Professional Documents

Culture Documents

Pay Pension2016 PDF

Uploaded by

Anonymous C6laqkPAAK0 ratings0% found this document useful (0 votes)

14 views15 pagesOriginal Title

Pay_Pension2016.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views15 pagesPay Pension2016 PDF

Uploaded by

Anonymous C6laqkPAAKCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

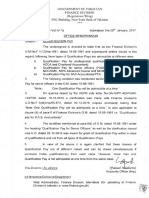

{2 NO.FD.PC.2-1/2016

tC, GOVERNMENT OF THE PUNJAB

SSS FINANCE DEPARTMENT

Sa

Dated Lahore, the 18” July, 2016

From

Mr. Shoukat Ali

Finance Secretary.

To

1. All Administrative Secretaries to Government of the Punjab.

2. The Principal Secretary to Governor, Punjab, Lahore.

3. The Principal Secretary to Chief Minister, Punjab, Lahore.

4. The Military Secretary to Governor, Punjab, Lahore.

5. The Secretary, Punjab Provincial Assembly, Lahore.

6. The Secretary, Punjab Public Service Commission, Lahore.

ze All Heads of Attached Departments in the Punjab.

8. All Commissioners in the Punjab.

9. All District Coordination Officers in the Punjab.

10. All District & Sessions Judges in the Punjab.

14. The Chief Pilot, VIP Flight, Lahore.

12. The Registrar, Lahore High Court, Lahore.

13. The Provincial Director, Local Fund Audit, Punjab, Lahore.

14, The Chief Inspector of Treasuries & Accounts, Lahore.

Subject REVISION OF BASIC PAY SCALES & ALLOWANCES OF CIVIL SERVANTS

OF THE PUNJAB GOVERNMENT (2016)

lam directed to state that the Governor of the Punjab has been pleased to

sanction Revision of Basic Pay Scales & Allowances with effect from 1" July, 2016 for the Civil

Servants of the Punjab Government as detailed in the succeeding paragraphs:

PART-1 (PAY)

2 Revision of Basic Pay Scales:

The Basic Pay Scales — 2016 shall replace the Basic Pay Scales — 2015 with

effect from 01.07.2016 as contained in the Annexure to this Notification.

3. Fixation of Pay of the Existing Employees:

i) The basic pay of an employee who was in service on 30.08.2016 shall be fixed

in the Basic Pay Scales - 2016 on point to point basis, i.e., at the stage

corresponding to that occupied by him/her above the minimum of Basic Pay

Scales - 2015,

ii) In case of Personal Pay being drawn by an employee as part of his/her basic

pay beyond the maximum of his/her pay scale on 30.06.2016, he/she shall

continue to draw such pay in the Basic Pay Scales - 2016 at the revised rates.

4 Fixation of Pay on Promotion:

In cases of promotion from a lower to higher posts/scale before introduction of

these scales, the pay of the employees concerned in the revised pay scale may be fixed and

so enhanced that it would not be less than the pay that would have been admissible to him if

his promotion to the higher post/scale had taken place after the introduction of these scales.

conditions, on 1* of December each year.

Annual Increment:

Annual increment shall continue to be admissible, subject to the existing

However, the first annual increment of existing

employees in Basic Pay Scales - 2016, in which their pay is fixed as on 01.07.2016 shall

accrue on the 1“ of December, 2016.

PART-II (ALLOWANCES)

Ad-hoc Relief Allowances:

The following Ad-hoc Relief Allowances granted w.e-f. 01.07.2013, 01.07.2014

and 01.07.2015 shall cease to exist with effect from 01.07.2016:

Sr. | Name of Ad-hoc Relief Notification ay

No. Allowance No. & Date Aamisetbe Rates|

i) | Ad-hoc Relief Allowance- | FD.PC.2-2/2013 dated 10% of the basic pay on |

2013 (01.07.2013) 19.07.2013 BPS-2011 = |

‘Ad-hoc Relief Allowance- | FD.PC.2-2/2014 dated 10% of the basic pay on |

_| 2014 (01.07.2014) 18.07.2014 | BPS 2011 |

‘Ad-hoc Relief Aliowance- | Para 8 of FD.PC.2-1/0015 % of the basic pay on

2015 (01.07.2015)

dated 22.07.2015

BPS-2015 |

Ad-hoc Allowance ~ 2010 (if admissible):

i) The Ad-hoc Allowance — 2010 @ 50% of the basic pay of Basic Pay Scales —

2008 (where admissible to the civil employees) shall continue to stand frozen at

the level of its admissibility/drawn as on 30.06.2016;

ii) All the new entrants shall be allowed Ad-hoc Allowance — 2010 @ 50% of the

minimum of relevant Basic Pay Scales — 2008 (if admissible in that

organization) on notional basis with effect from 01.07.2016, till further orders,

and shall stand frozen at the same level;

Ad-hoc Relief Allowance ~ 2016:

i) An Ad-hoc Relief Allowance — 2016 @ 10% of the running basic pay of BPS —

2016 to the civil servants of the Punjab Government including contract

employees employed against civil posts in Basic Pay Scales on standard terms

and conditions of contract appointment shall be allowed with effect from

01.07.2016 till further orders. This Allowance will not be admissible to contract

employees appointed on fixed pay package.

li) The Ad-hoc Relief Allowance will be subject to Income Tax.

iil) The Ad-hoc Relief Allowance will be admissible during leave and entire period

of LPR except during extra ordinary leave.

iv) The Ad-hoc Relief Allowance will not be treated as part of emoluments for the

purpose of calculation of Pension/Gratuity and recovery of House Rent.

v) The Ad-hoc Relief Allowance will not be admissible to the employees during the

tenure of their posting/deputation abroad

vi) The Ad-hoc Relief Allowance will be admissible to the employees on their

repatriation from posting/deputation abroad at the rate and amount which would

have been admissible to them had they not been posted abroad.

vii)

viii)

The Ad-hoc Relief Allowance will be admissible during the period of suspension.

‘The term “Basic Pay” for the purpose of Ad-hoc Relief Allowance — 2016 will

also include the amount of the personal pay granted on account of annual

increment(s) beyond the maximum of the existing pay scales.

9 Qualification Pay:

The rates of Qualification Pays shall be revised as under:

Existing ;

Sr.# Qualification Rates Re mbath

| (per month) | _[P°

a_ SASIPFA ——=7 Rs.800/ Rs.1,200/-

b_|CMA/ICWA (Parti) Rs.800/ Rs.1,200/-

¢_|ICMA/ICWAICIMA/ACCA* — Rs.2,100/ Rs.3, 150/-

d_ [Chartered Accountant Rs.2,300/ Rs.3,450/-

e _ [Staff College/ NMIC/NDG Rs.2,000/ Rs.3,000/-

1_ NIPA Advanced Course Rs. 1,000/ Rs.1,500/-|

q_[Mid Career Mgt Course Rs.500/ Rs.750/-

h__ [Mandatory Training at MPDD for promotion from] Rs.800/ Rs.1,200/-

BS-18 to BS-19

7 [Mandatory Training at MPDD for promotion from) Rs.700/ Rs.1,050/-|

BS-17 to BS-18 |

7 [Mandatory Training at MPD for promotion from] Rs.500/ Rs,750/-|

BS-16 to BS-17

("Note: CIMA and ACCA qualified employees may henceforth be allowed Qualification Pay at

the same rate as admissible for ICMA/ICWA)

10. Deputation/Additional Charge Allowance:

(sr.] Item Existing Rates Revised Rates

# (per month) (per month)

i |Deputation Allowance |20% of the Basic Pay subject | 20% of the Basic Pay subject,

to maximum Rs.6,000/- to maximum Rs.12,000/-

ii [Additional Charge [20% of the Basic Pay subject | 20% of the Basic Pay subject

|Allowance to maximum Rs.6,000/- to maximum Rs.12,000/-

ail Special Pays and Allowances:

All the Special Pays, Special Allowances or the Allowances admissible as

percentage of pay (excluding those which are capped by fixing maximum limit) including

House Rent Allowance and the Allowances/Special Allowances equal to initial or basic pay

granted to any employee of Punjab Government including Punjab Police, Border Military

Police, D.G. Khan & Rajanpur, Baluch Levy D.G. Khan, Prisons, Directorate of Reclamation &

Probation, Judiciary, MPDD, teaching/non-teaching staff of teaching institutes including

employees of Directorate of Special Education and employees of other Departments shall

stand frozen at the level of its admissibility as on 30.06.2016.

12. Option:

i) All the existing Civil Servants (BS-1 to 22) of the Punjab Government shall,

within 30 days from the date of issue of this notification, exercise an option in

writing and communicate it to the Accountant General Punjab/District Accounts

Office/DDO concerned, as the case may be, either to continue to draw salary in

the Basic Pay Scales- 2016 or in the Basic Pay Scales - 2016 as specified in

this Notification. Option once exercised shall be considered final.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Information Booklet 2016Document14 pagesInformation Booklet 2016Muhammad AliNo ratings yet

- Advancing The STMS Genomic Resources For Defining New Locations On The Intraspecific Genetic Linkage Map of Chickpea (Cicer Arietinum L.)Document18 pagesAdvancing The STMS Genomic Resources For Defining New Locations On The Intraspecific Genetic Linkage Map of Chickpea (Cicer Arietinum L.)Anonymous C6laqkPAAKNo ratings yet

- Comparative Genetics of Disease Resistance Within The SolanaceaeDocument15 pagesComparative Genetics of Disease Resistance Within The SolanaceaeAnonymous C6laqkPAAKNo ratings yet

- Circular 20012017Document10 pagesCircular 20012017muhammad nazirNo ratings yet

- The Major Resistance Gene Cluster in Lettuce Is Highly Duplicated and Spans Several MegabasesDocument16 pagesThe Major Resistance Gene Cluster in Lettuce Is Highly Duplicated and Spans Several MegabasesAnonymous C6laqkPAAKNo ratings yet

- 607 VipDocument13 pages607 VipAnonymous C6laqkPAAKNo ratings yet

- Selection of DNA Markers For Detection of Extreme Resistance To Potato Virus Y in Tetraploid Potato (Solanum Tuberosum L.) F ProgeniesDocument10 pagesSelection of DNA Markers For Detection of Extreme Resistance To Potato Virus Y in Tetraploid Potato (Solanum Tuberosum L.) F ProgeniesAnonymous C6laqkPAAKNo ratings yet

- Information Booklet 2016Document14 pagesInformation Booklet 2016Muhammad AliNo ratings yet

- Marker Assisted Selection: A Novel Approach For Crop ImprovementDocument5 pagesMarker Assisted Selection: A Novel Approach For Crop ImprovementAnonymous C6laqkPAAKNo ratings yet

- Selection of DNA Markers For Detection of Extreme Resistance To Potato Virus Y in Tetraploid Potato (Solanum Tuberosum L.) F ProgeniesDocument10 pagesSelection of DNA Markers For Detection of Extreme Resistance To Potato Virus Y in Tetraploid Potato (Solanum Tuberosum L.) F ProgeniesAnonymous C6laqkPAAKNo ratings yet

- Quanta RusDocument6 pagesQuanta RusAnonymous C6laqkPAAKNo ratings yet

- Marker Assisted Selection: A Novel Approach For Crop ImprovementDocument5 pagesMarker Assisted Selection: A Novel Approach For Crop ImprovementAnonymous C6laqkPAAKNo ratings yet

- Primus 96 Advanced®/ Primus 96 Advanced® Gradient: Innovative PCR-TechnologyDocument11 pagesPrimus 96 Advanced®/ Primus 96 Advanced® Gradient: Innovative PCR-TechnologyAnonymous C6laqkPAAKNo ratings yet

- Notification 4th Entry TestDocument197 pagesNotification 4th Entry TestMuhammad Hamayun kakarNo ratings yet

- Pay Pension2016Document15 pagesPay Pension2016Anonymous C6laqkPAAKNo ratings yet

- Death Notification PDFDocument1 pageDeath Notification PDFAnonymous C6laqkPAAKNo ratings yet

- Application Form PDFDocument2 pagesApplication Form PDFAnonymous C6laqkPAAKNo ratings yet

- Grapes Crop Cultivation in Pakistan Urdu Book PDFDocument5 pagesGrapes Crop Cultivation in Pakistan Urdu Book PDFAnonymous C6laqkPAAKNo ratings yet

- Application For Met 2016Document3 pagesApplication For Met 2016Anonymous C6laqkPAAKNo ratings yet

- 6 60 Roll Nos of Successful Candidates in Written Test (2016)Document1 page6 60 Roll Nos of Successful Candidates in Written Test (2016)Fazal Ur RehmanNo ratings yet

- Amjad1 2 2 2009 70 77Document8 pagesAmjad1 2 2 2009 70 77Anonymous C6laqkPAAKNo ratings yet

- Product Manual: GL RAPD Decamer SetsDocument35 pagesProduct Manual: GL RAPD Decamer SetsAnonymous C6laqkPAAKNo ratings yet

- Product Manual: GL RAPD Decamer SetsDocument35 pagesProduct Manual: GL RAPD Decamer SetsAnonymous C6laqkPAAKNo ratings yet

- List of Molecular Biology Grade Chemicals To Be Purchased Under Biotech ProjectDocument11 pagesList of Molecular Biology Grade Chemicals To Be Purchased Under Biotech ProjectAnonymous C6laqkPAAKNo ratings yet