Professional Documents

Culture Documents

Langfield-Smith7e IRM Ch20

Uploaded by

Sophia DuongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Langfield-Smith7e IRM Ch20

Uploaded by

Sophia DuongCopyright:

Available Formats

CHAPTER 20

PRICING AND PRODUCT MIX DECISIONS

ANSWERS TO REVIEW QUESTIONS

20.1 In the long run, organisations need to price their products above the cost of producing and marketing those

products. While it is important for the price to be competitive with other available products, in the long run

costs cannot be ignored. Understanding product costs helps companies to determine whether they can

afford to be in that market or perhaps need to work at reducing costs to enable them to be both competitive

and profitable. The cost of a product, whether goods or services, should be the basis for setting the lower

limit of the price.

20.2 Some examples include:

Childcare. The government subsidises childcare places, which lowers the price. This is because

childcare is often used by families who find it difficult to afford the service. The media may level

criticisms at childcare organisations when fees are too high.

Petrol. Customers are very sensitive to the price of petrol, and the public and the government may

criticise the petrol companies when prices rise. Petrol companies need to consider this when setting

their prices.

Banks. Banks need to consider how customers and the government will react when they raise interest

rates (prices). High interest rates can have an impact on many aspects of the economy, including

household wealth and the share market.

20.3 The definition of the product and the market are vital to setting a price, as a company needs to strategically

position itself to appeal to the right customer group. If the strategy is to appeal to high-income consumers,

a price noticeably lower than the competitors in that market will suggest that this product is less desirable

for one reason or another (possibly because of the image of the consumer). On the other hand, a product

that has a reputation of being of lower quality will not sell if equivalent products in that market are lower

priced.

Defining the product or market is not as simple as it sounds. A market can be defined too narrowly or too

broadly. For example, a company that produces buttons may define the product and market as buttons

and closely watch the activities of other button manufacturers as they are the relevant competitors.

However, if the button manufacturer believes it is operating in the clothing fasteners market, then

competitors will also include manufacturers of zippers, velcro fasteners and other clothing fasteners.

Selling prices and marketing strategies will differ depending on which definition of market and product is

selected.

Discussions about this issue can consider the need to understand customer value as, defining the product

and the market are necessary when identifying who the customer is and what it is about the product that

makes it attractive to customers. It is important to consider customer value when setting prices to ensure

that the price is not higher than customers perceptions of the value of the product.

20.4 The Australian furniture industry has experienced fierce competition from furniture importers. The

furniture that is imported from Asia into Australia is usually cheaper than furniture manufactured in

Australia due to much lower wages in Asian countries. Some Australian manufacturers find that they have

to reduce prices to match the competition.

20.5 The economic models of pricing decisions are of limited use.

1 It is difficult to determine accurate predictions for the demand and marginal revenue curves and the

impact of factors other than demand are not included.

2 The assumptions of simple economic pricing models do not apply to all forms of markets.

3 It is difficult to measure marginal cost.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

1

20.6 Value-based pricing is used to set product prices based on the customers perceptions of the value of the

product. The economic-value pricing method is used to set product prices based on the estimated costs and

benefits of the product to the customer that extend beyond the purchase price. The former pricing method

requires understanding of consumers perception of product value and the latter pricing method requires a

reference product as benchmark for comparison.

20.7 The reasons often cited for the widespread use of variable costing as the cost base in cost-plus formulas are

as follows:

(a) Variable cost data do not obscure the cost behaviour pattern by unitising fixed costs and making

them appear variable.

(b) Variable cost data do not require the allocation of fixed costs to individual product lines.

(c) Variable cost data are exactly the type of information managers need when facing certain tactical

short-term pricing decisions.

The primary disadvantage of variable cost is that in the long term price must be set to cover all costs and a

normal profit margin.

20.8 Three disadvantages of pricing based on absorption cost are as follows:

1 Absorption-cost data obscure the cost behaviour pattern by unitising fixed costs and making them

appear variable.

2 Absorption-cost data attempt to (inaccurately) allocate fixed costs to individual product lines.

3 Absorption-cost data are not useful for managers to make decisions, such as whether to accept a

special order.

20.9 The markup percentage is different depending on which product costing definition (absorption or total

variable costs) is adopted. The markup percentage is calculated as sum of the target profit and the total

annual costs not included in the cost base (denominator of the equation) divided by the total product costs

(cost base) derived from the costing method.

20.10 Under time and material pricing, the price includes a price for labour and a price for material. The labour

price is based on time and is calculated as a cost per hour plus a charge to cover some overheads and a

profit margin. The material price is based on the material costs incurred on the job plus a charge to cover

material-related overheads. By separating the time-based elements of the cost from the material costs it is

possible to use the method in industries where the material charges vary across jobs. This method assumes

that resources other than materials are consumed relatively steadily over time and can be costed to the

output on the basis of time. The need for profit to be earned steadily over time leads to adopting the

approach of marking up the hourly rate to generate the required profit. It is used in industries such as

construction, printing, repairs, legal and accounting offices.

20.11 Traditional, volume-based product-costing systems often overcost high volume and relatively simple

products while undercosting low volume and complex products. This practice can result in overpricing

high-volume and relatively simple products and underpricing low volume and complex products. Such

strategic pricing errors can have a disastrous impact on a firms competitive position and profitability.

20.12 (a) Skimming pricing: setting the initial price for a new product high in order to reap high short-term

profits. Over time, the price is reduced gradually. One example is the pricing of new technology

products such as MP4 players, Blu-ray recorders and portable video recorders.

(b) Penetration pricing: setting the initial price for a new product low in order to quickly attract a large

market share. For example, admission prices to a newly opened museum or art gallery, subscription

prices for newly launched magazines.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

2

20.13 The bid price may vary significantly in competitive bidding depending on whether or not the organisation

has spare capacity. Where an organisation has spare manufacturing capacity, only the incremental costs of

producing the extra order need to be covered to make a contribution to profits. For organisations with no

spare capacity, the opportunity costs forgone by taking the extra order need also to be covered by the bid

price. For this reason, an organisation with no spare manufacturing capacity may submit a higher bid than

an organisation with spare capacity.

20.14 The decision to accept or reject a special order and the selection of a price for a special order are similar

decisions. If a price has been offered for a special order, management can base its decision on whether or

not that price covers the incremental cost of producing the order. Another way of viewing the problem is to

set the price for the special order at a level sufficient to cover the incremental cost of producing the order.

20.15 Predatory pricing is a temporary cut in price to broaden demand for a product with the intention of later

restricting the supply and raising the price again. Resale price maintenance occurs when a supplier dictates

the minimum price at which a product or service is to be resold to a buyer or retailer.

20.16 The Australian Competition and Consumer Commission has wide-reaching responsibilities for surveillance

and enforcement of Commonwealth anti-competitive restrictive trade practices law and consumer law. In

regulating prices, there are certain practices that are restricted. These include the use of price-fixing

contracts, price discrimination and resale price maintenance.

For Qantas price fixing and cartels see: www.accc.gov.au/media-release/court-orders-qantas-to-pay-20-

million-for-price-fixing (viewed 1 February 2014).

For being guilty while ignorant of the law see: www.accc.gov.au/media-release/price-fixing-no-childs-play

(viewed 1 February 2014).

Students may need to be advised to access the ACCC web site and then put price fixing in the box in the

top right hand corner.

20.17 Short term product mix decisions involve changing the product mix temporarily, often because of some

constraint on the resources available, or because of unusual customer demands. A decision to be made in

situations where there is a resource shortage is based on using the scarce resource so that profitability is

maximised. This entails identifying the contribution per unit of scarce resource. Fluctuating customer

demands may create excess capacity for a brief period and the decision to utilise this for a one-off special

order may be based on exceeding the incremental cost of production (usually the variable cost only).

Long-term product mix decisions may entail whether new products should be adopted or existing products

discontinued. These decisions must consider costs that would have remained unchanged in the short term

product mix decisions. Fixed costs may change due to changing production requirements and there could

be an impact on market share. These issues must be considered when evaluating any investment required

to facilitate the long term change in mix.

20.18 The term contribution margin per unit of scarce resource is a products unit contribution margin divided by

the number of units of the scarce resource required to produce one unit of the product. For example, if a

products contribution margin per unit is $5 and it requires two hours of direct labour to produce one unit,

the contribution margin per direct labour hour is $2.50. In a short-term product mix decision, products are

produced in order of the highest contribution margin per unit of limited resource.

20.19 Linear programming (LP) is designed to help management to determine the optimum product mix that

would maximise the firms profit, where there are multiple limited resources. LP takes into account the

use that each product makes of each limited resource and considers the profitability of each product to

arrive at the optimum production mix.

20.20 Constraints: the limitations faced by an organisation, including limited production resources.

Decision variables: the variables about which a decision must be made.

Feasible region: the space between the axes and constraints within which lies the solution to a linear

programming problem.

Objective function: an algebraic expression of the firms goal that is used in linear programming.

These terms are used in linear programming. Linear programming is a method for identifying linear

relationships between decision variables to determine the optimal solution given a number of constraints.

Linear programming can be use to calculated the optimal product mix.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

3

SOLUTIONS TO EXERCISES

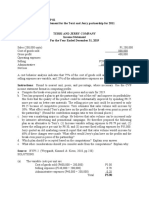

EXERCISE 20.21 (30 minutes) Demand and revenue data: manufacturer

1 Tabulated price, quantity and revenue data:

Quantity sold Unit sales Total revenue Changes in

per month price per month total revenue

20 $500 $10 000

40 475 19 000 } $9 000

} 8 000

60 450 27 000 } 7 000

} 6 000

80 425 34 000

100 400 40 000

2 Total revenue curve:

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

4

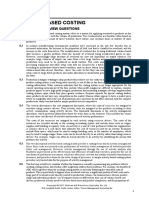

EXERCISE 20.22 (30 minutes) Continuation of Exercise 20.30; cost data: manufacturer

1 Tabulated cost and quantity data:

Quantity

produced and Average cost Total cost per Changes in

sold per month per unit month total cost

20 $450 $ 9 000

Dollars

40 425 17 000 } $ 8 000

Total cost } 7 600

60 410 24 600

} 9 800

80 430 34 400 } 10 100

100 445 44 500

45 000

Total cost increasesTotal revenue rate

at an increasing

2 Total cost curve:

Total cost increases at a declining rate

Curve is increasing throughout its rang

Quantity sold per month

Quantity s

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

5

EXERCISE 20.23 (30 minutes) Profit maximising price: manufacturer

1 Tabulated revenue, cost, and profit data:

Quantity Total

produced and Sales price revenue per Total cost per Profit per

sold per month per unit month month month

20 $500 $10 000 $ 9 000 $1 000

40 475 19 000 17 000 2 000

60 450 27 000 24 600 2 400

80 425 34 000 34 400 (400)

100 400 40 000 44 500 (4 500)

2 Total revenue and cost curves: see below.

3 Of the five possible prices listed, $450 is the optimal price. This price produces a monthly profit of $2400,

which is greater than the profit at the other four prices.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

6

4 Total revenue and cost curves

Total revenue

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

7

EXERCISE 20.24 (30 minutes) Determining markup percentage; target ROI:

manufacturer

Markup percentage applied to cost base in cost - plus pricing formula

profit required to achieve target ROI + total annual costs not included in cost base

= annual volume cost base per unit used in cost - plus pricing formula

1 Variable manufacturing cost

Markup percentage

$100 000 + total variable selling and administrative costs + total annual fixed costs

= 480 $400

$100 000 $24 000 $168 000

= 480 $400

= 152.08%

Thus, the Wave Darters price would be set equal to $1008.32, where $1008.32= $400 + ($400 1.5208).

2 Absorption cost:

$100 000 + total selling and administrative costs

Markup percentage = 480 $650 *

$100 000 $72 000

= $312 000

= 55.13% (rounded)

Thus, the Wave Darters price would be set equal to $1008.35*, where $1008.35= $650 + ($650 0.5513).

* the selling prices for parts 1 and 2 should be identical. The slight difference is due to rounding errors.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

8

EXERCISE 20.25 (30 minutes) Cost-plus pricing formulas; missing data: manufacturer

1 Price =total unit cost + (mark-up percentage total unit cost)

$495 =total unit cost + (12.5% total unit cost)

$495 =total unit cost 1.125

$495

Total unit cost = 1.125 = $440

Allocated fixed selling total unit all manufacturing variable selling and

=

and administrative cost cost costs administrative cost

= $440 ($275 + $55) $66

= $44

Cost-plus pricing formula

2 (a) Variable manufacturing cost $275 $495 = $275 + (80% $275)*

Applied fixed manufacturing cost 55

(b) Absorption manufacturing cost $330 $495 = $330 + (50% $330)

(c) Variable manufacturing cost $275

Variable selling and administrative

cost 66

Total variable cost $341 $495 = $341 + (45.16% $341)**

* ($495 $275) $275 = 80%

($495 $330) $330 = 50%

** ($495 $341) $341 = 45.16% (rounded)

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

9

EXERCISE 20.26 (25 minutes) Cost-plus pricing formulas: manufacturer

Cost-plus pricing formula

1 Variable manufacturing cost $200 $400 = $200 + (100% $200)a

Applied fixed manufacturing cost 70

2 Absorption manufacturing cost $270 $400= $270 + (48.15% $270)b

Variable selling and administrative cost 30

Allocated fixed selling and administrative cost 50

3 Total cost $350 $400= $350 + (14.29% $350)c

Variable manufacturing cost $200

Variable selling and administrative cost 30

4 Total variable cost $230 $400= $230 + (73.91% $230)d

a

($400 $200) $200 = 100%

b

($400 $270) $270 = 48.15% (rounded)

c

($400 $350) $350 = 14.29% (rounded)

d

($400 $230) $230 = 73.91% (rounded)

EXERCISE 20.27 (15 minutes) Time and material pricing: manufacturer

1 Material component of time and material pricing formula:

annual material handling and storage costs

material cost incurred on job + material cost incurred on job annual cost of materials used in Repair Dept 1.20

2 Material component of price, using formula developed in requirement 1:

[$8000 + ($8000 0.04)] 1.20 = $8320 1.20

= $9984

New price to be quoted on yacht refurbishment:

Total price of job = time charges + material charges

= $10 400* + $9984

= $20 384

* from Exhibit 20.5

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

10

EXERCISE 20.28 (20 minutes) Pricing; advertising; special order decisions:

manufacturer

1 Profit on sales of 60 000 units:

Sales revenue (60 000 $18.00) $1 080 000

Less: Variable costs:

Manufacturing and administrative (60 000 $9.00) 540 000

Sales commissions (60 000 $18.00 10%) 108 000 648 000

Contribution margin 432 000

Less: Fixed costs ($180 000 + $15 000) 195 000

Profit $237 000

2 Required price on special order:

Unit contribution margin required on target additional profit

special order =

unit sales volume in special order

$30 000

= $3.00 per unit

10 000

Sales price required = unit variable cost + required unit

contribution margin

= 9.00 + 3.00 = $12.00 per unit

As an alternative approach, let X denote the price required in order to earn additional profit of $30 000 on

the special order:

10 000X 10 000($9.00) = 30 000

10 000X = 120 000

X = $12.00 per unit

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

11

EXERCISE 20.29 (15 minutes) Product mix; limited resources: manufacturer

The most profitable product is the one that yields the highest contribution margin per unit of the scarce resource,

which is direct labour. The direct labour hours required per unit of West1 is 0.0476 ($1 $21) and per unit of

West2 is 0.2857 ($6 $21). The two products contribution margins per labour hour are calculated as follows:

West1 West2

Unit contribution margin $3.00 $12.00

Labour hours required per unit of product 0.0476 0.2857

Contribution margin per direct labour hour

West1: ($3.00 0. 0476) $62.03

West2: ($12.00 0. 2857) $ 42.00

Therefore, West1 is a more profitable product, since product West1 has the highest contribution margin per unit of

the scarce resource (direct labour hours).

EXERCISE 20.30 (20 minutes) (appendix) Linear programming; formulate and solve

graphically: manufacturer

1 (a) Notation: X denotes the quantity of Zanide produced per day

Y denotes the quantity of Kreolite produced per day

(b) Contribution margin:

Zanide Kreolite

Price $ 36 $ 42

Unit variable cost 28 28

Unit contribution margin $ 8 $ 14

(c) Linear program:

Maximise 8X + 14Y

Subject to: 2X + 2Y 24

1X + 3Y 24

X, Y 0

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

12

2 Graphical solution:

25

20

15

Machine I constraint

10

Optimal solution (X = 6, Y = 6)

Objective function

Machine II constraint

5

Feasible region

X

5 10 15 20 25

Corner points in feasible region Objective function value

X=0 Y=0 $ 0

X=0 Y=8 112

X=6 Y=6 132

X = 12 Y=0 96

The maximum objective function value is achieved when X = 6 and Y = 6. Thus, the company should

produce six drums of Zanide per day and six drums of Kreolite per day.

3 The objective function value at the optimal solution is a $132 total contribution margin as shown in

requirement 2.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

13

SOLUTIONS TO PROBLEMS

PROBLEM 20.31 (45 minutes) Economic-value pricing; strategic pricing of new

products

1 Economic-value pricing comparisonsDryWell versus Dry Master

DryWell Dry Master EV to customer

Purchase price $12 000 $12 000

Additional functionality $400 400

Installation 200 300 (100)

Maintenance costs 6 400 5 400 1 000

$13 300

2 The price which Razzle could charge is $13 300, given that the Dry Master represents increased economic

value to the customer. Whether the firm will charge this price depends on the attitude of the customers

when comparing the new machine to the present market leader. It may be more appropriate to price the

Dry Master closer to the DryWell initially in order to prove itself under operating conditions and thereby

gain market acceptance.

The laundry owners are unlikely to buy the new machine unless the annual cost to own and operate it at

least equals that of the existing machine, even if it has one more year of useful life. The annual cost to own

and operate both machines can be shown below, with the figures for the Dry Master built up from the

bottom line of the DryWell.

DryWell Dry Master

Initial cost $12 000 $15 225

Installation 200 300

12 200 15 525

Divide by useful life (8 and 9 years, respectively) 1 525 1 725

Add yearly maintenance 800 600

Annual cost to own and operate $2 325 $2 325

This suggests that the laundry owner could pay a maximum price of $13 300 and still be as well off, given

the added functionality and the longer life of the proposed new machine.

3 The demand for these machines is derived; that is, the user is the real customer, not the owner of the coin-

operated laundry. The laundry owner may not care about softer, fluffier clothes, but may have to respond to

this requirement if enough of their customers raise it as an issue. The laundry owners may be more likely

to value the speed of the wash. Razzle should undertake further research to see how the laundry owner

values each of these two featuresalthough the laundry owner may not care about soft, fluffy clothes, the

faster speed may benefit the business through added capacity. More information about the operating costs

such as relative electricity usage may be useful.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

14

PROBLEM 20.32 (50 minutes) Product cost distortion and product pricing;

departmental overhead rates: manufacturer

1 Budgeted overhead costs:

Department I Department II

Variable overhead

Department I: 37 500 $12 $450 000

Department II: 37 500 $6 $ 225 000

Fixed overhead 225 000 225 000

Total overhead $675 000 $ 450 000

Total budgeted overhead for both

departments ($675 000 + $450 000) $1 125 000

Total expected direct labour hours for

both departments (37 500 + 37 500) 75 000

budgeted overhead

budgeted direct labour hours

Predetermined overhead rate =

$1 125 000

= 75 000

= $15.00 per direct labour hour

2 Velvet Leather

Total cost $600.00 $750.00

Mark-up (15% of cost)

Velvet: $600 0.15 90.00

Leather: $750 0.15 ______ 112.50

Price $690.00 $862.50

3 Department I Department II

Budgeted overhead (from requirement 1) $675 000 $450 000

Budgeted direct labour hours 37 500 37 500

$675 000 $450 000

Calculation of predetermined overhead rate

37 500 37 500

Predetermined overhead rate $18.00 $12.00

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

15

4 Velvet Leather

Direct material $240 $390

Direct labour 210 210

Manufacturing overhead:

Department I:

Velvet: 2 $18 36

Leather: 8 $18 144

Department II:

Velvet: 8 $12 96

Leather: 2 $12 24

Total cost $582 $768

5 Velvet Leather

Total cost (from requirement 4) $582.00 $768.00

Mark-up (15% of cost)

Velvet: $582 0.15 87.30

Leather: $768 0.15 ______ 115.20

Price $669.30 $883.20

6 The management of Stevenson Furniture should use departmental overhead rates. The overhead cost

structures in the two production departments are quite different, and departmental rates more accurately

assign overhead costs to products. When the company used a plantwide overhead rate, the Velvet model

were overcosted and the Leather model were undercosted. This in turn resulted in the Velvet model being

overpriced and the Leather model being underpriced. The cost and price distortion resulted from the

following facts: (1) the Velvet model spends most of its production time in Department II, which is the

least costly of the two departments; and (2) the Leather model spends most of its production time in

Department I, which is more costly than Department II.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

16

PROBLEM 20.33 (30 minutes) Time and material pricing: service firm

1 (a) Time charges:

annual overhead (excluding

material handling and storage) hourly charge to

Hourly labour cost + annual labour hours + cover profit magin

$270 000

= $40.00 + 12 000 Labour hours + $10.00

= $72.50 per labour hour

(b) Material charges:

Material cost material cost annual materia l handling and storage costs

incurred on job incurred on job annual cost of materials used

$62 500

1

= Material cost incurred on the job x $625 000

= Material cost incurred on the job x 1.10

2 Price quotation

Time charges: Labour time 400 hours

Rate $72.50 per hour

Total $29 000

Material changes: Cost of materials for job $150 000

+ Charge for material handling and storage *

($150 000 x 0.10) 15 000

Total $165 000

Total price of job: Time $29 000

Material 165 000

Total $194 000

3 Price of job without markup on material costs (from requirement 2) $ 194 000

Markup on total material costs ($165 000 10%) 16 500

Total price of job $210 500

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

17

PROBLEM 20.34 (25 minutes) Cost-plus pricing; bidding: wholesaler

1 000 000 doses to be packaged

1 Direct labour hours (DLH) required for job = 2000 doses/DLH

= 500 DLH

Traceable out-of-pocket costs:

Direct labour ($24.00 500) $ 12 000

Variable overhead ($12.00 500) 6 000

Administrative cost 2 000

Total traceable out-of-pocket costs $20 000

total traceable out - of - pocket costs

Minimum price per dose = 1 000 000 doses

$20 000

= 1 000 000 doses = $0.02 per dose

2 As in requirement 1 500 direct labour hours are required for the job.

Direct labour ($24.00 500) $ 12 000

Variable overhead ($12.00 500) 6 000

Fixed overhead ($20.00 500) 10 000

Administrative cost 2 000

Total cost $30 000

Maximum markup (15%) 4 500

Total bid price $34 500

total bid price

Bid price per dose = 1 000 000 doses

$34 500

1 000 000 doses

=

= $0.0345 per dose

3 If the price calculated by Halifax Pharmaceuticals is greater than $0.03, some factors that Halifaxs

management should consider before deciding whether or not to submit a bid at the maximum allowable

price of $0.03 include:

whether Halifax Pharmaceuticals has spare capacity

whether there are other more profitable jobs that might use the spare capacity

whether the maximum bid of $0.03 contributes toward covering fixed costs (in this particular case

the contribution margin per dose would be $(0.03 0.02), which gives a total contribution margin

of $10 000)

the possible impact on existing customers who may be charged a higher selling price

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

18

whether or not the order is a one-off order.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

19

PROBLEM 20.35 (40 minutes) Bidding on a special order: manufacturer

1 Bid based on standard pricing policy:

Direct material $512 000

Direct labour (11 000 DLH @ $30) 330 000

Manufacturing overhead (11 000 DLH @ $18) 198 000

Full manufacturing costs $1 040 000

Markup (50% of total cost) 520 000

Standard pricing policy bid $1 560 000

2 Minimum bid acceptable to Ward:

Direct material $512 000

Direct labour (11 000 @ $30) 330 000

Variable manufacturing overhead (11 000 @ $10.80*) 118 800

Opportunity cost of lost sales 70 400

Minimum bid $1 031 200

budgeted overhead

* Variable overhead rate =

budgeted direct labour hours

$1 944 000

=

(12x15 000) DLHrs

= $10.80 per direct labour hour

Selling price per unit of standard product $24 000

Variable costs per unit

Direct material $5 000

Direct labour (250 DLH @ $30) 7 500

Variable overhead (250 DLH @ $10.80) 2 700 15 200

Net contribution per unit $ 8 800

Standard product requirements (12 000 DLH 3) 36 000 DLH

Special order requirements 11 000 DLH

Total hours required 47 000 DLH

Plant capacity per quarter (15 000 DLH 3) 45 000 DLH

Shortage in hours 2 000 DLH

Lost unit sales (2000 DLH 250 DLH) 8

Lost contribution $70 400

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

20

PROBLEM 20.36 (45 minutes) Pricing of special order: manufacturer

1 The order will boost Harmons net profit by $27 900, as the following calculations show.

Sales revenue $82 500

Less sales commissions (10%) 8 250 $74 250

Less manufacturing costs:

Direct material $14 600

Direct labour 28 000

Variable manufacturing overhead* 8 400

Total manufacturing costs 51 000

Net profit before tax $ 23 250

Income tax (40%) 9 300

Net profit after tax $ 13 950

* Based on an analysis of the year just ended, variable overhead is 30 per cent of direct labour ($1125 $3750).

For Holistics Pizzas order: Direct labour cost 0.30 = $28 000 0.30 = $8 400.

2 Yes. Although this amount is below the $82 500 full-cost price, the order is still profitable. Harmon can

afford to pick up some additional business, because the company is operating at 75 per cent of practical

capacity.

Sales revenue $63 500

Less sales commissions (10%) 6 350 $57 150

Less manufacturing costs:

Direct material $14 600

Direct labour 28 000

Variable manufacturing overhead 8 400

Total manufacturing costs 51 000

Net profit before tax $ 6 150

Income tax (40%) 2 460

Net profit after tax $ 3 690

Note that the fixed manufacturing overhead and fixed corporate administration costs are not relevant in this

decision, because these amounts will remain the same regardless of whether the order proceeds.

3 The break-even price is $56 667, computed as follows:

Let P = break-even bid price

(P 0.1P) $51 000 = 0

0.9P = $51 000

P = $56 667 (rounded)

Income taxes can be ignored, because there is no tax at the break-even point.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

21

4 Profits will probably decline. Harmon originally used a full-cost pricing formula to derive an $82 500 bid

price. A drop in the selling price to $63 500 signifies that the firm is now pricing all its orders at less than

full cost, which would decrease profitability.

Reduced prices could lead to an increase in profit if the company were able to generate additional volume.

This situation will not occur here, because the problem states that Harmon has operated, and will continue

to operate, at 75 per cent of practical capacity.

5 An Excel spreadsheet is used to answer requirements 1 and 2 using changed data.

First we need to recalculate Harmons bid price:

DATA INPUT

['000s]

Sales revenue $12 500

Less sales commission $ 1 000 Sales commission 8%

Net sales $11 500

Costs:

Direct material $ 2 900

Direct labour $ 3 800

Manufacturing overhead: variable $ 1 125

Manufacturing overhead: fixed $ 750

Corporate administration: fixed $ 375

Total costs $ 8 950

Net profit before tax $ 2 550

Income tax $ 1 020 Tax rate 40%

Net profit after tax $ 1 530

Capacity used 75%

Holistic Pizza Bid

Estimated direct material $14 600

Estimated direct labour $28 000

Estimated manufacturing overhead $14 000 Cost driver : Labour 50%

Estimated corporate overhead $ 2 800 Cost driver : Labour 10%

Estimated total costs excluding sales

commission $59 400

Add 25% for profit and taxes $14 850

Suggested total price before sales

commission $74 250

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

22

Suggested total price with adjustment

for sales commission $80 707

(a) If the bid price is accepted, this order would boost Harmons net income by $14 016:

Sales revenue $80 707

Less sales commission $ 6 457 $74 250

Less manufacturing costs

Direct material $14 600

Direct labour $28 000

Variable manufacturing overhead* $ 8 289

Total manufacturing costs $50 889

Net profit before tax $23 361

Income tax $ 9 344

Net profit after tax $14 016

*Based on an analysis of the year just ended (variable overhead/direct labour) = 29.6%

b) A sales price of $63 500 would be marginally profitable:

Sales revenue $63 500

Less sales commission $ 5 080 $58 420

Less manufacturing costs

Estimated manufacturing overhead $14 600

Direct labour $28 000

Variable manufacturing overhead $ 8 289

Total manufacturing costs $50 889

Net profit before tax $ 7 531

Income tax (40%) $ 3 012

Net profit after tax $ 4 518

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

23

PROBLEM 20.37 (40 minutes) Make or buy; use of limited resources: manufacturer

1 The incremental cost of producing one unit of component B18 is calculated as follows:

Direct material $ 7.50

Direct labour 9.00

Variable overhead 4.50

Total variable cost per unit $21.00

Purchase price quoted for component B18 $27 00

Incremental cost of production per unit 21.00

Net loss per unit if purchased from the supplier $ 6.00

Net loss per machine hour if component B18 is purchased = $6.00/3 machine hours = $2.00 per machine

hour

B12 B18

2

$ $

Purchase price quoted 22.50 27.00

Direct material 4.50 7.50

Direct labour 8.00 9.00

Variable overhead 4.00 4.50

Total variable cost 16.50 21.00

Net benefit per unit of making component 6.00 6.00

Machine hours required per unit 2.5 3

Net benefit per machine hour of making component 2.40 2.00

Machine hours available 41 000

Best use of machine time: produce 8000 units of component B12

[8000 (2.5 hrs. per unit)] 20 000

Machine hours remaining for production of component B18 21 000

Machine hours required per unit of component B18 3 t

Feasible production of component B18 (21 000/3) 7 000 units

Required quantity of component B18 11 000 units

Feasible production of component B18 7 000 units

Quantity of component B18 to be purchased from the supplier 4 000 units

Conclusion: purchase 4000 units of component B18 and manufacture the remaining bearings. The answer

to requirement 2 is d.

3 Variable cost per unit of component B18 $21.00

Traceable, avoidable, fixed cost per unit of component B18 ($88 000/11 000 units) 8.00

Maximum price Brighton Industries should pay for component B18 $29.00

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

24

PROBLEM 20.38 (15 minutes) Limited capacity; production planning: manufacturer

1 Machine hour requirements:

Department

Product 1 2 3 4

M07 500 500 1000 1000

T28 400 400 800

B19 2000 2000 1000 1000

Total required 2900 2900 2000 2800

Total available 3000 3100 2700 3300

Excess (deficiency) 100 200 700 500

Direct labour hour requirements:

Department

Product 1 2 3 4

M07 1000 1500 1500 500

T28 400 800 800

B19 2000 2000 2000 1000

Total required 3400 4300 3500 2300

Total available 3700 4500 2750 2600

Excess (deficiency) 300 200 (750) 300

The monthly sales demand cannot be met for all three products as a result of the labour shortage in

Department 3.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

25

2 The goal is to maximise contribution margin. Fixed costs are not relevant. The scarce resource is direct

labour hours (DLH) in Department 3.

EFM should first produce the product that maximizes contribution margin per unit of the scarce resource

(DLH). In this case two products, M07 and B19, require direct-labour hours in Department 3.

Product

M07 T28 B19

Sales price $196 $123 $167

Variable costs

Direct material $ 7 $13 $17

Direct labour 66 38 51

Variable overhead 27 20 25

Variable selling 3 2 4

Total variable costs $103 $73 $97

Contribution margin $93 $50 $70

Contribution

Contribution Department 3 margin

Product margin DLH per DLH

M07 $93 3 $31

B19 70 2 35

Department 3

DLH

Units required Balance (DLH)

Maximum DLH available

in Department 3 2750

Product B19 first 1000 2000 750

Product M07 second 250 750 -0-

Resulting production schedule

Product Units Comments

M07 250 Produce as much as the constraint allows (750 3 DLH per

unit). Reduced production is based on its lower contribution

margin per direct-labour hour.

T28 400 Produce up to monthly sales demand; unaffected by

Department 3.

B19 1000 Produce as much as possible to maximize contribution margin

per DHL.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

26

Schedule of contribution margin by product

Contribution Units Contribution

Product margin per unit produced to profit

M07 $93 250 $23 250

T28 50 400 20 000

B19 70 1000 70 000

Total contribution margin $113 250

3 To supply the additional quantities of M07 that are required, EFM should consider:

subcontracting the additional units

operating on an overtime basis

acquiring labour from outside the community.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

27

PROBLEM 20.39 (30 minutes) CVP analysis; advertising decisions; spare capacity:

manufacturer

1 The sales volume of Classic model must increase by at least 160 000 units in order to offset the cost of

increased advertising, as shown in the following calculations:

Breakeven sales = $320 000 ($8 $4 $2) = $320 000 $2 = 160 000 units.

2 The sales volume of the Economy model must increase by at least 1 920 000 units in order to offset the

cost of increased advertising, as shown in the following calculations:

Breakeven sales = $320 000 [($6 $3 $2) $6] = $320 000 .166666667 = 1 920 000 units.

3 Mammoth should advertise the more profitable model or the Economy model to maximise its profitability.

The most profitable product is the one that yields the highest contribution margin per unit of the scarce

resource, machine hours. The Economy model gives higher contribution margin per machine hour, as

shown below:

Classic Economy

Unit contribution margin $2.00 $1.00

Machine hours required per unit of product 0.75 0.2

(Fixed manufacturing cost/$2 per machine hour)

Contribution margin per machine hour

Classic: ($2.00 0.75) $2.66667

Economy: ($1.00 0.2) $5.00

The estimated increase in total contribution margin if all production were dedicated to producing the

Economy model instead of Classic model would be $266 667 (rounded), as shown below.

Increase in contribution margin = $5 100 000 machine hours $2.66667 100 000 machine hours

= $500 000 $266 667

= $233 333 (rounded)

Mammoth should advertise the more profitable model or the Economy model to maximise its profitability. The

most profitable product is the one that yields the highest contribution margin per unit of the scarce resource,

which is the machine hour. The economy model gives a higher contribution margin per machine hour.

4 The calculations in above requirements do not provide sufficient information to make an informed

decision. Additional information could include the following:

customer demand for both products

impact on customer demand if no classic pens are produced

customer preferences in the new private sector school market

the effectiveness of different forms of marketing

the market share of each product.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

28

PROBLEM 20.40 (40 minutes) (appendix) Linear programming; formulate and solve

graphically

1 In order to maximise contribution margin, the objective function and constraint functions would be

formulated as follows:

Notation:

S = number of batches of Star bars

M = number of batches of Moon bars

TCM = total contribution margin

The contribution margin is the selling price less variable cost for each product. Thus, for the Moon bar, the

contribution margin is $250 ($700 less $450), and for the Star bar, it is $400 ($600 less $200). Therefore,

the objective function is as follows:

Maximise TCM = 250M + 400S

Subject to the following constraints:

Mixing Department: 1.5S + 1.5M 525

Coating Department: 2.0S + 1.0M 500

Materials: M 300

Non-negativity: S 0 and M 0

2 The number of batches of each bar that should be produced to maximise contribution can be determined by

graphing the linear program, as shown below. The optimal solution is to produce 200 batches of Moon bars

and 150 batches of Star bars.

3 The total contribution margin, then, is $110 000 [(200 $250) + (150 $400)].

Graph of linear program:

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

29

PROBLEM 20.41 (45 minutes) (appendix) Linear programming): service firm

1 The objective function and constraints that Great Cooking Company should use to maximise profits are as

follows:

Maximise 60P + 45H

Subject to: 2P + H 60 (preparation)

2P + 3H 120 (cooking)

P 45 (freezing)

P0

H 0

2 Graph of linear program:

Haute Cuisine

70

60 Preparation constraint

Objective function

50

40

Optimal solution (P = 15, H = 30) Freezing constraint

30

20

Feasible

region

10

Cooking

constraint

Premier

Cuisine

0 10 20 30 40 50 60

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

30

3&4 Corner points Objective function

in feasible region value Contribution

margin at the

P=0 H=0 ($60)(0) + ($45)(0) = 0 optimal solution

P=0 H = 40 ($60)(0) + ($45)(40) = $1800 = $2250.

P = 15 H = 30 ($60)(15) + ($45)(30) = $2250

P = 30 H=0 ($60)(30) + ($45)(0) = $1800

5 Graph of linear

program:

Haute Cuisine

70

Objective function

60

50

Cooking

constraint

40

Freezing

constraint

30

20

Optimal solution

Feasible (P = 45, H = 10)

region

10

Premier

Cuisine

0 10 20 30 40 50 60

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

31

Corner points Objective function

in feasible region value

P=0 H =0 ($60)(0) + ($45)(0) = 0

P=0 H = 40 ($60)(0) + ($45)(40) = $1800

P = 45 H = 10 ($60)(45) + ($45)(10) = $3150

P = 45 H=0 ($60)(45) + ($45)(0) = $2700

Contribution margin at the optimal solution = $3150.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

32

SOLUTIONS TO CASES

CASE 20.42 (60 minutes) Pricing a professional conference: pricing strategies, relevant

costs and revenues

CGI can maximise its contribution from its annual conference by continuing to price each function separately.

This would yield a contribution of $1 095 216, which is significantly above the contribution that may be earned if

any of the flat fees were charged.

Pricing option Contribution

Separate pricing $1 095 216

Flat fee options:

$650 546 896

600 512 064

$550 $460 648

(a) Contribution analysis for separate pricing (estimated hotel registrations = 60% 2 000 = 1 200)

Estimated

Function Attendance Revenue Expense Contribution

Registration 100% 2 000 = 2 000 $1 000 000 $0 $1 000 000

Reception 100% 2 000 = 2 000 0 300 000 (300 000)

Plenary address* 100% 2 000 = 2 000 0 0* 0

Keynote luncheon 90% 2 000 = 1 800 144 000 108 000 36 000

Six concurrent sessions* 70% 2 000 = 1 400 112 000 0* 112 000

Plenary session* 70% 2 000 = 1 400 84 000 0* 84 000

Six workshops 50% 2 000 = 1 000 100 000 0* 100 000

Banquet 90% 2 000 = 1 800 $270 000 $216 000 $54 000

Hotel credit for free rooms:

1200

(9 216) 9 216

(

50 x $160 x .8 x 3 )

Total $1 710 000 $614 784 $1 095 216

* Meeting rooms and halls are free when 1000 members are expected to register at the hotel.

Reflects 20% discount.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

33

(b) Contribution analysis for flat fee pricing:

$650 fee $600 fee $550 fee

Number of attendees (given) 1 600 1 750 1 900

Estimated hotel registrations (60%) 960 1 050 1 140

Number of free rooms (registration divided by 50,

with no fractional credit) 19 21 22

Revenue (fee attendees) 1 040 000 1 050 000 1 045 000

Expenses

Reception ($150 100% attendees) 240 000 262 500 285 000

Plenary address * 0 0 0

Keynote luncheon ($60 90% attendees) 86 400 94 500 102 600

Six concurrent sessions* 0 0 0

Plenary session* 0 0 0

Six workshops 1 200 0 0

Banquet ($120 90% attendees) 172 800 189 000 205 200

Total expenses 500 400 546 000 592 800

Revenues less expenses 539 600 504 000 452 200

Room credit ($384 free rooms) 7 296 8064 8 448

Contribution $546 896 $512 064 $460 648

* Meeting rooms and halls are free when 1000 members register at the hotel.

Reflects 20% discount: ($160 3 days) .80 = $384

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

34

CASE 20.43 (90 minutes) Pricing a special order; ethics: manufacturer

1 The lowest price Swift would bid for a one-time special order of 25 000 kg (25 batches) would be $51 325,

which is equal to the incremental costs of producing the order, calculated as follows.

Direct materials:

On a one-time-only special order, chemicals used in manufacturing the firms main product have a

relevant cost of their expected future cost, represented by the current market price per kilogram.

Chemicals not used in current production, which have no other use, have a relevant cost that is their

salvage value to the firm.

CW-3: (400 kg per batch) (25 batches) = 10 000 kg.

Substitute CN-5 on a one-for-one basis to its total of 5500 kg.

The relevant cost is the salvage value. $1 000

The remaining 4500 kg would be CW-3 at a relevant cost of

$.90 per kgits expected future cost. 4 050

JX-6:(300 kg per batch) (25 batches) = 7500 kg at $0.60 per kg 4 500

MZ-8(200 kg per batch) (25 batches) = 5000 kg at $1.60 per kg 8 000

BE-7: (100 kg per batch) (25 batches) = 2500 kg.

The relevant cost per kg is $0.65 $0.20 (handling charge) = $0.45

the amount Swift could realise by selling BE-7. 1 125

Total direct materials cost $18 675

Direct labour:

(60 DLH per batch) (25 batches) = 1500 direct labour hours.

Because only 800 hours can be scheduled during regular time this month, overtime would have to

be used for the remaining 700 hours; therefore, overtime is a relevant cost of this order.

(1500 DLH) ($14.00 per DLH) $21 000

(700 DLH) ($7.00 per DLH) 4 900

Total direct labour cost $25 900

Overhead:

This special order will not increase fixed overhead costs. Therefore, fixed overhead is not relevant,

and the relevant overhead charge is the variable overhead rate, as follows:

(1500 DLH) ($4.50 per DLH)= 6 750

Total cost of special order $51 325

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

35

2 The price that Swift should quote Taylor for recurring orders of 25 000 kgs (25 batches) is $82 906, which

is calculated as follows.

Direct materials:

Because of the possibility of future orders, all raw materials must all be costed at the current

market price per kg.

CW-3:(10 000 kgs) ($0.90 per kg) $ 9 000

JX-6:(7500 kgs) ($0.60 per kg) 4 500

MZ-8:(5000 kgs) ($1.60 per kg) 8 000

BE-7:(2500 kgs) ($0.65 per kg) 1 625

Total direct materials cost $23 125

Direct labour:

60% of the production of a batch (900 DLH) can be done on regular time; the remaining 600 DLH

cause overtime to be incurred and are a relevant cost of this new product.

Regular time (1500 DLH) ($14.00 per DLH) $21 000

Overtime premium (600 DLH) ($7.00 per DLH) 4 200

Total direct labour cost $25 200

Overhead:

All new products should contribute to fixed overhead as well as cover all variable costs and

provide the 25 per cent markup. Therefore, the overhead charge would be:

(1500 DLH) ($12.00 per DLH) $ 18 000

Full absorption cost $ 66 325

Markup (25%) 16 581

Full manufacturing cost plus 25 markup $82 906

3 The owner of Taylor Nursery is not acting ethically in this situation. It is inappropriate to allow Swift to

revise its bid on the basis of sharing confidential information from the Dalton Industries bid. All firms

competing for the Taylor Nursery contract should be given the same product specifications, information,

and time frame with which to prepare a bid.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

36

CASE 20.44 (45 minutes) Adding a product line; limited capacity: manufacturer

1 In order to maximise the companys profitability, Sportway Corporation should purchase 9000 tackle

boxes from Maple Products, manufacture 17 500 skateboards, and manufacture 1000 tackle boxes. This

combination of purchased and manufactured goods maximises the contribution per direct labour hour

available. The analysis supporting this conclusion follows:

Calculate unit contribution margins

Purchased Manufactured

Tackle Tackle Skate-

Boxes Boxes boards

Selling price $91.00 $91.00 $50.00

Less:

Material (73.00) (22.00) (17.50)

Direct labour (18.75) (7.50)

Manufacturing overhead* (6.25) (2.50)

Selling and administrative cost (4.00) (11.00) (3.00)

Contribution margin $14.00 $33.00 $19.50

Direct labour hours per unit 1.25 0.5

Contribution per hour $26.40 $39.00

*Calculation of variable overhead per unit:

Tackle boxes:

Direct labour hours $18.75 $15.00 = 1.25 hours

Overhead per direct labour hour $12.50 1.25 = $10.00

Capacity 8000 boxes 1.25 = 10 000 hours

Total overhead 10 000 hours $10 per hour = $100 000

Total variable overhead $100 000 $50,000 = $50 000

Variable overhead per hour $50 000 10,000 = $5.00

Variable overhead per box $5.00 1.25 = $6.25

Skateboards:

Direct labour hours $7.50 $15.00 = .5 hours

Variable overhead $5.00 .5 = $2.50

In calculating the contribution margin, $6.00 of fixed overhead cost per unit for distribution

must be deducted from the selling and administrative cost.

The optimal use of Sportway Corporations scarce resource (direct labour) is to manufacture skateboards,

up to the number of skateboards that the company can sell (17 500). With its remaining labour time,

Sportway can produce 1000 tackle boxes.

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

37

2 The following table shows the improvement in the companys total contribution margin if it manufactures

17 500 skateboards and 1000 tackle boxes, rather than manufacturing 8000 tackle boxes.

The optimal use of Sportways available direct labour hours (DLH):

DLH Balance Unit Total

per Total of contri- contri-

Item Quantity unit DLH DLH bution bution

Total hours ........................ 10 000

Skateboards ......................17 500 0.50 8750 1250 $19.50 $341 250

Make boxes .......................1 000 1.25 1250 33.00 33 000

Buy boxes .........................9 000 14.00 126 000

Total contribution ............. $500 250

Less:

Contribution from manufacturing 8000 boxes

(8000 $33.00) .........................................................................................................................

264 000

Improvement in contribution margin ...............................................................................................

$236 250

Copyright 2015 McGraw-Hill Education (Australia) Pty Ltd

IRM t/a Langfield-Smith, Thorne, Smith, Hilton Management Accounting 7e

38

You might also like

- Langfield-Smith7e IRM Ch05Document71 pagesLangfield-Smith7e IRM Ch05Rujun Wu100% (1)

- CH 19Document30 pagesCH 19Phát TNNo ratings yet

- Langfield-Smith7e IRM Ch17Document27 pagesLangfield-Smith7e IRM Ch17Rujun Wu100% (2)

- Cma IpmiDocument3 pagesCma IpmiBobby's CastleNo ratings yet

- Group 1 - Managerial Accounting and Cost ConceptsDocument47 pagesGroup 1 - Managerial Accounting and Cost ConceptsJeejohn SodustaNo ratings yet

- Langfield-Smith7e IRM Ch03Document37 pagesLangfield-Smith7e IRM Ch03Rujun WuNo ratings yet

- LangfieldSmith7e PPT Ch13Document33 pagesLangfieldSmith7e PPT Ch13Bành Đức HảiNo ratings yet

- Chap6 PDFDocument46 pagesChap6 PDFعبدالله ماجد المطارنهNo ratings yet

- Chp2 Consumer BehaviorDocument32 pagesChp2 Consumer BehaviorWendy OngNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Solution Manual For Book CP 4Document107 pagesSolution Manual For Book CP 4SkfNo ratings yet

- Keat Managerial Economics 6eDocument6 pagesKeat Managerial Economics 6eNuha AbdelkarimNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Chapter 10 Solutions - Foundations of Finance 8th Edition - CheggDocument14 pagesChapter 10 Solutions - Foundations of Finance 8th Edition - ChegghshshdhdNo ratings yet

- Chapter 12 SolutionsDocument29 pagesChapter 12 SolutionsAnik Kumar MallickNo ratings yet

- Management Accounting Exam Paper May 2012Document23 pagesManagement Accounting Exam Paper May 2012MahmozNo ratings yet

- 2 Moodle Assignment 1Document6 pages2 Moodle Assignment 1SOHAIL TARIQNo ratings yet

- HorngrenIMA14eSM ch10Document66 pagesHorngrenIMA14eSM ch10Zarafshan Gul Gul MuhammadNo ratings yet

- Chap 15Document31 pagesChap 15Ahmed Mohamed100% (1)

- Managerial and Cost Accounting Exercises IVDocument28 pagesManagerial and Cost Accounting Exercises IVAleko tamiruNo ratings yet

- Preparation of Master BudgetDocument43 pagesPreparation of Master Budgetsaran_16100% (1)

- Assignment of Managerial AccountingDocument36 pagesAssignment of Managerial AccountingAlamgir Mohammad TuhinNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- Distinguish Between Diminishing Returns and Economies of ScaleDocument2 pagesDistinguish Between Diminishing Returns and Economies of ScalePierce Faraone33% (3)

- CH 1 Managerial Accounting BasicsDocument53 pagesCH 1 Managerial Accounting BasicsIra AdraNo ratings yet

- Chap 028Document12 pagesChap 028Rand Al-akam100% (1)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- CHAPTER 3 Problem SolutionsCost Accounting, A Managerial EmphasisDocument38 pagesCHAPTER 3 Problem SolutionsCost Accounting, A Managerial Emphasiscamd129040% (10)

- Horngren PricingDocument41 pagesHorngren Pricingpresentasi1No ratings yet

- Independent University, Bangladesh: Submitted ToDocument14 pagesIndependent University, Bangladesh: Submitted ToHashib ArmanNo ratings yet

- Assignment 2 PromDocument15 pagesAssignment 2 PromRussel Renz de MesaNo ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- Ch. 10 Managerial Accounting Ever Green SolutionsDocument18 pagesCh. 10 Managerial Accounting Ever Green Solutionsattique100% (1)

- The Purpose of Cost SheetDocument5 pagesThe Purpose of Cost SheetRishabh SinghNo ratings yet

- Target Costing Presentation FinalDocument57 pagesTarget Costing Presentation FinalMr Dampha100% (1)

- EetgbfvDocument38 pagesEetgbfvchialunNo ratings yet

- Activity Based CostingDocument36 pagesActivity Based Costingrizwan ziaNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- Tutorial 5 AnswerDocument5 pagesTutorial 5 AnswerSyuhaidah Binti Aziz ZudinNo ratings yet

- Aashita - Inventory Management Homework PDFDocument6 pagesAashita - Inventory Management Homework PDFAashita JainNo ratings yet

- MBA Managerial Accounting SummaryDocument31 pagesMBA Managerial Accounting Summarycamirpo100% (1)

- Bpme7103 Advanced Managerial Economics AssignmentDocument46 pagesBpme7103 Advanced Managerial Economics AssignmentJ PHUAH100% (2)

- CVP Analysis of Street Side Business in BangladeshDocument9 pagesCVP Analysis of Street Side Business in BangladeshToufiq ZaforNo ratings yet

- Risk and ReturnDocument117 pagesRisk and ReturnLee ChiaNo ratings yet

- CHAPTER 5 - Assignment SolutionDocument16 pagesCHAPTER 5 - Assignment SolutionCoci KhouryNo ratings yet

- PDFDocument114 pagesPDFMusa A. Hassan100% (1)

- Case Study - ABC CostingDocument3 pagesCase Study - ABC CostingDaiannaNo ratings yet

- Activity-Based Costing: Answers To Review QuestionsDocument50 pagesActivity-Based Costing: Answers To Review Questionschanlego123No ratings yet

- Budgeting Case Study Kraft PDFDocument2 pagesBudgeting Case Study Kraft PDFpoojahj100% (1)

- Managerial Accounting - Chapter 05Document11 pagesManagerial Accounting - Chapter 05jingsuke88% (8)

- Hilton Chapter 14 Adobe Connect LiveDocument18 pagesHilton Chapter 14 Adobe Connect LiveGirlie Regilme BalingbingNo ratings yet

- ACCT-312:: Exercises For Home Study (From Chapter 6)Document5 pagesACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasNo ratings yet

- Solution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocument51 pagesSolution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerCoco Zaide100% (2)

- Ch01 - International Financial ManagementDocument47 pagesCh01 - International Financial Managementalsatusatusatu100% (1)

- The Difference Between Financial and Managerial AccountingDocument1 pageThe Difference Between Financial and Managerial AccountingJonna LynneNo ratings yet

- Target Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsDocument48 pagesTarget Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsMJ Yacon0% (1)

- Solutions/solution Manual15Document50 pagesSolutions/solution Manual15Bea BlancoNo ratings yet

- Price The 2nd P of Marketing.Document63 pagesPrice The 2nd P of Marketing.vinaycool12344150No ratings yet

- Chap 015Document40 pagesChap 015palak32100% (2)

- MM ch-4 - PricingDocument30 pagesMM ch-4 - PricingChali KumaraNo ratings yet

- ACC ACF 2400 Assignment 1 - s2 2017 - Business Dashboard Instructions - STDocument8 pagesACC ACF 2400 Assignment 1 - s2 2017 - Business Dashboard Instructions - STSophia DuongNo ratings yet

- 2015 Specialist Maths Exam 1Document14 pages2015 Specialist Maths Exam 1Sophia DuongNo ratings yet

- 2015 Specialist Maths Exam 2Document32 pages2015 Specialist Maths Exam 2Sophia DuongNo ratings yet

- (Specialist) 2010 VCAA Exam 1 ITute SolutionsDocument2 pages(Specialist) 2010 VCAA Exam 1 ITute SolutionsSophia DuongNo ratings yet

- (Specialist) 2010 TSFX Exam 2Document28 pages(Specialist) 2010 TSFX Exam 2Sophia DuongNo ratings yet

- Ser 2 SME1Document22 pagesSer 2 SME1Sophia DuongNo ratings yet

- Ser 2 SME1Document22 pagesSer 2 SME1Sophia DuongNo ratings yet

- Year 2013 VCE Specialist Mathematics Trial Examination 2Document37 pagesYear 2013 VCE Specialist Mathematics Trial Examination 2Sophia DuongNo ratings yet

- 2014 Specialist Maths Exam 2Document34 pages2014 Specialist Maths Exam 2Sophia DuongNo ratings yet

- 2015 MAV SM Trial Exam 2Document23 pages2015 MAV SM Trial Exam 2Sophia Duong0% (1)

- Ben ChanDocument2 pagesBen ChanAlibabaNo ratings yet

- LAC BrigadaDocument6 pagesLAC BrigadaRina Mae LopezNo ratings yet

- User Manual of CHISON IVis 60 EXPERT PDFDocument164 pagesUser Manual of CHISON IVis 60 EXPERT PDFJuan Carlos GoyzuetaNo ratings yet

- Safety Data Sheet: Section 1. IdentificationDocument10 pagesSafety Data Sheet: Section 1. IdentificationAnonymous Wj1DqbENo ratings yet

- Proposal Mini Project SBL LatestDocument19 pagesProposal Mini Project SBL Latestapi-310034018No ratings yet

- FFL/ A: Tutorial On Reed-Solomon Error Correction CodingDocument144 pagesFFL/ A: Tutorial On Reed-Solomon Error Correction Codingbatman chamkadarNo ratings yet

- Sample Questions: 1 Midterm PracticeDocument6 pagesSample Questions: 1 Midterm PracticeValdimiro BelezaNo ratings yet

- Pex 03 02Document5 pagesPex 03 02aexillis0% (1)

- Oil RussiaDocument8 pagesOil RussiaAyush AhujaNo ratings yet

- TV ExplorerDocument2 pagesTV Explorerdan r.No ratings yet

- Income Tax - MidtermDocument9 pagesIncome Tax - MidtermThe Second OneNo ratings yet

- (FORD) Manual de Propietario Ford Ranger 1998Document160 pages(FORD) Manual de Propietario Ford Ranger 1998Marly Salas GonzalezNo ratings yet

- Phyto Pharmacy: Current Concepts and GMP NormsDocument22 pagesPhyto Pharmacy: Current Concepts and GMP NormsSunitha Katta100% (1)

- Research InstrumentsDocument28 pagesResearch InstrumentsAnjeneatte Amarille AlforqueNo ratings yet

- Yusof Ishak Secondary School Humanities Study Tour Ho Chi Minh City, VietnamDocument19 pagesYusof Ishak Secondary School Humanities Study Tour Ho Chi Minh City, Vietnamadamant751No ratings yet

- Pressuremeter TestDocument33 pagesPressuremeter TestHo100% (1)

- RK3066 Mid PDFDocument17 pagesRK3066 Mid PDFSharon MurphyNo ratings yet

- Chapter 3 Rotation and Revolution NotesDocument12 pagesChapter 3 Rotation and Revolution NotesMERLIN ANTHONYNo ratings yet

- Amazing RaceDocument2 pagesAmazing Racegena sanchez BernardinoNo ratings yet

- CHAPTER 5 Ground ImprovementDocument47 pagesCHAPTER 5 Ground ImprovementBeman EasyNo ratings yet

- Effect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant MaterialDocument14 pagesEffect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant Materialnitish kumar100% (1)

- AM2020-AFP1010 Installation Programming OperatingDocument268 pagesAM2020-AFP1010 Installation Programming OperatingBaron RicthenNo ratings yet

- Migloo's Day Info SheetDocument4 pagesMigloo's Day Info SheetCandlewick PressNo ratings yet

- Statistics For EconomicsDocument58 pagesStatistics For EconomicsKintu GeraldNo ratings yet

- Lecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceDocument7 pagesLecture Notes 1 - Finance - Principles of Finance Lecture Notes 1 - Finance - Principles of FinanceKim Cristian MaañoNo ratings yet

- The Sphere Circumscribing A TetrahedronDocument4 pagesThe Sphere Circumscribing A TetrahedronRaghuveer ChandraNo ratings yet

- 5CT PDVSA em - 18!00!05 EnglishDocument27 pages5CT PDVSA em - 18!00!05 EnglishJuan Gutierrez100% (1)

- Netflix Annual Report 2010Document76 pagesNetflix Annual Report 2010Arman AliNo ratings yet

- Vocabulary: ExileDocument5 pagesVocabulary: ExileWael MadyNo ratings yet