Professional Documents

Culture Documents

AngeBrokingResearch Ujjivan IPONote 270416

Uploaded by

durgasainathOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AngeBrokingResearch Ujjivan IPONote 270416

Uploaded by

durgasainathCopyright:

Available Formats

IPO Note | Financial Services

April 27, 2016

Ujjivan Financial Services SUBSCRIBE

Issue Open: April 28, 2016

IPO Note Issue Close: May 02, 2016

Ujjivan Financial Services (Ujjivan) is the third largest micro finance company on

AUM basis and one of the largest in terms of geographical reach with 470 Iss u e D eta ils

branches across 24 states in India. It is one of the 10 NBFCs which were granted Face Value: `10

an in-principle approval for setting up a small finance bank.

Present Eq. Paid up Capital: `86.1crs

Transition to small finance bank to be smooth; will enable scalability: The

proposed small finance bank (SFB) will have access to low cost funds, ie below the Fresh Issue**: `358crs (1.7cr Shares)

current 11.8% rate via deposits. However, there will be initial expenses while Offer for sale: `525crs (2.5cr Shares)

transitioning to be a SFB as new processes will have to be implemented along

with maintenance of CRR and SLR. Meeting the 75% Priority Sector Lending (PSL) Post Eq. Paid up Capital: `103crs

target will however not be a challenge for Ujjivan as its entire portfolio qualifies for

Market Lot: 70 Shares

PSL; hence, the migration from being an NBFC to a SFB should be smooth. With

leverage of only 5.6x, we believe there is enough scalability without further dilutions. Fresh Issue (amount): `358crs

Huge scope in the micro finance business as reflected in its strong AUM CAGR: Price Band: `207-210

Ujjivan reported a CAGR of 59% in its AUM over FY2013-9MFY2016 to

Post-issue implied mkt. cap ` 2,136*-

`4,589cr. There is a huge untapped opportunity in this segment as micro finance

2,167cr**

is targeted to the lower income segment which often lacks access to formal

No te:*at Lo wer price band and **Upper price band

financing sources. With a loan portfolio of ~`43,300cr the micro finance industry

is expected to report 30% CAGR over the next 3-4 years and Ujjivan with its pan-

India presence will be able to encash on the opportunity.

B o ok B u ild in g

Geographically diversified AUM with historically low NPAs: Ujjivan is present

across 24 states and has successfully diversified its AUM with no single state QIBs 50%

contributing more than 20% to its AUM, thereby mitigating concentration risk. Non-Institutional 15%

Karnataka, West Bengal, Maharashtra and Tamil Nadu together account for 56%

of its AUM; this makes a key differentiating point for Ujjivan as other micro Retail 35%

finance institutions are largely focused on the southern states of India. Though the

company largely extends loans in a joint lending system, it also offers individual

loans which accounted for ~10% of the AUM. We expect the companys overall Po st Sh a reh o ld in g Pa ttern (% )

individual loans portfolio to see strong growth going ahead.

Promoters 0.0%

Improving Cost/Income ratio: The company has been able to reduce its costs over

the past few years, thereby leading its Cost/Income ratio to come down to ~52% Foreign Holding 77.1%

in 9MFY2016 from 60% in FY2015. However, as the company migrates to

Others 22.9%

becoming a SFB, the cost structure might spike up again. Nevertheless, we believe

new avenues of lending should help in maintaining the ratio in the long run.

Outlook Valuation: At the upper end of the offer price band (`210), the issue is

priced at 1.8x its diluted BV of `118 (2.1x pre-dilution). The company has decent

ROE and ROA of 19.9% and 3.6%, respectively. Although the return ratios might

get a bit compressed post the companys conversion to a SFB, but we expect the

same to scale up subsequently. We believe the issue is attractively priced looking

at the growth options the company offers in the long run. We recommend a

SUBSCRIBE on the issue.

Key Financials

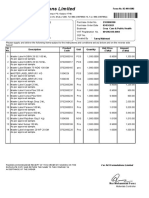

Y/E March (` cr) FY2012 FY2013 FY2014 FY2015 9MFY2016

NII 87.3 140.4 208.0 327.9 407.6

% chg (15.9) 60.8 48.1 57.6 24.3 Siddharth Purohit

Net profit 0.1 32.9 58.4 75.8 122.3 +91 22 39357800 Ext: 6872

% chg 77.7 29.7 61.4 siddharth.purohit@angelbroking.com

NIM (%) 11.26 13.76 13.57 11.62 12.31

Book Value (`) 42.0 48.5 56.8 85.5 99.7

P/ABV (x) 5.0 4.3 3.7 2.5 2.1 Chintan Shah

RoA (%) 0 2.9 3.4 2.5 3.6 +91 22 4000 3600 Ext: 6828

RoE (%) 0.1 11.8 16.9 13.7 19.9 chintan.shah@angelbroking.com

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares

and at upper end of the price band

Please refer to important disclosures at the end of this report 1

Ujjivan Financial Services | IPO Note

Company background

Ujjivan is one of the fastest growing micro finance companies in India.

Incorporated in 2005 and headquartered in Bengaluru, Ujjivan operates across 24

states through 470 branches. Ujjivan has emerged as the third largest micro

finance company in the country over the last few years and we believe its ability to

spread across the country will drive its next leg of growth. The company has also

received in-principle approval from the RBI to set up a small finance bank and

expects to start operations from April 1, 2017 as a new SFB.

Exhibit 1: Regulatory aspects pertaining to Small Finance Bank (SFB)

Key Regulations Companys Plan of Action

With micro finance instituions average ticket size of `9,364 and that of

50% of a SFBs loan portfolio should constitute of loans not exceeding

vehicle finance and MSEs at `3.8lakhs and `2.1 lakhs respectively, the

`25 lakhs.

proposed SFB will meet the guidelines.

As per FDI rules, foreign stake holders share holding in a SFB is capped The proposed IPO will reduce the foreign investors holding from 93% to

at a maximum of 49%. 35%.

SFBs need to operate 25% of their branches in unbanked rural areas. Existing branches of the company can be converted to SFB branches.

CRR & SLR to be maintained as per RBI norms.

SFBs need to have 75% of their loans under the priority sector. Will be complied to as per the guidelines of the RBI.

Maximum exposure to single entity and group to be capped at 10% &

15% of net worth respectively.

SFBs are not permitted to set up any subsidiary.

Minimum CAR of 15% of RWA, with Tier of 7.5%. With the proposed IPO, capital not to be a concern factor.

Source: Company, Angel Research

Key Management Personnel:

Mr K.R. Ramamoorthy is the Non-executive Chairman and Independent

Director of the company. He holds a bachelors degree in arts from Delhi

University and a bachelors degree in Law from Madras University. He is also

a fellow member of the Institute of Company Secretaries of India. He is the

former chairman and managing director of Corporation Bank and former

chairman & CEO of ING Vysya Bank. He has served as an advisor to CRISIL

and as consultant to The World Bank.

Mr Smait Ghosh is the MD & CEO. He founded Ujjivan Financials in 2005.

Mr. Ghosh has an experience of 30 years as a banker and has also served in

South Asia and the Middle East. He started his career with Citibank in 1975

and later worked with Standard Chartered Bank, HDFC Bank and Bank

Muscat. He holds a Master of Business Administration degree from the

Wharton School of Business at the University of Pennsylvania. He was the past

President of Microfinance Institutions Network and the chairman of Association

of Karnataka Microfinance Institutions Network and the chairman of

Association of Karnataka Microfinance Institutions (AKMI). He has been the

driving force behind the growth of the company.

Ms Sudha Suresh is the CFO of the company. She is a Chartered Accountant

with a corporate career spanning over 18 years. She is also a qualified Cost

Accountant. At Ujiivan, she is responsible for areas of strategic business

planning and budgetary controls, treasury management, accounts and

taxation, and management of board and regulatory compliance.

April 27, 2016 2

Ujjivan Financial Services | IPO Note

Issue details

The company is raising `358cr through fresh issue of equity shares in the price

band of `207-210. The fresh issue will constitute 19.8% of the pre-issue and

16.5% post-issuance paid-up equity share capital of the company assuming the

issue is subscribed at the upper end of the price band. Along with the fresh issue of

equity shares, there is also an Offer for Sale (OFS) of 2.5cr equity shares from the

existing shareholders.

Exhibit 2: Offer Details

Offer Details No. of equity shares ( In cr) Amount (in crs.)

Fresh Issue 1.7 358

Offer for Sale 2.5 525

Total Offering 4.2 883

Source: Company, Angel Research

The top 10 shareholders of the company are as follows:

Exhibit 3: Top10 Shareholders Pre Issue

Name of the Shareholder Shareholding %

CDC Group Plc 10.8

Alena Private Ltd 10.7

IFC 10.1

New Quest Asia Investments Ltd 8.1

Elevar Equity Maurituius 6.3

Sarva Capital LLC 5.8

Womens World Banking Capital Partners 5.3

Bajaj Holdings & Investment Ltd 5.1

Sequoia Capital Investments III 4.2

India Financial Inclusion Fund 3.5

Total 69.8

Source: Company, Angel Research

Objects of the offer

Ujjivan have received the in-principle approval for operating as a SFB. Post

conversion to a SFB, the new bank will need additional capital and hence the

Management intends to use the entire proceeds from the fresh issue of equity

to shore up its capital base.

As per RBI norms, foreign ownership in banks cant be more than 49%. In

order to reduce its existing foreign ownership, which is at 77.1%, the company

needs its existing foreign shareholders to sell their stake. Post the issue, the

foreign share holding in the company will come down to 40.2%.

April 27, 2016 3

Ujjivan Financial Services | IPO Note

Investment rationale

Micro finance business has huge scalability: Ujjivans AUM has reported a CAGR

of 59% over FY2013-9MFY2016 to `4,589cr. There is a huge untapped

opportunity in this segment as micro finance is targeted to the lower income

segment which often lacks access to formal financing sources. Ideally the ticket size

of the loans ranges from `2,000-`35,000 (in the group lending scheme) and

more than 90% of the borrowers are female, who access loans via group

borrowings (Self Help Group) for very small businesses. Sharing the group liability

has resulted in maintaining credit discipline and hence the delinquency in this type

of business has been very low despite it being an unsecured form of loan. EMIs are

collected on 14 days or 28 days basis, which reduces the risk of any bad loans.

With a loan portfolio of ~`43,300cr the micro finance industry is expected to

report 30% CAGR over the next 3-4 years and Ujjivan with its pan-India presence

will be able to encash on the opportunity. Given the governments focus on

financial inclusion together with better clarity on regulatory aspects, the micro

finance industry can look forward to healthy growth going ahead.

Exhibit 4: 59% AUM CAGR over the last 3 years

5,000 4,589

4,500

4,000

3,500 3,274

3,000

2,500

2,000 1,617

1,500 1,126

1,000 625 703

500

0

FY11 FY12 FY13 FY14 FY15 9MFY16

Assets Under Management (AUM) (`mn)

Source: Company DHRP, Angel Research

Diversified product offerings has helped in growing customer base: The company

has various types of loan products like small and micro business loans, education

loans, house renovation loans as well as emergency loans. Backed by a strong

network and customer satisfaction it has been able to achieve very high repeat

customer ratio and repeat group loans account for ~47% of the loan book, while

new group loans accounted for 37% of the loan book. Ujjivan also has a product

called loyalty loans which is extended to existing customers who have satisfactorily

repaid on time. The companys customer friendly approach has resulted in 45%

CAGR in number of loan accounts, ie from 1mn in FY2013 to 3.1mn by

9MFY2016.

April 27, 2016 4

Ujjivan Financial Services | IPO Note

Exhibit 5: Diversified loan offerings

9%

7%

37%

47%

New Group Loans Repeat Group Loan Loyality Individual Loans

Source: Company, Angel Research

Exhibit 6: Growing Customer Base

3.5

3.1

3.0

2.4 2.4

2.5

2.0

1.5 1.3

0.9 1.0

1.0

0.5

0.0

FY11 FY12 FY13 FY14 FY15 9MFY16

Number of loan accounts (in mn)

Source: Company DHRP, Angel Research

Advances out of group lending scheme should result in new

scope of growth

Though the company largely lends in joint lending system, it also offers individual

loans which account for ~10% of the overall AUM. Individual loans could see

strong growth going ahead. Post conversion to a SFB and in order to scale up its

balance sheet the company will have to grow its individual loan portfolio.

April 27, 2016 5

Ujjivan Financial Services | IPO Note

Exhibit 7: Portfolio Distribution

100% 5% 4% 7% 10% 12%

90%

80%

70%

60%

50% 95% 96% 93% 90% 88%

40%

30%

20%

10%

0%

FY 12 FY 13 FY 14 FY 15 9M16

Group lending AUM Individual lending AUM

Source: Company, Angel Research

Expect smooth transition to a SFB: Ujjivan is amongst the ten players to have

received a SFB license from the RBI. Migrating to become a SFB from being a

NBFC has its own pros and cons. On the positive side the proposed SFB will have

access to low cost funds via deposits and even borrowing costs could reduce

further via NCDs and CP/CDs. It can also start other retail loans at par with other

banks. While on the flip side there will be initial expenses associated with being a

bank as new processes will have to be implemented. Further, the SFB will have to

comply with CRR and SLR requirements. Meeting 75% Priority Sector Lending (PSL)

target will not be a challenge for the company as its entire portfolio qualifies for

PSL and hence the migration from NBFC to SFB should be smooth. These will

impact the overall NIM and ROA during the initial 2-3 years. Having said that, we

believe with an experienced Management the migration from NBFC to SFB would

be smooth.

Enjoys strong return ratios and is backed by reducing cost structure: In the last few

years Ujjivan has been able to improve its leverage from 4x in FY2013 to 5.5x in

9MFY2016. This has resulted in ROE improving from 11.8% to 19.9% during the

same period. With a new capital base the company will have further scope for

leveraging and hence we believe its ROE will remain strong. However, during the

process of migration to the SFB the company might see its cost structure escalating

which will temporarily pressurize the ROE.

April 27, 2016 6

Ujjivan Financial Services | IPO Note

Exhibit 8: Return ratios decent; lower leverage allows Exhibit 9: Operating expense/Average AUM

scope for RoA & RoE expansion

18.0% 16.9% 16.0%

15.5% 13.8%

16.0% 14.0%

13.7%

14.0%

12.0% 10.8%

12.0% 11.8%

10.0% 8.8% 8.5%

10.0%

7.6%

7.5% 8.0%

8.0%

6.0% 6.0%

2.9% 3.4% 4.0%

4.0% 2.5% 2.8%

1.7%

2.0% 2.0%

0.0% 0.0%

FY12 FY13 FY14 FY15 9MFY16 FY12 FY13 FY14 FY15 9MFY16

Return on average assets Return on average net worth Operating expense/ Average AUM

Source: Company, Angel Research Source: Company, Angel Research

Geographically diversified AUM

Ujjivan is present across 24 states and has successfully diversified its AUM with no

single state contributing >20% to the overall AUM. This mitigates the concentration

risk. Karnataka, West Bengal, Maharashtra and Tamil Nadu account for 56% of

the AUM; this makes a key differentiating point for Ujjivan as other micro finance

institutions are largely focused on the southern states of the country. Once the

company converts itself into a SFB, its diversified presence will come in as a great

help in scaling up the balance sheet as it already has the operating knowledge

and brand name in respective geographies.

Exhibit 10: State-wise distribution of AUM

3.0%

5.9% 5.0% 5.3%

3.5%

16.1%

5.7% 16.2%

13.1%

13.9% 2.7%

3.9%

2.8% 2.9%

Assam Gujarat Haryana Jharkhand Karnataka

Kerala Maharashtra Orissa Punjab Rajasthan

Tamil Nadu Uttar Pradesh West Bengal Others

Source: Company, Angel Research

April 27, 2016 7

Ujjivan Financial Services | IPO Note

Exhibit 11: Geographical distribution of branches

18.6%

27.4%

9.6%

16.8%

21.9%

5.7%

South North North East East Central West

Source: Company, Angel Research

Ujjivan has maintained impressive NIM and Asset Quality

The company has managed its NPA level quite strong despite aggressive growth in

the last 3-4 years. Micro finance is an unsecured form of loan, but still the

company has achieved an excellent track record of maintaining Gross NPA below

0.15% which is a commendable job. The same is also much lower than its nearest

peer and newly listed micro finance company - Equitas Holdings Ltd (Equitas).

However, unlike Equitas, Ujjivans presence so far is largely concentrated in the

micro finance business and once the company gets into other segments of lending

the asset quality could come under pressure initially. This will be a key area of

observation going ahead. The companys NIM has been on a declining trend over

the past few years and we expect the same to decline further over the next few

quarters before it stabilizes.

Exhibit 12: Reducing Gross & Net NPA (%) Exhibit 13: Healthy NII growth & NIM

1.00% 450 17.1% 18.0%

408

0.90% 400 16.0%

0.80% 13.8% 13.6%

350 328 14.0%

0.70% 12.3%

300 12.0%

11.6%

0.60% 11.3%

250 10.0%

0.50% 208

200 8.0%

0.40%

140

0.30% 150 6.0%

104

87

0.20% 100 4.0%

0.29%

0.26%

0.81%

0.08%

0.08%

0.07%

0.01%

0.07%

0.02%

0.15%

0.04%

0.91%

0.10% 50 2.0%

0.00%

0 0.0%

FY11 FY12 FY13 FY14 FY15 9MFY16

FY11 FY12 FY13 FY14 FY15 9MFY16

Gross NPA / On-Book AUM Net NPA / On-Book AUM Net interest income Net interest margin

Source: Company, Angel Research Source: Company, Angel Research

April 27, 2016 8

Ujjivan Financial Services | IPO Note

Overview of Micro finance industry:

The micro finance industry witnessed rapid growth after 2001, after the RBI

granted priority sector status to bank loans advanced to micro finance companies.

However, the micro finance industry had a problem of high cost of funds; in order

to tackle the problem the Union Budget 2016 announced setting up MUDRA Bank

to refinance the micro finance sector. As a result micro finance companies have

better access to funds at lower costs and can now scale up. Though there are ~60

micro finance companies in India, nearly 70% of the gross loan portfolio is

accounted by the top 10 players.

Exhibit 14: Top10 Micro Finance Companies in India

Top MFIs, gross loan portfolio (Rs. cr) Q3FY16 Market Share (%)

Janalakshmi 8,096 19.1

SKS 6,177 14.5

Ujjivan 4,088 9.6

Satin 2,538 6.0

Equitas 2,320 5.5

Grameen Koota 1811 4.3

L & T Finance 1700 4.0

ESAF 1495 3.5

Spandana 1221 2.9

Grama Vidiyal 1147 2.7

Total of Top 10 30,593 72.0

Source: MFIN

Exhibit 15: State-wise distribution of gross loan portfolio of the industry

State-wise distribution of gross loan portfolio Q3FY16

Tamil Nadu 16.1%

Karnataka 13.8%

Maharashtra 11.9%

Uttar Pradesh 10.9%

Madhya Pradesh 7.8%

Odisha 6.1%

West Bengal 5.8%

Bihar 5.4%

Kerela 4.4%

Gujarat 3.7%

Others 14.1%

Total 100.0%

Source: MFIN

April 27, 2016 9

Ujjivan Financial Services | IPO Note

Valuation

At the upper end of the offer price band (`210), the issue is priced at 1.8x its

diluted BV of `118 (2.1x pre-dilution). The company has decent ROE and ROA of

19.9% and 3.6%, respectively. Although the return ratios might get a bit

compressed post the companys conversion to a SFB, but we expect the same to

scale up subsequently. We believe the issue is attractively priced looking at the

growth options the company offers in the long run. We recommend a SUBSCRIBE

on the issue.

Comparative table

Within the listed space, we believe SKS Microfinance is the best comparable

company. Recently another micro finance company and expected SFB, Equitas

Holdings, came out with an IPO. We believe Equitas would be the best

comparable company for Ujjivan while on other parameters we have tried to make

a comparison with other listed NBFCs as well.

Exhibit 16: Comparative Micro Finance

Micro-Finance Equitas SKS Janlakshmi Ujjivan Satin

Gross Loan Portfolio (crs) 2,935 6,177 8,096 4,088 2,538

Avg loan o/s per client 9,634 14,857 21,146 15,739 15,873

Branches 377 1,167 338 469 364

Employees 4,255 11,086 7,978 7,786 3,419

Clients (lakhs) 24.1 41.6 38.3 26.0 16.0

Source: MFIN

Exhibit 17: Comparative Micro Finance

Ujjivan Equitas SKS Micro Fin

NIM (%) 12.3 11.1 5.6

ROA (%) 3.6 2.9 4.5

ROE (%) 19.9 19.1 25.0

CAR (%) 19.6 21.0 23.9

GNPAs (%) 0.2 0.2 0.1

NNPAs (%) 0.0 0.1 0.1

P/BV (x) 2.1 2.3 4.2

Leverage (%) 5.5 4.0 4.5

Source: Company, Angel Research

April 27, 2016 10

Ujjivan Financial Services | IPO Note

Risks

No prior experience of secured lending: Ujiivan is largely present in the micro

finance business only and doesnt have any prior experience in large scale secured

lending. Post conversion to SFB, Ujjivan will have to lend secured loans as well with

higher average ticket size and this could a testing time. Though secured loans are

considered to be safer, higher ticket sizes need close monitoring of the accounts

and hence the company will have to set up proper systems for the same.

Ability to scale up its operations fast: The company is raising `358cr through fresh

issuance of shares, amounting to 56% of the existing net worth. Inability to scale

up its operations will result in ROE dilution in the near term.

Ability to meet deposit targets post SFB conversion: Post conversion to a SFB,

Ujjivan will be allowed to raise deposits from customers. Ability to raise deposits

from its existing client base will be limited looking at the average income profile of

the said borrowers. It might have to offer higher rates vis-a-vis other banks which

might have a negative impact on the NIM.

April 27, 2016 11

Ujjivan Financial Services | IPO Note

Income statement

Y/E March (` cr) FY2012 FY2013 FY2014 FY2015 9MFY2016

NII 87.3 140.4 208.0 327.9 407.6

- YoY Growth (%) 60.8% 48.1% 57.6% 24.3%

Other Income 8.1 11.4 9.8 12.6 16.4

- YoY Growth (%) 41.6% -14.3% 28.6% 30.8%

Operating Income 95.4 151.9 217.8 340.5 424.1

- YoY Growth (%) 59.2% 43.4% 56.3% 24.5%

Operating Expenses 89.8 97.2 120.7 204.9 219.4

- YoY Growth (%) 8.3% 24.1% 69.8% 7.0%

Pre - Provision Profit 5.6 54.6 97.1 135.6 204.7

- YoY Growth (%) 872.8% 77.9% 39.6% 51.0%

Prov. & Cont. 5.8 6.9 8.3 21.0 17.0

- YoY Growth (%) ! 19.8% 20.1% 153.8% -19.1%

Profit Before Tax -0.1 47.7 88.8 114.5 187.7

- YoY Growth (%) 86.3% 28.9% 63.9%

Prov. for Taxation -0.3 14.8 30.4 38.7 65.4

- as a % of PBT 31.1% 34.2% 33.8% 34.8%

PAT 0.1 32.9 58.4 75.8 122.3

- YoY Growth (%) 77.7% 29.7% 61.4%

Balance sheet

Y/E March (` cr) FY2012 FY2013 FY2014 FY2015 9MFY2016

Share Capital 57.3 65.6 65.6 86.1 86.1

Reserve & Surplus 183.0 252.4 306.9 650.3 813.4

Loan Funds 639.2 1,018.5 1,675.4 3,179.6 3,814.6

- Growth (%) 9.7% 59.3% 64.5% 89.8% 20.0%

Other Liab.& Prov. 16.0 20.0 31.0 60.0 39.0

Total Liabilities 895.5 1,356.5 2,078.9 3,976.0 4,753.2

Cash and Cash Equivalents 161 179 394 645 56

Investments 3 3 5 7 14

Advances 700 1,136 1,626 3,229 4,588

- Growth (%) 10.1% 62.4% 43.1% 98.6% 42.1%

Fixed Assets 11 11 13 18 22

Other Assets 182 206 435 723 129

Total Assets 895.5 1,356.5 2,078.9 3,976.0 4,753.2

April 27, 2016 12

Ujjivan Financial Services | IPO Note

Ratio analysis

Y/E March FY2012 FY2013 FY2014 FY2015 9MFY2016

Profitability ratios (%)

NIMs 11.26% 13.76% 13.57% 11.62% 12.31%

RoA 0.0 2.9 3.4 2.5 3.6

RoE 0.1 11.8 16.9 13.7 19.9

Asset Quality (%)

Gross NPAs 0.91% 0.08% 0.07% 0.07% 0.15%

Net NPAs 0.81% 0.08% 0.01% 0.02% 0.04%

Per Share Data (`)

EPS 0.0 5.0 8.9 8.8 14.2

BVPS 42.0 48.5 56.8 85.5 99.7

Valuation Ratios

PER (x) 41.9 23.6 23.9 14.8

P/ABVPS (x) 5.0 4.3 3.7 2.5 2.1

DuPont Analysis

NII 10.9 12.5 12.1 10.8 12.0

(-) Prov. Exp. 0.7 0.6 0.5 0.7 0.5

Adj. NII 10.2 11.9 11.6 10.1 11.5

Other Inc. 1.0 1.0 0.6 0.4 0.5

Op. Inc. 11.2 12.9 12.2 10.6 12.0

Opex 11.2 8.6 7.0 6.8 6.4

PBT 0.0 4.2 5.2 3.8 5.5

Taxes (0.0) 1.3 1.8 1.3 1.9

RoA 0.0 2.9 3.4 2.5 3.6

Leverage 4.5 4.0 5.0 5.5 5.6

RoE 0.1 11.8 16.9 13.7 19.9

April 27, 2016 13

Ujjivan Financial Services | IPO Note

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

April 27, 2016 14

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- RAD Data Communications ETX-203A Installation and Operation ManualDocument310 pagesRAD Data Communications ETX-203A Installation and Operation ManualJuan MadrigalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- How To Conduct A Risk AssessmentDocument23 pagesHow To Conduct A Risk Assessmentdurgasainath100% (1)

- AFAR 2305 Not-for-Profit OrganizationsDocument14 pagesAFAR 2305 Not-for-Profit OrganizationsDzulija TalipanNo ratings yet

- SOC TrainingDocument27 pagesSOC Trainingdurgasainath100% (5)

- 0-CISSP Flash Cards Draft 6-6-2010Document126 pages0-CISSP Flash Cards Draft 6-6-2010Maurício SilvaNo ratings yet

- Chapter 7Document12 pagesChapter 7Camille GarciaNo ratings yet

- HDFC Bank Statement 09-08-2022Document5 pagesHDFC Bank Statement 09-08-2022mahakaal digital point bhopalNo ratings yet

- GDPR Compliance On AWSDocument32 pagesGDPR Compliance On AWSdurgasainathNo ratings yet

- Access funds anywhere with ATMsDocument10 pagesAccess funds anywhere with ATMsprofessor_manojNo ratings yet

- Definition of Credit RiskDocument5 pagesDefinition of Credit RiskraviNo ratings yet

- AngelBrokingResearch - Prince Pipes & Fittings LTD - IPONote - 171219Document8 pagesAngelBrokingResearch - Prince Pipes & Fittings LTD - IPONote - 171219durgasainathNo ratings yet

- Emerge Web2020Document1 pageEmerge Web2020durgasainathNo ratings yet

- AngelBrokingResearch MSTC IPO 120319Document7 pagesAngelBrokingResearch MSTC IPO 120319durgasainathNo ratings yet

- SpandanaDocument11 pagesSpandanadurgasainathNo ratings yet

- Aviatrix GCP UservpnDocument10 pagesAviatrix GCP UservpndurgasainathNo ratings yet

- Irctc Ipo IciciDocument14 pagesIrctc Ipo IcicidurgasainathNo ratings yet

- Sterling Ipo IciciDocument12 pagesSterling Ipo IcicidurgasainathNo ratings yet

- 2018 - 9 - Newsletter - Avoiding Many Types of MalwareDocument2 pages2018 - 9 - Newsletter - Avoiding Many Types of MalwaredurgasainathNo ratings yet

- Ujjivan Ipo Report IciciDocument9 pagesUjjivan Ipo Report IcicidurgasainathNo ratings yet

- CSB Ipo Report IciciDocument11 pagesCSB Ipo Report IcicidurgasainathNo ratings yet

- ExamBankChallanN PDFDocument2 pagesExamBankChallanN PDFRathnaNo ratings yet

- Student Result Management System PDFDocument1 pageStudent Result Management System PDFdurgasainathNo ratings yet

- IRCTC IPONoteDocument8 pagesIRCTC IPONotedurgasainathNo ratings yet

- Information Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsDocument1 pageInformation Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsdurgasainathNo ratings yet

- Thompson Complaint PDFDocument12 pagesThompson Complaint PDFdurgasainathNo ratings yet

- Spandana Sphoorty Financial IPO Note | Financials Aug 03, 2019Document7 pagesSpandana Sphoorty Financial IPO Note | Financials Aug 03, 2019durgasainathNo ratings yet

- Long Term Skill Shortage ListDocument8 pagesLong Term Skill Shortage ListAjesh mohanNo ratings yet

- Aviatrix GCP UservpnDocument10 pagesAviatrix GCP UservpndurgasainathNo ratings yet

- C LicenseDocument2 pagesC Licensechetamilaa50% (2)

- Aviatrix GCP UservpnDocument10 pagesAviatrix GCP UservpndurgasainathNo ratings yet

- IsacaDocument7 pagesIsacadurgasainathNo ratings yet

- Dde UgcDocument5 pagesDde UgcdurgasainathNo ratings yet

- PC Eng Tam 05092019Document15 pagesPC Eng Tam 05092019durgasainathNo ratings yet

- 2018 - 9 - Newsletter - Avoiding Many Types of MalwareDocument2 pages2018 - 9 - Newsletter - Avoiding Many Types of MalwaredurgasainathNo ratings yet

- Security Tips: Mississippi Department of Information Technology ServicesDocument2 pagesSecurity Tips: Mississippi Department of Information Technology ServicesdurgasainathNo ratings yet

- 2016 10 Beware of MalwareDocument2 pages2016 10 Beware of MalwaredurgasainathNo ratings yet

- Format Jurnal KhususDocument23 pagesFormat Jurnal KhususDewi RahmawatiNo ratings yet

- Chandru T G credit card statement for May 2021Document2 pagesChandru T G credit card statement for May 2021Chandru TGNo ratings yet

- NZ Om Display PRT PDFDocument12 pagesNZ Om Display PRT PDFVikash Kumar MeenaNo ratings yet

- Citibank's E-Business Strategy For Global BankingDocument35 pagesCitibank's E-Business Strategy For Global Bankingsafwan87No ratings yet

- Revision of Fund Transfer Limit For E-BankingDocument2 pagesRevision of Fund Transfer Limit For E-BankingVaibhav GuptaNo ratings yet

- Swift, Nift & Foreign BillsDocument6 pagesSwift, Nift & Foreign Billsamannan27No ratings yet

- Article by Prof Kshitij PatukaleDocument9 pagesArticle by Prof Kshitij Patukalebutte12345No ratings yet

- Amit Bhuwania Resume JPDocument1 pageAmit Bhuwania Resume JPGaurav JainNo ratings yet

- 4 Transportation Types To Move GoodsDocument4 pages4 Transportation Types To Move GoodsAravinth SNo ratings yet

- Philippine School of Business Administration: Auditing (Theoretical Concepts)Document5 pagesPhilippine School of Business Administration: Auditing (Theoretical Concepts)John Ellard M. SaturnoNo ratings yet

- ABACADADocument2 pagesABACADAKevin Magno BarrionNo ratings yet

- Ebay AutomationDocument10 pagesEbay AutomationMuhammad AslamNo ratings yet

- My European Clixsense Experience: Crypto Faucets TutorialDocument5 pagesMy European Clixsense Experience: Crypto Faucets TutorialÖzgür Barışcan KayaNo ratings yet

- Pharmaceutical Regulatory InspectionsDocument2 pagesPharmaceutical Regulatory InspectionsTim SandleNo ratings yet

- Shawacademy Invoice Hr5518nRSAQFc0YeC PDFDocument1 pageShawacademy Invoice Hr5518nRSAQFc0YeC PDFAdrian Joseph NuñezNo ratings yet

- Samsung Le32a656a1f XXH Quick StartDocument5 pagesSamsung Le32a656a1f XXH Quick StartTomasz SkrzypińskiNo ratings yet

- ACI Formulations Purchase OrderDocument2 pagesACI Formulations Purchase OrdermahmudNo ratings yet

- Types of InsuranceDocument22 pagesTypes of InsuranceamritaNo ratings yet

- A2 Form Indian BankDocument2 pagesA2 Form Indian BankVoletiram Babu100% (2)

- CIA 2004 Principles of Auditing Fraud InvestigationDocument10 pagesCIA 2004 Principles of Auditing Fraud InvestigationThiya. TtNo ratings yet

- Compleate FASTagDocument3 pagesCompleate FASTagSourav GhoshNo ratings yet

- NCHS President and CEO, Irma Cota, Announces RetirementDocument3 pagesNCHS President and CEO, Irma Cota, Announces RetirementPR.comNo ratings yet

- Ibt Report - Non-Tariff BarriersDocument3 pagesIbt Report - Non-Tariff BarriersChristen HerceNo ratings yet

- Managing Supply Chains: A Logistics ApproachDocument39 pagesManaging Supply Chains: A Logistics ApproachalkazumNo ratings yet