Professional Documents

Culture Documents

Midterm Exam FABM 2

Uploaded by

Vee Ma100%(2)100% found this document useful (2 votes)

751 views2 pagesdddd

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

751 views2 pagesMidterm Exam FABM 2

Uploaded by

Vee Madddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

THE HOLY LADY ACADEMY

Network Ave., Meralco Village, Lias, Marilao, Bulacan

S.Y. 2017-2018

MIDTERM EXAMINATION

in FUNDAMENTALS OF ACCOUTANCY, BUSINESS, AND MANAGEMENT 2

Grade 12

Name: _______________________________________ Score:_______________

Date :___________________Grade : _________________ Teacher: Ms. Benny B. Carpio

I. STATEMENT OF CHANGES IN EQUITY

There are three basic forms of business organizations, namely:

A. Corporation B. Partnership C. Sole Proprietorship

Choose your answer from the three basic forms of business organizations, and write the letter of the

correct answer on the space before the number.

________1. Allocation of net income is unique.

________2. It is managed by professional managers.

________3. Oftentimes, the owner is also a manager.

________4. It is owned by stockholders or shareholders.

________5. It is a business owned by two or more owners.

________6. It has legal personality separate from its owners.

________7. It is the simplest form of a business organization.

________8. The SFP and SoCE will present one capital account.

________9. It is the most complex form of business organization.

________10. There is allocating the net income to thousands of fast moving shareholders.

Answer the following questions correctly and properly.

PROBLEM #1: BBC STORE: SOLE PROPRIETORSHIP (15 points)

Belen Castro is the owner of the BBC Store. The store was established on January 1, 20xA. Belen

deposited 20,000.00PHP to a bank account in the name of BBC Store. She made four more deposits of

1,500.00PHP each during the year from her personal account. The store generated net income of

42,385.00PHP in 20xA. Belen regularly withdraws 2,000.00PHP per month from the stores banl

K account for her personal experience.

1. Determine the 20xA year-end balance of Belen Castro Drawings account.

2. Prepare a Statement of Changes in Equity for the year-ended December 31,20xA.

PROBLEM #2: PARTNERSHIP (25 points)

The NOR Partnership was established 20xC. The partners, Nick, Oscar, and Rene have January 1, 20xD

outstanding capital balances of 43,250.00PHP, 42,350.00PHP, and 45,550PHP respectively. Nick

contributed 20,000.00PHP, Oscar also contributed 18,000.00PHP, and Rene for 16,000.00 during 20xD.

The 20xD year-end balances of each partners Drawings account are as follows: Nick 10,000.00PHP,

Oscar 12,000.00PHP, and Rene 15,000.00PHP. The partnership generated net income of

110,000.00PHP in 20xD. According to the partnership agreement, the profit and loss sharing ratios are

as follows: 25%, 40%, and 35% for Nick, Oscar, and Rene.

1. Prepare the 20xD Statement Of Changes In Equity of NOR Partnership.

II. STATEMENT OF CASH FLOWS

1. What is a Statement of Cash Flow?(5 points)

2. T-account of Cash of BBC Company (15 points)

CASH bills

DEBIT CREDIT

January 1, 20x5 280,000PHP 1/28 Payment To Suppliers 65,000

1/15 Cash from cash sales 2,000 2/26 Payment Of Utility Bills 8. 368

2/16 Collection of AR 23,000 3/16Payment to employees 75,000

3/24 Cash from cash sales 3,500 4/15 Acquisition of computers 45,000

4/15 Collection of AR 33,000 5/12 Rent payments 26,000

5/20Additional contribution from 6/01 Payment to suppliers 10,000

Owner 76,500 7/05 Loan payment 15,000

6/15 Collection of AR 85,000 8/12 Interest payment 8,500

7/12Proceeds from bank borrowing 225,000 9/14 Owners drawing 3,800

8/15 Collection of AR 2 8,000

9/16 Cash from cash sales 8,000

10/12 Collection of AR 12,000

11/15 Collection of AR 18,000

Total Debit Total Credit

December 31, 20x5

3. Prepare the Statement of Cash Flow by re-arranging and classifying the transactions in the cash T-

account. (30 points)

You might also like

- FABM 1-Answer Sheet-Q1 - Summative TestDocument2 pagesFABM 1-Answer Sheet-Q1 - Summative TestFlorante De Leon100% (1)

- FABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessDocument20 pagesFABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessrioNo ratings yet

- Teachers-Learning-Guide - FABM1Document11 pagesTeachers-Learning-Guide - FABM1Lee Cerna100% (1)

- Preliminary Exam (Fabm1)Document4 pagesPreliminary Exam (Fabm1)Zybel RosalesNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (Q4W5-7)Document6 pagesFundamentals of Accountancy, Business and Management 1 (Q4W5-7)tsuki100% (1)

- Summative Exam I Answer Key (Fabm)Document5 pagesSummative Exam I Answer Key (Fabm)jelay agresorNo ratings yet

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- FABM1 4th Quarter Summative ExamDocument4 pagesFABM1 4th Quarter Summative ExamRizaphel J SalemNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- Summative Test-FABM2 2018-19Document3 pagesSummative Test-FABM2 2018-19Raul Soriano Cabanting0% (1)

- Accounting TransactionsDocument6 pagesAccounting TransactionsCelyn DeañoNo ratings yet

- Performance Task Week 5Document2 pagesPerformance Task Week 5nats pamplonaNo ratings yet

- Accounting PrincipleDocument28 pagesAccounting PrincipleAlyssa Nikki Versoza100% (1)

- Abm ExercisesDocument2 pagesAbm Exercisesgerett mendez100% (6)

- Abm1: Fundamentals of Accountancy, Business and Management 1 Prelim ExamDocument7 pagesAbm1: Fundamentals of Accountancy, Business and Management 1 Prelim ExamRene Dacua PalabricaNo ratings yet

- Fabm 1Document7 pagesFabm 1Phia Vhianna RamirezNo ratings yet

- Financial Statements RubricsDocument1 pageFinancial Statements RubricsMylene SantiagoNo ratings yet

- Fundamentals of SFP ElementsDocument33 pagesFundamentals of SFP ElementsAbyel Nebur100% (2)

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document12 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)trek boiNo ratings yet

- Accounting Cycle of A Service Business: Chapter 10-11Document2 pagesAccounting Cycle of A Service Business: Chapter 10-11des marzanNo ratings yet

- Fabm ExamDocument3 pagesFabm ExamRonald AlmagroNo ratings yet

- Books of Accounts RecordsDocument8 pagesBooks of Accounts RecordsMylene SantiagoNo ratings yet

- Diagnostic Test: Fundamental of Accounting Business & Management 1Document2 pagesDiagnostic Test: Fundamental of Accounting Business & Management 1Dindin Oromedlav Lorica100% (3)

- 8 Accounting Books Journal and LedgersDocument17 pages8 Accounting Books Journal and LedgersJc Coronacion100% (3)

- Lesson Title: Most Essential Learning Competencies (Melcs)Document4 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda Tumbaga100% (2)

- Performance Task IIDocument3 pagesPerformance Task IIJomar VillenaNo ratings yet

- The Accounting EquationDocument5 pagesThe Accounting EquationHuskyNo ratings yet

- Performance Task FOR Business Finance: Submitted byDocument6 pagesPerformance Task FOR Business Finance: Submitted byLileth Anne Panghulan Viduya100% (1)

- FABM1 Q4 Module 14Document15 pagesFABM1 Q4 Module 14Earl Christian BonaobraNo ratings yet

- Learning Activity Sheets Week 2: Applied EconomicsDocument8 pagesLearning Activity Sheets Week 2: Applied EconomicsRodj Eli Mikael Viernes-IncognitoNo ratings yet

- Abm 2 Summative TestDocument1 pageAbm 2 Summative TestSarah Mae Aventurado100% (1)

- Fundamentals of AccountancyDocument9 pagesFundamentals of AccountancyMarlyn LotivioNo ratings yet

- Quarter 1 Week 5 Module 6: Fundamentals of Accountancy, Business and Management 1Document17 pagesQuarter 1 Week 5 Module 6: Fundamentals of Accountancy, Business and Management 1Taj MahalNo ratings yet

- Fundamentals of ABM 1 Week 7Document15 pagesFundamentals of ABM 1 Week 7Jazzmine Ashley Erazo100% (1)

- Grade11 Fabm1 Q2 Week3Document14 pagesGrade11 Fabm1 Q2 Week3Mickaela MonterolaNo ratings yet

- PretestDocument4 pagesPretestRaul Soriano CabantingNo ratings yet

- This Study Resource Was: Module 1. Week 1 Statement of Financial PositionDocument8 pagesThis Study Resource Was: Module 1. Week 1 Statement of Financial PositionVhia Rashelle Galzote100% (1)

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- Second Quarter Test Grade 12: Fundamental of ABM-2Document2 pagesSecond Quarter Test Grade 12: Fundamental of ABM-2manuel hipolito100% (1)

- Module Business Finance Chapter 3Document16 pagesModule Business Finance Chapter 3Atria Lenn Villamiel Bugal100% (1)

- Exam Fabm 2Document27 pagesExam Fabm 2Raquel disomimbaNo ratings yet

- Business Finance-Senior High SchoolDocument54 pagesBusiness Finance-Senior High Schoolmichelle granadoNo ratings yet

- Fabm 1 MidtermsDocument9 pagesFabm 1 MidtermsNicole Dantes100% (1)

- FABM 1 Summative Exam Module 1 and 2Document2 pagesFABM 1 Summative Exam Module 1 and 2faye pgrn100% (1)

- Fundamentals of Accountancy, Business and Management 1 PowerpointDocument11 pagesFundamentals of Accountancy, Business and Management 1 PowerpointIan Bucoya100% (1)

- BUSINESS FINANCE 2nd Quarter AssessmentDocument1 pageBUSINESS FINANCE 2nd Quarter AssessmentPhegiel Honculada MagamayNo ratings yet

- Quarter Examination-FABM 1 SY 2018-2019Document4 pagesQuarter Examination-FABM 1 SY 2018-2019Raul Soriano Cabanting100% (2)

- FABM1 - 1st QuarterDocument9 pagesFABM1 - 1st QuarterRaquel Sibal Rodriguez100% (2)

- Tos Fabm2 First QuarterDocument2 pagesTos Fabm2 First QuarterRojane L. Alcantara100% (1)

- Diagnostic Test 1ST Sem S.Y. 2019 2020fabm 2Document16 pagesDiagnostic Test 1ST Sem S.Y. 2019 2020fabm 2FRANCESNo ratings yet

- ABM - Fundamentals of ABM 1 CGDocument7 pagesABM - Fundamentals of ABM 1 CGKassandra Kay100% (1)

- Fundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Document20 pagesFundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Althea MorseNo ratings yet

- Accounting 3 Fundamentals SyllabusDocument7 pagesAccounting 3 Fundamentals SyllabusAbigail InaoNo ratings yet

- History of Accounting: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document10 pagesHistory of Accounting: Fundamentals of Accountancy, Business and Management 1 (FABM 1)trek boiNo ratings yet

- Fundamentals of Accountancy 1Document2 pagesFundamentals of Accountancy 1Glaiza Dalayoan FloresNo ratings yet

- Fabm2 - Se (2) Answer KeyDocument2 pagesFabm2 - Se (2) Answer Keyl m100% (1)

- Fabm1 - DiagnosticDocument2 pagesFabm1 - Diagnosticar-jay romeroNo ratings yet

- Financial Statement ExampleDocument21 pagesFinancial Statement ExampleLucky MehNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Statement of Cash FlowsDocument28 pagesStatement of Cash FlowsseanakkigNo ratings yet

- Payroll Deduction Authorization FormDocument1 pagePayroll Deduction Authorization FormBernardino Jr Antonio100% (1)

- Pront PageDocument6 pagesPront PageVee MaNo ratings yet

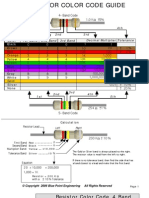

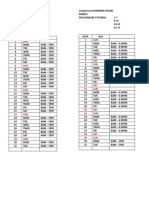

- Resistor ChartsDocument5 pagesResistor ChartsmarlonfatnetzeronetNo ratings yet

- GlueDocument1 pageGlueVee MaNo ratings yet

- Accident ReportDocument1 pageAccident ReportVee MaNo ratings yet

- Employer's Work Accident ReportDocument1 pageEmployer's Work Accident ReportRojohn BermudezNo ratings yet

- Brown and Beige Aesthetic Vintage Group Project PresentationDocument26 pagesBrown and Beige Aesthetic Vintage Group Project PresentationVee MaNo ratings yet

- Regular Working HoursDocument1 pageRegular Working HoursVee MaNo ratings yet

- Sir IkingDocument2 pagesSir IkingVee MaNo ratings yet

- VOUCHER Latest FormatDocument1 pageVOUCHER Latest FormatVee MaNo ratings yet

- English: Quarter 3 - Module 7: Fun With Long /ā/, / Ī /, /ō/, and /ū/ Sounds!Document24 pagesEnglish: Quarter 3 - Module 7: Fun With Long /ā/, / Ī /, /ō/, and /ū/ Sounds!Vee Ma100% (3)

- VOUCHER Latest FormatDocument1 pageVOUCHER Latest FormatVee MaNo ratings yet

- How To Join SSS WebinarDocument13 pagesHow To Join SSS WebinarVee MaNo ratings yet

- Contact TracingDocument2 pagesContact TracingVee MaNo ratings yet

- 02.14.18 EFPS - eGOV Corporate Enrollment Form (CMS-060 (12-17) TMP) - SaveableDocument2 pages02.14.18 EFPS - eGOV Corporate Enrollment Form (CMS-060 (12-17) TMP) - SaveableVee Ma50% (4)

- LegendDocument11 pagesLegendVee MaNo ratings yet

- President - Rodrigo DuterteDocument7 pagesPresident - Rodrigo DuterteVee MaNo ratings yet

- Regular Verbs: Base Form Simple Past Past ParticipleDocument1 pageRegular Verbs: Base Form Simple Past Past ParticipleVee MaNo ratings yet

- Indarapatra and SulaymanDocument3 pagesIndarapatra and SulaymanYnna G Fonacier100% (2)

- Investigatory ProjectDocument1 pageInvestigatory ProjectVee MaNo ratings yet

- The Origin of MaranaoDocument2 pagesThe Origin of MaranaoVee MaNo ratings yet

- The CentipedeDocument4 pagesThe CentipedeDakila Maloy0% (1)

- Batu Belah Batu BertangkupDocument2 pagesBatu Belah Batu BertangkupZnyjean Sophia69% (109)

- From The Day of DestinyDocument5 pagesFrom The Day of DestinyAlthea Roche AdemNo ratings yet

- Makato's Rise from Orphan to KingDocument10 pagesMakato's Rise from Orphan to KingJJ PernitezNo ratings yet

- Active VoiceDocument1 pageActive VoiceVee MaNo ratings yet

- List of Irregular VerbsDocument15 pagesList of Irregular VerbsVee MaNo ratings yet

- The Wedding Dance by Amador DaguioDocument9 pagesThe Wedding Dance by Amador Daguiodnsfrmin81% (27)

- All I Want For Christmas Is YouDocument3 pagesAll I Want For Christmas Is YoujoostNo ratings yet

- White Paper AttritionDocument8 pagesWhite Paper AttritionShiney AbrahamNo ratings yet

- Tanner Tools v16.0 Release NotesDocument14 pagesTanner Tools v16.0 Release NotesPareve SolanoNo ratings yet

- J101 Vocabularywith Kanji F10Document1 pageJ101 Vocabularywith Kanji F10Dong LiNo ratings yet

- GROUP 2 - A Comparative Study of Organic and Conventional FarmingDocument36 pagesGROUP 2 - A Comparative Study of Organic and Conventional Farminganonymous102798No ratings yet

- Dissertation PDFDocument45 pagesDissertation PDFMiguel GarcíaNo ratings yet

- Present Perfect Tense What A Busy Day Esl Reading Comprehension WorksheetDocument3 pagesPresent Perfect Tense What A Busy Day Esl Reading Comprehension WorksheetMari Onofrio100% (2)

- Cognitive Distortions Handout TemplateDocument3 pagesCognitive Distortions Handout TemplateLand Bank CatanauanNo ratings yet

- Zakynthos - Greece enDocument32 pagesZakynthos - Greece ensilversurfer3100% (4)

- The Universal Treatise of Global Economic Common SenseDocument727 pagesThe Universal Treatise of Global Economic Common SenseWilliam E. FieldsNo ratings yet

- Manifesto of Pakistan Awami Tehreek (PAT)Document35 pagesManifesto of Pakistan Awami Tehreek (PAT)MinhajBooksNo ratings yet

- Research Paper Worksheet Middle SchoolDocument5 pagesResearch Paper Worksheet Middle Schoolorotmbbkf100% (1)

- Capital Structure Theories AssumptionsDocument1 pageCapital Structure Theories AssumptionsKamala Kris100% (1)

- Chapter 1 Sample QuestionsDocument3 pagesChapter 1 Sample Questionschristina thearasNo ratings yet

- ASIAN INSTITUTE OF TECHNOLOGY WORK IMMERSION AT RYONAN ELECTRICDocument18 pagesASIAN INSTITUTE OF TECHNOLOGY WORK IMMERSION AT RYONAN ELECTRICAngelo DonesNo ratings yet

- 65° Panel Antenna: General SpecificationsDocument2 pages65° Panel Antenna: General SpecificationsAnnBliss100% (2)

- Mavroidis, Petros C - Trade in Goods - The GATT and The Other Agreements Regulating Trade in GoodsDocument541 pagesMavroidis, Petros C - Trade in Goods - The GATT and The Other Agreements Regulating Trade in GoodsDenny Bhatara100% (1)

- STS PPT Chapter 1 7 PDFDocument405 pagesSTS PPT Chapter 1 7 PDFearl beanscentNo ratings yet

- Contiki RPL TimersDocument7 pagesContiki RPL TimersĐông thành đạiNo ratings yet

- Diocletian Palace Split OrnamentsDocument3 pagesDiocletian Palace Split OrnamentsPandexaNo ratings yet

- Why Red Doesn't Sound Like A Bell - Understanding The Feel of Consciousness (PDFDrive)Document287 pagesWhy Red Doesn't Sound Like A Bell - Understanding The Feel of Consciousness (PDFDrive)Roger13No ratings yet

- Il Ritorno Di UliseDocument25 pagesIl Ritorno Di UliseDaniel TacheNo ratings yet

- Plaza Master Mar-2022Document10 pagesPlaza Master Mar-2022Raja SekharNo ratings yet

- Uganda Standards Catalogue As at 31 March 2019Document499 pagesUganda Standards Catalogue As at 31 March 2019Solomon AhimbisibweNo ratings yet

- Finding the intersection point of two linesDocument10 pagesFinding the intersection point of two linesLinh LêNo ratings yet

- Herbal Treatment ChildrenDocument333 pagesHerbal Treatment ChildrenMrudu Ranjan Tripathy100% (4)

- Act. Sheets Quarter 2, 2nd ModuleDocument3 pagesAct. Sheets Quarter 2, 2nd ModuleKIM OLIVER CAGUANNo ratings yet

- MODEL: GMC-3000 Crimp-n-Test: Operating Instructions Instrucciones de OperaciónDocument2 pagesMODEL: GMC-3000 Crimp-n-Test: Operating Instructions Instrucciones de OperaciónIng Kemberly OrdosgoittyNo ratings yet

- Iso9001 AsmeDocument2 pagesIso9001 AsmeAnonymous wKvJXBJ2iNo ratings yet

- Registration Card Sample 4Document5 pagesRegistration Card Sample 4Ben CruzNo ratings yet