Professional Documents

Culture Documents

G.R. No. 88168, August 30, 1990

Uploaded by

Samael Morningstar0 ratings0% found this document useful (0 votes)

17 views5 pagesTRADERS ROYAL BANK, PETITIONER, VS. NATIONAL LABOR RELATIONS COMMISSION & TRADERS ROYAL BANK EMPLOYEES UNION, RESPONDENTS.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTRADERS ROYAL BANK, PETITIONER, VS. NATIONAL LABOR RELATIONS COMMISSION & TRADERS ROYAL BANK EMPLOYEES UNION, RESPONDENTS.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views5 pagesG.R. No. 88168, August 30, 1990

Uploaded by

Samael MorningstarTRADERS ROYAL BANK, PETITIONER, VS. NATIONAL LABOR RELATIONS COMMISSION & TRADERS ROYAL BANK EMPLOYEES UNION, RESPONDENTS.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

FIRST DIVISION

G.R. No. 88168, August 30, 1990

TRADERS ROYAL BANK, PETITIONER, VS. NATIONAL

LABOR RELATIONS COMMISSION & TRADERS ROYAL BANK

EMPLOYEES UNION, RESPONDENTS.

DECISION

GRINO-AQUINO, J.:

This petition for certiorari seeks to nullify or set aside the

decision dated September 2, 1988 of the National Labor

Relations Commission, which found the petitioner, Traders

Royal Bank (or TRB), guilty of diminution of benefits due the

private respondents and ordered it to pay the said

employees' claims for differentials in their holiday, mid-year,

and year-end bonuses.

On November 18, 1986, the Union, through its president,

filed a letter-complaint against TRB with the Conciliation

Division of the Bureau of Labor Relations claiming that:

"First, the management of TRB per memo dated October 10,

1986 paid the employees their HOLIDAY PAY, but has

withheld from the Union the basis of their computation.

"Second, the computation in question, has allegedly

decreased the daily salary rate of the employees. This

diminution of existing benefits has decreased our overtime

rate and has affected the employees take home pay.

"Third, the diminution of benefits being enjoyed by the

employees since time immemorial, e.g. mid-year bonus, from

two (2) months gross pay to two (2) months basic and year-

end bonus from three (3) months gross to only two (2)

months.

"Fourth, the refusal by management to recall active union

members from the branches which were being transferred

without prior notice, solely at the instance of the branch

manager." (p. 26, Rollo.)

In its answer to the union's complaint, TRB pointed out that

the NLRC, not the Bureau of Labor Relations, had

jurisdiction over the money claims of the employees.

On March 24, 1987, the Secretary of Labor certified the

complaint to the NLRC for resolution of the following issues

raised by the complainants:

"1) The Management of TRB per memo dated October 10,

1986 paid the employees their holiday pay but has withheld

from the union the basis of their computation.

"2) The computation in question has allegedly decreased the

daily salary rate of the employees. This diminution of

existing benefits has decreased our overtime rate and has

affected the employees' take home pay.

"3) The diminution of benefits being enjoyed by the

employees since the (sic) immemorial, e.g. mid-year bonus,

from two (2) months gross pay to two (2) months basic and

year-end bonus from three (3) months gross to only two (2)

months.

"4) The refusal by management to recall active union

members from the branches which were being transferred

without prior notice, solely at the instance of the branch

manager." (p. 28, Rollo.)

In the meantime, the parties who had been negotiating for a

collective bargaining agreement, agreed on the terms of the

CBA, to wit:

"1. The whole of the bonuses given in previous years is not

demandable, i.e., there is no diminution, as to be liable for a

differential, if the bonus given is less than that in previous

years.

"2. Since only two months bonus is guaranteed, only to that

extent are bonuses deemed part of regular compensation.

"3. As regards the third and fourth bonuses, they are

entirely dependent on the income of the bank, and not

demandable as part of compensation." (pp. 67-68, Rollo.)

Despite the terms of the CBA, however, the union insisted on

pursuing the case, arguing that the CBA would apply

prospectively only to claims arising after its effectivity.

Petitioner, on the other hand, insisted that it had paid the

employees holiday pay. The practice of giving them bonuses

at year's end, would depend on how profitable the operation

of the bank had been. Generally, the bonus given was two

(2) months basic mid-year and two (2) months gross end-

year.

On September 2, 1988, the NLRC rendered a decision in

favor of the employees, the dispositive portion of which

reads:

"WHEREFORE, judgment is hereby rendered in favor of the

petitioner and ordering respondent bank to pay petitioner

members-employees the following:

"1. Holiday differential for the period covering 1983-1986 as

embodied in Resolution No. 4984-1986 of respondent's

Board of Directors but to start from November 11, 1983 and

using the Divisor 251 days in determining the daily rate of

the employees;

"2. Mid-year bonus differential representing the difference

between two (2) months gross pay and two (2) months basic

pay and end-year bonus differential of one (1) month gross

pay for 1986.

"The claim for holiday differential for the period earlier than

November 11, 1983 is hereby dismissed, the same having

prescribed.

"Likewise, the charge of unfair labor practice against the

respondent company is hereby dismissed for lack of merit."

(pp. 72-73, Rollo.)

A motion for reconsideration was filed by TRB but it was

denied. Hence, this petition for certiorari.

There is merit in the petitioner's contention that the NLRC

gravely abused its discretion in ordering it to pay mid-

year/year-end bonus differential for 1986 to its employees.

A bonus is "a gratuity or act of liberality of the giver which

the recipient has no right to demand as a matter of right"

(Aragon vs. Cebu Portland Cement Co., 61 O.G. 4597). "It is

something given in addition to what is ordinarily received by

or strictly due the recipient." The granting of a bonus is

basically a management prerogative which cannot be forced

upon the employer "who may not be obliged to assume the

onerous burden of granting bonuses or other benefits aside

from the employee's basic salaries or wages x x x" (Kamaya

Point Hotel vs. National Labor Relations Commission,

Federation of Free Workers and Nemia Quiambao, G.R. No.

75289, August 31, 1989).

It is clear from the above-cited rulings that the petitioner

may not be obliged to pay bonuses to its employees. The

matter of giving them bonuses over and above their lawful

salaries and allowances is entirely dependent on the profits,

if any, realized by the Bank from its operations during the

past year.

From 1979-1985, the bonuses were less because the income

of the Bank had decreased. In 1986, the income of the Bank

was only 20.2 million pesos, but the Bank still gave out the

usual two (2) months basic mid-year and two (2) months

gross year-end bonuses. The petitioner pointed out,

however, that the Bank weakened considerably after 1986 on

account of political developments in the country. Suspected

to be a Marcos?owned or controlled bank, it was placed

under sequestration by the present administration and is

now managed by the Presidential Commission on Good

Government (PCGG).

In the light of these submissions of the petitioner, the

contention of the Union that the granting of bonuses to the

employees had ripened into a company practice that may not

be adjusted to the prevailing financial condition of the Bank

has no legal and moral bases. Its fiscal condition having

declined, the Bank may not be forced to distribute bonuses

which it can no longer afford to pay and, in effect, be

penalized for its past generosity to its employees.

Private respondent's contention, that the decrease in the

mid-year and year-end bonuses constituted a diminution of

the employees' salaries, is not correct, for bonuses are not

part of labor standards in the same class as salaries, cost of

living allowances, holiday pay, and leave benefits, which are

provided by the Labor Code.

WHEREFORE, the petition for certiorari is granted. The

decision of the National Labor Relations Commission is

modified by deleting the award of bonus differentials to the

employees for 1986. In other respects, the decision is

affirmed. Costs against the respondent union.

SO ORDERED.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Court Rules on Family Support CaseDocument7 pagesCourt Rules on Family Support CaseSamael MorningstarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- CBA KaelDocument33 pagesCBA KaelSamael MorningstarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- GR No. 191531Document7 pagesGR No. 191531Samael MorningstarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- GR 151121Document19 pagesGR 151121Samael MorningstarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- CA Upholds No Contract Formed to Repurchase Foreclosed PropertiesDocument2 pagesCA Upholds No Contract Formed to Repurchase Foreclosed PropertiesSamael MorningstarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- De Lima v. GatdulaDocument11 pagesDe Lima v. GatdulaAMBNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- GR 167158 - Dy vs. Phil Banking CorpDocument10 pagesGR 167158 - Dy vs. Phil Banking CorpSamael MorningstarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Land Bank of the Philippines v. Heirs of Soriano (2013Document2 pagesLand Bank of the Philippines v. Heirs of Soriano (2013Samael Morningstar100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Supreme Court upholds P150/sqm just compensation for expropriated landDocument8 pagesSupreme Court upholds P150/sqm just compensation for expropriated landSamael MorningstarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- GR 198501 - Kastral Shipping vs. MunarDocument13 pagesGR 198501 - Kastral Shipping vs. MunarSamael MorningstarNo ratings yet

- Rape Case Leads to InsanityDocument10 pagesRape Case Leads to InsanityEmer MartinNo ratings yet

- Supreme CourtDocument8 pagesSupreme CourtSamael MorningstarNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Case SuccDocument3 pagesCase SuccSamael MorningstarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BIR clarifies tax rules for raw and refined sugarDocument3 pagesBIR clarifies tax rules for raw and refined sugarSamael MorningstarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Philippine Phoenix Surety Vs WoodworkDocument4 pagesPhilippine Phoenix Surety Vs WoodworkSamael MorningstarNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- In Re Enrique Lopez vs. Lopez G.R. 189984Document8 pagesIn Re Enrique Lopez vs. Lopez G.R. 189984Kathleen GalanoNo ratings yet

- GR No. 11784Document3 pagesGR No. 11784Samael MorningstarNo ratings yet

- In Re Enrique Lopez vs. Lopez G.R. 189984Document8 pagesIn Re Enrique Lopez vs. Lopez G.R. 189984Kathleen GalanoNo ratings yet

- GR No. 11784Document3 pagesGR No. 11784Samael MorningstarNo ratings yet

- GR No 82985Document4 pagesGR No 82985Samael MorningstarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Review Serious Incident Investigation Reports 20092012Document12 pagesReview Serious Incident Investigation Reports 20092012Samael MorningstarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- GR No 186583Document14 pagesGR No 186583Samael MorningstarNo ratings yet

- Scientific AccuracyDocument13 pagesScientific AccuracySamael MorningstarNo ratings yet

- Supreme Court rules on disputed land donation caseDocument6 pagesSupreme Court rules on disputed land donation caseSamael MorningstarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Philippines Supreme Court upholds dismissal but orders back wagesDocument16 pagesPhilippines Supreme Court upholds dismissal but orders back wagesSamael MorningstarNo ratings yet

- Wiki Public International LawDocument12 pagesWiki Public International LawSamael MorningstarNo ratings yet

- Philippines Supreme Court Upholds Marriage of Julian Ambalada and Modesta AfableDocument8 pagesPhilippines Supreme Court Upholds Marriage of Julian Ambalada and Modesta AfableSamael MorningstarNo ratings yet

- ADR Handbook Covers History, Benefits, TermsDocument9 pagesADR Handbook Covers History, Benefits, TermsRojan Alexei GranadoNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Consti in GenDocument21 pagesConsti in GenSamael MorningstarNo ratings yet

- No. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountDocument3 pagesNo. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountMond NaNo ratings yet

- Learning SolutionsDocument28 pagesLearning SolutionsSRAVANSUJA100% (1)

- Assignment 1.1Document2 pagesAssignment 1.1Heina LyllanNo ratings yet

- 2013-14 - Service - Identity - 1.0 14Document1 page2013-14 - Service - Identity - 1.0 14Fer LúaNo ratings yet

- SBM J22 Mark PlanDocument38 pagesSBM J22 Mark PlanWongani KaundaNo ratings yet

- Informative advertising is used heavily when introducing a new product categoryDocument3 pagesInformative advertising is used heavily when introducing a new product categoryMalik Mohamed100% (2)

- FAM FormulaDocument19 pagesFAM Formulasarthak mendirattaNo ratings yet

- 1.2.2 Role of Information Technologies On The Emergence of New Organizational FormsDocument9 pages1.2.2 Role of Information Technologies On The Emergence of New Organizational FormsppghoshinNo ratings yet

- Cba 2008-2009 PDFDocument10 pagesCba 2008-2009 PDFjeffdelacruzNo ratings yet

- Business PlanDocument17 pagesBusiness PlanMariaNo ratings yet

- Audit Powerpoint PresentationDocument21 pagesAudit Powerpoint PresentationSmashed PotatoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Marketing Management PPT AllsessionsDocument577 pagesMarketing Management PPT AllsessionsArfa FatimaNo ratings yet

- Enterprise Structure OverviewDocument5 pagesEnterprise Structure OverviewAnonymous 7CVuZbInUNo ratings yet

- Consumer Behavior in Relation To Insurance ProductsDocument52 pagesConsumer Behavior in Relation To Insurance Productsprarthna100% (1)

- Tutorial 2-5 Submitted BY:SULAV GIRI (40765)Document6 pagesTutorial 2-5 Submitted BY:SULAV GIRI (40765)Smarika ShresthaNo ratings yet

- An Assignment On Niche Marketing: Submitted ToDocument3 pagesAn Assignment On Niche Marketing: Submitted ToGazi HasibNo ratings yet

- Marketing and Sales ManualDocument17 pagesMarketing and Sales ManualWendimagen Meshesha Fanta89% (9)

- Kool King DivisionDocument6 pagesKool King DivisionAkhil GoyalNo ratings yet

- Statement of Cash FlowDocument45 pagesStatement of Cash FlowJay Bianca Abera Alistado100% (1)

- Technology AnnualDocument84 pagesTechnology AnnualSecurities Lending TimesNo ratings yet

- The Entrepreneur's Guide to Tracking Resources, Calculating Profit, and Financial PositionDocument14 pagesThe Entrepreneur's Guide to Tracking Resources, Calculating Profit, and Financial PositionChristine Bianca ChuaNo ratings yet

- Goodwill Questions and Their SolutionsDocument13 pagesGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADER100% (7)

- MAPS Coaching - Business Plan For AgentsDocument12 pagesMAPS Coaching - Business Plan For AgentsJohn McMillanNo ratings yet

- Case Study:: Zara & UniqloDocument14 pagesCase Study:: Zara & UniqloarjunNo ratings yet

- Dupont CaseDocument3 pagesDupont Casejaskaran narangNo ratings yet

- Integration The Growth Strategies of Hotel ChainsDocument14 pagesIntegration The Growth Strategies of Hotel ChainsTatiana PosseNo ratings yet

- 2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarDocument17 pages2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarBethuel KamauNo ratings yet

- SAP TM Course Content.......Document4 pagesSAP TM Course Content.......Prasad ChowdaryNo ratings yet

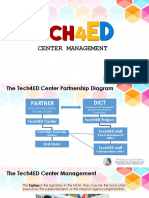

- BCMT Module 3 - Tech4ED Center ManagementDocument46 pagesBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNo ratings yet

- Book - Influence by Robert B CialdiniDocument18 pagesBook - Influence by Robert B CialdiniEjaz Bashir0% (1)