Professional Documents

Culture Documents

Problem Set 2 - MFIN1127-Sec04

Uploaded by

JessicaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 2 - MFIN1127-Sec04

Uploaded by

JessicaCopyright:

Available Formats

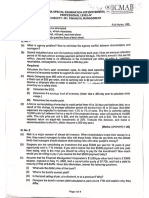

MFIIN11270

04:CorporaateFinancee

Spring2017

Prof.OuzhanKaraaka

ProblemSet#2

LecturreNotes#5

1. Re eviewthefolllowingquestiionsatthePrroblemSetss ectionofBMA,Chapter20

0:

Questions15,

Q 16,and18.

LecturreNotes#6

2. Re eviewthefolllowingquestiionsatthePrroblemSetss ectionofBMA,Chapter6::

Questions6,10

Q 0,and11.

3. A food processing company has just de eveloped a n ew kind of soup. It is now

w trying to d

decide

whethertobu

w ildaplantanndputthesoupintoproduuction.Inund dertakingthisscapitalbudggeting

exxercise whichh of the follo

owing cash flows

f should be treated as incremental when deeciding

whethertogo

w aheadandprroducetheso oup?

A.. Theresearchandde evelopmentccoststhatweereincurredd developingthesoup.

B.. Thevalueofthelan ndtheplantwwillbebuiltonnwhichiscurrentlyownedbythecom mpany.

C.. Theco onsequentred esalesofthe company'sexistingsoupb

ductioninthe brands.

D. Thesalvagevalueo ndequipmen tattheendo

oftheplantan ofitsplanned dlife.

E. Thean nnualdepreciaationcharge.

F. Marketingexpensesfortheprod duct.

G. Aprop portionofexp pensesfortheheadofficeeassumingth heseexpenseesareindepeendent

ofwhe ethersoupisproduced.

H. InteresstPayments.

I. DividendPayments.

J. Theexxpendituresfiveyearsfrom mnowwhich willbenecesssarytoensu uretheplant meets

regulattionswhichw willcomeintooforcethen.

4. Th he Follies Co

ompany need ds to replace some of ttheir lightingg equipment. They can either

puurchaselightssfromGEor fromPhilips..TheGEequ ipmentlasts forfouryearrswhiletheP Philips

eqquipmentlasttsforthree.TThediscountrateforthistypeofprojeectis10%.Theperforman nceof

thhetwotypes oflightisthe esame.The aftertaxcostts(i.e.alltheefiguresbelo owarenegatiive)at

eaachdateareaasfollows:

MFIN112704ProblemSeet2 1 of4 Spring

g2017

t=01234

GE 505101520

Philips 305515

Whichistheequipmentwiththelowestequivalentannualcost?

5. Afirmhasachoiceofundertakingaprojectnowornextyear.Thecashflowsinthetwocases

areasfollows:

t=0123

Startnow 1012180

Startnextyear081317

Whenshouldthefirmundertaketheprojectifthediscountrateis5percent?

6. ITT is building a new plant to make telephones in South Carolina. The initial working capital

needsoftheplanttofinanceinventory,payrollandsoforthare$5M.Eachyeartheseneedsare

expected to increase by 5 percent. After five years the plant will be closed and the working

capitalrecovered.Inundertakingacapitalbudgetingexercisetoseewhetherornottobuildthe

plant,whatarethecashflowsthatshouldbeincludedtotakeaccountoftheworkingcapital?

ExamStyleQuestions

7. You are asked to evaluate the following wooden cabinet manufacturing project for a

corporation.DevelopatableshowingtheannualcashflowsandcalculatetheNPVofthisproject

atan8%discountrate.Allfiguresaregiveninnominalterms.

20X620X720X8

PhysicalProduction(cabinets)3,1503,7503,800

LaborInput(hours)26,00030,00031,000

Wood(physicalunits)550630650

Therequiredinvestmenton12/31/20X5is$800,000.Thefirmfacesa34%incometaxrate,and

uses straightline depreciation. The salvage value of the investment which will be received on

12/31/X8 will be one fifth of the initial investment. The price of cabinets on 12/31/X5 will be

$250eachandwillremainconstantintheforeseeablefuture.Laborcostswillbe$15perhour

on12/31/X5andwillincreaseat5%peryear.Thecostforthewoodwillbe$200perphysical

unit on 12/31/X5 and will increase at 2% per year. Revenue is received and costs are paid at

year's end (i.e., use yearend prices in calculating revenues and costs so, for example, use the

12/31/X6 prices for calculating 20X6 revenues and costs). The firm has profitable ongoing

operationssothatanylossesfortaxpurposesfromtheprojectcanbeoffsetagainstthese.

LectureNotes#7

8. ReviewthefollowingquestionsattheProblemSetssectionofBMA,Chapter10:

Questions1,2,3,4,6,and7.

9. ReviewthefollowingquestionsattheProblemSetssectionofBMA,Chapter25:

Questions1,2,3,and4.

MFIN112704ProblemSet2 2 of4 Spring2017

LectureNotes#8&9

10. ReviewthefollowingquestionsattheProblemSetssectionofBMA,Chapter7:

Questions10(ignoreparenthesisinparte),11,and14.

11. ReviewthefollowingquestionsattheProblemSetssectionofBMA,Chapter8:

Questions14,15,and19.

12. Whichofthefollowingstatementsis/arecorrect(seeSiegelreadingintheCP)?

A. The total real aftertax rate of return on equity was lower between 19261990 than 1871

1925.

B.Therealrateofreturnonshorttermgovernmentbondswaslowerbetween19261990than

18711925.

C. In the period 19261990 the return from holding stocks for ten years was greater than the

returnfromholdingshorttermbondsforthesameperiod89.2percentofthetime.

D. In the period 18711990 the return from holding stocks for ten years was greater than the

returnfromholdinglongtermbondsforthesameperiod83.3percentofthetime.

13. Whichofthefollowingstatementsis/arecorrect?

A.Meanandstandarddeviationhavethesameunits.

B.Meanisameasureofdispersion.

C. If two random variables have a negative covariance it means they tend to move in the

oppositedirection.

D.Iftworandomvariablesdon'tmovetogetherorinoppositedirectionsonaverageatallthey

haveazerocovariance.

E.Correlationcoefficientsmustbeequalto1and+1orlieinbetween.

14. ThestocksAandBhavethefollowingdistributionsofreturns.

ABProbability

State1 340.2

State2 520.3

State3 480.2

State4 650.1

State5 610.2

(i)Whatarethemeans,variancesandstandarddeviationsofstocksAandB?

(ii)WhatarethecovarianceandcorrelationbetweenstocksAandB?

(iii)Consideraportfoliowith=0.50inAand1=0.5inB.Whatarethemean,varianceand

standarddeviationofthisportfolio?

15. Whichofthefollowingis/arecorrect?

A. When two stocks have a correlation of 1 it is always possible to construct a portfolio with

zerostandarddeviation.

B.Theriskofawelldiversifiedportfoliodependsontheuniqueriskofthestockscontainedin

theportfolio.

C.Otherthingsequal,thegreaterthenumberofindependentstocks(i.e.thecovariancesareall

zero)inanequallyweightedportfoliothesmallerthestandarddeviationoftheportfolio.

MFIN112704ProblemSet2 3 of4 Spring2017

D.Thestandarddeviationofaportfolioisalwaysaweightedaverageofthestandarddeviations

oftheindividualsecurities.

E.Betaisameasureofthemarketriskofastock.

F.Thebetaofapoorlydiversifiedportfolioisequaltotheweightedaverageofthebetasofthe

individualstockswheretheweightsaretheproportionsintheportfolio.

16. Use EXCEL to answer this question. Stock X has mean return 0.15 and standard deviation 0.6.

StockYhasmeanreturn0.10andstandarddeviation0.4.Thecorrelationbetweenthemis+0.1.

Plottheportfoliolocusforthesetwostocksinmeanstandarddeviationspacewiththemeanon

the vertical axis and the standard deviation on the horizontal axis. Specifically, trace the risk

return tradeoff given by combining these two stocks in varying amounts. Let represent the

proportionofwealthinvestedinXand1theproportioninY.Allowtovarybetween0.2and

1.2instepsof0.1.WhatinvestmentsinXandYdotheportfolioswith<0and>1correspond

to?Attachacopyofyourplot(fromExcel)oftheefficiencylocusandthedataitisbasedonwith

youranswers.

17. Supposethatthestandarddeviationofreturnsoneachindividualstockis40%perannumand

thatthecovariancebetweeneachpairofstocksis0.25.Whatistheannualstandarddeviationof

anequallyweightedwelldiversifiedportfolio?(Assume1/N=O)

18. The risk free rate is 8 percent and the expected return on the market portfolio is 16 percent.

Whatistheexpectedreturnonawelldiversifiedportfoliowithabetaof0.6?

19. Phillippeborrows$15,000at5%andinveststhistogetherwith$15,000ofhisownmoneyinthe

marketportfolio.Ifthemarketportfoliohasastandarddeviationof15%,whatisthestandard

deviationofthereturntohisinvestment?

20. Whichofthesestrategieswouldofferthesameexpectedreturntoaninvestorasastockwitha

betaof0.5?

A.InvestingahalfofhermoneyinTbillsandinvestingtheremainderinthemarketportfolio

B.Borrowinganamountequaltoonehalfofherownresourcesandinvestingeverythinginthe

marketportfolio

C. Borrowing an amount equal to her own resources and investing everything in the market

portfolio

D.Noneoftheabove

ExamStyleQuestions

21. (a)Supposetherearethreetypesofpeopleinaneconomy,typeA's,B'sandC's.Therearethree

assetsX,YandZ.AssetsXandYareriskybutassetZisriskfree.TypeA'shold45percentoftheir

portfoliosinX,30percentinYand25percentinZ.TypeB'shold30percentoftheirportfoliosin

X, 20 percent in Y and 50 percent in Z. Type C's hold 15 percent in X, 10 percent in Y and 75

percentinZ.AretheseholdingsconsistentwiththeCapitalAssetPricingModelbeingsatisfied?

Explainverybrieflywhyorwhynot.

(b) Suppose that the Capital Asset Pricing Model holds. The market portfolio has an expected

return of 0.14 and a standard deviation of 0.35. The risk free rate is 0.05. How could you

construct a portfolio having an expected return of 0.20? What are the beta and standard

deviationofthisportfolio?

MFIN112704ProblemSet2 4 of4 Spring2017

You might also like

- CPN Guide 2Document4 pagesCPN Guide 2Aut Beat95% (37)

- Fin 425 Final NIKEDocument11 pagesFin 425 Final NIKEcuterahaNo ratings yet

- Corporate Finance FinalsDocument66 pagesCorporate Finance FinalsRahul Patel50% (2)

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocument12 pagesShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- Comprehensive Individual AssignmentDocument13 pagesComprehensive Individual AssignmentNasir ShaikhNo ratings yet

- MA Mock - Questions S20-A21Document22 pagesMA Mock - Questions S20-A21FardienNo ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Acca F5 Mock Exem QuestionsDocument16 pagesAcca F5 Mock Exem QuestionsGeo DonNo ratings yet

- Chap 11Document67 pagesChap 11Reina Erasmo SulleraNo ratings yet

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- PWC Colonial Liability Order 122817Document92 pagesPWC Colonial Liability Order 122817Daniel Fisher100% (1)

- Chapter 2 Macro SolutionDocument12 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Alllied Food ProductsDocument4 pagesAlllied Food ProductsHaznetta HowellNo ratings yet

- Chapter 13 - SeatworkDocument8 pagesChapter 13 - SeatworkNicole ClaireNo ratings yet

- Question Details: Call Us On: +1 (646) 980-4914Document5 pagesQuestion Details: Call Us On: +1 (646) 980-4914Nathinael LimenhNo ratings yet

- 2006 FinalDocument30 pages2006 Finalriders29No ratings yet

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- Midterm Sample 2015Document22 pagesMidterm Sample 2015Kenneth KwokNo ratings yet

- MAS Cover To Cover QuizDocument6 pagesMAS Cover To Cover QuizWendyMayVillapaNo ratings yet

- Finance2019 20finalDocument6 pagesFinance2019 20finalAdolf DasslerNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- Final Examination: Management Advisory Services Semester of A.Y. 2021-2022Document11 pagesFinal Examination: Management Advisory Services Semester of A.Y. 2021-2022Andrea Florence Guy VidalNo ratings yet

- Final Exam, s2, 2019-FINALDocument13 pagesFinal Exam, s2, 2019-FINALReenalNo ratings yet

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- SEEM2440: Engineering Economics (2022 - 2023 Term 1) : Assignment 3 Due: 10:00 PM, November 29 (Tuesday), 2022Document3 pagesSEEM2440: Engineering Economics (2022 - 2023 Term 1) : Assignment 3 Due: 10:00 PM, November 29 (Tuesday), 2022韩思嘉No ratings yet

- AssignmentDocument5 pagesAssignmentAsmita MoonNo ratings yet

- Case AlliedDocument2 pagesCase AlliedChiNo ratings yet

- Management Advisory ServicesDocument28 pagesManagement Advisory ServicesAnnaliza DonqueNo ratings yet

- Exercise Session 1Document8 pagesExercise Session 1EdoardoMarangonNo ratings yet

- AU FINC 501 MidTerm Winter 2013hhh SsDocument16 pagesAU FINC 501 MidTerm Winter 2013hhh SsSomera Abdul QadirNo ratings yet

- ACTIVITY 5 CBE Module 4Document5 pagesACTIVITY 5 CBE Module 4Christian John Resabal BiolNo ratings yet

- Coporate Finance AssignmentsDocument36 pagesCoporate Finance AssignmentsZahra HussainNo ratings yet

- HW8 AnswersDocument6 pagesHW8 AnswersPushkar Singh100% (1)

- Exam Jun 21st ADocument7 pagesExam Jun 21st AOmer SalihNo ratings yet

- 2009 Sem1Document7 pages2009 Sem1Ella GorelikNo ratings yet

- BUS ADM 350: Exam 1 (ATTEMPT 2)Document6 pagesBUS ADM 350: Exam 1 (ATTEMPT 2)Maddah HussainNo ratings yet

- Tutorial Capital BudgetingDocument4 pagesTutorial Capital Budgetingmi luNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- Tute 6 PDFDocument4 pagesTute 6 PDFRony RahmanNo ratings yet

- Solutions Class Examples AFM2015Document36 pagesSolutions Class Examples AFM2015SherelleJiaxinLiNo ratings yet

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsGauravsNo ratings yet

- Fina1003abc - Hw#4Document4 pagesFina1003abc - Hw#4Peter JacksonNo ratings yet

- Fin370 Myfinancelab Week 3 New 2015Document4 pagesFin370 Myfinancelab Week 3 New 2015G JhaNo ratings yet

- Fin 370 Week 4 Team Assignment - Caledonia Products Integrative ProblemDocument7 pagesFin 370 Week 4 Team Assignment - Caledonia Products Integrative ProblemiziusherNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Fin 370 All My Finance LabDocument12 pagesFin 370 All My Finance Labjupiteruk0% (1)

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document14 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- Financial Management QualiDocument6 pagesFinancial Management QualiJaime II LustadoNo ratings yet

- Econ F315 1923 CM 2017 1Document3 pagesEcon F315 1923 CM 2017 1Abhishek GhoshNo ratings yet

- 2.time Value of MoneyDocument17 pages2.time Value of MoneyaaNo ratings yet

- Module 6 AND 7 AnswerDocument30 pagesModule 6 AND 7 AnswerSophia DayaoNo ratings yet

- Chap 11Document77 pagesChap 11Nguyễn Minh ThôngNo ratings yet

- FIM Old Syllabus Questions - OcredDocument75 pagesFIM Old Syllabus Questions - OcredPavel DhakaNo ratings yet

- A01150768 Problemascapitulos5y6 Tarea2 3 FinCorpAvDocument5 pagesA01150768 Problemascapitulos5y6 Tarea2 3 FinCorpAvAndrés Emmanuel NuñezNo ratings yet

- Review For ISE2040 Final ExamDocument4 pagesReview For ISE2040 Final ExamRyan SNo ratings yet

- I. Capital Budgeting (30 Questions)Document26 pagesI. Capital Budgeting (30 Questions)Joseph Prado Fernandez0% (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Fossil Fuel Subsidies in Thailand: Trends, Impacts, and ReformsFrom EverandFossil Fuel Subsidies in Thailand: Trends, Impacts, and ReformsNo ratings yet

- OPER Problem Set 6 Integer Programming s5.1Document21 pagesOPER Problem Set 6 Integer Programming s5.1JessicaNo ratings yet

- Neighborhood Virtual Tours QuestionsDocument1 pageNeighborhood Virtual Tours QuestionsJessicaNo ratings yet

- BasicsOfLeasingAndTenantMix BeatriceMoutonDocument109 pagesBasicsOfLeasingAndTenantMix BeatriceMoutontuing2ing4982100% (1)

- Lecture Slides 002 - MFIN1127-Sec04Document10 pagesLecture Slides 002 - MFIN1127-Sec04JessicaNo ratings yet

- The Sorrows of Young Werther - Johann Wolfgang Von Goethe PDFDocument78 pagesThe Sorrows of Young Werther - Johann Wolfgang Von Goethe PDFGary InthNo ratings yet

- Imogen Broke Mine Eye EditedDocument2 pagesImogen Broke Mine Eye EditedJessicaNo ratings yet

- SyllabusDocument4 pagesSyllabusJessicaNo ratings yet

- Formula Sheet M1Document2 pagesFormula Sheet M1JessicaNo ratings yet

- Solutions Waiting Lines SuppBDocument15 pagesSolutions Waiting Lines SuppBJessicaNo ratings yet

- Homework 1Document2 pagesHomework 1JessicaNo ratings yet

- Jesus Before Christianity PP 55-61-137 - 142Document8 pagesJesus Before Christianity PP 55-61-137 - 142suniljpNo ratings yet

- The Good PeopleDocument105 pagesThe Good PeopleJessicaNo ratings yet

- Syllabus Yoon Fall 2016Document8 pagesSyllabus Yoon Fall 2016JessicaNo ratings yet

- Reporting and Interpreting Sales Revenue, Receivables, and CashDocument33 pagesReporting and Interpreting Sales Revenue, Receivables, and CashJessicaNo ratings yet

- IPPTChap 003Document48 pagesIPPTChap 003JessicaNo ratings yet

- IPPTChap 012Document43 pagesIPPTChap 012JessicaNo ratings yet

- Work Poor Invisible in USDocument7 pagesWork Poor Invisible in USJessicaNo ratings yet

- Investing and Financing Decisions and The Accounting SystemDocument33 pagesInvesting and Financing Decisions and The Accounting SystemJessicaNo ratings yet

- Investing and Financing Decisions and The Accounting SystemDocument33 pagesInvesting and Financing Decisions and The Accounting SystemJessicaNo ratings yet

- Light ChaptersDocument78 pagesLight ChaptersJessicaNo ratings yet

- Investing and Financing Decisions and The Accounting SystemDocument33 pagesInvesting and Financing Decisions and The Accounting SystemJessicaNo ratings yet

- 3.sole Proprietorship& PartnershipDocument10 pages3.sole Proprietorship& PartnershipAnonymous 8Pyd22rExNo ratings yet

- Unjust Enrichment DigestsDocument6 pagesUnjust Enrichment DigestsRiva Mae CometaNo ratings yet

- TAX OutlineDocument42 pagesTAX Outlineabmo33No ratings yet

- Cost Accounting Level 3/series 2 2008 (Code 3017)Document18 pagesCost Accounting Level 3/series 2 2008 (Code 3017)Hein Linn Kyaw50% (2)

- Financial Management and AccountsDocument257 pagesFinancial Management and AccountsraggarwaNo ratings yet

- D & C Builders LTD V Rees (P)Document11 pagesD & C Builders LTD V Rees (P)harshitaNo ratings yet

- Lecture 1 Intro To WCMDocument19 pagesLecture 1 Intro To WCMMukul BhatiaNo ratings yet

- Ariba Invoice ProfessionalDocument10 pagesAriba Invoice ProfessionalSantosh Ravindra NadagoudaNo ratings yet

- Barclays Securitized Products Weekly Looking Past The EM ContagionDocument44 pagesBarclays Securitized Products Weekly Looking Past The EM ContagiondhyakshaNo ratings yet

- Chapter 21 Answersmultiple ChoicesDocument5 pagesChapter 21 Answersmultiple Choicescharlie simoNo ratings yet

- Case Digest in Insurance LawDocument8 pagesCase Digest in Insurance LawdenevoNo ratings yet

- Wulf & Mintz (1957) Haciendas and Plantations in Middle America and The AntillesDocument34 pagesWulf & Mintz (1957) Haciendas and Plantations in Middle America and The AntillesMiguel MorillasNo ratings yet

- Acknowledgment of Loan Application Form: Capri Global Capital LTDDocument9 pagesAcknowledgment of Loan Application Form: Capri Global Capital LTDRahul MahankalNo ratings yet

- Breeding AgreementDocument5 pagesBreeding AgreementArkatia78100% (1)

- Introduction To Financial Management: Mcgraw-Hill/IrwinDocument22 pagesIntroduction To Financial Management: Mcgraw-Hill/Irwinsenthilkumar99No ratings yet

- Teil 5 Foreclosure FraudDocument17 pagesTeil 5 Foreclosure FraudNathan BeamNo ratings yet

- Business Strategy, Corporate Restructuring and Take Overs - R. Ramesh ChandraDocument36 pagesBusiness Strategy, Corporate Restructuring and Take Overs - R. Ramesh ChandraDominic GouveiaNo ratings yet

- 08 Theoretical Aspects of Public DebtDocument35 pages08 Theoretical Aspects of Public DebtAnkit Singh100% (1)

- Partnerships: Liquidation: Mcgraw-Hill/IrwinDocument108 pagesPartnerships: Liquidation: Mcgraw-Hill/IrwinWong Cilek0% (1)

- Leticia Ligon V Court of Appeals and Iglesia Ni CristoDocument3 pagesLeticia Ligon V Court of Appeals and Iglesia Ni CristoALSANo ratings yet

- SssssDocument3 pagesSssssGerald Andea ProcilloNo ratings yet

- First National Bank and Trust Company of Williston, A National Banking Corporation v. St. Paul Fire and Marine Insurance Company, A Capital Stock Corporation, 971 F.2d 142, 1st Cir. (1992)Document8 pagesFirst National Bank and Trust Company of Williston, A National Banking Corporation v. St. Paul Fire and Marine Insurance Company, A Capital Stock Corporation, 971 F.2d 142, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- ProjectionDocument13 pagesProjectionNeha ThakurNo ratings yet

- Dsa List and Role of DsaDocument120 pagesDsa List and Role of Dsa26oct1995deepakNo ratings yet

- Soco v. MilitanteDocument2 pagesSoco v. MilitanteBeeya Echauz50% (2)