Professional Documents

Culture Documents

Accounting Concepts

Uploaded by

Vinayak SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Concepts

Uploaded by

Vinayak SharmaCopyright:

Available Formats

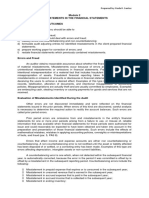

Accounting Concepts

1. Business entity concept: A business and its owner should

be treated separately as far as their financial transactions are

concerned.

best example would be placing profit under the head liabilities this is done because profit is

the amount owed by the business to its rightful owner, i.e. the Proprietor.

2. Money measurement concept: Only business

transactions that can be expressed in terms of money are

recorded in accounting, though records of other types of

transactions may be kept separately.

Example: Retirement of a great manager from a department cannot be entered in the financial

statements as it does not amount to any money related transaction.

3. Dual aspect concept: For every credit, a corresponding

debit is made. The recording of a transaction is complete only

with this dual aspect.

Example, M/s Vinayak purchases good (i.e. raw materials for the business) for cash, then in the

books of accounts Raw materials a/c is debited and cash a/c is credited. (Focus only on the 2-

sided aspect of the transaction, do not care for what gets debited or credited as that comes

later.)

4. Going concern concept: In accounting, a business is

expected to continue for a fairly long time and carry out its

commitments and obligations. This assumes that the business

will not be forced to stop functioning and liquidate its assets at

fire-sale prices.

This is the main reason for segregating assets and liabilities into fixed or current and also to

charge depreciation, because we believe that the business will continue for a foreseeable future

and therefore any benefits/losses derived from it should be evenly distributed through the

whole period.

5. Cost concept: The fixed assets of a business are recorded

on the basis of their original cost in the first year of

accounting. Subsequently, these assets are recorded minus

depreciation. No rise or fall in market price is taken into

account. The concept applies only to fixed assets.

The books of accounts are not bothered with the market condition of the assets of the business

(unless special circumstances). Therefore, suppose we buy a machine for 10,000 then the

machine should be recorded at 10,000 and depreciated every period on the same value.

6. Accounting year concept: Each business chooses a

specific time period to complete a cycle of the accounting

processfor example, monthly, quarterly, or annuallyas per

a fiscal or a calendar year.

7. Matching concept: This principle dictates that for every

entry of revenue recorded in a given accounting period, an

equal expense entry has to be recorded for correctly

calculating profit or loss in a given period.

8. Realisation concept: According to this concept, profit is

recognised only when it is earned. An advance or fee paid is

not considered a profit until the goods or services have been

delivered to the buyer.

V. Imp. According to accounts, any gain/income will only be recorded once we have earned it.

E.g. Business receives a huge advance payment in January, for a contract that is to be ended in May,

then that income will not be recognised as income until May, when the contract is complete.

However, to acknowledge the receipt of cash, the advance payment will be placed under liabilities as

prepaid income.

Accounting Conventions

There are four main conventions in practice in accounting: conservatism;

consistency; full disclosure; and materiality.

Conservatism is the convention by which, when two values of a

transaction are available, the lower-value transaction is recorded. By this

convention, profit should never be overestimated, and there should always

be a provision for losses.

In simple words, expected losses are losses, but expected gains are not gains.

Any liability that we may face, will be recorded in the books even before it has occurred (if we know

about it happening)

For example, Taxes or Payment of any penalty on late payment of taxes would be recorded in

advance, even if they havent been paid to the government yet.

However, if there is a court case against us, in which we have a 90% chance to win and receive

90,000 as compensation, we will not record it unless we actually receive it.

Consistency prescribes the use of the same accounting principles from

one period of an accounting cycle to the next, so that the same standards

are applied to calculate profit and loss.

Consistency is in terms of the process you choose for accounting. For example, if a business is

depreciating assets on the original value at 10%, then it should continue on the same process of

depreciation for future period as well.

Materiality means that all material facts should be recorded in

accounting. Accountants should record important data and leave out

insignificant information.

Materiality is a classification of information which is significant enough to change the opinion of

stakeholders. Such information should be mentioned. If its not in terms of money, then it should be

mentioned in notes of accounts the company (working notes).

E.g. taking the example of the retiring CEO, such information is material and therefore should be

mentioned in the notes of accounts.

Full disclosure entails the revelation of all information, both favourable and detrimental to

a business enterprise, and which are of material value to creditors and debtors.

It basically is the continuation of previous one, and it add that it is necessary to disclose all material

information. Withholding info is unethical and illegal.

Basic Accounting Terms

Here is a quick look at some important accounting terms.

Accounting equation: The accounting equation, the basis for the

double-entry system (see below), is written as follows:

Assets = Liabilities + Stakeholders equity

This means that all the assets owned by a company have been financed

from loans from creditors and from equity from investors. Assets here

stands for cash, account receivables, inventory, etc., that a company

possesses.

Accounting methods: Companies choose between two methodscash

accounting or accrual accounting. Under cash basis accounting, preferred

by small businesses, all revenues and expenditures at the time when

payments are actually received or sent are recorded. Under accrual basis

accounting, income is recorded when earned and expenses are recorded

when incurred.

Account receivable: The sum of money owed by your customers after

goods or services have been delivered and/or used.

Account payable: The amount of money you owe creditors, suppliers,

etc., in return for goods and/or services they have delivered.

Accrual accounting: See accounting methods.

Assets (fixed and current): Current assets are assets that will be

used within one year.

For example, cash, inventory, and accounts receivable (see above).

Fixed assets (non-current) may provide benefits to a company for more

than one yearfor example, land and machinery.

Balance sheet: A financial report that provides a gist of a companys

assets and liabilities and owners equity at a given time.

Capital: A financial asset and its value, such as cash and goods. Working

capital is current assets minus current liabilities.

Cash accounting: See accounting methods.

Cash flow statement: The cash flow statement of a business shows the

balance between the amount of cash earned and the cash expenditure

incurred.

Credit and debit: A credit is an accounting entry that either increases a

liability or equity account, or decreases an asset or expense account. It is

entered on the right in an accounting entry. A debit is an accounting entry

that either increases an asset or expense account, or decreases a liability or

equity account. It is entered on the left in an accounting entry.

Double-entry bookkeeping: Under double-entry bookkeeping, every

transaction is recorded in at least two accountsas a credit in one account

and as a debit in another.

For example, an automobile repair shop that collects Rs. 10,000 in cash

from a customer enters this amount in the revenue credit side and also in

the cash debit side. If the customer had been given credit, account

receivable (see above) would have been used instead of cash. (Also see

single-entry bookkeeping, below.)

Financial statement: A financial statement is a document that reveals

the financial transactions of a business or a person. The three most

important financial statements for businesses are the balance sheet, cash

flow statement, and profit and loss statement (all three listed here

alphabetically).

General ledger: A complete record of financial transactions over the

life of a company.

Journal entry: An entry in the journal that records financial transactions

in the chronological order.

Profit and loss statement (income statement): A financial

statement that summarises a companys performance by

reviewing revenues, costs and expenses during a specific period.

Single-entry bookkeeping: Under the single-entry bookkeeping,

mainly used by small or businesses, incomes and expenses are recorded

through daily and monthly summaries of cash receipts and disbursements.

(Also see double-entry bookkeeping, above.)

Types of accounting: Financial accounting reports information about

a companys performance to investors and credits.

Management accounting provides financial data to managers for business

development.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Theory Questions 5 PDF FreeDocument5 pagesTheory Questions 5 PDF FreeSamsung AccountNo ratings yet

- Course Title: Audit Course ID: ACN403 Section: 02 Assignment OnDocument12 pagesCourse Title: Audit Course ID: ACN403 Section: 02 Assignment OnIbn ShuraimNo ratings yet

- Social Responsibility Accounting: A Conceptual Framework For Universal AcceptanceDocument7 pagesSocial Responsibility Accounting: A Conceptual Framework For Universal AcceptancePritee SinghNo ratings yet

- Multiparadigm AccDocument20 pagesMultiparadigm AccJasmine VianaNo ratings yet

- 02-IAS 12 Income TaxesDocument42 pages02-IAS 12 Income TaxesHaseeb Ullah KhanNo ratings yet

- Test 10 - Problem 1Document4 pagesTest 10 - Problem 1YhamNo ratings yet

- Wk14 Summary Quizzer 2 - Set BDocument5 pagesWk14 Summary Quizzer 2 - Set Bmariesteinsher0No ratings yet

- Chapter One: Cost Management and StrategyDocument35 pagesChapter One: Cost Management and Strategymeliana100% (2)

- Accounts FinalDocument28 pagesAccounts FinalSatyam SinghNo ratings yet

- Riyadh Final PB Far 2019Document17 pagesRiyadh Final PB Far 2019jhaizonNo ratings yet

- CFO Controller VP Finance in Tulsa OK Resume Victoria DeBoefDocument2 pagesCFO Controller VP Finance in Tulsa OK Resume Victoria DeBoefVictoriaDeBoefNo ratings yet

- Quiz 1 Audtheo PDFDocument5 pagesQuiz 1 Audtheo PDFCharlen Relos GermanNo ratings yet

- Why Auditing Is NecessaryDocument15 pagesWhy Auditing Is NecessaryRiya Das RdNo ratings yet

- Basic Financial AccountingDocument118 pagesBasic Financial AccountingSaleem Javed100% (1)

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- BAB 7 Cash Flow AnalyisisDocument19 pagesBAB 7 Cash Flow AnalyisisMaun GovillianNo ratings yet

- 4 - Auditing MCQ 50Document23 pages4 - Auditing MCQ 50Muhammad Hamid100% (1)

- Accounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions ManualDocument36 pagesAccounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions Manualgauntreprovalaxdjx100% (25)

- PWC Vietnam Contact Book 2016 enDocument13 pagesPWC Vietnam Contact Book 2016 enThang Nguyen100% (1)

- Auditing and Assurance Services Louwers 4th Edition Solutions ManualDocument27 pagesAuditing and Assurance Services Louwers 4th Edition Solutions ManualKenneth EbertNo ratings yet

- IGCSE Parent Orientation 2022-23Document80 pagesIGCSE Parent Orientation 2022-23Jay SharmaNo ratings yet

- Chapter 7Document8 pagesChapter 7Roann Bargola60% (5)

- AC10 - Anh Van CN - KT1Document23 pagesAC10 - Anh Van CN - KT1Do Ngoc NhiNo ratings yet

- Financial Accounting - IIDocument4 pagesFinancial Accounting - IIPadmini VasanthNo ratings yet

- 222Document1 page222parhNo ratings yet

- M Acc Spring 2017Document383 pagesM Acc Spring 2017Awais MehmoodNo ratings yet

- English For The Financial Sector Intermediate Teachers Book FrontmatterDocument10 pagesEnglish For The Financial Sector Intermediate Teachers Book FrontmatterPS Lee0% (3)

- Accounting ChangesDocument5 pagesAccounting ChangesShielle AzonNo ratings yet

- Raviteja Bodi: Mobile: 9441106105Document3 pagesRaviteja Bodi: Mobile: 9441106105b.ravitejaNo ratings yet

- Internship Reflective ReportDocument26 pagesInternship Reflective ReportTan C Chi0% (1)