Professional Documents

Culture Documents

RPTA Field Evaluation Sheet

Uploaded by

Luningning CariosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RPTA Field Evaluation Sheet

Uploaded by

Luningning CariosCopyright:

Available Formats

BUREAU OF LOCAL GOVERNMENT FINANCE

LOCAL GOVERNMENT FINANCE AND DEVELOPMENT (LOGOFIND)

PROJECT

RPTA Program

__City/Municipality___

Field Evaluation Sheet

The LGU Applicant:_______________________________________

(City/Municipality)

Economic Base_______________

Province Region Income Class Population Land Area .

FINANCIAL & OTHER ANALYSIS

DEBT SERVICE, BORROWING, PAYING 3-YR INCOME/EXP DATA

Debt Service Ceiling P_________ 2000 2001 2002

Less: Outstanding Loans/Bonds, etc. Income:

Bank Amount Payable this Yr. Local Source

1. __________________ P_________ Real Property Tax

2. __________________ _________

Business Tax

3. __________________ _________

4. Bond Issues _________ Others

5. Others _________ Total Local Source

NBC (Net Borrowing Capacity) P_________ IRA

Borrowing Capacity (12%-5yrs) P________ ARI

Paying Capacity: 19___ 20___ 20___ Expenditure

POLITICAL/ADM CHARACTER P/S

Mayor: Term ; Academ. Qual. _______ MOOE

Vice Mayor: Term ; Acad. Qual _ _ Devt. Fund

Same pol. Side as Mayor? (Y/N) _______ Debt Service

SB Maj. Same pol side as Mayor? (Y/N) ______ Calamity Fund

Adm.: Academ. Qual. _______ No. of Yrs. ______ Disc. Fund

Budget Off: Acad. Qual:_ _ No. of Yrs._____ Bgy. Assistance

Treas.: Acad.Qual: __________ No. of Yrs.______

Total Expenditure

Planning Off. Acad.Qual:______No. of Yrs.____

Assessor:Acad.Qual:_______ No. of Yrs._______ Surplus/Deficit

SB Fin. Comm. Chmn.: Acad.Qual:________ IRA DEPENDENCY

SB Appro. Comm. Chmn.: Acad Qual:_____ P/S %

Devt. Fund

Others _____________________________________________

FINANCIAL ASSISTANCE APPLIED FOR

ACTIVITIES AMOUNT

REAL PROPERTY TAX COMPONENT

Real Property Tax Mapping (______ RPUs) P________________________

Real Property Tax Records conversion ________________________

Tax Collection Enhancement Activities ________________________

Personal Services, Supplies & Materials (_________ RPUs) ________________________

Trainings ________________________

Total Financial Assistance Requested _________________________

EVALUATION

ELIGIBILITY CRITERIA EVALUATION % COMPLIANCE

1. Must have submitted Letter of intent/application. _______________

2. Must have submitted Resolution of the Sangguniang Bayan expressing the

commitment on the following concerns:

- Authorization of the Municipal Mayor to enter into a sub-

project loan agreement with the Bureau of Local Government Finance

(BLGF) and Municipal Development Fund Office (MDFO) for the purpose; _______________

- Authorization for the annual appropriation of the semi-annual

amortization of the loan until full payment; _______________

- allocate P_________________ as equity of the financial

assistance applied for; _______________

- Expression of a strong support for the drive for strong tax

collection programs; _______________

- Authorization for allowing the project creditor Municipal

Development Project Fund Office (MDFO) to withhold the Internal Revenue

Allotment (IRA) of the municipality in the event of default/non-payment of

any amortization due within two (2) months of receipt of billing and in case,

the project is not completed within the period indicated in the agreement

wherein the grant component shall be converted into a loan and which

render the entire loan and grant amount due and demandable; _______________

- Authorization for the provision of office space and equipment

with technical and clerical personnel at least for the duration of the project; _______________

and

3. Must have submitted certification of the local treasurer that the LGU has in its

registry of at least 3,000 RPUs for Package A ____ and 20,000 RPUs for _______________

Package B _____;

4. Must have submitted certification of BLGF Regional Director that the incumbent

City/Municipality Assessor and Treasurer are regular appointment or occupy the _______________

position as Acting/OIC/ICO.

5. Must have submitted certification of the Prov./City PNP Director that peace and _______________

order is prevalent in the area

6. Must have submitted certification of the Provl. Gov./City/Municipal Mayor that

office space, equipment with technical and clerical personnel will provide for the _______________

duration of the project. _______________

7. Must have submitted the Project Implementation Plan

8. Must have submitted certification signed by local treasurer that the

City/Municipality submitted the Budget Operations Statement/SIE, whichever is

applicable for the immediate three (3) previous years and must have updated _______________

submission of the SIE up to the latest quarter

9. Must have submitted certified xerox copy of the machine validated deposit slip _______________

showing the amount of the equity portion deposited.

10. Must have submitted certification of the Province that it will render technical _______________

assistance/supervision for the duration of the project.

11. Must have submitted certification of the local assessor that the LGU will regularly ____________________

updates its SMV.

12. Must have submitted certification of the local assessor that the LGU real ____________________

properties have been tax mapped. (for Package B only)

_______________

FIELD EVALUATION

Real Property Tax Collection Existing System:

Procedures/Flows: ____________________________________________________________________

____________________________________________________________________________________

Gaps in Internal Control Practices: ________________________________________________________

____________________________________________________________________________________

State of Real Property Tax Records: _____________________________________________________

____________________________________________________________________________________

Time elapsed from application to payment _____ hrs.

ASSESSMENT OF VALUE ADDED BENEFITS

Estimated % increase in registered RPUs____%

Estimated % increase in business tax collection _____%

Estimated improvement in processing time from application to payment ____hrs.

Others __________________________________________________________________________________

________________________________________________________________________________________

COST-BENEFIT ANALYSIS

Please see attached computations

CONCLUSIONS

On financial management of the LGU:

On administrative/political character of the LGU:

On the eligibility of the LGU to avail of RPTA Project assistance:

RECOMMENDATIONS

Hereby recommending approval of the loan-grant-equity mix in favor of above LGU applicant in of

P___________ P_ __________, and P____________ respectively or total project cost of P_________ ,

distributed as follows:

REAL PROPERTY TAX

Real Prperty Tax Mapping P______________

Records conversion, _______________

____________

Tax collection enhancement activities __ ____________

Personal services, supplies & materials _______________

Trainings _______________

Total _______________

_________

subject to the following conditions:

1. Repayment period shall be five (5) years through ten (10) equal semi-annual amortization and a grace

period of one (1) year;

2. Interest shall be twelve (12%) percent per annum, fixed, inclusive of all charges and fees;

3. In the event of default/non-payment of any amortization due within two (2) months of receipt of semestral

billing, and in case the project is not completed within the period indicated in the Agreement, which

converts the grant into a loan, and which renders the entire loan and grant amount due and demandable,

the MDFO (creditor) shall have the prerogative/option to enforce the IRA intercept provision;

4. The amount approved for the LGU RPTA financial assistance shall be automatically adjusted to within the

plus/minus ten (10%) percent range at the final release stage, according to the number of RPUs as

reflected in the final validation/evaluation of BLGF;

5. The LGU borrower shall designate and authorize LGU staff, preferably the local treasurer or accountant not

only to coordinate with BLGF-DOF, but also to assume lead role in implementing this project;

6. The LGU borrower shall allot, establish and maintain office space, preferably at the local treasurers

office where project equipment can be kept together with relevant files and documents for easy access

during audit and inspection;

7. The LGU borrower, through the treasurer and accountant, shall furnish the BLGF-DOF consolidated

physical and financial and other operational reports, which shall be designed and prescribed, every quarter

for the six years that the loan is outstanding;

8. The LGU borrower shall maintain a separate accounting record for project inspection, monitoring and audit

purposes;

9. The grant portion shall be automatically converted into a loan and shall become due and demandable

immediately if the project is not completed within the period specified in the Agreement unless extension is

granted upon meritorious justification; and

10. The LGU shall maintain separate deposit accounts for the grant and loan portion, and the equity portion of

the financial assistance.

11. Others_______________________________________________________________________________

____________________________________________________________________________________

You might also like

- Module Exam For Cost Approach With AnswersDocument3 pagesModule Exam For Cost Approach With AnswersLuningning Carios100% (1)

- Criminal Law (PALS) 2016 PDFDocument53 pagesCriminal Law (PALS) 2016 PDFLuningning CariosNo ratings yet

- Valuation of Expropriated PropertiesDocument10 pagesValuation of Expropriated PropertiesLuningning CariosNo ratings yet

- Appraisal Report WritingDocument40 pagesAppraisal Report WritingLuningning Carios100% (4)

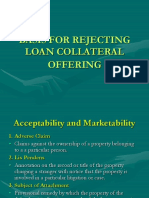

- When To Reject Loan Collateral OffersDocument6 pagesWhen To Reject Loan Collateral OffersLuningning CariosNo ratings yet

- 2012 Appraisers CRES - Q&ADocument13 pages2012 Appraisers CRES - Q&ALuningning CariosNo ratings yet

- Kruhay: Benny F. CastillonDocument3 pagesKruhay: Benny F. CastillonLuningning CariosNo ratings yet

- Philippines: Polar CenterDocument6 pagesPhilippines: Polar CenterLuningning CariosNo ratings yet

- Philippines: Polar CenterDocument5 pagesPhilippines: Polar CenterLuningning CariosNo ratings yet

- Module Exam For Cost Approach With AnswersDocument3 pagesModule Exam For Cost Approach With AnswersLuningning Carios100% (1)

- Philippine Association of Realty Appraisers, IncDocument12 pagesPhilippine Association of Realty Appraisers, IncLuningning CariosNo ratings yet

- Review Questions-Market Data ApproachDocument9 pagesReview Questions-Market Data ApproachLuningning CariosNo ratings yet

- Disney MedleyDocument7 pagesDisney MedleyLuningning CariosNo ratings yet

- Appraisal of PMEDocument37 pagesAppraisal of PMELuningning CariosNo ratings yet

- Valuation of CollateralDocument24 pagesValuation of CollateralLuningning Carios100% (1)

- Appraisal of Lease InterestsDocument55 pagesAppraisal of Lease InterestsLuningning CariosNo ratings yet

- Income Approach in Real Estate AppraisalDocument79 pagesIncome Approach in Real Estate AppraisalLuningning CariosNo ratings yet

- Aba Ginoong Maria (Anna Abeleda) PDFDocument6 pagesAba Ginoong Maria (Anna Abeleda) PDFLuningning CariosNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysisapi-339252193No ratings yet

- Stock TradingDocument7 pagesStock TradingJared RobisonNo ratings yet

- NOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisDocument23 pagesNOVARTIS Bangladesh Pharmaceutical Marketplace AnalysisAisha ZainNo ratings yet

- DRB 2019Document261 pagesDRB 2019Ratna TazulazharNo ratings yet

- Joy Film - Guided Viewing Questions & AnalysisDocument6 pagesJoy Film - Guided Viewing Questions & AnalysisMichael MarquisNo ratings yet

- M&S HRMDocument17 pagesM&S HRMDavis D ParakalNo ratings yet

- Petronas CobeDocument54 pagesPetronas CobeRifqiNo ratings yet

- North Philippines Visitors Bureau: Department of TourismDocument33 pagesNorth Philippines Visitors Bureau: Department of TourismdiscardmailNo ratings yet

- Chapter 7 Correction of Errors (II) TestDocument6 pagesChapter 7 Correction of Errors (II) Test陳韋佳No ratings yet

- Summer Training Red Project Report CocacolaDocument84 pagesSummer Training Red Project Report Cocacolagurunathambabu100% (2)

- IFRS Metodo Del Derivado HipoteticoDocument12 pagesIFRS Metodo Del Derivado HipoteticoEdgar Ramon Guillen VallejoNo ratings yet

- Vishnu AgenciesDocument2 pagesVishnu AgenciesBack-End MarketingNo ratings yet

- Stanford Detailed First Year CurriculumDocument6 pagesStanford Detailed First Year CurriculumsukandeNo ratings yet

- PayU - Sales DeckDocument25 pagesPayU - Sales Deckarjun prajapatNo ratings yet

- 1.5 Types of Decision-MakingDocument12 pages1.5 Types of Decision-MakingSonam Dema100% (1)

- Subhiksha Case StudyDocument9 pagesSubhiksha Case StudyRavi Keshava Reddy100% (1)

- T.poojithaDocument92 pagesT.poojithaSaroj SinghNo ratings yet

- Final COP-Section 1Document86 pagesFinal COP-Section 1Arbaz KhanNo ratings yet

- Dessler 03Document13 pagesDessler 03Yose DjaluwarsaNo ratings yet

- Modelo de Datos NorthwindDocument7 pagesModelo de Datos NorthwindMalena D'IngiannaNo ratings yet

- 1 Day KaizenDocument1 page1 Day KaizenpandaprasadNo ratings yet

- Leave Travel Concession (LTC) Rules: Office MemorandumDocument2 pagesLeave Travel Concession (LTC) Rules: Office Memorandumchintu_scribdNo ratings yet

- Demand in A Perfectly Competitive MarketDocument4 pagesDemand in A Perfectly Competitive MarketCrisielyn BuyanNo ratings yet

- Zambia in FiguresDocument24 pagesZambia in FiguresChola Mukanga100% (1)

- Project On SunsilkDocument11 pagesProject On Sunsilktanya sethiNo ratings yet

- Purpose of AuditDocument5 pagesPurpose of Auditannisa radiNo ratings yet

- Integrating COBIT 5 With COSO PDFDocument59 pagesIntegrating COBIT 5 With COSO PDFHenry Omar Espinal VasquezNo ratings yet

- Literature Review Effects of Demonetization On Retail OutletsDocument18 pagesLiterature Review Effects of Demonetization On Retail OutletsAniket RoyNo ratings yet

- Module #1 E-Procurement PreparationDocument20 pagesModule #1 E-Procurement PreparationAayush100% (1)

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionNo ratings yet