Professional Documents

Culture Documents

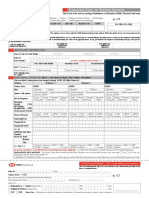

Franklin Transaction Form

Uploaded by

Gurvinder SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Franklin Transaction Form

Uploaded by

Gurvinder SinghCopyright:

Available Formats

Transaction Form

W99999

Advisor Name & Code* Sub Advisor Name & Code*

* AMFI Registered Distributors

The upfront commission on investment made by the investor, if any, shall be paid to the ARN Holder (AMFI registered distributor) directly by the investor, based on the investors

assessment of various factors including service rendered by the ARN Holder.

This Form is for use of Existing Investors only. Use this Form for ADDITIONAL PURCHASE REDEMPTION For Office Use Only

SWITCH CHANGE OF BANK DETAILS E-MAIL COMMUNICATIONS

Trxn Ref No.

Online Account Access SIP/STP NOMINATION DETAILS KNOW YOUR CUSTOMER (KYC)

Existing Unitholder Information

Name of Sole / First Account holder (Leave space between first/middle/last name) Account No.

Customer Folio No.

Know Your Customer (KYC)

KYC Compliance is mandatory for all investors irrespective of the amount of investment including guardian in case of minor and POA holders. Please provide a copy of the KYC

acknowledgement issued by CVL. Investments without valid KYC may be rejected. If you have already provided the KYC acknowledgement for this folio, you need not provide the same again.

Please Provide your PAN details if you have not registered them before

Holder PAN Proof of KYC enclosed PAN Card Copy Enclosed Proof of Identity & Address$

Sole/First

Second

Third

POA/Guardian

Mandatory Enclosures: PAN Card copy or Copy of KYC acknowledgment. Transactions not including these mandatory enclosures may be rejected

$Please attach proof of photo identity and address for investments only through Micro SIP.

Additional Purchase Order

Please fill the details of the goal(s), scheme name(s) and investment amount below:

Goal Retirement Child's Future 1 Wealth Builder 1 Child's Future 2 Wealth Builder 2

Additional Details e.g. Deepa's Marriage e.g. Home/Car e.g. Sanias Education e.g. Vacation

Fund / Scheme Name Account Number Plan/Options Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

(only for existing investor) (Please tick ( ) anyone)

1) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

2) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

Regular Investment

3) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

4) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

5) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

6) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

7) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

8) Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

Total Regular Investment per Goal

Total Regular Investment in all Goals ( in figures )

DR-Dividend Reinvestment, DP-Dividend Payout.

Amount Invested______________________________________(DD Charges)________________________________Net Amount____________________________________

Payment Details Cheque/DD No._____________________________ Bank__________________________________________________________________________________

Branch____________________________________________________________________________Bank A/C No.___________________________________________________

Please register my Pay-in bank details also as one of the banks in my/our account/folio based on the payment instrument attached. Please refer the instruction for supporting

document required for registering Bank Mandate. (Please tick ) I / We do not wish to register this bank as additional bank in my/our account details.

Instructions:

1. Cheque for the investment should be made in favour of Franklin Templeton Family Solutions

2. For payments by Demand Draft, please attach a certificate from the banker or instruction to bank or passbook/bank statement evidencing the debit for issuance.

Redemption

Account Number Goal Scheme / Plan / Option Units Amount in Rs.

Note: You must specify either the Account Number or Goal with Scheme/Plan/Option

Note: To receive the redemption payment in a bank account other than your default bank account (from any one of the banks already registered), please provide the required information mentioned below:

Payout to any one of the existing registered bank accounts:

Bank Name:__________________________________________Bank account No:_________________________________(Payment will be made in 1/3 business days)

Payout to new account (Payment will be made after 10 calender days of cooling period & based on validation). Please tick and use change of Bank Account section to fill new Bank details.

Signatures: Sole/First Holder/Guardian_____________________________________Second Holder______________________________________Third Holder__________________________________________

Change of Bank Account - For registration of bank details, please attach a cancelled cheque leaf and for more information please refer the instruction under section Registration of Bank Mandate.

Scheme Account No._________________________________________________________Folio No.__________________________________________________

All Schemes

Bank Account Number (Please provide the full Account Number)

Account type Savings Current NRO NRE Others ___________________________________________________________________ Repatriable Non Repatriable

Bank Name__________________________________Branch Name_____________________________________City_______________________Pin

*RTGS code *NEFT code *MICR code

Document attached (Any one)

Cancelled Cheque with name of 1st unit holder pre-printed Bank Statement and cancelled cheque Pass Book and cancelled cheque

Others please specify__________________________________________________________

Note: There will be a cooling period 10 calendar days for registering the COB requests. This new bank will be treated as your default bank account. All future Redemption and Dividends

payments will be made into this bank account only, for more information please refer the Registration of bank mandate instruction. * For more details on RTGS/NEFT/MICR codes, please

refer detailed instructions in the KIM

Please provide a cancelled, signed cheque of the bank account you wish to register. The registered bank will be the default bank and all redemptions / dividends proceeds will be processed into default

bank only through electronic payment facility. I/We DO NOT wish to avail Electronic Payment Facility (Please tick) . Please verify and ensure the accuracy of the bank details provided above

and as shown in your account statement. Franklin Templeton cannot be held responsible for delays or errors in processing your request if the information provided is incomplete or inaccurate.

Third Party Payment Documents

KYC Proof enclosed (tick below as appropriate) - Person making payment Payment by Parents/Grand-Parents/related persons on behalf of a Minor in consideration of natural

love and affection or as gift Custodian on behalf of an FII or a Client Payment by Employer on behalf of Employee - under Payroll deductions

Declaration - Attached Declaration from Beneficiary Declaration from Third Party (Custodian, Employer or Parents/Grand-Parents/related persons on behalf of a minor in

consideration of natural love and affection or as gift for a value not exceeding Rs.50,000/-).

Relationship with Investor _______________________________________________________________________________________________________________________

DD against Cash (Please attach): Banker Certificate

DD against Debit Bank (Please attach): Banker Certifcate or A copy of the passbook/bank statement evidencing the debit for issuance of a DD or Challan

Switch Systematic Transfer Plan (STP) (Fixed Amount)

Source Scheme Name_________________________________________________

Source Scheme Name________________________________________________ Source Account Number______________________________________________

Please transfer fixed amount Rs. ___________________to (As per details given

Source Account Number______________________________________________ in the STP Instruction for Fixed Amount table below)

Frequency: Daily Weekly Monthly Quarterly

Please transfer _______ units or Rs. _________________to (As per details Weekly: 7 14 21 28 - Monthly/Quarterly Specify date ________

Enrolment Period From ____ /_____/_______ (dd/mm/yy)

given in the Switch Instructions table below) To ____ /_____/_______ (dd/mm/yy)

Switch Instructions

Goal Retirement Child's Future 1 Wealth Builder 1 Child's Future 2 Wealth Builder 2

Additional Details e.g. Deepa's Marriage e.g. Home/Car e.g. Sanias Education e.g. Vacation

Sl. Destination Account Number Plan/Options Units / Units / Units / Units / Units /

No. Fund / Scheme Name (only for existing investor) (Please tick ( ) anyone) Amount Rs. Amount Rs. Amount Rs. Amount Rs. Amount Rs.

1 Growth DR DP

2 Growth DR DP

3 Growth DR DP

4 Growth DR DP

5 Growth DR DP

6 Growth DR DP

7 Growth DR DP

8 Growth DR DP

Systematic Transfer Plan (STP) Instructions for Fixed Amount

Goal Retirement Child's Future 1 Wealth Builder 1 Child's Future 2 Wealth Builder 2

Additional Details e.g. Deepa's Marriage e.g. Home/Car e.g. Sanias Education e.g. Vacation

Sl. Destination Account Number Plan/Options STP Amount Rs. STP Amount Rs. STP Amount Rs. STP Amount Rs. STP Amount Rs.

No. Fund / Scheme Name (only for existing investor) (Please tick ( ) anyone) (per installment) (per installment) (per installment) (per installment) (per installment)

1 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

2 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

3 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

4 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

5 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

6 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

7 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

8 Growth DR DP Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs. Amount in Rs.

Signatures: Sole/First Holder/Guardian_____________________________________Second Holder______________________________________Third Holder__________________________________________

Systematic Transfer Plan (STP) Instructions for Capital Appreciation (For STP through Capital Appreciation; all units will be transferred. Also one scheme to many schemes is not allowed in Capital Appreciation STP)

Source Scheme Name_____________________________________________________Source Account Number_______________________________________________________to

Goal Retirement Child's Future 1 Wealth Builder 1 Child's Future 2 Wealth Builder 2

Additional Details e.g. Deepa's Marriage e.g. Home/Car e.g. Sanias Education e.g. Vacation

Destination Account Number Plan/Options Please tick the Please tick the Please tick the Please tick the Please tick the

Fund / Scheme Name (only for existing investor) (Please tick ( ) anyone) selected option selected option selected option selected option selected option

Growth DR DP

Franklin Templeton Easy Services

1. Franklin Templeton Easy e-Update: Receive account statements, annual reports and 3. Franklin Templeton Easy Call: Just call 1800 425 4255 or 6000 4255 to access your

account using TPIN ____ Yes, I would like to receive my TPIN

other information instantly by Email *

4. Franklin Templeton Easy Mobile: Get instant SMS alerts to confirm your

Email Address:

transactions *

Mobile Number

I / We wish to receive the above by email I/We wish to register for SMS updates on my/our mobile phone.

I / We do not wish to receive the above by email Yes No

* Note: Where the investor has not opted for any option or has opted for both options, the

2. Franklin Templeton Easy Web: Access your account and transact online. Register

application will be processed as per the default option, i.e., receive the account statement,

online for Easy web by visiting our website www.franklintempletonindia.com annual report and other correspondence by E-mail and receive SMS updates on mobile.

Nomination Details (To be signed by all the joint holders irrespective of the mode of holdings. In case of more than one nominee, please submit a separate form available with any of our ISCs or on our website).

Goal 1

Nominee Name & Address__________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

Guardian name & address (if nominee is a minor)________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

Signature of Nominee / Guardian_____________________________________________________Nominee Date of Birth_________________________________(mandatory for minor).

Proof of minor DOB submitted. Witness Name and Address___________________________________________________________________________________________________

_____________________________________________________________________________________________Signature of Witness___________________________________________

I/We do not wish to nominate any person for my investments. Signature of Investor(s)___________________________________________________________________________

Goal 2

Nominee Name & Address__________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

Guardian name & address (if nominee is a minor)________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

Signature of Nominee / Guardian_____________________________________________________Nominee Date of Birth_________________________________(mandatory for minor).

Proof of minor DOB submitted. Witness Name and Address___________________________________________________________________________________________________

_____________________________________________________________________________________________Signature of Witness___________________________________________

I/We do not wish to nominate any person for my investments. Signature of Investor(s)___________________________________________________________________________

Note: Please submit a separate Nomination form incase of nominations more than 2 Goals.

Declaration

Having read and understood the contents of the Statement of Additional Information, Scheme Information Document of the Fund, the Key Information Memorandum and the Addenda issued till date, I/we hereby apply to the Trustees of Franklin

Templeton Mutual Fund for registration of SIP/STP/DTP/SWP as indicated above, and agree to abide by the terms, conditions, rules and regulations of the Fund and the SIP/STP/DTP/SWP as on the date of this investment. I/We hereby declare that

the particulars given above are correct and complete. I/We confirm that the funds invested legally belong to me/us and that I/we have not received nor been induced by any rebate or gifts, directly or indirectly in making this investment. * I / We confirm

that I am / we are Non-Resident Indians / Persons of Indian Origin but not United States persons within the meaning of Regulation (S) under the United States Securities Act of 1933, as amended from time to time, and I / We hereby further confirm

that the monies are remitted from abroad through approved banking channels or from my/our monies in my/our NRE/NRO Account. I/We hereby declare that all the particulars given herein are true, correct and complete to the best of my/our knowledge

and belief. I further agree not to hold Franklin Templeton Investments liable for any consequences in case of any of the above particulars being false, incorrect or incomplete.I hereby undertake to promptly inform the mutual fund of any changes to the

information provided hereinabove and agree and accept that the Mutual Funds, their authorised agents, representatives, distributors ('the Authorised Parties') are not liable or responsible for any losses, costs, damages arising out of any actions undertaken

or activities performed by them on the basis of the information provided by me as also due to my not intimating / delay in intimating such changes. I hereby authorize the mutual fund to disclose, share, remit in any form, mode or manner, all / any of

the information provided by me to Authorised Parties including Financial Intelligence unit-India (FIU-IND) including all changes, updates to such information as and when provided by me without any obligation of advising me/us of the same. I hereby

agree to provide any additional information / documentation that may be required by the Authorised Parties, in connection with this application." I have read and understood the terms and conditions of the Family Solutions facility and agree to abide

by the terms, conditions, rules and regulations of the said Facility as may be prescribed by Franklin Templeton Mutual Fund from time to time. I understand that the recommendation given is based on the inputs provided by me/us and that there is no

assurance or guarantee that the goal(s) will be achieved. I agree not to hold Franklin Templeton Mutual Fund or the Sponsor, the AMC, the Trustee or any of their directors, employees, affiliates or representatives responsible for any consequences arising

out of my investments under the said Facility including non achievement of goals and loss of profit or principal. I/We confirm that the subscription money paid is in accordance with the requirements regarding 3rd party payment for subscriptions I/We

confirm and declare that I/ We have read and understood the terms and conditions for HPIN usage and online transactions/ TPIN/ Email Services and also the disclaimer and terms and conditions as posted on the website, www.franklintempletonindia.com. I/

We agree and shall abide by the norms, terms and conditions for HPIN usage and online transactions/ TPIN/ Email services and agree not to hold Franklin Templeton Investments responsible for any action relating to the use of HPIN/ TPIN/ Email services

facility. The ARN holder has disclosed to me/us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of various Mutual Funds from amongst which the Scheme is being

recommended to me/us. I/We confirm that I/we do not have any other existing Systematic Investment Plan (SIP) with Franklin Templeton Mutual Fund which together with this proposed SIP will result in aggregate investments exceeding Rs.50,000/-

in a year. Further, I/we understand and accept that in case Franklin Templeton Mutual Fund processes the first Micro SIP installment and the application is subsequently found to be incomplete in any respect or not supported by adequate documentation

or if the existing aggregate investment installments together with this proposed SIP installments exceeds Rs.50,000/- in a year, the Micro SIP registration will be cancelled for future installments and no refund shall be made for the units already allotted.

Sole/First Holder/Guardian________________________________________Second Holder__________________________________________Third Holder__________________________________________

Date: ___________________________ * Applicable to Non Resident Investors

Acknowledgement Slip (To be filled in by the Investor)

Customer Folio Date

Received from

Service Centre

Additional Purchase: Total Amount (Rs.) Cheque No. Signature & Stamp

Bank & Branch details:

Redemption or Switch : Amount (Rs.) OR Units

STP Change of Bank Account Nomination Details KYC Change of Address W99999

Instructions for Transaction Form Transfer of Funds: Load: For all SWP transactions, an exit load as applicable in the respective scheme shall be

1. Use separate transaction forms for each Scheme / Plan of Franklin Templeton Mutual Fund Transfer of funds Fixed Amount Option Capital Appreciation levied.

and transaction. option Minimum withdrawal: Under the Fixed amount option, the minimum withdrawal will be

2. This Transaction Form can be used for all transactions that an existing FAMILY SOLUTIONS account Weekly STP A fixed amount can be The capital appreciation, as Rs.1,000/-.

holder may want to make with Franklin Templeton Funds. Existing unit holders should mention transferred on the 7th, on the immediately Where the Start Date of the SWP is not mentioned, then the same shall be deemed to be the first

the Goal, Fund / scheme, Plan & option of their existing investment in the provided box. In case of 14th, 21st and 28th day preceding business day for available SWP date depending upon the option chosen by the unitholder, after a period of 7 days

fresh purchases please read the Scheme Information Document and fill the application form. of every month to the the Source Scheme can be after the date of submission of the SWP request.

3. Cheque / DD should be drawn in favour of Franklin Templeton Family Solutions and payable specified destination transferred to the specified This facility is not available for investments under lock-in period. It is clarified that the load

locally. scheme Destination applicable for SWP shall be the load applicable for the respective purchase transaction.

4. Investors should provide the name of the bank, branch address, account type and account Scheme, on the 7th, 14th, 12. For Direct Credit of Redemptions / Dividend Direct Credit of Redemptions / Dividend is

number of the sole/first applicant. Please note that as per SEBI Directives, it is mandatory for 21st and 28th of every month currently available for select Scheme / Plans and with select Banks only and not with all Banks.

the investors to mention their bank account details. Monthly/ A fixed amount can be The Capital appreciation as Please contact the service centers for more details.

5. For Redeeming units Quarterly STP transferred on a on the last business day of 13. Investors are advised to read the Scheme Information Documents (SID) and Statement of

In case the balance in your account does not cover the amount of the request, the account shall pre- specified date (to every month /quarter can be Additional Information (SAI) alongwith the addendum issued from time to time before

be closed and the entire such (lesser) amount shall be sent to you. be chosen by the transferred to the specified investing.

In order to pay the investor the redemption amount requested for (in Rupees) Franklin investor) of every destination scheme SIP Payment through Electronic Clearing Services/Direct Debit

Templeton will redeem that many units as would give the investor the net redemption amount month/every quarter to General Instructions:

requested for, after deducting Securities Transaction Tax and exit load as applicable. the transferred to the 1) This facility is offered to investors having Bank accounts in select cities mentioned below. The

6. Systematic Investment Plan (SIP) specified Destination cities in the list may be modified/updated/ changed/removed at any time in future entirely at the

Investor can choose to invest via an SIP in Family Solutions Available through the ECS facility Scheme discretion of Franklin Templeton Investments without assigning any reasons or prior notice. SIP

only. Post dated Cheque will not be accepted for FAMILY SOLUTIONS SIP transactions. Daily STP A fixed amount can be NA instructions for investors in such cities via ECS/Direct Debit route will be discontinued.

Each FAMILY SOLUTIONS SIP form allows up to 4 schemes across goals. For additional SIPs transferred from the 2) The bank branch provided for ECS/Direct Debit should participate in the local MICR clearing.

in the same Family Solutions Application, he will need to fill additional SIP ECS forms. source scheme to the The investor shall inform their Bankers about the ECS/Direct Debit mandate and Franklin

Each SIP ECS form may have only the same date, frequency and tenure. Hence, if the investor Destination Scheme on Templeton will not liable for any transaction failures due to rejection by the investors

chooses to have different dates, frequency or tenures he needs to fill up another SIP ECS form every business day of bank/branch.

If the SIP dates are different in a particular goal/across goals submitted through a single ECS respective scheme 3) SIP through ECS/Direct Debit is available only on 1st / 7th / 10th / 20th / 25th of the month.

form, it will be rejected In case these days are non business days for the scheme, then SIP will be processed on the next

In case the specified date is a non-business day for either the Source Scheme or the Destination

In case of Lump sum and Future Dated SIP, Single Cheque (lump sum amount only) with business day.

Scheme, the STP will be processed on the following business day for both the schemes. The STP

FAMILY SOLUTIONS SIP ECS form will be accepted (Note: SIP will start after 30 days) 4) The investor agrees to abide by the terms and conditions of ECS/Direct Debit facility of Reserve

will be applicable subject to the terms of the destination scheme.

This facility is available in the following schemes/plans: All plans of Franklin India Bluechip Bank of India (RBI).

Minimum Amount and Term:

Fund (FIBCF), Templeton India Growth Fund (TIGF), Templeton India Equity Income Fund 5) Investor will not hold Franklin Templeton Investments and its service providers responsible if

(a Under the Fixed Amount Option Daily STP needs to be added the transaction is delayed or not effected by the investor Bank or if debited in advance or after

(TIEIF), Franklin India Prima Plus (FIPP), Franklin India Prima Fund (FIPF), Franklin India

Flexi Cap Fund (FIFCF), Franklin Asian Equity Fund (FAEF), Franklin India High Growth Transfer Frequency Equity/Hybrid Scheme FOF Scheme the specific SIP date due to various reasons.

Companies Fund (FIHGCF), Franklin Build India Fund (FBIF), Franklin India Taxshield (FIT), Weekly STP Rs. 500 per week Rs. 1,000 per week for 6 months 6) Franklin Templeton reserves the right to reverse allotments in case the ECS debit is rejected by

Franklin India Index Fund (FIIF), Franklin Infotech Fund (FIF), Franklin FMCG Fund (FFF), Monthly STP Rs. 1,000 per month Rs 4,000 per month for 6 the bank for any reason whatsoever.

Franklin Pharma Fund (FPF), Franklin India Opportunities Fund (FIOF), FT India Balanced for 6 months or Rs. 500 months or Rs 2,000 per 7) Franklin Templeton Investments shall not be responsible and liable for any

Fund (FTIBF), Templeton India Pension Plan (TIPP), Templeton India Childrens Asset Plan per month for 12 months month for 12 months damages/compensation for any loss, damage etc., incurred by the investor. The investor assumes

(TICAP), FT India Life Stage Fund of Funds (FTLF) and FT India Dynamic PE Ratio Fund of Quarterly STP Rs. 1,000 per quarter for Rs 4,000 per quarter for 6 the entire risk of using the ECS/Direct Debit facility and takes full responsibility for the same.

Funds (FTDPEF); Growth plans/options of Templeton India Income Fund (TIIF), Templeton 6 quarters Rs. 500 per quarter or Rs 2000 per 8) The AMC/Trustees reserve the right to discontinue or modify the SIP facility at any time in

India Income Builder Account (TIIBA), Templeton India Low Duration Fund (TILDF) FT India quarter for 12 quarters quarter for 12 quarters future on a prospective basis.

Monthly Income Plan (FTIMIP), Templeton India Government Securities Fund (TGSF), Daily STP Rs 500 per day , minimum Rs 1000 per day, minimum 9) Franklin Templeton Investments reserves the right to discontinue the SIP in case of Direct Debit

Templeton Floating Rate Income Fund (TFIF), Templeton India Short Term Income Plan-Retail 30 days and maximum 3 years 30 days and maximum 3 years through ECS / Direct Debit routes are rejected by the investor bank for any reasons.

Plan (TISTIP-Retail) and Templeton India Income Opportunities Fund (TIIOF). (b Under Capital Appreciation Option, the minimum term shall be 6 installments. 10) For load details, please refer to the Key Information Memorandum .

Franklin Templeton Mutual Fund will accept an instruction for minimum of 12 installments (only Features - 11) Franklin Templeton Investments reserves the right to reject any application without assigning

through ECS/Direct Debit instructions) each of Rs. 500/- or more or minimum of 6 installments, Family solution accounts need to be created prior to the STP any reason thereof.

each of Rs. 1,000/- or more from any SIP investor. However, in case of FTLF Franklin Templeton Investor can start an STP from Non FAMILY SOLUTIONS funds into selected FAMILY 12) For intimating the change in bank particulars, please tick the box provided overleaf under the

Mutual Fund will accept an instruction for minimum of 12 installments each of Rs. 2,000/- or SOLUTIONS funds Bank Details. Also fillup all the relevant details as applicable. Changes in the ECS Bank

more or minimum of 6 installments each of Rs. 4,000/- or more, in case of FTDPEF minimum of STP in Family Solutions Mandate request should be submitted 30 days in advance and cancellation of ECS should be

12 installments, each of Rs.1000 or more or a minimum of 6 installments each of Rs.2000/- or more Fixed amount option STP from one scheme to many schemes is allowed submitted 15 days in advance.

and in case of TGSF PF Plan, minimum 12 installments each of Rs. 10,000/- or more or minimum Capital appreciation option In Capital Appreciation option all units have to be 13) Please contact Franklin Templeton ISC / visit www.franklintempletonindia.com for updated

of 6 installments each of Rs. 20,000/- or more from any SIP investor. transferred from once scheme to another scheme. list of banks / branches eligible for Direct Debit Facility.

In case the specified date is a non-business day for the scheme, the SIP will be processed on the However, one to many schemes is not allowed. 14.) In case of micro SIPs, please provide any one of the following photo identification documents

following business day for that scheme. as mentioned below:

Load: For all STP purchase transactions, the entry and exit load as applicable in the Destination

If during the currency of a SIP, the unitholder changes the plan or option in which he/she had Voter Identity Card, Driving License, Government / Defense identification card, Passport, Photo

Scheme for normal purchases shall be applicable. Further, for all STP (out) transactions, an

invested, the same would be treated as termination of existing SIP and re-registration of a new Ration Card, Photo Debit Card (Credit card will not be accepted)., Employee ID cards issued

exit load as applicable in the Source Scheme shall be levied.

SIP and all the terms and conditions of the SIP such as minimum term/amount etc. shall apply by companies registered with Registrar of Companies, Photo Identification issued by Bank

At least 7 days prior intimation should be given to the Mutual Fund for commencement of a

in both plans/options. Managers of Scheduled Commercial Banks / Gazetted Officer / Elected Representatives to the

fresh STP or cancellation/termination of an existing STP.

Load: For all SIP purchase transactions, the entry and exit load as applicable for normal Legislative Assembly / Parliament, ID card issued to employees of Scheduled Commercial /

If during the currency of a STP, the unitholder changes the plan or option in which he/she had

purchases shall be applicable. State / District Co-operative Banks., Senior Citizen / Freedom Fighter ID card issued by

invested, the same would be treated as termination of existing STP and re-registration of a new

The AMC reserves the right to discontinue the SIP in case of cheque return, and debit the Government., Cards issued by Universities / deemed Universities or institutes under statutes

STP and all the terms and conditions of the STP such as minimum term/amount etc. shall apply

cheque return charges to the investors account. like ICAI, ICWA, ICSI., Permanent Retirement Account No (PRAN) card issued to New Pension

in both plans/options.

The Trustee/AMC reserves the right to modify or discontinue the SIP facility at any time in System (NPS) subscribers by CRA (NSDL)., Any other photo ID card issued by Central

If in case of a monthly/quarterly STP with Fixed Amount Option, if the unitholder specifies 30th

future on a prospective basis. It is clarified that the load applicable for SIP shall be the load Government / State Governments /Municipal authorities / Government organizations like ESIC

or 31st of the month (28th/29th in case of February) as the "Specified Date" for the STP

prevailing on the date of registration. / EPFO.

transaction, then the STP shall be processed on the day, which is the last business day in that

7. Systematic Transfer Plan (STP) Terms and Conditions for Systematic Investment Plan through ECS / Direct Debit (please read this

month for both the schemes.

This facility is available in the following schemes/plans ("Source Schemes"): Templeton India with General Instructions)

Where the Start Date of the STP is not mentioned, then for an STP under Monthly/Quarterly

Income Fund (TIIF), Templeton India Income Builder Account (TIIBA), Templeton India Low 1) Minimum Investments: 12 instalments of Rs.500/- (or) 6 instalments of Rs.1000/-. All

option, the Start Date shall be deemed as follows: Instalments should be of the same amount.

Duration Fund (TILDF) FT India Monthly Income Plan@ (FTIMIP), Templeton India

Government Securities Fund (except PF Plan) (TGSF), Templeton Floating Rate Income Fund If STP is submitted .. Then Start Date shall be deemed to be In FTLF 12 installments of Rs.2000/- (or) 6 instalments of Rs.4000/-, in FTDPEF 12

(TFIF), Templeton India Short-Term Income Plan (TISTIP), Templeton India Ultra Short Bond On or before 8th day of the month 15th day of that month installments of Rs.1000/- (or) 6 installments of Rs. 2000/- and in TGSF-PF Plan 12 instalments

Fund (TIUBF), Templeton India Treasury Management Account (TITMA) and Templeton India After 8th day but on or before last business day of that month for both the schemes of Rs.10,000/- or 6 instalments of Rs.20,000/-.

Income Opportunities Fund (TIIOF). 23rd day of the month 2) To effect ECS/Direct debit, investors must provide a cancelled cheque or copy thereof or the first

In order to start the STP facility, the minimum account balance under Fixed Amount Option After 23rd day of the month 15th day of the next month investment must be by means of cheque from that account. Bankers attestation is recommended

(Weekly, Monthly & Quarterly) should be Rs.12,000/-, & under Daily STP the minimum Where the Start Date of the STP is not mentioned, under Daily option, the Start Date shall be for Payable at par cheque.

account balance should be Rs 15,000/- (The minimum amount for Daily STP should be Rs.500/- deemed to be the 8th day from the date of submission of the request at FT. 3) Existing investors must provide their Folio Number / Account number and need not fill up a

per day if the Destination Scheme is an equity or a hybrid scheme and Rs.1,000/- per day if the This facility is not available for investments under lock-in period or on which any lien or Common Application Form.

Destination Scheme is a Fund of Funds (FOF) scheme. The minimum term/duration of Daily encumbrances is marked or in respect of which the status of realisation of cheque is not 4) New investors who wish to enroll for SIP through ECS/Direct Debit should also fill up the

STP will be 30 days). and the same under Capital Appreciation Option should be available to the AMC. Common Application form in addition to this form.

Rs. 5,00,000/- for Weekly Transfer of Funds facility (Weekly STP) It shall be the responsibility of the investor to ensure that sufficient balance (free from any 5) The SIP through ECS/Direct Debit Form, and the Common Application Form (in case of new

Rs. 1,00,000/- for Monthly Transfer of Funds facility (Monthly STP) Lock-in or encumbrances) is available in the account on the date of transfer, failing which the investors), along with the necessary cheque or copy thereof should be submitted at least 30

Rs. 1,00,000/- for Quarterly Transfer of Funds facility (Quarterly STP). transfer will not be effected. The AMC reserves the right to discontinue the STP in case the days in advance of the date of the first ECS/Direct Debit Transaction.

Except in TITMA Institutional Plan where the same should be Rs. 1,00,00,000. transfer is not effected due to insufficient balance in the investors account. 6) For further details of the Scheme features like minimum amounts, risk factors etc, investors

Destination Scheme: The investors may choose any of the following Franklin Templeton open ended The AMC/Trustees reserve the right to discontinue or modify the STP facility at any time in should, before investment, refer to the Scheme Information Document(s), Key Information

equity, hybrid or Fund of Funds schemes for transferring the amount from the Source Scheme: future on a prospective basis. It is clarified that the load applicable for STP shall be the load Memorandum and Addenda issued till date available free of cost at any of the Investor Service

Equity schemes - prevailing on the date of registration. Centers or distributors or from the website www.franklintempletonindia.com.

Franklin India Bluechip Fund (FIBCF), Templeton India Growth Fund (TIGF), Templeton 8.. Systematic Withdrawal Plan (SWP) List of cities where SIP through ECS Debit is available:

India Equity Income Fund (TIEIF), Franklin India Prima Fund (FIPF), Franklin India Prima This facility is available in the following schemes/plans: All plans of - Franklin India Bluechip Agra, Ahmedabad, Allahabad, Amritsar, Anand, Asansol, Aurangabad, Bangalore, Bardhaman,

Plus (FIPP), Franklin India Flexi Cap Fund (FIFCF), Franklin India High Growth Companies Fund (FIBCF), Templeton India Growth Fund (TIGF), Templeton India Equity Income Fund Baroda, Belgaum, Bhavnagar, Bhilwara, Bhopal, Bhubaneshwar, Bijapur, Bikaner, Calicut,

Fund (FIHGCF), Franklin India Index Fund (FIIF), Franklin Infotech Fund (FIF), Franklin (TIEIF), Franklin India Prima Plus (FIPP), Franklin India Prima Fund (FIPF), Franklin India Chandigarh, Chennai, Cochin, Coimbatore, Cuttack, Dargeeling, Davangere, Dehradun, Delhi,

FMCG Fund (FFF), Franklin Pharma Fund (FPF), Franklin India Opportunities Fund (FIOF), Flexi Cap Fund (FIFCF), Franklin India High Growth Companies Fund (FIHGCF), Franklin Dhanbad, Durgapur, Erode, Gadag, Gangtok, Goa, Gorakhpur, Gulbarga, Guwahati, Gwalior,

Franklin Asian Equity Fund (FAEF), Franklin India Taxshield (FIT), Franklin Build India Fund India Index Fund (FIIF), Franklin Infotech Fund (FIF), Franklin FMCG Fund (FFF), Franklin Haldia, Hubli, Hyderabad, Indore, Jabalpur, Jaipur, Jalandhar, Jammu, Jamnagar, Jamshedpur,

(FBIF), Franklin India Smaller companies fund (FISCF) and Templeton India Income Pharma Fund (FPF), Franklin India Opportunities Fund (FIOF), FT India Balanced Fund Jodhpur, Kakinada, Kanpur, Kolhapur, Kolkata, Kota, Lucknow, Ludhiana, Madurai, Mandya,

Opportunities Fund (TIIOF). (FTIBF), Franklin Asian Equity Fund (FAEF), Franklin Build India Fund (FBIF), FT India Life Mangalore, Mumbai, Mysore, Nagpur, Nasik, Nellore, Patna, Pondicherry, Pune, Raichur, Raipur,

Hybrid schemes - Stage Fund of Funds (FTLF); Growth plans/Options of Templeton India Income Fund (TIIF), Rajkot, Ranchi, Salem, Shimla, Shimoga, Sholapur, Siliguri, Surat, Thirupur, Tirupati, Trichur,

FT India Balanced Fund (FTIBF), Templeton India Pension Plan (TIPP), Templeton India Templeton India Income Builder Account (TIIBA), FT India Monthly Income Plan (FTIMIP), Trichy, Trivandrum, Tumkur, Udaipur, Udipi, Varanasi, Vijaywada and Vizag

Childrens Asset Plan (TICAP) and FT India Monthly Income Plan (FTIMIP). Fund of Funds Templeton India Government Securities Fund (except PF Plan) (TGSF), Templeton India Low List of banks / branches for SIP through Direct Debit /Standing Instructions Facility is available:

schemes (FOF) - FT India Life Stage Fund of Funds (FTLF) and FT India Dynamic PE Ratio Duration Fund (TILDF), Templeton Floating Rate Income Fund (TFIF), Templeton India Short Banks Branches

Fund of Funds (FTDPEF). Term Income Plan (TISTIP), Franklin India Smaller Companies Fund (FISCF) and Templeton IDBI Bank, HDFC Bank, IndusInd bank, All Branches

Options: There are two options available, Fixed Amount Option and Capital Appreciation India Income Opportunities Fund (TIIOF) Kotak Mahindra Bank & Axis Bank

Option. The Capital Appreciation option will be available only under the growth plans of the In order to start the SWP facility, the minimum account balance should be Rs.25,000/- except Royal Bank of Scotland (RBS) All Branches

Source Schemes in case of FTLF where the same should be Rs.12,000/-. (only for Royal Bank of Scotland

Frequency: The frequency can be Daily, Weekly, Monthly or Quarterly. The frequency can be Monthly or Quarterly. (RBS) Customers)

FAMILY SOLUTIONS accounts need to be created prior to the STP There are two options available: Bank of India, Bank of Baroda, State Select Branches

Investor can start an STP from Non FAMILY SOLUTIONS funds into selected FAMILY (a) Fixed amount: A fixed amount can be withdrawn either on the 15th or the last business day of Bank of India & Punjab National Bank (where core banking facility is

SOLUTIONS funds every month/quarter. available)

The STP will have to be from accounts within the same Customer Folio since inter-folio (b) Capital Appreciation: The capital appreciation as on the last business day of the month can be ICICI Bank Branches not covered under

transactions are not allowed withdrawn. ECS Locations

You might also like

- Action Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELDocument5 pagesAction Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELJulu EmimaryNo ratings yet

- Acknowledgement Receipt 20190526 151008Document2 pagesAcknowledgement Receipt 20190526 151008Arman PenalosaNo ratings yet

- Manage Beneficiaries TIAA BankDocument2 pagesManage Beneficiaries TIAA BankAbdy Fernando SanchezNo ratings yet

- Globalive Challenges Telus On Foreign Ownership RulesDocument20 pagesGlobalive Challenges Telus On Foreign Ownership RulesThe Globe and MailNo ratings yet

- NFT INT Statement of InfoDocument2 pagesNFT INT Statement of InfoGMG EditorialNo ratings yet

- To, Mrs Padmapriya R No 2/7 Akshya Plot G1 Bharathidasan Street Nillamaggai Nagar Adambakkam 600088 Kanchipuram TAMILNADU 600088 Mobile:9840584756Document4 pagesTo, Mrs Padmapriya R No 2/7 Akshya Plot G1 Bharathidasan Street Nillamaggai Nagar Adambakkam 600088 Kanchipuram TAMILNADU 600088 Mobile:9840584756shidoNo ratings yet

- Amazon's Choice ResponseDocument4 pagesAmazon's Choice Responsefox43wpmtNo ratings yet

- Liability Insurance GEMINI InsuredDocument2 pagesLiability Insurance GEMINI Insuredjgreene_dallaslive1606100% (2)

- Payment Schedule - 20190430 - 073337 PDFDocument2 pagesPayment Schedule - 20190430 - 073337 PDFKylyn JynNo ratings yet

- Edzel AberiaDocument1 pageEdzel AberiaEdz carl AberiaNo ratings yet

- Separation Notice: (Mm/dd/yy) (Mm/dd/yy)Document2 pagesSeparation Notice: (Mm/dd/yy) (Mm/dd/yy)batambintanNo ratings yet

- HSBC Golfer InsuranceDocument9 pagesHSBC Golfer Insuranceblefler1No ratings yet

- 2021 Agency Legislative Bill Analysis:: Department of TransportationDocument10 pages2021 Agency Legislative Bill Analysis:: Department of TransportationChris VaughnNo ratings yet

- ht2000w PDFDocument12 pagesht2000w PDFThiha KyawNo ratings yet

- Digitally Signed by Reliance General Insurance Company Limited Date: 2022.09.26Document7 pagesDigitally Signed by Reliance General Insurance Company Limited Date: 2022.09.26Aswini Kumar PaloNo ratings yet

- BVB0033270 PDFDocument6 pagesBVB0033270 PDFMohd Fakhrul Nizam HusainNo ratings yet

- M240i AutoCheckDocument5 pagesM240i AutoCheckSUHIMAN SALMANNo ratings yet

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocument9 pagesHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369No ratings yet

- My: Optima SecureDocument4 pagesMy: Optima SecureDr Ankit PardhiNo ratings yet

- MAPFRE Insurance Terms and Conditions PDFDocument3 pagesMAPFRE Insurance Terms and Conditions PDFSarah MccoyNo ratings yet

- Autocheck Vehicle History ReportDocument5 pagesAutocheck Vehicle History ReportkhananlolNo ratings yet

- Interested Party: The Standard On West Dallas: ConfirmationDocument1 pageInterested Party: The Standard On West Dallas: ConfirmationDaniel Lee Eisenberg JacobsNo ratings yet

- This Is Your Ticket.: Present This Entire Page at The EventDocument1 pageThis Is Your Ticket.: Present This Entire Page at The EventbootybethathangNo ratings yet

- Southwest Airlines Boarding Pass Southwest Airlines Print ReceiptDocument1 pageSouthwest Airlines Boarding Pass Southwest Airlines Print ReceiptLingNo ratings yet

- MetLife Enroll Form All ProductDocument5 pagesMetLife Enroll Form All ProducttxceoNo ratings yet

- AAR Corp. ReportDocument15 pagesAAR Corp. Reportakr200714No ratings yet

- DUG6989708Document1 pageDUG6989708Ganesh NandNo ratings yet

- Monthly Services: Included at No Extra CostDocument1 pageMonthly Services: Included at No Extra CostRajnish VermaNo ratings yet

- Insurance CertificateDocument2 pagesInsurance CertificateDavid LeeNo ratings yet

- #WethenorthDocument1 page#WethenorthAisha SyedNo ratings yet

- Trieu AxwellDocument1 pageTrieu AxwellLocNguyenNo ratings yet

- Your Postpay BillDocument12 pagesYour Postpay Billmetraj1No ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 September 18Document5 pagesCoreLogic Weekly Market Update Week Ending 2016 September 18Australian Property ForumNo ratings yet

- Full Vehicle ReportDocument5 pagesFull Vehicle ReportvoltprinterNo ratings yet

- Order HistoryDocument1 pageOrder HistoryTrenton DunstanNo ratings yet

- State Data - OPTNDocument2 pagesState Data - OPTNDrew KnightNo ratings yet

- 61ab1c8d904a9f1ad7260855 All UPSTOX SIGNEDDocument22 pages61ab1c8d904a9f1ad7260855 All UPSTOX SIGNEDRaj PNo ratings yet

- Tickets PDFDocument2 pagesTickets PDFJennifer JensenNo ratings yet

- Brazil Small Caps PortfolioDocument8 pagesBrazil Small Caps PortfolioElidiel BarrosoNo ratings yet

- Reemployment Assistance Application EngDocument6 pagesReemployment Assistance Application EngMelissa RatliffNo ratings yet

- DownloadDocument2 pagesDownloadMayanand MishraNo ratings yet

- Blue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementDocument6 pagesBlue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementWAKESHEEP Marie RNNo ratings yet

- 17-11-2022 Policy DocDocument1 page17-11-2022 Policy DocOfficial Sumit SafeshopNo ratings yet

- KeyBank Rollover FormDocument1 pageKeyBank Rollover FormmicheleNo ratings yet

- 2022-23 San Antonio Spurs RosterDocument1 page2022-23 San Antonio Spurs RosterDavid IbanezNo ratings yet

- MyDocument PDFDocument6 pagesMyDocument PDFTelc3No ratings yet

- Itinerary Receipt: Basic InfoDocument2 pagesItinerary Receipt: Basic Infocraig1014No ratings yet

- 6905 Ruthette Court - NRHDocument3 pages6905 Ruthette Court - NRHTanner LeggettNo ratings yet

- Bud APAC - Prospectus PDFDocument506 pagesBud APAC - Prospectus PDFtaixsNo ratings yet

- SPD 422391812Document2 pagesSPD 422391812David DangNo ratings yet

- This Is Your Ticket.: Present This Entire Page at The EventDocument1 pageThis Is Your Ticket.: Present This Entire Page at The EventJOSH CarterNo ratings yet

- 2017 Toyota Camry Le Se Xle XseDocument4 pages2017 Toyota Camry Le Se Xle XseGeorge ZabarasNo ratings yet

- E Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryDocument6 pagesE Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryBot makerNo ratings yet

- Shatadru DeyDocument1 pageShatadru DeyDev JyotiNo ratings yet

- Invoice FebDocument2 pagesInvoice FebSadashiv RahaneNo ratings yet

- Agenda JPMorgan Healthcare Conference 2013Document4 pagesAgenda JPMorgan Healthcare Conference 2013behnamin_rahmaniNo ratings yet

- Experi AnDocument56 pagesExperi AnSid HannaNo ratings yet

- Protect This Ticket!: Aiken Walker 68-38395 / AUSDocument1 pageProtect This Ticket!: Aiken Walker 68-38395 / AUSconorkellysligoNo ratings yet

- A Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingDocument2 pagesA Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingProfessional positiveNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Transcript Panjab University ChandigarhDocument4 pagesTranscript Panjab University ChandigarhGurvinder SinghNo ratings yet

- Achieving Hedge Accounting in Practice Under Ifrs9Document236 pagesAchieving Hedge Accounting in Practice Under Ifrs9Jorge Da MataNo ratings yet

- Plan Vouchers June 2021Document12 pagesPlan Vouchers June 2021ARUNNo ratings yet

- Diploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideDocument14 pagesDiploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideGurvinder SinghNo ratings yet

- Achieving Hedge Accounting in Practice Under Ifrs9Document236 pagesAchieving Hedge Accounting in Practice Under Ifrs9Jorge Da MataNo ratings yet

- Voices On Reporting: Quarterly Updates PublicationDocument31 pagesVoices On Reporting: Quarterly Updates PublicationGurvinder SinghNo ratings yet

- Amendments in Schedule Iii & Other Matters To Be Included in Auditors ReportDocument38 pagesAmendments in Schedule Iii & Other Matters To Be Included in Auditors ReportGurvinder SinghNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankeNo ratings yet

- Microwave Oven Owner'S Manual: MODEL: 20BC4Document32 pagesMicrowave Oven Owner'S Manual: MODEL: 20BC4Jithin ThazhathayilNo ratings yet

- Ifrs Us Gaap 12 2020Document564 pagesIfrs Us Gaap 12 2020Jéssica GuimarãesNo ratings yet

- Terms and Conditions:: Page - 1 - of 3Document4 pagesTerms and Conditions:: Page - 1 - of 3HarshadNo ratings yet

- HDFC Credit Risk Debt Fund - 31 August 2021Document16 pagesHDFC Credit Risk Debt Fund - 31 August 2021Gurvinder SinghNo ratings yet

- EFL RO and UV Sep 2021 OfferDocument20 pagesEFL RO and UV Sep 2021 OfferGurvinder SinghNo ratings yet

- Sector 78Document1 pageSector 78Gurvinder SinghNo ratings yet

- Nominee Change FormDocument1 pageNominee Change FormGurvinder SinghNo ratings yet

- Chang NameDocument1 pageChang Namedr_293411881No ratings yet

- Activation Vouchers - Axis Bank Freecharge Credit CardDocument1 pageActivation Vouchers - Axis Bank Freecharge Credit CardGurvinder Singh100% (1)

- Ifrs Us Gaap 12 2020Document564 pagesIfrs Us Gaap 12 2020Jéssica GuimarãesNo ratings yet

- Great News: US CPA Exams in India: Resolve 2021Document23 pagesGreat News: US CPA Exams in India: Resolve 2021Luv KohliNo ratings yet

- E-Verification User ManualDocument16 pagesE-Verification User ManualGurvinder SinghNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- 7-PDF - 1 - S o 1902 (E)Document31 pages7-PDF - 1 - S o 1902 (E)Gurvinder SinghNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- SBILife DirectCredit MandateFormDocument1 pageSBILife DirectCredit MandateFormGurvinder SinghNo ratings yet

- RBI 506assistantsDocument14 pagesRBI 506assistantsGurvinder SinghNo ratings yet

- Final E-CS Nitor SecondDocument56 pagesFinal E-CS Nitor SecondGurvinder SinghNo ratings yet

- Internship Report On MCB Bank LimitedDocument40 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Act 4 National Payment System 2021Document27 pagesAct 4 National Payment System 2021RavineshNo ratings yet

- SetlmentDocument15 pagesSetlmentJJNo ratings yet

- 150 Years of Fintech: An Evolutionary Analysis: January 2016Document9 pages150 Years of Fintech: An Evolutionary Analysis: January 2016PEACE OYEYEMINo ratings yet

- Managing Cash: Merits & Demerits of Holding CashDocument4 pagesManaging Cash: Merits & Demerits of Holding Cashverty asdNo ratings yet

- Depository AssignmentDocument11 pagesDepository AssignmentDinesh GodhaniNo ratings yet

- SCB Assignment by MGTDocument27 pagesSCB Assignment by MGTfarahNo ratings yet

- Power of Attorney in Favour of Motilal Oswal Financial Services Limited (On Stamp Paper of Rs. 50/-)Document4 pagesPower of Attorney in Favour of Motilal Oswal Financial Services Limited (On Stamp Paper of Rs. 50/-)Investment 3sixtyNo ratings yet

- Banking Chapter 2Document7 pagesBanking Chapter 2Tilahun MikiasNo ratings yet

- Document/Account Maintenance: © 2004 IBM CorporationDocument12 pagesDocument/Account Maintenance: © 2004 IBM CorporationAmar BonthuNo ratings yet

- Mantas Interface Oracle FLEXCUBE Universal Banking Release 11.3.0 (May) (2011) Oracle Part Number E51536-01Document24 pagesMantas Interface Oracle FLEXCUBE Universal Banking Release 11.3.0 (May) (2011) Oracle Part Number E51536-01Sam 1980100% (1)

- Ali Mentesh Temenos Digital Payment Framework TRF 2019 PresentationDocument18 pagesAli Mentesh Temenos Digital Payment Framework TRF 2019 PresentationHubab Khalid100% (1)

- Te040 R12 Cash Management Test ScriptsDocument62 pagesTe040 R12 Cash Management Test ScriptsGrace Ohh100% (2)

- SLCM Revision Notes - June 23Document263 pagesSLCM Revision Notes - June 23jacob michelNo ratings yet

- 04 Products and Services For OFWsDocument87 pages04 Products and Services For OFWsJuanHanzelLimboNo ratings yet

- Final Project of Banking and Financial MarketsDocument32 pagesFinal Project of Banking and Financial MarketsNaveed KhokharNo ratings yet

- Red BookDocument532 pagesRed BookFlaviub23100% (1)

- CRM Complete ProjectDocument61 pagesCRM Complete ProjectPratik GosaviNo ratings yet

- Business Continuity Planning at The Bank of JapanDocument11 pagesBusiness Continuity Planning at The Bank of Japanblue_l1No ratings yet

- RoleOf It Technology in Banking SectorDocument70 pagesRoleOf It Technology in Banking SectorRads Datta86% (21)

- International Cheque ApplicationDocument2 pagesInternational Cheque ApplicationsureNo ratings yet

- SAP Best Practices Cross-Industry PackageDocument33 pagesSAP Best Practices Cross-Industry PackagesampathNo ratings yet

- Payments ReleaseHighlightsDocument8 pagesPayments ReleaseHighlightsadnanbwNo ratings yet

- (FM02) - Chapter 9 Credit TermsDocument14 pages(FM02) - Chapter 9 Credit TermsKenneth John TomasNo ratings yet

- CH 08 Clearing House SystemDocument13 pagesCH 08 Clearing House SystemMoshhiur RahmanNo ratings yet

- Response Submission To Proposals Paper G4-Ird Central Clearing MandateDocument12 pagesResponse Submission To Proposals Paper G4-Ird Central Clearing MandateEin LuckyNo ratings yet

- Sebi Master Circular DepositoriesDocument53 pagesSebi Master Circular DepositoriesPrasanna RathNo ratings yet

- Reporting UK 2020Document98 pagesReporting UK 2020Leandro VidalNo ratings yet

- Latif GK For Exam Phase 2Document22 pagesLatif GK For Exam Phase 2Farhan SakiNo ratings yet

- Aunpp BrochureDocument4 pagesAunpp BrochureUser ShareNo ratings yet

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (328)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (273)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (709)

- Summary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityFrom EverandSummary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityNo ratings yet

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (383)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (556)

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageRating: 4.5 out of 5 stars4.5/5 (329)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Book Summary of Ego Is The Enemy by Ryan HolidayFrom EverandBook Summary of Ego Is The Enemy by Ryan HolidayRating: 4.5 out of 5 stars4.5/5 (387)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (169)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- Sell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeFrom EverandSell or Be Sold by Grant Cardone - Book Summary: How to Get Your Way in Business and in LifeRating: 4.5 out of 5 stars4.5/5 (86)

- Summary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönFrom EverandSummary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönRating: 4.5 out of 5 stars4.5/5 (22)

- Summary of Miracle Morning Millionaires: What the Wealthy Do Before 8AM That Will Make You Rich by Hal Elrod and David OsbornFrom EverandSummary of Miracle Morning Millionaires: What the Wealthy Do Before 8AM That Will Make You Rich by Hal Elrod and David OsbornRating: 5 out of 5 stars5/5 (201)

- How Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseFrom EverandHow Not to Die by Michael Greger MD, Gene Stone - Book Summary: Discover the Foods Scientifically Proven to Prevent and Reverse DiseaseRating: 4.5 out of 5 stars4.5/5 (84)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingFrom EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingRating: 4.5 out of 5 stars4.5/5 (114)

- Summary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowFrom EverandSummary, Analysis, and Review of Daniel Kahneman's Thinking, Fast and SlowRating: 3.5 out of 5 stars3.5/5 (2)

- Zero To One by Peter Thiel; Blake Masters - Book Summary: Notes on Startups, or How to Build the FutureFrom EverandZero To One by Peter Thiel; Blake Masters - Book Summary: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (108)

- Tiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingFrom EverandTiny Habits by BJ Fogg - Book Summary: The Small Changes That Change EverythingRating: 4.5 out of 5 stars4.5/5 (111)