Professional Documents

Culture Documents

Study of Internet Banking Scenario in India

Uploaded by

ShabeerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study of Internet Banking Scenario in India

Uploaded by

ShabeerCopyright:

Available Formats

International Journal of

Emerging Research in Management &Technology Research Article May

ISSN: 2278-9359 (Volume-5, Issue-5) 2016

Study of Internet Banking Scenario in India

Dr. Geeta Sharma

Reader, IIPS, Devi Ahilya University, Indore,

MP, India

Abstract:

F

inancial sector plays an importatnt role in the economic development of a country. A strong and healthy

banking system is important requirement for economic growth. Indian banking industry, today is observing

an IT revolution. A combination of regulatory and competitive reasons has led to increasing importance of

total banking automation in the Indian Banking Industry. Information Technology has basically been used under two

different avenues in Banking. One is Communication and Connectivity and other is Business Process Reengineering.

Information technology enables sophisticated product development, better market infrastructure, implementation of

reliable techniques for control of risks and helps the financial intermediaries to reach geographically distant and

diversified markets. The shift towards internet banking is fuelled by the changing dynamics in India. By 2020 the

average age of India will be 29 years and this young consumer base is internet savvy and wants real time online

information. Indian banks therefore need to aspire high and move toward implementing a world class internet

banking capability. The objective of the present paper is to examine and analyze the progress made by Internet

Banking in India. The study is secondary based and analytical in nature.

Keywords: IDS, TCP/IP, SMTP, FTP

I. INTRODUCTION

Internet plays vital role between banks and customers to receive and deliver information, this form of banking is

described as Internet banking (Reserve Bank of India, 2001).

The process in which internet and computer device are used as a medium to facilitate banking services is termed as

internet banking. Internet banking is a web-based service that enables the banks authorized customers to access their

account information. It permits the customers to log on to the banks website with the help of banks issued identification

and personal identification number (PIN). The banking system verifies the user and provides access to the requested

services, the range of products and service offered by each bank on the internet differs widely in their content. Banks

have traditionally been in the forefront of harnessing technology to improve their products, services and efficiency.

Banks are using electronic and telecommunication networks for delivering a wide range of value added products and

services. The delivery channels include direct dial up connections, private networks, public networks etc and the

devices include Personal Computers. With the popularity of PCs, easy access to Internet and World Wide Web (WWW),

Internet is increasingly used by banks as a channel for receiving instructions and delivering their products and services to

their customers. Most of the banks offer internet banking as a value-added service.

Previously many researchers performed research on internet banking in different parameters in different parts of the

globe and described about the internet banking. Various researchers have discussed internet banking concept in following

way:

Jun and Cai (2001) defined Internet banking as the use of Internet as a delivery channel for banking services which

include opening a deposit account, transferring funds, electronic bill presentment and payment.

Internet banking is an integrated system that provides their customers a flexible, convenient and inexpensive

platform with integrated services including online bank balance checking and savings accounts, money market accounts,

certificates of deposit, credit cards, home equity loans, home mortgage, insurance, investment services, portfolio

management, and other related financial services (Bhattacherjee, 2001).

According to Siu and Mou (2005) the internet (electronic) banking is prominent example of information technology

in the service industry; it is convenient and time saving in comparison to traditional banking. In traditional retail banking,

one has to visit branch to conduct banking activity like money transfer, to issue cheque book, DD etc. but with the use of

internet in banking, user can conduct these activities from any part of the globe, it requires internet connection and

computer only. Apart from these activities user can purchase/sell, pay bills etc. from any convenient place.

Daniel (1999) also studied about e-banking and he described electronic banking as the delivery of banks information

and services by banks to customers via different delivery platforms that can be used with different terminal devices such

as personal computer and mobile phone with browser or desktop software, telephone or digital television. Further,

Zeithaml et. al, (2002) stated about internet banking as a phenomenon where customers can access their bank account via

the internet using a PC or mobile phone and web-browser. It has not only created opportunities for businesses to reach

out to consumers directly but also allows consumers an immediate access to the electronic markets (Gupta and Bansal,

2012). This result in growth in the internet banking users, almost all banks i.e. private, public and foreign banks are

providing this facility to their customer. Banks also advertise or may say promote this service among the customers.

2016, IJERMT All Rights Reserved Page | 43

Sharma International Journal of Emerging Research in Management &Technology

ISSN: 2278-9359 (Volume-5, Issue-5)

According to Patil (2012) financial institution Internet offerings can be broadly classified into three groups with

distinct risk profiles. Informational (basic level of internet banking, the bank has marketing information about the bank

products and services, risk is relatively low), Communicative (Internet banking system allows some interaction between

the bank's systems and the customer. the risk is higher with this configuration than with informational systems),

Transactional (Internet banking allows customers to execute transactions. this is the highest risk architecture). According

to Srinivasan (2012) The advent of internet banking offers banking firms a new frontier of opportunities and challenges.

II. LITERATURE REVIEW

Balwinder Singh and Pooja Malhotra (2014) he paper presents data, drawn from a survey of commercial banks

websites, on the number of commercial banks that offer Internet banking and on the products and services they offer. It

investigates the profile of commercial banks that offer Internet banking, using univariate statistical analysis, relative to

other commercial banks with respect to profitability, cost efficiency, and other characteristics. By the end of first quarter,

2004, differences between Internet and non-Internet banks had begun to emerge in funding, in sources of income and

expenditures and in measures of performance. It was also found that the profitability and offering of Internet banking

does not have any significant correlation.

Jayshree Chavan (2013) paper discusses some challenges in an emerging economy. Paper concluded that one of the

benefits that banks experience when using ebanking is increased customer satisfaction. This due to that customers may

access their accounts whenever, from anywhere, and they get involved more, this creating relationships with banks.

Banks should provide their customers with convenience, meaning offering service through several distribution channels

(ATM, Internet, physical branches) and have more functions available online.

Rajpreet Kaur Jassal et. el (2013) This paper aims to explains about the reason behind the security breaches and the

participation of both customers and the banks to enable the hackers or crackers to access others network. The present

study aims to find various types of flaws in the security of online banking those results in loss of money of account

holders and financial institutions. Security breaches are not only because of banks faults and banks inadequate police but

customers are equally responsible for it, because customers awareness regarding security is equally important.

Roshanlal and R saluja (2012) The progress in e-banking in Indian banking industry is measured through various

parameters such as Computerization of branches, Automated Teller Machines, Transactions through Retail Electronic

Payment Methods etc. Statistical and mathematical tools such as simple growth rate, percentages and averages etc are

used. The paper also highlights the challenges faced by Indian banks in adoption of technology and recommendations are

made to tackle these challenges. The paper concludes that in years to come e- banking will not only be acceptable mode

of banking but preferred mode of banking.

Vikas Chauhan and vipin Choudhary (2015) The present paper attempts to understand the concept of internet

banking as well as study the benefit of internet banking from perspective of consumers as Well as banks. Further, this

paper discusses the challenges and opportunities associated with the internet banking in Indian context. The discussion

Concludes that Concept of Internet banking Is slowly gaining Acceptance in Indian Scenario and Efforts are Being made

by government Agencies to make It more Popular among consumers.

III. INTERNET BANKING BENEFITS

Internet banking provides numbers of benefits to its customers, some of the benefits are: It removes the traditional

geographical barriers for customers. The customer can access their account anytime and from any part of the world, Due

to new innovative and convenient facility it attracts new customers who are using traditional banking system so far, It

facilitate the offering of more services because this is internet based services which is time saving and customer can

access and regulate his/her account himself/herself, This facility have zero fee, so no monthly payments are required to

forfeit for availing this service, Free of charge bill reimbursement and refunds on ATM surcharges, Simple online

submissions for personal accounts, loans and credits, Due to self access system it reduce customer attrition and Increase

customer loyalty, High-tech technical advancements in the form of intrusion detection systems (IDS) to virus control

equipments have made Online Banking system hazard free. However, regardless of the fact it is vital on the part of every

customer to undertake few precautionary measures while transacting online.

IV. TECHNOLOGIES BEHIND INTERNET BANKING

Presently, the banks are using the internet network and use technology like Protocols; World Wide Web (www) in

order to provide internet banking to their customer (fig 2.1). The data transmission protocol suite used for the Internet is

known as the Transmission Control Protocol/Internet Protocol (TCP/IP).

Figure Process of internet banking sending and receiving information between customer and bank

Information Information

Exchange Exchange

Banking Customer Internet Bank

Source: Prepared by researcher

2016, IJERMT All Rights Reserved Page | 44

Sharma International Journal of Emerging Research in Management &Technology

ISSN: 2278-9359 (Volume-5, Issue-5)

The Internet is primarily a network of networks. The networks in a particular geographical area are connected into a

large regional network. The regional networks are connected via a high speed 'back bone'. The data sent from one region

to another is first transmitted to a Network Access Point (NAP) and are then routed over the backbone. Each computer

connected to the Internet is given a unique IP address (such as 10.81.203.148) and a hierarchical domain name(such as

www. dauniv.ac.in).The Internet can be accessed using various application-level protocols such as FTP (File Transfer

Protocol), Telnet (Remote Terminal Control Protocol), Simple Mail Transport Protocol (SMTP), Hypertext Transfer

Protocol (HTTP). These protocols run on top of TCP/IP. The most innovative part of the Internet is the World Wide Web

(WWW). The web uses hyperlinks, which allow users to move from any place on the web to any other place. The web

consists of web pages, which are multimedia pages composed of text, graphics, sound and video. The web pages are

made using Hypertext Markup Language (HTML). The web works on a client-server model in which the client software,

known as the browser, runs on the local machine and the server software, called the web server, runs on a possibly

remote machine. Some of the popular browsers are Microsoft Internet Explorer and Netscape Navigator.

V. STATUS OF INTERNET BANKING IN INDIA

Indian banks have a wonderful history. Banks were started during British mandate; they formed many large and

small private banks. After independence, Indian government revealed interest towards banks which results the

nationalization of banks, leading to the emergence of the public sector banks. Later on in 90s the banking industry

embracing technology in a massive way, led in particular by the new private banks and MNC banks. The Indian banking

industry has undergone unprecedented rivalry among unconventional banking organizations. The introduction of latest

technologies along with the deregulation of the banking sector has attracted new players to make a foray into the industry

rapidly and competently. On online banking has made things much easier and has saved lot of time of bank employees as

well as general public. The traditional way of waiting in a queue and filling up all the forms manually, is no hassle now

for transacting with any bank. Banks in India are offering wide range of their services and their products through internet

banking. Some of the major services and products in India are:

Statements: Provide account statement (account info), Balance enquiry, balance statement and transaction reports

used. Customers can even download and print the statement of accounts.

Online Fund Transfer: Transfer funds between accounts, even if they are in different branches or cities. Customer can

also transfer funds to any person having an account with the same bank anytime, anywhere, using third party funds

transfer option.

Bill Payment Service: Banks Bill Payment is the easiest way to manage bills. Account holder can pay their regular

monthly bills i.e. telephone, electricity, mobile phone, insurance etc. at anytime, anywhere for free. Saves time and effort.

Make bill payments at customers convenience form their home or office. Lets account holders check their bill amount

before it is debited form their account.

Requests and Intimations: Can electronically submit a request for Cheque-book, Stop payment instructions, Opening a

fixed deposit, Opening a recurring deposit, Intimate for the loss of ATM card, Register online for phone and mobile

banking, Cheque status, Online application for debit card, Issue a DD or a Bankers cheque form account at special rates.

Demat Account and Share Trading Demat Account: Demat is commonly used abbreviation of Dematerialisation, which is a

process where by securities like share, debentures are converted from the material (paper documents) into electronic

data and stored in the computer of an electronic Depository. A depository is a security banks, where dematerialized

physical securities are held in custody, and form where they can be traded. This facilitates faster, risk-free and low cost

settlement.

According to a report by Boston Consulting Group (BCG), In India, out of 1.2 billion s, only 200 million people

having bank accounts, which is only 17 % of Indian and according to McKinsey report (2011) (fig. 4.1), with 120

million internet , India has third largest internet in the world after China and the US and India targeted for 330--370

million internet users in 2015 which will make it second largest internet . In same report, it is mention that in made

positive improvement in e-commerce (fig. 4.2).

Further it is reported that 7% of account holders in the country are using the Internet for banking transactions, while

branch banking has fallen by a full 15 percentage points.

Figure: Indias Projected Internet Users

Source: McKinsey Report, 2011

2016, IJERMT All Rights Reserved Page | 45

Sharma International Journal of Emerging Research in Management &Technology

ISSN: 2278-9359 (Volume-5, Issue-5)

Fig: Commerce Platform Index Indicating Scope for Improvement in Internet

Source: McKinsey Report, 2011

Fig: Growth by (%) reach of online banking sites

Source: ComScore., 2012

According to comScore, 423.5 million people accessed online banking sites worldwide during April 2012, reaching

28.7 percent of the internet audience. 45 percent of the internet audience in North America accessed bank sites, an

increase of 1.2 percentage points, making it the top region for these sites. Europe ranked second by penetration (37.8

percent reach) with Latin America (25.1 percent) rounding up the top three. Asia Pacific saw the strongest growth rate of

5.1 percentage points to 22.0 percent of the internet audience accessing bank sites in April 2012.

When it comes to digital banking in Asia, the Mc Kinsey & company survey said, "India leads growth in Asia in

mobile and Internet usage for banking.

According to IDC's Financial Insights, an increase on Internet banking usage across nine countries in Asia Pacific,

namely Australia, China, Hong Kong, India, Korea, Malaysia, Singapore, Taiwan and Thailand. "Growth in Internet

banking usage has not abated, and it shows no signs of doing so," said Douglas Jaffe, senior research manager for

Financial Services for Financial Insights Asia/Pacific.

2016, IJERMT All Rights Reserved Page | 46

Sharma International Journal of Emerging Research in Management &Technology

ISSN: 2278-9359 (Volume-5, Issue-5)

According to a report by Rajeesh Nair in economic times Online Payment In India Accounted For 14% Of Total

Transaction Amount In FY 2015.

The main reason behind this spike in cashless transactions is the growth of eCommerce industry in India, which

allowed consumers to purchase products at discounted rates at the realm of their homes. Also, the new generation is

shifting towards hi-tech gadgets and technology to make funds transfer as its easier, hassle-free and instant transaction

compared to paying by cash or cheque. With online funds transfer or virtual payment system, people can send or receive

payments instantly at the touch of a button rather than visiting banks to withdraw or deposit money.

The majority of cashless payments comes from retail electronic clearing which contributes more than 71% of the

overall cashless transactions in FY 2015 Deputy Managing Director (corporate strategy and new businesses) at State

Bank of India, Sunil Srivastava says that , At SBI, about 69% of daily transactions happen through alternative channels,

including internet, ATM and mobile banking. We see it rising every year with more young people becoming our

customers.

The number of internet users in India is expected to reach 402 million by December 2015, registering a growth of

49% over last year, says a report by industry body IAMAI. This number is expected to further surge to 462 million by

June next year as more people come online, especially through their mobile devices.The total internet user base stood at

over 300 million in December last year, which grew to 375 million by October this year. "Currently, India has the third

largest internet user base in the world but it is estimated that by December, India will overtake the US (as the second-

largest base). China currently leads with more than 600 million internet users," it said.The report said mobile internet

user base in urban India has grown 65% over last year to reach 197 million, while the rural user base surged 99% to 80

million by October this year. This is expected to grow to 219 million (urban) and 87 million (rural), respectively.

It also found that of all the internet non-users surveyed in the 35 cities as part of this study, 11.4 million said they are

willing to access the internet in the next one year with over two-thirds intending to do so through mobile phones.

When we come to conclusion part, it is clear that Indian people shows positive growth in use of internet and internet

banking, BCG report says that about 200million people are having bank account in India and in McKinsey report only

7% account holders are using banking transaction online, it means 14million people in India using internet banking.

When we see world scenario in internet banking we found that Asia Pacific shows highest growth (+5.1) in internet

banking site and McKinsey & company stated that India leads growth in Asia and India has scope to improve in online

payment and internet readiness.

VI. THE FUTURE

All the major Banks in India are trying to promote online transactions in the country including the rural parts of the

country. Being a huge fan of e-Governance, Indian Prime Minister Mr. Narendra Modi has initiated a project estimated

at INR 20,000 crores to build a broadband highway connecting 2.5 lakh panchayats across the country. Once fully set up,

this infrastructure would help the rural India connect with the urban India while boosting the rate of online transactions in

the country.

Despite the rosy predictions and increased corporate activity, the Indian Internet banking system is facing many

hurdles. The problems include operational risks, security risks, system architecture risks, reputational risks and legal risks

(See Exhibit I for Problems in Internet Banking).

Apart from the security issues, there are a host of other problems like:

PC user base in India is extremely low compared to global standards.

The Internet user base is limited.

Lack of infrastructure to advanced technology based banking services.

The absence of a regulatory framework for Internet banking transactions in India.

The mindset of the Indian consumer, who prefers personal interactions and is not very comfortable, doing

transactions through the Internet.

However, banks are working towards addressing these problems. The security issues can be tackled by having the bank's

systems technologically equipped to evade operational and security risks. Reputational risks can be prevented by testing

of the system before implementation, developing contingency plans (to handle system disruptions, system hackers,

security lapses and virus attacks) and creating back-up facilities. Legal and cross-border risks can be avoided through

proper customer identification devices, information screening techniques, periodic reviews on compliance with various

laws, and gaining knowledge of various national laws (applicable) and guide the customers through their cross-border

dealings.

VII. CONCLUSION

Internet banking seems poised to become an important part of the Indian banking sector in the years to come. The

banking today is re-defined and re-engineered with the use of Information Technology and it is sure that the future of

banking will offer more sophisticated services to the customers with the continuous product and process innovations.

Thus, there is a paradigm shift from the seller's market to buyer's market in the industry and finally it affected at the

bankers level to change their approach from "conventional banking to convenience banking" and "mass banking to class

banking". The shift has also increased the degree of accessibility of a common man to bank for his variety of needs and

requirements. Analysts claim that Internet banking holds lots of potential with the emergence of growing Internet

2016, IJERMT All Rights Reserved Page | 47

Sharma International Journal of Emerging Research in Management &Technology

ISSN: 2278-9359 (Volume-5, Issue-5)

awareness among customers, integration of banking services with e-commerce service, the increasing reach of the

Internet and the entry of global players in the banking sector. Reserve Bank of India has come out with Internet banking

related guidelines.

REFERENCE

[1] Balwinder Singh and Pooja Malhotra (2014) Adoption of Internet Banking: An Empirical Investigation of

Indian Banking Sector, The Journal of Internet Banking and Commerce, ISSN: 1204-5357

[6] Jayshree Chavan (2013), Internet Banking- Benefits and Challenges In An Emerging Economy, International

Journal of Research in Business Management (IJRBM), Vol. 1, Issue 1, June 2013, 19-26

[7] Roshan Lal and Rajni Saluja (2012), E-Banking: The Indian Scenario, Asia Pacific Journal of Marketing &

Management Review, ISSN 2319 2836 Vol.1 (4),

[8] Chauhan & Choudhary (2015), Internet Banking Challenges and Opportunities in Indian Context. Apeejay

Journal of Management Sciences and Technology, (ISSN-2347-5005 )

[9] Jun, M., & Cai, S. (2001). The key determinants of internet banking service quality: a content

analysis. International Journal of Bank Marketing, 19(7), 276-291.

[10] Siu, N. Y. M ., & Mou, J. C. W. (2005). Measuring service quality in internet banking: the case of Hong

Kong. Journal of International Consumer Marketing, 17(4), 99-116.

[11] Daniel, E. (1999). Provision of electronic banking in the UK and the Republic of Ireland. International Journal

of Bank Marketing, 17(2), 72-83.

2016, IJERMT All Rights Reserved Page | 48

You might also like

- Onlinejournal - Aue ChitkarauivprocedingsDocument7 pagesOnlinejournal - Aue ChitkarauivprocedingsMita DasNo ratings yet

- Electronic Banking in India-366 PDFDocument8 pagesElectronic Banking in India-366 PDFAmal HameedNo ratings yet

- BRM Cce-2Document8 pagesBRM Cce-2Akshat PandeNo ratings yet

- Impact of Internet On Banking SectorDocument13 pagesImpact of Internet On Banking SectorInamul HaqueNo ratings yet

- Practice of E-Banking in Commercial Bank: An Empirical Study in BangladeshDocument11 pagesPractice of E-Banking in Commercial Bank: An Empirical Study in Bangladeshmamun khanNo ratings yet

- Problems Faced by Consumers While Using Internet Banking Services A SurveyDocument12 pagesProblems Faced by Consumers While Using Internet Banking Services A Surveyarcherselevators0% (1)

- Acceptance of E-Banking Among Adult CustomersDocument17 pagesAcceptance of E-Banking Among Adult Customersoracle259No ratings yet

- RM Term Paper Am1212, Am2512Document20 pagesRM Term Paper Am1212, Am2512Neel PatelNo ratings yet

- Perceptions of Customers On Implementation of Internet Banking in IndiaDocument8 pagesPerceptions of Customers On Implementation of Internet Banking in IndiaRakeshconclaveNo ratings yet

- Customer Perception Towards E-Banking Services: A Study On Public and Private BanksDocument7 pagesCustomer Perception Towards E-Banking Services: A Study On Public and Private BanksIJRASETPublicationsNo ratings yet

- Online BankingDocument39 pagesOnline Bankingsumit sharma100% (1)

- Internet Banking Advantages MBA ProjectDocument85 pagesInternet Banking Advantages MBA ProjectVishal Sanjay SamratNo ratings yet

- Role of E - Banking Services in The Banking Sector: ProfDocument10 pagesRole of E - Banking Services in The Banking Sector: ProfArjun Prasad RijalNo ratings yet

- Electronic Payment Study: Current Scenario and Scope for ImprovementDocument8 pagesElectronic Payment Study: Current Scenario and Scope for ImprovementM Goutham17% (6)

- PRJP - 1653Document9 pagesPRJP - 1653PraKhar PandeNo ratings yet

- Literature Review: (S.Vignesh, 2014)Document2 pagesLiterature Review: (S.Vignesh, 2014)Manish RavatNo ratings yet

- Role of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractDocument12 pagesRole of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractAkshay BoladeNo ratings yet

- Chapter 1 PDFDocument26 pagesChapter 1 PDFPriyanka KanseNo ratings yet

- Risks and Security of Digital BankingDocument12 pagesRisks and Security of Digital BankingAniruddha BorkarNo ratings yet

- Consumer Perception On Influence of Technology in Banking SectorDocument8 pagesConsumer Perception On Influence of Technology in Banking SectorIJRASETPublicationsNo ratings yet

- E Banking in India A Case Study of KanDocument12 pagesE Banking in India A Case Study of KanPrathameshNo ratings yet

- 1018am - 72.EPRA JOURNALS 10728Document7 pages1018am - 72.EPRA JOURNALS 10728shamelesss.0724No ratings yet

- A Study of Customers' Utilization of Internet Banking Channel in MumbaiDocument9 pagesA Study of Customers' Utilization of Internet Banking Channel in Mumbaianon_884114108No ratings yet

- Role of IT in Banking Sector (IndiaDocument17 pagesRole of IT in Banking Sector (IndiaAADITYA POPATNo ratings yet

- Research Repot (E-Banking)Document14 pagesResearch Repot (E-Banking)priyanshu palNo ratings yet

- Bharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)Document19 pagesBharati Vidyapeeth Institute of Management and Research MBA (Masters of Business Administratio)nisha chopraNo ratings yet

- Axisbnk OnlineDocument27 pagesAxisbnk OnlineAjmal KhanNo ratings yet

- Internet BankingDocument22 pagesInternet BankingPratiksha JagdishNo ratings yet

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaNo ratings yet

- A Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictDocument8 pagesA Study On Customer's Perception and Satisfaction Towards Electronic Banking in Khammam DistrictIOSRjournalNo ratings yet

- Research PaperDocument17 pagesResearch Papermahyargh377No ratings yet

- Review of LiteratureDocument2 pagesReview of LiteratureSandeep MauryaNo ratings yet

- A Comparative Study of Customer Perception Toward E-Banking Services Provided by Selected Private & Public Sector Bank in IndiaDocument5 pagesA Comparative Study of Customer Perception Toward E-Banking Services Provided by Selected Private & Public Sector Bank in IndiaPooja AdhikariNo ratings yet

- Growth and Development of Online BankingDocument45 pagesGrowth and Development of Online BankingSwati SrivastavNo ratings yet

- Factors Influencing Use of Internet Banking ServicesDocument7 pagesFactors Influencing Use of Internet Banking ServicesHarshita DwivediNo ratings yet

- Customer Perception Towards Internet BankingDocument106 pagesCustomer Perception Towards Internet BankingAnonymous G9g8z4DGrINo ratings yet

- E BankingDocument72 pagesE Bankingmuhammad_hasnai243850% (2)

- Acceptance of E-Banking Among Adult Customers An Empirical Investigation in IndiaDocument18 pagesAcceptance of E-Banking Among Adult Customers An Empirical Investigation in IndiaVijayasarathi VNo ratings yet

- Role of Information Technology in Indian Banking Sector: Dr.G.Tulasi Rao, T.Lokeswara RaoDocument5 pagesRole of Information Technology in Indian Banking Sector: Dr.G.Tulasi Rao, T.Lokeswara RaoNikhil patilNo ratings yet

- Analysis of Perception of The Customers Towards Digitization of Banking SectorDocument11 pagesAnalysis of Perception of The Customers Towards Digitization of Banking SectorHARSH MALPANINo ratings yet

- Users' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenDocument6 pagesUsers' Preference Towards Traditional Banking Versus E-Banking - An Analysis Dr. S. Anthony Rahul GoldenOmotayo AkinpelumiNo ratings yet

- Electronic Banking and Customer Satisfaction in Rwanda A Study On Bank of Kigali, RwandaDocument10 pagesElectronic Banking and Customer Satisfaction in Rwanda A Study On Bank of Kigali, RwandaEditor IJTSRDNo ratings yet

- E-Banking in India - Problems and Prospects: ISSN (PRINT) : 2393-8374, (ONLINE) : 2394-0697, VOLUME-5, ISSUE-1, 2018Document5 pagesE-Banking in India - Problems and Prospects: ISSN (PRINT) : 2393-8374, (ONLINE) : 2394-0697, VOLUME-5, ISSUE-1, 2018Ankit JainNo ratings yet

- Review on Importance of Information Technology in Banking SectorDocument13 pagesReview on Importance of Information Technology in Banking SectorPratik WANKHEDENo ratings yet

- Understanding Youth Satisfaction with Mobile Banking AppsDocument41 pagesUnderstanding Youth Satisfaction with Mobile Banking AppsaishwaryaNo ratings yet

- Impact of Online Banking Services: A Study: Associate Professor, Department of Commerce, Alagappa University, KaraikudiDocument10 pagesImpact of Online Banking Services: A Study: Associate Professor, Department of Commerce, Alagappa University, KaraikudiALL OVER EMPIRENo ratings yet

- Digital Banking Services Customer PerspectivesDocument7 pagesDigital Banking Services Customer PerspectivesAltaf ShaikhNo ratings yet

- 1..research Paper FebDocument18 pages1..research Paper FebABHISHEK CHATTERJEENo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebPooja AdhikariNo ratings yet

- 1..research Paper-FebDocument18 pages1..research Paper-FebShivangi SinghNo ratings yet

- E-Banking in Developing EconomyDocument11 pagesE-Banking in Developing EconomyKwame PiesareNo ratings yet

- JETIR1812C44Document13 pagesJETIR1812C44Harsh KumbharNo ratings yet

- History of BankingDocument14 pagesHistory of Bankingrajeshpathak9No ratings yet

- Internet Banking and Mobile Banking - Safe and Secure BankingDocument99 pagesInternet Banking and Mobile Banking - Safe and Secure BankingRehanCoolestBoy0% (1)

- 13 Growth of E - Banking Challenges and Opportunities in IndiaDocument5 pages13 Growth of E - Banking Challenges and Opportunities in IndiaPARAMASIVAN CHELLIAHNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- Impact of E-Commerce On Supply Chain ManagementFrom EverandImpact of E-Commerce On Supply Chain ManagementRating: 3.5 out of 5 stars3.5/5 (3)

- Shabeer - MMS Exam Form AcknowledgmentDocument2 pagesShabeer - MMS Exam Form AcknowledgmentShabeerNo ratings yet

- Saksham DetailsDocument3 pagesSaksham DetailsShabeerNo ratings yet

- Notification IOCL Marketing Professional Posts PDFDocument8 pagesNotification IOCL Marketing Professional Posts PDFRounak SinghNo ratings yet

- Fast RackDocument39 pagesFast RackShabeerNo ratings yet

- Individual Assignment 9 (Evaluation) : Group 6Document2 pagesIndividual Assignment 9 (Evaluation) : Group 6ShabeerNo ratings yet

- 3 Customer Expectations and PerceptionsDocument14 pages3 Customer Expectations and PerceptionsShabeerNo ratings yet

- A Project Report On CSR Activities by ACCDocument20 pagesA Project Report On CSR Activities by ACCShabeer100% (1)

- R12 Toplines SummaryDocument10 pagesR12 Toplines SummaryShabeerNo ratings yet

- Cryptocurrency IndexDocument2 pagesCryptocurrency IndexShabeerNo ratings yet

- Statistics Overview in 40 CharactersDocument15 pagesStatistics Overview in 40 CharactersShabeerNo ratings yet

- Cryptocurrency IndexDocument2 pagesCryptocurrency IndexShabeerNo ratings yet

- 25752-GlobalizationInequality Oct06 PDFDocument32 pages25752-GlobalizationInequality Oct06 PDFShabeerNo ratings yet

- TocDocument3 pagesTocShabeerNo ratings yet

- Volume 4 Issue 10 Paper 11Document13 pagesVolume 4 Issue 10 Paper 11Parikshit MagarNo ratings yet

- 2 Classification of Services & Consumer BehaviourDocument21 pages2 Classification of Services & Consumer BehaviourShabeerNo ratings yet

- Services Marketing: Session1 8 July 2017Document15 pagesServices Marketing: Session1 8 July 2017ShabeerNo ratings yet

- 12 14 25p GaileviciuteDocument12 pages12 14 25p GaileviciuteShabeerNo ratings yet

- 12 14 25p GaileviciuteDocument12 pages12 14 25p GaileviciuteShabeerNo ratings yet

- National Development Indicators in BhutanDocument12 pagesNational Development Indicators in BhutanShabeerNo ratings yet

- Ey Global Ipo Trends q1 2017Document32 pagesEy Global Ipo Trends q1 2017ShabeerNo ratings yet

- Cap II - Pi ScheduleDocument13 pagesCap II - Pi ScheduleShabeerNo ratings yet

- Abhyudaya TRIALDocument14 pagesAbhyudaya TRIALShabeerNo ratings yet

- A Study On Derivatives and Risk ManagementDocument77 pagesA Study On Derivatives and Risk ManagementShabeerNo ratings yet

- 12.7 ParagoanDocument1 page12.7 ParagoanShabeerNo ratings yet

- Plastic RecyclingDocument19 pagesPlastic RecyclingShabeerNo ratings yet

- MMC Register 30 Apr 2017Document9,872 pagesMMC Register 30 Apr 2017Shabeer50% (2)

- ArgentinaDocument18 pagesArgentinaShabeerNo ratings yet

- Steel Plant Case StudyDocument8 pagesSteel Plant Case StudyShabeerNo ratings yet

- Steel Plant Case StudyDocument8 pagesSteel Plant Case StudyShabeerNo ratings yet

- CPA Exam Questions on FASB Conceptual FrameworkDocument26 pagesCPA Exam Questions on FASB Conceptual FrameworkTerry GuNo ratings yet

- New Income Tax Law 2018.1 NewDocument87 pagesNew Income Tax Law 2018.1 NewDamascene100% (1)

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet

- Chapter 6 - ProblemsDocument6 pagesChapter 6 - ProblemsDeanna GicaleNo ratings yet

- 2015 Accountancy Question PaperDocument4 pages2015 Accountancy Question PaperJoginder SinghNo ratings yet

- Chapter - 9: General Financial Rules 2017Document40 pagesChapter - 9: General Financial Rules 2017PatrickNo ratings yet

- Daily Current Affairs: 20 January 2024Document17 pagesDaily Current Affairs: 20 January 2024YASH PANDEYNo ratings yet

- KYC checklist for filling formDocument35 pagesKYC checklist for filling formAjay Kumar MattupalliNo ratings yet

- Dawood Habib GroupDocument3 pagesDawood Habib GroupShuja HussainNo ratings yet

- Risk Based Investment in Davanrik Drug CompoundDocument19 pagesRisk Based Investment in Davanrik Drug Compoundjk kumarNo ratings yet

- 25dairy Cow ModuleDocument47 pages25dairy Cow ModulericoliwanagNo ratings yet

- Ruchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesDocument3 pagesRuchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesHarshit GuptaNo ratings yet

- Credit Card Statement SummaryDocument6 pagesCredit Card Statement SummaryLim Su PingNo ratings yet

- Assignment PDFDocument31 pagesAssignment PDFjjNo ratings yet

- AgreementDocument16 pagesAgreementarun_cool816No ratings yet

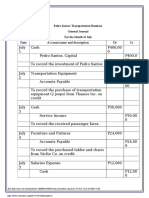

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- Settings 1000 Pip Climber System EADocument11 pagesSettings 1000 Pip Climber System EAMUDRICK ACCOUNTSNo ratings yet

- SPT PPH BDN 2009 English OrtaxDocument29 pagesSPT PPH BDN 2009 English OrtaxCoba SajaNo ratings yet

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- Registration flow and documentsDocument22 pagesRegistration flow and documentsmdzainiNo ratings yet

- Ross 12e PPT Ch02Document25 pagesRoss 12e PPT Ch02Giang HoàngNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- Final Exam/2: Multiple ChoiceDocument4 pagesFinal Exam/2: Multiple ChoiceJing SongNo ratings yet

- Deed of Conditional Sale House and Lot DraftDocument3 pagesDeed of Conditional Sale House and Lot DraftJanmari G. FajardoNo ratings yet

- Elements of Capital BudgetingDocument3 pagesElements of Capital BudgetingDivina SalazarNo ratings yet

- Sustainable Banking: A Systematic Review of Concepts and MeasurementsDocument39 pagesSustainable Banking: A Systematic Review of Concepts and Measurementsثقتي بك ياربNo ratings yet

- Calm Finance Unit PlanDocument7 pagesCalm Finance Unit Planapi-331006019No ratings yet

- Admission of A PartnerDocument21 pagesAdmission of A PartnerHarmohandeep singhNo ratings yet

- TCCB Revision - ProblemsDocument4 pagesTCCB Revision - ProblemsDiễm Quỳnh 1292 Vũ ĐặngNo ratings yet