Professional Documents

Culture Documents

Waman Hari Pethe Sons BankLoan 170Cr Rationale 10nov2016

Uploaded by

DEVESH BHOLEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Waman Hari Pethe Sons BankLoan 170Cr Rationale 10nov2016

Uploaded by

DEVESH BHOLECopyright:

Available Formats

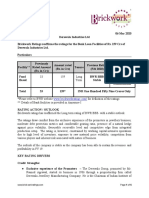

Rating Rationale

Brickwork Ratings assigns BWR BBB+ Outlook (Stable) rating for Bank Credit

Facilities aggregating 170.00 Cr of Waman Hari Pethe Sons Pvt Ltd.

Brickwork Ratings (BWR) has assigned the Rating1 of BWR BBB+ (Pronounced BWR Triple

B plus) with a stable outlook for the long term Bank credit facilities of Rs.170 Crore of Waman

Hari Pethe Sons Pvt Ltd. (WHPS or the Company)1,.

Limits in

Facility Tenure Rating1

Amount (Cr)

BWR BBB+

Cash Credit 170.00 Long Term (Pronounced BWR Triple B Plus)

(Outlook- Stable)

Total Limits 170.00 (INR One Hundred Seventy Crores Only)

The rating inter alia factors promoters experience and long track record in retail jewelry

industry, established brand name particularly in Maharashtra region, and efficient inventory

management and robust financial parameters.

The rating is however constrained by moderate financial risk profile, weak profitability, intense

competition in retail jewellery segment, and exposure to risk of change in Government policies

and regulations with respect to retail jewelry segment/ gold control.

Background

Waman Hari Pethe Sons Pvt Ltd (WHPS) is incorporated by Mr. Subodh Pethe and Mrs Sonali

Pethe in year 2010 engaged in retail jewelley business. The family business was carried out

under a single entity till year 2001 when the family business was spun off in four different

entities. Mr. Subodh Pethe inherited name Waman Hari Pethe and a single shop at Thane in

year 2001. Presently WHPS has 12 showrooms located in Thane, other eastern suburbs of

Mumbai, Aurangabad, Solapur and Pune.

WHPS deals in hallmarked gold jewellery, silver articles and certified diamond jewellery. The

company has also extended its product line to affordable Kundan and Antique Gold jewellery.

WHPS customer base constitutes primarily Maharashtrian middle class and upper middleclass

families as it deals in traditional gold jewellery.

The operations of the company are managed by Mr. Subodh Pethe and Mrs. Sonali Pethe

supported by team of experienced professionals.

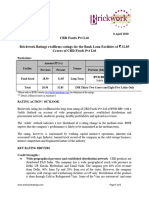

Financial Performance

WHPS reported revenues of Rs. 615.24 Crore in FY16 compared to Rs. 665.43 Crore in FY15, the

de-growth of 7.5% in revenues was primarily on account of nationwide strike of 42 days (from

2-Mar-2016 to 13-Apr-2016) by jewelers against imposition of excise duty of 1%.

1

Please refer to www.brickworkratings.com for definition of the Ratings

www.brickworkratings.com 1 10 Nov 2016

WHPSs operating profits declined to Rs.27.34 crore for FY2016 from Rs.30.32 crore in FY15.

Further net profit declined to Rs.4.24 crore in FY16 from Rs.5.60 crore in FY15.

The capital structure of the company is highly geared with debt equity ratio at 2.30x as on

March 31st 2016 as against 2.8x as on March 31st 2015. The companys debt primarily comprises

of working capital facilities and gold-on-loan scheme of the Lending Bank which provides

natural hedge against fluctuations in gold prices. The company is also contemplating expansion

of outlets for next 2 to 3 years.

Outlook

Going forward, the companys ability to scale up its operations revenues, improve profitability,

geographically diversify the business and improve its capital structure by timely equity infusion

will be key rating sensitivities of the firm.

Analyst Contact Relationship Contact

analyst@brickworkratings.com425-24 bd@brickworkratings.com

Phone Media Contact

1-860-425-2742 media@brickworkratings.com

Disclaimer: Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the issuer and other reliable sources,

which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine the precision or

completeness of the information obtained. And hence, the information in this report is presented as is without any express or implied warranty

of any kind. BWR does not make any representation in respect to the truth or accuracy of any such information. The rating assigned by BWR

should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses

incurred by users from any use of this report or its contents. BWR has the right to change, suspend or withdraw the ratings at any time for any

reasons.

www.brickworkratings.com 2 10 Nov 2016

You might also like

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- BWR A- & BWR A2+ Ratings Assigned to Megha Engineering & Infrastructures LtdDocument3 pagesBWR A- & BWR A2+ Ratings Assigned to Megha Engineering & Infrastructures Ltdvivekpatel1234No ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Brickwork assigns BWR BB- rating to Asquare Food & BeveragesDocument6 pagesBrickwork assigns BWR BB- rating to Asquare Food & BeveragesTanmay GuptaNo ratings yet

- Microlite Indsutries 30may2020Document3 pagesMicrolite Indsutries 30may2020utkarsh kumarNo ratings yet

- Hindustan - Associates - 4 Tanishq Stores in UPDocument5 pagesHindustan - Associates - 4 Tanishq Stores in UPJai PhookanNo ratings yet

- Yashodhara Super Speciality Hospital Private LimitedDocument6 pagesYashodhara Super Speciality Hospital Private LimitedAvinash ShelkeNo ratings yet

- Faridabad Steel Mongers Rating RationaleDocument4 pagesFaridabad Steel Mongers Rating RationaleShamNo ratings yet

- Avenue Supermarts LimitedDocument6 pagesAvenue Supermarts LimitedAvinash GollaNo ratings yet

- DR Datson Labs 22mar2021Document5 pagesDR Datson Labs 22mar2021office88kolNo ratings yet

- BWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesDocument4 pagesBWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesNalla ThambiNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- JSSI Hydraulics Credit RatingDocument2 pagesJSSI Hydraulics Credit RatingVibhu SinghNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Sri Kauvery Medical Care 11 01 24Document10 pagesSri Kauvery Medical Care 11 01 24mskumar01992No ratings yet

- Welspun-Specialty-Solutions-4Nov2019 BrickworkDocument7 pagesWelspun-Specialty-Solutions-4Nov2019 BrickworkPuneet367No ratings yet

- RBL BANK's Valuation - Perception or Reality Check?: TH TH TH TH THDocument2 pagesRBL BANK's Valuation - Perception or Reality Check?: TH TH TH TH THHARSHIT AHUJA PGP 2021-23 BatchNo ratings yet

- Sri - Shyam - Jewellers - Tanishq Franchise 1 StoreDocument4 pagesSri - Shyam - Jewellers - Tanishq Franchise 1 StoreJai PhookanNo ratings yet

- Sri Someshwara - R-27022017 PDFDocument6 pagesSri Someshwara - R-27022017 PDFAjith KumarNo ratings yet

- Anoop Oswal Hosiery Final NoteDocument35 pagesAnoop Oswal Hosiery Final Notetejasj171484No ratings yet

- Credit Rating LetterDocument10 pagesCredit Rating LetterMAHI LADNo ratings yet

- RATING RATIONALE FOR DEREWALA INDUSTRIES LTDDocument6 pagesRATING RATIONALE FOR DEREWALA INDUSTRIES LTDMukul SoniNo ratings yet

- Y-Wildcraft-India-18Oct 2022Document8 pagesY-Wildcraft-India-18Oct 2022PratyushNo ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- RBI Policy - Key Challenges For The Banking SectorDocument4 pagesRBI Policy - Key Challenges For The Banking SectorRekha LohiaNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Investigation On The Flow Behaviour of ADocument6 pagesInvestigation On The Flow Behaviour of ANikhil GuptaNo ratings yet

- SRC Chemicals Private LimitedDocument8 pagesSRC Chemicals Private Limitedgcgary87No ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Y-Wildcraft-India-18Oct 2022Document8 pagesY-Wildcraft-India-18Oct 2022PratyushNo ratings yet

- Maha Durga Charitable Trust: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesMaha Durga Charitable Trust: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionNeeraj_Kumar_AgrawalNo ratings yet

- Kutch Chemical Industries BankLoan 222Cr Revision Rationale 9may2016Document2 pagesKutch Chemical Industries BankLoan 222Cr Revision Rationale 9may2016JatinBansalNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Shiv Health Foods Llp-RU-12-06-2023Document12 pagesShiv Health Foods Llp-RU-12-06-2023Rituraj solankiNo ratings yet

- SBI Will Slash RatesDocument2 pagesSBI Will Slash RatesChetan PanchamiaNo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Ujjivan Small Finance Bank LimitedDocument5 pagesUjjivan Small Finance Bank LimitedSaurav KumarNo ratings yet

- Maruti Suzuki Kizashi Marketing PlanDocument8 pagesMaruti Suzuki Kizashi Marketing Planniranjan bhagatNo ratings yet

- PresentationSUMMARY (A)Document2 pagesPresentationSUMMARY (A)Rakib HasanNo ratings yet

- RBL Bank AR - 2020Document156 pagesRBL Bank AR - 2020anil1820No ratings yet

- BWR assigns BBB rating to Manikaran PowerDocument2 pagesBWR assigns BBB rating to Manikaran PowerCA Rakesh JhaNo ratings yet

- Corporate-Finance-AM-STDocument5 pagesCorporate-Finance-AM-STAash RedmiNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Procedure of Credit RatingDocument57 pagesProcedure of Credit RatingMilon SultanNo ratings yet

- Milkfood Ltd. Bank Loan Rating Downgraded to BBB- on Revenue DeclineDocument7 pagesMilkfood Ltd. Bank Loan Rating Downgraded to BBB- on Revenue DeclineUthay UthayNo ratings yet

- Motisons IPONoteDocument4 pagesMotisons IPONotefirozalam841227No ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Price Waterhouse & Co Chartered Accountants LLPDocument8 pagesPrice Waterhouse & Co Chartered Accountants LLPSuraj KumarNo ratings yet

- IPO - RBZ Jewellers 1Document3 pagesIPO - RBZ Jewellers 1Ravi DiyoraNo ratings yet

- Microfinance Private LimitedDocument5 pagesMicrofinance Private LimitedsantoshbsantuNo ratings yet

- Chromachemie Laboratory Private LimitedDocument7 pagesChromachemie Laboratory Private Limitedkrushna.maneNo ratings yet

- Shilchar_Technologies_LimitedDocument5 pagesShilchar_Technologies_Limitedjaikumar608jainNo ratings yet

- EarningUpdatesPresentation BBL 30092021 PDFDocument29 pagesEarningUpdatesPresentation BBL 30092021 PDFsuman sheikhNo ratings yet

- Bikaji Foods International LimitedDocument7 pagesBikaji Foods International Limitedadhyan kashyapNo ratings yet

- PacraDocument6 pagesPacraJunaid KhalidNo ratings yet

- Professional Profile Saurav Sethia 21-22Document2 pagesProfessional Profile Saurav Sethia 21-22utkarsh singhNo ratings yet

- Rolls-Royce Motorcars Range Product Overview Brochure - RoW PDFDocument76 pagesRolls-Royce Motorcars Range Product Overview Brochure - RoW PDFDEVESH BHOLENo ratings yet

- Data Monitor Report - Soft DrinksDocument26 pagesData Monitor Report - Soft DrinksKhushi SawlaniNo ratings yet

- Adani AR 2019-20Document220 pagesAdani AR 2019-20DEVESH BHOLENo ratings yet

- A Short History of Corruption, Destruction and Criminal ActivityDocument16 pagesA Short History of Corruption, Destruction and Criminal ActivityDEVESH BHOLENo ratings yet

- Ijsrp p5658 PDFDocument6 pagesIjsrp p5658 PDFDEVESH BHOLENo ratings yet

- Bata India Annual 2013Document140 pagesBata India Annual 2013Aditya ChauhanNo ratings yet

- SMB University 120307 Networking Fundamentals PDFDocument38 pagesSMB University 120307 Networking Fundamentals PDFJacques Giard100% (1)

- 1009 4980Document5 pages1009 4980DEVESH BHOLENo ratings yet

- Mobile Phone Bangla KeypadDocument6 pagesMobile Phone Bangla KeypadDEVESH BHOLENo ratings yet

- Coal Industry PDFDocument10 pagesCoal Industry PDFVineet SharmaNo ratings yet

- Simplex MethodDocument16 pagesSimplex MethodShantanu Dutta100% (1)

- Perception of Brand Positioning of Aje Big Cola: Chaleeporn LeampriboonDocument2 pagesPerception of Brand Positioning of Aje Big Cola: Chaleeporn LeampriboonDEVESH BHOLENo ratings yet

- Nse PDFDocument104 pagesNse PDFVicky VaioNo ratings yet

- Ambit BataIndia Initiation DistributionhaslittlePowerleft 09dec2015Document36 pagesAmbit BataIndia Initiation DistributionhaslittlePowerleft 09dec2015DEVESH BHOLENo ratings yet

- Ijsrp p5658 PDFDocument6 pagesIjsrp p5658 PDFDEVESH BHOLENo ratings yet

- Coke PPAHDocument5 pagesCoke PPAHOscar PettersNo ratings yet

- Research Report Fortis Healthcare LTDDocument13 pagesResearch Report Fortis Healthcare LTDDEVESH BHOLENo ratings yet

- Coke IPDocument99 pagesCoke IPAmit SarkarNo ratings yet

- Oracle 12c TOC PDFDocument18 pagesOracle 12c TOC PDFDEVESH BHOLE100% (1)

- En16 Ar SecDocument244 pagesEn16 Ar SecDEVESH BHOLENo ratings yet

- 636122917776478561 (1)Document52 pages636122917776478561 (1)DEVESH BHOLENo ratings yet

- Win a Trip to Adopt a Giraffe with BIG ColaDocument2 pagesWin a Trip to Adopt a Giraffe with BIG ColaDEVESH BHOLENo ratings yet

- 20th Annual Report 2015 16 - Opt PDFDocument300 pages20th Annual Report 2015 16 - Opt PDFDEVESH BHOLENo ratings yet

- Advertisement Financial Results 310314Document1 pageAdvertisement Financial Results 310314DEVESH BHOLENo ratings yet

- Colorbond Steel Colours For Your Home Colour Chart PDFDocument4 pagesColorbond Steel Colours For Your Home Colour Chart PDFDEVESH BHOLENo ratings yet

- 4 ColoursDocument4 pages4 ColoursDEVESH BHOLENo ratings yet

- TX Star Plus HandbookDocument86 pagesTX Star Plus HandbookDEVESH BHOLENo ratings yet

- Gly Star Plus H LabelDocument72 pagesGly Star Plus H LabelDEVESH BHOLENo ratings yet

- Manual Potenciometro ThermoDocument299 pagesManual Potenciometro ThermoDiegoMzaNo ratings yet

- Superior Healthplan (Superior) Star+Plus Medicare-Medicaid Plan (MMP) 2017 Provider & Pharmacy Directory InformationDocument11 pagesSuperior Healthplan (Superior) Star+Plus Medicare-Medicaid Plan (MMP) 2017 Provider & Pharmacy Directory InformationDEVESH BHOLENo ratings yet

- Florida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesDocument98 pagesFlorida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesForeclosure Fraud100% (12)

- Comparison of Unit Link Products Performance in IndonesiaDocument17 pagesComparison of Unit Link Products Performance in IndonesiaFitria HasanahNo ratings yet

- TBChap 007Document101 pagesTBChap 007wannaflynowNo ratings yet

- RREEF Investment Outlook 8-10Document15 pagesRREEF Investment Outlook 8-10dealjunkieblog9676No ratings yet

- Banking TheoryDocument299 pagesBanking TheoryMohammedNo ratings yet

- Portfolio RiskDocument24 pagesPortfolio RiskABC DEFNo ratings yet

- Brian Windsor CalculationDocument12 pagesBrian Windsor CalculationprakashNo ratings yet

- Exhibits For First LetterDocument34 pagesExhibits For First Letterapi-359234129No ratings yet

- Butterfly Spread Profit Table for Seminar 9 – Problem 3Document11 pagesButterfly Spread Profit Table for Seminar 9 – Problem 3Raghuveer ChandraNo ratings yet

- Silkair Singapore Vs CirDocument15 pagesSilkair Singapore Vs Circode4saleNo ratings yet

- Leverage and Pip ValueDocument4 pagesLeverage and Pip ValueSanjayNo ratings yet

- 2018 CafmoDocument8 pages2018 CafmovilchizableNo ratings yet

- RBI Banking Awareness CapsuleDocument118 pagesRBI Banking Awareness CapsuleAbhishek Choudhary100% (1)

- LME trading calendar comparison 2018-2021Document2 pagesLME trading calendar comparison 2018-2021Rasmi RanjanNo ratings yet

- BSG PowerPoint Presentation - V1.5Document41 pagesBSG PowerPoint Presentation - V1.5Henry PamaNo ratings yet

- Partnership 2Document64 pagesPartnership 2Anis AlwaniNo ratings yet

- Raschke 0203 SFODocument4 pagesRaschke 0203 SFONandeshsinha75% (4)

- AIIBDocument142 pagesAIIBanon_761044641No ratings yet

- G.R. No. 205469 Bpi Family Savings Bank, Inc., Petitioner, St. Michael Medical Center, Inc., Respondent. Decision Perlas-Bernabe, J.Document61 pagesG.R. No. 205469 Bpi Family Savings Bank, Inc., Petitioner, St. Michael Medical Center, Inc., Respondent. Decision Perlas-Bernabe, J.Apling DincogNo ratings yet

- Manual Quick TrailingDocument2 pagesManual Quick TrailingDaniels JackNo ratings yet

- HybridDocument6 pagesHybridFernando SunNo ratings yet

- SFC Fund Manager Code of Conduct Workshop (Clifford Chance - Jan 2018)Document37 pagesSFC Fund Manager Code of Conduct Workshop (Clifford Chance - Jan 2018)Chris W ChanNo ratings yet

- Cardholder Dispute Form V3Document1 pageCardholder Dispute Form V3ShangHidalgoNo ratings yet

- Corporate Powers and Votes RequiredDocument2 pagesCorporate Powers and Votes Requiredrezeile morandarteNo ratings yet

- FINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELDocument95 pagesFINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELRajNo ratings yet

- Poly EnsaeDocument139 pagesPoly EnsaeSolo HakunaNo ratings yet

- Solution Manual For Financial Management 13th Edition by TitmanDocument3 pagesSolution Manual For Financial Management 13th Edition by Titmanazif kurnia100% (1)

- Notes On The Art of Short SellingDocument25 pagesNotes On The Art of Short Sellingbamzoo100% (1)

- 8 - An Economic Analysis On Financial StructureDocument18 pages8 - An Economic Analysis On Financial StructurecihtanbioNo ratings yet

- NavitasDocument16 pagesNavitaswikoliawensNo ratings yet