Professional Documents

Culture Documents

R16 Intercorporate Investment Q Bank PDF

Uploaded by

Zidane KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R16 Intercorporate Investment Q Bank PDF

Uploaded by

Zidane KhanCopyright:

Available Formats

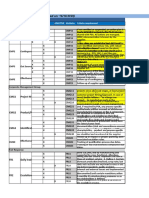

Intercorporate Investment Q Bank www.ift.

world

LO.a: Describe the classification, measurement, and disclosure under International

Financial Reporting Standards (IFRS) for 1) investments in financial assets, 2) investments

in associates, 3) joint ventures, 4) business combinations, and 5) special purpose and

variable interest entities.

1. The minority interest account will most likely appear on the consolidated balance sheet

under:

A. the proportionate consolidation method.

B. the acquisition method.

C. both proportionate consolidation and acquisition method.

2. Company A acquired 20% of the 1 million outstanding shares of company B on January 1.

During the year, company B earned $2 per share and had a dividend payout ratio of 50%. As

of December 31, company B shares were trading at a price of $10 per share. Under the equity

method, the impact on company As income statement for its investment in company B will

be closest to:

A. $100,000.

B. $200,000.

C. $400,000.

3. Analyst 1: The sponsor usually maintains the decision-making power and voting control over

the SPE.

Analyst 2: The equity owners of an SPE usually receive a rate of return that is tied to the

performance of the SPE.

A. Analyst 1 is correct.

B. Analyst 2 is correct.

C. Both analysts are incorrect.

4. Analyst 1: One potential benefit of a VIE is a lower cost of capital since the assets and

liabilities of the VIE are isolated in the event the sponsor experiences financial difficulties.

Analyst 2: The organizational form of a VIE must be either a partnership or a joint venture

and it is necessary for the VIE to have separate management and employees.

A. Analyst 1 is correct.

B. Analyst 2 is correct.

C. Both analysts are incorrect.

5. Which of the following securities will most likely be classified as an available for sale

security?

A. Equity securities representing 25% ownership in another firm.

B. Debt securities that a company has a positive intent and ability to hold to maturity.

C. Debt or equity securities that are carried on the balance sheet at fair market value and

may be sold for liquidity purposes.

6. Company A purchased a 5% interest in Company B. It is now the single largest shareholder

of Company B. It will hold a seat on the Board of Directors of Company B. Company A will

account for its investment in Company B using the:

Copyright IFT. All rights reserved. Page 1

Intercorporate Investment Q Bank www.ift.world

A. equity method.

B. lower of cost or market method.

C. acquisition

7. Company A recently acquired a 55% stake in Company B. Which of the following methods

will Company A use to account for its investment in Company B?

A. equity method.

B. purchase method.

C. acquisition.

8. Which of the following would most likely be classified as a held-to-maturity security?

I. Debt security

II. Equity security that the management has decided to hold for more than 5 years.

A. Only I.

B. Only II.

C. Both I and II.

LO.b: Distinguish between IFRS and US GAAP in the classification, measurement, and

disclosure of investments in financial assets, investments in associates, joint ventures,

business combinations, and special purpose and variable interest entities.

9. Company A owns 40% of the voting shares in Company B and is able to control Company B.

Under U.S. GAAP which of the following methods is most appropriate to use?

A. Equity method.

B. Proportionate consolidation method.

C. Acquisition method.

10. In case of joint ventures with shared control, which of the following accounting treatments is

most preferred under IFRS?

A. Equity method.

B. Proportionate consolidation method.

C. Acquisition method.

11. Which of the following methods is not allowed under U.S. GAAP but is permitted under

IFRS?

A. Equity method.

B. Proportionate consolidation method.

C. Acquisition method.

LO.c: Analyze how different methods used to account for intercorporate investments affect

financial statements and ratios.

12. Which of the following methods will result in the lowest assets and liabilities on a companys

balance sheet?

A. Equity method.

Copyright IFT. All rights reserved. Page 2

Intercorporate Investment Q Bank www.ift.world

B. Acquisition method.

C. Both methods will result in the same amount of assets and liabilities.

13. Which of the following methods will result in the lowest net income on a companys income

statement?

A. Equity method.

B. Acquisition method.

C. Both methods will result in the same amount of net income.

14. Which of the following methods will generally report the most favorable results for an

intercorporate investment?

A. Equity method.

B. Proportionate Consolidation method.

C. Acquisition method.

Copyright IFT. All rights reserved. Page 3

Intercorporate Investment Q Bank www.ift.world

Solutions

1. B is correct. In proportionate consolidation the investor only reports the proportionate share

of the assets, liabilities, revenues, and expenses of the joint venture. Therefore reporting

minority owners interest is not necessary.

2. C is correct. Under the equity method, the investor recognizes its pro-rata share of the

affiliate's income on the income statement. Since Company A owns 200,000 shares of

Company B and Company B earned $2 per share, the income statement impact of the

investment is $400,000.

3. C is correct. Both statements are incorrect. The sponsor does not usually have voting control

over the SPE. The activities of an SPE are specifically detailed in governing documents

created at the origination of the SPE. The structure of the SPE transfers the risks and rewards

from the equity owners to the variable interest owners. In return, the equity owners usually

receive a fixed rate of return.

4. A is correct. Analyst 1 is correct. A lower cost of capital is a potential benefit of forming a

VIE. Analyst 2 is incorrect. The organizational form can be a corporation, partnership, joint

venture or trust. It is not necessary for the VIE to have separate management and employees

5. C is correct. Debt or equity securities that are carried on the balance sheet at fair market

value and may be sold for liquidity purposes are likely to be considered as available-for-sale.

6. A is correct. Even though Company As interest is low at 5%, it has significant influence by

having a seat on Company Bs board. They must therefore use the equity method.

7. C is correct. When the parent company has at least a 50% ownership stake and control over

the subsidiary, the acquisition method is used.

8. A is correct. Only debt securities, which the firm has the positive intent and ability to hold

until final maturity, may be classified as held to maturity.

9. C is correct. It is possible to control with less than a 50% ownership interest. In this case, the

investment is still considered controlling and the acquisition method would be most

appropriate.

10. B is correct. Although the equity method is permitted under IFRS, proportionate

consolidation is the preferred accounting method.

11. B is correct. The proportionate consolidation method is not allowed under U.S. GAAP.

Copyright IFT. All rights reserved. Page 4

Intercorporate Investment Q Bank www.ift.world

12. A is correct. The equity method will reflect the lowest assets and liabilities. The acquisition

method would reflect the highest.

13. C is correct. Both methods will report the same net income.

14. A is correct. Generally, the equity method will provide the most favorable results, while the

acquisition method will provide the least favorable results.

Copyright IFT. All rights reserved. Page 5

You might also like

- R47 The Porfolio Management Process and The IPS Q Bank PDFDocument4 pagesR47 The Porfolio Management Process and The IPS Q Bank PDFZidane KhanNo ratings yet

- R50 Economics and Investment Markets Q Bank PDFDocument5 pagesR50 Economics and Investment Markets Q Bank PDFZidane KhanNo ratings yet

- R46 Commodities and Commodity Derivatives Q Bank PDFDocument7 pagesR46 Commodities and Commodity Derivatives Q Bank PDFZidane KhanNo ratings yet

- R41 Valuation of Contingent Claims IFT Notes PDFDocument28 pagesR41 Valuation of Contingent Claims IFT Notes PDFZidane Khan100% (1)

- R45 Private Equity Valuation Q Bank PDFDocument9 pagesR45 Private Equity Valuation Q Bank PDFZidane KhanNo ratings yet

- R48 Introduction To Multifactor Models Q Bank PDFDocument4 pagesR48 Introduction To Multifactor Models Q Bank PDFZidane KhanNo ratings yet

- R52 Algorithmic Trading and High-Frequency Trading Q Bank PDFDocument4 pagesR52 Algorithmic Trading and High-Frequency Trading Q Bank PDFZidane KhanNo ratings yet

- R36 The Arbitrage-Free Valuation Framework Q Bank PDFDocument9 pagesR36 The Arbitrage-Free Valuation Framework Q Bank PDFZidane Khan100% (1)

- R44 Publicly Traded Real Estate Securities Q Bank PDFDocument6 pagesR44 Publicly Traded Real Estate Securities Q Bank PDFZidane KhanNo ratings yet

- R37 Valuation and Analysis Q Bank PDFDocument14 pagesR37 Valuation and Analysis Q Bank PDFZidane KhanNo ratings yet

- R43 Private Real Estate Investments Q Bank PDFDocument9 pagesR43 Private Real Estate Investments Q Bank PDFZidane KhanNo ratings yet

- R39 Credit Default Swaps Q Bank PDFDocument5 pagesR39 Credit Default Swaps Q Bank PDFZidane KhanNo ratings yet

- R30 Discounted Dividend Valuation Q Bank PDFDocument9 pagesR30 Discounted Dividend Valuation Q Bank PDFZidane KhanNo ratings yet

- R40 Pricing and Valuation of Forward Commitments IFT Notes PDFDocument24 pagesR40 Pricing and Valuation of Forward Commitments IFT Notes PDFZidane KhanNo ratings yet

- R42 Derivative Strategies Q Bank PDFDocument8 pagesR42 Derivative Strategies Q Bank PDFZidane Khan100% (1)

- R32 Market-Based Valuation Q Bank PDFDocument7 pagesR32 Market-Based Valuation Q Bank PDFZidane KhanNo ratings yet

- R41 Valuation of Contingent Claims Q Bank PDFDocument9 pagesR41 Valuation of Contingent Claims Q Bank PDFZidane KhanNo ratings yet

- R42 Derivatives Strategies IFT Notes PDFDocument24 pagesR42 Derivatives Strategies IFT Notes PDFZidane KhanNo ratings yet

- R26 Mergers Acquisitions Q Bank PDFDocument11 pagesR26 Mergers Acquisitions Q Bank PDFZidane KhanNo ratings yet

- R40 Pricing and Valuation of Forward Commitments Q Bank PDFDocument7 pagesR40 Pricing and Valuation of Forward Commitments Q Bank PDFZidane KhanNo ratings yet

- R34 Private Company Valuation Q Bank PDFDocument5 pagesR34 Private Company Valuation Q Bank PDFZidane KhanNo ratings yet

- R38 Credit Analysis Models Q Bank PDFDocument8 pagesR38 Credit Analysis Models Q Bank PDFZidane KhanNo ratings yet

- R27 Equity Valuation Q Bank PDFDocument5 pagesR27 Equity Valuation Q Bank PDFZidane KhanNo ratings yet

- R35 The Term Structure and Interest Rate Dyamics Q Bank PDFDocument12 pagesR35 The Term Structure and Interest Rate Dyamics Q Bank PDFZidane KhanNo ratings yet

- R29 Industry and Company Analysis Q Bank PDFDocument8 pagesR29 Industry and Company Analysis Q Bank PDFZidane KhanNo ratings yet

- R25 Corporate Governance Q Bank PDFDocument6 pagesR25 Corporate Governance Q Bank PDFZidane KhanNo ratings yet

- R33 Residual Income Valuation Q Bank PDFDocument5 pagesR33 Residual Income Valuation Q Bank PDFZidane KhanNo ratings yet

- R28 Return Concepts Q Bank PDFDocument6 pagesR28 Return Concepts Q Bank PDFZidane KhanNo ratings yet

- R23 Dividends and Share Repurchases Q Bank PDFDocument8 pagesR23 Dividends and Share Repurchases Q Bank PDFZidane KhanNo ratings yet

- R31 Free Cash Flow Valuation Q Bank PDFDocument8 pagesR31 Free Cash Flow Valuation Q Bank PDFZidane Khan100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- On Competitive StrategiesDocument33 pagesOn Competitive Strategiesmmjmmj100% (1)

- Learner Guide: Cambridge IGCSE /cambridge IGCSE (9-1) Business Studies 0450 / 0986Document38 pagesLearner Guide: Cambridge IGCSE /cambridge IGCSE (9-1) Business Studies 0450 / 0986FarrukhsgNo ratings yet

- Business DiversificationDocument20 pagesBusiness DiversificationRajat MishraNo ratings yet

- Bahan Lain KokokrunchDocument7 pagesBahan Lain KokokrunchsurianimerhalimNo ratings yet

- Evercore TearsheetDocument1 pageEvercore TearsheetJennifer KwonNo ratings yet

- HCL ProposalDocument2 pagesHCL Proposalrishabh21No ratings yet

- Nafdac Nigeria GMP 2021Document116 pagesNafdac Nigeria GMP 2021Dilawar BakhtNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- Saja Al-Jbour ResumeDocument2 pagesSaja Al-Jbour ResumesajamaljbourNo ratings yet

- Project Report On HR Policies and Its Implementation at Deepak Nitrite LimitedDocument64 pagesProject Report On HR Policies and Its Implementation at Deepak Nitrite LimitedRajkumar Das75% (4)

- Capital Market, Consumption and Investment RelationshipsDocument22 pagesCapital Market, Consumption and Investment RelationshipsKamran Kamran100% (1)

- CFAS Chapter 2 Problem 3Document1 pageCFAS Chapter 2 Problem 3jelou ubagNo ratings yet

- Asm1 - Bee - Ha Thi VanDocument25 pagesAsm1 - Bee - Ha Thi VanVân HàNo ratings yet

- SMM Test 20Document94 pagesSMM Test 20Vũ Thị Thanh ThảoNo ratings yet

- Vishal JainDocument2 pagesVishal JainVishal JainNo ratings yet

- Lecture 1 Understanding EntrepreneurshipDocument15 pagesLecture 1 Understanding EntrepreneurshipTest MockNo ratings yet

- Baf 361 Introduction To Corporate Finance and Banking: LECTURE 7-Cost of Capital IIDocument12 pagesBaf 361 Introduction To Corporate Finance and Banking: LECTURE 7-Cost of Capital IIRevivalist Arthur - GeomanNo ratings yet

- HTTP WWW - Aiqsystems.com HitandRunTradingDocument5 pagesHTTP WWW - Aiqsystems.com HitandRunTradingpderby1No ratings yet

- Five Forces ModelDocument6 pagesFive Forces Modelakankshashahi1986No ratings yet

- Queen's MBA Operations Management CourseDocument9 pagesQueen's MBA Operations Management CourseNguyen Tran Tuan100% (1)

- Group 6 Strategic AuditDocument39 pagesGroup 6 Strategic Auditarsy syahNo ratings yet

- A Study of Artificial Intelligence and Its Role in Human Resource ManagementDocument6 pagesA Study of Artificial Intelligence and Its Role in Human Resource Management19266439No ratings yet

- Ap-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryDocument8 pagesAp-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryJohn Paulo SamonteNo ratings yet

- MB4 - Compliance Requirements 010615Document12 pagesMB4 - Compliance Requirements 010615ninja980117No ratings yet

- Sponsorship Proposal TemplateDocument11 pagesSponsorship Proposal TemplateMichaell Moore100% (2)

- Slide 1: Your Coffee ShopDocument15 pagesSlide 1: Your Coffee ShopMahardika Agil Bima IINo ratings yet

- PLDT Vs - Estranero, GR No.192518, Oct 15, 2014 FactsDocument2 pagesPLDT Vs - Estranero, GR No.192518, Oct 15, 2014 FactsHoreb FelixNo ratings yet

- Qip QSB v4.2 - Trad P Anotaçôes Rev02Document17 pagesQip QSB v4.2 - Trad P Anotaçôes Rev02Yasmin BatistaNo ratings yet

- Test Bank With Answers of Accounting Information System by Turner Chapter 15Document35 pagesTest Bank With Answers of Accounting Information System by Turner Chapter 15Ebook free0% (1)

- Procurement Reminders (Prebid 02072018)Document12 pagesProcurement Reminders (Prebid 02072018)mr. oneNo ratings yet