Professional Documents

Culture Documents

Rajesh Tambe

Uploaded by

modakmmOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rajesh Tambe

Uploaded by

modakmmCopyright:

Available Formats

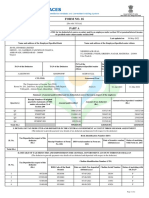

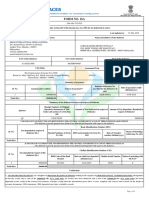

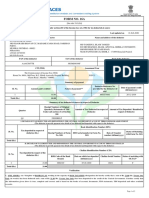

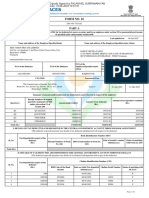

FORM NO.

16A TDS\194J\24

[See Rule 31(1)(b)]

Certificate of deduction of tax at source under section 203 of the Income-tax Act, 1961

For interest on securities; dividends; interest other than “interest on securities”; winnings from lottery or crossword puzzle; winnings

from horse race; payments to contractors and sub-contractors; insurance commission; payments to non-resident sportsmen/sports

associations; payments in respect of deposits under National Savings Scheme; payments on account of repurchase of units by

Mutual Fund or Unit Trust of India; commission, remuneration or prize on sale of lottery tickets; commission or brokerage; rent; fees

for professional or technical services; royalty and any sum under section 28(va); income in respect of units; payment of compensation

on acquisition of certain immovable property; other sums under section 195; income in respect of units of non-residents referred to in

section 196A; income from units referred to in section 196B; income from foreign currency bonds or shares of an Indian company

referred to in section 196C; income of Foreign Institutional Investors from securities referred to in section 196D

Name and address of the person Acknowledgement Nos. of all Quarterly Name and address of the person to whom

deducting tax Statements of TDS under sub-section payment made or in whose account it is

(3) of section 200 as provided by TIN credited

Facilitation Centre or NSDL web-site

Fable Farm Studios Private Rajesh Tambe

Quarter Acknowledgement No.

Limited

207-229, Near Versova Telephone 1 060270200404632 18/4th Floor, New Ashwin Soc, Tukaram

Ex, Andheri (west), Mumbai, NagarAyre Road, Dombivali(east),

400053, Maharashtra 2 060270200404621 Mumbai, Maharashtra

3 060270200404610

4 060270200404606

TAX DEDUCTION A/C NO. OF THE NATURE OF PAYMENT PAN NO. OF THE PAYEE

DEDUCTOR

MUMF 05577 F Fees for professional or technical AIKPT 1206 F

services

PAN NO. OF THE DEDUCTOR FOR THE PERIOD

AABCF 3242 M 01-04-2009 TO 31-03-2010

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX INTO

CENTRAL GOVERNMENT ACCOUNT

(The Deductor is to provide transaction –wise details of tax deducted and deposited)

Transfer

Date on

Date of Education Total tax Cheque/ BSR code voucher/

S Amount paid/ TDS Surcharge which tax

payment Cess deposited DD No.(if of Bank Challan

No credited Rs. Rs. deposited

/credit Rs. Rs. any) Branch Identification

(dd/mm/yy) No.

1 20,000 31-01-2010 2,000 0 0 2,000 E-Payt 0350218 06-03-2010 1200

2 20,000 28-02-2010 2,000 0 0 2,000 E-Payt 0350218 06-03-2010 4022

3 20,000 31-01-2010 2,000 0 0 2,000 E-Payt 0350218 06-03-2010 0120

60,000 6,000 0 0 6,000

Certified that a sum of Rs. (in words) Six Thousand only has been deducted at source and paid to the credit of the Central

Government as per details given above

Place : Mumbai

Date : 31-May-2010 Signature of the person responsible for deduction of tax

Full Name Biju Dhanapalan

Designation Director

You might also like

- Nursing Care PlansDocument10 pagesNursing Care PlansGracie S. Vergara100% (1)

- Right To HealthDocument9 pagesRight To HealthPriya SharmaNo ratings yet

- Canada's Health Care SystemDocument11 pagesCanada's Health Care SystemHuffy27100% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Block 1 Board Review - Lecture NotesDocument127 pagesBlock 1 Board Review - Lecture NotesCece RereNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Mod 6 Soft Tissue InjuriesDocument5 pagesMod 6 Soft Tissue Injuriesrez1987100% (1)

- of Types of Nuclear ReactorDocument33 pagesof Types of Nuclear Reactormandhir67% (3)

- FORM 16 CERTIFICATEDocument8 pagesFORM 16 CERTIFICATENidhish AgrawalNo ratings yet

- Magnetic FieldDocument19 pagesMagnetic FieldNitinSrivastava100% (2)

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- Proper restraint techniques for dogs and catsDocument153 pagesProper restraint techniques for dogs and catsjademattican75% (4)

- Investigating Population Growth SimulationDocument11 pagesInvestigating Population Growth Simulationapi-3823725640% (3)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Zygomatic Complex FracturesDocument128 pagesZygomatic Complex FracturesTarun KashyapNo ratings yet

- Piping Material Classes GuideDocument98 pagesPiping Material Classes GuideLuis Pottozen VillanuevaNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDocument6 pagesNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNo ratings yet

- Archana Deshmukh - 001Document2 pagesArchana Deshmukh - 001bhupdeshNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- Format of 26QDocument59 pagesFormat of 26Qpka_1969No ratings yet

- View Tax Payment Details: Reference Number: 29973328Document1 pageView Tax Payment Details: Reference Number: 29973328arjuntyagi22No ratings yet

- CBDTSMChallanForm02 09 2022Document1 pageCBDTSMChallanForm02 09 2022asok maitiNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challannaeem1990No ratings yet

- Happy To Help: Customer No: 163367288Document8 pagesHappy To Help: Customer No: 163367288fggfNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMUNNA SKNo ratings yet

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- Income Tax Payment Challan: PSID #: 57373338Document1 pageIncome Tax Payment Challan: PSID #: 57373338Kashif NiaziNo ratings yet

- Abdfa2602a Q2 2019-20 PDFDocument2 pagesAbdfa2602a Q2 2019-20 PDFTarun AgarwalNo ratings yet

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- Shriram Transport fixed deposit detailsDocument2 pagesShriram Transport fixed deposit detailsRaveendra Babu CherukuriNo ratings yet

- Medipath TDS 1st Oct 22Document1 pageMedipath TDS 1st Oct 22asok maitiNo ratings yet

- View Tax Payment Details: Reference Number: 29973456Document2 pagesView Tax Payment Details: Reference Number: 29973456arjuntyagi22No ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet

- BOHPxxxx5E Q3 2019-20Document2 pagesBOHPxxxx5E Q3 2019-20Tamziul IslamNo ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- Dinkar Thakur - ATBPT9919P - 2023-24Document11 pagesDinkar Thakur - ATBPT9919P - 2023-24Dinkar Prasad ThakurNo ratings yet

- It 000134800902 2023 03Document1 pageIt 000134800902 2023 03AbbasNo ratings yet

- Income Tax PaymentDocument1 pageIncome Tax PaymentKashif NiaziNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Income Tax Payment Challan: PSID #: 57373755Document1 pageIncome Tax Payment Challan: PSID #: 57373755Kashif NiaziNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- BNWPM3315C 2022-23Document7 pagesBNWPM3315C 2022-23Mohan KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 57363867Document1 pageIncome Tax Payment Challan: PSID #: 57363867Kashif NiaziNo ratings yet

- Report Name:: Internet Expense India HR PolicyDocument4 pagesReport Name:: Internet Expense India HR PolicySachin PatilNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Aaaca4267a Q1 2023-24-1Document2 pagesAaaca4267a Q1 2023-24-1amrj27609No ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 57372718Document1 pageIncome Tax Payment Challan: PSID #: 57372718Kashif NiaziNo ratings yet

- Tds16a Revised As Per Notification No. 92010 Dated 18022010Document1 pageTds16a Revised As Per Notification No. 92010 Dated 18022010Sameer GanekarNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form 16A TDS CertificateDocument3 pagesForm 16A TDS Certificatejishna mathewNo ratings yet

- Cybdeer at Q1Document2 pagesCybdeer at Q1KALASH SHARMANo ratings yet

- MUMTAZ KHAN 236 K 6000Document1 pageMUMTAZ KHAN 236 K 6000mazharehsan08No ratings yet

- Ht2406i000422645Document2 pagesHt2406i000422645Kumar TNo ratings yet

- Form 16A TDS CertificateDocument2 pagesForm 16A TDS CertificateJAYDIPVDNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomukti nath guptaNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- Aaaaj5854c Q1 Ay201819 16aDocument2 pagesAaaaj5854c Q1 Ay201819 16aAnonymous V0UxsCdZo9No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Hinduism Today April May June 2015Document43 pagesHinduism Today April May June 2015jpmahadevNo ratings yet

- PB PWR e R1 PDFDocument8 pagesPB PWR e R1 PDFnallinikanth sivalankaNo ratings yet

- Dr. Namrata Misra Head of Bioinnovations at KIIT UniversityDocument1 pageDr. Namrata Misra Head of Bioinnovations at KIIT Universitymanisha maniNo ratings yet

- Week 6 Blood and Tissue FlagellatesDocument7 pagesWeek 6 Blood and Tissue FlagellatesaemancarpioNo ratings yet

- Grade 3 science syllabus 1st and 2nd semesterDocument2 pagesGrade 3 science syllabus 1st and 2nd semesterelyzabeth SibaraniNo ratings yet

- CERADocument10 pagesCERAKeren Margarette AlcantaraNo ratings yet

- Quality ImprovementDocument3 pagesQuality ImprovementViky SinghNo ratings yet

- MLS 321 Aubf M6u2 Other Metabolic Diseases V2122Document7 pagesMLS 321 Aubf M6u2 Other Metabolic Diseases V2122proximusNo ratings yet

- 7 Surprising Cyberbullying StatisticsDocument4 pages7 Surprising Cyberbullying StatisticsJuby Ann Enconado100% (1)

- WSO 2022 IB Working Conditions SurveyDocument42 pagesWSO 2022 IB Working Conditions SurveyPhạm Hồng HuếNo ratings yet

- Cellular Basis of HeredityDocument12 pagesCellular Basis of HeredityLadyvirdi CarbonellNo ratings yet

- Case Report on Right Knee FuruncleDocument47 pagesCase Report on Right Knee Furuncle馮宥忻No ratings yet

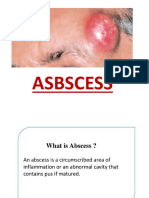

- ABSCESSDocument35 pagesABSCESSlax prajapatiNo ratings yet

- Notice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesDocument2 pagesNotice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesJustia.comNo ratings yet

- Quality Nutrition and Dietetics PracticeDocument3 pagesQuality Nutrition and Dietetics PracticeNurlienda HasanahNo ratings yet

- Solids Level Measurement Application Guide en 78224 PDFDocument144 pagesSolids Level Measurement Application Guide en 78224 PDFwalcalNo ratings yet

- Tutorial 7: Electromagnetic Induction MARCH 2015: Phy 150 (Electricity and Magnetism)Document3 pagesTutorial 7: Electromagnetic Induction MARCH 2015: Phy 150 (Electricity and Magnetism)NOR SYAZLIANA ROS AZAHARNo ratings yet

- Micdak BackgroundDocument3 pagesMicdak Backgroundappiah ernestNo ratings yet

- NLOG GS PUB 1580 VGEXP-INT3-GG-RPT-0001.00 P11-06 Geological FWRDocument296 pagesNLOG GS PUB 1580 VGEXP-INT3-GG-RPT-0001.00 P11-06 Geological FWRAhmed GharbiNo ratings yet