Professional Documents

Culture Documents

Escaping The Sword of Damocles PDF

Uploaded by

Kanjakha PalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Escaping The Sword of Damocles PDF

Uploaded by

Kanjakha PalCopyright:

Available Formats

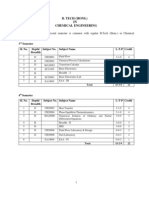

2

Escaping the sword of Damocles:

Toward a new future for

pharmaceutical R&D

McKinsey perspectives on drug and device R&D 2012 3

Escaping the sword of Damocles: Toward a new future for pharmaceutical R&D

Recent years have seen a collapse in the industrys R&D productivity

and a loss of faith in its innovation model. Regaining customers and

shareholders trust by delivering life-changing new drugs is still an

achievable goal, but it will require discipline, creativity, and luck in

equal measure.

Ajay Dhankhar, Matthias Evers, and Martin Mller

Damocles was a courtier in Greece in A decade of doubt

the fourth century BC. The story has

it that he used to flatter the king by The pharmaceutical and biotech industry

saying what a marvelous life he had. has failed to meet shareholder expectations

When the king offered to swap places over the past decade, and has come

with him for a day, Damocles agreed, nowhere near beating the R&D odds.

only to find himself sitting beneath Indeed, R&D looks like a rigged game.

a huge sword that was hanging by Though a few companies have bucked the

a single hair from a horses tail. He trend, the jury is still out on whether they

couldnt move without putting his are making genuine improvements to their

life in danger. The episode taught models that will stand the test of time.

Damocles a sharp lesson about the

gravity of a leaders responsibilities. In the past 25 years the industry has

created in excess of $1 trillion of

The trends of the past few years can be shareholder value, but destroyed around

likened to a sword of Damocles hanging $550 billion of value during the decade

over the pharmaceutical industry. Yet of doubt from 2000 to 2010. That value

there are good reasons for continuing destruction coincided with a 60 percent

to believe in it. Unmet needs, scientific increase in the R&D spending rate from

advances, and increasing affluence should 10 to 16 percent of sales, and with an

translate into continuing opportunities to even higher increase in absolute spend

innovate for the benefit of patients. We as worldwide sales grew from $200

expect to see evolution at the core and billion in 1995 to $800 billion in 2009.

revolutions at the periphery, as well as

some fundamentally new R&D ideas. A recent McKinsey analysis calculates that

the average economic return on R&D has

So what does this mean in practical dropped from between 13 and 15 percent

terms? As we discuss below, companies in the 1990s to between 4 and 9 percent in

must adopt a different approach to the past decade (Exhibit 1). This suggests

their R&D spend, create more exciting that much of the current investment in

environments to attract the brightest R&D is not creating value. We estimate

scientists, find ways of creating an that cumulative success rates have fallen

ownership mindset, and embrace by as much as 50 percent as the number

collaboration and co-invention to take R&D of drug development programs and the

beyond the walls of their organization. cost per program have doubled.1 For the

4

companies under the most Exhibit 1: Economic return on R&D investment

pressure, the net present value for top 10 biopharma players

Includes impact of working capital, property, plant, and equipment, and goodwill

of their pipeline is negative.

Forecast Performance

returns trajectory

1415%

Not surprisingly, stakeholders 1314%

and shareholders are losing 1012%

89%

patience and exerting 68%

mounting pressure on 45%

boards, CEOs, and executive

teams to acknowledge the 199195 19962000 200105 200610 Current Step-change

trajectory (30% further

situation and reduce R&D productivity

improvement)

costs. In addition, it is widely

believed that one-off launches Percent of sales

reinvested in R&D

910% 12% 16% 17% 1516% ?

may show only ephemeral Decade of Decade of high The way

improvements in return on high returns re-investment forward?

investment and encourage

bravado, hiding deeper issues

about growing trial costs, Exhibit 2: Players are losing their ability to

falling success rates in virtually outperform the market

Selection of top 20 pharma and biotech players

all therapeutic areas (TAs) Total return to shareholders, CAGR, percent

and molecule types, more 19852010 20002010

crowded markets, higher bars Company A 23 -2

B 18 18

for commercial success, and C 15 4

the unexpectedly swift loss D

E

15

14

-2

0

of the partnering advantage. F 13 3

G 13 -5

H 12 -6

I 11 -1

As yet there is no evidence J 10 -1

that the trend has bottomed K

L 9

10 -6

0

out and success rates are M 9 -5

N 7 -3

improving. Things may get O 7 -1

worse before they get better, S&P 500 S&P 500

index: 9.9 index: 1.4

a view endorsed by most

serious industry observers.

Admittedly, some companies

have beaten the odds, but whether whether TA specialization is a winning

their success is down to sustainable model, or whether the future might lie in

value creation or serendipity is unclear. higher exposure to biologics, for every

Many pharmaceutical companies have such trend there are counter-examples

had significant 25-year shareholder and reasons to suppose that the opposite

value creation, although their results conclusion might be equally valid.

for the past ten years are more modest

(Exhibit2). These success stories dont

point to one promising direction that the

industry can follow; rather, several fields

have pockets of excellence that seem to

pay off. Tempting though it is to wonder

McKinsey perspectives on drug and device R&D 2012 5

Escaping the sword of Damocles: Toward a new future for pharmaceutical R&D

The environment is getting tougher on drug profiles, and the

getting tougher US is no longer immune. As real-world

outcomes become more and more

Those who take a pessimistic view important, there is limited willingness to pay

can point to still more headwinds that for efficacy alone. Countries with formal

will hold back R&D productivity. cost-effectiveness assessments in drug-

funding decisions now account for some

Most low-hanging fruit has already 60 percent of global prescription sales, a

been picked. Libraries have been number that is growing fast. As a result,

screened and monoclonal antibody most companies internal innovation hurdle

approaches have been run on all has shifted beyond me too strategies

obvious extra-cellular targets. Expensive toward earlier screening (as early as lead

technology investments in such areas optimization) for differentiation against

as functional genomics have not yet the evolving standard of care. As payors

paid off, and it is unclear whether they grow ever more sophisticated and more

ever will. The industry is suffering from and more technologies and techniques

a surfeit of similarity, as evident in the for personalized or protocolized

massive competition in oncology and healthcare become available, the

elsewhere among many players circling differentiation requirements for individual

a handful of targets. No one has really drugs will become increasingly specific.

cracked how to capture advantage from

the emerging science around disease Returns for many companies will

biology and understanding, biomarkers, deteriorate further. That isnt because

and model-based drug development. there are no advances left to make, but

because too many duplicative bets are

Regulatory environments remain being placed by relatively low-skilled

challenging in the post-Vioxx world. resources that are the legacy of excess

New medicines are unlikely to be approved investment during the artificially high profit

without major risk management measures umbrella of the late 1990s. Put simply,

or label restrictions. The progress made this is a case of overcapacityand the

by regulatory science in adapting to capacity with the lowest productivity

new model-based drug development will be removed from the market. This

approaches has been limited. Recent is already happening through the R&D

favorable reviews of applications appear to restructurings, mergers and acquisitions,

reflect good science rather than a change and site closures seen throughout the

in processes, productivity, or risk tolerance. industry in the past couple of years.

Remnants of the old shots on goal

paradigm persist in the portfolio.

High attrition in Phase II and III may Not all doom and gloom

continue for several more years if lower-

quality compounds continue to be pushed For the optimists among us, however, there

forward instead of getting weeded out. are bright spots that provide some hope.

A major new post-approval hurdle Investigational new drug (IND) filings

has emerged. Pricing, reimbursement, have come down by 17 percent in the

and health technology assessments are past few years. This is a clear sign that

6

excess and unproductive Exhibit 3: IND filings decline

Number of commercial investigational new drugs

capacity is starting to be

removed (Exhibit 3).

17% pa

Numerous players +5% pa 883

are piloting new ideas 779

720*

successfully. Examples

602

include Novartiss pathway

approach; multiple companies Migration away

from shots on

proof-of-concept strategies; goal model

heavyweight teams and

streamlined decision-making

1986 1990 1995 2000 2005 2010

processes; GlaxoSmithKlines

modularization into ever- * Estimate

Data after 2004 includes INDs for therapeutic biologic products transferred from CBER to CDER

smaller performance units; Source: CDER; FDA

Lillys Chorus; numerous

Covance-like contractresearch

organization(CRO)deals;and Regulators are starting to recognize

many partnerships. that regulatory science must

improve. They are also beginning

The industrys understanding of biology to understand that a new type of

is expected to improve over the next dialogue with industry is needed.

decade. Entrants with new talents, skills,

and orthogonal perspectives are joining Electronic health information (EHI),

the party: the NIH, the FDA, academia, e-trials, and real-world evidence could

the Bill & Melinda Gates Foundation, and create significant value across the

many governments. Fresh opportunities product lifecycle. For example, they

may emerge in modeling and simulations, could inform trial design and decision

biomarker identification and usage, making and improve market access by

and the use of outcome data as a way providing more robust data on comparative

to focus and guide clinical trials. The effectiveness and safety (Exhibit 4).

potential opportunity, and big cost, of

massive bioinformatic and genomics,

proteomics, and metabolomics tools and

insights could finally start to pay off. Evolution at the core,

revolutions on the periphery

These advances could eventually open

the door to the world of personalized The R&D strategy and operating model

healthcare. This would present major we see for the future is one forged

uncertainties for the industrys business around variablizedand in most but not

model, but clear opportunities for better all cases reducedspend. We also see

treatment of individual patientsand hence evolutionary but deep changes at the core,

commercial potential. Better biology, better complemented by targeted revolutionary

and less costly genomics, and personalized bets in a few game-changing areas.

medicine may also allow some failed This will require an overall reduction in

molecules of the past to be resurrected. the number of programs, a Darwinian

discipline in portfolio development and

McKinsey perspectives on drug and device R&D 2012 7

Escaping the sword of Damocles: Toward a new future for pharmaceutical R&D

Exhibit 4: How EHI can add value Economic

benefit

Development Approval and launch Growth and maintenance

Product

phase

Time

New indicators/ Loss of exclusivity/

Phase III Approval/HTA New competition

formulations competition

Define ideal patient Assess burden of Support continued Demonstrate Differentiate from

population/unmet disease/unmet success unmet need competitors going

need need Additional Identify target generic

Demonstrate Estimate cost evidence on populations Differences in usage

Uses of burden of disease effectiveness and clinical outcomes Outcomes in sub-

real-world Recruit trial budget impacts Differentiation populations

evidence patients accurately (vs. usage and Cost effectiveness

Understand standard of care) prescribing Effects of switching on

standard of care Meet post- patterns outcomes

and clinical and marketing Adherence to Adherence to drug

cost effectiveness requirements drug regimen regimen

to achieve a (safety, utilization) Differentiate with or

reimbursable against protected

product profile galenics

decision making so that only the strongest Variablize and possibly

programs survive, and an ownership reduce R&Dinvestment

mindset among R&D leaders and project The days of the shots on goal model

teams so that resources are used much are numbered. There are not enough

more thoughtfully, as if we owned the quality pipeline assets and validated

assets and the company ourselves. targets in discovery or the clinic to launch

so many shots while maintaining a

We expect companies to focus on formulaic investment of 15 to 20 percent

well-known levers to make the smaller of sales. Instead, we expect companies

number of programs more effective. to take quality shots on goal starting

Reorganizations and mergers will be from new libraries and sources of targets.

much less important than, for example, Standard high-throughput screening (HTS)

quality of governance, senior team approaches and numbers-based incentives

decision-making processes, metrics, will be supplemented or even abandoned.

incentives, and a culture of innovation.

We also expect to see some creativity Its time to make the level of R&D

and willingness to experiment. spending more flexible. R&D outlay

need not be fixed at 15 percent of

Our view of what will drive superior R&D revenue, nor at the 1990s level of

productivity is based on lessons from 10percent. Instead, companies could flex

the past as well as the pressures and it between 5 and 25 percent depending

opportunities we have outlined. Some of on portfolio quality, pipeline evolution,

our predictions are well supported and and fluctuations in the quality of external

consistent with industry views; others assets. They could pursue opportunities

are more speculative and controversial. that show genuine promise and be ready

8

to reduce or increase funding as each Enhance the environment you offer.

case dictates. Before they can do this, Make your R&D organization the Apple or

though, companies will have to dismantle Google for ambitious scientists. Attracting,

fixed infrastructurea process that has developing, and ensuring collaboration

already started across the industry. among the brightest researchers and

drug hunters truly matters.2 Place as

Redundant capacity must go. Obvious much emphasis on creating a stimulating

overlaps are already being removed environment as on driving efficiency.

through partnerships in R&D, such as

that between Boehringer Ingelheim Ensure clear differentiation in a

and Eli Lilly in diabetes. Partnerships challenging payor environment. This

and alliances are a natural way to is about medical and clinical and cost-

reduce capacity while continuing to effective differentiation, not just novelty.

access good science in the therapeutic Creating cross-functional alignment

areas that are strategically valuable. on what differentiation means and

allocating funds appropriately are key.

Teams should act as owners, not So is conducting evidence-based drug

managers, of R&D assets. The concept development in real-world settings.

of better owner has been poorly applied

to R&D assets. It requires a mindset Make the most of your differentiated

that an R&D team doesnt consider assets. Improve the effectiveness of

itself distinctive unless it genuinely is, your lifecycle management (LCM) as

and leaders who are prepared to make a way to add value to a franchise. The

dispassionate decisions to sell or licence scarcest and hence most valuable of

out compounds that may be more all assets is an approved molecule. It is

valuable in others hands. For example, it important to create a franchise that can

is not clear that many companies can be expand the brand, perhaps even beyond

distinctive in more than five therapeutic the active pharmaceutical ingredient,

areas and multiple disease biology areas while maintaining the brand equity.

unless they have huge budgets and scale.

Better ownership also requires leaders who Take a Darwinian approach to decision

view investments as if they were their own, making. Evaluating the portfolio objectively,

and companies that enable and empower eliminating decision-making biases,

them to do so. Companies should create and allowing only the best programs to

incentives to kill programs when necessary, survive are critical. We find its almost

and make it clear they do not regard a impossible for a management team

program kill as a career-limiting move. of non-scientists to act as responsible

stewards of a research portfolio;

Pursue evolutionary but deep conversely, scientific teams often find it

changesat the core difficult to be dispassionate. Companies

R&D will not be transformed overnight, seldom get a truly independent read on

nor will there be a paradigm shift. their pipeline quality, but when they do,

The priority should be purposeful it can yield valuable insights. Possible

execution against well-known but approaches to achieve this include creating

often poorly executed levers: a blue-ribbon FDA that applies the

same level of scrutiny to a draft dossier

as the FDA would, bringing the same

McKinsey perspectives on drug and device R&D 2012 9

Escaping the sword of Damocles: Toward a new future for pharmaceutical R&D

Exhibit 5: Segmenting the portfolio into swim streams Devise a new incentive

Based on estimates of approximate aggregate attrition rates for medicines in the following therapeutic areas:

central nervous system, endocrine, cardiovascular, infectious diseases, oncology, and respiratory model. Basing incentives and

Quadrant D Quadrant C goals only on the number of

FAST LANE filings or the size of a portfolio

More destroys more value than

perhaps any other action in

Attrition rate 60% Attrition rate 25%

Objectivity

of endpoints*

the industry. To rekindle a

Attrition rate 70% Attrition rate 35%

culture of innovation while

Less simultaneously managing

SLOW LANE

scientists, leaders need to

Quadrant A Quadrant B

create performance metrics

No Yes

and incentives that promote

Established mechanism of action

R&D quality and output

* More objective endpoints relate to more easily reproducible diagnostic tests or measures, as opposed

to less reproducible scales or patients self-reporting diaries

Novelty of mechanism is more relevant than objectivity of endpoints

rather than just throughput

Source: Evaluate; Pharmaprojects; Factiva; McKinsey analysis efficiency (which often takes

care of itself when resources

are constrained). Companies

cross-functional lens to evaluate internal should put in place a system that enables

assets as in-licenced molecules, and the best biologists and chemists to work

adopting a venture capitalists approach in the highest-value areas and allows

to R&D decisions. Indeed, the trend them to have portfolios at all levels, an

toward more VC and investor funding excess of ideas and investment options,

of development programs may well be and limited funds. Instead of putting

driven by the dispassionate analysis that people in a position where they have

such leaders bring to decision making to prosecute bad molecules to avoid

rather than by the funding itself, which ending their careers, give them incentives

usually comes at a high cost of capital. to suggest better avenues to pursue.

Avoid making Toyotas in a Lexus Improve basic efficiency and

factory. Companies should consider effectiveness. High levels of waste and

segmenting their portfolio into swim gold-plated solutions can still be found in

streams that move at different speeds R&D, and indeed in pharma as a whole.

through steady waters or rapids, Staff who join from other industries

internally and externally (Exhibit 5). They are frequently surprised by the lack of

should systematically differentiate the discipline in cost management. Companies

way they treat R&D projects not just by should adopt methods such as lean,

value, but also by risk and data clarity. outsourcing and offshoring, and external

This would determine how teams are spend management and oversight.

staffed, how much frontloading to do,

and when it is necessary to go external. Amplify your discovery and clinical

Companies should also decide their research expertise. It is extraordinarily

strategy in terms of which water to challenging to design laboratory or clinical

swim inthe kiddie pool or the piranha- experiments that are both informative

infested stream?for each therapeutic under all possible outcomes and tailored to

area and for the portfolio as a whole. regulatory and real-world success factors.

Too many experiments fail because of

subtle design flaws. Developing a pool

10

of seasoned researchers is one of the discussion on the optimal size of an R&D

most obvious productivity levers, yet unit. Is it 200 to 300 researchers or as few

many get it wrong. Every company has a as 50 to 70? Or should even smaller units

small group of world-class researchers; coordinate networks of increasingly global

the best companies figure out how to contract research organizations (CROs)

amplify their contributions by helping to get the work done, while planning,

them build the next generation of leaders strategy, and design are the preserve of a

in scientific and medical research. team of high-caliber scientists and medics?

More companies are likely to experiment

Consider revolutions at the periphery with such models. In time, they may even

Potential game changers or new lead to the complete disaggregation of

paradigm solutions include: the industry value chain as CROs take

over the lions share of operational work.

Next-generation licencing or drug co-

invention. If pharmaceutical companies

could collaborate as effectively as high-

tech and movie companies do, significant Revisiting R&D strategy

value could be created. Biology research

should happen less through in-house Although it would be unwise to over-

efforts and more through early-stage generalize about R&D operating models,

collaborations. Strategy should revolve our outside-in view suggests that most

around fractional bets on a larger portfolio companies have room to improve. They

of molecules. Opportunities exist to dont have to nail every single factor that

separate out who funds, who prosecutes, we have highlighted, but they do need a

and who markets a molecule, and to base level of performance in most of them,

craft multi-party agreements to make coupled with genuine distinctiveness in a

that happen. Another way to create a few. Most companies would find it useful

co-invention ecosystem is to undertake to consider the following questions:

deep collaborations with academics.

Instead of setting a top-down budget,

such as dedicating 15 percent of

A scale-up of faster, cheaper drug

investment to R&D, should we assess

to proof of concept paradigms.

our pipeline and external options

If the Chorus model proves to be

as candidates for investment and

feasible at scale, it could be emulated

build a bottom-up budget to allow

by others. Pharmaceutical companies

greater flexibility from year to year?

could do what carmakers do and work

with multiple partners in emerging What are the therapeutic and other

markets to help them develop from areas where we are truly distinctive

service providers with individual slivers and have critical mass? Would a

of the value chain to more integrated venture capitalist or the FDA reach

participants in the development process. the same conclusions? Should

we refine the number and mix of

Small, empowered, entrepreneurial therapeutic areas we cover?

R&D units. Ever since GlaxoSmithKline Could we embrace and institutionalize a

launched its Centers of Excellence for mindset to address the fourth hurdle

Drug Discovery (CEDDs) concept more to developmentthe market access

than 10 years ago, there has been much challengeto ensure effective LCM?

McKinsey perspectives on drug and device R&D 2012 11

Escaping the sword of Damocles: Toward a new future for pharmaceutical R&D

How Darwinian are our R&D

governance and decision-making

processes? Are there biases we

After a decade-long crisis in R&D

should eliminate? Do we strike the

productivity, there is much sound thinking

right balance of risk for internal

on how to do things better. Whats

and external candidates?

more, many companies are improving

What could we do to improve our parts of their business, and some are

efficiency and effectiveness? managing to outperform in most or all

How could we benefit from of it. The real challenge is being able

broader partnerships, drug co- to change at scale: not only individual

invention approaches, and an functions and therapeutic areas, but major

environment of borderless R&D? companies and ultimately the industry

What other revolutions could as a whole. Perhaps pharma will then be

we embrace: faster drug to able to put its decade of doubt behind

proof of concept paradigms, it and embrace a decade of change.

more entrepreneurial R&D units,

government collaborations?

Companies have tried or are trying

most if not all of the approaches we

have described above. It isnt yet clear

what will work and what wont. The

right mix of interventions is likely to vary

from one company to another, given

the differences in starting points.

Notes

1 For more detail on the decline in success rates, see The anatomy of attrition revisited, pp. 247.

2 For more on this topic, see Managing the health of early-stage discovery, pp. 2833.

Ajay Dhankhar is a director in McKinseys New Jersey office, Matthias Evers is a principal in the Hamburg

office, and Martin Mller is a principal in the Copenhagen office. The authors wish to acknowledge the

contributions of many colleagues to this article, in particular Lynn Dorsey Bleil, Sylvain Milet, Lucy Perez,

Tejash Shah, Nav Singh, and Nicole Szlezak.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Harvard ModeloDocument45 pagesHarvard ModeloRodrigo Cru Cruz HNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Deloitte NL Manufacturing Opportunities For The Fermentation Based Chemical Industry 2014 PDFDocument58 pagesDeloitte NL Manufacturing Opportunities For The Fermentation Based Chemical Industry 2014 PDFKanjakha PalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Top 20 Industry Positions for PhDs: Application Scientist & Quantitative AnalystDocument58 pagesTop 20 Industry Positions for PhDs: Application Scientist & Quantitative AnalystTwinkle KheraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- 20 Transferable Skills For PhDs in Biotech, Biomed & BiopharmaDocument37 pages20 Transferable Skills For PhDs in Biotech, Biomed & BiopharmaSneha Gupta100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- State Space ModellingDocument19 pagesState Space Modellingindula123No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Manual Casio Fx-9860GIIDocument412 pagesManual Casio Fx-9860GIISantiagoNo ratings yet

- 2017ss Sheen CatalogDocument12 pages2017ss Sheen CatalogKanjakha PalNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- +50 Business Model Examples PDFDocument119 pages+50 Business Model Examples PDFKanjakha Pal50% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 20 Transferable Skills For PhDs in Biotech, Biomed & BiopharmaDocument37 pages20 Transferable Skills For PhDs in Biotech, Biomed & BiopharmaSneha Gupta100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Nusselt Number Liq MetalsDocument7 pagesNusselt Number Liq MetalsKanjakha PalNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Medieval India Satish ChandraDocument139 pagesMedieval India Satish ChandraPruthvi Kommu90% (10)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Harvard ModeloDocument45 pagesHarvard ModeloRodrigo Cru Cruz HNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Manual Casio Fx-9860GIIDocument412 pagesManual Casio Fx-9860GIISantiagoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Manual Casio Fx-9860GIIDocument412 pagesManual Casio Fx-9860GIISantiagoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Lec 1Document20 pagesLec 1Kanjakha PalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Global Top 50Document4 pagesGlobal Top 50Kanjakha Pal100% (1)

- Span TweenDocument0 pagesSpan Tweenbexigaobrother100% (1)

- Success Story Uni HD - BASFDocument1 pageSuccess Story Uni HD - BASFKanjakha PalNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- PGSG Spring Career Fair Report Data Student DemographicsDocument4 pagesPGSG Spring Career Fair Report Data Student DemographicsKanjakha PalNo ratings yet

- CH10Document5 pagesCH10Kanjakha PalNo ratings yet

- The ICIS Top 100 Chemical Companies saw the good times roll in 2007, but 2008 brings a more challenging environment, testing their mettleDocument5 pagesThe ICIS Top 100 Chemical Companies saw the good times roll in 2007, but 2008 brings a more challenging environment, testing their mettle123456789pppppNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Guideline: Computational Interdisciplinary Graduate ProgramsDocument16 pagesGuideline: Computational Interdisciplinary Graduate ProgramsKanjakha PalNo ratings yet

- BMV Documentation ListDocument1 pageBMV Documentation ListKanjakha PalNo ratings yet

- Soy Products GDocument48 pagesSoy Products GKanjakha PalNo ratings yet

- CL Btech 2010Document22 pagesCL Btech 2010Kanjakha PalNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- B.Sc. TY Biotechnology PDFDocument26 pagesB.Sc. TY Biotechnology PDFHanumant Suryawanshi0% (1)

- Bio - Means "Life " Techno - Means "Tools " - Ology Means "The Study Of."Document38 pagesBio - Means "Life " Techno - Means "Tools " - Ology Means "The Study Of."Ismail Hanif Abdur-RahimNo ratings yet

- BITP 2015-16 Trainees ProfileDocument492 pagesBITP 2015-16 Trainees ProfilepstindiaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Clivaje FmocDocument12 pagesClivaje FmocAna Maria Barrera DiazNo ratings yet

- TOP 250 Pharma CompaniesDocument7 pagesTOP 250 Pharma CompaniesadityakhadkeNo ratings yet

- B Techr2015Document188 pagesB Techr2015End Semester Theory Exams SathyabamaNo ratings yet

- Recombinant DNA TechnologyDocument11 pagesRecombinant DNA TechnologyBagya kavirathneNo ratings yet

- Resume 2017Document2 pagesResume 2017Min JangNo ratings yet

- Chapter 7EDocument9 pagesChapter 7EChandan KumarNo ratings yet

- Production Optimisation and Characterisation of Extracellular Protease Secreted by Bacillus - PATEL PDFDocument33 pagesProduction Optimisation and Characterisation of Extracellular Protease Secreted by Bacillus - PATEL PDFFabiola Valle MielesNo ratings yet

- Modern Biotechnology Discovery and ApplicationsDocument9 pagesModern Biotechnology Discovery and ApplicationsBea FernandezNo ratings yet

- EPIGENETICSDocument1 pageEPIGENETICSapi-20009652No ratings yet

- Kiran Mazumdar ShawDocument16 pagesKiran Mazumdar ShawShachi SangharajkaNo ratings yet

- Deciphering Hidden DNA Meta-Codes - The Great Unification & Master Code of BiologyDocument20 pagesDeciphering Hidden DNA Meta-Codes - The Great Unification & Master Code of BiologyJean-claude PerezNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MTHFR Polymorphisms and DiseaseDocument224 pagesMTHFR Polymorphisms and DiseaseRaphael Menezes100% (1)

- Promoting BioEntrepreneurshipDocument24 pagesPromoting BioEntrepreneurshipdr.r.kalaivaniNo ratings yet

- Kombucha Full ReportDocument8 pagesKombucha Full ReportBảoChâuNo ratings yet

- Proteomics in Domestic AnimalsDocument485 pagesProteomics in Domestic AnimalsИгор ГалоскиNo ratings yet

- MCB 130L Protein Localization and Transfection TechniquesDocument34 pagesMCB 130L Protein Localization and Transfection TechniquesVipul TomarNo ratings yet

- List of Pharmaceutical Companies in PuneDocument5 pagesList of Pharmaceutical Companies in PuneMuhammad SalmanNo ratings yet

- BMW Sop For CC'SDocument30 pagesBMW Sop For CC'SVisheshNo ratings yet

- Genetic RecombinationDocument24 pagesGenetic Recombinationkai dollNo ratings yet

- BIOINFORMATICS LAB ReportDocument14 pagesBIOINFORMATICS LAB ReportKaleemUllah SulimankhailNo ratings yet

- Understanding Color BlindnessDocument9 pagesUnderstanding Color BlindnessJorge PlanoNo ratings yet

- Rediscovering Biology TextbookDocument203 pagesRediscovering Biology TextbookJuiced-IN itNo ratings yet

- Fund MicroDocument311 pagesFund MicroHussam HassanNo ratings yet

- Patenting in Biological Invention in India: Amity Law School, Amity University Sector-125, Uttar PradeshDocument12 pagesPatenting in Biological Invention in India: Amity Law School, Amity University Sector-125, Uttar Pradeshsmalhotra2414No ratings yet

- MMC 3Document337 pagesMMC 3gosciewskik1983No ratings yet

- Seminar - Write-Up FormatDocument8 pagesSeminar - Write-Up Formatd.orreenselcouthNo ratings yet

- Primers in BiologyDocument19 pagesPrimers in BiologyAjay Pathak0% (1)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)