Professional Documents

Culture Documents

AUG-10 Mizuho Technical Analysis EUR USD

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUG-10 Mizuho Technical Analysis EUR USD

Uploaded by

Miir ViirCopyright:

Available Formats

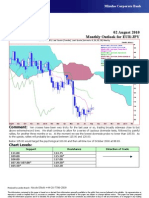

Mizuho Corporate Bank

Technical Analysis 10 August 2010

EUR

EUR=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

29Apr10 - 15Sep10

Pr

EUR=EBS , Last Quote, Candle

10Aug10 1.3221 1.3233 1.3135 1.3162

EUR=EBS , Last Quote, Tenkan Sen 9 1.34

10Aug10 1.3156

EUR=EBS , Last Quote, Kijun Sen 26

10Aug10 1.2907 1.33

EUR=EBS , Last Quote, Senkou Span(a) 52

14Sep10 1.3031 1.32

EUR=EBS , Last Quote, Senkou Span(b) 52

14Sep10 1.2605

EUR=EBS , Last Quote, Chikou Span 26 1.31

06Jul10 1.3162

1.3

1.29

1.28

1.27

1.26

1.25

1.24

1.23

1.22

1.21

1.2

1.19

03May10 10May 17May 24May 31May 07Jun 14Jun 21Jun 28Jun 05Jul 12Jul 19Jul 26Jul 02Aug 09Aug 16Aug 23Aug 30Aug 06Sep 13Sep

Comment: Having clambered back up to where we were at the beginning of May it is possible that we will

take a small breather this week. Let’s see if the 9-day moving average helps prop it up as the 26-day one is quite a

lot lower. The Euro is no longer overbought against the dollar but there are a raft of resistance levels between

1.3300 and 1.3800.

Strategy: Attempt longs 1.3155; stop well below 1.3100. First target 1.3230, then 1.3330.

Chart Levels:

Support Resistance Direction of Trade

1.3135 1.3233

1.3119 1.3262

1.3035 1.3334*

1.2980 1.3365

1.2950 1.3420

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Working Capital Management at Padmavathi Co-operative BankDocument53 pagesWorking Capital Management at Padmavathi Co-operative BankMamidishetty Manasa67% (3)

- The Issue of Body ShamingDocument4 pagesThe Issue of Body ShamingErleenNo ratings yet

- Transactionreceipt Ethereum: Transaction IdentifierDocument1 pageTransactionreceipt Ethereum: Transaction IdentifierVALR INVESTMENTNo ratings yet

- School readiness assessmentDocument10 pagesSchool readiness assessmentJave Gene De AquinoNo ratings yet

- BCMEDocument9 pagesBCMEVenkateshwaran VenkyNo ratings yet

- Acl Data Analytics EbookDocument14 pagesAcl Data Analytics Ebookcassiemanok01No ratings yet

- HOW To Use Jmeter To Load Test T24Document27 pagesHOW To Use Jmeter To Load Test T24Hiếu KoolNo ratings yet

- Edtpa Lesson Plan 1Document3 pagesEdtpa Lesson Plan 1api-364684662No ratings yet

- Analog Communication Interview Questions and AnswersDocument34 pagesAnalog Communication Interview Questions and AnswerssarveshNo ratings yet

- UNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMDocument1 pageUNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMAlejandro PortoNo ratings yet

- Demo TeachingDocument22 pagesDemo TeachingCrissy Alison NonNo ratings yet

- Aemses Sof Be LCP 2021 2022Document16 pagesAemses Sof Be LCP 2021 2022ROMEO SANTILLANNo ratings yet

- Encrypt and decrypt a file using AESDocument5 pagesEncrypt and decrypt a file using AESShaunak bagadeNo ratings yet

- Nurses Week Program InvitationDocument2 pagesNurses Week Program InvitationBenilda TuanoNo ratings yet

- Analysis I - SyllabusDocument3 pagesAnalysis I - SyllabusJUan GAbrielNo ratings yet

- LSAP 423 Tech Data 25kVA-40KVA - 3PH 400VDocument1 pageLSAP 423 Tech Data 25kVA-40KVA - 3PH 400Vrooies13No ratings yet

- KOREADocument124 pagesKOREAchilla himmudNo ratings yet

- IRC-114-2013 Use of Silica Fume in Rigid PavementDocument14 pagesIRC-114-2013 Use of Silica Fume in Rigid PavementZakee MohamedNo ratings yet

- Database Case Study Mountain View HospitalDocument6 pagesDatabase Case Study Mountain View HospitalNicole Tulagan57% (7)

- System Bus in Computer Architecture: Goran Wnis Hama AliDocument34 pagesSystem Bus in Computer Architecture: Goran Wnis Hama AliGoran WnisNo ratings yet

- Etoposide JurnalDocument6 pagesEtoposide JurnalShalie VhiantyNo ratings yet

- Single-phase half-bridge inverter modes and componentsDocument18 pagesSingle-phase half-bridge inverter modes and components03 Anton P JacksonNo ratings yet

- CFC KIDS FOR CHRIST 2020 FINAL EXAMDocument13 pagesCFC KIDS FOR CHRIST 2020 FINAL EXAMKaisser John Pura AcuñaNo ratings yet

- Assurance Audit of Prepaid ExpendituresDocument7 pagesAssurance Audit of Prepaid ExpendituresRatna Dwi YulintinaNo ratings yet

- Limit Switch 1LX7001-J AZBILDocument8 pagesLimit Switch 1LX7001-J AZBILHoàng Sơn PhạmNo ratings yet

- Booklet English 2016Document17 pagesBooklet English 2016Noranita ZakariaNo ratings yet

- The Seven Seals of Revelation and The SevenDocument14 pagesThe Seven Seals of Revelation and The Sevenyulamula100% (2)

- Lesson Plan Garbage Gym GameDocument3 pagesLesson Plan Garbage Gym Gameapi-272479731No ratings yet

- Fci FC CotsDocument25 pagesFci FC CotsMatthew DuNo ratings yet

- 1ST Periodical Test ReviewDocument16 pages1ST Periodical Test Reviewkaren rose maximoNo ratings yet