Professional Documents

Culture Documents

Venture Syl

Uploaded by

Charly Mint Atamosa Israel0 ratings0% found this document useful (0 votes)

20 views5 pagessyllabus venture

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsyllabus venture

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views5 pagesVenture Syl

Uploaded by

Charly Mint Atamosa Israelsyllabus venture

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

ARRIESGADO COLLEGE FOUNDATION, INC.

Bonifacio St., Tagum City

BACHELOR OF SCIENCE IN BUSINESS AMINISTRATION

COURSE SYLLABUS

VISION AND MISSION OF THE PROGRAM:

PROGRAM OUTCOMES:

Course Outcomes:

At the end of the semester, the students are expected to:

1. Identify the main factors that influence the fundraising of venture capital funds and partnership

2. Identify the issues relating to how to make venture capital investments

3. Understand the main issues associated with monitoring investment

4. Learn the method to exit a venture capital investment.

5. Appreciate the key factors that contribute to the success of an entrepreneurial venture

Course Number Elective 5 Venture Capital

Course Credit 3 units

Course Description This course is offered to provide students with a good grasp of the venture capital cycle. It examines

venture capital and private equity investments not previously analyzed in the finance discipline. In

particular, it focusses on entrepreneurial investment, otherwise known as venture capital or private equity

financing. The course departs from conventional investment approaches to examining risk and return, and

analyses issues associated with long term financing of growing private businesses.

Contact Hours / Week 3 Hours

Prerequisite Elective 4

References:

Metrick A. And Yasuda A. , Venture Capital & The Finance Of Innovation, Second Edition, 2011

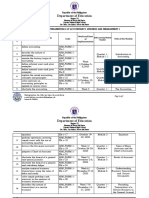

DETAILED COURSE OUTLINE

WEEK HRS. TOPICS LEARNING STRATEGIES/ACTIVITIES ASSESSMENT OF

OUTCOMES LEARNING

OUTCOMES

PRELIM 1. Discuss five main Interactive lecture / Actual

1. The venture Capital characteristics of Discussion Assessment

Industry venture capital

Week 1-4 3hrs/ What is Venture Capital? Oral Report Demonstration

wee What do Venture 2. Explain the flow of

k Capitalist Do? funds in the venture Independent Learning Assignments

The History of Venture capital cycle

Capital Experiential Learning Short Formative

3. Explain and

Patterns of VC Test

compare other

investment Illustration

alternative

- Investment by stage Classical Test

investment

- Investment by Industry

Graded Recitation

- Investment by location

4. Enumerate and Guided Activity

discuss the group Group works

2. Venture Capital Players

activities of venture

Firms and Funds capital

The Limited Partners

VC Partnership 5. introduce key

players in venture

3. Famous Venture Capitalist capital industry

In terms of Industry

In terms of Shares 6. Present top-tier

In terms of Location Venture Capitalists

MIDTER 4. Venture Capital Returns 1. analyze the return Interactive lecture / Actual

M Industry returns of the entire venture Discussion Assessment

- Definitions capital industry

3hrs/ - A Gross-Return Index Oral Report Demonstration

Week 5-8 wee - A net-return index 2. Discuss what

k Fund Returns value-added Independent Learning Assignments

- Definitions activities do venture

- Evidence capital perform

Experiential Learning Short Formative

Test

5. The Best Venture Capital 3. Learn the global

distribution of venture Illustration

The Economics of capital investing Classical Test

Venture Capital Graded Recitation

4. Discuss the cost of Guided Activity

The Best VCs: A capital for Group works

Subjective List international venture

capital

VC Value Added and the

Monitoring of portfolio

Firms

6. Venture Capital Around the

World

The Global distribution of

VC investing

The cost of Capital for

international VC

SEMI- 7. Term Sheets 1. Discuss the Interactive lecture / Actual

FINAL The Basics definition of the Discussion Assessment

charter and the

-Investors

investor rights Oral Report Demonstration

Week 3hrs/ -Price per Share agreement

9-12 wee -Pre-money and Post-

Independent Learning Assignments

k money Valuation 2. Analyze the main

-Capitalization types of preferred

stock and learn how Experiential Learning Short Formative

The Charter Test

to graphically

-Dividends represent them Illustration

-Liquidation Preference Classical Test

-Voting Rights and other 3. Provide Graded Recitation

mathematical formula Guided Activity

protective Provisons

and examples to

-Mandatory Conversion Group works

illustrate the impact

-Redemption Rights of antidilution

Investor Rights protections

Agreement

-Registration Rights 4. Introduce concepts

and mechanics for

-Matters Requiring

the venture capital

Investor-Director method

Approval

Other Items 5. Discuss the four

-Rights and Restrictions common elements of

-Founders Stock venture capital

method

8. Preferred Stocks

Types of Preferred 6. Explain different

Stocks ways to implement

Antidilution Provisions the venture capital

9. The Venture Capital method

Method

The VC Method:

Introduction

-Exit Valuation

-Target Returns

-Expected Retention

-The Investment

Recommendation

The Standard VC

Method

The Modified VC Method

FINAL 10. DCF Analysis of Growth 1. Provide Interactive lecture / Actual

Companies Framework for DCF Discussion Assessment

DCF Analysis: Concepts Analysis

DCF Analysis: Oral Report Demonstration

2. Discuss the

Mechanics concepts and Independent Learning Assignments

Graduation Value Mechanics of DCF

DCF Analysis: The analysis

Experiential Learning Short Formative

Reality-Check Model Test

3. Discuss two main

- Baseline Assumptions Illustration

methods to estimate

- Reality Check DCF exit values Classical Test

11. Comparables Analysis Graded Recitation

Introduction to 4. Analyze exit values Guided Activity

Comparables Analysis using comparables Group works

Choosing Comparable analysis

Companies 5. Learn the steps

Using Comparable necessary to perform

Companies to Estimate a more careful

the Cost of Capital comparable analysis

Grading System:

40% Base , Cumulative

Long Exam 50%

Quizzes 25%

Participation 20%

Requirements 5%

100%

Prepared by:

CHARLY MINT A. ISRAEL

INSTRUCTOR

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Objective 3Document1 pageObjective 3Charly Mint Atamosa IsraelNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Objective 2Document1 pageObjective 2Charly Mint Atamosa IsraelNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ACTIVITY SHEETS ONE WORD PROBLEMSDocument2 pagesACTIVITY SHEETS ONE WORD PROBLEMSCharly Mint Atamosa IsraelNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Management. The Textbook Is Geared Toward A Diverse Approach To Teaching. Class Discussion IsDocument12 pagesManagement. The Textbook Is Geared Toward A Diverse Approach To Teaching. Class Discussion IsTRISTANE ERIC SUMANDENo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- GALELA SALN Revised As of January 2015Document2 pagesGALELA SALN Revised As of January 2015RONEL GALELANo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Content, Knowledge & PedagogyDocument2 pagesContent, Knowledge & PedagogyCharly Mint Atamosa IsraelNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Results-Based Performance Management System (RPMS) PortfolioDocument1 pageResults-Based Performance Management System (RPMS) PortfolioCharly Mint Atamosa IsraelNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- SF2-SHS Daily Attendance ReportDocument2 pagesSF2-SHS Daily Attendance ReportCharly Mint Atamosa IsraelNo ratings yet

- SF2 Belgium Wellness Massage FebDocument2 pagesSF2 Belgium Wellness Massage FebCharly Mint Atamosa IsraelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Weekly Home Learning Plan Fabm1Document2 pagesWeekly Home Learning Plan Fabm1Charly Mint Atamosa Israel100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- WEEKLY-HOME-TASK-CMAI 3rd WeekDocument2 pagesWEEKLY-HOME-TASK-CMAI 3rd WeekCharly Mint Atamosa IsraelNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Department of Education: Reflection in Module 3aDocument1 pageDepartment of Education: Reflection in Module 3aCharly Mint Atamosa IsraelNo ratings yet

- Form 4. LAC Engagement ReportDocument2 pagesForm 4. LAC Engagement ReportTitser Rock Son88% (129)

- Written Work With TOS FABM1Document2 pagesWritten Work With TOS FABM1Charly Mint Atamosa IsraelNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Valediction Sa HillcrestDocument4 pagesValediction Sa HillcrestCharly Mint Atamosa IsraelNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Target Market ProspectsDocument51 pagesTarget Market ProspectsCharly Mint Atamosa IsraelNo ratings yet

- ReferencesDocument4 pagesReferencesCharly Mint Atamosa IsraelNo ratings yet

- Target Market ProspectsDocument51 pagesTarget Market ProspectsCharly Mint Atamosa IsraelNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Table of ContentsDocument6 pagesTable of ContentsCharly Mint Atamosa IsraelNo ratings yet

- Empowerment Technologies: Lesson 2: Online Safety, Security and Rules of NetiquetteDocument8 pagesEmpowerment Technologies: Lesson 2: Online Safety, Security and Rules of NetiquetteCharly Mint Atamosa IsraelNo ratings yet

- Contemporary 3rdDocument4 pagesContemporary 3rdCharly Mint Atamosa IsraelNo ratings yet

- ReferencesDocument4 pagesReferencesCharly Mint Atamosa IsraelNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- EconomicsDocument20 pagesEconomicsCharly Mint Atamosa IsraelNo ratings yet

- Document Economo MicsDocument6 pagesDocument Economo MicsCharly Mint Atamosa IsraelNo ratings yet

- 01 Automatic English To Braille TranslatorDocument8 pages01 Automatic English To Braille TranslatorShreejith NairNo ratings yet

- Craft's Folder StructureDocument2 pagesCraft's Folder StructureWowNo ratings yet

- Lorilie Muring ResumeDocument1 pageLorilie Muring ResumeEzekiel Jake Del MundoNo ratings yet

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- 2CG ELTT2 KS TitanMagazine Anazelle-Shan PromoDocument12 pages2CG ELTT2 KS TitanMagazine Anazelle-Shan PromoJohn SmithNo ratings yet

- 28 Government Service Insurance System (GSIS) vs. Velasco, 834 SCRA 409, G.R. No. 196564 August 7, 2017Document26 pages28 Government Service Insurance System (GSIS) vs. Velasco, 834 SCRA 409, G.R. No. 196564 August 7, 2017ekangNo ratings yet

- Benchmarking Guide OracleDocument53 pagesBenchmarking Guide OracleTsion YehualaNo ratings yet

- Beams On Elastic Foundations TheoryDocument15 pagesBeams On Elastic Foundations TheoryCharl de Reuck100% (1)

- Department of Ece Vjec 1Document29 pagesDepartment of Ece Vjec 1Surangma ParasharNo ratings yet

- Compressive Strength Beam DesignDocument70 pagesCompressive Strength Beam DesignDjuned0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1Document36 pagesFundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1jillhernandezqortfpmndz100% (22)

- KDL 23S2000Document82 pagesKDL 23S2000Carlos SeguraNo ratings yet

- Week 3 SEED in Role ActivityDocument2 pagesWeek 3 SEED in Role ActivityPrince DenhaagNo ratings yet

- BS EN 364-1993 (Testing Methods For Protective Equipment AgaiDocument21 pagesBS EN 364-1993 (Testing Methods For Protective Equipment AgaiSakib AyubNo ratings yet

- Case Study - Soren ChemicalDocument3 pagesCase Study - Soren ChemicalSallySakhvadzeNo ratings yet

- Pyrometallurgical Refining of Copper in An Anode Furnace: January 2005Document13 pagesPyrometallurgical Refining of Copper in An Anode Furnace: January 2005maxi roaNo ratings yet

- CSEC IT Fundamentals of Hardware and SoftwareDocument2 pagesCSEC IT Fundamentals of Hardware and SoftwareR.D. Khan100% (1)

- RTL8316C GR RealtekDocument93 pagesRTL8316C GR RealtekMaugrys CastilloNo ratings yet

- BRD TemplateDocument4 pagesBRD TemplateTrang Nguyen0% (1)

- 1990-1994 Electrical Wiring - DiagramsDocument13 pages1990-1994 Electrical Wiring - Diagramsal exNo ratings yet

- Department Order No 05-92Document3 pagesDepartment Order No 05-92NinaNo ratings yet

- 4Q Labor Case DigestsDocument53 pages4Q Labor Case DigestsKaren Pascal100% (2)

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating EmplDocument37 pagesTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 16 Motivating Emplpolkadots939100% (1)

- Question Paper Code: 31364Document3 pagesQuestion Paper Code: 31364vinovictory8571No ratings yet

- Account STMT XX0226 19122023Document13 pagesAccount STMT XX0226 19122023rdineshyNo ratings yet

- Tutorial 5 HExDocument16 pagesTutorial 5 HExishita.brahmbhattNo ratings yet

- Ieee Research Papers On Software Testing PDFDocument5 pagesIeee Research Papers On Software Testing PDFfvgjcq6a100% (1)

- Leg Wri FInal ExamDocument15 pagesLeg Wri FInal ExamGillian CalpitoNo ratings yet

- Denial and AR Basic Manual v2Document31 pagesDenial and AR Basic Manual v2Calvin PatrickNo ratings yet

- CCT AsqDocument12 pagesCCT Asqlcando100% (1)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (12)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (54)