Professional Documents

Culture Documents

Auction Sale Notice Ads - 24 (W) X 38 (H) Cms

Uploaded by

Sachin Khandare0 ratings0% found this document useful (0 votes)

37 views1 pageAuction Sale Notice

Original Title

Auction Sale Notice Ads - 24 (w) x 38 (h) Cms

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAuction Sale Notice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views1 pageAuction Sale Notice Ads - 24 (W) X 38 (H) Cms

Uploaded by

Sachin KhandareAuction Sale Notice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

AUCTION SALE NOTICE

(Sale through e-bidding only)

HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED

Branch : A - 901, 9th Floor, Marathon Futurex Mafatlal Mills Compound, N M Joshi Marg, Lower Parel East, Mumbai - 400 013.

Regd. Office: Ramon House, H.T. Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020.

Tel : 022-66113020 CIN: L70100MH1977PLC019916 Website: www.hdfc.com

Whereas the Authorised Officer of Housing Development Finance Corporation Limited [hereinafter called HDFC Ltd.] under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

(The Act) and in exercise of power conferred under section 13(12) read with rule 3 of the Security Interest (Enforcement) Rules, 2002 (The Rules) issued Demand Notice/s under section 13(2) of the Act calling upon the Borrower(s)

/ Mortgagor(s) / legal heirs, legal representatives (whether known or unknown), executor(s), administrator(s), successor(s) and assign(s) of the respective Borrower(s) / Mortgagor(s)(since deceased), as the case may be, whose

name/s have been indicated in Column (A) below, to repay the outstanding amounts as mentioned therein within 60 days from the date of receipt of the said Demand Notice.

However, the Borrower / Mortgagor(s) / legal heirs, legal representatives (whether known or unknown), executor(s), administrator(s), successor(s) and assign(s) of the respective Borrower(s) / Mortgagor(s)(since deceased), as

the case may be, indicated in Column (A) having failed to repay the amounts and/or discharge the loan liability / debt in full, the Authorised Officer of HDFC Ltd has taken over possession and control of the respective immovable

property(ies) / secured asset(s) mortgaged with HDFC Limited, described in column (C) hereinbelow, to recover the said debt / outstanding amounts, in exercise of powers conferred upon the Authorised Officer by section 13 (4)

of the Act.

The Authorised Officer issued notice/s as indicated in to Borrower / Mortgagor(s) / legal heirs, legal representatives (whether known or unknown), executor(s), administrator(s), successor(s) and assign(s) of the respective Borrower(s)

/ Mortgagor(s)(since deceased), as the case may be, indicated in Column (A) under Rule 8(6) of the Security Interest (Enforcement) Rules 2002 to pay the entire outstanding dues within 30 days from the date of the notice; else

Authorised Officer shall proceed to sell the said Mortgaged Properties / Secured Assets by adopting any of the methods mentioned in Rule 8 (5) of the Security Interest (Enforcement) Rules, 2002.

The Borrower / Mortgagor(s) / legal heirs, legal representatives (whether known or unknown), executor(s), administrator(s), successor(s) and assign(s) of the respective Borrower(s) / Mortgagor(s)(since deceased), as the case

may be, indicated in Column (A) and the public in general are hereby informed that the said Immovable Property / Secured Asset described in Column (C) would be sold on as is where is & as is what is basis by holding

a Public Auction under Rule 8(5)(c) of the Security Interest (Enforcement) Rules, 2002 adopting the e-bidding method and as per the procedure and subject to the applicable terms, conditions and disclaimers.

(A) (B) (C) (D) (E) (F) (G)

Sr. Name/s of Borrower(s)/Mortgagor(s)/Guarantor(s)/ Outstanding dues Description of the Date of Inspection Last date of Bid Date and

No. Legal Heirs and Legal Representatives to be recovered Immovable Property / Secured Asset of Immovable submission incremental time of

(whether known or unknown) Executor(s), (Secured Debt) (1 Sq. mtr. is equivalent to 10.76 Sq.ft) Properties / of bids amount Auction

Administrator(s), Successor(s) and Assign(s) (Rs.)* and Reserve Price Secured Assets (Rs.)

of the respective Borrower(s) / Mortgagor(s) /

Guarantor(s) (since deceased), as the case may be.

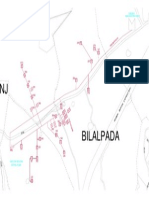

PANVEL

1 Mr. Mulkalwar Vivek Bhagvantrao & Rs. 26,98,209 Flat No- 701, 7TH Floor, Space Enclave, Plot No- 161, Sector- 4, 08-08-2017 28-08-2017 Rs.25,000/- 30-08-2017

Mrs. Mulkalwar Sangita Vivek As on 30-09-2016* Karanjade, Panvel- 410206. Between Between

Admeasuring 328.78 Sq. Ft. Carpet Equivalent To 30.56 Sq. Mtrs. 11:00 am 11:00 am

(Carpet Area) Or Thereabouts to to

Reserve Price: Rs.25,00,000/- 4:00 pm 12:00 noon

BADLAPUR

2 Mr. Kulkarni Sanjay Anantrao & Rs. 20,46,969/- Flat No.202, 2nd Floor, Mahakavi Kalidas Heights, Sn 13/4, 09-08-2017 28-08-2017 Rs.25,000/- 30-08-2017

Mr. Kulkarni Anant Vasudeo as on 28-FEB-2017* Plot 2,3, Nr T V Tower, Surya Nagar, Badlapur [E] Between Between

Dist Thane- 421503. 11:00 am 12:00 noon

Admeasuring 825 sq. ft. Built up equivalent to 76.67 sq. mtrs. to to

(Built up Area) or thereabouts 4:00 pm 01:00 pm

Reserve Price: Rs.28,00,000/-

MIRA ROAD

3 Mr. Khandzode Raju Mahadeo & Rs. 4,95,645/- Flat No 002 On Ground Floor, Green Village 3 Chsl Bldg No 3, 11-08-2017 28-08-2017 Rs.25,000/- 30-08-2017

Mrs. Khandzode Surekha Raju as on 31-JUL-2015* S No 23/1, Village Kashi, Mira Road [E], Dist Thane- 401107. Between Between

Admeasuring 471 sq. ft. Built up equivalent to 43.77 sq. mtrs. 11:00 am 01:00 pm

(Built up Area) or thereabouts to to

Reserve Price: Rs.29,50,000/- 4:00 pm 02:00 pm

MALAD

4 Mr. Mohammed Mehdi Hussain Rs. 67,31,827/- Flat no- 101, 1st Floor, Wing- A, Vimlachal Apartment Co-Op 12-08-2017 28-08-2017 Rs.25,000/- 30-08-2017

as on 30-04-2016* Housing Society, Plot No- 307/66, S No 26/1, Village Valnai, Between Between

Evershine Nagar, Malad (W), Mumbai- 400064. 11:00 am 02:00 pm

Admeasuring 550 Sq. Ft. Built up Equivalent To 51.12 Sq. Mtrs. to to

(Built up Area) Or Thereabouts 4:00 pm 03:00 pm

Reserve Price: Rs.58,00,000/-

*together with further interest @ 18% p.a. as applicable, incidental expenses, costs, charges etc. incurred up to the date of payment and / or realisation thereof.

NOTE: To the best of knowledge and information of the Authorized Officer of HDFC, there are no other encumbrances in respect of the above immovable properties / Secured Assets save

and except immovable properties / Secured Assets at Sr. No. 1 above.

DISCLOSURE OF ENCUMBRANCES / CLAIMS

No.1. In the case of Mr. Mulkalwar Vivek Bhagvantrao & Mrs. Mulkalwar Sangita Vivek mentioned at Sr. No. 1, an outstanding amount for Rs.3,17,000/- is due to builder as on 31-01-17, will

be cleared by HDFC Ltd, before registration of this flat in favour of successful bidder.

The secured asset is being sold on AS IS WHERE IS and AS IS WHAT IS basis.

The particulars in respect of the Immovable Property / Secured Asset specified hereinabove have been stated to the best of the information and knowledge of the Authorised Officer / HDFC Ltd. However,

the Authorised Officer / HDFC Ltd shall not be responsible for any error, misstatement or omission in the said particulars. The Bidders are therefore requested in their own interest, to satisfy themselves

with regard to the above and all other relevant details / material information pertaining to the abovementioned Immovable Property / Secured Asset, before submitting the bids.

Statutory dues like property taxes / cess and transfer charges, arrears of electricity dues, arrears of water charges, sundry creditors, vendors, suppliers and other charges known and unknown, shall

be ascertained by the Bidder beforehand and the payment of the same shall be the responsibility of the buyer of Secured Assets.

Wherever applicable, it is the responsibility of buyer of Secured Assets to deduct tax at source (TDS) @ of 1% of the total sell consideration on behalf of the resident owner (seller) on the transfer

of immovable property having consideration equal to Rs.50 Lacs and above and deposit the same with appropriate authority u/s 194 IA of Income Tax Act.

TERMS & CONDITIONS OF SALE:

1. Sale is strictly subject to the Terms, Conditions and Disclaimers stipulated in the prescribed Bid Document, Offer Acceptance Letter, this Public Notice and any other related documents.

2. Secured Asset is available for inspection as mentioned in column (D) hereinabove.

3. Bid Document can be obtained online from the website property.samil.in or can be obtained at A-901, 9th Floor, Marathon Futurex, Mafatlal Mills Compound, N.M Joshi Marg, Lower Parel East,

Mumbai- 400013.

4. For any assistance related to inspection of the property, or for obtaining the Bid document and for any other queries, please get in touch with Mr. Debjyoti Roy of M/s. Shriram Automall India Ltd.

Through Mobile No. +91-9874702021, E-mail ID: debjyoti.r@samil.in or from the Authorised Officer of HDFC Ltd. Through Telephone 022-66113020.

5. Earnest Money Deposit (EMD) amount of 10% Offer amount shall be deposited by the bidders through Demand Draft / Pay Order in Favour of HDFC Limited payable at par.

6. Minimum bid increment amount is as indicated in Column (F) above for respective properties / Secured Assets.

7. The offer amount shall be above Reserve Price and bidders shall improve their offers in multiples of Bid incremental amount indicated in Column (F) above.

8. Bid document duly filled in along with the details of payment of EMD shall be submitted at A- 901, 9th Floor, Marathon Futurex, Mafatlal Mills Compound, N M Joshi Marg, Lower Parel East,

Mumbai- 400013.

9. The last date of submission of bids with all necessary documents and EMD in stipulated manner is indicated in Column (E) hereinabove.

10. Incomplete Bid Documents or bids with inadequate EMD amount or bids received after the date indicated in Column (E) hereinabove shall be treated as invalid. Conditional offers shall also be treated

as invalid.

11. Shriram Automall India Ltd would be assisting the Authorized Officer in conducting the auction through an e-bidding process.

12. Upon receipt of Bid with the necessary documents as mentioned therein and in this sale notice within the stipulated date and time mentioned in Column (E), a password/ user ID will be provided

by M/s. Shriram Automall India Ltd. to eligible bidders / prospective purchasers to participate in the online auction at property.samil.in Necessary trainings will be provided by M/s. Shriram Automall

India Ltd. for the purpose.

13. The auction by way of e-bidding will be conducted on the date and time indicated in Column (G).

14. The Immovable Property / Secured Asset shall not be sold below the Reserve Price.

15. On sale of the property the purchaser shall not have any claim of whatsoever nature against HDFC Ltd or its Authorised Officer.

16. The e-bidding would commence and end at the time indicated in Column (G) above. However, if a bid is received 5 minutes prior to the closing time indicated therein, it would get extended by five

minutes every time a bid is offered. The auction would end if there is no bid for a period exceeding five minutes.

17. It shall be at the discretion of the Authorised officer to cancel the auction proceeding for any reason and return the EMD submitted and HDFC Ltd will not entertain any claim or representation in

that regard from the bidders.

18. The Authorized officer has the absolute right to accept or reject the highest and / or all Bid(s) or postpone or cancel the sale, as the case may be without assigning any reasons thereof and also

to modify any of the terms and condition of this sale without prior notice.

19. The sale shall be conferred on the highest bidder subject to confirmation by HDFC Ltd.

20. EMD of successful bidder shall be adjusted and for all other unsuccessful bidders, the same shall be refunded within 10 days from the date of Auction. The Earnest money deposit will not carry any

interest.

21. Along with Bid Documents the Bidder(s) should also attach his/her photo identity proof such as copy of the passport, election commission card, ration card, driving license, copy of the PAN card

issued by the Income Tax department etc. and the proof of residence countersigned by the bidder herself/himself.

22. The successful bidder shall be required to pay 25% of the offer amount (including the amount of EMD) immediately to HDFC Ltd i.e. on the same day or not later than next working day, as the

case may be (as per the amended provisions of Rule 9(3) of the Security Interest (Enforcement) Rules, 2002) on confirmation of offer acceptance by HDFC, failing which the EMD amount remitted

will stand forfeited. The balance 75% of offer amount shall be paid within 15 days of confirmation of sale by the Authorised officer. If the balance amount is not remitted within stipulated time the

amount of 25% will stand forfeited as per the amended provisions of Rule 9(4) of the Security Interest (Enforcement) Rules, 2002.

Note: Bidding in the last minute and second should be avoided in bidders own interest. Neither HDFC Ltd. nor the service provider shall be responsible for any lapses / failure (Internet failure, Power

failure etc.) on the part of the vendor. In order to ward-off such contingent situation bidders are requested to make all the necessary arrangements / alternatives such as back-up power supply or whatever

required so that they are able to participate in the auction successfully.

For Housing Development Finance Corporation Ltd.

Date: 28-07-2017 Sd/-

Place: Mumbai Authorised Officer

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ISC 112 Chapter 1 and 2Document3 pagesISC 112 Chapter 1 and 2James WootenNo ratings yet

- Advocates For Truth Vs Bangko SentralDocument2 pagesAdvocates For Truth Vs Bangko SentralSamuel Terseis100% (4)

- TA Comm Advt 050517 - For OnlineDocument3 pagesTA Comm Advt 050517 - For OnlineSunny SharmaNo ratings yet

- Coding and Decoding ReasoningDocument5 pagesCoding and Decoding ReasoninglenovojiNo ratings yet

- Appointment Reciept NewDocument3 pagesAppointment Reciept NewSachin KhandareNo ratings yet

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument3 pagesवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptSachin KhandareNo ratings yet

- AnnexureD PDFDocument1 pageAnnexureD PDFMukesh ShahNo ratings yet

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument3 pagesवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptSachin KhandareNo ratings yet

- Importantdate EngDocument1 pageImportantdate EngSachin KhandareNo ratings yet

- Add On Admin Officer PDFDocument3 pagesAdd On Admin Officer PDFSachin KhandareNo ratings yet

- Add On Admin Officer PDFDocument3 pagesAdd On Admin Officer PDFSachin KhandareNo ratings yet

- National Institute of Employment Services: Hall TicketDocument1 pageNational Institute of Employment Services: Hall TicketSachin KhandareNo ratings yet

- Online Form System GeneratedDocument2 pagesOnline Form System GeneratedSachin KhandareNo ratings yet

- MAHIM ICICI AgreementDocument6 pagesMAHIM ICICI AgreementSachin KhandareNo ratings yet

- Amvi 2017Document2 pagesAmvi 2017Sachin KhandareNo ratings yet

- Clerk Typist First Key 2017Document3 pagesClerk Typist First Key 2017Sachin KhandareNo ratings yet

- Advt For Retired Personnel-Chemist Egnineer Full Final in WebsiteDocument6 pagesAdvt For Retired Personnel-Chemist Egnineer Full Final in WebsiteSachin KhandareNo ratings yet

- JE-Updated ScheduleData 25112016Document2,757 pagesJE-Updated ScheduleData 25112016Sachin KhandareNo ratings yet

- Code No.263 Waiting Opretated List of Applicant (As Per Waiting Priority)Document15 pagesCode No.263 Waiting Opretated List of Applicant (As Per Waiting Priority)Sachin KhandareNo ratings yet

- ADB Selection ListDocument2 pagesADB Selection ListSachin KhandareNo ratings yet

- Post Applied: Sub Regional Officer (उप 넀စादे 넀စशक अ눀ആधकार뤀嬆) Name: Khandare Sachin VasantDocument1 pagePost Applied: Sub Regional Officer (उप 넀စादे 넀စशक अ눀ആधकार뤀嬆) Name: Khandare Sachin VasantSachin KhandareNo ratings yet

- Advertisement On DeputationDocument6 pagesAdvertisement On DeputationSachin KhandareNo ratings yet

- Rac Advt 120Document4 pagesRac Advt 120MANOJ SATAPATHYNo ratings yet

- Hall TicketDocument3 pagesHall TicketSachin KhandareNo ratings yet

- Advertisement On DeputationDocument6 pagesAdvertisement On DeputationSachin KhandareNo ratings yet

- Advt. Exe. EngrDocument1 pageAdvt. Exe. EngrSachin KhandareNo ratings yet

- CMD Rectt Color 16x13 EngDocument1 pageCMD Rectt Color 16x13 EngSachin KhandareNo ratings yet

- ABAQUS Getting Started TutorialsDocument2 pagesABAQUS Getting Started TutorialsS.m. MoniruzzamanNo ratings yet

- Lsrmususol 1404094197Document24 pagesLsrmususol 1404094197Sachin KhandareNo ratings yet

- Notification AAI Junior Exeutive PostsDocument2 pagesNotification AAI Junior Exeutive PostsAkshay MishraNo ratings yet

- 220/22KV Nallasopara Ehvt: Feeder No.9Document1 page220/22KV Nallasopara Ehvt: Feeder No.9Sachin KhandareNo ratings yet

- Bill of Lading 2 PDFDocument2 pagesBill of Lading 2 PDFAnonymous pj1Zz073No ratings yet

- Awho - Monthly - Handout - Apr 2011Document2 pagesAwho - Monthly - Handout - Apr 2011pankajdewanNo ratings yet

- Discovery Essentials by John D. RowellDocument14 pagesDiscovery Essentials by John D. RowellCDRB100% (1)

- E-Ticket Itinerary & ReceiptDocument5 pagesE-Ticket Itinerary & ReceiptAn ZullNo ratings yet

- Herbert Smith Freehills Guide To Restructuring Turnaround and Insolvency in Asia Pacific 2016 TEASERDocument20 pagesHerbert Smith Freehills Guide To Restructuring Turnaround and Insolvency in Asia Pacific 2016 TEASEREmily TanNo ratings yet

- Representative Payee ReportDocument1 pageRepresentative Payee ReportChristopher NallNo ratings yet

- Jurisprudence - ContractsDocument154 pagesJurisprudence - ContractsErwin FunaNo ratings yet

- Bermudez vs. Executive Secretary G.R. No. 131429Document1 pageBermudez vs. Executive Secretary G.R. No. 131429G-one PaisonesNo ratings yet

- AgencyDocument5 pagesAgencyMerve OzcanNo ratings yet

- Nfpa 13Document4 pagesNfpa 13Arthur Noel Castro50% (2)

- Ordinance 101Document3 pagesOrdinance 101Faye Nadine CaburalNo ratings yet

- Soriente v. Estate of ConcepcionDocument13 pagesSoriente v. Estate of ConcepcionCk Bongalos AdolfoNo ratings yet

- Short Duration Discussions (Rule-193) Further Discussion On Need ... On 7 May, 2010Document10 pagesShort Duration Discussions (Rule-193) Further Discussion On Need ... On 7 May, 2010sreevarshaNo ratings yet

- Balaram Abaji Patil v. Ragojiwalla (M. C.) Case AnalysisDocument5 pagesBalaram Abaji Patil v. Ragojiwalla (M. C.) Case AnalysisAjit Singh PariharNo ratings yet

- Laurel v. CSC (1991) - DigestDocument3 pagesLaurel v. CSC (1991) - DigestHansel Jake B. Pampilo0% (1)

- CoreLogic Solutions v. Collateral AnalyticsDocument5 pagesCoreLogic Solutions v. Collateral AnalyticsPriorSmartNo ratings yet

- Asuuconstitution PDFDocument27 pagesAsuuconstitution PDFDickson MusaNo ratings yet

- No Inquiry Before FIRDocument2 pagesNo Inquiry Before FIRpriyaNo ratings yet

- MAPEH - Team Sports IIDocument3 pagesMAPEH - Team Sports IIPat Baladjay Gonzales Jr.No ratings yet

- How To Fix CreditDocument65 pagesHow To Fix CreditHard Work Dedication83% (6)

- Michelin North America v. Tire Mart - ComplaintDocument18 pagesMichelin North America v. Tire Mart - ComplaintSarah BursteinNo ratings yet

- IEA PK Tamnava West FieldDocument163 pagesIEA PK Tamnava West FieldrizonicoNo ratings yet

- Shaw-Ottoman Archival Materials PDFDocument22 pagesShaw-Ottoman Archival Materials PDFRosa OsbornNo ratings yet

- Oktubre vs. VelascoDocument9 pagesOktubre vs. VelascoAdrianne BenignoNo ratings yet

- Personal Data Sheet: Brgy. 62-A Navotas, Laoag CityDocument4 pagesPersonal Data Sheet: Brgy. 62-A Navotas, Laoag CityRomel Remolacio AngngasingNo ratings yet

- Giosamar vs. DOTC PDFDocument2 pagesGiosamar vs. DOTC PDFJustine Joy Pablo100% (1)

- State of Rajasthan v. Union of India (AIR 1977 SC 1361)Document13 pagesState of Rajasthan v. Union of India (AIR 1977 SC 1361)meghakain56% (9)

- Management AgreementDocument3 pagesManagement Agreementanne guizanoNo ratings yet