Professional Documents

Culture Documents

Federal Tax Lien Against Floyd Mayweather Jr. For 2015 - $22.2M

Uploaded by

Oskar Garcia0 ratings0% found this document useful (0 votes)

11K views1 pageThe IRS says boxer Floyd Mayweather Jr. still owes $22.2 million in taxes from 2015, the year he earned his biggest payday with a blockbuster fight against Manny Pacquiao.

A notice of a federal tax lien filed against the undefeated fighter nicknamed "Money" shows the balance as unpaid as of March 6. The document was filed with county officials in Las Vegas in April.

Mayweather's tax troubles come as he gets ready to come out of retirement to fight against Irish MMA star Conor McGregor in August.

Original Title

Federal Tax Lien against Floyd Mayweather Jr. for 2015 -- $22.2M

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe IRS says boxer Floyd Mayweather Jr. still owes $22.2 million in taxes from 2015, the year he earned his biggest payday with a blockbuster fight against Manny Pacquiao.

A notice of a federal tax lien filed against the undefeated fighter nicknamed "Money" shows the balance as unpaid as of March 6. The document was filed with county officials in Las Vegas in April.

Mayweather's tax troubles come as he gets ready to come out of retirement to fight against Irish MMA star Conor McGregor in August.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11K views1 pageFederal Tax Lien Against Floyd Mayweather Jr. For 2015 - $22.2M

Uploaded by

Oskar GarciaThe IRS says boxer Floyd Mayweather Jr. still owes $22.2 million in taxes from 2015, the year he earned his biggest payday with a blockbuster fight against Manny Pacquiao.

A notice of a federal tax lien filed against the undefeated fighter nicknamed "Money" shows the balance as unpaid as of March 6. The document was filed with county officials in Las Vegas in April.

Mayweather's tax troubles come as he gets ready to come out of retirement to fight against Irish MMA star Conor McGregor in August.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

SEAT

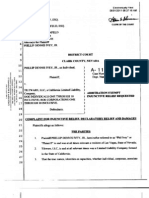

Department of the Treasury - Internal Revenue Servico

Form 668 (Yc)

Rev. Febery 2004), Notice of Federal Tax Lien

Area: Serial Number | —#2+ Options! Use by Resonding Giiee

‘SMALL BUSINESS/SELF EMPLOYED AREA #6

Lian Unit Phone: (800) 913-6050 |

As provided by section 6321, 6322, and 6323 of the Internal Revenue

Code, we are giving a notice that taxes (including interest and penalties)

have been assessed against the following-named taxpayer. We have made

a demand for payment of this liability, but i remains unpald. Therefore, WC Fee: $0.00

there Is a fen in favor of the United States on all property and rights to 5

Property belonging to this taxpayer for the amount of these taxes, and (04/03/2017 03:20:38 PA

additional penalties, Interest, and costs chat may accrue. Receipt +:

‘ame of Taxpayer FLOYD 0 NAYWEATHER —}__ Requestor:

INTERNAL REVENUE SERVICE

Recorded By: RNS Px

CLARK COUNTY RECORDER:

IMPORTANT RELEASE INFORMATION: For each assessment listad below,

‘niess notice of the lien is refied by the date given in column (e), this notice shall

‘on tho day following such date, operate as a certificate of release as defined

in RC 632640).

Period Last Day for Unpaid Balance

Thing | denetying Number Rating oF Assesment

Ab) (d) fe) )

1040 /12/31/2015] xxx-xx-I [01/16/2017| 02/15/2027 22238255 .00

Place of Filing

COUNTY RECORDER

CLARK COUNTY Total |$ 22238255.00

LAS VEGAS, NV 89155

‘This notice was prepared and signed at SEATTLE, WA. on this,

the 06th ggy ge March 2017

a Tews orriem eraoniass

for I. AGUILAR (702) 868-5350

Pare 1 - Kept By Recording Oftce (CAT. NO 80028%

You might also like

- NCAA Position On Sports WageringDocument2 pagesNCAA Position On Sports WageringOskar GarciaNo ratings yet

- Letter From Pete Rose's AttorneyDocument7 pagesLetter From Pete Rose's AttorneyCincinnatiEnquirerNo ratings yet

- International Paralympic Committee Letter Banning Russia From Rio Paralympic GamesDocument2 pagesInternational Paralympic Committee Letter Banning Russia From Rio Paralympic GamesOskar GarciaNo ratings yet

- 2nd US Circuit Ruling On Tom Brady 'Deflategate' SuspensionDocument33 pages2nd US Circuit Ruling On Tom Brady 'Deflategate' SuspensionOskar GarciaNo ratings yet

- 2nd US Circuit Dissent On Brady 'Deflategate' CaseDocument9 pages2nd US Circuit Dissent On Brady 'Deflategate' CaseOskar GarciaNo ratings yet

- Unofficial Mayweather-Pacquiao ScorecardDocument1 pageUnofficial Mayweather-Pacquiao ScorecardOskar GarciaNo ratings yet

- NCAA Referees Evaluation FormDocument2 pagesNCAA Referees Evaluation FormOskar Garcia100% (1)

- Alderney FTP StatementDocument1 pageAlderney FTP StatementOskar GarciaNo ratings yet

- MGM Grand Golden Lion Baccarat Tournament Fact SheetDocument1 pageMGM Grand Golden Lion Baccarat Tournament Fact SheetOskar GarciaNo ratings yet

- Ivey-Tiltware Complaint 060111Document11 pagesIvey-Tiltware Complaint 060111Oskar Garcia100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)