Professional Documents

Culture Documents

GST Impact in A Nut Shell

Uploaded by

Sri NiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Impact in A Nut Shell

Uploaded by

Sri NiCopyright:

Available Formats

Whats Changing in Oracle

Setups

Master Data Setup

Transactions

Accounting Entries

PricewaterhouseCoopers Private Ltd Slide 1

High level IT impact due to GST

Financials Procurement Controls and compliance

Procurement schemas

Accounts Payable and Receivables Setting up new warehouses Tracking of CGST, SGST and IGST

Invoicing (Non-PO) Tax compliant warehouses Utilization of taxes

Management of Master Records Vendor master Statutory reporting

Process domestic & import

Billing (Non-SO) Oracle Financials Reports(Custom)

Procurement of goods & services,

Petty Cash Other Statutory Reporting

Material/Service Master

Invoices and Credit Notes Purchase orders, Invoices

Vendor, Customer

General Voucher Subsequent Credit /Debit, G/L Account Reporting

G/L Account Debit/Credit Notes Print Layouts

Purchase Info Records

Sales

Front End Business Human Resource

Pricing procedures Applications

Customer master

Pricing master Travel & Expenses

Process Domestic & Export, Sales

Returns , Debit & Credit Notes

Print Layouts

PricewaterhouseCoopers Private Ltd

High level IT impact due to GST

Processes (Illustrative) System changes

Procurement Processes Procurement pricing schemes will under go modifications.

Import procurement Tax calculations /tax codes changes

Domestic procurement of goods Purchase prints

(within /outside state) Compliance System to help meet the statutory requirements

through process design, controls and reporting.

Sales Processes Sales pricing schemes will under go modification

Domestic Sale of Goods Tax calculations will undergo changes

Sale of Services Invoice prints

Compliance System to help meet the statutory requirements

through process design, controls and reporting

Stock Transfers Stock transfers to be configured since it will attract taxes and it has to

Within State comply to the statutory requirements

Outside state Compliance System to help meet the statutory requirements

through process design, controls and reporting.

System Configuration/Master data will have to undergo modifications as a result of

process, tax, print changes and compliance requirements

Other key area of focus would be cut over planning and migration

PricewaterhouseCoopers Private Ltd

GST Impact on IT systems

GST Impact on Oracle can broadly be classified into following heads

Master Data RICEF Roles &

Configuration

Maintenance Components Authorization

PricewaterhouseCoopers Private Ltd

Setups

Tax Defaulting Basis

Tax Defaulting Basis

Item Category Basis Tax Rules Basis

Application

Item Customer Reporting Code

First Party Registration Number

First Party Reporting Code

Item Classification

Tax Category

Item Reporting Code

Ship From Location

Ship To Location

Supplier Reporting Code

Third Party Registration Number

New Responsibility Oracle Financials for India being introduced for Tax Rules Basis Setups

PricewaterhouseCoopers Private Ltd

Setups

Tax Defaulting Basis ..contd

1. Tax Configuration can either be at Inventory Organization Level or Operating Unit Level

2. When Type Operating Unit is selected then the Location Field is greyed out

3. Defaulting is on Date Range Basis; Defaulting on transactions will be based on the applicable rule for that transaction date based on

Start Date / End Date

4. Defaulting Basis LoV has two values :

a. Rule Basis Tax Basis Defaulting

b. Item Category Item Level Defaulting

Impact

In scenarios where client have multiple Inventory Organization across States under single Operating unit then

the Organization Type as Inventory Organization will help to do the defaulting

PricewaterhouseCoopers Private Ltd

Setups

TDS

1. TDS Setups also being moved into the new Tax Regime Architecture

Impact

Configuration of TDS Taxes do be done afresh and would require testing/UAT of TDS scenarios as well

Existing Custom TDS Reports would require retro fitment as the Master data table for Taxes and Vendor

Information like PAN NO, TDS Vendor Type are changing.

PricewaterhouseCoopers Private Ltd

Setups

Tax Rules

Tax Defaulting from Ship From(Vendor)/Ship To(Customer) Location

1. The Tax Determination Value in this case Maharashtra is the State in the Supplier Site Address;(Ship From)

2. For Customers Ship To State is determined from the Location(Define Locations) address attached to the Ship To

(Shipping Details) Inventory Org;

3. In case currently multiple sites for the same address were sharing the same address for ease of maintenance the

same would need to be updated with correct Vendor Site address;

PricewaterhouseCoopers Private Ltd

Setups

Defining GST Regime

Navigation: Oracle Financials for India Tax Configuration Define Regime

PricewaterhouseCoopers Private Ltd

Setups

Defining GST Tax Types

Navigation: Oracle Financials for India Tax Configuration Define Tax Types

Since GST is a Destination based Tax, the Tax Point Basis will be Delivery

Likewise Tax Type Code for CGST and IGST to be defined;

PricewaterhouseCoopers Private Ltd

Setups

Defining GST Tax Types Accounting Default

Navigation: Oracle Financials for India Tax Configuration Define Tax Types

First Level Default of Accounting for Taxes will default from the Tax Type Accounting Definition

Depending on the COA of the client the code combination would be determined; Whether there will be multiple GL Codes

State wise or common GL codes along with other segment combination (i.e. Location Segment)

PricewaterhouseCoopers Private Ltd

Setups

Defining Tax Rules

Navigation: Oracle Financials for India Tax Configuration Define Tax Rules

The Tax Category will be attached with the Tax Rule code for Defaulting

It is important to understand the relevance of the Field Priority; Priority Number is unique to a code thus a priority

number cannot be shared across Rule Codes;

X Tax Rule Code = Priority 1 having 3 Attributes as Tax Determination Basis

Y Tax Rule Code = Priority 2 having 4 Attributes as Tax Determination Basis

Then Rule Y will take precedence for Defaulting as it has more attributes as tax determination basis

PricewaterhouseCoopers Private Ltd

Master Data

Oracle Financials for India - Snapshot

1. All Customer and Supplier would need to be defined through the Third Party Registrations

PricewaterhouseCoopers Private Ltd

Master Data

Supplier/Customer Master

1. Current Supplier/Customer Additional Information Forms will expire.

2. All Vendor / Customer Indian Localization Information will be captured through Third Party Registration Form under GST

3. Reporting Codes can be configured based on Client Requirement like additional informed being stored currently in Descriptive Flex

Fields(DFF) or the hard coded Registration Number fields in the current localization forms

Impact

All Existing Localization Information of a Vendor/Customer would need to migrated to this structure.

During the Bootcamp the question was raised by us whether the migration will happen through some migration

script or the client will need to build it ? We are awaiting further information on this from Oracle

PricewaterhouseCoopers Private Ltd

Master Data

Defining Item Classification

Navigation: Oracle Financials for India Item Definition Define Item Classification

A New Template for GST would need to be defined; This is more in line with the current IL Item Template Definition

PricewaterhouseCoopers Private Ltd

Transactions

Purchase Orders

Impact

Existing PO Localized Forms will expire

Open PO as on 31-Mar-16 with current IL Taxes like Excise, VAT when GRN being made in FY 16-17 for those the

Tax Defaulting Rule as per GST will take precedence; hence no Program for updating taxes on Open Items

PricewaterhouseCoopers Private Ltd

Transactions

Purchase Orders.. India Tax Details

Impact

The Tax Category will default based on the Determination basis i.e. Tax Rule or Item Classification basis

PricewaterhouseCoopers Private Ltd

Transactions

GRN.. India Tax Details

Change from Existing

On Navigation to the Base GRN Form Navigate to Tools India Tax Details

Confirm Taxes to be checked

Receipts(Localized) form will expire;

Impact

GRN Cannot be saved unless Confirm Taxes is checked. Currently Base GRN creation and Taxes on the same are two

independent activities;

India Localization Accounting entry interfaced to GL_INTERFACE at the time of GRN creation; No time gap in base

accounting and India Localization accounting

PricewaterhouseCoopers Private Ltd

Transactions

Sales Order

Impact

Sales Order Localized Form will Expire

Defaulting will be based on either Tax Rule or Item Basis

PricewaterhouseCoopers Private Ltd

Transactions

Document Sequencing Invoice Numbering

Impact

Invoice Numbering to be refreshed at the beginning of each Financial Year

PricewaterhouseCoopers Private Ltd

Accounting Entries

Tax

Point

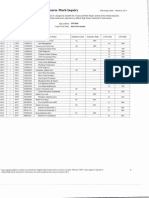

Sl Flow Module Event Basis GL Description Dr Cr Remarks

Tax

Suspense Account Amount Refer Slide - Tax Types

1 O2C OM Ship Confirm Delivery

Tax

Liability Amount Refer Slide - Tax Types

Tax

Receivable Account Amount Debtor Control Account

2 O2C AR Auto Invoice Delivery

Tax

Suspense Account Amount Debit in Sl 1 ; Squares off

Tax

Standalone AR Receivable Account Amount Debtor Control Account

3 O2C AR Invoice

Invoice Tax

Liability Account Amount Refer Slide - Tax Types

Tax Interim Recovery Tax Under GST ; GRN will not be able

GRN Standard

Account Amount to be saved unless Taxes

4 P2P Inventory Routing / Direct Delivery

Tax Confirmed

Delivery

Inventory AP Accrual A/c Amount

Tax

GRN Matching with Inventory AP Accrual A/c Amount

5 P2P AP Delivery

Invoice Tax

Sundry Creditors Account Amount

Tax Interim Recovery Tax

Standalone AP Account Amount Refer Slide - Tax Types

6 P2P AP Invoice

Invoice Tax

Sundry Creditors Account Amount

Tax Currently Manually to be

Delivery/ Tax Recovery Account Amount Processed in Release 1 Patch;

7 P2P AP Tax Recovery

Invoice Tax Interim Recovery Tax Oracle working to Automate this

Account Amount process;

PricewaterhouseCoopers Private Ltd

Section 5

Client Should Start.

PricewaterhouseCoopers Private Ltd Slide 22

Client Tasks at Hand

Mapping of Existing Item Codes both Procurement and Sales with HSN Codes

Revisit the Current System Landscape

ERP User Base Impacted Data Entry Points

Need for realigning of User Roles in ERP?

Update the SOPs , User Manuals based on new functionalities , new business requirements being

introduced in Oracle.

Slide 23

PwC

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction CompilerDocument47 pagesIntroduction CompilerHarshit SinghNo ratings yet

- ICMApprovedCentres - Ghana PDFDocument8 pagesICMApprovedCentres - Ghana PDFPrince Kelly100% (2)

- Ultra ConductorsDocument28 pagesUltra ConductorsAnu Kp50% (8)

- PD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsDocument20 pagesPD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsHazel Jael HernandezNo ratings yet

- Cobol v1Document334 pagesCobol v1Nagaraju BNo ratings yet

- Central University of Karnataka: Entrance Examinations Results 2016Document4 pagesCentral University of Karnataka: Entrance Examinations Results 2016Saurabh ShubhamNo ratings yet

- The Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDocument30 pagesThe Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDusen VanNo ratings yet

- Institutional Group Agencies For EducationDocument22 pagesInstitutional Group Agencies For EducationGlory Aroma100% (1)

- Debate ReportDocument15 pagesDebate Reportapi-435309716No ratings yet

- DirectionDocument1 pageDirectionJessica BacaniNo ratings yet

- 220245-MSBTE-22412-Java (Unit 1)Document40 pages220245-MSBTE-22412-Java (Unit 1)Nomaan ShaikhNo ratings yet

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet

- Department of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year AssessmentDocument3 pagesDepartment of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year Assessmentkathrine cadalsoNo ratings yet

- DIR-819 A1 Manual v1.02WW PDFDocument172 pagesDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaeNo ratings yet

- Mcdaniel Tanilla Civilian Resume Complete v1Document3 pagesMcdaniel Tanilla Civilian Resume Complete v1api-246751844No ratings yet

- Is 2 - 2000 Rules For Rounded Off For Numericals PDFDocument18 pagesIs 2 - 2000 Rules For Rounded Off For Numericals PDFbala subramanyamNo ratings yet

- State Space ModelsDocument19 pagesState Space Modelswat2013rahulNo ratings yet

- 2Document8 pages2Eduardo Antonio Comaru Gouveia75% (4)

- PostScript Quick ReferenceDocument2 pagesPostScript Quick ReferenceSneetsher CrispyNo ratings yet

- Culture 2007 2013 Projects Overview 2018-03-18Document133 pagesCulture 2007 2013 Projects Overview 2018-03-18PontesDeboraNo ratings yet

- Grade 8 Science - Second GradingDocument5 pagesGrade 8 Science - Second GradingMykelCañete0% (1)

- Design of Reinforced Cement Concrete ElementsDocument14 pagesDesign of Reinforced Cement Concrete ElementsSudeesh M SNo ratings yet

- Immunity Question Paper For A Level BiologyDocument2 pagesImmunity Question Paper For A Level BiologyJansi Angel100% (1)

- Instant Download Business in Action 7Th Edition Bovee Solutions Manual PDF ScribdDocument17 pagesInstant Download Business in Action 7Th Edition Bovee Solutions Manual PDF ScribdLance CorreaNo ratings yet

- Vitamins - CyanocobalaminDocument12 pagesVitamins - CyanocobalaminK PrashasthaNo ratings yet

- Diogenes Laertius-Book 10 - Epicurus - Tomado de Lives of The Eminent Philosophers (Oxford, 2018) PDFDocument54 pagesDiogenes Laertius-Book 10 - Epicurus - Tomado de Lives of The Eminent Philosophers (Oxford, 2018) PDFAndres Felipe Pineda JaimesNo ratings yet

- Mission and VisionDocument5 pagesMission and VisionsanjedNo ratings yet

- Hanwha Q Cells Data Sheet Qpeak L-g4.2 360-370 2017-10 Rev02 NaDocument2 pagesHanwha Q Cells Data Sheet Qpeak L-g4.2 360-370 2017-10 Rev02 NazulfikarNo ratings yet

- RCA LCD26V6SY Service Manual 1.0 PDFDocument33 pagesRCA LCD26V6SY Service Manual 1.0 PDFPocho Pochito100% (1)

- Hele Grade4Document56 pagesHele Grade4Chard Gonzales100% (3)