Professional Documents

Culture Documents

2013 Tax Bracket Calculator

Uploaded by

salauddin19790 ratings0% found this document useful (0 votes)

13 views1 pagetax calculator

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 page2013 Tax Bracket Calculator

Uploaded by

salauddin1979tax calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

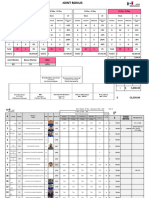

2012/2013 AUSTRALIAN TAXATION CALCULATOR

Data Table showing Sensitivity of Tax

How do changes to the tax tiers affect you? Savings to Income

Tax in Tax in

Income 12/13 11/12 Savings

$12,671 $13,050 Sensitivity of Annual Tax Savings to Income

2012/2013 INCOME TAX TIERS $10,000 $0 $600 $600

### $2,000

$0 $18,200 0.0% Enter your taxable income $65,000 $15,000 $0 $1,350 $1,350

###

$1,800

$18,201 $37,000 19.0% $20,000 $342 $2,100 $1,758

###

$1,600

$37,001 $80,000 32.5% 2012/13 annual tax $12,671 or $1,056 per month $25,000 $1,292 $2,850 $1,558

###

$80,001 $180,000 37.0% average tax rate 19% $30,000 $2,242 $3,600 $1,358

### $1,400

$180,001 + 45.0% $35,000 $3,192 $4,350 $1,158

### $1,200

$40,000 $4,546 $5,550 $1,003

### $1,000

2011/2012 INCOME TAX TIERS $45,000 $6,171 $7,050 $878

###

$800

$0 $6,000 0.0% 2011/2012 annual tax $13,050 or $1,087 per month $50,000 $7,796 $8,550 $753

###

$6,001 $37,000 15.0% average tax rate 20% $55,000 $9,421 $10,050 $628

### $600

$37,001 $80,000 30.0% $60,000 $11,046 $11,550 $503

### $400

$80,001 $180,000 37.0% If you are earning the same amount, your tax will decrease by $65,000 $12,671 $13,050 $378

### $200

$180,001 + 45.0% around $378 per annum, $32 per month, or $7 per week. $70,000 $14,296 $14,550 $253

###

$0

Excludes Medicare & Flood Levy and Low Income Tax Offset $75,000 $15,921 $16,050 $128

###

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

$80,000 $17,546 $17,550 $3

### 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00

0 , 15 , 20 , 25 , 30 , 35 , 40 , 45 , 50 , 55 , 6 0 , 6 5 , 7 0 , 7 5 , 8 0 , 8 5 ,

email us if you would like the password to this model $85,000 $19,396 $19,399 $3

### $1 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

The greatest tax savings will be felt by those earning around $20k per annum

www.plumsolutions.com.au Those earning over $80k will not experience much difference

Disclaimer: This model is written for the purpose of demonstrating the practical application of financial modelling.

Factors such as superannuation, tax deductions and other allowances have not been taken into consideration.

Please contact your accountant or financial adviser for an assessment of your individual situation.

You might also like

- NIKE Inc ReportDocument4 pagesNIKE Inc Reportdeepal patilNo ratings yet

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- Forex PlanningDocument4 pagesForex PlanningAli RidhaNo ratings yet

- ELP COPQ - PPMS & ImprovementsDocument16 pagesELP COPQ - PPMS & Improvementscharly4877No ratings yet

- $100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceDocument4 pages$100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceAli RidhaNo ratings yet

- MWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization BelowDocument6 pagesMWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization Belowhung nguyenNo ratings yet

- Education Technology QuarterlyDocument14 pagesEducation Technology QuarterlyAmit GalaNo ratings yet

- TSX Aw-Un 2019Document52 pagesTSX Aw-Un 2019gaja babaNo ratings yet

- Zynga Fin ReportDocument33 pagesZynga Fin Reportapi-19987738No ratings yet

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- Cash Flow 10.10.56Document10 pagesCash Flow 10.10.56Katherine PandoNo ratings yet

- Acc 5.2Document2 pagesAcc 5.2morinNo ratings yet

- Armas Industries FinancialDocument1 pageArmas Industries FinancialKevin KellyNo ratings yet

- Denge Kimya - First Quarter ReportDocument16 pagesDenge Kimya - First Quarter ReportAli SarwarNo ratings yet

- Profit and Loss Statement TemplateDocument6 pagesProfit and Loss Statement TemplateyashveerNo ratings yet

- Fintech RevolutionDocument49 pagesFintech RevolutionKevinNo ratings yet

- Resumen Cartera Enero 2018Document7 pagesResumen Cartera Enero 2018yorgen alvarezNo ratings yet

- 02 - Cash Flow TemplateDocument2 pages02 - Cash Flow Templateprhipolito22No ratings yet

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDocument7 pagesWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniNo ratings yet

- Retireplan 5Document4 pagesRetireplan 5api-3763762No ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Tugas Accounting IntermediateDocument1 pageTugas Accounting IntermediateYohanes PitherNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Nasdaq Aaon 2007Document39 pagesNasdaq Aaon 2007gaja babaNo ratings yet

- September 2013 budget, income, and expense trackingDocument12 pagesSeptember 2013 budget, income, and expense trackingMani Falou ÉnigmeNo ratings yet

- Insert Personal Data in Cells N2 Through N18 Only! Do Not Change Any Other Cells!Document8 pagesInsert Personal Data in Cells N2 Through N18 Only! Do Not Change Any Other Cells!api-3833040No ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument7 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsmorrisioNo ratings yet

- Salarii Pe Numar de AngajatDocument4 pagesSalarii Pe Numar de AngajatBani OnlineNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- JB WK 21Document6 pagesJB WK 21Anto LopezNo ratings yet

- Starbucks Fiscal 2015 - Financial HighlightsDocument2 pagesStarbucks Fiscal 2015 - Financial HighlightsSagar NareshNo ratings yet

- PR Marketing Budget TemplateDocument11 pagesPR Marketing Budget TemplatewewakeNo ratings yet

- Setup Costs (Incl GST)Document2 pagesSetup Costs (Incl GST)IswichNo ratings yet

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Document1 pageDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNo ratings yet

- Cost Overruns: Task Cost Variance Resource Cost VarianceDocument1 pageCost Overruns: Task Cost Variance Resource Cost VarianceAlexandru BaciuNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Accounting Principles Assignment on Depreciation and Allowance for Doubtful AccountsDocument7 pagesAccounting Principles Assignment on Depreciation and Allowance for Doubtful AccountsMohsin HassanNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- GSMN Priormonth 1Document1 pageGSMN Priormonth 1api-255333441No ratings yet

- Scenario 2 - OW ComparisonDocument1 pageScenario 2 - OW ComparisonJosephNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- CamilleDocument3 pagesCamilleCAMILLE VILLAFLORESNo ratings yet

- Nasdaq Aaon 2008Document37 pagesNasdaq Aaon 2008gaja babaNo ratings yet

- Trading Journal: Date Symbol View B/s Buy Price Initial Stop Quantity Buy CommisionDocument3 pagesTrading Journal: Date Symbol View B/s Buy Price Initial Stop Quantity Buy CommisionAvinash GaikwadNo ratings yet

- Google PresentationDocument22 pagesGoogle Presentationcia100% (10)

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Ing. Economica Pregunta 2Document2 pagesIng. Economica Pregunta 2Sheiler Alvarado SanchezNo ratings yet

- Tugas 1 - Pengantar Akuntansi - Athaya Sekar - 120110190049Document9 pagesTugas 1 - Pengantar Akuntansi - Athaya Sekar - 120110190049AthayaSekarNovianaNo ratings yet

- Fahmi Gilang Madani - 120110170024 - Tugas AKLDocument6 pagesFahmi Gilang Madani - 120110170024 - Tugas AKLFahmi GilangNo ratings yet

- Valuation of L.A. Café Restaurant Using 3 ScenariosDocument4 pagesValuation of L.A. Café Restaurant Using 3 ScenariosCelso Lopez100% (3)

- Laurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Document6 pagesLaurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Laurensius Adrian Wahyu SetiajiNo ratings yet

- Pengurusan Kewangan KeluargaDocument6 pagesPengurusan Kewangan KeluargaNurul NadiahNo ratings yet

- P&L YTDDocument3 pagesP&L YTDMd Mahmudul HassanNo ratings yet

- Dynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsDocument17 pagesDynamic Charting Index: Income Charts Balance Sheet Charts Forecast Charts Ratio ChartsEt. MensahNo ratings yet

- Dynamic ChartingDocument17 pagesDynamic ChartingHemanthaJayamaneNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Accounting For Intercompany Transactions - FinalDocument15 pagesAccounting For Intercompany Transactions - FinalEunice WongNo ratings yet

- Ratio Analysis & Financial Benchmarking for NonprofitsDocument38 pagesRatio Analysis & Financial Benchmarking for NonprofitsRehan NasirNo ratings yet

- Malaysian Trustee Incorporation Act SummaryDocument19 pagesMalaysian Trustee Incorporation Act SummarySchen NgNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Discover StatementDocument6 pagesDiscover StatementhzNo ratings yet

- I FHMHFMDocument1 pageI FHMHFMRaghuraman NarasimmaluNo ratings yet

- SEC Accredited Asset Valuer As of February 29 2016Document1 pageSEC Accredited Asset Valuer As of February 29 2016Gean Pearl IcaoNo ratings yet

- Analysis of Business Portfolio of A Beverage Company Using BCG and EC MatrixDocument4 pagesAnalysis of Business Portfolio of A Beverage Company Using BCG and EC MatrixarararaNo ratings yet

- SAS Test Series-09Document9 pagesSAS Test Series-09nagarjuna_upscNo ratings yet

- Oriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformDocument28 pagesOriental Petroleum & Minerals Corporation: Coral Reef Growth Beneath Nido-AP PlatformTABAH RIZKINo ratings yet

- Notes and Solutions of The Math of Financial Derivatives Wilmott PDFDocument224 pagesNotes and Solutions of The Math of Financial Derivatives Wilmott PDFKiers100% (1)

- MCWQS For All XamsDocument97 pagesMCWQS For All Xamsvini_anj3980No ratings yet

- Fashion ShoeDocument5 pagesFashion ShoeManal ElkhoshkhanyNo ratings yet

- Management Accounting Overhead VariancesDocument12 pagesManagement Accounting Overhead VariancesNors PataytayNo ratings yet

- Amended Guidelines Abot-Kamay Pabahay Program'Document30 pagesAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNo ratings yet

- Compounding InterestDocument11 pagesCompounding Interestagus joharudinNo ratings yet

- Final HBL PresentationDocument75 pagesFinal HBL PresentationShehzaib Sunny100% (4)

- Case Study ALSA Contract Negotiation Workshop - Local PartnerDocument2 pagesCase Study ALSA Contract Negotiation Workshop - Local PartnerAMSNo ratings yet

- Amended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument11 pagesAmended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramVaishaNo ratings yet

- Jaffar and Musa (2013) PDFDocument10 pagesJaffar and Musa (2013) PDFMohamed FAKHFEKHNo ratings yet

- Https WWW - Irctc.co - in Eticketing PrintTicketDocument1 pageHttps WWW - Irctc.co - in Eticketing PrintTicketKalyan UppadaNo ratings yet

- Positional TradingDocument69 pagesPositional TradingManoj Kumar0% (2)

- CKSBDocument23 pagesCKSBayushiNo ratings yet

- 8 - 8 - 31 - 2023 12 - 00 - 00 Am - 2023Document2 pages8 - 8 - 31 - 2023 12 - 00 - 00 Am - 2023Larry GatlinNo ratings yet

- Financial PlanningDocument119 pagesFinancial PlanningUmang Jain100% (1)

- Partnership AgreementDocument4 pagesPartnership AgreementJohn Mark Paracad100% (2)

- General Power of AttorneyDocument1 pageGeneral Power of AttorneyAriel Hartung100% (1)

- Error Correction (Part 2) - Suspense Accounts (Including RQS)Document6 pagesError Correction (Part 2) - Suspense Accounts (Including RQS)King JulianNo ratings yet

- International Monetary SystemDocument16 pagesInternational Monetary Systemriyaskalpetta100% (2)