Professional Documents

Culture Documents

Weekly Equity Market Report of Indian Market

Uploaded by

Rahul SolankiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Equity Market Report of Indian Market

Uploaded by

Rahul SolankiCopyright:

Available Formats

Weekly Market Insights

29 th May 02n June 2017

Market Snippet `4321 Indian Markets

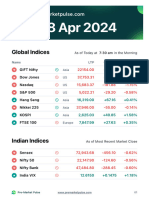

Market hits fresh record high; Nifty closed above INDEX VALUE CHANGE %CHANG

9550 mark. E

Bharat Forge raises stake in KEIPL to 8.4 percent NIFTY 9585.45 +157.55 +1.64%

from 5 percent. SENSEX 31028.2 +563.31 +1.81%

Fortis Healthcare board approves increase in FII limit NIFTYBAN 23362 +592.40 +2.53%

K

up to 74 percent.

INDIA VIX 10.8625 -0.44 -4.05%

Mphasis Q4 net profit rises 17% to Rs 184 crore in

FY17 against Rs 156.5 crore compared on yearly

International Markets

basis.

INDEX VALUE CHANGE %CHANGE

Manappuram Finance Q4 profit up 54 percent which

DOW 21083 +278.15 +1.31%

stood at Rs 201 crore. NASDAQ 6205.26 +121.56 +1.95%

Vedanta to ramp up production to capitalise on strong FTSE 7530.2 +59.49 +0.79%

LME prices. SHANGHA 3110.16 +19.23 +0.62%

Vedanta to ramp up production to capitalise on strong I

LME prices. NIKKEI 19686.8

FII & DII Activity +96.04 +0.48%

Infosys Announces strategic alliance with HP Inc. to FII DII

Date

Accelerate Digital Transformation for the Enterprise. (in Rs. cr.) (in Rs. cr.)

Glenmark Pharma gets ANDA approval by the 22-MAY-17 -321.27 +1262.64

USFDA or Olmesartan Medoxomil Tablets.

Ashok Layland has recommended a dividend of Rs 23-MAY-17 -400.53 +352.54

1.56 per equity share of Rs 1 each for FY 17

24-MAY-17 +81.88 +197.31

Gainers

LARGECAP %CHANG MIDCAP %CHANG 25-MAY-17 +589.11 -236.44

E E

TATAMOTORS +8.51% JINDALSTEL +11.46% 26-MAY-17 -274.14 +1008.56

ITC +8.00% MINDTREE +7.58%

TATAMTRDVR +7.51% BHARATFIN +5.90%

BPCL +6.72% DCBBANK +1.20% OUR PREVIOUS CALLS UPDATE

INDUSINDBK +6.37% JUBILANT +0.69%

Calls of the week

Losers

Date Stocks Entry Exit P/L

LARGECAP %CHANG MID CAP %CHANG 22/0 TVSMOTOR(L) 537.55 548.50 +4074

E E 5

LUPIN -15.60% RCOM -15.71% 22/0 TATASTEEL 499 510 +4409

CIPLA -13.46% DISHTV -11.98% 5

SUNPHARMA -13.09% WOCKPHARMA -11.08% Weekly Pick

AUROPHARMA -10.55% ADANIPOWER -10.80% Date Stock Entry Exit P/L

DRREDDY -9.11% UNIONBANK -7.70% 22/0 +648

HDFCBANK 1574 1625

5 0

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Weekly Market View Nifty

Nifty started the weeks trading on a flat note and witnessed

a historic day as benchmark indices clocked fresh record

highs, Nifty and scaled to new life time high of 9586.50 on

sustained foreign capital inflows amid robust earnings. Nifty

gains and breached its important resistance i.e. of 9540 and

closed the weeks trading at 9575.80 which indicates more

buying momentum in coming week for now 9650 which will

act as an important resistance for Nifty However a close

below the support of 9530 may drag down the index to test

the support level of 9470.

Support & Resistance

Close S1 S2 Crucia R1 R2

l

9575.7 9470 9340 9650 9650 9750

Weekly

5 Nifty Bank View

Nifty Bank started the weak on positive note as well as

gains for the fifth straight week and closed at life time high Nifty Bank

of 23256.95. Nifty bank looks bullish on weekly and daily

chart on close above the level of 23238 which further looks

strong for buy side while on lower side 23000 may trigger

selling in the banking index up to the next support level of

22460.

Support & Resistance

Close S1 S2 Crucia R1 R2

l

23256.95 23000 22460 23500 23500

23800

Global Markets Update

World market traded in green after US federal reserve

meeting minute which show that fed may use the system

where cap limits are implementation and the meeting of

OPEC nation they are agree to extend output cut for

upcoming nice month .European share struggled for new high

with investor are searching fresh opportunity this help for new

high and Asian market are traded with mixed trend after the

Janans Consumer price index met all time high by 0.4% YOY.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Calls of the week (Premium Section)

UPL EQ gains and closed near to the resistance level on daily chart. If it surpasses the mentioned level then

some positive momentum is expected in the stock.

BUY ABOVE 845.80 TARGETS 863/880 SL 824.

GAIL EQ is heading towards its immediate trend line resistance which indicates more buying from above

mentioned level.

BUY ABOVE 404 TARGETS 412/420.30 SL 393.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Weekly Pick (Premium Section)

IBULHSGFIN EQ gains and closed around its immediate resistance which can be seen in above daily charts if

positive momentum is gained by the stock then it may reach to new highs in coming sessions.

BUY ABOVE 1095 TARGETS 1128/1162 SL 1056.

CIPLA EQ has been constantly rising since last three sessions and closed strongly around the immediate resistance

levels. If it holds above this mark then further up move can be seen.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Weekly Pick (Premium Section)

Trifid Research respects and values the Right to Policy of each and every individual. We are esteemed by

the relationship and by becoming our clients; you have a promise from our side that we shall remain loyal

to all our clients and non-clients whose information resides with us. This Privacy Policy of Trifid Research

applies to the current clients as well as former clients. Below are the word by word credentials of our

Privacy Policy:

1. Your information, whether public or private, will not be sold, rented, exchanged, transferred or given

to any company or individual for any reason without your consent.

2. The only use we will be bringing to your information will be for providing the services to you for

which you have subscribed to us.

3. Your information given to us represents your identity with us. If any changes are brought in any of

the fields of which you have provided us the information, you shall bring it to our notice by either

calling us or dropping a mail to us.

4. In addition to the service provided to you, your information (mobile number, E-mail ID etc.) can be

brought in use for sending you newsletters, surveys, contest information, or information about any

new services of the company which will be for your benefit and while subscribing for our services,

you agree that Trifid Research has the right to do so.

5. By subscribing to our services, you consent to our Privacy Policy and Terms of Use.

6. Trifid research does not guarantee or is responsible in any which way, for the trade execution of our

recommendations, this is the sole responsibility of the client.

7. Due to the markets volatile nature, the trader may/ may not get appropriate opportunity to execute

the trades at the mentioned prices and Trifid Research holds no liability for any profit/ loss incurred

whatsoever in this case.

8. It is the responsibility of the client to view the report timely from our Premium member section on

our website: www.trifidresearch.com and the same will also be mailed to this registered email id.

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of reports, as this

depends on our mail service providers network infrastructure.

10. The clients can call us for any query related to buying/selling the securities, based on our

recommendations.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

You might also like

- High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading SystemsFrom EverandHigh-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading SystemsRating: 2 out of 5 stars2/5 (1)

- Weekly Equity Market ReportDocument6 pagesWeekly Equity Market ReportRahul SolankiNo ratings yet

- Weekly Stock Market Trend and UpdatesDocument6 pagesWeekly Stock Market Trend and UpdatesRahul SolankiNo ratings yet

- Weekly Special Reports From CapitalHeight 25 06 2018Document10 pagesWeekly Special Reports From CapitalHeight 25 06 2018Damini CapitalNo ratings yet

- Pre - Market ActionDocument24 pagesPre - Market ActionVivaan AgarwalNo ratings yet

- Sharekhan Pre Market Presentation 6th July 2020 Monday FinalDocument25 pagesSharekhan Pre Market Presentation 6th July 2020 Monday FinalOqtec Engg Acerris TeksolNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- MOSt Market Outlook 5 TH February 2024Document10 pagesMOSt Market Outlook 5 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 TH February 24Document12 pagesMost Market Out Look 27 TH February 24Realm PhangchoNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- Derivative Report 02 May UpdateDocument6 pagesDerivative Report 02 May UpdateDEEPAK MISHRANo ratings yet

- New High Again, Profit Booking Seems Around The CornerDocument2 pagesNew High Again, Profit Booking Seems Around The CornersaboxaNo ratings yet

- Weekly Wrap - 24-28 July - ICICIDirectDocument11 pagesWeekly Wrap - 24-28 July - ICICIDirectAditi WareNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- MOStMarketOutlook3rdMay2023 PDFDocument10 pagesMOStMarketOutlook3rdMay2023 PDFLakhan SharmaNo ratings yet

- Daring DerivativesDocument3 pagesDaring DerivativesSakha SabkaNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- Weekly Equity NewsletterDocument4 pagesWeekly Equity Newsletterapi-210648926No ratings yet

- For Our BIG PROFIT Calls and LATEST Reports, SUBSCRIBE To Our Premium Reports. Click Here .Document8 pagesFor Our BIG PROFIT Calls and LATEST Reports, SUBSCRIBE To Our Premium Reports. Click Here .MLastTryNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Market Radiance 30th October 2023Document8 pagesMarket Radiance 30th October 2023SUNDAR PNo ratings yet

- Most Market Outlook: Morning UpdateDocument5 pagesMost Market Outlook: Morning UpdateVinayak ChennuriNo ratings yet

- India Morning Bell 5th December 2014Document18 pagesIndia Morning Bell 5th December 2014Just ChillNo ratings yet

- Motilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryDocument8 pagesMotilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryMohammed Israr ShaikhNo ratings yet

- Weekly Special Report of CapitalHeight 23 July 2018Document11 pagesWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNo ratings yet

- Daringderivatives-Nov11 11Document3 pagesDaringderivatives-Nov11 11Shahid IbrahimNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 04/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 04/06/2010MansukhNo ratings yet

- 243 Weekly Equity ReportDocument7 pages243 Weekly Equity ReportSuresh CANo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010MansukhNo ratings yet

- td140218 2Document6 pagestd140218 2Joyce SampoernaNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Equity Market Reports For The Week (18th - 22nd April 11)Document6 pagesEquity Market Reports For The Week (18th - 22nd April 11)Dasher_No_1No ratings yet

- INOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial ExpressDocument1 pageINOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial Expressravi kumarNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- Equity Derivatives - Research: IndiaDocument2 pagesEquity Derivatives - Research: IndiahdfcblgoaNo ratings yet

- Avanti: Feeds LimitedDocument27 pagesAvanti: Feeds LimitedSudhir Kumar SinghNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Capstocks (Daily Reports) 14 Mar 2024Document13 pagesCapstocks (Daily Reports) 14 Mar 2024Sashil ReddyNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Market Outlook Review and StrategyDocument34 pagesMarket Outlook Review and StrategyVijay Kumar GabaNo ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Money Maker Research Pvt. LTD.: Daily Equity ReportDocument6 pagesMoney Maker Research Pvt. LTD.: Daily Equity ReportMoney Maker ResearchNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Stocks for the Long Run, 4th Edition: The Definitive Guide to Financial Market Returns & Long Term Investment StrategiesFrom EverandStocks for the Long Run, 4th Edition: The Definitive Guide to Financial Market Returns & Long Term Investment StrategiesNo ratings yet

- Bank of AmericaDocument1 pageBank of AmericaBethany MangahasNo ratings yet

- Introduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions ManualDocument12 pagesIntroduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions Manualethelbertsangffz100% (34)

- Sangeetahealingtemples Com Tarot Card Reading Course in UsaDocument3 pagesSangeetahealingtemples Com Tarot Card Reading Course in UsaSangeetahealing templesNo ratings yet

- Concrete For Water StructureDocument22 pagesConcrete For Water StructureIntan MadiaaNo ratings yet

- TQM BisleriDocument27 pagesTQM BisleriDishank ShahNo ratings yet

- Codex Standard EnglishDocument4 pagesCodex Standard EnglishTriyaniNo ratings yet

- Allplan 2006 Engineering Tutorial PDFDocument374 pagesAllplan 2006 Engineering Tutorial PDFEvelin EsthefaniaNo ratings yet

- Minor Project Report Format MCADocument11 pagesMinor Project Report Format MCAAnurag AroraNo ratings yet

- CH 2 Nature of ConflictDocument45 pagesCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- KrauseDocument3 pagesKrauseVasile CuprianNo ratings yet

- AkDocument7 pagesAkDavid BakcyumNo ratings yet

- Principles of SOADocument36 pagesPrinciples of SOANgoc LeNo ratings yet

- YeetDocument8 pagesYeetBeLoopersNo ratings yet

- Revit 2019 Collaboration ToolsDocument80 pagesRevit 2019 Collaboration ToolsNoureddineNo ratings yet

- Application of ARIMAX ModelDocument5 pagesApplication of ARIMAX ModelAgus Setiansyah Idris ShalehNo ratings yet

- Lecture 1Document11 pagesLecture 1Taniah Mahmuda Tinni100% (1)

- Question Bank For Vlsi LabDocument4 pagesQuestion Bank For Vlsi LabSav ThaNo ratings yet

- Exercise 23 - Sulfur OintmentDocument4 pagesExercise 23 - Sulfur OintmentmaimaiNo ratings yet

- August 2015Document96 pagesAugust 2015Cleaner MagazineNo ratings yet

- Defeating An Old Adversary Cement Kiln BallsDocument5 pagesDefeating An Old Adversary Cement Kiln BallsManish KumarNo ratings yet

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDocument4 pagesLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarNo ratings yet

- Preventive Maintenance - HematologyDocument5 pagesPreventive Maintenance - HematologyBem GarciaNo ratings yet

- Sales Manager Latin AmericaDocument3 pagesSales Manager Latin Americaapi-76934736No ratings yet

- Project Management: Chapter-2Document26 pagesProject Management: Chapter-2Juned BhavayaNo ratings yet

- MCoal Coal July Investor SlidesDocument26 pagesMCoal Coal July Investor SlidesMCoaldataNo ratings yet

- PW Unit 8 PDFDocument4 pagesPW Unit 8 PDFDragana Antic50% (2)

- CNG Fabrication Certificate16217Document1 pageCNG Fabrication Certificate16217pune2019officeNo ratings yet

- XI STD Economics Vol-1 EM Combined 12.10.18 PDFDocument288 pagesXI STD Economics Vol-1 EM Combined 12.10.18 PDFFebin Kurian Francis0% (1)

- SQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFDocument13 pagesSQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFRaul E CardozoNo ratings yet

- MLT Torque Ring Field Make-Up HandbookDocument44 pagesMLT Torque Ring Field Make-Up HandbookKolawole Adisa100% (2)