Professional Documents

Culture Documents

AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EUR

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EUR

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

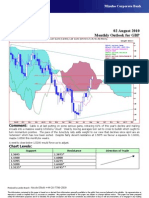

Weekly Technical Commentary 09 August 2010

Links: http://www.mizuho-sc.com/ Bloomberg Page: MIZH Website: http://www.mizuho-cb.co.uk/

GBP/USD Chart Levels: Support 1.5800..1.5700..1.5565..1.5400. Resistance 1.6000..1.6225..1.6300..1.6500.

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Weekly

01Aug09 - 15Feb11 This week This month

Pr

GBP=D3 , Last Quote, Candle

1.7

15Aug10 1.5975 1.5998 1.5931 1.5944

GBP=D3 , Last Quote, Tenkan Sen 9

15Aug10 1.5272 1.68

GBP=D3 , Last Quote, Kijun Sen 26

15Aug10 1.5114

GBP=D3 , Last Quote, Senkou Span(a) 52

06Feb11 1.5193

1.66 A sterling performance as Cable retraces all of

GBP=D3 , Last Quote, Senkou Span(b) 52

06Feb11 1.5554 1.64

the loses since early February, over 61% of the

decline since November 2008, testing the top of

GBP=D3 , Last Quote, Chikou Span 26

21Feb10 1.5944

1.62

a very large weekly Ichimoku ‘cloud’ and the

1.6

psychological level at 1.6000. Nine and twenty-

six week moving averages have crossed to a

61.8

1.58

1.56

long position which should help push this pair up

50.0

to our next upside target at 1.6500 seeing as

1.54

38.2

bullish momentum is stronger than it has been

1.52

in a year. Cable is overbought though, yet one-

1.5 month at-the-money implied volatility is only

1.48 fractionally higher than its long term mean at

1.46

8.80%. More short-covering is likely to emerge

soon. Note that important long term resistance

1.44

lies between 1.6800 and 1.7000 and only above

1.42 here will serious fretting start.

Sep09 Oct Nov Dec Jan10 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan11 Feb

EUR/GBP Chart Levels: Support 0.8250..0.8180..0.8100..0.8065. Resistance 0.8415..0.8465..0.8535..0.8600.

EURGBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Weekly

30Nov08 - 30Jan11 This week This month

Pr

EURGBP=D3 , Last Quote, Candle 0.98

01Aug10 0.83630 0.83810 0.83245 0.83275

EURGBP=D3 , Last Quote, Tenkan Sen 9 0.97

01Aug10 0.83000

EURGBP=D3 , Last Quote, Kijun Sen 26 0.96

01Aug10 0.86085

EURGBP=D3 , Last Quote, Senkou Span(a) 52

0.95

Consolidating in neat little ranges at some of the

lowest levels since Lehman’s collapse in 2008.

23Jan11 0.84543

EURGBP=D3 , Last Quote, Senkou Span(b) 52

23Jan11 0.87400 0.94

EURGBP=D3 , Last Quote, Chikou Span 26

07Feb10 0.83275 0.93

Prices remain in the narrow ‘channel’ with July’s

0.92

small ‘spike high’ at 0.8532 possibly marking a

0.91

new interim high point. Weekly moving

0.9

averages still point to a short position so over

0.89

the next week and maybe the coming month we

0.88

favour consolidation between 0.8067, this year’s

0.87

low, and 0.8500. Then the gentle downtrend

0.86

ought to resume taking the Euro down to

'spike high' 0.85

0.8000 and probably 0.7800 some time in the

0.84

autumn. Note the lower edge of the weekly

0.83

‘cloud’ starts dropping mid-October so hopefully

0.82

by the sterling will start holding clearly below

0.81

the pivotal 0.8400 area. A weekly close above

0.8 0.8700 would be very worrying.

Dec08 Jan09 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan10 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan11

Produced by London Branch - Nicole Elliott +44-20-7786-2509 (email: Nicole.Elliott@mhcb.co.uk)

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ce Digital Banking Maturity Study EmeaDocument30 pagesCe Digital Banking Maturity Study EmeaRajeevNo ratings yet

- Coastal Pacific Trading Inc. v. Southern Rolling Mills Co., Inc.Document36 pagesCoastal Pacific Trading Inc. v. Southern Rolling Mills Co., Inc.arsalle2014No ratings yet

- Telekom Bill: Page 1 of 6Document6 pagesTelekom Bill: Page 1 of 6Zulkhibri ZulNo ratings yet

- Back Office SerivceDocument172 pagesBack Office SerivceAbhijith Pai100% (2)

- Building an Islamic Venture Capital ModelDocument12 pagesBuilding an Islamic Venture Capital ModelNader MehdawiNo ratings yet

- Introduction To T24 - Treasury - R10.1Document34 pagesIntroduction To T24 - Treasury - R10.1Gnana Sambandam50% (2)

- Banking Theory Law & Practice GuideDocument22 pagesBanking Theory Law & Practice GuidePraveen CoolNo ratings yet

- Treasury BillsDocument11 pagesTreasury BillspoojaNo ratings yet

- Canara Bank OfficersDocument2,524 pagesCanara Bank Officerssaurs283% (6)

- Interim Statement 10-Mar-2023 12-25-49Document2 pagesInterim Statement 10-Mar-2023 12-25-49zani arslanNo ratings yet

- Homework #1: Nguyen Xuan Thanh Strategy division-TCBDocument2 pagesHomework #1: Nguyen Xuan Thanh Strategy division-TCBThanh NguyenNo ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- Statement DEC2022 265757521Document6 pagesStatement DEC2022 265757521Ranjit LengureNo ratings yet

- Supplemental Budget No. 3, Series 2016 PDFDocument2 pagesSupplemental Budget No. 3, Series 2016 PDFSheena Valenzuela100% (1)

- Citi Summer Internship Experience Iim LucknowDocument3 pagesCiti Summer Internship Experience Iim LucknowBibaswan Banerjee100% (1)

- Can you get a refund of stamp duty paid in MaharashtraDocument3 pagesCan you get a refund of stamp duty paid in MaharashtrafakesNo ratings yet

- Fabm 2-9Document27 pagesFabm 2-9Janine Balcueva100% (3)

- Interest Free BankingDocument19 pagesInterest Free BankingSameer ShafqatNo ratings yet

- Manual Google SitesDocument28 pagesManual Google SitesAntonio DelgadoNo ratings yet

- Games v. Allied BankingDocument8 pagesGames v. Allied BankingRoan HabocNo ratings yet

- Kerala Govt Raises House Building Loan Limit to Rs. 25 LakhDocument2 pagesKerala Govt Raises House Building Loan Limit to Rs. 25 LakhnarenczNo ratings yet

- Philippine Postal Corporation Notes To Financial Statements 1. Agency ProfileDocument15 pagesPhilippine Postal Corporation Notes To Financial Statements 1. Agency ProfileJD BallosNo ratings yet

- Banking ChicagoDocument2 pagesBanking ChicagoIsrael ZepahuaNo ratings yet

- Bank Credit Instruments-Fm122Document27 pagesBank Credit Instruments-Fm122Jade Solante Cervantes100% (1)

- Open an Individual Tier III AccountDocument7 pagesOpen an Individual Tier III AccountHenry SimsNo ratings yet

- WIHCON Road To Homeownership EbookDocument9 pagesWIHCON Road To Homeownership EbookAnn VictoriaNo ratings yet

- Know Your MoneyDocument3 pagesKnow Your MoneyGary DetmanNo ratings yet

- Zain - Management TeamDocument2 pagesZain - Management TeamalbidaiaNo ratings yet

- 1 - GREPA v. CA G.R. No. 113899 October 13, 1999Document2 pages1 - GREPA v. CA G.R. No. 113899 October 13, 1999Emrico CabahugNo ratings yet

- BPI Capital Audited Financial StatementsDocument66 pagesBPI Capital Audited Financial StatementsGes Glai-em BayabordaNo ratings yet