Professional Documents

Culture Documents

CS MarketNeutral HOLT Notes PDF

Uploaded by

Michael GuanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CS MarketNeutral HOLT Notes PDF

Uploaded by

Michael GuanCopyright:

Available Formats

HOLT

November 2012

HOLT NOTES

bryant.matthews@credit-suisse.com 312.345.6187

Valuation raymond.stokes@credit-suisse.com 44.20.7883.6143

Definition Cash flows are forecast over a horizon equal to

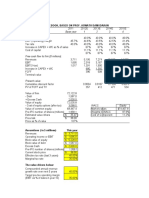

Example: Apple Inc. as of April 2012

Estimating the value or worth of a business. Stage 1

100+N years, where N is a firms Asset Project

Life, and discounted at the weighted average FY1 and FY2 CFROI are derived from

Overview cost of capital (WACC). The present value sumI/B/E/S consensus eps estimates combined

A firms worth equals the market value of its equals Total Operating Enterprise Value (OEV). with HOLTs normalized asset growth estimate.

invested capital (IC) plus the present value of HOLTs Warranted Equity Price equals OEV plus Last years achieved CFROI of 30.3% is

future economic profit (EP): Investments less Debt and Minority Interest. forecast to climb to 32.6% in 2012 and fall to

25.2% in 2013. CFROI used in valuation (t+1)

N

EPi Fade-to Levels is a blend of FY1 and FY2 CFROI, in this case

Firm Value = IC 0 + Industrials: CFROI and WACC fade to 6.0%; equaling 30.4%. This level is forecast to shed

i=1 (1 + WACC i ) i Financials: CFROE and re fade to 7.5%; 32% of excess return over the next 4 years,

Regulated Utils: CFROI and WACC fade to resulting in a CFROI at t+5 of 22.5%. Growth

WACC = Weighted Average Cost of Capital 3.5%. is also forecast to fade, albeit more sharply,

from 43.5% to 18.9%, over the same interval.

Firm value is a function of product or service HOLT uses a 3-stage discounted cash flow Fade is a function of CFROI Level, Trend,

offering, management skill, brand value and (DCF) model, where: Volatility and Reinvestment Rate.

other intangible assets, barriers to entry, ease

N

of replication, and a host of other factors that FCFFi Apple, Inc.

enhance or diminish value. Ultimately, the price WEV = 9/11 9/12 9/13

paid for a firm is a product of investor i=1 (1 + WACC i ) i CFROI

LFY

30.3

FY+1

32.6

FY+2

25.2

FY+3 FY+4 FY+5

perception. Still, basic principles of corporate WEV = Warranted Enterprise Value

valuation are helpful in estimating firm value. WACCi = cost of capital at time t=i, {i|1,...N}

Used in Valuation t+1 t+2 t+3 t+4 t+5

N = Terminal period (N) CFROI 30.4 28.4 26.4 24.5 22.5

Accounting Treatment Growth 43.5 36.4 30.1 24.2 18.9

Most assets are valued at historical cost, HOLTs Valuation Stages

Discount Rate 4.3 4.3 4.3 4.3 4.3

except assets using mark-to-market Stage 1: an explicit forecast fades near-term

accounting (MMA). MMA requires corporations CFROI and Growth estimates to likely levels

Stage 2

to value specific assets at estimated current based on empirical outcomes for firms with

Apples t+5 CFROI fades from 22.5% to 6%

market price whereas historical cost reflects similar starting CFROI and asset growth features.

over 95 years. Growth fades toward 2.5%.

the price of an asset at some prior point in The discount rate fades from 4.3% to 6%.

time. Financial instruments are typical assets Stage 2: CFROI and growth mean-revert at an

using MMA. IASB ruled that all Pensions will exponential decay rate over 95 years, eliminating

Stage 3

be mark-to-market after January 1, 2013. excess profits and converging toward the cost of

Assets are wound off the balance sheet.

Historical cost accounting does not reflect capital and long-term growth rate. Economic

Terminal value equals the Inflation Adjusted

current replacement cost or expected value. profit equals the required capital charge at t=N.

Net Assets at T=100. Terminal value can also

CFROIWACC6%; Growth2.5%.

be modeled as a constant growth, cost of

HOLT Treatment

capital business: TV = FCFFN(1+gn)/(rN-gN).

HOLT estimates a companys worth by Stage 3: Assets are wound off the balance

forecasting likely CFROI and real growth rates sheet. Since firm CFROI=WACC, this is

over an extended period. CFROI and Growth equivalent to a constant growth perpetuity.

determine enterprise free cash flows (FCFF)

which are discounted to present value. All Apple Inc

three factors (CFROI, Real Growth, and

WACC) are mean-reverting, such that zero Stage 1 Stage 2 Stage 3

economic profits are generated in distant

years. 30 2. CFROI, Growth and WACC 3. Since Assets are wound off the

1a. Consensus gravitate toward balance sheet, Terminal Value equals

the Inflation Adjusted Net Assets at

Method eps result in FY1 long-term averages

T=100. This is equivalent to a constant

(6%, 2.5%, 6%)

Near-term CFROI are derived from consensus and FY2 CFROI 20 growth cost of capital perpetuity.

eps estimates and then faded over 4 years to 1b. Near-term FCFFN (1 + gN )

likely levels based on empirical outcomes for CFROI fades to ( WACC N gN )

firms with similar starting CFROI and growth likely t+5 10

outcome

features. From this, cash flows are produced

for periods 1 to 5. Thereafter, cash flows are

generated as CFROI fades toward the cost of 0

0 10 20 30 40 100

capital and growth toward its long-term mean

CFROI WACC LT CFROI=6.0%

of 2.5%. Fade (yrs 1-5) Fade (yrs 6-100) Terminal value

Advanced Concepts Total System Approach HOLT provides both multiples and a forecast

Key points: HOLT employs a total system approach to of free cash flow for estimating firm value. In

1. Mean reversion offers objective reference measuring and forecasting corporate returns, both cases, HOLTs approach is unique and

2. Resolves terminal value issue growth rates, risk and valuation. Within this Percent to Best offers a superior screening

3. Total system calibration system, CFROI is measured as a real rate of factor to traditional alternatives.

4. Superior to alternatives return, adjusted for inflation and other distortive

effects. This increases comparability across time, Multiples Versus DCF

Objective countries, industries, and peers and makes Multiples offer insight into the relative value, or

HOLTs system of mean-reversion results in CFROI a more useful quality factor in stock attractiveness, of a firm. In a typical multiples

forecasted cash flows that, on average, reflect screens. Historical CFROI serve as a benchmark approach to valuation, a stock is compared to

the economic reality of a corporate lifecycle. against which current and expected returns can a set of similar peers, and a premium or

Empirical observation shows that corporate be compared. discount is applied to the stock based on the

rates of return converge toward a long-term analysts expectations of future profitability

average of 6% as industries mature and Since CFROI is a real rate of return, it is directly and/or growth.

consolidate. Moreover, growth declines as comparable to a real cost of capital.

industries mature, eventually tracking a long- HOLT provides two especially useful valuation

term average population and industrial HOLTs total system approach is objective: near- multiples, including:

production real growth rate of 2.5%. Percent term earnings estimates are converted to CFROI

to Best offers investors an objective reference and linked to probable medium and long-term Economic PE Ratio

stripped of subjectivity and bias against which outcomes. An extensive history of HOLT- Value-Cost Ratio

other valuation signals can be compared. adjusted data offers an unsurpassed source for

measuring the long-term required yield and HOLTs Economic PE is equal to Enterprise

growth rate and for providing meaningful Value divided by Gross Cash Flow minus

Median CFROI Through Time empirical benchmarks. economic depreciation, analogous to the

based on starting CFROI

traditional P/E ratio. Firms with low Economic

highest high average low lowest Within this comprehensive system, the discount PE tend to out-perform firms with high

15 rate acts as the final calibrating mechanism, Economic PE. The average firm displays an

10 tuning current aggregate price levels to empirical Economic PE multiple of 16.7. This multiple is

tendencies and the prevailing risk appetite. This highly effective in selecting stocks most likely

5

results in a relative valuation framework that to out/under perform.

0 displays monotonic properties in rank Percent to

-5 Best across all sectors. HOLTs Value-Cost Ratio (VCR) is a measure

0 5 10

Years after formation

15 of a firms market enterprise value relative to

Source: Credit Suisse, HOLT Valuation Alternatives its inflation adjusted net assets, in concept,

Global Industrials, 1950-2011

Estimating firm value is a challenging task. At its similar to Price-to-Book or, even better,

simplest, firm value would equal total net assets, Tobins Q. Cost of capital businesses trade at

Median WACC Through Time which would define the total value of the VCR close to 1.0. When VCR exceeds 1.0,

based on starting WACC enterprise for all capital providers. Equity value expected future economic profit exceeds zero.

highest high average low lowest would then equal residual Shareholder Equity. The average firm has a VCR close to 1.4.

10 However, assets, when utilized by skilled VCR is highly effective in selecting stocks

8 management, often exceed book value. Thus, most likely to out/under perform.

determining firm value becomes an exercise in

6

pricing expectations, that is: valuing expected HOLT Percent to Best, Economic Yield, and

4 future cash flow. Value-Cost Ratio all display consistent and

2

exceptional strength, compared to other

0 5 10 15 There are three primary techniques used to multiples, in identifying firms most likely to

Years after formation

Source: Credit Suisse, HOLT estimate firm value: outperform.

Global Industrials, 1950-2011 Multiples

Forecast free cash flow Probability Based

Terminal Valuation Issue Options (not discussed) Most DCF models are based on an explicit

A significant benefit of HOLTs mean-reverting cash flow forecast that may incorporate

valuation framework is that it eliminates excess Multiples offer a simple, fast, and often effective anywhere from 2 to 20 years. These forecasts

profits in distant years, thereby forcing firms to method for gauging relative value. Multiples can can be quite valuable, often produced by

become cost of capital enterprises, as suffer from several drawbacks, including: experts with a deep understanding of the firm,

evidenced by mature industries. Unless the its competitive position, and the industry within

rate of return converges toward the discount Weaknesses of Multiples which the firm competes. The HOLT Valuation

rate, the terminal value will embed excess Comparable only for similar peers model produces an estimate of firm value

profit or loss indefinitely. This facet of DCF Distorted by negative earnings or cash flow based on probabilities, that is, the best likely

modeling is easily overlooked, but has a Easily distorted by growth estimated outcome given a firms starting

significant impact on estimated firm value. Easily distorted by firm accounting methods CFROI and growth characteristics. HOLTs

HOLT research shows that seemingly sticky Easily distorted by capital structure changes Warranted Price is a com pelling and

profits or losses are generally eliminated over Can become unsynchronized for cyclical objective counter-point to subjective

time as capital is reallocated toward the most firms analyst-based m odels.

profitable opportunities.

HOLT

November 2012

Disclosure and Notice

This material has been prepared by individual traders or sales personnel of Credit Suisse Securities (USA) LLC and its affiliates ("CSSU") and not by the CSSU

research department. It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. It is intended for

institutional customers of CSSU only, is provided for informational purposes, is intended for your use only and does not constitute an invitation or offer to

subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an

investment decision. It is intended only to provide observations and views of individual traders or sales personnel, which may be different from, or inconsistent

with, the observations and views of CSSU research department analysts, other CSSU traders or sales personnel, or the proprietary positions of CSSU.

Observations and views expressed herein may be changed by the trader or sales personnel at any time without notice. Trade report information is preliminary

and subject to our formal written confirmation. This material may have previously been communicated to the CSSU trading desk or other CSSU clients. You

should assume that the trading desk makes markets and/or currently maintains positions in any of the securities mentioned above.

CSSU may, from time to time, participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services

for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof. To obtain a copy of the most

recent CSSU research on any company mentioned please contact your sales representative or go to Research & Analytics.

FOR IMPORTANT DISCLOSURES on companies covered in Credit Suisse Investment Banking Division research reports, please see www.credit-

suisse.com/researchdisclosures

Backtested, hypothetical or simulated performance results have inherent limitations. Simulated results are achieved by the retroactive application of a

backtested model itself designed with the benefit of hindsight. The backtesting of performance differs from the actual account performance because the

investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved.

Alternative modeling techniques or assumptions might produce significantly different results and prove to be more appropriate. Past hypothetical backtest

results are neither an indicator nor a guarantee of future returns. Actual results will vary from the analysis.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made

regarding future performance. The information set forth above has been obtained from or based upon sources believed by the trader or sales personnel to be

reliable, but each of the trader or sales personnel and CSSU does not represent or warrant its accuracy or completeness and is not responsible for losses or

damages arising out of errors, omissions or changes in market factors. This material does not purport to contain all of the information that an interested party

may desire and, in fact, provides only a limited view of a particular market.

HOLT Disclaimer

The HOLT methodology does not assign ratings or a target price to a security. It is an analytical tool that involves use of a set of proprietary quantitative

algorithms and warranted value calculations, collectively called the HOLT valuation model, that are consistently applied to all the companies included in its

database. Third-party data (including consensus earnings estimates) are systematically translated into a number of default variables and incorporated into the

algorithms available in the HOLT valuation model. The source financial statement, pricing, and earnings data provided by outside data vendors are subject to

quality control and may also be adjusted to more closely measure the underlying economics of firm performance. These adjustments provide consistency when

analyzing a single company across time, or analyzing multiple companies across industries or national borders. The default scenario that is produced by the

HOLT valuation model establishes a warranted price for a security, and as the third-party data are updated, the warranted price may also change. The default

variables may also be adjusted to produce alternative warranted prices, any of which could occur. Additional information about the HOLT methodology is

available on request.

CFROI, CFROE, HOLT, HOLT Lens, HOLTfolio, HOLTSelect, HS60, HS40, ValueSearch, AggreGator, Signal Flag, Forecaster, Clarity is Confidence and

Powered by HOLT are trademarks or registered trademarks of Credit Suisse Group AG or its affiliates in the United States and other countries.

HOLT is a corporate performance and valuation advisory service of Credit Suisse.

2012 Credit Suisse Group AG and its subsidiaries and affiliates. All rights reserved.

Clarity is Confidence Education & Training

You might also like

- 2020 Mock Exam B - Morning SessionDocument27 pages2020 Mock Exam B - Morning SessionLê Chấn Phong100% (2)

- Barclays Investment Banking Case CompetitionDocument15 pagesBarclays Investment Banking Case Competitionseandsmith93No ratings yet

- Peter Brandt MTA 1989 - Classical Charting PrincipleDocument27 pagesPeter Brandt MTA 1989 - Classical Charting Principleghafarkhani100% (2)

- Practice Technicals 1Document75 pagesPractice Technicals 1tiger100% (1)

- Alta Fox JYNT Long - Final Version PDFDocument38 pagesAlta Fox JYNT Long - Final Version PDFJerry HsiangNo ratings yet

- Mark Yusko LetterDocument43 pagesMark Yusko LetterValueWalk100% (2)

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOeNo ratings yet

- Mark Yusko's Presentation at iCIO: Year of The AlligatorDocument123 pagesMark Yusko's Presentation at iCIO: Year of The AlligatorValueWalkNo ratings yet

- Guggenheim ROIC PDFDocument16 pagesGuggenheim ROIC PDFJames PattersonNo ratings yet

- Starboard Value LP LetterDocument4 pagesStarboard Value LP Lettersumit.bitsNo ratings yet

- Duff and Phelps Equity Risk PremiumDocument20 pagesDuff and Phelps Equity Risk PremiumAparajita SharmaNo ratings yet

- The Purpose of This CourseDocument6 pagesThe Purpose of This CourseSasha GrayNo ratings yet

- Stat Arb 1 ThorpDocument2 pagesStat Arb 1 Thorpjimmy.pendryNo ratings yet

- Case Studies On Cooper Industries IncDocument12 pagesCase Studies On Cooper Industries Inc黃靖順75% (4)

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- CFROIDocument15 pagesCFROImakrantjiNo ratings yet

- HOLT Notes - FadeDocument3 pagesHOLT Notes - FadeElliott JimenezNo ratings yet

- Tiburon Systemic Risk PresentationDocument12 pagesTiburon Systemic Risk PresentationDistressedDebtInvestNo ratings yet

- Cashflow.comDocument40 pagesCashflow.comad9292No ratings yet

- Yacktman PresentationDocument34 pagesYacktman PresentationVijay MalikNo ratings yet

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsDocument55 pagesIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996No ratings yet

- HOLT Wealth Creation Principles Don't Suffer From A Terminal Flaw, Add Fade To Your DCF Document-807204250Document13 pagesHOLT Wealth Creation Principles Don't Suffer From A Terminal Flaw, Add Fade To Your DCF Document-807204250tomfriisNo ratings yet

- Understanding DilutionDocument4 pagesUnderstanding DilutionKunalNo ratings yet

- Private Debt Investor Special ReportDocument7 pagesPrivate Debt Investor Special ReportB.C. MoonNo ratings yet

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocument12 pagesBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonNo ratings yet

- Merits of CFROIDocument7 pagesMerits of CFROIfreemind3682No ratings yet

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDocument68 pagesGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kNo ratings yet

- Pershing Square European Investor Meeting PresentationDocument67 pagesPershing Square European Investor Meeting Presentationmarketfolly.com100% (1)

- The Mechanics of Economic Model-Of-DFC - ROIC - CAPDocument29 pagesThe Mechanics of Economic Model-Of-DFC - ROIC - CAPLouis C. MartinNo ratings yet

- Raymond James Agribusiness 2011Document185 pagesRaymond James Agribusiness 2011Capita1No ratings yet

- Global Airlines: Procurement Partnerships Coming CloserDocument14 pagesGlobal Airlines: Procurement Partnerships Coming CloserSangwoo KimNo ratings yet

- Disbursing Cash To Shareholders: Frequently Asked Questions About Buybacks and DividendsDocument21 pagesDisbursing Cash To Shareholders: Frequently Asked Questions About Buybacks and DividendsDQNo ratings yet

- Reading List J Montier 2008-06-16Document12 pagesReading List J Montier 2008-06-16rodmorley100% (2)

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- The Rise of The Leveraged LoanDocument7 pagesThe Rise of The Leveraged LoanTanit PaochindaNo ratings yet

- Cadbury Trian LetterDocument14 pagesCadbury Trian Letterbillroberts981No ratings yet

- The Mind of An AnalystDocument82 pagesThe Mind of An AnalystkessbrokerNo ratings yet

- Roe To CfroiDocument30 pagesRoe To CfroiSyifa034No ratings yet

- How To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results RevertDocument26 pagesHow To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results Revertpjs15No ratings yet

- Bottom-Up EV Calculation (Finatics)Document5 pagesBottom-Up EV Calculation (Finatics)Jessica KaryonoNo ratings yet

- Vanguard Asset AllocationDocument19 pagesVanguard Asset AllocationVinicius QueirozNo ratings yet

- One Job: Counterpoint Global InsightsDocument25 pagesOne Job: Counterpoint Global Insightscartigayan100% (1)

- Complexity in Economic and Financial MarketsDocument16 pagesComplexity in Economic and Financial Marketsdavebell30No ratings yet

- Article - Mercer Capital Guide Option Pricing ModelDocument18 pagesArticle - Mercer Capital Guide Option Pricing ModelKshitij SharmaNo ratings yet

- The Analyst Matrix Profiting From Sell Side Analysts Coverage NetworksDocument20 pagesThe Analyst Matrix Profiting From Sell Side Analysts Coverage NetworksJames MitchellNo ratings yet

- Capital Allocation Outside The U.SDocument83 pagesCapital Allocation Outside The U.SSwapnil GorantiwarNo ratings yet

- Third Point 2011 ADV Part 2a BrochureDocument23 pagesThird Point 2011 ADV Part 2a BrochureWho's in my FundNo ratings yet

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocument17 pagesWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15No ratings yet

- The Incredible Shrinking Universe of StocksDocument29 pagesThe Incredible Shrinking Universe of StocksErsin Seçkin100% (1)

- Wisdom & Whims of The CollectiveDocument8 pagesWisdom & Whims of The CollectiveTraderCat SolarisNo ratings yet

- CFROI - Merril LynchDocument12 pagesCFROI - Merril LynchCristi RaitaNo ratings yet

- Daniel Ahn Speculation Commodity PricesDocument29 pagesDaniel Ahn Speculation Commodity PricesDan DickerNo ratings yet

- MS - Good Losses, Bad LossesDocument13 pagesMS - Good Losses, Bad LossesResearch ReportsNo ratings yet

- Special SituationsDocument5 pagesSpecial SituationsTim PriceNo ratings yet

- g38n12d VariantPerceptionDocument2 pagesg38n12d VariantPerceptionVariant Perception ResearchNo ratings yet

- Michael Mauboussin - Seeking Portfolio Manager Skill 2-24-12Document13 pagesMichael Mauboussin - Seeking Portfolio Manager Skill 2-24-12Phaedrus34No ratings yet

- BBrief Six Degrees of Tiger Management 01 03 12Document11 pagesBBrief Six Degrees of Tiger Management 01 03 12Sarah RamirezNo ratings yet

- Investment Banking Valuation - Equity Value - and Enterprise ValueDocument18 pagesInvestment Banking Valuation - Equity Value - and Enterprise ValuejyguygNo ratings yet

- Global Investment Returns Yearbook 2014Document68 pagesGlobal Investment Returns Yearbook 2014Rosetta RennerNo ratings yet

- Michael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesDocument49 pagesMichael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesCanadianValueNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- Cs Negative RatesDocument30 pagesCs Negative RatesMichael GuanNo ratings yet

- Market Neutral Hedge FundsDocument36 pagesMarket Neutral Hedge FundsMichael GuanNo ratings yet

- Improving Trading Strategies With Lob SignalsDocument38 pagesImproving Trading Strategies With Lob SignalsMichael GuanNo ratings yet

- Helicopters 101: Your Guide To Monetary Financing: ResearchDocument23 pagesHelicopters 101: Your Guide To Monetary Financing: ResearchMichael GuanNo ratings yet

- CS Fixed Income Outlookback2011 PDFDocument12 pagesCS Fixed Income Outlookback2011 PDFMichael GuanNo ratings yet

- UnderstandingTheYieldCurve P1 SalomonSmithBarney PDFDocument22 pagesUnderstandingTheYieldCurve P1 SalomonSmithBarney PDFMichael GuanNo ratings yet

- (Goldman Sachs) Fixed Income Research - The Investment Implications of An Inverted Yield CurveDocument34 pages(Goldman Sachs) Fixed Income Research - The Investment Implications of An Inverted Yield CurveMohamad KarakiNo ratings yet

- Shih, Thomas and Duan, RanDocument28 pagesShih, Thomas and Duan, RanMichael GuanNo ratings yet

- Price PressuresDocument19 pagesPrice PressuresMichael GuanNo ratings yet

- Conv BookDocument47 pagesConv BookMichael GuanNo ratings yet

- RyanDocument72 pagesRyanMichael GuanNo ratings yet

- Chapter Geman 2008Document12 pagesChapter Geman 2008Michael GuanNo ratings yet

- SSRN - Pairs TradingDocument47 pagesSSRN - Pairs TradingBrian100% (1)

- APT Five Facts Factor ModelsDocument4 pagesAPT Five Facts Factor ModelsMichael GuanNo ratings yet

- Lab+1+ +Spreadsheet+BasicsDocument6 pagesLab+1+ +Spreadsheet+BasicsMichael GuanNo ratings yet

- Economic Flow ChartDocument1 pageEconomic Flow ChartMichael GuanNo ratings yet

- RyanDocument72 pagesRyanMichael GuanNo ratings yet

- BridgewaterPureAlpha CaseStudy MPIDocument9 pagesBridgewaterPureAlpha CaseStudy MPIMichael Guan100% (2)

- StatArb FuturesDocument4 pagesStatArb FuturesMichael GuanNo ratings yet

- Stat Arb ArunDocument18 pagesStat Arb ArunMichael GuanNo ratings yet

- The Cointegration AlphaDocument0 pagesThe Cointegration AlphagliptakNo ratings yet

- Determining Optimal RiskDocument5 pagesDetermining Optimal Riskwaffle333No ratings yet

- Re-Examining The Profitability of Technical Analysis With White's Reality CheckDocument28 pagesRe-Examining The Profitability of Technical Analysis With White's Reality CheckMichael GuanNo ratings yet

- SEx 5Document44 pagesSEx 5Amir Madani100% (3)

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- M & ADocument6 pagesM & AiluaggarwalNo ratings yet

- FT12 - Day 6 - SSV - GKR - 06062021Document81 pagesFT12 - Day 6 - SSV - GKR - 06062021AnshulNo ratings yet

- FINS3625 Case Study Report Davy Edit 1Document15 pagesFINS3625 Case Study Report Davy Edit 1DavyZhouNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- RCS Finance GuideDocument32 pagesRCS Finance GuideSameer JainNo ratings yet

- Terminal Value (TV) DefinitionDocument7 pagesTerminal Value (TV) Definitionatul.jha2545No ratings yet

- ZomatoDocument56 pagesZomatopreethishNo ratings yet

- UDCF 10YR (EBITDA Exit) Template - FinboxDocument19 pagesUDCF 10YR (EBITDA Exit) Template - FinboxteenavNo ratings yet

- Discounted Cash Flow AnalysisDocument21 pagesDiscounted Cash Flow AnalysisMinie KimNo ratings yet

- Exxon Mobil MergerDocument60 pagesExxon Mobil MergerTojobdNo ratings yet

- ValuationDocument53 pagesValuationArdoni Saharil100% (3)

- Financial Modeling & Valuation Workshop - WallStreetMojoDocument14 pagesFinancial Modeling & Valuation Workshop - WallStreetMojoPavithra GowthamNo ratings yet

- Free Cash Flow To Equity Valuation Model For Coca ColaDocument5 pagesFree Cash Flow To Equity Valuation Model For Coca Colaafridi65No ratings yet

- Value Determinants in Seed Stage SaaS ValuationsDocument100 pagesValue Determinants in Seed Stage SaaS Valuationsabsensi bplNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- 1 Assignment-1Document4 pages1 Assignment-1Tushar Gupta100% (1)

- FM11 CH 07 Mini CaseDocument12 pagesFM11 CH 07 Mini CaseMariam Sharif100% (2)

- Chap 10 SolutionsDocument10 pagesChap 10 SolutionsMiftahudin Miftahudin100% (1)

- Question and Answers On D.C.F: See You in My ClassDocument26 pagesQuestion and Answers On D.C.F: See You in My ClassSiddhant AggarwalNo ratings yet

- XOM 41.42 - 0.84 (Exxon Mobil Corp)Document7 pagesXOM 41.42 - 0.84 (Exxon Mobil Corp)garikai masawiNo ratings yet

- Competition and Valuation: A Case Study of Tesla Motors: IOP Conference Series: Earth and Environmental ScienceDocument10 pagesCompetition and Valuation: A Case Study of Tesla Motors: IOP Conference Series: Earth and Environmental ScienceAvinaw SrivastavaNo ratings yet

- Nestle Equity Research ReportDocument7 pagesNestle Equity Research Reportyadhu krishnaNo ratings yet