 2186.77 1296.25 5147.85 2474.97 6228.77 3616.30 3 Capital Employed

9 Exceptional Items 0.00 0.00 0.00 0.00 0.00 370.57 a Treasury 19685.76 19303.77

10 PROFIT FROM ORDINARY ACTIVITIES BEFORE TAX (7-8-9) 2844.47 3899.39 13926.08 14180.66 18682.02 17894.83 b Corporate / Wholesale Banking 19249.28 15672.85

11 Tax expense 977.88 1157.08 4760.03 5059.42 6668.38 6721.77 c Retail Banking 27014.16 22971.07

12 NET PROFIT FROM ORDINARY ACTIVITIES AFTER TAX (10-11) 1866.60 2742.31 9166.05 9121.24 12013.64 11173.06 Total 65949.20 57947.69

13 Extraordinary items (net of tax expense) 0.00 0.00 0.00 0.00 0.00 0.00

14 NET PROFIT FOR THE PERIOD (12-13) 1866.60 2742.31 9166.05 9121.24 12013.64 11173.06

Share of Minority 0.00 0.00 0.0000 0.00 279.81 217.78 * Equity Capital is allocated between segments in proportion of the Assets of respective segments

15 NET PROFIT AFTER MINORITY INTEREST 11733.83 10955.28

16 Paid-up equity Share Capital 634.88 634.88 634.88 634.88 634.88 634.88 Part B : Secondary Segments Rs.in.crores

(Face Value of Rs.10 per share) Geographic Domestic Operation Foreign Operation Total

17 Reserves excluding Revaluation Reserves 65314.32 57312.81 65314.32 57312.81 82500.70 71755.51 Year ended Year ended Year ended

(as per balance sheet of previous accounting year) Particulars 31.03.2010 31.03.2009 31.03.2010 31.03.2009 31.03.2010 31.03.2009

18 Analytical Ratios Revenue 81244.50 71563.34 4717.57 4915.88 85962.07 76479.22

(i ) Percentage of shares held by Government of India 59.41% 59.41% 59.41% 59.41% 59.41% 59.41% Assets 930150.43 856147.58 123263.30 108284.50 1053413.73 964432.08

(ii) Capital Adequacy Ratio

Basel I 12.00% 12.97% 12.00% 12.97%

Basel II 13.39% 14.25% 13.39% 14.25%

(iii) Earnings Per Share (EPS) (in Rs.)

st

(a) Basic and diluted EPS before Extraordinary items (net of tax 29.40 43.23 144.37 143.77 184.82 172.68 1. The Central Board have declared a dividend of Rs.30.00 per share (@ 300 %) for the year ended 31 March 2010

(not annualised) (not annualised) inclusive of an interim dividend already paid of Rs. 10.00 per share (@100 %))

(b) Basic and diluted EPS after Extraordinary items 29.40 43.23 144.37 143.77 184.82 172.68

(iv) NPA Ratios (not annualised) (not annualised) 2. Number of investor’s complaints received and disposed off during the quarter ended 31.03.2010:

(a) Amount of gross non-performing assets 19534.89 15714.00 19534.89 15714.00 (i) pending at the beginning of the quarter-Nil (ii) received during the quarter-58

(b) Amount of net non-performing assets 10870.17 9677.42 10870.17 9677.42 (iii) disposed off during the quarter 58 (iv) outstanding at the end of the quarter- Nil.

(c) % of gross NPAs 3.05% 2.86% 3.05% 2.86%

(d) % of net NPAs 1.72% 1.79% 1.72% 1.79% 3 In terms of RBI letter No. DBOD.BP.No. 19264/21.04.018/2009-10 dated 11.05.2010,RBI has permitted to transfer

(v) Return on Assets (Annualised) 0.69% 1.10% 0.88% 1.04% entries in inter branch account outstanding for a period of 10 years i.e. pertaining to the year 1999-2000. Accordingly,

19 Public Shareholding a net credit of Rs 60.15 crores has been transferred to Profit and Loss account . An amount of Rs 29.51 crores (net of

.. .. .. No. of shares 257675444 257673022 257675444 257673022 taxes and Statutory Reserves ) has therefore been transferred to General Reserve.

.. .. .. Percentage of Shareholding 40.59% 40.59% 40.59% 40.59%

20 Promotors and Promotor Group Shareholding

(a) Pledged/Encumbered 4 As per the Agricultural Debt Waiver and Debt Relief Scheme 2008, the amount receivable from the Central

Number of Shares Government on account of debt waiver being Rs. 5307 Crores (net of receipts of Rs 3424 crores) and debt relief

Percentage of Shares (as a percentage of the total shareholding of being Rs. 903.31 crore (net of receipts of Rs 226.69 crores) are treated as part of advances in accordance with the

NIL

and promotor group) scheme read with circular issued by RBI.

Percentage of Shares (as a percentage of the total share capital of the

(b) Non-encumbered 5 Pursuant to a scheme of Amalgamation approved by the Central Board at its meeting on 19 th June 2009, State Bank

Number of Shares 377207200 377207200 377207200 377207200 of Indore, where SBI holds 98.05% stake, is to be merged with the Bank. The Government of India has accorded

Percentage of Shares (as a percentage of the total shareholding of sanction to the Bank for entering into negotiations for acquiring the business, including assets and liabilities of State

and promotor group) 100.00% 100.00% 100.00% 100.00% Bank of Indore.

Percentage of Shares (as a percentage of the total share capital of the

company) 59.41% 59.41% 59.41% 59.41%

The above results have been approved by the Central Board of the Bank on the 14 May 2010.

Date 14.05.2010 R. SRIDHARAN S. K. BHATTACHARYYA O. P. BHATT

Kolkata MD & GE (A&S) MD & CCRO CHAIRMAN

You might also like

- Trent Q4 and FY19 financial resultsDocument9 pagesTrent Q4 and FY19 financial resultsSujesh GNo ratings yet

- Nesco 19.05.20Document19 pagesNesco 19.05.20Miku DhanukaNo ratings yet

- Reviewed Consolidated Financial ResultDocument1 pageReviewed Consolidated Financial ResultJyoti RanjanNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89No ratings yet

- Sep 2010-Audited ResultsDocument2 pagesSep 2010-Audited Resultssalilsingh86No ratings yet

- Bank Results TitleDocument34 pagesBank Results TitleMohit SainiNo ratings yet

- City Union Bank Audited Results for Q2 FY2011Document2 pagesCity Union Bank Audited Results for Q2 FY2011Ram KumarNo ratings yet

- 2021-22Document3 pages2021-2241 lavanya NairNo ratings yet

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaRohit bitpNo ratings yet

- 2022 04 Q4-2022 PR2-New-roomDocument10 pages2022 04 Q4-2022 PR2-New-roomTejpal SainiNo ratings yet

- SEBI Mar 2010Document2 pagesSEBI Mar 2010reachsubbusNo ratings yet

- With The: One SunDocument14 pagesWith The: One SunPoojaDasguptaNo ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Financial Results 31 Mar 2010 HSBC Invest DirectDocument2 pagesFinancial Results 31 Mar 2010 HSBC Invest Directbhavnesh_muthaNo ratings yet

- Standalone Financial Results 9M 2020 21Document1 pageStandalone Financial Results 9M 2020 21Shekhar AgarwalNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Financial ResultsDocument44 pagesFinancial ResultshouseNo ratings yet

- Re: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Document43 pagesRe: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Mahesh DhalNo ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- HDFC Bank Q3 FY22 resultsDocument7 pagesHDFC Bank Q3 FY22 resultsknowme73No ratings yet

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Document9 pagesStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88No ratings yet

- Q2 Results Bal 2021 22Document11 pagesQ2 Results Bal 2021 22Suraj PatilNo ratings yet

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lNo ratings yet

- Rbiformat 092009Document1 pageRbiformat 092009Ketan VermaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Q2 20 & 6 Months DhunseriDocument7 pagesQ2 20 & 6 Months Dhunserica.anup.kNo ratings yet

- Bse Limited The National Stock Exchange of India LimitedDocument8 pagesBse Limited The National Stock Exchange of India LimitedFareen SyedNo ratings yet

- Bharat Forge Q3 FY22 ResultsDocument7 pagesBharat Forge Q3 FY22 ResultsPratik PatilNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 6month Audited ResultsDocument2 pages6month Audited ResultsJessica HarveyNo ratings yet

- ICICI Financial StatementsDocument9 pagesICICI Financial StatementsNandini JhaNo ratings yet

- APL Outcome BM 26072021 NSE 26072021150942Document26 pagesAPL Outcome BM 26072021 NSE 26072021150942Karun KumarNo ratings yet

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDocument20 pagesSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Segment Reporting (Rs. in Crore)Document4 pagesSegment Reporting (Rs. in Crore)Vishal ModiNo ratings yet

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Audited Financial Results and Other Matters: Enduring ValueDocument23 pagesAudited Financial Results and Other Matters: Enduring ValueSai KishoreNo ratings yet

- PDFDocument6 pagesPDFKaran PatilNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- HDFC Bank Limited: (Excluding Provisions & Contingencies)Document4 pagesHDFC Bank Limited: (Excluding Provisions & Contingencies)ash82No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- Paramount V QVC AnnotatedDocument13 pagesParamount V QVC AnnotatedGeorge Jugeli100% (1)

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- Applied Auditing Audit of InvestmentsDocument2 pagesApplied Auditing Audit of InvestmentsCar Mae LaNo ratings yet

- CFAS Overview of AccountingDocument28 pagesCFAS Overview of AccountingMarriel Fate CullanoNo ratings yet

- R.A. 8791 General Banking Law o PDFDocument22 pagesR.A. 8791 General Banking Law o PDFMaricar Besa100% (1)

- Philippine Long Distance Telephone Co. Vs National Telecommunications Commission 190 SCRA 717 (GR No. 88404 October 18, 1990)Document6 pagesPhilippine Long Distance Telephone Co. Vs National Telecommunications Commission 190 SCRA 717 (GR No. 88404 October 18, 1990)Bob LawNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Damodaran On RiskDocument106 pagesDamodaran On Riskgioro_mi100% (1)

- Annual Report of Lafarge Surma Cement 2012 BangladeshDocument161 pagesAnnual Report of Lafarge Surma Cement 2012 BangladeshAnonymous okVyZFmqqXNo ratings yet

- Example Accounting Problems - SolutionsDocument7 pagesExample Accounting Problems - Solutionscarol indangan100% (1)

- TTC Group, IncDocument13 pagesTTC Group, IncBob RGNo ratings yet

- (PNB) Company BackgroundDocument1 page(PNB) Company BackgroundAlbert Ocno Almine100% (2)

- Mergers and Amalgamations Under Companies Act, 2013: From The Team ofDocument14 pagesMergers and Amalgamations Under Companies Act, 2013: From The Team ofanand aNo ratings yet

- Fmi Assignment #8: Ind - Ps - Ps - A1 McqsDocument4 pagesFmi Assignment #8: Ind - Ps - Ps - A1 McqsAditi RawatNo ratings yet

- Basics of Building & Managing RelationshipDocument35 pagesBasics of Building & Managing RelationshipMaheish AyyerNo ratings yet

- MBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionDocument5 pagesMBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionrudypatilNo ratings yet

- 05 Donina Halley vs. Printwell, IncDocument2 pages05 Donina Halley vs. Printwell, IncrbNo ratings yet

- pUBLIC COMPANY VS PRIVATE COMPANYDocument14 pagespUBLIC COMPANY VS PRIVATE COMPANYAnuj KumarNo ratings yet

- ACC 3000 Chapter 1 NotesDocument14 pagesACC 3000 Chapter 1 NotesAaiysha MistryNo ratings yet

- Assignment - Stocks and CBDocument2 pagesAssignment - Stocks and CBGhulam HassanNo ratings yet

- Job Order in TallyDocument5 pagesJob Order in TallySheikh Tahir MahmoodNo ratings yet

- SHAREHOLDERSDocument6 pagesSHAREHOLDERSJoana MarieNo ratings yet

- Pse Anrpt2006Document88 pagesPse Anrpt2006John Paul Samuel ChuaNo ratings yet

- Consolidated-Financial-Statements-80%-Owned-SubsidiaryDocument10 pagesConsolidated-Financial-Statements-80%-Owned-SubsidiaryBetty SantiagoNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- GTCR Announces Partnership Michael Rhodes Form Palladian Financial HoldingsDocument2 pagesGTCR Announces Partnership Michael Rhodes Form Palladian Financial HoldingsctgELLCNo ratings yet

- Bacc106 PDFDocument212 pagesBacc106 PDFlordNo ratings yet

- Accounting BusinessDocument11 pagesAccounting BusinessLyndonNo ratings yet

- PLDT Company ProfileDocument82 pagesPLDT Company ProfileDanreb TanNo ratings yet

- Investment Accounting W.R.T. As-13Document4 pagesInvestment Accounting W.R.T. As-13navin_khubchandaniNo ratings yet