Professional Documents

Culture Documents

ST9 Pu 15 PDF

Uploaded by

PolelarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ST9 Pu 15 PDF

Uploaded by

PolelarCopyright:

Available Formats

ST9: CMP Upgrade 2014/15 Page 1

Subject ST9

CMP Upgrade 2014/15

CMP Upgrade

This CMP Upgrade lists all significant changes to the Core Reading and the ActEd

material since last year so that you can manually amend your 2014 study material to

make it suitable for study for the 2015 exams. It includes replacement pages and

additional pages where appropriate. Alternatively, you can buy a full replacement set of

up-to-date Course Notes at a significantly reduced price if you have previously bought

the full price Course Notes in this subject. Please see our 2015 Student Brochure for

more details.

This CMP Upgrade contains:

all major changes to the Syllabus objectives and Core Reading.

changes to the ActEd Course Notes, Series X Assignments and Question and

Answer Bank that will make them suitable for study for the 2015 exams.

The Actuarial Education Company IFE: 2015 Examinations

Page 2 ST9: CMP Upgrade 2014/15

1 Changes to the Syllabus objectives and Core Reading

1.1 Syllabus objectives

Objective 1.4.2

Reference to Basel II now is to Basel Accord

Objective 3.2.1

Counterparty risk has been added to the list of risk categories.

Objective 6.4

Counterparty risk has been added. The objective now reads:

Describe the tools and techniques for identifying and managing credit and counterparty

risk.

Objective 6.5

Other key risks has been added. The objective now reads:

Discuss the management of operational, liquidity, insurance and other key risks.

Objective 7

The objective is now titled Capital Management.

The word economic has been removed from objective 7.1 and 7.1.2.

1.2 Core Reading

The reference to the Lam textbook has been amended to the following (ie the second

edition is now mandatory required reading):

Enterprise Risk Management From Incentives to Controls Second edition James

Lam. Wiley, 2014. ISBN: 9781118413616

Page references have been updated accordingly and some new chapters and sections of

the new textbook have been added to the lists of required reading.

IFE: 2015 Examinations The Actuarial Education Company

ST9: CMP Upgrade 2014/15 Page 3

The main changes to the Core Reading are as follows:

Chapter 3

The Core Reading on ORSA has been altered and now reads:

The ORSA concept now forms part of the International Association of Insurance

Supervisors (IAIS) standards, and has been introduced in several jurisdictions,

including the USA. Although some of the detailed requirements differ between

adoptions (eg Solvency II v. USA ORSAs), the overall principles are equivalent.

The ORSA is being promoted by the IAIS as a tool both for improving insurance

business practice and for allowing regulators to enhance their assessments of

the ability of insurance companies to withstand stress events.

The Core Reading now includes reference to the Swiss Solvency Test:

The Swiss Solvency Test is a risk-based regulatory capital regime which has

been fully in-force in Switzerland since 1 January 2011.

It takes a market consistent approach and has similarities with the Solvency II

Pillar 1 requirements. Differences include calibration of the solvency capital

requirements to a Tail Value at Risk (TVaR) measure at 99% confidence rather

than Value at Risk (VaR) at 99.5% confidence (these risk measures are described

further in Chapter 10).

Chapter 9

The description of credit / counterparty risk has been redrafted to read:

Credit risk in its general sense is the risk that a counterparty to an agreement

will be unable or unwilling to make the payments required under that agreement.

Some organisations define credit risk more narrowly as the risk that a borrower

will partially or wholly default on repayment of debt (interest and/or capital

payments). The phrase credit risk is also sometimes used to include risks

relating to variations in credit spreads in the market.

Counterparty risk is the risk that another party to a transaction or agreement

fails to perform its contractual obligations, including failure to perform them in a

timely manner. An example would be the default of a counterparty within a

derivatives transaction, or the failure of an outsourcing company. Some

organisations include counterparty risk within the wider credit risk category,

and this is also generally the case in the required reading for this and later

Chapters.

The Actuarial Education Company IFE: 2015 Examinations

Page 4 ST9: CMP Upgrade 2014/15

Chapter 26

Some new introductory Core Reading has been added:

Capital models can be used for a number of purposes within an organisation,

such as regulatory capital setting or considering economic capital

requirements.

Although the underlying assumptions and parameters are likely to be similar, if

not identical, between these two purposes, they are likely to have different risk

measures and calibrations associated with them. For example, a 1 in 200 year

risk measure is typical of regulatory capital requirements, whereas a 1 in 500

year calibration might be considered to be more appropriate for setting

economic capital, which typically would be in excess of minimum regulatory

capital requirements.

Within regulatory and economic capital models there may also be different

scenarios run to allow for some of the accounting requirements of specific

countries that are not appropriate when considering either regulatory or

economic capital requirements.

There may be other ways to assess capital requirements within an organisation,

such as regulatory standard formulae (or other prescribed calculations) and

rating agency factor-based models. Where relevant, these are also an important

part of the capital management process.

The reading material for this Chapter focuses on the concept of economic

capital, but the principles (modelling techniques and capital allocation

approaches) can apply similarly to regulatory required capital.

Chapter 28

Certain principal terms have been altered / added as follows:

Credit risk

Credit risk in its general sense is the risk that a counterparty to an agreement

will be unable or unwilling to make the payments required under that agreement.

Some organisations define credit risk more narrowly as the risk that a borrower

will partially or wholly default on repayment of debt (interest and/or capital

payments), and it may also include risks relating to variations in credit spreads

in the market.

IFE: 2015 Examinations The Actuarial Education Company

ST9: CMP Upgrade 2014/15 Page 5

Solvency II

Solvency II is an updated set of regulatory requirements for insurance firms in

the EU, which is planned to replace the current Solvency I regime from the

beginning of 2016.

Counterparty risk

Counterparty risk is the risk that another party to a transaction or agreement

fails to perform its contractual obligations, including failure to perform them in a

timely manner.

Swiss Solvency Test

The Swiss Solvency Test is a risk-based regulatory capital regime which has

similarities to Pillar 1 of Solvency II, although uses a different calibration

measure.

The Actuarial Education Company IFE: 2015 Examinations

Page 6 ST9: CMP Upgrade 2014/15

2 Changes to the ActEd Course Notes

Minor changes have been made to the Course Notes to reflect the changes to the Core

Reading listed above.

Page references have been updated to match those in the second edition of Lam.

Extensive changes have been made to the notes, particularly to Parts 1 and 2, to

incorporate the new required reading in Lam.

Due to the extent of the changes and the mandatory use of the new textbook it is not

practical to produce updated or replacement pages. We recommend that students:

purchase the second edition of the Lam textbook

purchase a new set of Course Notes (or a new Combined Materials Pack) at the

special retaker price.

IFE: 2015 Examinations The Actuarial Education Company

ST9: CMP Upgrade 2014/15 Page 7

3 Changes to the Q&A Bank

Some minor changes have been made to some solutions to ensure they are consistent

with revised text in the Course Notes (eg the term economic capital has been largely

removed from the course and so the term capital is used in its place). However, in

such cases, the 2014 questions and solutions are fit for purpose and hence are not listed

below.

Question 3.33

This question has been moved to the Development Questions section.

Questions 6.10 & 6.11

Counterparty risk has been added to the list of risks to be considered in the two

questions.

4 Changes to the X assignments

Some minor changes have been made to some questions and solutions (particularly in

Assignment 6) to ensure they are consistent with revised text in the Course Notes

(eg the term economic capital has been largely removed from the course and so the

term capital is used in its place). However, in such cases, the 2014 questions and

solutions are fit for purpose and hence are not listed.

The Actuarial Education Company IFE: 2015 Examinations

Page 8 ST9: CMP Upgrade 2014/15

5 Other tuition services

In addition to this CMP Upgrade you might find the following services helpful with

your study.

5.1 Study material

We offer the following study material in Subject ST9:

Mock Exam

Additional Mock Pack

ASET (ActEd Solutions with Exam Technique) and Mini-ASET

Flashcards.

For further details on ActEds study materials, please refer to the 2015 Student

Brochure, which is available from the ActEd website at www.ActEd.co.uk.

5.2 Tutorials

We offer the following tutorials in Subject ST9:

a set of Regular Tutorials (lasting three full days)

a Block Tutorial (lasting three full days)

Online Tutorials.

For further details on ActEds tutorials, please refer to our latest Tuition Bulletin, which

is available from the ActEd website at www.ActEd.co.uk.

5.3 Marking

You can have your attempts at any of our assignments or mock exams marked by

ActEd. When marking your scripts, we aim to provide specific advice to improve your

chances of success in the exam and to return your scripts as quickly as possible.

For further details on ActEds marking services, please refer to the 2015 Student

Brochure, which is available from the ActEd website at www.ActEd.co.uk.

IFE: 2015 Examinations The Actuarial Education Company

ST9: CMP Upgrade 2014/15 Page 9

6 Feedback on the study material

ActEd is always pleased to get feedback from students about any aspect of our study

programmes. Please let us know if you have any specific comments (eg about certain

sections of the notes or particular questions) or general suggestions about how we can

improve the study material. We will incorporate as many of your suggestions as we can

when we update the course material each year.

If you have any comments on this course please send them by email to ST9@bpp.com

or by fax to 01235 550085.

The Actuarial Education Company IFE: 2015 Examinations

All study material produced by ActEd is copyright and is sold

for the exclusive use of the purchaser. The copyright is owned

by Institute and Faculty Education Limited, a subsidiary of

the Institute and Faculty of Actuaries.

Unless prior authority is granted by ActEd, you may not hire

out, lend, give out, sell, store or transmit electronically or

photocopy any part of the study material.

You must take care of your study material to ensure that it is

not used or copied by anybody else.

Legal action will be taken if these terms are infringed. In

addition, we may seek to take disciplinary action through the

profession or through your employer.

These conditions remain in force after you have finished using

the course.

IFE: 2015 Examinations The Actuarial Education Company

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ST5 Pu 15 PDFDocument30 pagesST5 Pu 15 PDFPolelarNo ratings yet

- ST7 Pu 15 PDFDocument82 pagesST7 Pu 15 PDFPolelarNo ratings yet

- ST6 Pu 15 PDFDocument60 pagesST6 Pu 15 PDFPolelarNo ratings yet

- ST8 Pu 15 PDFDocument58 pagesST8 Pu 15 PDFPolelarNo ratings yet

- Sa5 Pu 15 PDFDocument52 pagesSa5 Pu 15 PDFPolelarNo ratings yet

- ST4 Pu 15 PDFDocument106 pagesST4 Pu 15 PDFPolelarNo ratings yet

- Ca1 Pu 15 PDFDocument30 pagesCa1 Pu 15 PDFPolelar0% (1)

- Sa4 Pu 15 PDFDocument9 pagesSa4 Pu 15 PDFPolelarNo ratings yet

- ST2 Pu 15 PDFDocument26 pagesST2 Pu 15 PDFPolelarNo ratings yet

- Ca3 Pu 15 PDFDocument10 pagesCa3 Pu 15 PDFPolelarNo ratings yet

- Sa1 Pu 15 PDFDocument78 pagesSa1 Pu 15 PDFPolelarNo ratings yet

- Sa2 Pu 14 PDFDocument150 pagesSa2 Pu 14 PDFPolelarNo ratings yet

- Sa2 Pu 15 PDFDocument108 pagesSa2 Pu 15 PDFPolelarNo ratings yet

- CT7 Pu 15 PDFDocument8 pagesCT7 Pu 15 PDFPolelarNo ratings yet

- ST4 Pu 14 PDFDocument10 pagesST4 Pu 14 PDFPolelarNo ratings yet

- Sa5 Pu 14 PDFDocument102 pagesSa5 Pu 14 PDFPolelarNo ratings yet

- ST8 Pu 14 PDFDocument42 pagesST8 Pu 14 PDFPolelarNo ratings yet

- ST2 Pu 14 PDFDocument26 pagesST2 Pu 14 PDFPolelarNo ratings yet

- ST9 Pu 14 PDFDocument6 pagesST9 Pu 14 PDFPolelarNo ratings yet

- ST7 Pu 14 PDFDocument84 pagesST7 Pu 14 PDFPolelarNo ratings yet

- Sa6 Pu 14 PDFDocument118 pagesSa6 Pu 14 PDFPolelarNo ratings yet

- Sa1 Pu 14 PDFDocument212 pagesSa1 Pu 14 PDFPolelarNo ratings yet

- ST5 Pu 14 PDFDocument12 pagesST5 Pu 14 PDFPolelarNo ratings yet

- ST6 Pu 14 PDFDocument60 pagesST6 Pu 14 PDFPolelarNo ratings yet

- Sa3 Pu 14 PDFDocument114 pagesSa3 Pu 14 PDFPolelarNo ratings yet

- Sa4 Pu 14 PDFDocument36 pagesSa4 Pu 14 PDFPolelarNo ratings yet

- Subject CA2: CMP Upgrade 2013/14Document7 pagesSubject CA2: CMP Upgrade 2013/14PolelarNo ratings yet

- R.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionDocument2 pagesR.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionPolelarNo ratings yet

- Ca3 Pu 14 PDFDocument16 pagesCa3 Pu 14 PDFPolelarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

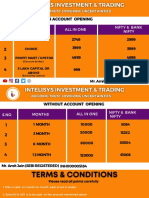

- Intelisys Pricing PlanDocument5 pagesIntelisys Pricing PlanregsNo ratings yet

- E Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Document1 pageE Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Abhishek KulkarniNo ratings yet

- Jntuk Mba 3rd Sem r13 TT Nov 2016Document1 pageJntuk Mba 3rd Sem r13 TT Nov 2016haibye424No ratings yet

- BaselDocument28 pagesBaselKavithaNo ratings yet

- Class 10 BankingDocument3 pagesClass 10 BankingPATASHIMUL GRAM PACHAYATNo ratings yet

- Audit Class Notes EvidenceDocument15 pagesAudit Class Notes EvidencePrince Wayne SibandaNo ratings yet

- Citi Cards Non Perm Res Al Cre Card AppDocument8 pagesCiti Cards Non Perm Res Al Cre Card AppHarish KrishnaNo ratings yet

- Organogram - State Bank of Pakistan: Approved by The Board On October 26, 2020Document1 pageOrganogram - State Bank of Pakistan: Approved by The Board On October 26, 2020Bilal ZaidiNo ratings yet

- Css Challan Form 2022Document1 pageCss Challan Form 2022SairaNo ratings yet

- FAR 3 Sample QuestionsDocument2 pagesFAR 3 Sample Questionsfrancis dungcaNo ratings yet

- Fixed Deposits - November 12 2018Document1 pageFixed Deposits - November 12 2018Tiso Blackstar GroupNo ratings yet

- Exam3 Buscom T F MC Problems FinalDocument23 pagesExam3 Buscom T F MC Problems FinalErico PaderesNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- Financial Analysis of Janata Bank LimitedDocument8 pagesFinancial Analysis of Janata Bank LimitedBirendra Dasaudi100% (1)

- Investment Proof Submission Guidelines 2022-23Document17 pagesInvestment Proof Submission Guidelines 2022-23Rajshree SamantrayNo ratings yet

- Week 6-7 Let's Analyze Acc213Document5 pagesWeek 6-7 Let's Analyze Acc213Swetzi CzeshNo ratings yet

- Private Tibetan Language LessonsDocument5 pagesPrivate Tibetan Language LessonsGuilherme PintadoNo ratings yet

- SIMPLE INTEREST & COMPOUND INTEREST - 1st - Chapter PDFDocument6 pagesSIMPLE INTEREST & COMPOUND INTEREST - 1st - Chapter PDFarasuNo ratings yet

- IT Certificate 2020-21 BajajDocument1 pageIT Certificate 2020-21 BajajPushpendra SinghNo ratings yet

- ACC 311 ReviewDocument2 pagesACC 311 ReviewMaricar DimayugaNo ratings yet

- Term Sheet WhiteDocument3 pagesTerm Sheet WhiteholtfoxNo ratings yet

- INTACCT - Online Modules SummaryDocument3 pagesINTACCT - Online Modules SummarysfsdfsdfNo ratings yet

- Indian Financial MarketDocument114 pagesIndian Financial MarketmilindpreetiNo ratings yet

- 5-10 Fa1Document10 pages5-10 Fa1Shahab ShafiNo ratings yet

- Debt To Total Asset RatioDocument13 pagesDebt To Total Asset RatioMjNo ratings yet

- MR Dolphy D'Souza, Partner, E&YDocument4 pagesMR Dolphy D'Souza, Partner, E&YPradeep Singh100% (1)

- Valuation of BondsDocument30 pagesValuation of BondsRuchi SharmaNo ratings yet

- Module Training Internal Audit HISDocument38 pagesModule Training Internal Audit HISarieznavalNo ratings yet

- Review in General Mathematics (Quiz Bee)Document26 pagesReview in General Mathematics (Quiz Bee)cherrie annNo ratings yet

- Int. Acc 1 Chap 2Document7 pagesInt. Acc 1 Chap 2Nicole Anne Santiago SibuloNo ratings yet