Professional Documents

Culture Documents

Principles of Taxation

Uploaded by

yogasri g0 ratings0% found this document useful (0 votes)

196 views3 pagesThis document outlines the modules and units covered in the Principles of Taxation semester course. The course covers the historical perspective and introduction to taxation, general perspectives on definitions and concepts, income from salaries, income from house property, income from business/profession, capital gains and other sources of income. It also addresses tax authorities, tax avoidance and evasion, and miscellaneous topics including service tax and GST. The prescribed textbooks provide further information on India's direct tax law and practice.

Original Description:

income

Original Title

Principle of Taxation Law

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the modules and units covered in the Principles of Taxation semester course. The course covers the historical perspective and introduction to taxation, general perspectives on definitions and concepts, income from salaries, income from house property, income from business/profession, capital gains and other sources of income. It also addresses tax authorities, tax avoidance and evasion, and miscellaneous topics including service tax and GST. The prescribed textbooks provide further information on India's direct tax law and practice.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

196 views3 pagesPrinciples of Taxation

Uploaded by

yogasri gThis document outlines the modules and units covered in the Principles of Taxation semester course. The course covers the historical perspective and introduction to taxation, general perspectives on definitions and concepts, income from salaries, income from house property, income from business/profession, capital gains and other sources of income. It also addresses tax authorities, tax avoidance and evasion, and miscellaneous topics including service tax and GST. The prescribed textbooks provide further information on India's direct tax law and practice.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

PRINCIPLES OF TAXATION (SEMESTER - V)

Module-I: Historical Perspective and Introduction

Unit-1: Historical Perspective of Taxation

Unit-2: Meaning of Tax

a. Types of Tax

b. Difference between Direct Tax and Indirect Tax

c. Characteristics of Tax, Fee and its differences

d. Difference between Tax and Duty

e. Concept of Cess and Surcharge

f. Principle of Ability/Capacity to pay

Unit-3: Taxation under the Indian Constitution

Unit-4: Canons of Taxation and Laffer curve

Unit-5: Characteristics of a Good Tax System.

Module-II: General Perspective

Unit-1: Important Definitions

a. Previous Year g. Agricultural Income

b. Assessment Year h. Average Rate of Income Tax

c. Income i. Business

d. Assesse j. Capital Asset

e. Person k. Company

f. Total Income

Unit 2- Charge (Section 4)

Unit-3: Residential Status of Assesse

Unit-4: Scope of Total Income

Unit-5: Income Exempt from Tax

Module-III: Income from Salaries

Unit-1: Meaning and Characteristics of Salary

Unit-2: Relationship of Employer and Employee

Unit-3: Income from Office not amounting to Employment

Unit-4: Incomes Forming Part of Salary

(a. Basic Salary b. Fees, Commission and Bonus c. Taxable Value of Allowances d. Taxable

Value of Perquisites e. Retirement Benefit)

Unit-5: Deductions from Gross Salary (Section 16 and 80)

Unit-6: Computation of Income from Salary

Module-IV: Income from House Property

Unit-1: Basis of Charge (Section 22)

Applicability of Section 22 (Buildings or lands appurtenant thereto, Ownership of

house property, Property used for own business or profession, Rental income of a

dealer in house property, House property in a foreign country)

Unit-2: Property Income Exempt from Tax

Unit-3: Computation of Income from Let Out House Property

(Determination of annual value, Gross annual value, Deductions under section 24)

Unit-4: Computation of Income from Self Occupied House Property

Unit-5: Deduction from Income from House Property

Module-V: Income from Profit and Gains of Business or Profession

Unit-1: Concept of Profit and Gains

Unit-2: scope of Section 28 (Basis of Charge)

Unit-3: Business, Profession and Vocation

Unit-5: Different Deductions under This Head

a. Schemes of Business Deductions

b. Specific Deductions under this Act

c. Deductions under sections 30 & 31

Module VI Income from Capital Gains and Income from Other Sources

Unit-1: Short Term and Long Term Capital Gains

Unit-2: Set Off and Carry Forward Rule

Module VII Income Tax Authorities

Unit-1: Hierarchy

Unit-2: Appointment

Unit-3: Powers: Search and Seizure- Section 132

a. Fulfillment of statutory Conditions

b. Test of Reason to believe

Module-VIII: Tax Avoidance, Tax Evasion and Tax Planning

Unit-1: Basic Concept of Tax Avoidance, Tax Evasion and Tax Planning

Unit-2: Reason of Tax Avoidance, Tax Evasion

Unit-3: Distinction between Tax Avoidance and Tax Evasion

Unit-4: Recommendation of Wanchoo Committee to Fight Tax Evasion

Unit-5: Effect of Tax Avoidance and Tax Evasion

Module-IX: Miscellaneous

Unit-1: Service Tax

Unit-2: Central Sales Tax and VAT

Unit-3: Introduction to DTC Bill

Unit-4: Introduction to GST Bill

Prescribed Books:

1. A C Sampath Iyengar, The Law of Income Tax, Bharat Law House

2. Chaturvedi and Pithisarias Income Tax Law

3. Girish Ahuja & Ravi Gupta, Direct Tax- Law and Practice

4. Girish Ahuja & Ravi Gupta, Direct Taxes Ready Reckoner (Bharat Publication)

5. Kanga, Palkhiwala and Vyas, The Law and Practice of Income Tax (Lexis Nexis

Butterworths)

6. Vinod K Singhania and Kapil Singhania, Taxmans Direct Tax- Law and Practice.

You might also like

- Sem-V Principle of Taxation LawDocument3 pagesSem-V Principle of Taxation LawAnantHimanshuEkkaNo ratings yet

- Sem-V Principle of Taxation Law PDFDocument3 pagesSem-V Principle of Taxation Law PDFAnantHimanshuEkkaNo ratings yet

- PRINCIPLES OF TAXATION LAWDocument2 pagesPRINCIPLES OF TAXATION LAWChoudhary Shadab phalwan100% (1)

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawNaveen SihareNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawTaraChandraChouhanNo ratings yet

- Principles of Taxation Semester V Module OverviewDocument3 pagesPrinciples of Taxation Semester V Module OverviewVinay SahuNo ratings yet

- Syllabus of Principle of Taxation Law For BALLB V SemesterDocument3 pagesSyllabus of Principle of Taxation Law For BALLB V SemesterYashNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawAnantHimanshuEkkaNo ratings yet

- Paper - Vii TaxationDocument350 pagesPaper - Vii TaxationvengaidjNo ratings yet

- Definition or Concept of TaxationDocument24 pagesDefinition or Concept of TaxationJustine DagdagNo ratings yet

- Rsm324 Week 1Document18 pagesRsm324 Week 1Rudy GuNo ratings yet

- Direct Tax - 2011Document494 pagesDirect Tax - 2011vinagoyaNo ratings yet

- Direct TaxationDocument760 pagesDirect TaxationCalmguy Chaitu75% (4)

- DTaxation PDFDocument808 pagesDTaxation PDFcoolmanzNo ratings yet

- Income Tax IDocument4 pagesIncome Tax InishatNo ratings yet

- Aaa TAXDocument13 pagesAaa TAXLeyy De GuzmanNo ratings yet

- Taxation Law Syllabus OverviewDocument14 pagesTaxation Law Syllabus OverviewRoxanne Peña100% (2)

- PGDTDocument68 pagesPGDTFahmi AbdullaNo ratings yet

- M Com Tax PDFDocument336 pagesM Com Tax PDFakshNo ratings yet

- U1A OverviewDocument7 pagesU1A Overview4mggxj68cyNo ratings yet

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluNo ratings yet

- Semester IIIDocument5 pagesSemester IIIayusharma1608No ratings yet

- Applied Direct Taxation Paper-7 Inter GR (1) .1Document552 pagesApplied Direct Taxation Paper-7 Inter GR (1) .1aliNo ratings yet

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- Advance Taxation Fy 2076Document340 pagesAdvance Taxation Fy 2076Anil ShahNo ratings yet

- Taxation (UK) : Aim of The CourseDocument2 pagesTaxation (UK) : Aim of The CourseHasan Ali BokhariNo ratings yet

- Public Finance and Taxation - 1 Nbaa Cpa-1Document265 pagesPublic Finance and Taxation - 1 Nbaa Cpa-1Osmund100% (1)

- TAXATION I KEY TERMSDocument58 pagesTAXATION I KEY TERMSDrew RodriguezNo ratings yet

- Code Questions AnswersDocument2 pagesCode Questions AnswersSowdhamini GanesunNo ratings yet

- Tax 1 Vthsem Module 1,2, and 3Document97 pagesTax 1 Vthsem Module 1,2, and 3Sahana narayanNo ratings yet

- Sde 665Document123 pagesSde 665amritNo ratings yet

- Direct Tax - Likely QuestionsDocument4 pagesDirect Tax - Likely QuestionsVaishnaviNo ratings yet

- TaxationDocument9 pagesTaxationRohit SoniNo ratings yet

- Law of Direct TaxationDocument4 pagesLaw of Direct TaxationAshwanth M.SNo ratings yet

- V Sem It Course Plan 2011Document4 pagesV Sem It Course Plan 2011Rohith MaheswariNo ratings yet

- Budgeting BasicsDocument74 pagesBudgeting BasicsNor Ihsan Abd LatifNo ratings yet

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- LMR Tax Laws and PracticeDocument49 pagesLMR Tax Laws and PracticeGayathri MageshNo ratings yet

- Principles of TaxationDocument7 pagesPrinciples of TaxationNishant RajNo ratings yet

- Icwa Inter FoundationDocument760 pagesIcwa Inter FoundationSunil Babu100% (1)

- Cma Tax PaperDocument760 pagesCma Tax Paperritesh shrinewarNo ratings yet

- Draft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Document303 pagesDraft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Optimal Management Solution100% (1)

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Income Tax Law and Practice Renaissance Law College NotesDocument169 pagesIncome Tax Law and Practice Renaissance Law College NotesSiddhesh Vyas100% (1)

- Final Level Advanced Taxation 2: ObjectiveDocument5 pagesFinal Level Advanced Taxation 2: Objectiveadibahhanaffi01No ratings yet

- 11 CPA TAXATION Paper 11Document8 pages11 CPA TAXATION Paper 11Kiwalabye OsephNo ratings yet

- Income TaxDocument109 pagesIncome TaxDaksh KohliNo ratings yet

- 17 CPA ADVANCED TAXATION Paper 17Document9 pages17 CPA ADVANCED TAXATION Paper 17kabendejunior4No ratings yet

- Direct Tax and Compliance Farheen 202200535 WordsDocument11 pagesDirect Tax and Compliance Farheen 202200535 Wordsnaazfarheen7777No ratings yet

- SyllabusDocument1 pageSyllabusIsha KhuranaNo ratings yet

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Document150 pagesICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- Income Tax Unit-1 PDFDocument12 pagesIncome Tax Unit-1 PDFAnirban ThakurNo ratings yet

- App Dirt Ax 6Document490 pagesApp Dirt Ax 6Prem Anand KidambiNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Chapter 4Document43 pagesChapter 4yogasri gNo ratings yet

- Evidence through video conferencing permissibleDocument2 pagesEvidence through video conferencing permissibleyogasri gNo ratings yet

- India Polluter Pays PrincipleDocument3 pagesIndia Polluter Pays Principleyogasri gNo ratings yet

- Environmental RefugeesDocument3 pagesEnvironmental Refugeesyogasri gNo ratings yet

- Khap PanchayatsDocument12 pagesKhap Panchayatsyogasri gNo ratings yet

- 027 - The Polluter Pays Principle and The Supreme Court of India (108-116)Document9 pages027 - The Polluter Pays Principle and The Supreme Court of India (108-116)yogasri gNo ratings yet

- Jipr 8 (6) 449-461Document13 pagesJipr 8 (6) 449-461yogasri gNo ratings yet

- Environmental Refugees: A Growing Phenomenon of The 21st CenturyDocument5 pagesEnvironmental Refugees: A Growing Phenomenon of The 21st Centuryyogasri gNo ratings yet

- Interpretation of StatutesDocument33 pagesInterpretation of StatutesChaitu Chaitu100% (4)

- Income From HPDocument36 pagesIncome From HPjidnyasabhoirNo ratings yet

- Article TPDocument3 pagesArticle TPpawanagrawal83No ratings yet

- 2009UIllLRev PDFDocument2 pages2009UIllLRev PDFyogasri gNo ratings yet

- LL.B. Part-IV (7th & 8th Semester) Five Year CourseDocument35 pagesLL.B. Part-IV (7th & 8th Semester) Five Year Courseyogasri gNo ratings yet

- Income From House Property KarthikDocument56 pagesIncome From House Property KarthikCorey PageNo ratings yet

- Cheque Payment Voucher Format in ExcelDocument2 pagesCheque Payment Voucher Format in ExcelAhmed Farouk Al ShuwaikhNo ratings yet

- Ey 2022 WCTG WebDocument2,010 pagesEy 2022 WCTG WebPedro J Contreras ContrerasNo ratings yet

- KCT Online Fees Payment ReceiptDocument1 pageKCT Online Fees Payment Receiptvidhyapathy0% (1)

- 60 TL To Eur - Pesquisa GoogleDocument1 page60 TL To Eur - Pesquisa GoogleRafael Filipe Fernandes Reino AlunoNo ratings yet

- File Return On TimeDocument7 pagesFile Return On TimeAmanat AhmedNo ratings yet

- AccountStatement 3286686240 Oct09 104105Document1 pageAccountStatement 3286686240 Oct09 104105AvijitSinharoyNo ratings yet

- Mesfin Betru PDFDocument83 pagesMesfin Betru PDFchuchuNo ratings yet

- Tax Invoice: RAJKOT GAS SERVICE (000010176)Document1 pageTax Invoice: RAJKOT GAS SERVICE (000010176)Rahul ShuklaNo ratings yet

- BqZ WiFi Voucher Codes ListDocument1 pageBqZ WiFi Voucher Codes Listangga13No ratings yet

- L63 MobDocument35 pagesL63 MobLove AmbienceNo ratings yet

- Exempted Supplies Under GSTDocument127 pagesExempted Supplies Under GSTmonikaNo ratings yet

- Train Law Income TaxationDocument9 pagesTrain Law Income TaxationRuth CepeNo ratings yet

- Mund Manufacturing Inc Started Operations at The Beginning of TheDocument1 pageMund Manufacturing Inc Started Operations at The Beginning of TheLet's Talk With HassanNo ratings yet

- Clearance Form Caution MoneyDocument2 pagesClearance Form Caution MoneyFaizan AsgharNo ratings yet

- Summer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Document60 pagesSummer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Sumit Ranjan100% (6)

- Si04253409 4 PDFDocument1 pageSi04253409 4 PDFclintNo ratings yet

- CustomAccountStatement07 02 2024Document3 pagesCustomAccountStatement07 02 2024bsen51642No ratings yet

- Transaction Acceptance Device Guide (TADG) : July 2014Document252 pagesTransaction Acceptance Device Guide (TADG) : July 2014norabidinNo ratings yet

- 1571988702732Document33 pages1571988702732LS GUPTANo ratings yet

- Auth Representative Consent FormDocument2 pagesAuth Representative Consent FormRaminder SinghNo ratings yet

- Tax 1 FinalDocument8 pagesTax 1 Finalarvind667No ratings yet

- GST ChallanDocument2 pagesGST ChallanGajendrakumarHNo ratings yet

- HBL Internet Banking account activity statementDocument1 pageHBL Internet Banking account activity statementMuhammad Ilhamsyah PutraNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementAaditya ThapaNo ratings yet

- Saudi Arabia Tax SetupDocument23 pagesSaudi Arabia Tax SetupAnshuanupamNo ratings yet

- Meaning Scope of Tax ManagementDocument5 pagesMeaning Scope of Tax ManagementAnish yadavNo ratings yet

- Theoritical Framework &literature ReviewDocument27 pagesTheoritical Framework &literature ReviewGelani PradipNo ratings yet

- Mobile Services Tax Invoice BreakdownDocument3 pagesMobile Services Tax Invoice BreakdownValencia MabenNo ratings yet

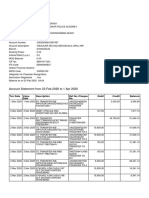

- Mr. Shyam Singh's bank account statement and detailsDocument3 pagesMr. Shyam Singh's bank account statement and detailsShyamNo ratings yet

- Peza Erd Form No. 03-01 2018Document2 pagesPeza Erd Form No. 03-01 2018John LuNo ratings yet