Professional Documents

Culture Documents

Atrrition in HDFC

Uploaded by

AnKit SacHanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atrrition in HDFC

Uploaded by

AnKit SacHanCopyright:

Available Formats

Volume-2, Issue-5, May-2015 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

(RHIMRJ)

Research Paper

Available online at: www.rhimrj.com

Comprehensive Study of Attrition Strategy of HDFC

BANK in Ahmadabad Region

Prof. Trupti C. Gelani

Lecturer,

Dept. of Management & Accountancy,

Shri M. P. Shah Commerce & BBA College,

Surendranagar, Gujarat (India)

Abstract: It is expected the study of these topic would contribute in clarifying all concepts relating to attrition study, root

causes, problems, practices followed by the company. After study of the topic in depth the fundamental concepts have been

made very clear. The beneficiary from the study of this topic would be first of all self-researcher, academicians, practicing

managers, prospects researchers and banks. If these parties refer this research study in future may take advantage of the

findings and suggestions. Academician, practicing managers and research students may take advantage for academic purpose

and in the jobs. The Banks may implement the suggestions for improvement in attrition reduction programmes. It can be said

the benefits would be multidimensional for above mentioned parties.

Keywords: banks, concept, prospect, managers.

I. INTRODUCTION

The employees always assess the management values, work culture, work practices and credibility of the organization. The

Indian companies do have difficulties in getting the businesses and retain it for a long time. There are always ups and downs in the

business. When there is no focus and in the absence of business plans, non-availability of the campaigns makes people to quickly

move out of the organization.

In the recent decades the Indian industry has changed its outlook. The employment scene has changed its appearance .The

factors like skill sets, job satisfaction drive the employment and not just the money .The employer hence faces the heat of

continuous employee turnover .Continuous efforts are made by organizations to control the employee turnover rate as it directly

affects the performance of the organization as many key people leave the organisations for various reasons at crucial points. This

turnover is normally known as attrition.

II. DEFINITION OF ATTRITION

Attrition is the rate of shrinkage in size or a gradual, natural reduction in membership or personnel as through retirement,

resignation or death

III. CONCEPT OF ATTRITION

Working environment is the most important cause of attrition. Todays Gen Next employees expect a professional approach and

an international style working environment. They expect a friendly and learning environment. Employees look for freedom, good

treatment from the superiors, good encouragement, friendly approach from one and all, and good motivation. No doubt the jobs

today bring lots of pressure and stress is high. The employees often switch jobs if there is too much pressure on performance or

any work related pressure. It is quite common that employees are moved from one process to another. They take time to get

adjusted with the new processes while few employees find it difficult to adjust and consequently leave. Monotony sets in very

quickly and this is one of the main reasons for attrition. Job hopping is very common among youngsters who look at jobs as being

temporary. Another commonly looked option is to move to such other process where there is little or no pressure of sales and

meeting service level agreements (SLA). The employees move out if there are strained relations with the superiors or with the

subordinates or any slightest, discontent.

IV. COMPANY PROFILE

HDFC was incorporated in the year 1977 with the primary objective of meeting a social need that of promoting home

ownership by providing long term finance to households for their housing needs .HDFC was promoted with an initial share capital

of Rs 100 million. HDFC standard life insurance Ltd is a joint venture between HDFC .Indias largest housing finance institution

and standard life assurance company .Europes largest mutual life company. HDFC manages over Rs 28000 crore in assets and

standard life manages over US $100 billions in assets .Both the promoters are well known for their ethical dealings, their

financial strength and their commitment to be a long term player in the life insurance market. HDFC and standard life first came

2015, RHIMRJ, All Rights Reserved Page 1 of 6 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

Volume-2, Issue-5, May-2015

together for a possible joint venture to enter the life insurance market , in January 1995 .It was clear from the outset that both

companies shared similar values and beliefs and a strong relationship was quickly formed .In October 1995 the companies formed

a three year joint venture agreement . The primary objectives of HDFC is to enhance residential housing stock in the country

through provision of housing finance in a systematic and professional manner, and to promote home ownership .Another objective

is to increase the flow of resources to the housing finance sector with the overall domestic financial market.

V. ATTRITION STRATEGY OF HDFC BANK

It is becoming increasingly important for companies to ensure they have the right people in the place to guide future business

success, so company is using following strategies:

Transparant work culture:

HDFC is using the programme called Sparsh which provide the work place where employees are able to use their full potential.

Quality of work:

The basic objective of HDFC is to improve working conditions for the employees and increasing organizational effectiveness

and for that company is running the programme which called Shikhar.

Communication between employer & employees:

HDFC is using the Umang programme which will be using full to properly communicate with their employees.

Manage employees turnover:

The strategy used by HDFC is they always balance the employee turnover by reducing the rate of attrition.

VI. IMPACT OF ATTRITION ON HDFC

There are two main impacts of attrition i.e. Direct & Indirect A high attrition indicates that failure on companys ability to set

effective HR priorities. New hires need to be constantly added, further the cost in training, getting them aligned with culture all a

challenge & attrition bring decrease in productivity. Because of all these impacts I am inspired to study about the attrition strategy.

VII. OBJECTIVE OF THE STUDY

People are considered to be the most important assets of the organization Therefore The employees are encouraged for the

Organization to retain for the maximum time period.

To understand the concept of attrition, reasons, needs, objectives, importance and impact on employees and

organizations in competitive situation etc

To understand the practices followed and find out problems faced by the HDFC Bank due to attrition.

To suggest ways and means to check attrition rate in company.

To complete the requirement of research study.

VIII. RATIONAL OF THE STUDY

In present situation not only in one industry but also all sectors are facing tough competition. It has become very difficult to

grow, stabilize & excel in business performance. Over & above, business environment is changing drastically. It is very difficult

to predict about future, high degree of risk is involved in it. Sincere & dedicated efforts are needed in retaining the existing

employees. While generating high rate of attrition in company it causes some problems or hurdles like: high rate of training,

complication for other existing employees, reduce the amount of encouragement to achieve their targets. Even if sometimes

attrition give some benefits to the organization as well as employees like: new employees bring new ideas, abilities, approaches &

attitudes, remove bottlenecks in progress, create space for new talents etc. by studying the attrition we can come to know about

causes of increasing rate of attrition, we can come to know about retention strategies used by the co.etc. The importance of it

attracted my attention to select these topics for research.

IX. RESEARCH PROBLEM

An attempt is made in present research to address the basic problem:

1. Why Employees leave from the organization?

2. What are the problems they face in the organization?

3. What is the impact of attrition on organization?

4. What are strategies organization use to control the attrition?

2015, RHIMRJ, All Rights Reserved Page 2 of 6 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

Volume-2, Issue-5, May-2015

X. REVIEW OF RESEARCH & DEVELOPMENT IN THE SUBJECT

International Status:

Many study reports are available related to present study which throw light on international status of attrition on economy. One

of them is mention here below:

Embattled TV maker Sharp to cut 2000 jobs in Japan:Tokyo

Struggling Japanese TV maker sharp corp would offer severance packages to as many as 2000 workers in Japan as part to lay

off. One tenth of its global work force in a bid to reduce costs. This article was published in Economic Times on August, 28,

2012.

National Status:

Many study reports are also available related to present study, which throw light on national

status. Some of the reviews are as under:

1. Average quarterly attrition up to 4.7% from MNC and RD Banglore:

MNC and RD centers in India will continue to witness attrition during first and second quarter of 2010 but things will smoothen

out during second half of the year with minimal attrition, a study said. This was published in ET on 2nd June 2010.

2. IT Firms caught in Attrition Trap; Mumbai:

The fluctuating growth rate in software industry is comparable to only the rising attrition rate among employees. Growth and

attrition go hand in hand in software Industries. All publicly listed Indian software services companies name witnessed a rise in

their attrition rates to last year.

XI. RESEARCH METHODOLOGY

A research methodology explains the method and procedures for conducting a particular survey or study. It is the arrangement

of conditions for collection and analyses of data in a logical sequence of the steps involved in research. Research methodology

includes the following:

Type of Research:

Research Methodology is classified into following 3 categories:

Exploratory

Descriptive

Experimental

This research will be descriptive research because I classify the data as per the Age, Sex, Education, Occupation wise and the

effect of this factor on study.

Sources of Data:

For study purpose both primary & secondary data will be used. For study purpose the data used are as under:

9 Primary Data:

Primary data is the information collected during the course of an experiment during experimental research. It can also be

obtained through observation or through direct communication, with the person associated with the selected subject, by

performing survey or descriptive research. Primary data is that which is collected fresh & for the first time.It is also known as

basic data or original data.

Observation:

Structured Unstructured observation.

Disguised Undisguised observation.

Direct Indirect observation.

Human Mechanical observation.

Survey:

Personal Survey.

Mail Survey.

Telephone Survey.

9 Secondary Data:

Secondary data means the data that is already available in various reports, diaries, letters, books etc. Secondary data is that data

which has been used previously for any research and now is used second time. In short, the data presented in research reports

when used again for further research is called secondary data.

Internal sources:

Internal reports.

2015, RHIMRJ, All Rights Reserved Page 3 of 6 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

Volume-2, Issue-5, May-2015

Miscellaneous reports.

Accounting research.

Sales force report.

External sources:

Government publications.

Non- Government publication.

Syndicated services.

Consumer research services.

Publications of insurance magazines.

Instruments For Data Collection:

For collection of data the following instruments will be used:

Questionnaire, interview, telephone, mobile phones, mail etc. These may be as per need as effectiveness of the instruments.

Sampling:

For study purpose the universe will include employees, salesmen, traders & customers of the companies from different location

in Gujarat. But all these cannot be studied due to location, time & cost factors. Therefore, sampling is necessary. Sampling

process will include:

Sampling Method:

Taking sampling from population I can take Stratified Random Sampling Method. I took sample from population without any

human judgment.

Sampling Size:

It will be sufficient enough in number to represent every segment of the population on the basis of units, levels like managerial,

supervisory, new entrants and jobs. Sample size will be of 100.

XII. DATA ANALYSIS AND INTERPRETATION

Interpretation: As Attrition is the burning problem nowadays so we can see from the above graph that in each and every

sectors of economy like FMCG , Manufacturing, capital goods, construction, Non voice BPOs, IT , Telecom, Pharmacy, Bio-tech,

Service, Financial, Retail, Voice based BPOs etc effects of attrition is very much high.

2015, RHIMRJ, All Rights Reserved Page 4 of 6 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

Volume-2, Issue-5, May-2015

Interpretation: Attrition affect on Public as well as private banks also, But as we can see from the table that compare to

private sectors public sectors are not facing the problem of attrition much. The lowest rate of attrition is in Punjab Nation Bank

and the highest problem is faced by the ICICI Bank.

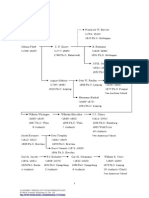

Interpretation: Here is the year wise attrition rate pf the HDFC Bank of Ahemdabad region and as we can see that because of

the entry of many private banks in the banking sector day by day a well known bank like HDFC is also facing the problem of

attrition and the every year its increases.

Calculation of Attrition Rate:

Total No. of employees left

Attrition Rate = X 100

No. of employees present

Interpretation: The above table shows the attrition rate of HDFC for the Year Apr-11 to Mar-12, The fluctuations are there in

every month at the start of the year the attrition rate was higher but after it becomes lower in the month like June, July, September,

& January the rate is 1.3, 0.86, 0.86 & 0.86 respectively but at the end of the year its increases again.

Interpretation: If we study the rate of attrition for particular month we can see the line of attrition is becoming higher for the

HDFC Bank.

2015, RHIMRJ, All Rights Reserved Page 5 of 6 ISSN: 2349-7637 (Online)

RESEARCH HUB International Multidisciplinary Research Journal

Volume-2, Issue-5, May-2015

XIII. FINDINGS

As we know that today attrition is the burning problem in each every sector so we can see that every sector in the economy are

facing this problem.

Banking sector provides the one of the basic necessity to the economy. But in each banks we are finding that people

are leaving their jobs because of the one or the other reasons either it is a private or public bank.

If we see the attrition rate for HDFC day by day its increasing because of many reasons n many organizations are

providing different types of working facilities which creates a keen competition in the market.

Most of the people surveyed were satisfied with the working conditions provided by HDFC and they were very much

aware of the companys product & their comparative advantages over the competition in the market.

Job profile provided by the company was also liked by the respondents.

There were respondents who were having a good experience of working with HDFC.

It was clear and evident from the study that there was no problem like bad behavior of colleagues and superiors in the

organization.

Most of the respondents were fully aware of the companys terms and conditions since joining the organization.

The problem was present in the training and development part. Employees were not satisfied with the type and

schedule of training and development programs run by the organization.

Further, the next problem that was evident in the form of entrance of new life insurance players in the market.

Employees appraisal system was also found to be one of the causes of attrition.

As we all know that banking sector is full of stress and working hours are too hectic. Same is the case in HDFC;

employees were not satisfied with the working hours in the system.

XIV. LIMITATION OF THE STUDY

To carry out the research study the following limitations are expected that these will be faced:

Availability of secondary data from banks may be difficult.

Employees may avoid or hesitate to give relevant data.

Management may not like to share their views on the topic.

Time, cost & location factors may cause difficulties.

Sample size may not be exact representative of the universe.

REFERENCES

1. www.naukrihub.com

2. www.citehr.coms

3. www.projectparadise.com

4. www.hdfcinsurance.com

5. www.irda.com

6. www.hdfc.com

7. Retention.naukrihub.com

8. Payroll.naukrihub.com

9. Bpo.india.org

10. appraisals.naukri.com

11. training and development.naukri.com

12. Human Resource Management by V.S.P.Rao

13. Human Resource Management by K. Aswathappa

14. Human Resource Management by Gary Desseler

15. Research Methodology by Kothari

2015, RHIMRJ, All Rights Reserved Page 6 of 6 ISSN: 2349-7637 (Online)

You might also like

- Deepna ITC Project ReportDocument124 pagesDeepna ITC Project ReportAnKit SacHanNo ratings yet

- Summer Training Project Report: Employee Performance Appraisal-Planning & Procedures in RSPLDocument4 pagesSummer Training Project Report: Employee Performance Appraisal-Planning & Procedures in RSPLAnKit SacHanNo ratings yet

- Form For HR AuditDocument5 pagesForm For HR AuditVandana NagarajanNo ratings yet

- Vision Statement PDFDocument1 pageVision Statement PDFAnKit SacHanNo ratings yet

- Ti Larsen Annd ToubroDocument11 pagesTi Larsen Annd ToubroAnKit SacHanNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireAnKit SacHanNo ratings yet

- Indian National PDFDocument24 pagesIndian National PDFAnKit SacHanNo ratings yet

- Table 1 Demographic ProfileDocument4 pagesTable 1 Demographic ProfileAnKit SacHanNo ratings yet

- Table 1 Demographic ProfileDocument4 pagesTable 1 Demographic ProfileAnKit SacHanNo ratings yet

- Employee Attrition Research ObjectivesDocument1 pageEmployee Attrition Research ObjectivesAnKit SacHanNo ratings yet

- Objectives Critical and Noncritical FactorDocument4 pagesObjectives Critical and Noncritical FactorAnKit SacHanNo ratings yet

- I. Critical Factors:: Introduction: How To Retain EmployeesDocument34 pagesI. Critical Factors:: Introduction: How To Retain EmployeesAnKit SacHanNo ratings yet

- MBA Summer Internship Project GuidelinesDocument1 pageMBA Summer Internship Project GuidelinesAnKit SacHanNo ratings yet

- Skill Detail of 13.06.17Document1,482 pagesSkill Detail of 13.06.17AnKit SacHanNo ratings yet

- Employee Satisfaction at Tata TeleservicesDocument71 pagesEmployee Satisfaction at Tata TeleservicesAnKit SacHanNo ratings yet

- Summer Training GuidelinesDocument27 pagesSummer Training GuidelinesAnKit SacHanNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireAnKit SacHanNo ratings yet

- SeparationList 01Apr-19Nov2016Document8 pagesSeparationList 01Apr-19Nov2016AnKit SacHanNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireAnKit SacHanNo ratings yet

- A Study On Overview of Employee Attrition Rate in India 150759937Document5 pagesA Study On Overview of Employee Attrition Rate in India 150759937Pramit NarayanNo ratings yet

- Data InputDocument105 pagesData InputAnKit SacHanNo ratings yet

- MBA Summer Internship Project GuidelinesDocument1 pageMBA Summer Internship Project GuidelinesAnKit SacHanNo ratings yet

- Data InputDocument105 pagesData InputAnKit SacHanNo ratings yet

- DisneyDocument15 pagesDisneyAnKit SacHanNo ratings yet

- Vision Statement PDFDocument1 pageVision Statement PDFAnKit SacHanNo ratings yet

- I. Critical Factors:: Introduction: How To Retain EmployeesDocument34 pagesI. Critical Factors:: Introduction: How To Retain EmployeesAnKit SacHanNo ratings yet

- Guidelines for Summer Training ReportDocument27 pagesGuidelines for Summer Training ReportAnKit SacHanNo ratings yet

- Indian National PDFDocument24 pagesIndian National PDFAnKit SacHanNo ratings yet

- Summer Training Project: Employee AttritionDocument15 pagesSummer Training Project: Employee AttritionAnKit SacHanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elements of Administration PPT 1Document25 pagesElements of Administration PPT 1Miguel Mansilla43% (7)

- Front Page of Term Paper SampleDocument8 pagesFront Page of Term Paper Sampleafdtsebxc100% (1)

- Instant Download Ebook PDF Essentials of Health Care Marketing 4th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Essentials of Health Care Marketing 4th Edition PDF Scribdjames.nohel84497% (39)

- Activity No. 1Document6 pagesActivity No. 1Hyman Jay BlancoNo ratings yet

- OWL at Purdue University Using APA FormatDocument20 pagesOWL at Purdue University Using APA Formatrryan100% (10)

- Index of Thought Leaders 2012Document4 pagesIndex of Thought Leaders 2012lomax2No ratings yet

- Medication Therapy Management Current ChallengesDocument11 pagesMedication Therapy Management Current ChallengesDzaky UlayyaNo ratings yet

- Efficacy of Clear Aligners in Controlling Orthodontic Tooth MovementDocument9 pagesEfficacy of Clear Aligners in Controlling Orthodontic Tooth MovementMirnaLizNo ratings yet

- Effect of Learning Activity Package (Lap) On Students' Achievement and Retention in Senior Secondary School BiologyDocument55 pagesEffect of Learning Activity Package (Lap) On Students' Achievement and Retention in Senior Secondary School Biologyjamessabraham2No ratings yet

- Introduction of Internship ReportDocument6 pagesIntroduction of Internship ReportKazi Jakir Hossain17% (6)

- Pur - Brochure - 1706 Esponjas BWP CatverDocument2 pagesPur - Brochure - 1706 Esponjas BWP CatverMarilyn PeñarandaNo ratings yet

- Assess PDFDocument5 pagesAssess PDFLouis UranoNo ratings yet

- Sample Research Proposal 1Document3 pagesSample Research Proposal 1api-460354029100% (2)

- The Gaps Model of Service Quality: "Service Marketing", Valarie A. Zeithaml & Mary Jo BitnerDocument16 pagesThe Gaps Model of Service Quality: "Service Marketing", Valarie A. Zeithaml & Mary Jo BitnerMohammed ObaidNo ratings yet

- Journal Critique HET524Document9 pagesJournal Critique HET524Qing YiNo ratings yet

- Photodegradation Products of PropranololDocument9 pagesPhotodegradation Products of PropranololAmalia PănescuNo ratings yet

- Community Engagement, Solidarity, and CitizenshipDocument2 pagesCommunity Engagement, Solidarity, and CitizenshipSummer HarielleNo ratings yet

- Discourse Pragmatics Group 3Document11 pagesDiscourse Pragmatics Group 3Han D-RyNo ratings yet

- Doi Suppl 10.1142 7420 Suppl File 7420 Chap01Document81 pagesDoi Suppl 10.1142 7420 Suppl File 7420 Chap01xyz_universeNo ratings yet

- Examiners' Report June 2018: IAL Arabic WAA02 01Document40 pagesExaminers' Report June 2018: IAL Arabic WAA02 01Rafa67% (3)

- Cooperative Management Midterm ReviewDocument22 pagesCooperative Management Midterm ReviewPesidas, Shiela Mae J.No ratings yet

- NancyHernandez Research2022 PDFDocument23 pagesNancyHernandez Research2022 PDFAkash TomarNo ratings yet

- Contents:: An Introduction To Social Psychology by Miles Hewstone, Wolfgang Stroebe, KlausDocument36 pagesContents:: An Introduction To Social Psychology by Miles Hewstone, Wolfgang Stroebe, KlausMuskanNo ratings yet

- Probability PlotDocument17 pagesProbability PlotCharmianNo ratings yet

- GEOGRAPHY'S QUESTION: THE NATURE OF PLACEDocument6 pagesGEOGRAPHY'S QUESTION: THE NATURE OF PLACEIan OrchidsNo ratings yet

- SPSS Statistics 19 Guide Exercises AnswersDocument68 pagesSPSS Statistics 19 Guide Exercises AnswersAgnes Lau100% (1)

- The 2003 European HeatwaveDocument12 pagesThe 2003 European HeatwaveCúc NguyễnNo ratings yet

- Voting System For StudentsDocument51 pagesVoting System For Studentsshindou aiNo ratings yet

- Leader Follower StrategyDocument42 pagesLeader Follower StrategyNaman Bhojak0% (1)

- A Practical Guide To Writing A Feasibility Study: Ndalahwa MUSA MasanjaDocument34 pagesA Practical Guide To Writing A Feasibility Study: Ndalahwa MUSA MasanjaRuth PenuliarNo ratings yet