Professional Documents

Culture Documents

Realyn

Uploaded by

realynbarrientosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Realyn

Uploaded by

realynbarrientosCopyright:

Available Formats

RELATED STUDIES AND SYSTEMS

2.1 FOREIGN STUDIES

2.2 LOCAL STUDIES

2.3 SYNTHESIS AND RELEVANCE TO THE STUDY

(MATRIX-COMPARATIVE ANALYSIS)

Accounts Payable and Receivable Page 1

CHAPTER II

2.0 INTRODUCTION

The hotel industry is unique and has accounting issues specific only to the

industry. The hotel industry was one of the first industries to develop definitive

standards to provide specific guidance to accountants and operators.

Analyzing financial information based on benchmarks set by the industry is

essential to the hotel success. Accounting has to work seamlessly with hotel

management and operations to interpret the financial information and react

accordingly. Timely reporting is a key to making quick decisions in this economy

Hotel accounting is not simply about managing revenue and expenses.

Independent hotels and hotel franchises have unique financial needs that demand

competent staff and an accounting system that will allow management to plan for the

future and improve services for both guests and staff alike. There are many things to

consider when assessing the quality of accounting of a hotel property, including staff

training, accounting software and forecasting.

2.1 Foreign Studies

Hampton hotel

Account Receivables, Payables, Direct bills, City ledger and Hilton invoice.

Interviewing, hiring, scheduling, coaching, disciplining of FD and Comp Serv.

employees.

Reviewing and processing PO forms from departments, check books, and A/P

invoices.

Resolving complex issues, keeping record of transactions, being ready for audit any

time.

Review FD's transactions, ensuring right charges have been made to right accts.

Handling paid-outs, receipts, petty cash payments, and bank transactions.

Processing daily bank deposits, balancing accounts and necessary FD error

corrections.

Reviewing, detailing and reporting Budget, P&L, WBR, Income Journal, 90 day

forecast.

Payroll processing, hiring procedures, DOL unemployment responses, Aetna EZ link,

401K.

Monitoring Cash, Check payments, daily system over/shorts, process Honours etc.

on On.

Monitoring Guest Assistance site & SALT Scores and resolve problems.

Being available anytime for guests and employees.

Accounts Payable and Receivable Page 2

Invoices 365

Can automate accounts payable/accounts receivable processes and integrate

with your existing ERP system, making all related documents accessible at any time

and reducing the need for duplicate data entry. Our accounts payable/accounts

receivable solutions can eliminate paper and manual data entry improving

visibility, increasing productivity, improving quality, and increasing your

organizations efficiency.

How Accounts Payable can

benefit from Invoices365: How Accounts Receivable can benefit from

Invoices365:

Reduced storage and paper

costs Quicker invoice processing

Quicker processing time Improves cash flow

Less misplaced or lost invoices Improve process efficiency such as: orders,

invoicing, and collecting payments

Make payments on time

Automatic data validation

Take advantage or early

payment discounts Integration with ERP systems

Less errors Automation of payments

Easy, instant, and reliable Receive and process orders in less time with

access to invoices PO receipt automation

Opportune

Managing the daily flow of invoicing and billing is an essential operation within

any business. We at Opportune understand that this vital account activity requires

close scrutiny, with attention to detail and accurate execution.

As our back-office professionals receive and process coded administrative

and operational invoices, we employ an accounts payable system to verify approval

authority and limits based on the specific criteria you set before any checks are

printed.

Our system also gives us the capabilities to:

Maintain voucher logging to track the location of unpaid invoices

Receive and respond to vendor inquiries as long as invoices are paid within invoice

terms

Accounts Payable and Receivable Page 3

Review, monitor, analyze and resolve any over/under billings, suspense issues, etc.

Enter and apply coded cash receipts

Generate aging reports

Interface with Spend works for electronic invoice processing

Opportune leading-edge software technology, broad expertise and right-

sized outsourcing team make everyday account management effortless and efficient.

MIS Account Payable &Receivable

The MIS Accounts Receivable system is a comprehensive module that allows

for the management, logging and tracking of your receivables, invoices, sales taxes,

and cash receipts.

Customer File Information

Some of the information contained in the customer file includes: billing and shipping

information (the system supports multiple shipping addresses per customer),

purchase and credit contact information,

shipping instructions and route designator, sales tax and exempt controls, general

contact information (phone, fax, email), credit limit

and terms, pricing controls, service charge controls, branch and sales

territory controls, salesperson assignment, customer type and SIC

indicators, account status controls (active, frozen, closed, prospect, etc.),

sales commission controls, backorder fill priority controls, links to external

files (Word documents, Google Map, PDF and Image files, etc.) and more!

Free-form customer notes are maintained for marketing, credit, collection, and sales

management purposes.

The Sales Manager option in the MIS Sales Analysis module maintains and displays

customer purchase history, sales trends, profit trends, unit trends, stock sufficiency

levels (ability to stock and ship percentages), rankings, and graphs.

Collections/Cash Management

The Collections/Cash Management section of the Accounts Receivable module

consolidates and organizes the functions necessary to manage your customer

accounts. Some of the functions included in this section are:

Account Review

Credit Manager Review

Design-It-Yourself Credit Report

Statements

Dunning Notifications

Various Aging Reports

Accounts Payable and Receivable Page 4

Due Date Register

Collection Review & Report

Collection Call Back Report

and more!

Cash Receipts

The Cash Receipts function allows payment of invoices by oldest (on account) or

specific. Deposits and

miscellaneous cash receipts can also be entered. Discounts or short payments can

be handled from

within the cash receipts function and detailed invoice review is available on-line, thus

saving time when

an account adjustment is needed. Once your receipts have been entered, a proof list

option is available,

along with a bank deposit slip.

Sales Tax Management

the MIS system allows for multi-level tax codes. Tax code reporting provides the

necessary information

for tax forms (many taxing authorities accept the reports printed by the system), and

you have the option to update the taxes due to the MIS Accounts Payable module.

Accounts Receivable Reports

The Accounts Receivable, Sales Analysis, and Order Entry modules contain many

reports that allow

you to audit, monitor, track, and analyze the many indicators necessary for superior

customer service,

accounting and management of your customers.

The MIS Accounts Payable system is a comprehensive module that allows for the

logging, tracking and reporting of your payables, while helping to manage cash

requirements and disbursements. The system

integrates with the MIS General Ledger and Purchase Order modules.

Vendor File

Some of the information contained in the vendor file includes: Address and contact

information, standard due date controls, standard discount date controls, standard

terms discount controls, default general ledger controls, vendor classification,

payment cycle controls, purchasing goals, extended information for contract terms

and conditions, and more.

The Vendor Ordering file is used to maintain discount schedules/levels and is used

in conjunction with the Purchase Manager function to assist in optimizing your

ordering process.

Accounts Payable and Receivable Page 5

Transactions

Invoices/Vouchers can be input in a live or batch mode. Vendor look-up windows

provide easy access to the vendor account. The system will automatically calculate

the due date, discount date and discount

amount, based upon the vendor profile. Invoices can be associated with a purchase

order in order to track and monitor unrecorded liabilities, under receipts, over

receipts and cost discrepancies.

The system allows for account adjustments and credits, along with due date and

discount rate changes. You may also void checks from current and previous periods.

Check Writing and Cash Management

Several features are available for controlling which invoices will be paid and when.

Selection/Exclusion of payment can be based upon vendor, due date, invoice

number, discount date, due date and vendor, payment cycle, promise date, dollar

amount, and others.

Various cash requirements reports are available to assist you with cash flow

planning. The system also features immediate/demand check printing, manual

checks, bank reconciliation and multiple bank accounts.

Bank Account Reconciliation

The bank reconciliation function includes deposits, checks from Accounts Payable,

checks from Payroll,

and any journals affecting the cash account from transactions entered directly

through the General Ledger.

Some of the Accounts Payables Reports:

Multiple Unrecorded Liabilities Reports

Multiple Aging Reports

Invoices by Status, Class, Dollar Amount, etc, Reports

Detailed History Report

Transaction Summary

Purchase History

Vendor Inactivity

Check Registers

Multiple Cash Requirements Reports

Multiple Vendor Lists

Accounts Payable and Receivable Page 6

FI ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE | SAP FI PDF

MANUAL

The following topics are an introduction to the Accounts Receivable and

Accounts Payable application components.

The Accounts Payable application component records and manages accounting data

for all vendors. It is also an integral part of the purchasing system: Deliveries

and invoices are managed according to vendors. The system automatically triggers

postings in response to the operative transactions. In the same way, the system

supplies the Cash Management application component with figures from invoices in

order to optimize liquidity planning.

Payables are paid with the payment program. The payment program supports all

standard payment methods (such as checks and transfers) in printed form as well as

in electronic form (data medium exchange on disk and electronic data interchange).

This program also covers country-specific payment methods.

If necessary, dunning notices can be created for outstanding receivables (for

example, to receive payment for a credit memo). The dunning program supports this

function.

Postings made in Accounts Payable are simultaneously recorded in the General

Ledger where different G/L accounts are updated based on the transaction involved

(payables and down payments, for example). The system contains due date

forecasts and other standard reports that you can use to help you monitor open

items.

You can design balance confirmations, account statements, and other forms of

reports to suit your requirements in business correspondence with vendors. There

are balance lists, journals, balance audit trails, and other internal evaluations

available for documenting transactions in Accounts Payable.

The Accounts Receivable application component records and manages accounting

data of all customers. It is also an integral part of sales management.

All postings in Accounts Receivable are also recorded directly in the General Ledger.

Different G/L accounts are updated depending on the transaction involved (for

example, receivables, down payments, and bills of exchange). The system contains

a range of tools that you can use to monitor open items, such as account

analyses, alarm reports, due date lists, and a flexible dunning program. The

correspondence linked to these tools can be individually formulated to suit your

requirements. This is also the case for payment notices, balance confirmations,

account statements, and interest calculations. Incoming payments can be assigned

Accounts Payable and Receivable Page 7

to due receivables using user-friendly screen functions or by electronic means, such

as EDI.

The payment program can automatically carry out direct debiting and down

payments.

There are a range of tools available for documenting the transactions that occur in

Accounts Receivable, including balance lists, journals, balance audit trails, and other

standard reports. When drawing up financial statements, the items in foreign

currency are revalue, customers who are also vendors are listed, and the balances

on the accounts are sorted by remaining life.

Accounts Receivable is not merely one of the branches of accounting that forms the

basis of adequate and orderly accounting. It also provides the data required for

effective credit management, (as a result of its close integration with the Sales and

Distribution component), as well as important information for the optimization of

liquidity planning, (through its link to Cash Management).

2.2 Local Studies

IQ BackOffices

Accounts Payable Outsourcing

Increased savings and control with digitized invoices

IQ BackOffices procurement-to-payment approach delivers savings of up to 68%

and a per-transaction quality rate of 99.97%. We'll take that stack of paper invoices

off your desk and apply a combination of web-based workflows and outsourced

processing that readies them for approval and electronic payment in less than a day.

With IQ BackOffice, your processes become standardized into SAS70 Type II

and SSAE 16-qualifying business rules. We code these rules into our state-of-the-art

Archimedes software and digitize your invoices for processing by our highly-trained

and carefully monitored staff. We note exceptions for your resolution and review

each invoice across multiple data points to spot duplicate billing.

Our best practices approach gives you better control over your processes.

Instead of going through stacks of invoices and file folders, with a few clicks, you can

drill down into any invoice to see its status, find out who needs to review it, know

how long theyve had it in their inbox, and approve it for payment.

IQ BackOffice enables disbursement via checks, ACH, wire transfers and credit

cards with rebates. Our solutions offer:

Enhanced visibility into the accounts payable cash flow

The flexibility to work with any bank, with no charge for changing banks

Accounts Payable and Receivable Page 8

Reduced vendor remittance costs through online presentment and self-service

options

Secure Virtual Payment MasterCard, with cash-back revenue options

With IQ BackOffice, your accounts payable processing becomes digital, predictable,

efficient and quality-focused. Your control increases while your costs and risks

decrease, enabling you, and your company, to do more.

Accounts Receivable Outsourcing & Billing

Comprehensive billing, cash application and collections management

Working capital is the lifeblood of a company, but it is still largely tracked via hand-

processed billing, cash application and collections management functions. IQ

BackOffice is ready to move you forward with web-based workflows and outsourced

processing that can cut your costs in half while providing real-time insight into your

accounts receivable and cash flow.

We start with a top-to-bottom review of your processes, reengineering them to

SAS70 Type II and SSAE 16 standards. Then we deploy your updated procedures

into our proprietary Archimedes workflow software. Archimedes ensures that our

processing staff applies your business rules rigorously and lets you drill down into

any bill to review its status. As needed, we can reach out to overdue accounts with

reminder calls and emails, based on your business rules.

By integrating your existing accounts receivable functions, reducing processing

costs and providing detailed reporting at every step, IQ BackOffice will ensure you

have the tools and data you need for real-time decision support.

2.3 Synthesis

The overall transaction and tracking of the invoice and reports.

Hotel accounting is not simply about managing revenue and expenses.

Independent hotels and hotel franchises have unique financial needs that

demand competent staff and an accounting system that will allow management to

plan for the future and improve services for both guests and staff alike. There are

many things to consider when assessing the quality of accounting of a hotel

property, including staff training, accounting software and forecasting.

Accounts Payable and Receivable Page 9

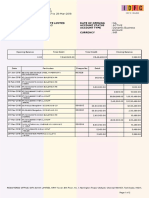

PROPOSED

FORIEGN RELATED STUDY

SYTEM

FI Accounts

FEATURES MIS

Receivable Accounts

Hampton Account

Invoices 365 Opportune and Payable and

Hotel Payable &

Accounts Receivable

receivable

Payable

keeping

record of

transaction

being ready

for audit

anytime

Receipt

Invoice

Check

payments

Adjustment

entries

PROPOSED

LOCAL RELATED STUDY

SYTEM

FEATURES Accounting

Accounts

IQ ERP System of

SYSPRO E-invoicing Payable and

BackOffice's Business Corporate

Receivable

Business

keeping

record of

transaction

being ready

for audit

anytime

Receipt

Invoice

Check

payments

Adjustment

entries

Accounts Payable and Receivable Page 10

Accounts Payable and Receivable Page 11

You might also like

- Dynamics 365 Business Central Capability Guide - En-En - Final - v2Document30 pagesDynamics 365 Business Central Capability Guide - En-En - Final - v2Jesus CastroNo ratings yet

- PLDT Account No. 0193069916 PDFDocument4 pagesPLDT Account No. 0193069916 PDFEli FaustinoNo ratings yet

- Account ReceivablesDocument285 pagesAccount ReceivablesOgwuche Oche SimonNo ratings yet

- Datasheet Workday Financial ManagementDocument4 pagesDatasheet Workday Financial ManagementarunNo ratings yet

- Gumabon v. PNBDocument2 pagesGumabon v. PNBVon Lee De LunaNo ratings yet

- Fire Lotto: White PaperDocument26 pagesFire Lotto: White PaperioanabrinzasNo ratings yet

- Flow Chart - Simplifying The Accounts Payable ProcessDocument7 pagesFlow Chart - Simplifying The Accounts Payable Processmatthew mafaraNo ratings yet

- Manage AP and cash flowDocument15 pagesManage AP and cash flowNishant SainiNo ratings yet

- The Study of The Effectiveness of Cashless Payment Method in The Philippine Supermarket Through Consumer SatisfactionDocument16 pagesThe Study of The Effectiveness of Cashless Payment Method in The Philippine Supermarket Through Consumer SatisfactionBarao JonathanNo ratings yet

- 2009 03 ICA Member DirectoryDocument60 pages2009 03 ICA Member DirectoryRay CollinsNo ratings yet

- LBP v Belle Corp - Bank not mortgagee in good faithDocument3 pagesLBP v Belle Corp - Bank not mortgagee in good faithAlyssa Clarizze Malaluan25% (4)

- Accounting SystemDocument22 pagesAccounting SystemAnkit NagdeoNo ratings yet

- Baraza PayrollDocument10 pagesBaraza PayrollAlokojjal BanerjeeNo ratings yet

- AP Process Automation WP 2284450Document10 pagesAP Process Automation WP 2284450HeroanNo ratings yet

- IDFC Bank StatementDocument2 pagesIDFC Bank StatementSURANA197367% (3)

- Optimizing Invoice Processing With Open Text VIM WhitepaperDocument20 pagesOptimizing Invoice Processing With Open Text VIM WhitepaperAswin Girmaji100% (1)

- Allied Banking Corporation vs. Sps. MacamDocument2 pagesAllied Banking Corporation vs. Sps. MacamMarvien BarriosNo ratings yet

- Ar AP SystemDocument47 pagesAr AP SystemAnon NetflixNo ratings yet

- Accounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054Document6 pagesAccounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054BAVYA RNo ratings yet

- Analyzing Accounting Software SystemsDocument4 pagesAnalyzing Accounting Software SystemsDah NEPALNo ratings yet

- Expanding Horizon of Entrepreneurship Through Computerized Accounting FullDocument10 pagesExpanding Horizon of Entrepreneurship Through Computerized Accounting FullVasim AhmadNo ratings yet

- Gets SyetemDocument11 pagesGets SyetemdprosenjitNo ratings yet

- PRIORITY Short DescriptionDocument5 pagesPRIORITY Short DescriptionLuiza HudeaNo ratings yet

- Accounting Software IntroductionDocument3 pagesAccounting Software IntroductionMakinwa RehobothNo ratings yet

- Accelerate Cash Flow with Invoices On-LineDocument6 pagesAccelerate Cash Flow with Invoices On-LineArnold LeapNo ratings yet

- Financial Operations Are A Collection of Functions in The AreasDocument2 pagesFinancial Operations Are A Collection of Functions in The Areasv jayNo ratings yet

- Improve Invoice Verification ProcessDocument75 pagesImprove Invoice Verification ProcessVivek Bhoir0% (2)

- Characteristics of The Accounting Information SystemDocument2 pagesCharacteristics of The Accounting Information SystemNoraini Abd RahmanNo ratings yet

- Tally Orginal21-12-05Document41 pagesTally Orginal21-12-05Suresh VeigandlaNo ratings yet

- Tally - Erp 9 FlyerDocument2 pagesTally - Erp 9 FlyerManish SharmaNo ratings yet

- HR, Accounting & Finance ISDocument26 pagesHR, Accounting & Finance ISDrPratibha VermaNo ratings yet

- Credit and CollectionDocument2 pagesCredit and CollectionDorhea Kristha Guian SantosNo ratings yet

- Review of Literature on Billing, Inventory ManagementDocument14 pagesReview of Literature on Billing, Inventory ManagementHoney Sepala JaposNo ratings yet

- Microsoft Dynamics 365 Business Central Capability GuideDocument28 pagesMicrosoft Dynamics 365 Business Central Capability GuideMatarNo ratings yet

- Report Billing Management SystemDocument7 pagesReport Billing Management SystemBasant RayNo ratings yet

- Chapter 4 The Revenue CyclesDocument23 pagesChapter 4 The Revenue CyclesHassanNo ratings yet

- Cash AppsDocument10 pagesCash AppsShameera BegamNo ratings yet

- Analysis of Holmes Institute’s Revenue CycleDocument11 pagesAnalysis of Holmes Institute’s Revenue Cyclekavita adhikariNo ratings yet

- ADVANCE AUDIT Assignment 3Document6 pagesADVANCE AUDIT Assignment 3zainab malikNo ratings yet

- Accounts Payable: Quickly Resolve Business IssuesDocument4 pagesAccounts Payable: Quickly Resolve Business IssuesRujhan FarookNo ratings yet

- Guest Management Day Closing. Call Management, Internet BillingDocument2 pagesGuest Management Day Closing. Call Management, Internet Billingalakh400No ratings yet

- SAP Business One - Key FunctionalitiesDocument6 pagesSAP Business One - Key FunctionalitiesAkanksha TiwariNo ratings yet

- IT in Accounting and FinanceDocument6 pagesIT in Accounting and FinanceHarshk JainNo ratings yet

- The Buyers' Guide To: Financial Management SoftwareDocument32 pagesThe Buyers' Guide To: Financial Management SoftwareRoland ValNo ratings yet

- Apogee ERP Solution Overview of All Modules and SmartVision Tools With New LogosDocument45 pagesApogee ERP Solution Overview of All Modules and SmartVision Tools With New LogosWuilmerNo ratings yet

- Accounting Information System Customer Master DataDocument15 pagesAccounting Information System Customer Master DataFatimatus ZehrohNo ratings yet

- Lets Not Fear ERP, Fear Lack of ERPDocument16 pagesLets Not Fear ERP, Fear Lack of ERPyogesh patilNo ratings yet

- Accounting PackageDocument21 pagesAccounting PackageSha dowNo ratings yet

- Related LiteratureDocument6 pagesRelated LiteratureCarelyn Grace MonserateNo ratings yet

- SystemsDocument4 pagesSystemsJenyl Mae NobleNo ratings yet

- Computerized Accounting-An IntroductionDocument15 pagesComputerized Accounting-An IntroductionpalpitopitooNo ratings yet

- Accounting in Tally PrimeDocument5 pagesAccounting in Tally PrimeNiladri SenNo ratings yet

- FRSA Activity No 1Document3 pagesFRSA Activity No 1Chhaya bardia 8005No ratings yet

- PRe 6 MaterialsDocument15 pagesPRe 6 MaterialsV-Heron BanalNo ratings yet

- Company Profile 032019 (Autosaved)Document23 pagesCompany Profile 032019 (Autosaved)ePeople ManpowerNo ratings yet

- Integrated Accounting SystemDocument12 pagesIntegrated Accounting SystemManmeet RajputNo ratings yet

- SAINT LOUIS UNIVERSITY PRODUCT IDEA ANALYSISDocument6 pagesSAINT LOUIS UNIVERSITY PRODUCT IDEA ANALYSISFlorenzOpingaNo ratings yet

- Computerizedapplicationsinaccounting 150725070105 Lva1 App6891Document15 pagesComputerizedapplicationsinaccounting 150725070105 Lva1 App6891Aabid NaikNo ratings yet

- AccountingDocument11 pagesAccountingPg HandmadesNo ratings yet

- Revenue Cycle Activities ExplainedDocument6 pagesRevenue Cycle Activities ExplainedSamonte JemimahNo ratings yet

- 6 Module VI Recent TrendsDocument14 pages6 Module VI Recent TrendsIsha kaleNo ratings yet

- Product Sap Vim Product OverviewDocument2 pagesProduct Sap Vim Product OverviewHarshaNo ratings yet

- Financials Management With SAP Business OneDocument4 pagesFinancials Management With SAP Business OneTariq RajputNo ratings yet

- Qdoc - Tips - PHP and Mysql Project On Invoice Management SystemDocument119 pagesQdoc - Tips - PHP and Mysql Project On Invoice Management SystemREDNo ratings yet

- Accounts Receivable Process Optimization ProjectDocument28 pagesAccounts Receivable Process Optimization ProjectbarbarabolognesiNo ratings yet

- Chapter Four Accounting SystemsDocument7 pagesChapter Four Accounting SystemsMathewos Woldemariam Birru100% (2)

- DS Revenue ManagementDocument3 pagesDS Revenue ManagementJorge CespedesNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- Unit 3: Internal Control Over CashDocument10 pagesUnit 3: Internal Control Over CashBereket DesalegnNo ratings yet

- ZTBL ProjectDocument41 pagesZTBL Projectshahab_8585100% (1)

- Pay1 Internship Program: Business AnalyticsDocument1 pagePay1 Internship Program: Business Analyticstest twotestNo ratings yet

- Treasury ManagementDocument10 pagesTreasury Managementrakeshrakesh1No ratings yet

- St. Augustine University of Tanzania P.O. BOX 307 Mwanza, TanzaniaDocument5 pagesSt. Augustine University of Tanzania P.O. BOX 307 Mwanza, TanzaniaNdomba YonasNo ratings yet

- History of Banking IndustryDocument7 pagesHistory of Banking IndustryKimberly PasaloNo ratings yet

- Accounting MCQsDocument7 pagesAccounting MCQssaeedqk100% (7)

- BOCDownload 23 5 202213 20 40Document2 pagesBOCDownload 23 5 202213 20 40Bhagya PereraNo ratings yet

- SBI PO recruitment result 2014Document4 pagesSBI PO recruitment result 2014शेरसिंह खदावNo ratings yet

- Matt Lockwood Resume 2019Document1 pageMatt Lockwood Resume 2019api-483115033No ratings yet

- The Burma Code Vol-5Document465 pagesThe Burma Code Vol-5kerrypwlNo ratings yet

- Policy 9Document27 pagesPolicy 9sachinash664No ratings yet

- Loans and Deposits ExplainedDocument8 pagesLoans and Deposits ExplainedVsgg NniaNo ratings yet

- A. P. (DIR Series) Circular No.109 Dated June 11, 2013 A.P. (DIR Series) Circular No.17 Dated November 16, 2010Document5 pagesA. P. (DIR Series) Circular No.109 Dated June 11, 2013 A.P. (DIR Series) Circular No.17 Dated November 16, 2010vikalp123123No ratings yet

- Report of Islamic Banking Product DevelopmentDocument3 pagesReport of Islamic Banking Product DevelopmenttisuchiNo ratings yet

- MCFP Cases Projects AssignmentDocument3 pagesMCFP Cases Projects AssignmentNaveen K. JindalNo ratings yet

- Miller and ZhangDocument25 pagesMiller and ZhangChaman TulsyanNo ratings yet

- Chapter 18 Derivatives and Risk Management No CoverDocument85 pagesChapter 18 Derivatives and Risk Management No CoverVenn Bacus RabadonNo ratings yet

- FL Bar Rules On Trust Account Records 5-1.2 - AttorneyDocument5 pagesFL Bar Rules On Trust Account Records 5-1.2 - AttorneygoentrustNo ratings yet

- Stm-Question BDocument8 pagesStm-Question BfelistasNo ratings yet

- STS - Form - Rawal Junejo - 4110527324773Document3 pagesSTS - Form - Rawal Junejo - 4110527324773alijahanzeb749No ratings yet

- Risk Management in Microfinance InstitutionsDocument16 pagesRisk Management in Microfinance InstitutionsMubeen ShaikhNo ratings yet