Professional Documents

Culture Documents

Government Failure Notes Lesson 9

Uploaded by

Raghvi AryaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Failure Notes Lesson 9

Uploaded by

Raghvi AryaCopyright:

Available Formats

Government Failure

Government failure occurs when government intervention leads to economic inefficiency, and therefore a net loss of

economic welfare.

Lack of market information:

a. Setting tax levels to low, his will lead to the externality not being internalised and MSC will not equal MSB.

b. Setting tax levels to high will cause excessive costs to business or consumers, damaging markets. e.g.

the fuel tax protests in 2000

c. Subsidy of merit goods will lead to over consumption, for instance health care.

d. Provision of public goods, amount of these goods provided is often a value judgement (politically based).

However, under-provision can lead to external costs, such as crime or road accidents.

Distortion of market forces

i. Farm subsidies or minimum prices, can lead to over-production, heavy tax burden on

consumers and other businesses and external costs such as pollution and storage. An

example of market failure in this area is the Common Agricultural Policy (CAP)

ii. Prohibition: An attempt to prevent consumption of a demerit good by declaring it illegal. Ac

a result of prohibition prices are driven up. And since illegal drugs are addictive there is no

guarantee that consumption will fall, so externalities remain. Prohibition risks criminalizing

people that otherwise would not be so. Increase costs of policing and imprisonment.

Creates criminal gangs and often encourages farmers to grow illegal crops because they

can earn a lot more than form legitimate crops.

iii. The National Minimum Wage (NMW): If the NMW is set to high, it may reduce poverty

amongst those who keep their jobs, but at the cost of some of them becoming unemployed.

If it set too low it will have little impact on poverty.

iv. Income and corporation tax level: The higher rates are set the greater the disincentive to

work and the more tax avoidance becomes.

v. Benefits: If unemployment is set at too high a level it becomes a disincentive to work. Job

Seekers Allowance is credited with reducing unemployment because the payment of

benefits is dependent on the unemployed actively looking for work.

vi. Maximum rent controls: Keeping rental costs for housing below the market price will lead

to a shortage of affordable housing. This incurs external costs such over-crowding, poor

quality housing and homelessness.

Conflicts in government Policy

Economic efficiency versus equity: Often the government must attempt to correct cases in which it

considers the market to create inequality. Such as rent controls, the national minimum wage and the

free provision of education and health.

Economic efficiency versus the environment: Sometimes the government considers managing the

environment more important than the free working of the market. Such as tax on fuel, tradable permits

or refusing planning permission for new roads or airports.

Very often the government is slow to identify market failures, because of time lags. Often various time consuming

and expensive enquiries have to take place before new laws or building projects are given the go-ahead.

Also markets change very quickly (dynamically) because of the effect of globalisation and technology, that

governments find hard to respond to.

You might also like

- Applying For A Property FormDocument1 pageApplying For A Property FormRaghvi AryaNo ratings yet

- A.wong Menu 2018Document6 pagesA.wong Menu 2018WazzupWorldNo ratings yet

- Government Conflicts in Macroeconomic PolicyDocument1 pageGovernment Conflicts in Macroeconomic PolicyRaghvi AryaNo ratings yet

- Ks2 Mathematics 2011 Level 6 Test ADocument20 pagesKs2 Mathematics 2011 Level 6 Test ARaghvi AryaNo ratings yet

- Economics SubwayDocument3 pagesEconomics SubwayRaghvi AryaNo ratings yet

- For Candidates Applying For The Joint School of Economics and ManagementDocument4 pagesFor Candidates Applying For The Joint School of Economics and ManagementRaghvi AryaNo ratings yet

- Hazards and Response ReadingDocument11 pagesHazards and Response ReadingRaghvi AryaNo ratings yet

- Assess The Reasons Why Countries Like Greece Portugal and Ireland Required Bailouts From The IMF and The European UnionDocument3 pagesAssess The Reasons Why Countries Like Greece Portugal and Ireland Required Bailouts From The IMF and The European UnionRaghvi AryaNo ratings yet

- Westminster Skills Clubs New - OverviewDocument1 pageWestminster Skills Clubs New - OverviewRaghvi AryaNo ratings yet

- Ks2 Mathematics 2011 Level 6 Test BDocument20 pagesKs2 Mathematics 2011 Level 6 Test BRaghvi AryaNo ratings yet

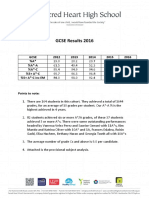

- Governors GCSE ResultsDocument2 pagesGovernors GCSE ResultsRaghvi AryaNo ratings yet

- 2015 Young Economist of The Year Essay Competition Archive WebpageDocument2 pages2015 Young Economist of The Year Essay Competition Archive WebpageRaghvi AryaNo ratings yet

- 2015 Maths Level Thresholds - GOVDocument1 page2015 Maths Level Thresholds - GOVRaghvi AryaNo ratings yet

- Ks2 Mathematics 2011 Level 6 Test BDocument20 pagesKs2 Mathematics 2011 Level 6 Test BRaghvi AryaNo ratings yet

- c3 Differentiation - Basic DifferentiationDocument8 pagesc3 Differentiation - Basic DifferentiationRaghvi AryaNo ratings yet

- Westminster Skills Clubs New - OverviewDocument1 pageWestminster Skills Clubs New - OverviewRaghvi AryaNo ratings yet

- Example Humanities EPQ Project Proposal - Good VersionDocument2 pagesExample Humanities EPQ Project Proposal - Good VersionRaghvi AryaNo ratings yet

- TsunamiDocument1 pageTsunamiRaghvi AryaNo ratings yet

- Aea 2005Document6 pagesAea 2005Joseph O'SullivanNo ratings yet

- Tennis balls factory experiment shows diminishing returnsDocument1 pageTennis balls factory experiment shows diminishing returnsRaghvi AryaNo ratings yet

- Dalmation CoastDocument1 pageDalmation CoastRaghvi AryaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lal Kitab Vol 3 1952 PDFDocument167 pagesLal Kitab Vol 3 1952 PDFraja bhai100% (2)

- Cruel Paradise (Oryolov Bratva Book 1) (Nicole Fox)Document425 pagesCruel Paradise (Oryolov Bratva Book 1) (Nicole Fox)Sara AlvesNo ratings yet

- 6-Villacorta Vs Insurance CommissionDocument2 pages6-Villacorta Vs Insurance CommissionChristine AngeliNo ratings yet

- Project Cyber CrimeDocument51 pagesProject Cyber CrimevesascNo ratings yet

- Day of Protest, Night of Violence (Century Plaza, June 23, 1967) (ACLUSC) .OCRDocument63 pagesDay of Protest, Night of Violence (Century Plaza, June 23, 1967) (ACLUSC) .OCRmletwin7138100% (1)

- Case Digest On Criminal Law IDocument2 pagesCase Digest On Criminal Law IVanessa Yvonne GurtizaNo ratings yet

- United States v. Michael Blackmon, 4th Cir. (2012)Document4 pagesUnited States v. Michael Blackmon, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- CYBERBULLYING LEADS TO TEEN SUICIDEDocument4 pagesCYBERBULLYING LEADS TO TEEN SUICIDEJordy Mendoza FernandezNo ratings yet

- Leyte Samar Daily ExpressDocument8 pagesLeyte Samar Daily ExpressLeyteSamar DailyExpressNo ratings yet

- Sketchy Spot July 28, 2022Document3 pagesSketchy Spot July 28, 2022Maxy BregsNo ratings yet

- PURC MOOT - AGGRAVATED SEXUAL ASSAULTDocument6 pagesPURC MOOT - AGGRAVATED SEXUAL ASSAULTVaidaihi DixitNo ratings yet

- Alternative Dispute Resolution Act SummaryDocument15 pagesAlternative Dispute Resolution Act SummaryIrene RamiloNo ratings yet

- Two Months To File Unjust Vexation ComplaintDocument2 pagesTwo Months To File Unjust Vexation Complaintyurets929100% (2)

- Sample Complaint Affidavit For Violation of RA 9262Document6 pagesSample Complaint Affidavit For Violation of RA 9262keithnavaltaNo ratings yet

- 30 July 2014 - People v. Billones (CTA Crim. Case No. O-128)Document27 pages30 July 2014 - People v. Billones (CTA Crim. Case No. O-128)Pierre Martin ReyesNo ratings yet

- Situational AwarenessDocument19 pagesSituational Awarenesshafizi fahriNo ratings yet

- Manila Gas Vs CADocument2 pagesManila Gas Vs CAMichelle Dulce Mariano CandelariaNo ratings yet

- Did New World Order Fabians Murder John Smith MP ?Document3 pagesDid New World Order Fabians Murder John Smith MP ?justgiving100% (5)

- Criminology: Edwin SutherlandDocument4 pagesCriminology: Edwin Sutherlandprashansha kumudNo ratings yet

- Employer Liability for Employee NegligenceDocument6 pagesEmployer Liability for Employee NegligenceShiena Lou B. Amodia-RabacalNo ratings yet

- Pear Paper Final DraftDocument10 pagesPear Paper Final Draftapi-253445706No ratings yet

- 3400 Bags of Heroin Seized by Hampden District Attorney Gulluni's Narcotics TaskforceDocument2 pages3400 Bags of Heroin Seized by Hampden District Attorney Gulluni's Narcotics TaskforceJim LeydonNo ratings yet

- 2016 2017 Price Media Law Moot Court Competition CaseDocument6 pages2016 2017 Price Media Law Moot Court Competition CaseVidushi Trehan0% (1)

- Farrukh B. Hakeem, M.RDocument154 pagesFarrukh B. Hakeem, M.Raffa shahNo ratings yet

- PP Vs AbapoDocument4 pagesPP Vs Abapogeorgina6160% (1)

- Torture EssayDocument4 pagesTorture Essayapi-284419003No ratings yet

- 67 People Vs PavillareDocument3 pages67 People Vs Pavillarekarl doceoNo ratings yet

- Encryption SubstitutesDocument16 pagesEncryption SubstitutesHoover Institution76% (171)

- Nature and Meaning of Drug AbuseDocument42 pagesNature and Meaning of Drug AbuseNoor MahmoodNo ratings yet

- Domestic ViolenceDocument2 pagesDomestic ViolenceIsrar AhmadNo ratings yet