Professional Documents

Culture Documents

9) Cha Vs CA - Paguio (D2017)

Uploaded by

CzarPaguioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9) Cha Vs CA - Paguio (D2017)

Uploaded by

CzarPaguioCopyright:

Available Formats

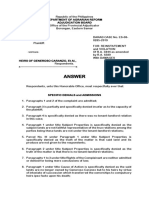

CHA v. CA (1997) RULING + RATIO: NO, it is not.

Stipulations contained in a contract cannot

Petitioner: Spouses NILO CHA and STELLA UY CHA, and UNITED be contrary to law, morals, good customs, public order or public policy. Sec.

INSURANCE CO., INC 18 of the Insurance Code provides that no contract or policy of insurance on

Respondent: COURT OF APPEALS and CKS DEVELOPMENT property shall be enforceable except for the benefit of some person having

CORPORATION an insurable interest in the property insured.

Ponencia: PADILLA, J.:

A fire insurance policy taken by petitioner-spouses over their merchandise is

primarily a contract of indemnity. Insurable interest in the property insured

DOCTRINE: No policy of insurance shall be enforceable except for the must exist at the time the insurance takes effect and at the time the loss

benefit of some person having an insurable interest in the property occurs. The basis of such requirement of insurable interest in property

insured. In a contract of lease, such insurable interest remains with the insured is based on sound public policy: to prevent a person from taking out

lessee. an insurance policy on property upon which he has no insurable interest and

collecting the proceeds of said policy in case of loss of the property. In such

a case, the contract of insurance is a mere wager which is void under

FACTS: Section 25 of the Insurance Code.

1. Sps. Cha, as lessees, entered into a 1 year lease contract with CKS

Development Corporation, as lessor. In the present case, it cannot be denied that CKS has no insurable interest in

2. One of the stipulations of the contract states: the goods and merchandise inside the leased premises.

The LESSEE shall not insure against fire the chattels, merchandise, textiles, Therefore, respondent CKS cannot, under the Insurance Code a special law

goods and effects placed at any stall or store or space in the leased be validly a beneficiary of the fire insurance policy taken by the Sps. over

premises without first obtaining the written consent and approval of the their merchandise. This insurable interest over said merchandise remains

LESSOR. If the LESSEE obtain(s) the insurance thereof without the consent with the insured, the Cha spouses. The automatic assignment of the policy to

of the LESSOR then the policy is deemed assigned and transferred to the CKS under the provision of the lease contract previously quoted is void for

LESSOR for its own benefit being contrary to law and/or public policy. The proceeds of the fire insurance

policy thus rightfully belong to the spouses and the insurer cannot be

3. Notwithstanding the above stipulation, Sps. insured against loss by compelled to pay the proceeds to a person who has no insurable interest.

fire their merchandise inside the leased premises for P500k with the

United Insurance without the written consent of CKS. The liability of the Cha spouses to CKS for violating their lease contract in

that Cha spouses obtained a fire insurance policy over their own

4. On the day that the lease contract was to expire, fire broke out inside merchandise, without the consent of CKS, is a separate and distinct issue

the leased premises. which we do not resolve in this case.

5. When CKS learned of the insurance, it wrote the insurer a demand

letter asking that the proceeds of the insurance contract be paid DISPOSITION: WHEREFORE, the decision of the Court of Appeals in CA-

directly to CKS, based on its lease contract with Cha spouses. G.R. CV No. 39328 is SET ASIDE and a new decision is hereby entered,

awarding the proceeds of the fire insurance policy to petitioners Nilo Cha and

6. United refused to pay CKS. Hence, the latter filed a complaint Stella Uy-Cha.

against the Cha spouses and United.

7. RTC: ordered United and Sps. to pay CKS; CA: affirmed, but deleted

awards for exemplary damages and attorneys fees

ISSUES: W/N paragraph 18 of the lease contract entered into between CKS

and the Cha spouses is valid

You might also like

- Peso DollarDocument61 pagesPeso DollarAnonymous HWfwDFRMPsNo ratings yet

- Clinical Trial Registration FormDocument3 pagesClinical Trial Registration FormJerilee Grantoza100% (1)

- Committee Report No. 189Document6 pagesCommittee Report No. 189CzarPaguioNo ratings yet

- Peso DollarDocument61 pagesPeso DollarAnonymous HWfwDFRMPsNo ratings yet

- FDA - Clinical Trial Guidelines Consultation PDFDocument31 pagesFDA - Clinical Trial Guidelines Consultation PDFCzarPaguioNo ratings yet

- Annex F - Authority To Issue VAT RefundDocument1 pageAnnex F - Authority To Issue VAT RefundCzarPaguioNo ratings yet

- 2016UpdatedForm10 2andchecklistDocument6 pages2016UpdatedForm10 2andchecklistMarj Fulgueras-GoNo ratings yet

- UP College of Law reservation fee deadline and interview scheduleDocument9 pagesUP College of Law reservation fee deadline and interview schedulelabellejolieNo ratings yet

- 2016UpdatedForm10 2andchecklistDocument6 pages2016UpdatedForm10 2andchecklistMarj Fulgueras-GoNo ratings yet

- Package One PDFDocument66 pagesPackage One PDFjmn_0905No ratings yet

- 1 - Sponsor CRO SATK Form - Initial Application of LTODocument3 pages1 - Sponsor CRO SATK Form - Initial Application of LTOCzarPaguioNo ratings yet

- Finex Nomination FormDocument5 pagesFinex Nomination FormCzarPaguioNo ratings yet

- Digest Format (General)Document1 pageDigest Format (General)CzarPaguioNo ratings yet

- Cta 1D CV 08366 R 2016aug30 AssDocument7 pagesCta 1D CV 08366 R 2016aug30 AssCzarPaguioNo ratings yet

- RA 10963 (TRAIN Law) PDFDocument54 pagesRA 10963 (TRAIN Law) PDFReinald Kurt Villaraza100% (3)

- Climate Change Act of 2009 establishes Climate Change CommissionDocument12 pagesClimate Change Act of 2009 establishes Climate Change CommissionDennis Dela TorreNo ratings yet

- Bir Ruling Da 081 03Document2 pagesBir Ruling Da 081 03CzarPaguio100% (1)

- Special Penal Laws and Probation ExplainedDocument7 pagesSpecial Penal Laws and Probation ExplainedCzarPaguioNo ratings yet

- Letters of Credit Reviewer ExplainedDocument8 pagesLetters of Credit Reviewer ExplainedCzarPaguioNo ratings yet

- List of Special Penal LawsDocument1 pageList of Special Penal LawsCzarPaguio100% (1)

- NRA AP L and Handicapped WorkersDocument2 pagesNRA AP L and Handicapped WorkersCzarPaguioNo ratings yet

- 3) Garces v. Court of Appeals - LIMDocument2 pages3) Garces v. Court of Appeals - LIMCzarPaguioNo ratings yet

- Sy-Quia Vs Sheriff - Paguio (d2017)Document1 pageSy-Quia Vs Sheriff - Paguio (d2017)CzarPaguioNo ratings yet

- Dario vs Mison 1988 rulingDocument1 pageDario vs Mison 1988 rulingCzarPaguioNo ratings yet

- 4.) Abs-Cbn v. Comelec - Alcid (d2017)Document1 page4.) Abs-Cbn v. Comelec - Alcid (d2017)CzarPaguioNo ratings yet

- Page 94Document1 pagePage 94CzarPaguioNo ratings yet

- MN LaborDocument1 pageMN LaborCzarPaguioNo ratings yet

- Eating Healthy For Fat Loss at 150 Pesos A DayDocument21 pagesEating Healthy For Fat Loss at 150 Pesos A DayAlexander Julio ValeraNo ratings yet

- ChevDocument1 pageChevCzarPaguioNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Escrow Agreement SummaryDocument12 pagesEscrow Agreement SummaryFloyd MagoNo ratings yet

- Class Action LawsuitDocument26 pagesClass Action LawsuitRichard KestenbaumNo ratings yet

- Section 2. Sec. 3 of Presidential Decree No. 1866, As Amended, Is HerebyDocument2 pagesSection 2. Sec. 3 of Presidential Decree No. 1866, As Amended, Is HerebyGela Bea Barrios100% (1)

- Gift DeedDocument22 pagesGift DeedVinod YbNo ratings yet

- Detailed Reading Guide S1 2017Document36 pagesDetailed Reading Guide S1 2017Chris YuanNo ratings yet

- Police Investigation CasesDocument41 pagesPolice Investigation CasesBrian Jonathan ParaanNo ratings yet

- Vicarious Liability Under Criminal Law in IndiaDocument12 pagesVicarious Liability Under Criminal Law in IndiaAnantHimanshuEkka100% (2)

- Adez Realty Corp Vs CADocument4 pagesAdez Realty Corp Vs CAShari ThompsonNo ratings yet

- Pension Papers ProformaDocument12 pagesPension Papers Proformasajidnazir56No ratings yet

- Case Brief 2Document2 pagesCase Brief 2api-330936965No ratings yet

- Management Corporation Sues Developer Over Unpaid Maintenance FeesDocument21 pagesManagement Corporation Sues Developer Over Unpaid Maintenance FeesChar Ree NgNo ratings yet

- DARAB Land Dispute CaseDocument3 pagesDARAB Land Dispute CaseFernando Tanglao Jr.100% (1)

- Introduction To Law: LAWS1011 Tutorial FourDocument3 pagesIntroduction To Law: LAWS1011 Tutorial FourajibadNo ratings yet

- Negotiate Technology Licensing AgreementsDocument5 pagesNegotiate Technology Licensing AgreementsClaudia Janeth Rivera FuentesNo ratings yet

- 1L Case Brief: Anderson v. Owens-Corning Fiberglas CorpDocument3 pages1L Case Brief: Anderson v. Owens-Corning Fiberglas CorpAmber Young100% (2)

- Adez Realty Inc vs. CADocument1 pageAdez Realty Inc vs. CAPaolo AdalemNo ratings yet

- Anshul Natani CVDocument3 pagesAnshul Natani CVANSHUL NATANINo ratings yet

- Reagan Vs CirDocument1 pageReagan Vs CirJennelie jandusay100% (2)

- Meralco Securities vs. SavellanoDocument3 pagesMeralco Securities vs. SavellanoMark Anthony Manuel100% (1)

- Ejectment SuitDocument3 pagesEjectment SuitChristian RoqueNo ratings yet

- Memorial On Behalf of PetitionerDocument22 pagesMemorial On Behalf of PetitionerKoshalNo ratings yet

- Philippines Supreme Court Ruling on Admissibility of Evidence in Estafa CaseDocument7 pagesPhilippines Supreme Court Ruling on Admissibility of Evidence in Estafa CaseHappynako WholesomeNo ratings yet

- Camp John Hay Development Corporation v. Charter Chemical and Coating Corporation G.R. No. 198849Document5 pagesCamp John Hay Development Corporation v. Charter Chemical and Coating Corporation G.R. No. 198849Jeanne DumaualNo ratings yet

- Full Faith & Credit EducationDocument4 pagesFull Faith & Credit Educationzicjrurt100% (3)

- EBanking Alert Mobile Application FormDocument2 pagesEBanking Alert Mobile Application FormKBA AMIR100% (1)

- Not PrecedentialDocument3 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Cindy Fernandez Criminal Justice SystemDocument13 pagesCindy Fernandez Criminal Justice SystemShan Michelle ChavezNo ratings yet

- Law 446 (Tutorial 1)Document6 pagesLaw 446 (Tutorial 1)thirah athirahNo ratings yet

- Runaway Negro Creek Georgia Senate ResolutionDocument3 pagesRunaway Negro Creek Georgia Senate Resolutionsavannahnow.comNo ratings yet

- Article VIII The Judicial DepartmentDocument26 pagesArticle VIII The Judicial Departmentdan malapira100% (2)