Professional Documents

Culture Documents

AUG 03 NBC Financial Group US Watch Hot Charts

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUG 03 NBC Financial Group US Watch Hot Charts

Uploaded by

Miir ViirCopyright:

Available Formats

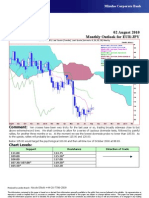

August 3, 2010– (Vol. XI, No.

96)

U.S. Watch U.S.: will consumption growth be sustained?

Just-released data by the BEA showed U.S. households Real personal disposable income and Real consumption

savings rate now stands at 6.4% of disposable income. savings rate

The current low level of interest rates provides little In order for Q3 to get

incentives to further build up savings relative to income Real personal the same consumption

10 5 %, q/q ann.

disposable income rose growth as in Q2, we

while the stock market is recovering and home prices 4.4% in Q2…

have stabilized. As today’s Hot Charts shows, a solid 8 Savings rate need monthly growth of

4 0.15% over the next

4.4% increased in real disposable income in Q2 was able three months…

to push upward both consumption and savings. With a 6

3

hand off of 0.5% entering the third quarter, consumption

4

needs to grow 0.15% m/m on average in Q3 to replicate 2

Q2 consumption’s performance. Could consumption 2 4.4%

grow in Q3 in line with its average growth rate 1

experienced since the beginning of the recovery? If 0

households decide to spend part of their Q2 income 0

gains, this scenario should be relatively easy to achieve. -2

Like Mr. Bernanke said yesterday, ‘’rising demand from -1

-4 Hand off in

households and businesses should help sustain growth”. …which allowed the

R.D.I. …this is exactly Q3 = 0.5%

However, support for consumption requires more than -6 savings rate to move in -2

just a possible one-off reduction in the savings rate. In tandem with the mean growth

consumption since the

order to be sustained, consumption growth must -8 -3 beginning of the

undoubtedly rely on a more solid footing. That puts the recovery

spotlight on Friday’s job report: not only the amount of -10 -4

2004 2005 2006 2007 2008 2009 2010 06Q1 06Q3 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3

private jobs created, but also its wage bill.

Yanick Desnoyers NBF Economy & Strategy (Bureau of Economic Analysis data via Global Insight)

NBF Economics & Strategy Group (514) 879-2529

Stéfane Marion, Chief Economist and Strategist

General: National Bank Financial (NBF) is an indirect wholly owned subsidiary of National Bank of Canada. National Bank of Canada is a public company listed on Canadian stock exchanges. ♦ The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us

and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. ♦Canadian Residents: In respect of the distribution of this report in Canada, NBF accepts

responsibility for its contents. To make further inquiry related to this report or effect any transaction, Canadian residents should contact their NBF Investment advisor. ♦ U.S. Residents: NBF Securities (USA) Corp., an affiliate of NBF, accepts responsibility for the contents of this report, subject to any terms set out

above. Any U.S. person wishing to effect transactions in any security discussed herein should do so only through NBF Securities (USA) Corp. UK Residents: In respect of the distribution of this report to UK residents, NBF has approved this financial promotion for the purposes of Section 21(1) of the Financial

Services and Markets Act 2000. NBF and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or may have had interests or long or short positions in, and may at any time make purchases and/or sales as principal or

agent, or may act or may have acted as market maker in the relevant securities or related financial instruments discussed in this report, or may act or have acted as investment and/or commercial banker with respect thereto. The value of investments can go down as well as up. Past performance will not necessarily be

repeated in the future. The investments contained in this report are not available to private customers. This report does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for the securities described herein nor shall it or any part of it form the basis of or be

relied on in connection with any contract or commitment whatsoever. This information is only for distribution to non-private customers in the United Kingdom within the meaning of the rules of the Regulated by the Financial Services Authority. ♦ Copyright: This report may not be reproduced in whole or in part, or

further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of National Bank Financial.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Cash Budget Template TilesDocument1 pageCash Budget Template TilesVeronica BaileyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Portable Private BankerDocument214 pagesPortable Private BankerDavid Adeabah Osafo100% (2)

- Market Research and Product Development: Citi Global Consumer BankDocument4 pagesMarket Research and Product Development: Citi Global Consumer BankAnil Kumar ShahNo ratings yet

- Acc802 Tut Topc 7 QuestionsDocument3 pagesAcc802 Tut Topc 7 Questionssanjeet kumarNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- PM Sect B Test 5Document3 pagesPM Sect B Test 5FarahAin FainNo ratings yet

- Investing in The Philippine Stock Market - Fv3Document64 pagesInvesting in The Philippine Stock Market - Fv3Rocky CadizNo ratings yet

- BSBFIM601 - Assessment 2 ProjectDocument8 pagesBSBFIM601 - Assessment 2 ProjectSaanjit KcNo ratings yet

- DR - Ritu Sapra - Distributions To ShareholdersDocument34 pagesDR - Ritu Sapra - Distributions To ShareholdersAdil AliNo ratings yet

- Comptroller Steals $53 Million From City Funds: EthicsDocument4 pagesComptroller Steals $53 Million From City Funds: EthicsChess NutsNo ratings yet

- BeanFX Boom Et Crash Scalper - Blog Des Traders FXDocument22 pagesBeanFX Boom Et Crash Scalper - Blog Des Traders FXRomi Carter L'impérialNo ratings yet

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessDocument51 pagesChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateNo ratings yet

- Working Capital Management of Reliance Infra LTDDocument76 pagesWorking Capital Management of Reliance Infra LTDniceprachiNo ratings yet

- Easy Pinjaman Ekspres PDSDocument4 pagesEasy Pinjaman Ekspres PDSFizz FirdausNo ratings yet

- AU Small Finance Bank 23-Mar-2023Document6 pagesAU Small Finance Bank 23-Mar-2023vaibhav vidwansNo ratings yet

- LatinFocus Consensus Forecast - November 2023 (Argentina)Document1 pageLatinFocus Consensus Forecast - November 2023 (Argentina)Phileas FoggNo ratings yet

- PGDMSM 2022 Prospectus PDFDocument24 pagesPGDMSM 2022 Prospectus PDFAkash SherryNo ratings yet

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalNo ratings yet

- Chapter 5 Time Value of MoneyDocument39 pagesChapter 5 Time Value of MoneyAU Sharma100% (2)

- Final Presentation On Accounting FraudDocument15 pagesFinal Presentation On Accounting FraudDisha JugatNo ratings yet

- Sabeetha Final ProjectDocument52 pagesSabeetha Final ProjectPriyesh KumarNo ratings yet

- Apply for Canara Bank Debit CardDocument2 pagesApply for Canara Bank Debit CardJohn Athaide100% (1)

- Mudassar Ahmed SP19-BBA-186 Assignment 4Document5 pagesMudassar Ahmed SP19-BBA-186 Assignment 4Raja MohsinNo ratings yet

- TM BseDocument4 pagesTM BseVansh GoelNo ratings yet

- Financing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014Document2 pagesFinancing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014J.V. Siritt ChangNo ratings yet

- HSBC Uk Launches Green Finance Proposition To Support Uk Businesses PDFDocument2 pagesHSBC Uk Launches Green Finance Proposition To Support Uk Businesses PDFSahjeet MenonNo ratings yet

- Principles of Accounting IIDocument175 pagesPrinciples of Accounting IIsamuel debebe95% (22)

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- Harvard Professor Benjamin Esty CVDocument8 pagesHarvard Professor Benjamin Esty CVadi2005No ratings yet

- Payback PeriodDocument15 pagesPayback PeriodDeepankumar AthiyannanNo ratings yet

- Money and BankingDocument8 pagesMoney and BankingMuskan RahimNo ratings yet