Professional Documents

Culture Documents

A. Analysis of Preparation of Balance Sheet and Ratio Analysis 1. Supporting Data A. Pro Forma Profit and Loss Company

Uploaded by

hamzahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A. Analysis of Preparation of Balance Sheet and Ratio Analysis 1. Supporting Data A. Pro Forma Profit and Loss Company

Uploaded by

hamzahCopyright:

Available Formats

A.

Analysis of Preparation of balance sheet and Ratio Analysis

1. Supporting Data

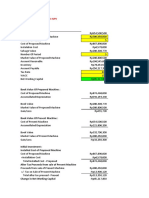

a. pro forma profit and loss company

INCOME

Year 2018 2019 2020

Sales revenue Rp 2,799,753,000 Rp 2,982,339,675 Rp 3,387,919,106

Total income Rp 2,799,753,000 Rp 2,982,339,675 Rp 3,387,919,106

ESTIMATE COST OF GOODS SOLD

Initial inventory of finished products Rp - Rp 14,357,662 Rp 14,911,625

Estimate Cost Of Goods Manufactured

Direct Cost

Direct Material Cost Rp 1,267,705,812 Rp 1,290,547,200 Rp 1,491,752,820

Direct Labor Cost Rp 147,807,660 Rp 180,916,576 Rp 184,534,907

Total Direct Cost Rp 1,415,513,472 Rp 1,471,463,776 Rp 1,676,287,727

Overhead Cost

Power Supply Cost Rp 4,502,160 Rp 4,502,160 Rp 4,502,160

Cost Depreciation Factory

Cost Depreciation Tools Rp 156,600 Rp 156,600 Rp 156,600

Cost Depreciation Machine Rp 6,911,600 Rp 6,911,600 Rp 6,911,600

Cost Depreciation Vehicle Rp 23,040,000 Rp 23,040,000 Rp 23,040,000

Total Biaya Overhead Cost Rp 34,610,360 Rp 34,610,360 Rp 34,610,360

Total Cost of Goods Manufactured (Harga Pokok Produksi) Rp 1,450,123,832 Rp 1,506,074,136 Rp 1,710,898,087

Production Main Cost Rp 1,450,123,832 Rp 1,520,431,798 Rp 1,725,809,712

Las Stock Product Rp 14,357,662 Rp 14,911,625 Rp 16,939,585

Total Cost Of Goods Sold (Harga Pokok Penjualan) Rp 1,435,766,170 Rp 1,505,520,172 Rp 1,708,870,127

OPERATING INCOME BEFORE Rp 1,363,986,830 Rp 1,476,819,503 Rp 1,679,048,979

Other Operating Cost

Marketing Cost Rp 38,350,000 Rp 38,350,000 Rp 38,350,000

Salary costs Executive Board Rp 344,535,566 Rp 351,426,238 Rp 389,210,541

Recruitment Cost Rp 36,187,000 Rp - Rp 26,387,000

Employee wealthy Cost Rp 26,094,191 Rp 28,214,169 Rp 30,408,509

Insentif, Rabat dan Bonus Rp - Rp 44,188,453 Rp 48,147,799

Cost Depreciation Office Tools Rp 3,124,000 Rp 3,124,000 Rp 3,124,000

Total Other Operating Cost Rp 448,290,757 Rp 465,302,860 Rp 535,627,849

EBIT(Earning Before Interest and Tax) Rp 915,696,073 Rp 1,011,516,643 Rp 1,143,421,129

Interest expense Rp 12,894,173 Rp 8,262,136 Rp 3,056,062

EBT (Earning Before Tax) Rp 902,801,900 Rp 1,003,254,507 Rp 1,140,365,068

Tax (25%) 225,700,475.07 250,813,626.72 285,091,266.92

EAIT(Earning After Interest and Tax) Rp 677,101,425 Rp 752,440,880 Rp 855,273,801

b. Proforma of Company Cashflow

CASH FLOW

Tahun 2017 2018 2019 2020

Estimasi Cash Inflow

Personal Investment Rp 506,403,678

Bank Loan Rp 126,600,919

sale Rp 2,799,753,000 Rp 2,982,339,675 Rp 3,387,919,106

Total Estimasi Cash Inflow Rp 633,004,597 Rp 2,799,753,000 Rp 2,982,339,675 Rp 3,387,919,106

Estimasi Cash Outflow

Machine Cost Rp 20,734,800 Rp - Rp - Rp -

Tool Cost Rp 350,200 Rp - Rp - Rp -

Vehicle Cost Rp 115,200,000 Rp - Rp - Rp -

Factory Cost Rp 18,000,000 Rp - Rp - Rp -

office Tool Cost Rp 9,124,000 Rp - Rp - Rp -

SIUP cost Rp 2,700,000 Rp - Rp - Rp -

Brand Rp 600,000 Rp - Rp - Rp -

Working Capital Rp 466,295,597

Direct Cost Rp 1,415,513,472 Rp 1,471,463,776 Rp 1,676,287,727

Power Suply Cost Rp 4,502,160 Rp 4,502,160 Rp 4,502,160

Marketing Cost Rp 38,350,000 Rp 38,350,000 Rp 38,350,000

Salary costs Executive Board Rp 344,535,566 Rp 351,426,238 Rp 389,210,541

Recruitment Cost Rp 36,187,000 Rp - Rp 26,387,000

Employee wealthy Cost Rp 26,094,191 Rp 28,214,169 Rp 30,408,509

Insentif, Rabat dan Bonus Rp - Rp 44,188,453 Rp 48,147,799

total interest Rp 12,894,173 Rp 8,262,136 Rp 3,056,062

installment / month Rp 37,376,924 Rp 42,008,961 Rp 47,215,035

Tax Payment Rp - Rp 225,700,475 Rp 250,813,627 Rp 285,091,267

Total Cash Outflow Rp 633,004,597 Rp 2,141,153,960 Rp 2,239,229,519 Rp 2,548,656,100

Net Cash Flow Rp (506,403,678) Rp 658,599,040 Rp 743,110,156 Rp 839,263,006

End Cash Balance Rp (506,403,678) Rp 2,293,349,322 Rp 3,640,938,715 Rp 4,131,029,262

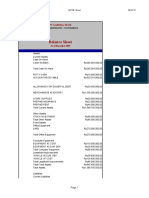

2. Performa Balance Sheet of Company

2018 2019 2020

AKTIVA

Currents Asset

Akumulasi Kas Rp 658,599,040 Rp 1,401,709,196 Rp 2,240,972,202

Persediaan Akhir Produk Jadi Rp 14,357,662 Rp 14,911,625 Rp 16,939,585

Total Currents Asset Rp 672,956,701 Rp 1,416,620,821 Rp 2,257,911,787

Fixed & Intangible Assets

SIUP Rp 2,700,000 Rp 2,700,000 Rp 2,700,000

Merk Dagang Rp 600,000 Rp 600,000 Rp 600,000

Working Capital Rp 466,295,597 Rp 466,295,597 Rp 466,295,597

Fixed Asset Rp 163,409,000 Rp 163,409,000 Rp 163,409,000

Akumulasi Depresiasi Rp (33,232,200) Rp (66,464,400) Rp (99,696,600)

Total Fixed & Intangible Assets Rp 599,772,397 Rp 566,540,197 Rp 533,307,997

Total Assets Rp 1,272,729,098 Rp 1,983,161,018 Rp 2,791,219,784

PASSIVA

Liabilities

Kredit Bank Rp 89,223,996 Rp 47,215,035 Rp (0)

Total Liabilities Rp 89,223,996 Rp 47,215,035 Rp (0)

Capital

Modal Awal Rp 506,403,678 Rp 506,403,678 Rp 506,403,678

Laba ditahan (EAIT) Rp 677,101,425 Rp 752,440,880 Rp 855,273,801

Akumulasi laba ditahan Rp 677,101,425 Rp 1,429,542,305 Rp 2,284,816,106

Total Capital Rp 1,183,505,103 Rp 1,935,945,983 Rp 2,791,219,784

Total Capital & Liabilities Rp 1,272,729,098 Rp 1,983,161,018 Rp 2,791,219,784

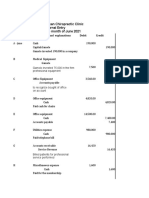

3. Proforma of Company Financial Ratios

c. Return of Asset

Tahun 2018 2019 2020

EAI T Rp 677,101,425.20 Rp 752,440,880.15 Rp 855,273,800.76

Total Aktiv a Rp 599,772,397.19 Rp 566,540,197.19 Rp 533,307,997.19

ROA 1.13 1.33 1.60

d. Return on Equity

Tahun 2018 2019 2020

EAI T Rp 677,101,425.20 Rp 752,440,880.15 Rp 855,273,800.76

Total Ekuitas Rp 506,403,677.75 Rp 506,403,677.75 Rp 506,403,677.75

ROE 0.75 0.67 0.59

e. Return of Investment

Tahun 2018 2019 2020

EAI T Rp 677,101,425.20 Rp 752,440,880.15 Rp 855,273,800.76

Total Aset Rp 672,956,701.30 Rp 1,416,620,820.87 Rp 2,257,911,786.67

ROI 1.01 0.53 0.38

4. Proposed business strategy is based on analysis of pro forma financial ratios

Based on company financial ratios, in return on assets shows from year 2018 until

year 2020 the good performance of the company. But in return on equity and return of

investment show the company performance decreasing and needed the change in the

strategy so that the profit can be increase.

You might also like

- Compiled Exercises FAR 1Document59 pagesCompiled Exercises FAR 1KianJohnCentenoTurico100% (7)

- Depletion: Problem 34-1 (IFRS)Document20 pagesDepletion: Problem 34-1 (IFRS)수지100% (8)

- Managerial Accounting Excel Project 2Document8 pagesManagerial Accounting Excel Project 2John GuerreroNo ratings yet

- 1 - Nvidia Pitch ReportDocument4 pages1 - Nvidia Pitch Reportapi-475759227No ratings yet

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- Finance Interview QuestionsDocument12 pagesFinance Interview QuestionsMD RehanNo ratings yet

- 7.3 Projected Profit Loss: IncomeDocument10 pages7.3 Projected Profit Loss: IncomeYusuf RaharjaNo ratings yet

- PDF YuuheeeeeeeeeeeDocument2 pagesPDF YuuheeeeeeeeeeeEka Alfiatun NabilaNo ratings yet

- PDF YahhhDocument2 pagesPDF YahhhEka Alfiatun NabilaNo ratings yet

- Cashflow EnecoDocument14 pagesCashflow EnecoRusli HasanNo ratings yet

- Pajak P2 JayatamaDocument2 pagesPajak P2 JayatamaShula KinantiNo ratings yet

- Excel BLP BeautyDocument19 pagesExcel BLP BeautyDHEASITANo ratings yet

- Final Test M. Fauzian Alk 17661098Document11 pagesFinal Test M. Fauzian Alk 17661098Muhammad FauzianNo ratings yet

- EKOTEKDocument6 pagesEKOTEKDHILA AYUNINGTYASNo ratings yet

- Asg 4 Chap 2Document8 pagesAsg 4 Chap 2Ajeng FadillahNo ratings yet

- Key Assumptions: Project NPVDocument3 pagesKey Assumptions: Project NPVGarry HutomoNo ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)WINDA WIDIYANTINo ratings yet

- Ekotek MariiniDocument5 pagesEkotek MariiniDHILA AYUNINGTYASNo ratings yet

- Cost Structure Year 2018 2019: (Rp6,540,099,000) (Rp2,701,857,150) (Rp6,540,099,000) (Rp9,241,956,150)Document3 pagesCost Structure Year 2018 2019: (Rp6,540,099,000) (Rp2,701,857,150) (Rp6,540,099,000) (Rp9,241,956,150)Martin Octavianus AstardiNo ratings yet

- Performance Management Pada Umkm Tahu: Analsis Decision Making, Master Budget DanDocument5 pagesPerformance Management Pada Umkm Tahu: Analsis Decision Making, Master Budget Danadzani maulidaNo ratings yet

- Akuntansi Ilmu Yang MenyenankkanDocument8 pagesAkuntansi Ilmu Yang MenyenankkanFitri YaniNo ratings yet

- CV. AIDEA - Capital BudgetingDocument14 pagesCV. AIDEA - Capital BudgetingSilvia HandikaNo ratings yet

- CashflowDocument2 pagesCashflowWirdan RowiyadiNo ratings yet

- Pt. Alibaba, Tbk. Statement of Financial Position For The Year Ended Dec 31, 2020Document22 pagesPt. Alibaba, Tbk. Statement of Financial Position For The Year Ended Dec 31, 2020ShineNo ratings yet

- 12 - Shella Endang - Akl 4 - Laba Rugi PDFDocument1 page12 - Shella Endang - Akl 4 - Laba Rugi PDFShella EndangNo ratings yet

- Multi-Period SpreadsheetDocument1 pageMulti-Period SpreadsheetriyadiNo ratings yet

- Ulangan Laporan KeuanganDocument12 pagesUlangan Laporan KeuanganMaulidian AprilianiNo ratings yet

- Tugas Besar AkuntansiDocument4 pagesTugas Besar AkuntansiVania KrissiNo ratings yet

- Cash Flow Mining Operation SamarindaDocument3 pagesCash Flow Mining Operation SamarindaRatmokoAdiNugrohoNo ratings yet

- PT Kharisma Digital Laporan Keuangan - Ruhama-1Document34 pagesPT Kharisma Digital Laporan Keuangan - Ruhama-1Marsya Nur AmaliaNo ratings yet

- Nazva Sandhiya M DDocument17 pagesNazva Sandhiya M DNazva MaharaNo ratings yet

- Financial ConexionDocument2 pagesFinancial ConexionarifNo ratings yet

- Analisis Data InventoryDocument30 pagesAnalisis Data InventoryMuhammad Hilman ZayyanNo ratings yet

- UAS MBS - Maria .H (20196220018)Document9 pagesUAS MBS - Maria .H (20196220018)Maria YohanaNo ratings yet

- Bab Iii: 3.1 Kebutuhan Investasi 3.1.1 Modal Tetap (MT)Document4 pagesBab Iii: 3.1 Kebutuhan Investasi 3.1.1 Modal Tetap (MT)Carry NihonNo ratings yet

- Contoh Laba RugiDocument1 pageContoh Laba RugiindriNo ratings yet

- Tugas UTS 2Document2 pagesTugas UTS 2Yue engNo ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)veriaryantoNo ratings yet

- Pengajuan Event KempekDocument1 pagePengajuan Event KempekAna Sholeh HataNo ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)finta febriyantiNo ratings yet

- 20 - Muhammad Greyfan SetyadiDocument15 pages20 - Muhammad Greyfan SetyadigreyfanNo ratings yet

- Nida F.A Ka 202 - PRAKTEK AUDIT2Document58 pagesNida F.A Ka 202 - PRAKTEK AUDIT2Lidwina EdithyaningtyasNo ratings yet

- Cashflow Pak ChongDocument20 pagesCashflow Pak ChongNur CahyonoNo ratings yet

- Contoh Cash FlowDocument9 pagesContoh Cash FlowIrma Felicia WidjajaNo ratings yet

- PT. Fadhlan Furniture Carving ArtDocument2 pagesPT. Fadhlan Furniture Carving ArtAldy SaputraNo ratings yet

- Trial Balance Cipta DewiDocument1 pageTrial Balance Cipta DewiNgurah EkaNo ratings yet

- Estimation MJDocument1 pageEstimation MJprasetyo bbiNo ratings yet

- RM Mubarak Financial Statement Dikonversi Diedit PDFDocument1 pageRM Mubarak Financial Statement Dikonversi Diedit PDFAgil RosdianaNo ratings yet

- RM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFDocument1 pageRM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFBulan julpi suwellyNo ratings yet

- RM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFDocument1 pageRM MUBARAK FINANCIAL STATEMENT-dikonversi-diedit PDFBulan julpi suwelly100% (1)

- CapmDocument17 pagesCapmDian Nur IlmiNo ratings yet

- Exercise P4 2ADocument4 pagesExercise P4 2AKeyra Audrey Annabelle ChristianNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceSri SusantiNo ratings yet

- BreakEvenPointAnalysis and Selling PriceDocument8 pagesBreakEvenPointAnalysis and Selling PriceAnonymous zOo2mbaVANo ratings yet

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- PT - Zalia Nofi Nurlaila (23) Neraca LajurDocument6 pagesPT - Zalia Nofi Nurlaila (23) Neraca LajurNofi Nurlaila100% (1)

- Analisis Finansial Kelompok 2Document11 pagesAnalisis Finansial Kelompok 2Nazli Wulantri BinabaNo ratings yet

- Profit & Loss (Accrual) SuciDocument1 pageProfit & Loss (Accrual) Suciniarini12No ratings yet

- Balance Sheet: PT Garuda TechDocument2 pagesBalance Sheet: PT Garuda TechSMKJTRGNo ratings yet

- Financial Projection v7Document99 pagesFinancial Projection v7Bramantyo AdiNo ratings yet

- Multi Period - Profit Loss (November SD Thirteen)Document1 pageMulti Period - Profit Loss (November SD Thirteen)Dodi IndrawanNo ratings yet

- Muhammad Fatihakan 024032001140 QUIZ PERTEMUAN 14Document14 pagesMuhammad Fatihakan 024032001140 QUIZ PERTEMUAN 14Ivan Suriansyah Matusin IvanNo ratings yet

- Management of Business Operations 4.1. Equipment: SpoonDocument5 pagesManagement of Business Operations 4.1. Equipment: Spoongede wasisthaNo ratings yet

- Standard Balance SheetDocument1 pageStandard Balance SheetSekar ArumNo ratings yet

- Nama Barang Quantity Merk Harga Satuan TotalDocument4 pagesNama Barang Quantity Merk Harga Satuan TotalBudi MulyonoNo ratings yet

- Inventory Cost FlowDocument2 pagesInventory Cost FlowFe ValenciaNo ratings yet

- Capital Budgeting - Project Cash Flow - NPV: AssumptionsDocument6 pagesCapital Budgeting - Project Cash Flow - NPV: AssumptionsBijay DharNo ratings yet

- Manual-Contabilidad Basica Ejercicios 2018Document118 pagesManual-Contabilidad Basica Ejercicios 2018juanNo ratings yet

- Boac Edralyn QuizDocument7 pagesBoac Edralyn QuizEdralyn BoacNo ratings yet

- Valdez Blessed Nizelle - Midterm Assignemnt - Aud ProbDocument9 pagesValdez Blessed Nizelle - Midterm Assignemnt - Aud ProbEsse ValdezNo ratings yet

- CH 10 PPT Examples Relaxing Credit Standards QnssolnsDocument8 pagesCH 10 PPT Examples Relaxing Credit Standards QnssolnsRiri FahraniNo ratings yet

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 7 Questions and AnswersDocument24 pagesACCA Strategic Business Reporting (SBR) Achievement Ladder Step 7 Questions and AnswersAdam M100% (1)

- Fundamental Analysis of Stocks Quick GuideDocument13 pagesFundamental Analysis of Stocks Quick GuidejeevandranNo ratings yet

- Problem p2 41 Continues With The Consulting Business Begun in Problem PDFDocument1 pageProblem p2 41 Continues With The Consulting Business Begun in Problem PDFTaimour HassanNo ratings yet

- Types of Costs: Tejvan PettingerDocument2 pagesTypes of Costs: Tejvan PettingerMani KrishNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Breadtalk Group LTD: Singapore Company GuideDocument14 pagesBreadtalk Group LTD: Singapore Company GuideCleoNo ratings yet

- QRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)Document16 pagesQRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)waman.gokhaleNo ratings yet

- Actng 1 2Document16 pagesActng 1 2Aries Christian S PadillaNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Final Examination in Accounting For Business CombinationDocument9 pagesFinal Examination in Accounting For Business CombinationJasmin Dela CruzNo ratings yet

- 16656561931665656193FinancialModellingProfessional 1 (1) CompressedDocument17 pages16656561931665656193FinancialModellingProfessional 1 (1) CompressedDharmik UndaviyaNo ratings yet

- 2Q 2020 GLVA Galva+Technologies+TbkDocument66 pages2Q 2020 GLVA Galva+Technologies+TbkAank KurniaNo ratings yet

- Test Bank of Advanced Accounting by Guerrero Peralta Chapter 10Document16 pagesTest Bank of Advanced Accounting by Guerrero Peralta Chapter 10Aldrin ZolinaNo ratings yet

- Aishwaraya Srivastava 23MS1002Document19 pagesAishwaraya Srivastava 23MS1002Aishwarya SrivastavaNo ratings yet

- QUIZ 6 Joint ArrangementDocument2 pagesQUIZ 6 Joint ArrangementEki SunriseNo ratings yet

- 01 CHED COURSE OUTLINE Acctg 15ADocument3 pages01 CHED COURSE OUTLINE Acctg 15APat TabujaraNo ratings yet

- Government of Sierra Leone: OriginalDocument23 pagesGovernment of Sierra Leone: OriginalRaviNo ratings yet

- Working Capital ReviewerDocument4 pagesWorking Capital Reviewerjennyxrous26No ratings yet